The entire industry is shifting from narrative to infrastructure, from speculation to systematic solutions, and from hype to actual products.

Author: 0xJeff

Translation: Deep Tide TechFlow

A review of the development history of Crypto and AI, the narratives that have survived and thrived, and the future of the field in 2026.

The year 2024 marks the true beginning of Crypto x AI's popularity on Crypto Twitter, with many interesting, practical, and entertaining crypto agents emerging in the market, each equipped with its own token.

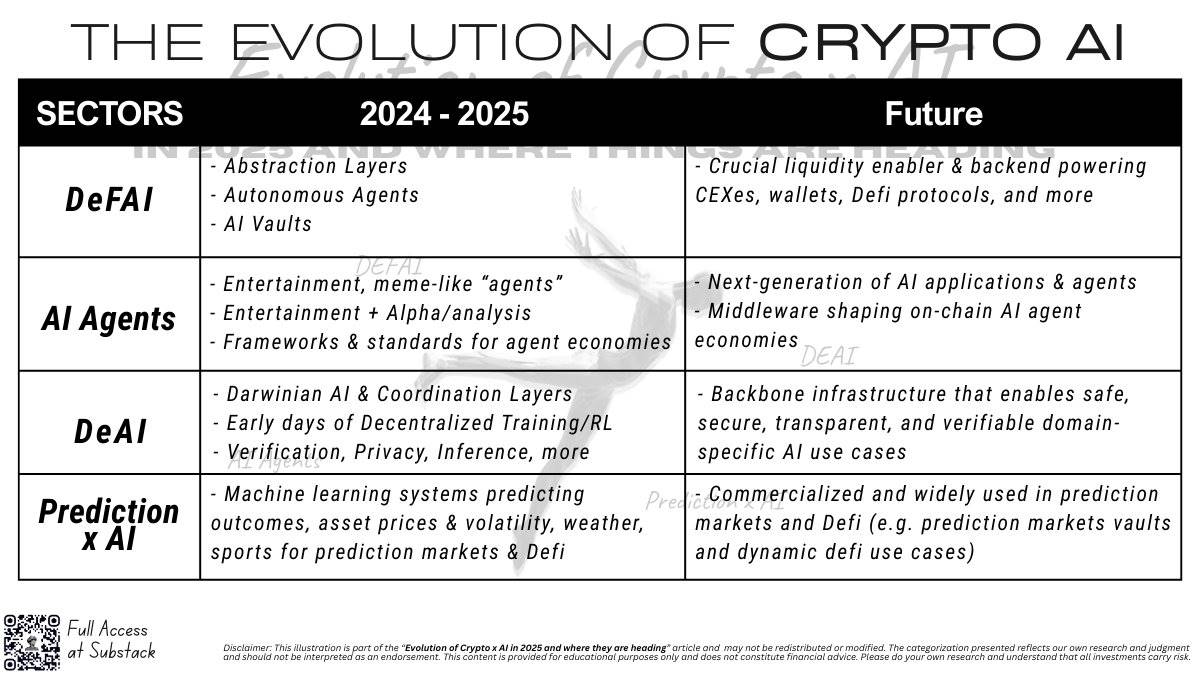

By 2025, speculation around crypto agents gradually shifts towards real AI applications, with decentralized AI moving from research and conceptual stages to early productization. "Darwinian AI" becomes the preferred method to attract new talent and accelerate the development of decentralized AI. Meanwhile, DeFi x AI emerges as the most valuable niche, further enhancing the core value proposition of the crypto space.

2026 will be the year of Crypto AI.

Building on the efforts and experiments from 2024 to 2025, we begin to see early signs of product-market fit and a clearer direction on how cryptocurrencies, blockchain, and distributed systems can enhance AI.

Narratives that lack practicality or market demand, or cannot compete with Web2 AI startups, have either disappeared or stagnated (e.g., AI x gaming, AI entertainment, generative AI, video/voice agents, AI workflows for productivity enhancement).

Those narratives that have survived have transformed into innovative models that could change the way we work.

DeFAI: The Next Generation of DeFi

DeFAI (Artificial Intelligence in Decentralized Finance) emerged in early 2025 in the crypto space, sparking a massive wave of utilizing AI to enhance existing DeFi systems.

The first iterative product of DeFi x AI is called "abstraction layers," allowing users to directly prompt the desired results through a ChatGPT-like interface.

