Abstract

Based on a systematic review of domestic and international financial regulatory frameworks, this article deeply analyzes the differentiated decision-making logic of traditional brokerages in the layout of blockchain public chains. The study finds that regulatory boundaries are the primary variable determining the technological architecture, profoundly influencing the public chain layout logic of mainland brokerages, Hong Kong brokerages, and international brokerages.

The core conclusions of this study are as follows:

The layout logic of mainland brokerages is "minimizing compliance costs": Restricted by "penetrative regulation" and data export limitations, mainland brokerages are not feasible for self-research or public chain integration in the short term. Their optimal solution lies in utilizing consortium blockchain technology, focusing on scenarios such as investment banking document preservation and supply chain finance ABS to "reduce costs and increase efficiency," thereby meeting the stringent compliance requirements of the "Securities Industry Blockchain Electronic Data Preservation Application Specification" and achieving low-cost digital transformation.

The layout logic of Hong Kong brokerages is "maximizing business value": Under the licensing and "sandbox regulation" framework, Hong Kong brokerages are more inclined to select mature external public chains (such as Ethereum, Solana, Pharos, etc.). Their core demand is to utilize the mature liquidity ecosystem of public chains for asset tokenization (RWA) issuance or to achieve atomic settlement through high-performance public chains, thereby seizing incremental market opportunities in innovative businesses such as tokenized funds and cross-border payments.

The layout logic of international brokerages is "defining the global standards for blockchain finance": Leading international institutions represented by JPMorgan and fintech firms represented by Robinhood are evolving towards self-research Layer 2 architectures, aiming to become "super nodes" in the future blockchain financial network by controlling core technological standards and compliance interfaces.

01. Theoretical Analysis of Brokerages' Public Chain Layout

As licensed traditional financial institutions, brokerages must consider regulatory constraints and business demands when laying out emerging businesses such as blockchain both domestically and internationally. This article will first analyze the core matching points between current blockchain technology and brokerage business, as well as the regulatory policy orientation and regulatory framework regarding brokerages' public chain layout, laying a solid theoretical and policy foundation for the subsequent analysis of brokerages' public chain decision-making logic.

1.1 Internal Control and Compliance Perspective: Emphasizing Document Authenticity and Responding to Regulatory Requirements

Mainland brokerages are constrained by the CSRC's requirements for "penetrative and continuous regulation," ensuring the authenticity and traceability of investment banking documents, asset management product operations, and transaction records. Blockchain technology can achieve data immutability through "hash value on-chain and timestamp solidification"—for example, after being reviewed by lawyers and accountants, the hash value of investment banking documents is recorded on-chain in real-time (such as in the Securities Industry Preservation Alliance Chain), allowing regulatory agencies to retrieve the on-chain hash value and compare it with the original document at any time to verify authenticity; simultaneously, smart contracts can automatically record modification logs of documents (such as modifier, modification time, modification content), meeting continuous regulatory requirements. According to the pilot data in the preparation instructions of the "Securities Industry Blockchain Electronic Data Preservation Application Specification" published by the China Securities Association, after adopting a consortium blockchain architecture for preservation, empirical data from GF Securities in asset securitization (ABS) business shows that this architecture promotes an overall processing efficiency improvement of over 1/3; at the same time, according to disclosures from the China Banking Association, in the core 'confirmation' stage of documents, the blockchain platform has significantly compressed the average response cycle from the traditional approximately 15 days to 2-3 days (with the fastest reaching minute-level)

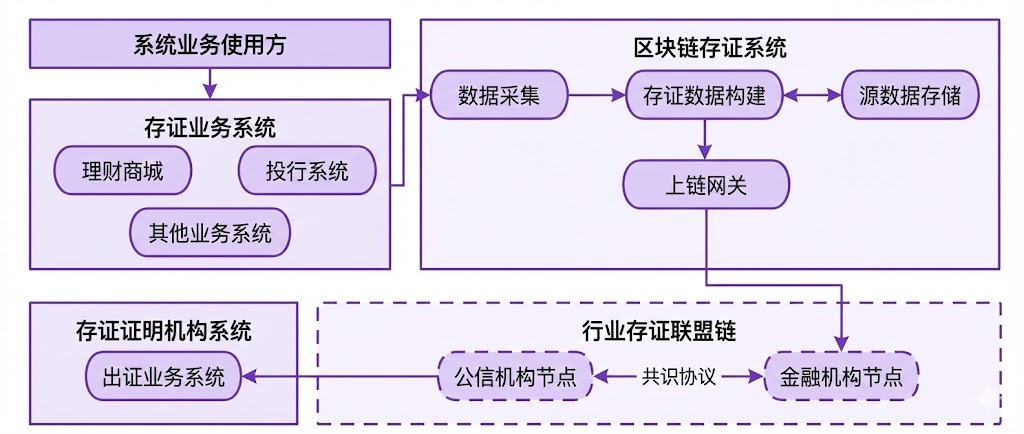

Figure 1: Blockchain Preservation Platform System Framework

Source: "Securities Industry Blockchain Electronic Data Preservation Application Specification"

1.2 Customer Suitability Management: Achieving Traceability and Non-Denial of Customer Actions

Brokerages must adhere to the principle of customer suitability, ensuring that customer actions (such as risk assessment and product subscription) are genuine, voluntary, and traceable. Blockchain technology can convert customer actions (such as click confirmation and signatures) into on-chain transaction records, including "customer identity identification, operation time, operation content," etc., with records that are immutable and traceable. For example, when a customer subscribes to a private placement product, their risk assessment results, reading records of the product prospectus, and subscription confirmation actions are all preserved on-chain. If disputes arise later, the on-chain records can serve as legal evidence, avoiding the risk of customers "denying actions." Additionally, Distributed Identity (DID) technology can integrate customer identity information across multiple platforms, achieving "one-time authentication and multi-scenario reuse," enhancing customer experience while ensuring compliance management of identity information (in accordance with the "Technical Specification for Personal Financial Information Protection").

