04. Typical Cases: Practical Verification of Decision-Making Logic

This article effectively responds to the layout logic of international leading brokerages, Hong Kong brokerages, and mainland brokerages regarding public chains, as discussed in Chapter Three, through the examples of JPMorgan Chase, CMB International, and Huatai Securities. The specific analysis is as follows.

4.1 Self-Research Evolution Case: JPMorgan Chase's "Private Chain - Alliance Chain - Layer 2" Path

4.1.1 Private Chain Stage Mainly Focuses on Business Exploration

In the early stages of blockchain technology, JPMorgan Chase first chose the research and development model of a private blockchain. The core goal of this stage is to reduce innovation risks while ensuring data security and privacy. Through the private chain, JPMorgan Chase can conduct experiments such as transaction settlement, asset custody, and smart contract testing in a closed internal environment, ensuring that new technologies do not have uncontrollable impacts on core business systems.

JPMorgan Chase's private chain model mainly focuses on three core aspects: security and privacy control, performance and scalability, and business model validation: all nodes are controlled internally by the bank, ensuring that transaction data and sensitive information are not accessible externally; at the same time, the internal-only nature allows the private chain to achieve a high TPS (transactions per second) to meet the needs of large payments and transaction settlements; additionally, the bank can also validate the automation potential of complex business processes such as cross-border payments, internal clearing, and derivatives trading through the private chain, laying the foundation for future external expansion. Under the private chain model, JPMorgan Chase mainly focuses on the following aspects:

JPMorgan Chase's "JPM Coin" is one of the exploration results of this stage. It is a digital currency built on Quorum (JPMorgan Chase's open-source enterprise version of Ethereum) private chain, used to optimize cross-border payments and instant settlements, significantly improving the efficiency of fund flow.[24]

4.1.2 Alliance Chain Stage Mainly Focuses on External Collaboration and Standardization

After successfully validating the private chain, JPMorgan Chase expanded the application of technology to cross-institutional scenarios, entering the alliance chain stage. The core practices of JPMorgan Chase in the alliance chain model include interbank settlement and clearing, standardization of smart contracts, and compliance assurance: achieving real-time settlement and asset transfer among multiple banks through the alliance chain, reducing intermediaries and enhancing transparency; simultaneously, reusable smart contract templates are established on-chain to reduce technical friction in multi-institution collaboration; in addition, it can also meet regulatory requirements of different jurisdictions through node permissions, data sharding, and auditing mechanisms. In the alliance chain model, JPMorgan Chase's practices include:

The application of the Quorum alliance chain further reflects JPMorgan Chase's strategic approach to technological evolution. By extending the successful experience of the internal private chain to external partners through the alliance chain, it achieves business scalability and gradually shapes the blockchain standards in the financial industry.

4.1.3 Layer 2 Architecture Self-Research Stage Emphasizes Scalability and Accessibility

With the development of the blockchain ecosystem and the rise of DeFi and digital asset markets, JPMorgan Chase realized that solely relying on private chains and alliance chains would be insufficient to meet larger-scale transaction and innovation demands. Thus, its technological strategy evolved to the Layer 2 (second-layer expansion solution) stage[25]. The core value of Layer 2 is to achieve efficient transaction processing on top of the main chain (Layer 1) while maintaining security and final settlement capabilities of the main chain.

The core R&D points of JPMorgan Chase in the Layer 2 stage include high-performance transaction processing, compatibility with public chains, and controllable compliance and regulation: achieving high TPS transactions through technologies such as state channels and Rollup to reduce on-chain congestion and transaction fee costs; at the same time, Layer 2 can connect to public chains or alliance chains, providing broader liquidity and cross-ecosystem access for its financial products; additionally, necessary permission controls and auditing capabilities can still be retained on Layer 2 to meet compliance requirements of different countries and regions.

This Layer 2 architecture can not only support high-frequency businesses such as cross-border payments, digital asset trading, and securities settlement but also provides technical preparation for potential applications of digital renminbi or central bank digital currencies (CBDC). JPMorgan Chase's Layer 2 evolution demonstrates its proactive embrace of the blockchain open ecosystem while maintaining financial security and regulatory compliance, achieving a balance between innovation and stability.

4.2 Alliance Chain Cooperation Case: Huatai Securities' Quality Evaluation of Investment Banking Business Submitted to the China Securities Association

4.2.1 Case Background

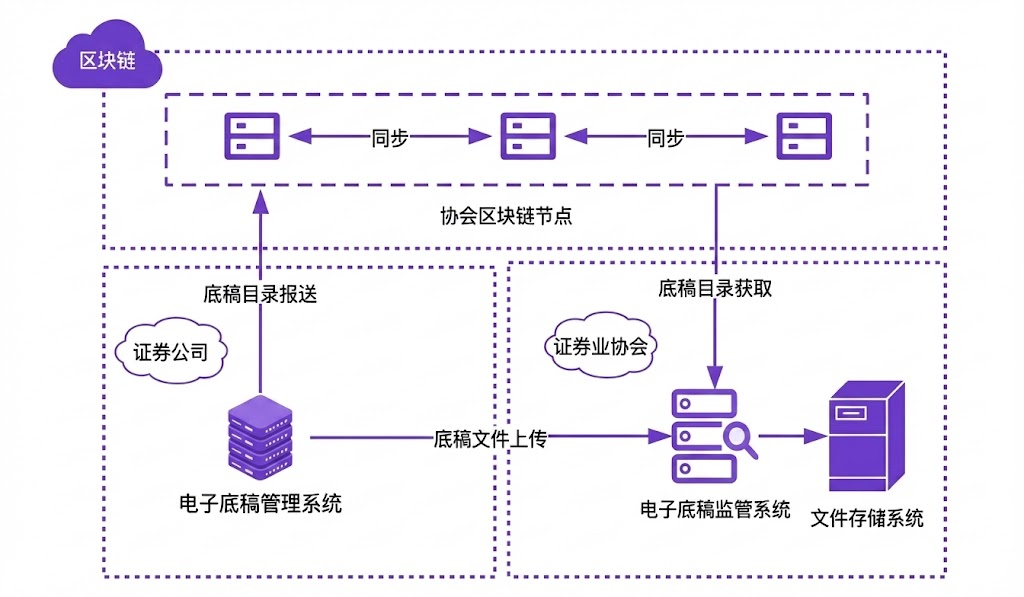

The China Securities Association launched a self-regulatory supervision platform for investment banking business[26], covering five major functions: management of electronic draft directories for investment banking business, random checks of electronic drafts, management of investment banking business activities, management of information on the professional conduct of sponsoring representatives, and quality evaluation of investment banking. Brokerages can submit investment banking business data to the China Securities Association through the "Zhenglian Chain" blockchain infrastructure. The investment banking self-regulatory supervision platform is integrated based on the draft supervision system and quality evaluation system, gathering five core functions, including supporting the management of electronic draft directories for investment banking, random checks of electronic drafts, management of investment banking business activities, management of information on the professional conduct of sponsoring representatives, and quality evaluation of investment banking.

Source: "Guidelines for the Construction of Electronic Management Systems for Investment Banking Drafts of Securities Companies"

According to the consultation draft, the submission method for draft directory information has been modified to interact directly with Zhenglian Chain nodes or IPFS (InterPlanetary File System), with some project information fields and project member information being streamlined, while the structure requirements for the submitted draft directory remain unchanged. Brokerages are required to submit projects contracted from January 1, 2021, in accordance with the "Guidelines for the Construction of Electronic Management Systems for Investment Banking Drafts of Securities Companies" [27], with the types of submitted projects detailed in the data dictionary. Brokerages are allowed to prioritize submitting draft directory information before submitting complete project information.