This was an "aha moment" for many, as DeFi itself is very complex—users need to find the right bridging tools to transfer assets or fuel fees, understand how top decentralized exchanges (DEXs) and lending protocols operate on new chains, and grasp the nature, risks, and underlying assets of the protocols.

Tools that can help users quickly achieve the desired results seem to be the perfect first step towards making DeFi more accessible.

While it sounds great in theory, the integration in reality faces numerous challenges. Most DeFAI solutions either have significant vulnerabilities or are very difficult to use. User interface and user experience (UI/UX) issues can be frustrating, with users unsure how to input prompts or even what can or cannot be input.

As a result, most projects failed, leaving only a few players to pivot or continue to delve deeper.

@HeyAnonai was once a top DeFAI project but has now pivoted to a trading assistant and prediction market tool.

@griffaindotcom has not updated on the X platform since April and is suspected to have disappeared.

Those who persist and double down

@AIWayfinder continues to maintain its original terminal/ChatGPT-style interface and has expanded its functionality to include perpetual contract trading, DeFi strategies, predictions, and more.

@bankrbot remains focused on becoming a terminal-based co-pilot, helping users with trade execution, research, and analysis.

@Infinit_Labs focuses on executing DeFi strategies while introducing crowd-sourced/creator-driven DeFi strategies (becoming a hub for users to curate and/or invest in top DeFi strategies).

The first iterative product of DeFAI failed to achieve product-market fit (PMF) in 2025, but some of these projects may succeed in helping newcomers navigate the on-chain environment more easily.

The failure of the first-generation products to find PMF prompted the rise of second-generation DeFAI projects known as "autonomous yield agents." The core of these projects is that users no longer need to think about how to input prompts, which strategies to execute, when to rebalance, and which strategy to choose next; instead, autonomous agents handle all this heavy lifting for users.

This model offers a "set it and forget it" simple experience, allowing users to delegate all complex operations to personalized intelligent agents. @gizatechxyz was the first project to popularize this model, equipping its agent system with numerous safety measures (e.g., smart wallets with preset permissions that clearly define executable and non-executable actions and interactive protocols. Additionally, a session key mechanism was introduced, allowing agents to access necessary permissions for a limited time to complete tasks).

This time, the initial product-market fit was validated—Giza successfully managed approximately $30 million in assets under agent (AuA) and generated over $3 billion in trading volume on top lending protocols. Following closely, the second-tier project @ZyfAI_ also achieved significant growth, reaching approximately $8 million in AuA and about $1.1 billion in trading volume.

However, challenges remain. Large capital, institutional funds, and significant investments remain cautious about entrusting hundreds of millions to autonomous agents, primarily due to concerns over "black box operations," potential erroneous decisions (such as AI "hallucinations"), and other issues.

It is against this backdrop that the third generation of DeFAI emerged, known as "AI Vaults." This model utilizes a group of specialized intelligent agents to quickly generate and optimize DeFi smart contracts. @almanak was the first to realize that this architecture could combine the advantages of both models.

In this model, the core of the strategy remains DeFi smart contracts. These contracts are generated by intelligent agents within minutes through "vibe-code," significantly reducing the time required for quantitative analysts and fund allocators to create complex strategies. These contracts are auditable, with all content remaining open and transparent, similar to traditional DeFi contracts, which have been market-tested for years and are therefore more secure.

DeFAI Outlook

DeFAI is gradually evolving towards optimizing AI systems to support DeFi, with its main iterations including:

Abstraction layers—lowering the barrier to entry, helping new users interested in trading and DeFi yield mining to get started quickly.

Autonomous agents—assisting users in managing "set it and forget it" DeFi strategies, simplifying operational processes.

AI vaults—providing on-chain capital allocators with more efficient strategy-building tools, significantly enhancing efficiency.

In the future, these three directions may continue to optimize for their respective target user groups, and we can also expect major DeFi protocols, wallet service providers, and centralized/decentralized exchanges (CEXs/DEXs) to gradually adopt these products to improve users' DeFi experience.

Trends Worth Watching but Still in Early Stages

Trading agents: Currently, most dApps either provide market analysis features or are "black box" AIs for user trading, while products that can offer users a full-featured end-to-end solution from zero to one are not yet mature. @Cod3xOrg provides the most comprehensive solution, but its UI/UX still needs optimization to meet the needs of everyday users.