Figure 2: Disclosure of the Dispute between Cinda Securities and Customers on the China Judgments Online

Source: China Judgments Online

1.3 New Business Expansion Directions: Broadening the Boundaries of Investment Banking and Asset Management

Traditional brokerage businesses are limited to standardized assets such as stocks and bonds. Blockchain technology can help brokerages expand into the tokenization of non-standardized assets (such as real estate, artworks, and renewable energy facilities), providing clients with comprehensive asset allocation services. For example, Hong Kong brokerages can participate in RWA tokenization issuance (such as GCL-Poly Energy's RWA financing of 200 million yuan), offering clients opportunities for "small investments in high-value assets"; mainland brokerages can conduct asset digital certificate circulation business for accounts receivable through consortium chains, helping small and medium-sized enterprises activate assets while providing clients with fixed-income products. Furthermore, the cross-border characteristics of public chains can help leading global brokerages break through geographical limitations in branch layouts—such as JPMorgan's Onyx platform (now named Kinexys) achieving cross-border collateral settlement through blockchain, covering institutional clients in over 20 countries, effectively broadening the cross-border business boundaries of brokerages.

02. Regulatory Policy System for Blockchain Business of Domestic and International Brokerages

Considering the relatively significant differences in the financial regulatory systems of mainland China and Hong Kong, as well as the varying regulatory tendencies regarding blockchain and crypto assets, this article will analyze the regulatory policy systems for blockchain business of domestic and international brokerages separately to enhance the relevance of the conclusions.

2.1 Policy System for Blockchain-Related Business of Mainland Brokerages

2.1.1 Policy Tone Analysis

(1) Prudent and Inclusive

Prudence is an inherent attribute of financial regulation. Regarding the emerging technology of blockchain, mainland regulatory authorities first emphasize a risk bottom-line thinking to avoid systemic financial risks caused by technological applications. Inclusiveness reflects support for innovation, providing a certain trial-and-error space for pilot blockchain business of brokerages, avoiding a one-size-fits-all prohibition from a technical perspective.

The application scenarios of blockchain technology in brokerage businesses are diverse, with varying degrees of risk and technical complexity; at the same time, there are differences in the technological research and development capabilities and risk control levels of different brokerages. Based on this, mainland regulatory authorities have actually adopted a tiered regulatory principle, implementing differentiated regulation based on business risk levels and brokerage qualifications to avoid waste of regulatory resources and ensure precise and effective regulation. In practice, the regulatory approach for blockchain preservation, information sharing, and other businesses that do not involve capital flow, businesses that involve capital flow but are small in scale and limited in impact, and businesses involving large capital flows, cross-market linkage, or innovative models varies significantly.

(2) Emphasizing Technical Security and Data Compliance

In terms of technical security, regulatory authorities require that brokerage blockchain systems must meet financial-grade security standards, including data encryption, identity authentication, and fault tolerance backup. The CSRC clearly states in the "14th Five-Year Plan for Technological Development in the Securities and Futures Industry" that brokerage blockchain systems must pass the national cybersecurity level protection level three or above certification, and core data must be encrypted and stored using national secret algorithms to prevent data leakage or tampering. At the same time, mainland regulatory authorities also require brokerages to establish emergency response mechanisms for blockchain systems, formulating emergency plans for unexpected situations such as node failures and network attacks to ensure continuous business operation.

In terms of data compliance, mainland regulatory authorities strictly require that brokerage blockchain businesses comply with laws and regulations such as the "Data Security Law" and the "Personal Information Protection Law," prohibiting illegal collection and use of customer data. For example, when brokerages use blockchain technology for customer identity authentication, they must obtain explicit authorization from customers and must not upload customer personal information to public blockchain networks; for cross-border data transmission, they must be filed with the national data cross-border transmission security management platform to ensure the safety of data going abroad. Additionally, mainland regulatory authorities require brokerages to classify and manage data on the blockchain, implementing access control for sensitive data (such as customer asset information and transaction records), allowing only authorized personnel to query and operate.

(3) Ideally, it should achieve the function of serving the real economy

At the level of serving the real economy, mainland regulatory authorities focus on supporting brokerages in using blockchain technology to address pain points in the real economy. For example, in the field of supply chain finance, small and medium-sized enterprises face difficulties in financing due to accounts receivable occupation issues. Brokerages can use blockchain technology to digitize, split, and circulate accounts receivable, forming digital debt certificates, which small and medium-sized enterprises can use to apply for financing from banks or brokerages, significantly shortening financing cycles and reducing financing costs. This also aligns with the core positioning of the entire financial system in mainland China to serve the real economy.