Huatai Securities actively responded to the call of the China Securities Association and participated in the "Securities Industry Alliance Chain" project launched by the association, aiming to enhance the technological regulatory capabilities of the securities industry through blockchain technology, promote digital transformation, and form a co-built, co-governed, and shared industry digital ecosystem. The quality of investment banking practice is one of the important standards for measuring the capabilities of securities companies in investment banking. To adapt to the needs of the registration system reform and implement the relevant requirements of the China Securities Regulatory Commission, the investment banking cloud business system was the first to join the Zhenglian Chain application in 2022, completing the connection between the quality evaluation system and the Zhenglian Chain. By utilizing the traceable and tamper-proof characteristics of blockchain technology, the self-evaluation information of practice quality is submitted to the China Securities Association according to standards, enhancing the transparency and efficiency of regulation.[28]

4.2.2 Innovative Achievements

Huatai Securities deployed nodes of the securities industry alliance chain and IPFS nodes in its internal data center to join the Zhenglian Chain network. The investment banking business system only needs to connect to internal nodes to submit data in real-time, constructing a blockchain-based penetrating regulatory model, achieving electronic archiving of the entire chain and full cycle of investment banking business regulation, ensuring traceability throughout the process, and realizing automated collection functions through technologies such as full-process robotic automation, effectively improving the usability of the company's investment banking business evaluation system and enhancing submission efficiency.

In terms of business innovation, this system effectively utilizes the automatic collection function and reasonably sets system verification rules to avoid the work model of purely manual reporting, uploading, and checking whether documents are complete and pass verification, significantly improving the consistency and accuracy of relevant information and the completeness of draft documents, reducing the risk of regulatory penalties due to missing draft documents. After the project went live, a total of over 900 projects were submitted throughout 2023, completing submission tasks more than 1,500 times, greatly improving submission efficiency and regulatory effectiveness compared to traditional methods.

4.2.3 Industrial Value

This system is a case of financial institutions submitting evidence of business to regulators, applicable to scenarios with a need for improved regulatory efficiency, addressing pain points such as untimely, inaccurate, and non-standard submissions. The functions of this system can meet the quality evaluation standards required by the China Securities Association, filling the gap in the online collection, review, and submission of investment banking personnel to the association, saving manpower for project team members and quality control reviewers. At the same time, it can effectively save time costs for financial institutions and regulatory departments, improving the accuracy and timeliness of obtaining various quality evaluation data and documents, and enhancing submission efficiency.

4.3 External Selection Case: CMB International and Solana Cooperation on Tokenized Fund

4.3.1 Background and Demand

On August 8, 2025, CMB International, a subsidiary of China Merchants Bank, announced its collaboration with Singapore's digital exchange DigiFT and Solana public chain service provider OnChain to tokenize a US dollar money market fund recognized in both Hong Kong and Singapore, issuing the token CMBMINT on-chain. Notably, this is the first tokenized fund to appear across multiple jurisdictions, and its issuance by a financial giant in Asia will provide a good compliance model for future multi-regional cooperation on RWA.[29]

Behind this fund tokenization project is a collaboration of multiple forces from traditional finance and the blockchain field. CMB International Asset Management provides quality fund assets and regulatory compliance assurance, DigiFT offers on-chain issuance and trading platforms, and OnChain is responsible for underlying technology deployment and public chain distribution support, with the three working together to achieve the on-chain issuance of traditional money funds.

4.3.2 Business Analysis

The tokenized asset is the CMB International US Dollar Money Market Fund (CMBMINT), a dollar-denominated money fund established in February 2024, with 70% of its funds invested in low-volatility instruments such as short-term high-quality US dollar deposits, treasury bills, and commercial paper, and 30% invested in non-dollar-denominated short-term deposits and high-quality money market instruments, overall pursuing capital preservation and stable returns.

Since its establishment, the fund has performed excellently, ranking first among similar money funds in the Asia-Pacific region according to Bloomberg as of July 31, 2025. As it is a Hong Kong-Singapore mutual recognition fund, the fund is subject to regulation in both regions, and its investors are classified as qualified professional investors. Therefore, the project initially limits subscriptions of fund tokens to recognized investors in Singapore through the DigiFT platform to ensure that participants meet local regulatory requirements (in the future, depending on the degree of regulatory openness, it may expand to institutional clients in Hong Kong and other jurisdictions).

OnChain embedded the entire tokenization process into its self-developed on-chain capital market infrastructure, providing comprehensive technical support. First, in terms of compliance architecture and asset tokenization security, OnChain introduced a "transfer hook" mechanism based on the Solana Token-2022 standard, ensuring that fund tokens can only be redeemed through contracts, eliminating private transfers, thereby strengthening transaction compliance.

At the same time, it adopts a dual-standard architecture of SPL and Token-2022, ensuring compatibility with other on-chain assets while possessing flexible liquidity programming capabilities, and avoids traditional fund settlement delays through a real-time net value anchoring mechanism. Secondly, in the subscription and redemption stages, OnChain has built a full-link security protection system, isolating core functions such as fund management, liquidity pools, and token minting into different PDA addresses to prevent single-point risks. A whitelist mechanism strictly limits key operation executors, including fund company access and large transaction approvals. Additionally, real-time asset and permission scanning, bidirectional net value calculation, and net value update time restrictions are introduced throughout the entire link to ensure price stability and account accuracy.

Finally, in liquidity management, OnChain has designed a layered liquidity architecture, with an independent redemption pool (redeemcashpool) specifically to meet immediate redemption needs, avoiding liquidity runs; at the same time, it provides both instant and delayed redemption modes, intelligently allocating based on the liquidity status within the pool, and ensuring principal safety through a multi-account asset isolation mechanism even under extreme market conditions, thus achieving an almost T+0 fund arrival experience.

4.3.3 Industrial Value

As the on-chain version of the Hong Kong-Singapore mutual recognition fund, CMBMINT adopts an innovative and robust model in its regulatory compliance architecture, with the fund itself still under the supervision of the Hong Kong Securities and Futures Commission and the Monetary Authority of Singapore (through the mutual recognition mechanism), while the issuance and trading of tokens are conducted on the platform of the licensed institution DigiFT in Singapore. This "dual-regulation" structure ensures that both the underlying assets and the trading environment are in a legal and compliant state. At the same time, the smart contracts of the fund tokens have undergone strict security audits and introduced risk reserves and proof of reserves mechanisms, ensuring that on-chain assets are secure, transparent, and adequately supported.

4.4 Ant Group Case: Full-Stack Layout from Alliance Chain to Public Chain Services

4.4.1 AntChain: Reconstructing Supply Chain ABS with "Dual Chain Connection"

In the mainland market, AntChain has reconstructed the trust mechanism of traditional supply chain finance through the "Dual Chain Connection" platform, effectively addressing the pain points of rights confirmation and circulation difficulties faced by small and medium-sized enterprises. The core of this model lies in utilizing alliance chain technology to transform the credit of core enterprises into divisible and transferable digital debt certificates, enabling the integration of capital flow, information flow, and logistics on-chain, compressing the financing efficiency of end enterprises in the supply chain from traditional months to seconds. For brokerage investment banks, this architecture significantly reduces the due diligence costs in asset securitization (ABS) business, ensuring the authenticity of the trading background of underlying assets through the immutability of on-chain data, achieving a transition from entity credit to on-chain digital credit.