Dynamic DeFi: Utilizing machine learning systems to make DeFi strategies more dynamic, achieving better risk-adjusted returns. @AlloraNetwork is currently the only project exploring this area, but it is still in a very early stage.

The Rise, Fall, and Reemergence of AI Intelligent Agents

The narrative of AI agents was first led by @virtuals_io at the end of 2024, officially entering the public eye by combining AI applications/products with fair-launched tokens.

This narrative emerged at a timely moment when the market was fatigued with low liquidity, high fully diluted valuation (FDV) venture tokens, and the combination of high liquidity, low FDV fair-launched tokens with the right narrative was the antidote.

The first generation of AI agents was primarily entertainment and "alpha" agents. For example, @truth_terminal drove the emergence of numerous AI agents on the X platform (commonly referred to as "slops"), which would chat and respond to users all day. Initially, they were mainly for pure entertainment but gradually transformed into more useful tools (e.g., sharing market analysis, token analysis, etc.). Among them, @aixbt_agent became a standout in this field, winning users' affection with a humorous yet professional "degen" persona.

With the rapid proliferation of "slops," the demand for development frameworks surged—these middleware solutions helped developers easily build AI agent workflows on the X platform. ElizaOS (originally named AI16Z) quickly became a household name, launching the largest open-source AI wave in crypto history. This further spurred the emergence of more AI agents but also led to user fatigue on Crypto Twitter (CT).

By 2025, the narrative around AI agents began to cool, primarily due to a lack of practical utility and overhyped valuations.

It is worth noting that the actual definition of AI agents is an application that can:

Extract information from a constantly changing and unstructured environment;

Reason about the information based on objectives;

Discover patterns in data and learn how to leverage those patterns;

Execute operations that even their owners may not have considered.

(Thanks to @almanak for providing the precise definition.)

The initial AI agent products were not true "AI agents" in the real sense; they were more like eye-catching AI workflows or applications that amazed first-time viewers.

However, as people gradually became aware of this, attention began to shift towards other narrative directions, such as DeFAI (Decentralized Finance and AI), DeAI (Decentralized AI), robotics, and even completely outside the realm of Crypto x AI.

Things changed between October and November 2025. The payment standard x402 developed by Coinbase began to gain favor among enterprises, with giants like Google and Cloudflare also adopting it. An increasing number of Web3 developers started experimenting with x402, giving rise to many refreshing applications, such as token issuance linked through x402 or on-demand payment microservices based on x402.

Meanwhile, the Ethereum Foundation increased its investment in AI, and the ERC-8004 standard gradually gained popularity. This standard created a decentralized "trust layer" for autonomous AI agents, granting them verifiable identities, reputations, and proof of work, enabling them to reliably discover, collaborate, and transact without centralized institutions. The Ethereum Foundation also established the Ethereum dAI team to specifically support AI agent teams using ERC-8004.

The emergence of x402 and ERC-8004 once again filled the market with expectations for the narrative of AI agents, but due to fluctuations in the macroeconomic environment, this enthusiasm and market uptrend did not last long.

Nevertheless, @virtuals_io remains the leading hub for AI agents, but so far, we have not seen any application or agent that has emerged from this narrative to achieve significant user volume or revenue.

Perhaps 2026 will see such a breakthrough agent, or perhaps it will not. My prediction is that breakthrough agents may first appear in other narrative areas, particularly DeFAI and DeAI.

Regardless, frameworks and standards like x402, ERC-8004, and ACP (provided by Virtuals) will shape the future of the on-chain AI agent economy in 2026.

Decentralized AI: The True Product-Market Fit (PMF) for Crypto x AI

Since 2023 (or even earlier), decentralized AI (DeAI) has been a potential direction in the Crypto x AI narrative. Building distributed systems through blockchain and tokens, allowing humans and machines to jointly contribute work and resources, is undoubtedly a vast prospect.

In reality, we find many underutilized resources:

GPUs, gaming chips, and edge devices (like work laptops and phones) may be idle for more than half the time;

Engineers and data scientists in India, Pakistan, and the Philippines, despite their excellent skills, lack opportunities to enter top tech companies and cutting-edge AI labs;

Investors worldwide wish to support early-stage startups to drive the next generation of AI innovations that change the world, but they may not have access to companies in YC (Y Combinator) and Silicon Valley.

This is precisely where decentralized AI comes into play. Through coordination layers and "Darwinian AI" ecosystems, various resources can be integrated, allowing stakeholders to contribute to the development of open-source and decentralized AI in their own ways.