2.1.2 Regulatory Framework Analysis

(1) Top-level design emphasizes technology as the core

Top-level design is the overarching framework of the regulatory framework, formulated by national-level departments such as the State Council, the central bank, and the CSRC, clarifying the strategic positioning, development goals, and regulatory principles of brokerage blockchain businesses, providing guidance for the entire regulatory system. From the policy documents, top-level design is mainly implemented through the form of "national planning + regulatory guidance." In the "14th Five-Year Plan for Digital Economy Development" released by the State Council in 2021, it is clearly stated to "promote the compliant application of blockchain technology in the financial sector, supporting securities, insurance, and other institutions in utilizing blockchain technology to optimize business processes and enhance risk control capabilities," incorporating brokerage blockchain businesses into the national digital economy development strategy, establishing their legal status and development direction. In 2022, the central bank, CSRC, and other departments jointly released the "Financial Technology Development Plan (2022-2025)," further detailing the requirements, proposing to "establish regulatory rules for brokerage blockchain businesses, standardize technical application scenarios, and prevent technological and financial risks," providing a basis for regulatory authorities to formulate specific policies.

(2) Multi-departmental collaborative regulation forms a regulatory synergy.

The central bank is responsible for regulating the payment settlement and digital currency-related businesses involved in brokerage blockchain operations, preventing risks such as money laundering and terrorist financing. For application scenarios involving the digital renminbi (such as brokerages using digital renminbi for client fund settlements), the central bank needs to conduct special supervision to ensure the compliant use of digital renminbi. The CSRC, as the regulatory authority for the brokerage industry, bears core regulatory responsibilities, including formulating specific rules for brokerage blockchain businesses (such as business access, risk prevention, and compliance requirements), reviewing brokerage pilot applications, conducting daily supervision and on-site inspections, and penalizing violations. The Ministry of Industry and Information Technology (MIIT) is responsible for overseeing the security and standardization of blockchain technology itself, having led the formulation of the "Security Requirements for Blockchain Technology Architecture." Brokerage blockchain systems must also meet technical standards such as data encryption, node management, and smart contract security, and be tested by third-party institutions recognized by the MIIT. The Cyberspace Administration is responsible for regulating data security and network security related to brokerage blockchain businesses, preventing issues such as data leakage and cyberattacks. For blockchain systems involving overseas nodes, the Cyberspace Administration must also review the compliance of their cross-border data transmission to prevent data export risks.

(3) Local Pilot Logic

Mainland China habitually adopts a local pilot approach for promoting major innovative technologies, gaining experience before rolling them out nationwide, and the blockchain technology layout for brokerage businesses is no exception. Such local pilots mainly rely on policy high grounds such as "Free Trade Pilot Zones" and "Financial Technology Pilot Cities," which typically have advantages such as high policy flexibility, a solid industrial foundation, and concentrated brokerage resources. In June 2025, the Central Financial Committee issued the "Opinions on Supporting the Acceleration of Building Shanghai into an International Financial Center," proposing to effectively maintain financial security under open conditions and to use technologies such as blockchain, big data, and artificial intelligence to strengthen proactive research and timely judgment on risks. It aims to prevent and resolve cross-border financial risks and establish a sound monitoring and early warning system for cross-border capital flows, as well as a macro-prudential assessment and coordination system that adapts to a high level of openness.

In summary, mainland regulatory authorities highly emphasize technological compliance, data security, and the practical application value of blockchain technology, requiring brokerages to focus on the needs of the real economy and their own business demands when laying out related businesses, and to appropriately conduct pilots in certain policy-favorable areas, suggesting a focus on this policy orientation.

2.2 Hong Kong's Policy System for Brokerage Blockchain-Related Businesses

2.2.1 Policy Tone Analysis

Hong Kong views blockchain and crypto assets as important components of financial innovation, while prioritizing investor protection, market integrity, and financial stability. The overall regulatory approach adopts a path of innovation availability and risk controllability, balancing technological development with systemic risk management through phased institutional design, clear licensing and compliance requirements, and leveraging regulatory sandboxes and cross-regulatory coordination.

(1) Balancing Innovation and Risk, Clarifying Compliance Bottom Lines

Hong Kong's regulation does not pursue a one-size-fits-all complete liberalization, nor does it block technological implementation with strict prohibitions; instead, it uses activities and risks as judgment standards. Different activities (spot trading, market making, custody, asset management, stablecoin issuance, pledging, etc.) are subject to varying licensing, operational, and compliance requirements, with stricter access and ongoing supervision for high-risk segments (such as high-volatility token sales aimed at retail investors and fiat currency exchange/payment functions).

This article emphasizes the need to clarify the compliance bottom line of Hong Kong regulatory authorities during the process of conducting related businesses. First, the Hong Kong Securities and Futures Commission (SFC) explicitly proposes the "99.5% principle," meaning that the crypto asset industry currently accounts for only 0.5% of the total revenue of its regulatory portfolio, thus any innovation must not undermine the health of the traditional financial system. The core mechanism is the liquidity isolation mechanism, requiring licensed brokerages and funds to only cooperate with licensed virtual asset trading platforms (VATPs) to prevent risk spillover to traditional markets. Even with the introduction of a "global order book" in 2025 allowing licensed platforms to share liquidity with overseas affiliated platforms, it still requires overseas platforms to pre-deposit funds, adopt payment and settlement, and establish real-time monitoring systems to ensure transaction security.