Additionally, AntChain has built a "trust base" connecting the physical world and digital finance through the integration of "IoT + blockchain" in its technical architecture. By embedding the "AntChain Inside" module, operational data of physical assets (such as photovoltaic panels, charging piles, and storage equipment) can be uploaded to the chain in real-time, ensuring the uniqueness and real operational status of the underlying assets. A typical case is Ant Group's collaboration with GCL-Poly Energy to promote energy intelligence, achieving the digitization and valuation of photovoltaic assets through blockchain technology, successfully supporting related RWA financing projects, and providing a solid technical path for brokerages to develop innovative ABS businesses based on IoT data.

4.4.2 Jovay: RWA Dedicated Compliance Layer 2

From its inception, Jovay has adopted an "institution-level compliance" positioning, not issuing native tokens, thereby eliminating traditional financial institutions' compliance concerns regarding cryptocurrency-related businesses. It aims to address the high gas fees and congestion of the Ethereum mainnet by providing financial-grade high concurrency processing capabilities and deterministic settlement services, offering an efficient and controllable on-chain execution environment for institutions to issue and manage real-world asset tokens.

In the "Two Chains and One Bridge" strategic framework, Jovay plays a key role as a "fund and transaction hub." It seamlessly connects with the mainland's AntChain (asset chain) through a trusted cross-chain bridge, allowing IoT-verified physical assets to be mapped as digital assets on the Jovay chain, directly connecting to the liquidity of the global Web3 market. In the case of green financing for Towngas, Jovay successfully supported the RWA tokenization issuance of energy assets, with its sub-second transaction confirmation speed and atomic settlement capability ensuring the precise execution of complex financial instructions, providing the core trading infrastructure for brokerages to conduct cross-border asset securitization.

4.4.3 ZAN: Focused on Web3 Compliance Infrastructure Services

For the Hong Kong and overseas markets, Ant Group has launched the compliance-oriented Web3 technology brand ZAN, whose strategic positioning is not to replicate the construction of underlying public chains but to serve as an infrastructure provider connecting traditional finance and the Web3 ecosystem. Given the stringent requirements of Hong Kong regulators regarding virtual asset trading platforms (VATP) and RWA businesses in terms of anti-money laundering and fund traceability, ZAN encapsulates Ant's accumulated identity verification and risk control capabilities in traditional finance into standardized services, providing institutions with a one-stop compliance solution that includes electronic identity verification (eKYC), on-chain transaction anti-money laundering (KYT), and smart contract auditing, helping financial institutions safely access the public chain ecosystem without touching the underlying complex technology.

In specific business practices, ZAN's technical services have become an important bridge connecting high-quality assets in the mainland with overseas funds. In RWA scenarios, ZAN assists institutions in mapping physical asset data from the mainland (such as operational data of new energy facilities) to Hong Kong within a compliance framework, supporting the tokenization issuance of assets and cross-border financing. At the same time, as a technical partner, ZAN actively supports the compliance construction of mainstream licensed virtual asset exchanges in Hong Kong by providing high concurrency, low latency node services and full-link security protection, effectively lowering the technical threshold and compliance risks for institutions to engage in Web3 innovative businesses.

4.4.4 Analysis of the Advantages of Ant Group's Technology Selection

The core advantage of Ant Group's technology selection lies in its construction of a "Two Chains and One Bridge" strategic synergy capability, perfectly matching the urgent need for brokerages to conduct cross-border business under dual regulatory environments. On the mainland side, its self-developed alliance chain architecture fully supports national secret algorithms and trusted innovation standards, ensuring that supply chain finance and draft storage business comply with the requirements of the "Data Security Law"; on the Hong Kong side, its compliance components can seamlessly connect with mainstream public chain ecosystems such as Ethereum. This closed-loop architecture of "assets in the mainland, funds outside" allows brokerages to compliantly utilize high-quality physical assets from the mainland while connecting to global liquidity through Hong Kong, avoiding the regulatory fragmentation risks that a single technical path may face.

From the perspective of underlying technical performance and security, AntChain possesses high concurrency processing capabilities validated by massive transactions during "Double Eleven," capable of supporting financial-grade high-frequency settlement needs, addressing the performance bottlenecks of traditional blockchains. At the same time, its unique "IoT + blockchain" full-stack technical capability can provide penetrating trust assurance for brokerages' RWA businesses, from physical hardware to on-chain assets, making it more difficult to forge or tamper with compared to purely software-based public chain solutions. This "hard technology" barrier, combined with a deep financial risk control gene, gives Ant Group's technology solutions a natural competitive advantage and compliance premium when facing complex financial scenarios that require penetrating regulation.

05. Core Technical Points of Public Chain Layout Related Business Practices of Domestic and Foreign Brokerages

From Chapter Two to Chapter Four, this article first analyzes the theoretical logic of brokerages laying out blockchain businesses, thoroughly studying the regulatory guidance and framework for public chain layouts of brokerages in the mainland and Hong Kong. Subsequently, based on the aforementioned theory + regulatory policy analysis, combined with brokerage business, it provides the decision-making logic for domestic and foreign brokerages' public chain layouts.

To supplement the subsequent practical details, this article focuses on discussing in Chapter Five: if relevant brokerages and blockchain technology developers need to lay out such businesses, the key R&D directions and technical details that need to be emphasized during the specific business development process.

5.1 Domestic Brokerages: It is Recommended to Focus on Electronic Evidence and Transaction Traceability as Two Alliance Chain Business Directions

