Author: 0xBrooker

The Federal Reserve's interest rate cut and liquidity release have raised the price bottom of BTC this week; however, disappointing earnings reports from AI tech stocks continue to squeeze the valuations of high-beta assets, limiting BTC's upward potential. Ultimately, after testing last week's high, BTC continues to maintain a mid-term "bottom-fishing" trend.

ETH, which had a larger decline earlier, has rebounded more strongly, but ultimately also fell back with the overall trend.

Under the influence of the interest rate cut and a slight improvement in short-term liquidity, both BTC and ETH attempted to break through the downward trend line this week, but ultimately returned without success, falling back within the upper boundary of the downward trend line.

Overall, BTC continues to move in sync with the Nasdaq, waiting for the release of next week's November CPI and non-farm employment data to provide guidance for a market lacking trading points, while also facing the impact of Japan's interest rate hike next week.

Policy, Macro Finance, and Economic Data

After a rollercoaster ride that severely impacted BTC's upward momentum, the Federal Reserve's November meeting resulted in a scheduled interest rate cut of 25 basis points to 3.50%~3.75%. The Fed's statement emphasized that in the "dual-target risk assessment," the downside risk on the employment side has increased, while inflation "remains slightly elevated"; future adjustments will depend on data, outlook, and risk balance. This indicates that the Fed is currently slightly leaning towards the employment side in its dual mandate.

This somewhat dovish statement was diluted by internal discord within the Fed—9 in favor, 3 against (1 advocating for a 50bp cut; 2 advocating for no cut).

The dot plot for 2026-2028 is noticeably more dispersed, indicating inconsistent assessments of "inflation stickiness vs. employment slowdown"; the right side "Longer run" points are concentrated around the 3% mark to slightly above 3%, suggesting that the long-term neutral interest rate may be higher than pre-pandemic policy implications. This lowers the expected number of rate cuts in 2026 to 1-2, totaling 50 basis points. This is a neutral guidance that may provide some help for employment, but is currently insufficient to support high-beta assets.

In response to short-term liquidity tightness, the Fed has restarted short-term Treasury bond purchases, explaining that it will conduct RMP to maintain "adequate reserves," with approximately $40 billion in the first month, and emphasized that RMP does not imply a change in monetary policy stance. The first bond purchase has already been completed.

After more than a month of valuation cuts, high-beta assets represented by AI tech stocks have not stabilized. This week, earnings reports from Oracle and Broadcom once again shook market confidence.

After Q3 spending expansion drove stock prices up, the market is now more concerned about the debt issues of AI stocks and whether high investments can quickly translate into profit growth. The release of earnings reports from the two companies formed a "soft and hard" dual blow, leading the market to re-evaluate the "AI return realization cycle," causing AI-weighted stocks to drag down the Nasdaq and overall market risk appetite. Nvidia and BTC both lost their rebound gains, returning to this week's starting point.

The yield on 10-year U.S. Treasuries remains around 4.18%, exerting pressure on long-duration assets.

Although the Fed has started purchasing bonds, the Treasury's TGA account has also begun to decline due to spending, and SOFR has returned to the federal rate range, short-term liquidity is gradually easing but remains tight. Against the backdrop of doubts about AI stock debt and profit returns, there are signs of capital shifting in U.S. stocks towards consumer and cyclical stocks. The Dow Jones and Russell 2000 indices both reached new highs this week.

In the context of unclear interest rate cuts in 2026, coupled with the fact that the new Fed chair has not yet been determined, high-beta assets, including AI tech stocks and BTC, have still not attracted capital favor. The most optimistic estimate is that after Japan's interest rate hike next week and the release of U.S. employment and inflation data, the market may open up a "Christmas rally."

Crypto Market

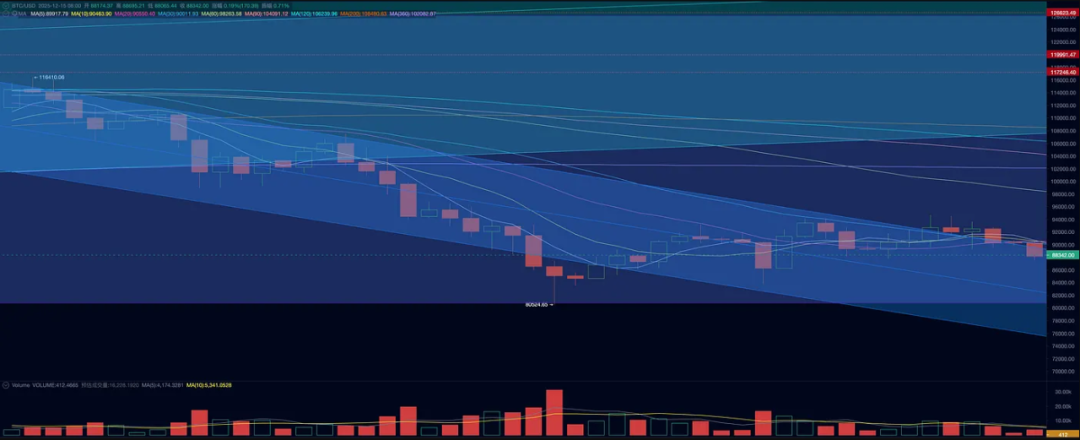

This week, BTC opened at $90,402.30 and closed at $88,171.61, down 2.47%, with a volatility of 7.83% and a slight contraction in trading volume. Technically, BTC briefly broke through the downward trend channel before the interest rate cut, but then fully retraced due to the impact of AI stock earnings.