Investor protection is another compliance bottom line for Hong Kong regulation. It requires strict access for retail investors, allowing only licensed platforms to offer high liquidity, low-risk virtual assets (such as non-security tokens included in mainstream indices) to retail investors, and they must meet a 12-month trading record requirement (the new regulations in 2025 exempt this restriction for professional investors). Platforms must conduct KYC and risk assessments to ensure that the recommended investment products align with the client's risk tolerance and retain the right to refuse high-risk transactions. The new regulations in 2025 allow professional investors to trade virtual assets without trading record requirements, including more innovative tokens, but platforms must still ensure asset transparency and compliance.

In addition to the above two points, Hong Kong regulation also requires that relevant financial institutions must operate with licenses, meaning that all crypto asset trading platforms, stablecoin issuers, and custody service providers must obtain licenses from the Hong Kong SFC or the Monetary Authority and undergo appropriate candidate assessments (including financial soundness, management experience, and compliance records).

(2) Dynamic Assessment of Global Developments

Given the cross-border nature of crypto assets, Hong Kong regulation emphasizes continuous tracking of developments in the UK, Singapore, the EU, the US, and international organizations (such as FATF and IOSCO), and local adaptation: absorbing mature practices (such as trading platform licensing, stablecoin reserve rules, and high AML/CFT standards) while retaining local flexibility (for example, differentiated treatment of market service targets and business models). Regulation typically achieves dynamic adoption through public consultations, pilots, and phased implementation. Due to space limitations, this article will not elaborate on the numerous foreign laws and regulations involved.

(3) Emphasizing Substance Over Form in Business

Hong Kong regulation clearly does not determine regulation based on labeled names but judges regulatory affiliation based on the economic and legal substance of the business ("similar activities, similar regulation"). For example, if "tokenized securities" or "tokens with securities attributes" appear, they will be handled according to the securities rules and offering/distribution regulations of the Securities and Futures Ordinance (SFO); if a token actually performs payment and settlement functions, banking/payment regulation and specific stablecoin rules must be considered to minimize arbitrage opportunities.

2.2.2 Regulatory Framework Analysis

Based on our summary and review of regulatory policies, Hong Kong is gradually constructing a framework for brokerage blockchain business regulation composed of dual core regulatory entities + clearly defined standards for different scenarios + continuous advancement of regulatory sandboxes.

(1) Dual Core Regulatory Entities: Hong Kong Securities and Futures Commission (SFC) and Hong Kong Monetary Authority (HKMA)

The dual core regulatory entities refer to the two main regulatory agencies/functions responsible within the regulatory system: the Hong Kong Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA). Each has its own responsibilities and regulatory duties while maintaining coordination.

The Hong Kong Securities and Futures Commission (SFC) is the main regulatory body for the securities and futures market in Hong Kong, regulating virtual assets or trading platforms existing in the form of securities or futures according to the Securities and Futures Ordinance (SFO) and related regulations. Specific functions include requiring licenses for virtual asset trading platforms (VATPs) operating in Hong Kong or providing services to Hong Kong investors. According to the official website of the Hong Kong Securities and Futures Commission, "centralized virtual asset trading platforms" must obtain regulatory approval if they provide services to Hong Kong investors. The SFC formulates operational guidelines for virtual asset trading platforms, setting requirements for platform eligibility, trading behavior, client asset custody, anti-money laundering/anti-terrorist financing (AML/CFT), cybersecurity, and client suitability. It also provides regulatory notices and guidelines for asset managers, funds, and products containing virtual asset exposure.

The Hong Kong Monetary Authority (HKMA) is Hong Kong's central bank and banking regulatory authority, primarily responsible for the regulation of banks, payment systems, stored value facilities, stablecoin issuance, and related financial infrastructure. Its functions are reflected as follows:

It formulates specific regulatory systems for stablecoin issuance. According to the HKMA website, the "Stablecoin Issuer Regulatory System" will take effect on August 1, 2025, implementing a licensing system. It also formulates regulatory guidelines for banks or authorized institutions (AIs) engaging in virtual asset-related services (such as custody, pledging, lending) and collaborates closely with the Hong Kong SFC.

The SFC and HKMA each have their own focus, with the former emphasizing the "securities-trading platform-asset management" scenario and the latter focusing on the "banking/payment/stablecoin/payment infrastructure" scenario.

(2) Clearly Defined Standards for Different Scenarios: Differentiated Regulation from Trading Platforms to Stablecoins