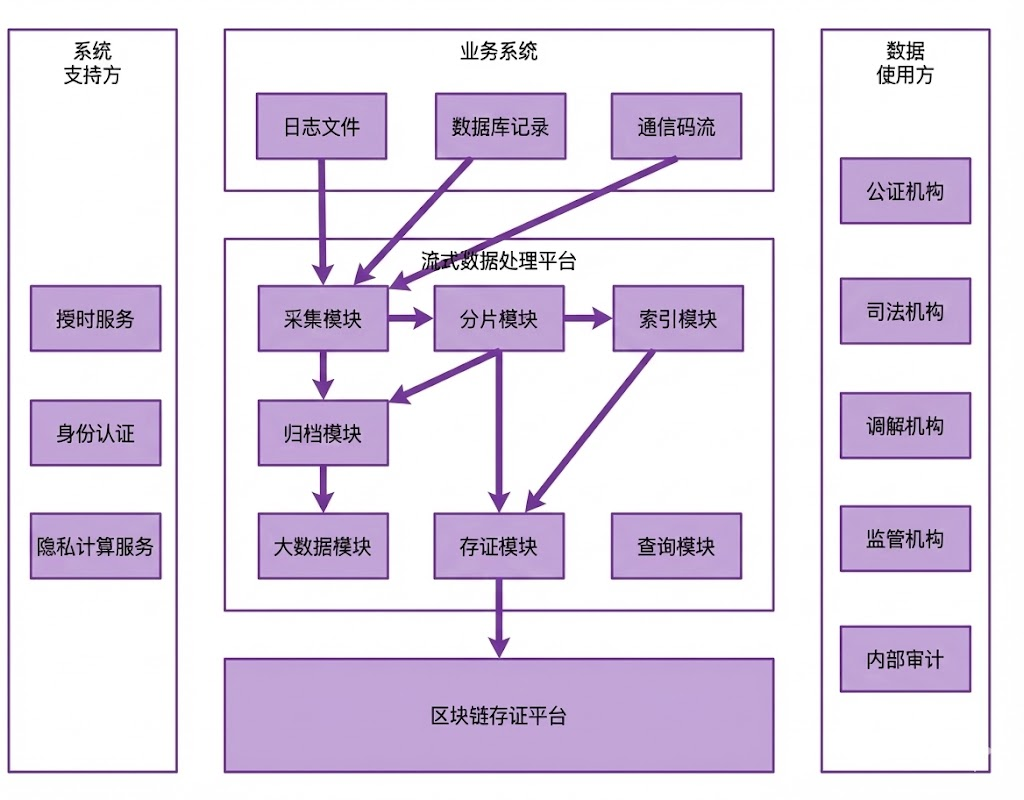

Under the policy frameworks such as the "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry" (T/SAC 004-2024), "Guidelines for the Construction of Blockchain and Distributed Ledger Technology Standard System" [30], and "Evaluation Rules for Financial Applications of Blockchain Technology" [31] (JR/T 0193-2020), the public chain layout of brokerages should prioritize "compliance first, scene landing," among which electronic evidence and transaction traceability are the most urgent compliance needs internally. These two types of scenarios need to closely align with policy technical requirements and business operational pain points, refining landing details from dimensions such as technology selection, process design, privacy protection, and audit traceability, ensuring compliance with regulatory norms while solving practical business problems.

5.1.1 Electronic Evidence: Core Landing with "Compliance Verifiable, Security Controllable"

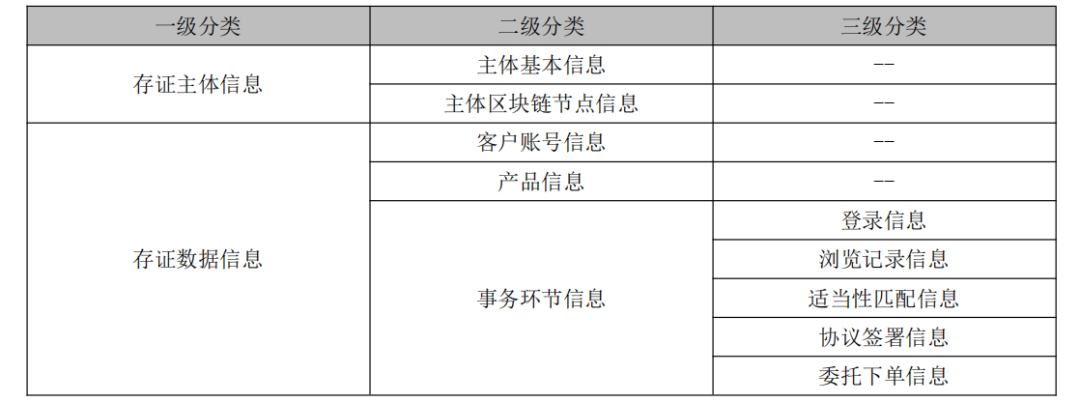

Electronic evidence is the foundational scenario for brokerage compliance, covering key data such as investment banking drafts, client agreements, and transaction vouchers, with policies clearly requiring it to meet three core objectives: "tamper-proof, traceable, and privacy protection." In practice, the landing details need to be broken down from three levels: technical architecture, process design, and compliance verification:

(1) Technical Architecture Level

Policies clearly state that brokerages' evidence storage must use an alliance chain, and nodes must have "authorized access." In practice, this alliance chain node should include three core roles. The core nodes are the brokerage headquarters and various local branches, responsible for uploading business data to the chain and participating in consensus, with node access requiring "qualification review + technical verification." The credibility nodes need to connect with local courts, notary offices, and judicial appraisal centers, synchronizing on-chain evidence data in real-time, using dedicated encrypted communication to ensure that the evidence data has judicial effectiveness. Regulatory nodes need to reserve access interfaces for the Securities Regulatory Commission and local securities regulatory bureaus, supporting real-time queries of evidence data by regulatory departments, with interface calls requiring two-factor authentication.

In terms of cryptographic algorithms and key management, compliance algorithms + hardware security storage are emphasized. Policies require that cryptographic algorithms comply with GM/T 0111-2021, and in practice, algorithm selection and key control need to be refined. Data hashing should use the SM3 algorithm to process evidence data (such as investment banking draft files). Digital signatures need to use the SM2 asymmetric encryption algorithm, with brokerage node private keys stored in hardware security modules (HSM) to avoid the risk of soft encryption leakage. Key backups should adopt "off-site three-copy" backups, stored respectively in the brokerage headquarters, off-site disaster recovery center, and partner bank vaults, with backup media meeting the certification of the National Cryptography Administration.

In terms of ledger design, emphasis is placed on dual guarantees of tamper-proofing + traceability. The ledger should include a "block header + block body" structure, and in practice, field design and data synchronization rules need to be clearly defined. Mandatory fields in the block header must include the previous block ID (32-bit hash), timestamp (accurate to milliseconds, interfacing with the national time center), Merkle tree root (containing all transaction hashes), and block height (auto-incrementing sequence). New nodes must synchronize historical full data, using "resume from breakpoint + hash verification" during synchronization; if the network is interrupted, it should continue from the last successfully synchronized block height after recovery, and after synchronization is complete, the local and other nodes' Merkle tree roots must be compared, and if inconsistent, resynchronization is required.

(2) Process design must cover the entire link of "data construction - on-chain - issuance"

The construction of evidence data needs to adopt dual processing of structured + de-identification, with policies requiring that evidence data be "compliant, complete, and de-identified," and in practice, templates need to be designed according to business scenarios. The evidence storage template for investment banking drafts should include fields such as "project number, draft name, draft hash, uploader, upload time," with the "project issuer information" needing to be de-identified.

The on-chain mechanism can be selected as needed, with policies allowing for "real-time, asynchronous, and scheduled batch" on-chain processes, which should be matched according to data characteristics in practice. Real-time on-chain is often suitable for key data such as investment banking drafts and major transaction vouchers, with an on-chain response time of ≤1 second, using a "distributed transaction + compensation mechanism." If the on-chain process fails, it will automatically retry 3 times (with a 10-second interval), and if it fails after that, a text message alert will be triggered to the operations and maintenance team. Scheduled batch on-chain is suitable for customer browsing logs and non-critical operation records, processed in batches every 5 minutes, with a batch size not exceeding 1000 records per batch. Data integrity must be verified before going on-chain (e.g., matching log count with hash).