A developer from Pakistan can train the most accurate ETH price prediction model and reap substantial rewards;

An investor from Iceland can invest in a $20 million startup focused on innovations in reinforcement learning;

A gamer from Mongolia can contribute their idle GPU resources to support AI model training.

Such examples are numerous.

The year 2025 was a significant year for decentralized AI (DeAI). During this year, countless research papers and experiments emerged in areas such as decentralized training, reinforcement learning, federated learning, privacy protection, verification technology, and security. @MessariCrypto provided in-depth coverage of these advancements in its "2025 AI State Report," which friends who haven't read it can check out.

Highlights of the Year

- Bittensor (@opentensor) Consolidated Its Leadership in the Decentralized AI Ecosystem

Bittensor successfully solidified its position as the leader of the decentralized AI ecosystem, becoming an important hub for many unique AI startups (subnets). There are now 128 subnets, each innovating and researching in different fields. Bittensor promotes innovation by subsidizing the operational and capital expenditures of AI development through coordinated incentive mechanisms. Its "Darwinian AI" concept (driving development through competitive incentives and innovation competition) has also inspired many other projects.

- Decentralized Reinforcement Learning (RL) Achieved Scalability

Decentralized reinforcement learning technology has proven capable of large-scale applications. Reinforcement learning is typically used to optimize models, making them smarter through self-learning and self-play. Several decentralized AI labs, such as @gensynai, @NousResearch, @PrimeIntellect, @Gradient_HQ, and @Pluralis, have made progress in the field of reinforcement learning. Once commercialized, this technology has the potential to provide enterprises with highly intelligent domain-specific solutions, such as sales/customer service agents, logistics/supply chain agents, legal, finance, and more.

Enhancing AI Transparency and Compliance

To gain the trust of enterprises, governments, and traditional financial institutions, AI must no longer be a "black box" but rather a more deterministic and compliant tool. The following technologies are gradually being adopted:

TEE (Trusted Execution Environment) for hardware security (@PhalaNetwork);

AI Output Verification technologies, such as zkML, opML, EigenAI (@eigencloud);

Privacy Data and Computing technologies (@vana);

Federated Learning (@flock_io), training AI while keeping data localized and private.

The Rise of Multi-Agent Systems (Swarm)

The emergence of multi-agent systems has increased the demand for coordination and orchestration. Standards like MCP (Multi-Agent Communication Protocol) facilitate integration, while orchestration layers enable multiple agents to work together, providing users with more complex AI workflows. Related projects like @questflow and @openservai are driving development in this direction.

All these advancements point to a future where both domain-specific application scenarios and crypto-native use cases (such as DeFi, trading, prediction, on-chain operations) will be able to execute and scale in a safer and more efficient manner. The risks of AI vulnerabilities, loss of control, and "hallucination" issues will be significantly reduced.

Outlook for Decentralized AI (DeAI)

An increasing number of startups from Y Combinator (YC) and Silicon Valley are choosing to develop open-source models and adopt decentralized computing, a trend that is accelerating. Inference service providers like @chutes_ai are already supporting billions of token processing volumes daily, and this trend is expected to continue into 2026.

Decentralized AI will drive the emergence of AI agents that are commercially viable and applicable to traditional enterprises.

Moreover, its infrastructure will support the growth of yield farming, trading, and prediction agents, becoming a core pillar for DeFi protocols, prediction market platforms, centralized exchanges (CEX), and mainstream wallet services.

For those who want to delve deeper into decentralized AI, you can read the following articles:

From Closed AI to Open Source AI to Decentralized AI ➔ Trends Driving DeAI Development

How Decentralized AI Competes with Centralized AI ➔ Decentralized Training and Reinforcement Learning (RL)

The Economies of Scale in Decentralized AI ➔ Network Effects of DeAI

The Rise of Prediction Markets and AI

With the rise of prediction markets, machine learning systems have found an excellent application scenario—not only to predict event outcomes but also to make directional bets and provide liquidity in prediction markets.

Among these, the popularity of the latter is continuously rising. Several subnets of Bittensor, such as @sportstensor, @SynthdataCo, @webuildscore, and @sire_agent, are developing machine learning systems capable of predicting the prices of cryptocurrencies like BTC, ETH, and SOL; developing prediction market yield vault products to allow users to bet and generate returns.