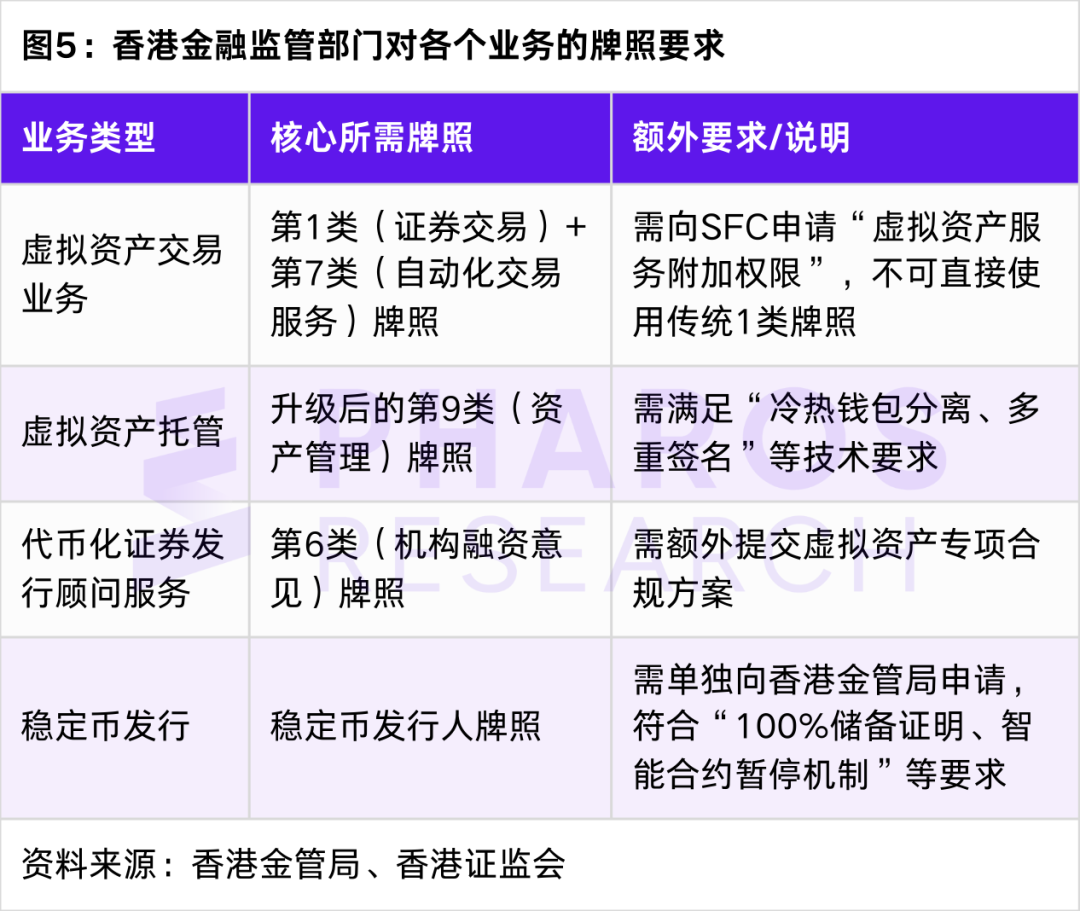

Based on our summary analysis of the relevant regulatory policies of the Hong Kong SFC and HKMA, we outline the regulatory standards of Hong Kong's financial regulatory authorities for various business scenarios as follows.

Virtual Asset Trading Platforms (VATP): When a platform provides trading services to Hong Kong investors (especially centralized matching, automated matching engines, token trading + custody), it must apply for a license from the Hong Kong SFC. The 2023 edition of the "VATP Guidelines" outlines many standards: eligibility, conduct, internal controls, cybersecurity, client asset segregation, market manipulation prevention, ongoing disclosure, etc. Additionally, the Hong Kong SFC website specifies that VATPs must fulfill requirements for secure custody, KYC/AML, transaction monitoring, preventing market abuse, accounting audits, and cybersecurity. Below is a list of licensed platforms and those in the application process published regularly in "Hong Kong Licensed Virtual Asset Trading Platforms" for reference.

Crypto Asset Custody/Pledging/Lending (Staking/Lending): Hong Kong financial regulatory authorities have provided special guidance for banks and institutions engaging in pledging services (locking client virtual assets in blockchain verification mechanisms to earn rewards). For example: internal control requirements, client asset segregation, conflict of interest management, and security infrastructure requirements. Additionally, regulatory authorities are currently consulting on the proposed establishment of a "virtual asset custody/trading/intermediary" licensing system.

Stablecoin Issuance: Stablecoins (especially fiat-referenced stablecoins) are a regulatory focus. According to relevant policy documents from the HKMA, starting from August 1, 2025, stablecoin issuers must be licensed. Issuers must meet capital requirements, maintain high-quality liquid reserves, have a redemption mechanism, and are prohibited from paying interest on the tokens themselves.

Asset Management: If a fund or asset management product holds virtual assets, the SFC requires managers to assess its valuation, liquidity, custody, security, and auditing across five core dimensions and disclose related risks.

Product Design, Lending/Financing, Derivatives (Pending Regulation): Regulatory authorities are also consulting on regulatory proposals for scenarios involving virtual asset trading, lending, pledging, derivatives, and tokenized assets. The SFC/FSTB issued a consultation on "VA Dealers & VA Custodians" in 2025.

(3) Continuous Advancement of Regulatory Sandboxes

The regulatory sandbox mechanism of the Hong Kong Securities and Futures Commission (SFC) has become a core tool for promoting innovation in the fintech and virtual asset fields since its launch in September 2017. This mechanism continues to upgrade under the ASPIRe virtual asset regulatory roadmap framework, forming a dynamic regulatory system covering diverse scenarios such as virtual asset trading platforms, RWA tokenization, and cross-border settlement.

The regulatory sandbox of the Hong Kong Securities and Futures Commission (SFC) is open to two types of entities: the first type is licensed institutions, such as virtual asset trading platforms that have obtained SFC Class 1 (securities trading) or Class 7 (automated trading services) licenses. The second type is startups, which must demonstrate technological innovation, compliance commitment, and market value, such as projects that optimize securities settlement processes through blockchain technology. During the testing period, participants can conduct business within a limited user scope, trading scale, and geographical restrictions, while also needing to report data to the SFC in real-time (such as smart contract audit results and user complaint records) and undergo stress testing to assess risk controllability.