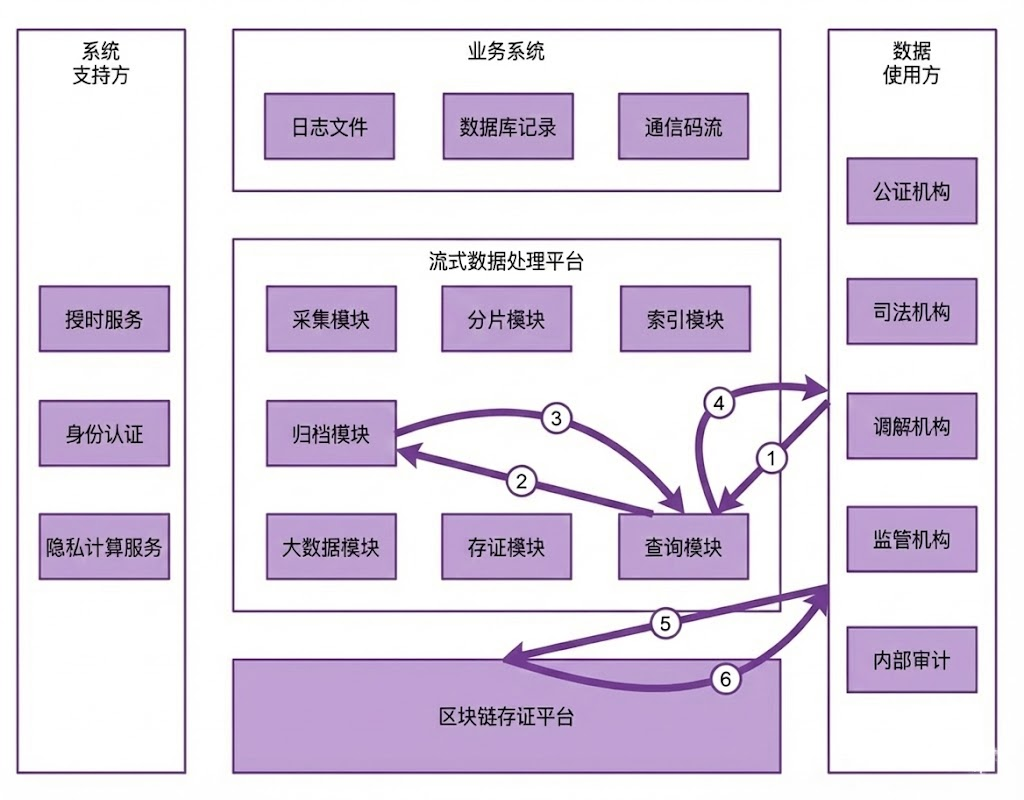

Figure 7: Message Flow Diagram of the Evidence On-Chain Process

Source: "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry"

The issuance process needs to interface with credible institutions (such as courts, notary institutions, arbitration institutions, auditing institutions, judicial appraisal centers, etc.) to ensure verifiability. Policies require that issuance data "directly comes from the consensus ledger," and in practice, the issuance process needs to be simplified. During issuance, users submit applications in the brokerage APP, uploading "ID card + business voucher," and the system automatically verifies the relationship between the applicant and the evidence subject (e.g., the customer agreement evidence must match the customer account). The issuance record must include "applicant, application time, report number, verification node," and be retained for ≥6 years (in compliance with the archival requirements of the "Securities Law"), supporting regulatory departments' inquiries.

Figure 8: Message Flow Diagram of the Evidence Retrieval Process

Source: "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry"

Source: "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry"

(3) Compliance verification needs to embed privacy protection and audit logs

Privacy protection should adopt a tiered approach to handling sensitive data. According to policy documents, evidence data must distinguish between "sensitive/non-sensitive." Highly sensitive data (e.g., customer phone numbers, bank card numbers) must use "anonymization + encrypted storage," with only hashes stored on-chain, and the original text must be encrypted using the SM4 algorithm, with keys managed by the customer (e.g., through an APP key vault). Medium-sensitive data (e.g., transaction amounts) should be "de-identified," such as displaying the amount as "100*** yuan," with complete data visible only to regulatory nodes. Non-sensitive data (e.g., project names) can be stored in plain text on-chain but must indicate the data source (e.g., "某券商投行一部").

Audit logs must ensure traceability throughout the entire process. Policies require that the evidence storage process be traceable, and in practice, three types of logs need to be recorded. The first type is operation logs, which must include "operating user, operation time, data ID, operation type (add/edit/delete)," and the logs must be tamper-proof (using blockchain evidence). The second type is system logs, which need to record system behaviors such as node synchronization, algorithm calls, and key updates, retained for ≥6 months. The third type is audit logs, which need to generate compliance reports for evidence storage regularly (monthly), including "on-chain data volume, issuance frequency, abnormal data volume," and automatically push them to the compliance department.

5.1.2 Transaction Traceability: Core Landing with "Full-Link Connection, Compliance Verification"

Transaction traceability is a key scenario for brokerages to prevent compliance risks, covering businesses such as public fund order placement, stock trading, and investment advisory services. Policies require that the transaction process be traceable and operational behaviors be verifiable. In practice, this needs to be achieved through "data connection, compliance verification, and performance assurance."

(1) Unique coding rules for transaction links

Policies clearly state that chain data must "have a logical correlation," and in practice, a unified coding rule and data model need to be designed. Specifically, the unique coding rule for transaction links specifies the coding format as "customer account (12 digits) + business type (2 digits, e.g., 01 = fund order, 02 = stock trading) + date (8 digits) + random 6 digits," for example, "6226000000010120240520123456." This code runs through the entire transaction process, with each link's data associated with this code, ensuring that traceability can be achieved with "one-click full chain lookup."

Figure 9: Evidence Storage Model for Public Fund Order Placement Business

Source: "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry"

Source: "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry"

(2) Compliance verification requires real-time rule checks + post-event traceability

Real-time compliance verification means that before the transaction goes on-chain, the system must automatically verify compliance to avoid illegal transactions. The first item is suitability matching; if the customer's risk level is lower than the product's risk level, the system automatically intercepts the order and triggers a manual review process. The second item is transaction limit verification; if the customer's daily order amount exceeds the regulatory limit, the system automatically prompts the customer for confirmation before going on-chain. The third item is identity verification; when placing an order, the customer's digital signature (SM2) must be verified, and if the signature is invalid, the on-chain process is rejected to ensure that the operator is the customer themselves.

The post-event traceability function needs to design multi-dimensional query capabilities in practice. The first item is client-side queries, where customers can check "transaction traceability records for the past year" in the APP, displaying the operation time, key data (after desensitization), and hash values for each link, supporting the download of traceability reports. The second item is employee-side queries, where account managers can check transaction traceability records authorized by customers to answer customer inquiries, with queries needing to record "employee ID, query time, customer authorization proof." The third item is regulatory-side queries, where regulatory departments can query all data (including non-desensitized information) through a dedicated interface, which must comply with "IP whitelisting + two-factor authentication," with query records going on-chain in real-time.

(3) Performance assurance must meet high concurrency and low latency requirements

Policy documents have clear requirements for transaction performance, and in practice, technical optimizations must be implemented to ensure this. For transaction throughput optimization, "data sharding + parallel consensus" can be used, sharding by "customer account last digit" (e.g., 0-9 for a total of 10 shards).

For query performance optimization, local caching (Redis cluster) can be established for high-frequency queried transaction data (e.g., records from the past 3 months), with a cache expiration time set to 1 hour and query response time ≤500 ms; historical data (over 3 months) should use "indexing + archiving," establishing indexes by "date + business type," querying first by index and then retrieving archived data to avoid full scans.

Abnormal recovery assurance is also important; if a node loses power or experiences network fluctuations, it must automatically synchronize missing transaction data after recovery, using "incremental synchronization + hash verification" to ensure that the data is consistent with other nodes after recovery; at the same time, the system must record "abnormal time, number of affected transactions, recovery time," generating an abnormal report to submit to the compliance department.