BTC Price Trend (Daily)

Currently, BTC is still in a platform consolidation phase after a significant sell-off. Whether it will rebound upwards with U.S. stocks to enter a "new cycle" or collapse again after consolidation to continue the "old cycle" still depends on the combination of internal and external factors and the reactions of market participants.

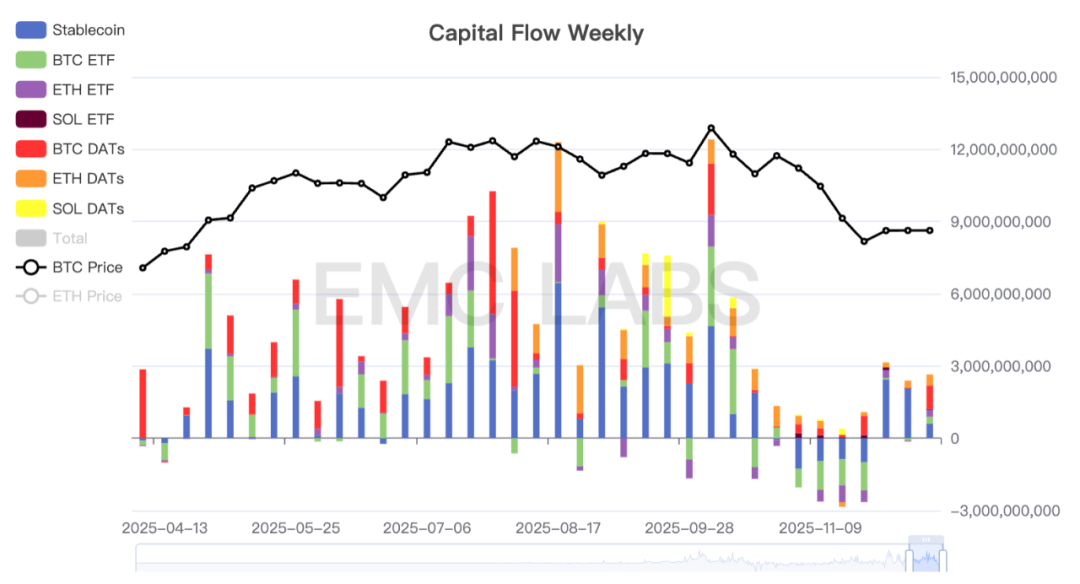

In terms of capital, the situation is relatively optimistic. Statistics show that there was no significant change in inflow this week, but last week, Strategy increased its BTC holdings by over $900 million, and Bitmine also significantly increased its ETH holdings, which undoubtedly boosted market confidence.

Crypto Market Capital Inflow and Outflow Statistics (Weekly)

Among them, BTC ETF and ETH ETF channels, which have significant pricing power over crypto assets, also recorded positive inflows, totaling over $500 million.

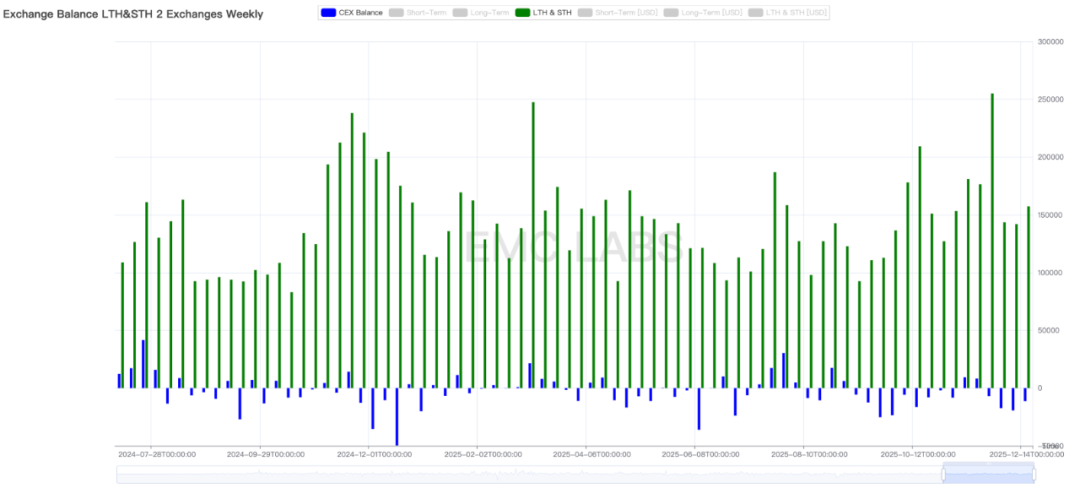

On the selling side, the situation is slightly pessimistic. Last week, long and short positions collectively sold over 157,000 coins, exceeding the scale of the previous two weeks. As selling increased, the outflow from exchanges also showed a slight decline.

Exchange Selling and Inflow/Outflow Statistics (Weekly)

Moreover, long positions continue to sell. The historical cyclical curse still profoundly affects this group. If they cannot return to an accumulation state, BTC prices may struggle to stabilize.

On the industry level, there are also positive developments. The CFTC announced the launch of a digital asset pilot program, allowing regulated derivatives markets to use BTC, ETH, and USDC as collateral, along with stricter monitoring and reporting mechanisms. The breakthrough of crypto assets as collateral in derivatives scenarios is beneficial for the integration of DeFi and CeFi, increasing the application scenarios of crypto, which is a long-term positive for crypto. Additionally, the much-anticipated "structural plan" has reportedly made some progress and has received unanimous support from both the Democratic and Republican parties. The final passage of this bill would benefit the further development of the crypto industry in the U.S. and promote institutional allocation towards crypto assets.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, entering a "downward phase" (bear market).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。