The Financial Technology Regulatory Sandbox (FSS) and the Financial Technology Promotion Office (FFO) of the Hong Kong Monetary Authority (HKMA) are not specifically established for crypto assets but have been applied to related innovative businesses. The Financial Technology Regulatory Sandbox (FSS) was launched in September 2016, allowing banks and their partner technology companies to conduct pilot tests of their fintech plans without fully complying with HKMA regulatory requirements, involving a limited number of participating customers. This arrangement enables banks and technology companies to collect data and user feedback to improve new measures, thereby accelerating the launch of new technological products and reducing development costs.

Regarding tokenization, the HKMA held the launch ceremony for the Ensemble project sandbox on August 28, 2024, announcing that the first phase of the experiment will cover four major tokenized asset use case themes, marking an important step in the financial industry's practical application of tokenization technology. After fully considering industry intentions, market development trends, and the potential impact of innovation, the first phase of the sandbox experiment will encompass the tokenization of traditional financial assets and real-world assets, focusing on four themes: fixed income and investment funds, liquidity management, green and sustainable finance, and trade and supply chain financing. To consolidate Hong Kong's position as an international financial center and explore new economic fields with an innovative spirit, the HKMA will continue to actively communicate with the industry to understand their interest in tokenization development and jointly develop and identify new themes and use cases related to tokenization.

Source: HKMA official website

Considering the rapid technological iteration in this field and the novelty of regulatory challenges such as staking, decentralized autonomous organizations, and tokenized assets, this combination of sandbox testing and phased deployment allows regulators to first observe, then correct, and finally promote.

In summary, Hong Kong's financial regulatory authorities have a more positive attitude towards brokerages' layout of public chains. Although there is currently some cooling due to certain window guidance, we predict that as the crypto asset industries in countries like the US and Singapore continue to accelerate, there is still an expectation of moderate relaxation of regulatory boundaries in the future. Under this regulatory framework, brokerages and blockchain developers need to proactively meet regulatory compliance bottom lines regarding licensing access and investor protection, and conduct differentiated public chain development for different businesses. To further enhance their competitiveness, it is recommended to actively engage in the cutting-edge directions involved in the regulatory sandbox to effectively seize opportunities.

03. Decision Logic Analysis of Brokerages' Public Chain Layout

Based on the above theoretical and policy analysis, combined with the current business practices of domestic and foreign brokerages, we will discuss the decision logic of public chain layout for mainland brokerages, Hong Kong brokerages, global leading brokerages, and fintech brokerages.

3.1 Decision Logic of Mainland Brokerages' Public Chain Layout: Compliance First, Alliance Chain Adaptation for Short-Term Needs

Considering the regulatory attitude and logic in mainland China, the decision-making for public chain layout by mainland brokerages is mainly constrained by three factors: "strong policy constraints, weak business demand, and high cost investment." The core logic is to meet compliance requirements at the lowest cost, with no immediate consideration for public chain layout, specifically manifested as:

3.1.1 Compliance Priority: Highly Emphasizing the Rigid Constraints of Regulatory Boundaries

The regulation of blockchain technology in mainland China is based on the compliance path of alliance chains, and brokerages face two major compliance obstacles in public chain layout: first, the conflict between decentralization and regulation, as the decentralized nature of public chains makes it difficult for regulators to achieve penetrating management, which does not meet the SFC's requirements for real-time monitoring and risk controllability; second, the risk of data export, as the global nodes of public chains may lead to the export of customer data and business data, violating the "local storage of important data" requirement of the Data Security Law. In contrast, the alliance chain's characteristics of "controllable nodes and regulatory data" fully adapt to mainland compliance requirements—such as the securities industry evidence alliance chain only allowing licensed brokerages and regulatory agencies as nodes, with data stored on domestic servers, meeting both penetrating regulation and data security requirements.

3.1.2 Business Value Anchoring: Precisely Addressing Key Pain Points of Traditional Business

Currently, mainland brokerages' blockchain businesses focus on scenarios such as data evidence, investment banking document management, and customer suitability tracing, where the core needs are data immutability and traceability, which alliance chains can fully meet without relying on public chains. For example, for investment banking document evidence, the hash value of the documents can be uploaded to the alliance chain, allowing regulatory agencies to verify authenticity at any time, thus avoiding issues of traditional paper documents being easily tampered with and electronic documents being easily lost. In customer suitability management, customer risk assessments and product subscription operations can be uploaded to the chain, achieving "non-repudiation of operations" and effectively reducing customer dispute rates. For the disclosure of asset management product net values, real-time uploading of product net value data to the chain allows investors to query through the alliance chain, enhancing information transparency and reducing investor complaint rates.

These scenarios do not involve areas where public chains excel, such as "global liquidity and high-concurrency trading," and the technical performance of alliance chains is already sufficient, meaning the technical advantages of public chains cannot be converted into business value.

3.1.3 Limited Resource Investment: Achieving Technical Optimization Under Hard Cost Constraints

Developing a public chain in-house or selecting an external option incurs high costs, while mainland brokerages' blockchain businesses have not yet formed a profitable model, leading to limited resource investment. From a cost structure perspective, the costs of developing a public chain in-house include technical teams (blockchain engineers, security experts), infrastructure (node servers, operations), and compliance certification (multi-department filing, auditing), which require significant annual investment and continuous iterative investment, making it difficult to recover costs in the short term. Although the costs of external selection are lower than in-house development, they still require payment of public chain gas fees, technical adaptation fees (such as smart contract modifications), and compliance audit fees, while facing policy risks. Compared to these two options, alliance chains have lower costs, as multiple brokerages can jointly build (such as the securities industry evidence alliance chain), sharing R&D costs and fully complying with regulatory requirements.