In summary, the public chain layout for brokerages in electronic evidence and transaction traceability scenarios must avoid "technology for technology's sake" and closely adhere to three core principles. First is policy alignment; all technology selections (such as algorithms, chain types) and process designs (such as issuance, traceability) must correspond to the "Application Specifications for Blockchain Electronic Data Storage of the Securities Industry" and the "Evaluation Rules for Financial Applications of Blockchain Technology," ensuring that every step has a policy basis. Second is business adaptation, avoiding excessive technicalization; for example, evidence storage templates must align with the actual needs of investment banking and brokerage businesses, not increasing the operational costs for frontline employees (e.g., automatically capturing draft hashes without manual uploads). Finally, risk control must be established, creating a risk management system of "pre-verification, in-process monitoring, and post-audit" to ensure early detection and resolution of risks.

5.2 Hong Kong Brokerages: Analyzing Business and Technical Requirements in Five Major Innovative Scenarios

Hong Kong brokerages should leverage policy support and mature ecosystems, primarily focusing on external selections, with specific practical points corresponding to different innovative businesses as follows:

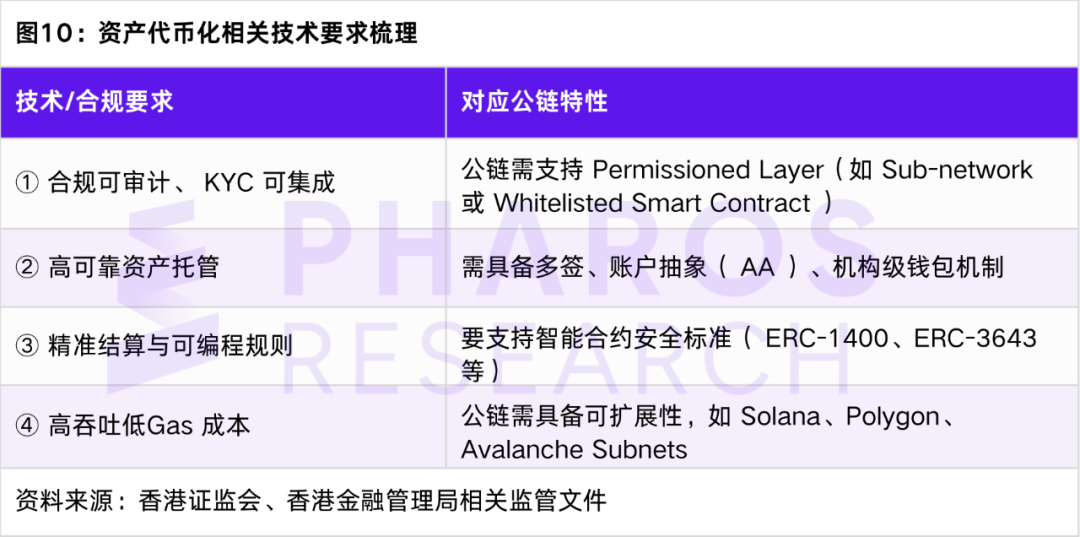

5.2.1 Asset Tokenization

The business logic is to achieve a digital, divisible, and traceable tokenized form of traditional securities, bonds, fund shares, or physical assets (such as gold, real estate, carbon emission rights) through blockchain, supporting compliant issuance and secondary market circulation.

Representative projects include: GF Securities (HK) × HashKey Chain: the first end-to-end on-chain tokenized security. UBS × Ethereum: issuance of Hong Kong's first tokenized warrant. HSBC × Digital Gold (Tokenised Gold), etc.[32].

Typical public chain selections: Ethereum (mature standards), Polygon (low cost), HashKey Chain (Hong Kong local ecosystem), Solana (performance), Pharos (performance + EVM compatibility).

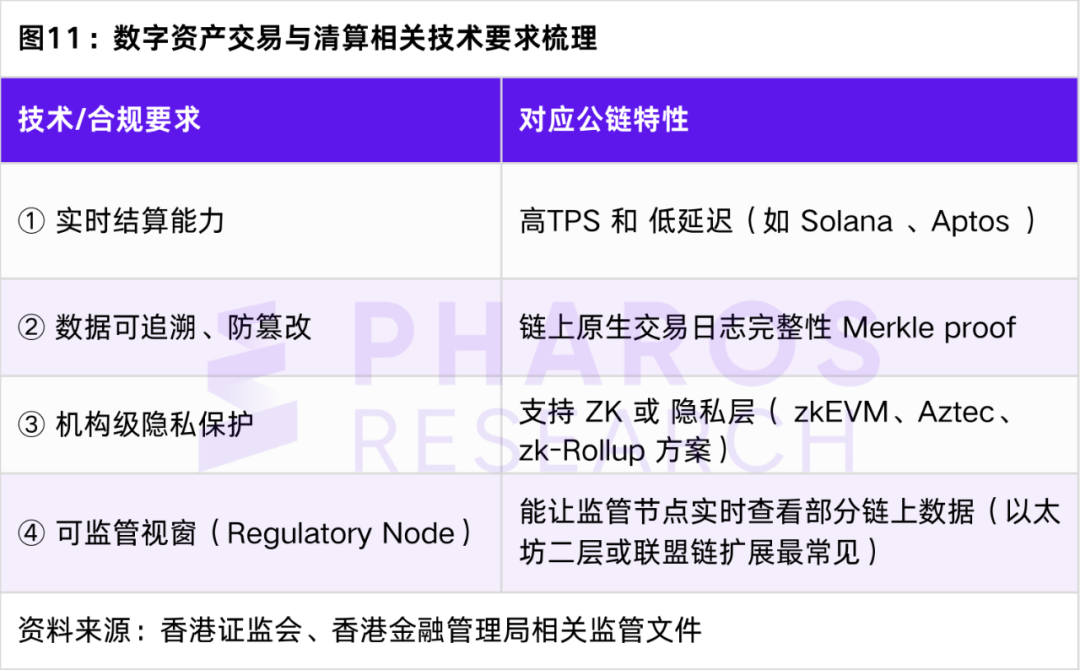

5.2.2 Cryptocurrency Trading and Settlement

The business logic is for brokerages to directly achieve trade matching, clearing, settlement, and fund delivery (Atomic Settlement) on the blockchain, reducing traditional custody links and enhancing transparency. Representative projects include HashKey Exchange (licensed VATP) × HashKey Chain / Ethereum. OSL × Polygon and Ethereum ecosystems.

Typical public chain selections: Solana (high performance), Ethereum Layer 2 (mature compliance ecosystem), HashKey Chain (with compliance interfaces), Pharos (real-time + EVM compatibility).