Sportsensor: Became the official liquidity provider/market maker for @Polymarket earlier this year, focusing on the sports and esports markets.

Synth: Publicly predicted on Polymarket, achieving over 20 times returns in just two months, growing capital from $3,000 to $60,000, with significant success due to its accurate prediction signals.

Sire: Achieved a weekly investment return rate of 5%-10% through its prediction market yield vault product.

We are also seeing more and more Darwinian AI projects beginning to explore this field, delving into the deep integration of prediction markets and artificial intelligence.

- @AlloraNetwork: Making DeFi More Dynamic

AlloraNetwork utilizes machine learning systems provided by a network of contributors to predict asset prices and volatility. These price and volatility models can be integrated into smart contracts, becoming AI Oracles, enabling dynamic strategy adjustments based on predictions. For example:

Automated leverage and deleveraging cycle strategies;

AI-managed CLAMM strategies (Concentrated Liquidity Market Making);

Delta-neutral strategies (risk hedging). These features significantly enhance the flexibility and efficiency of DeFi.

- @crunchDAO: The Supply Side of Darwinian AI

crunchDAO focuses on the supply side of Darwinian AI, attracting high-quality engineers, data scientists, and talent to participate and contribute to machine learning subnets (like Synth). By mining and optimizing these subnets, it drives the enhancement of AI predictive capabilities.

- @FractionAI_xyz: Enhancing AI Agent Capabilities through Competitions

FractionAI promotes the fine-tuning and expansion of domain-specific AI agent capabilities through real competition environments. They have launched agent-centric "Spaces," which are games that allow AI agents to continuously improve. The most notable projects include:

ALFA: Humans can bet on trading duels between agents;

StableUp: AI agents for stablecoin yield farming.

In addition to the booming prediction markets, Bittensor's competition activities and @the_nof1 trading competitions have injected strong momentum into this field, further promoting the rapid growth of prediction markets x AI.

Outlook for Prediction Markets x AI

With the development of large language models (LLMs) and AI workflows, AI terminals, copy-trading in prediction markets, data analysis, and signal tools will become more widespread. These tools will greatly simplify the research and acquisition of information, providing traders in prediction markets with more advantages (edge). Among them, @Polysights remains a leader in mining internal signals.

APIs for prediction markets and yield vault products that allow users to "set up and profit automatically with one click" will also become more widely available, offering users more opportunities to experiment.

Despite the bright prospects, prediction markets still face two major challenges:

Insufficient Liquidity: Prediction markets are relatively small in scale, and liquidity is scarce;

Edge Decay: As the scale of betting increases, trading advantages quickly disappear.

Therefore, machine learning systems focused on arbitrage and providing liquidity (for example, liquidity mining through limit orders in Yes/No markets) may become the most successful products in prediction markets in 2026. As prediction markets attract significant capital, the value of point rewards and airdrops will be worth exploring, similar to the early performance of Hyperliquid in the perpetual contract space.

The Future of Decentralized AI and Finance

In all fields, there is a common trend—the narratives that survive are those projects with real users, actual utility, and economic alignment.

Decentralized Finance AI (DeFAI) will gradually mature, evolving into a three-layer architecture:

Abstraction Layer

Automation Layer

AI Agent-Driven Strategy Creation Layer

It will quietly become the entry and execution layer for millions of users accessing on-chain finance, many of whom may not even realize they are using cryptographic technology.

The previously overhyped AI agents will rise again as verifiable economic participants.

This transformation is aided by standards that grant AI agents identity, reputation, and deterministic behavior, which are currently being actively developed and supported by institutions such as the Ethereum Foundation, Coinbase, Google, and Cloudflare.

Decentralized AI (DeAI) remains the most important structural pillar. Networks that can stand out in the following areas will become long-term winners:

Efficiently coordinating computing resources

Attracting and retaining global developer talent

Verifying results and provenance

Providing enterprise-level reliability

As the market deepens, tools continue to optimize, and machine learning-driven liquidity becomes a sustainable source of income, prediction markets x AI will continue to expand. However, liquidity constraints and edge decay will remain fundamental challenges faced by any participants attempting to scale capital.

Overall, these trends indicate that the entire industry is shifting from narratives to infrastructure, from speculation to systematic solutions, and from hype to actual products. The year 2026 will become a pivotal year when crypto-native AI products start to become indispensable.

If you are new to Crypto x AI, it is recommended to read this Beginner's Guide to quickly understand the latest developments in this field.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。