Therefore, under high costs and unclear profitability, even from a market-oriented perspective, mainland brokerages will naturally choose the low-cost path of alliance chain cooperation and will not consider public chain layout for the time being.

3.2 Decision Logic of Hong Kong Brokerages' Public Chain Layout: Innovation-Driven, External Selection to Meet Business Needs

Considering the attitude and regulatory logic of Hong Kong's financial regulators, the public chain layout of Hong Kong brokerages focuses on quickly entering innovative businesses and obtaining incremental revenue, with the decision logic being to acquire licenses and technical capabilities at controllable costs, with external selection of public chains as the optimal solution, specifically manifested as:

3.2.1 Regulatory Compliance as the Basis: The Regulatory Attitude Towards External Public Chains Will Be the Core Entry Ticket

Hong Kong's regulation of brokerage blockchain businesses centers on licensing management, requiring brokerages to first obtain the relevant licenses before selecting suitable technical paths. Connecting with mature external public chains can reduce compliance costs in specific scenarios, but attention must be paid to the SFC's regulatory boundaries. On one hand, if brokerages use public chains, they still need to demonstrate compliance through third-party security audits (such as smart contract vulnerability detection), risk disclosures, etc., and must indicate risks such as "51% attack, irreversible on-chain data" in product documentation. On the other hand, compliance tools in the public chain ecosystem must meet localization requirements. Specifically, they must first comply with FATF Travel Rule standards and pass local compliance tests in Hong Kong, while also integrating with the brokerage's internal KYC/AML processes and suspicious transaction reporting mechanisms (such as linking on-chain address risk scores with customer identity information) to meet the requirements of the Anti-Money Laundering Ordinance.

In practice, Hong Kong brokerages often connect to public chains through licensed exchanges (such as OSL, Hashkey) rather than directly accessing public chain nodes. For example, GF Securities Hong Kong has chosen to conduct tokenized securities business using the Ethereum Layer 2 scaling network HashKey Chain, where HashKey Chain serves as the associated infrastructure of the licensed virtual asset exchange (HashKey Exchange), complying with the SFC's regulatory requirements for tokenized securities and effectively shortening the issuance and listing cycle of tokenized securities products, significantly reducing compliance costs.

3.2.2 Business Value Driven: Selecting Corresponding Public Chains Based on Business Needs

(1) Asset Tokenization Business: Emphasizing the Maturity of the On-Chain Ecosystem

Asset tokenization refers to the registration and circulation of traditional financial assets (such as bonds, stocks, fund shares, real estate rights, etc.) in blockchain form. For brokerages, this process is not only a technical issue but also involves compliance, liquidity, and custody. Therefore, in such businesses, brokerages pay more attention to the maturity of the public chain ecosystem and institutional acceptance. There are three main points to focus on.

First is the completeness of the developer and application ecosystem. An active developer community can continuously provide smart contract tools, security audit services, and application innovations. For example, Ethereum's leading position in token standards (ERC-20, ERC-1400, ERC-3643, etc.) gives it a significant advantage in the field of security tokens.

Second is the compliance compatibility. Asset tokenization often needs to meet requirements such as investor whitelisting, KYC verification, and transfer restrictions. Choosing a public chain that supports permission management and programmable compliance logic can effectively reduce regulatory friction. For instance, some Hong Kong institutions use permissioned layer solutions based on Ethereum to ensure that tokenized assets can only circulate among compliant investors.

Finally, liquidity and interoperability. Mature public chains typically have extensive DeFi ecosystems and cross-chain bridges, allowing tokenized assets to have potential secondary market liquidity and support integration with stablecoins, custody wallets, and other services, thereby enhancing the market attractiveness of the assets.

(2) Settlement and Clearing Business Emphasizes Public Chain Performance

Unlike asset tokenization, settlement and clearing businesses emphasize transaction efficiency and system reliability. Brokerages need to ensure that funds and assets can achieve atomic settlement in tokenized securities or virtual asset transactions to avoid settlement risks. This places high demands on the performance of public chains. Specifically, settlement and clearing systems need to have high throughput (TPS) to support institutional-level batch trading; low confirmation delays to ensure that fund transfers and asset deliveries are completed almost in real-time; network stability and security to prevent congestion, rollbacks, or chain fork events that could lead to settlement failures; and predictable transaction costs to allow brokerages to accurately calculate fees and control operational costs.

Therefore, in settlement and clearing scenarios, high-performance public chains (such as Solana, Pharos, Avalanche, or high-performance Layer 2 solutions based on Ethereum like Arbitrum) are of greater interest to brokerages. Some brokerages even consider adopting a hybrid architecture, using dedicated sub-chains in high-performance requirements to balance performance and compliance.

Due to space constraints, this article focuses on the public chain selection requirements in two specific business scenarios, while other business scenario demands can refer to the discussion on business practice details in the final chapter of this article.