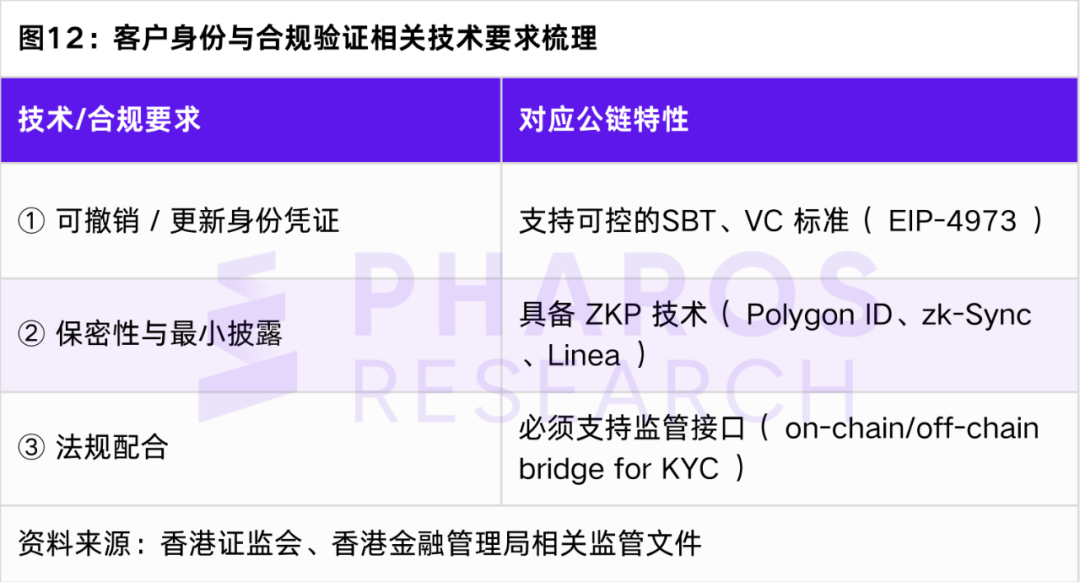

5.2.3 Customer Identity and Compliance Verification

The business logic is to achieve shared and verifiable identity management for brokerage customer information, compliance records, and investor type verification through on-chain credentials (Verifiable Credential) or Soul-Bound Tokens (SBT). Representative projects include HKMA × Hong Kong Cyberport × financial institution collaboration on the "Digital Identity Sandbox." HashKey ID × financial institution public chain connection pilot.

Typical public chain selections: Polygon ID, Consensys Linea, Aptos with ZK Module.

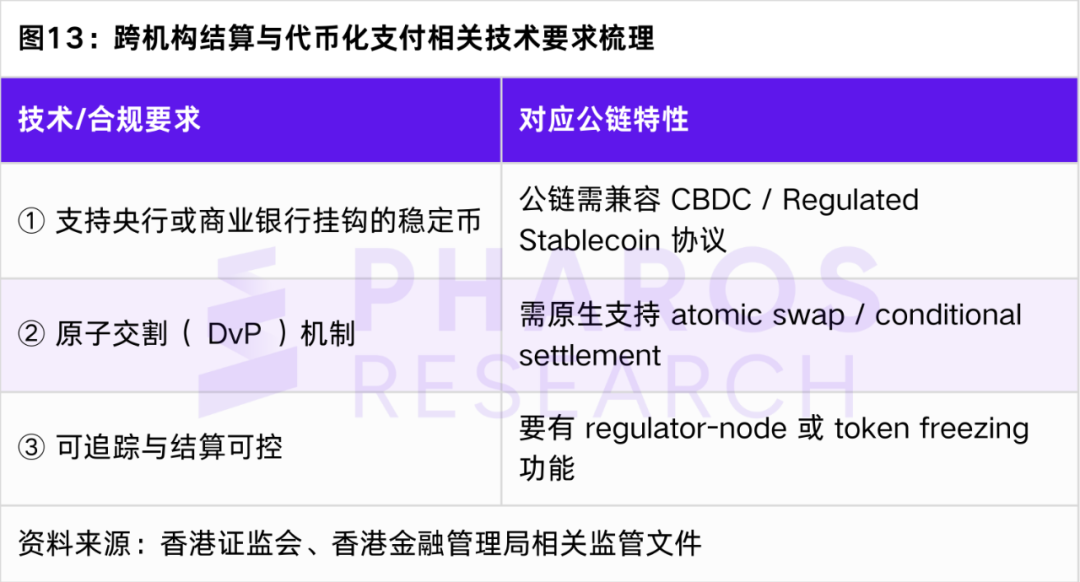

5.2.4 Cross-Institution Settlement and Tokenized Payments

The business logic is that when brokerages issue or trade tokenized assets, they need to complete cash settlement (Tokenised Deposit or CBDC delivery) directly on-chain, reducing time differences and credit risks. Representative projects include: HSBC Tokenised Deposit Project (on-chain cash management based on corporate clients). Project mBridge (HKMA × People's Bank of China Digital Currency Research Institute × BIS).

Typical public chain selections: mBridge platform (quasi-consortium chain), Ethereum (mature contract ecosystem), Pharos (real-time + SPN subnet), and the CBDC-compatible side chain being tested in Hong Kong.

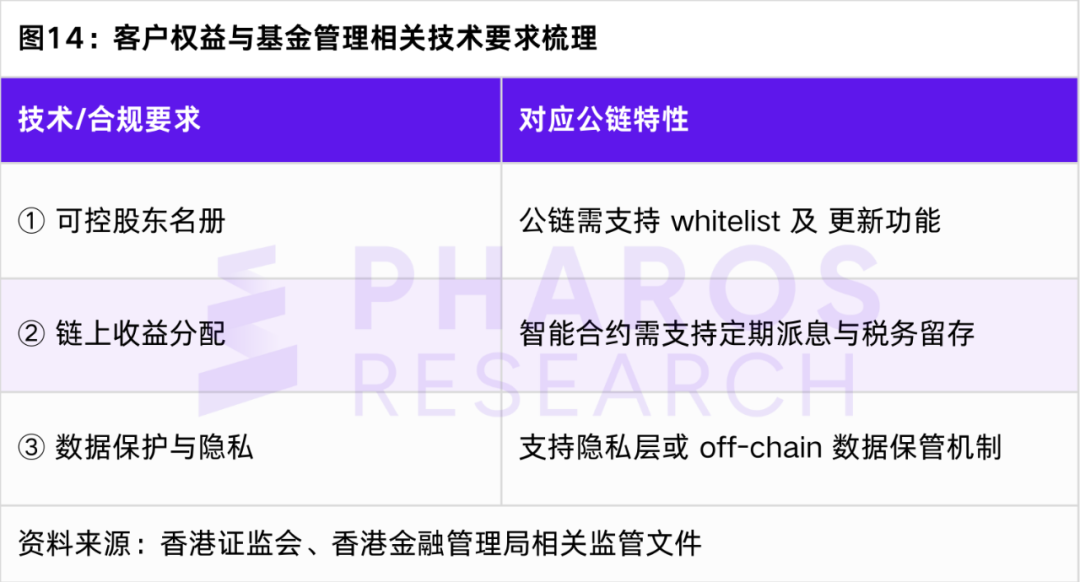

5.2.5 Customer Rights and Fund Management

The business logic is to digitize fund shares, shareholder registration, and dividend distribution processes through blockchain, improving registration efficiency and transparency. Representative projects include: Asia Allied Infrastructure × HSBC × HashKey RWA Pilot. Franklin Templeton × Stellar and Polygon's fund tokenization precedents serve as a demonstration for Hong Kong brokerages.

Typical public chain selections: Ethereum, Polygon, Stellar (focusing on security tokens and stable settlement), HashKey Chain, Pharos (EVM compatible + SPN subnet).

06. Conclusion

The decision-making logic for traditional brokerages' public chain layout is not merely a technical choice but a comprehensive framework of policy compliance, business demands, cost constraints, and future profit expectations, with varying factor weights for domestic and foreign brokerages. A comprehensive analysis of domestic and foreign policy frameworks, brokerage public chain decision-making logic, and reference to various cases and specific technical practice details leads us to propose the following conclusions:

First, the current regulatory attitude in mainland China towards brokerages' blockchain business layout remains relatively cautious, emphasizing the ability of blockchain technology to solve actual business problems for brokerages. In the short term, self-developed public chains and external selections are unlikely to be realized. If brokerages wish to engage in blockchain-related business in mainland China, it is recommended to focus on electronic evidence storage and transaction traceability as two consortium chain business directions.