3.2.3 Actively Participate in Innovation: Coordinating with Early Layout in the Regulatory Sandbox Will Be a Plus

Under the current financial technology regulatory framework in Hong Kong, the regulatory sandbox provides financial institutions with a mechanism to test innovative businesses in a controlled environment. For brokerages intending to engage in blockchain-related businesses, entering the sandbox means being able to test multiple innovative functions, including tokenized securities issuance, on-chain clearing and settlement, digital identity verification, and compliant custody, under the supervision of regulatory agencies. Through sandbox experiments, brokerages can not only validate technical feasibility but also gain early insights into regulatory requirements regarding business processes, data security, and customer protection.

In terms of compliance for crypto asset trading platforms, the SFC's sandbox is a key phase for platforms to obtain formal licenses. For example, HashKey Exchange became one of the first licensed platforms after passing sandbox testing in 2022, currently supporting spot trading of Bitcoin, Ethereum, and exploring derivatives business. HKbitEX was approved in December 2024, with its sandbox testing focusing on cross-chain asset exchange and institutional-level custody services, during which user asset scale reached HKD 1 billion. The SFC requires platforms to verify key indicators such as order matching efficiency and cold-hot wallet separation mechanisms within the sandbox. At the RWA level, the sandbox is also a key landing phase for subsequent tokenization. For instance, the RWA of Xiexin Energy's photovoltaic power station issued tokens to raise HKD 200 million through sandbox testing, with an expected annualized return exceeding 5%, and reduced cross-border settlement time from 3 days to minutes.

Brokerages adopting external mature public chains have a natural advantage in sandbox testing but need to undergo additional compliance modifications (such as node real-name authentication) to meet Hong Kong regulatory requirements. Since external public chains already have stable technical architectures, extensive ecosystem support, and auditable security foundations, brokerages can quickly complete access and verification, shortening the cycle from proof of concept to actual deployment. This approach helps brokerages establish compliant and feasible business models ahead of the gradual relaxation of regulations, seizing market opportunities. Additionally, through continuous testing and feedback in the sandbox, brokerages can also influence the formation of regulatory policies, promoting industry standardization and institutional improvement.

3.3 Decision Logic of International Leading Brokerages and Fintech Brokerages in Public Chain Layout: Self-Developed Layer 2 Architecture, Controlling Core Standards

Considering the length of the article and the completeness of the research, this article only provides a brief summary of the public chain layout situation of international leading brokerages and fintech brokerages, rather than a systematic logical analysis.

In the context of the global digital transformation of finance, an increasing number of international leading brokerages and fintech brokerages are actively laying out blockchain and public chain infrastructure. Compared to the early simple participation in tokenization projects or the use of third-party public chains to deploy applications, these institutions' strategies are significantly upgrading: they tend to self-develop Layer 2 architectures or sidechain systems on existing mainstream public chain ecosystems (such as Ethereum) to control key standards, reduce compliance risks, and occupy core positions in future digital asset settlement networks.

First, from the perspective of technical architecture and controllability, leading financial institutions generally seek to balance open ecosystems and autonomous control. While mainstream public chains (such as Ethereum and Solana) have mature ecosystems and ample liquidity, their public transparency and immutability also mean that transaction privacy, data sovereignty, and performance predictability are difficult to fully meet institutional-level needs. By self-developing Layer 2 architectures (for example, based on ZK-Rollup, Optimistic Rollup, or Validium solutions), brokerages can achieve tiered management of on-chain data visibility, retaining the open attributes of interoperability with the mainnet while ensuring compliance, privacy, and security control through an independent settlement layer. This architecture can support the concept of "Regulated Open Finance," providing a technical foundation for financial institutions to achieve compliant innovation within the public chain ecosystem.

Second, from the perspective of compliance and regulatory adaptation, self-developed Layer 2 architectures can more flexibly embed regulatory interfaces and compliance controls. International brokerages, when facing different market regulatory systems, need to dynamically implement KYC/AML (Know Your Customer/Anti-Money Laundering) mechanisms, transaction traceability, and permission management requirements. If they rely entirely on external public chains, these functions often need to be implemented through additional intermediary layers or whitelisted contracts, leading to operational complexity and regulatory inconsistencies. By self-developing Layer 2 networks, institutions can embed compliance logic at the underlying protocol level, achieving "Compliance by Design," thus more efficiently connecting with financial regulatory agencies in various countries, especially under the EU MiCA legislation, the expansion of SEC regulation in the US, and the tokenization regulatory frameworks in Hong Kong and Singapore, which holds significant strategic value.

Finally, from the perspective of ecosystem and standard competition, international leading brokerages are more focused on controlling the discourse power of future digital financial infrastructure. The competition in blockchain ultimately goes beyond performance and cost; it is also about who can set and dominate key interface and asset mapping standards. By self-developing Layer 2, brokerages can establish standardized protocol layers aimed at institutional-level standards, such as Tokenized Asset Registry, Settlement Messaging Format, and On-chain KYC Framework. As more assets and institutions operate based on these standards, the party developing Layer 2 becomes the standard setter and network hub of the "next-generation financial infrastructure."

For example, Goldman Sachs and JPMorgan have respectively promoted the integration of internal blockchain systems (such as GS DAP and Onyx) with external ecosystems and are actively researching how to be compatible with the Ethereum ecosystem; while fintech brokerages like Robinhood are studying high-speed trading and cross-chain settlement solutions based on Layer 2. The common logic behind these actions is: by self-developing interoperable Layer 2 systems, they aim to master the core standards and pricing power of the next-generation financial network.

Source:

https://mp.weixin.qq.com/s/wE5sP7puYexaVK5oCiNCvw?scene=1&click_id=1

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。