Second, the regulatory attitude in Hong Kong towards brokerages' blockchain layout is relatively accommodating, and there is a possibility of some relaxation with the advancement of relevant regulatory policies and industrial layouts in the United States and Singapore. In the short term, due to relatively cumbersome compliance requirements and high public chain development costs, the current scale of innovative businesses is insufficient to support Hong Kong brokerages in vigorously developing self-developed public chains. Most Hong Kong brokerages' subsequent public chain layout logic should primarily focus on external selections. If they wish to engage in related businesses in Hong Kong, it is advisable to design specifically based on the actual business needs of brokerages or to leverage their own public chain advantages to facilitate corresponding business matches.

Third, it is recommended to actively monitor the public chain self-development situations of leading international brokerages such as JPMorgan and Goldman Sachs, as well as leading fintech brokerages like Robinhood, as they will significantly influence the business standards for global brokerage public chain layouts.

This article, due to space limitations, still has certain research deficiencies, such as specific judgments on the trends of future Hong Kong financial regulatory policy changes based on the financial regulatory policies and developments in the cryptocurrency industry in countries like the United States and Singapore, as well as detailed comparisons of technical indicators and advantages of Solana, Pharos, HashKey Chain, and various public chains in different business scenarios. Practitioners and research experts are welcome to provide corrections and continuously improve together.

References

[1] China Securities Association. Application Specifications for Blockchain Electronic Data Storage in the Securities Industry (T/SAC 004—2024) [S]. Beijing: China Securities Association, 2024-07-29.

[2] 21st Century Business Herald. GF Securities: Actively Exploring Digital Application Innovations to Enhance Digital Compliance and Risk Management Capabilities [EB/OL].

[3] China Banking Association. The Business Scale of the Bank Letter Verification Blockchain Service Platform Steadily Grows, Empowering the Digital Transformation of the Industry [EB/OL].

[4] People's Bank of China. Technical Specifications for Personal Financial Information Protection (JR/T 0171—2020) [S]. Beijing: People's Bank of China, 2020-02-13.

[5] China Wealth Network. Ant Group Collaborates with Xiexin Energy to Establish Ant Xinneng to Promote Energy Intelligence [EB/OL]. (2025-06-12).

[6] Onyx DAO. An Introduction to the Onyx Protocol [R/OL].

[7] China Securities Regulatory Commission. "14th Five-Year" Plan for the Technological Development of the Securities and Futures Industry [EB/OL]. (2021-10-21).

[8] Standing Committee of the National People's Congress of the People's Republic of China. Data Security Law of the People's Republic of China [EB/OL]. (2021-06-10).

[9] Standing Committee of the National People's Congress of the People's Republic of China. Personal Information Protection Law of the People's Republic of China [EB/OL]. (2021-08-20).

[10] State Council. "14th Five-Year" Digital Economy Development Plan: Chapter 4, Section 1 [EB/OL]. (2021-12-12).

[11] Ministry of Industry and Information Technology of the People's Republic of China. Security Requirements for Blockchain Technology Architecture: YD/T 3747-2020 [S]. Beijing: China Communications Standards Association, 2020-10-01.

[12] Ministry of Industry and Information Technology of the People's Republic of China. Security Requirements for Blockchain Technology Architecture: YD/T 3747-2020 [S]. Beijing: China Communications Standards Association, 2020-10-01: 6.2.

[13] Central Financial Committee. Opinions on Supporting the Acceleration of the Construction of Shanghai International Financial Center [EB/OL]. (2025-06-18)

[14] Securities and Futures Commission of Hong Kong. The SFC Announces Regulatory Measures for Virtual Asset Trading Platforms to Balance Innovation and Investor Protection [EB/OL]. (2023-06-16)

[15] Securities and Futures Ordinance, Cap. 571, Laws of Hong Kong [EB/OL]. (2002-03-08)

[16] Securities and Futures Commission (SFC). Guidelines for Virtual Asset Trading Platforms (HKEX-GL81-23): Chapter 3 "Eligibility Requirements", Chapter 4 "Conduct Standards", Chapter 5 "Internal Controls" [EB/OL]. (2023-06-16).

[17] Securities and Futures Commission (SFC). List of Licensed Virtual Asset Trading Platforms [EB/OL]. (2025-08-28).

[18] Securities and Futures Commission (SFC) & Financial Services and Treasury Bureau (FSTB). (2025, March 15). Consultation Paper: Regulatory Framework for Virtual Asset (VA) Dealers and VA Custodians.

[19] Financial Services and Treasury Bureau (FSTB) & Securities and Futures Commission (SFC). (2024, October 20). ASPIRe Virtual Asset Regulatory Roadmap: Dynamic Regulatory Framework for Diverse Scenarios.

[20] Financial Services and Treasury Bureau (FSTB). (2016, September 5). FinTech Supervisory Sandbox (FSS) Launch Announcement.

[21] Hong Kong Monetary Authority (HKMA). (2024, August 28). Launch Ceremony of the Ensemble Project Sandbox.

[22] GF Securities Hong Kong. GF Securities Hong Kong Selects HashKey Chain (Ethereum Layer 2) for Tokenized Securities Business [EB/OL]. (2024-10-18).

[23] HKbitEX. HKbitEX Secures SFC Licence (CE No. BPO721) After Sandbox Testing Focused on Cross-Chain Exchange and Institutional Custody [EB/OL]. (2024-12-18).

[24] J.P. Morgan Onyx. JPM Coin: A Digital Asset for Instant Cross-Border Payments and Settlements [EB/OL]. (2019-02-14).

[25] J.P. Morgan Institute. Evolving Blockchain Strategy: From Private/Consortium Chains to Layer 2 Scaling [R/OL]. (2024-10-20).

[26] China Securities Association. China Securities Association Launches Self-Regulatory Supervision Platform for Investment Banking Business [EB/OL]. (2024-12-30).

[27] China Securities Association. Notice on the Implementation of the "Guidelines for the Construction of Electronic Management Systems for Investment Banking Work Papers of Securities Companies" [EB/OL]. (2020-02-28).

[28] Caijing.com. China Securities Association Plans to Build a Self-Regulatory Supervision Platform for Investment Banking Business to Optimize the Submission Function of Work Paper Catalogs [EB/OL].

[29] CMB International. CMB International Launches Tokenized USD Money Market Fund in Collaboration With DigiFT and OnChain [EB/OL]. (2025-08-08).

[30] Ministry of Industry and Information Technology and Other Three Departments. Guidelines for the Construction of Blockchain and Distributed Ledger Technology Standard System [EB/OL]. (2023-12-29)

[31] People's Bank of China. Evaluation Rules for Financial Applications of Blockchain Technology (JR/T 0193-2020) [S]. Beijing: People's Bank of China, 2020.

[32] HSBC Holdings. (2024, September 19). HSBC pilots quantum-safe technology for tokenised gold.

Core Contributions

Author: Cat Buddha (X:@showtime9965)

Reviewed by: Colin Su, Grace Gui, NingNing, Owen Chen

Design: Alita Li

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。