TCG is a real asset class, not a short-term trend.

Author: Max Wang @IOSG

In the past few months of 2025, the on-chain TCG (Trading Card Game) scene has gained significant attention. Off-chain, particularly since 2019, the popularity of TCGs has rapidly increased—however, few people know that TCGs have existed for over 50 years, and the ecosystem is actually quite mature, comparable in scale to the sneaker/watch market. This article aims to introduce the latest developments in the TCG field, early startups in the sector, and their respective scales, with the goal of providing readers with a better perspective on the development of the on-chain card market.

TL;DR

# TCG is a real asset class, not a short-term trend.

The global TCG market size has reached $8-10 billion, comparable to sneakers and below watches, with an annual compound growth rate of about 8%, and over 25 years of cultural depth (Pokémon, MTG, Yu-Gi-Oh).

# The on-chain TCG market structure is skewed, driven by the gray market.

Supply flows from publishers → distributors → big box/traditional stores → gray market → retail. True collectors rarely interact with MSRP; over 50% of volume/price discovery occurs in the gray market, driving up the cost of card breaks.

# Card grading is a massive, centralized "picking and shoveling" business.

About 1.5 million items per month, approximately 18 million items per year, each around $40: this is an industry worth about $720 million annually, with PSA holding about 77% market share.

About 65% of grading volume is TCG, while sealed card grading is the financialization layer that turns cards into tradable "assets."

# The market size of sealed packs/products dwarfs Gacha (card draw).

Just for Pokémon: about 10 billion cards → about 1 billion packs/year, average pack price around $15 → about $15 billion in sealed pack sales, while the overall Gacha market is about $800 billion. Gacha is booming in CT; however, for the TCG field, sealed products are the real economic powerhouse.

Targeting hardcore fans/TCG collectors, who are more dedicated and sticky than Gacha players.

# Hardcore fans/TCG collectors (the consumer group of rip.fun) are willing to accept digital assets and have significant spending power.

Spent $1.3 billion on digital versions of Pokémon packs with no monetary value.

$3 billion GMV (users purchase packs from streamers, who open the packs for them, even with significant trust issues, rip.fun can resolve).

# Direct statements from leading participants in the Gacha field (Collector Crypt, Beezie) show they do not intend to enter the sealed product/live pack opening market.

# Opportunity: Build infrastructure, not just another "casino."

We believe the biggest growth potential lies in

Access tracks (fair on-chain distribution, fragmented asset ownership, live pack openings at near MSRP),

Liquidity tracks (vaults, tokenization, MM/AMM layer for segments/sealed), and

Derivatives/credit (perps, indices, options, TCG collateral lending).

# On-chain TCG is mainly divided into four verticals:

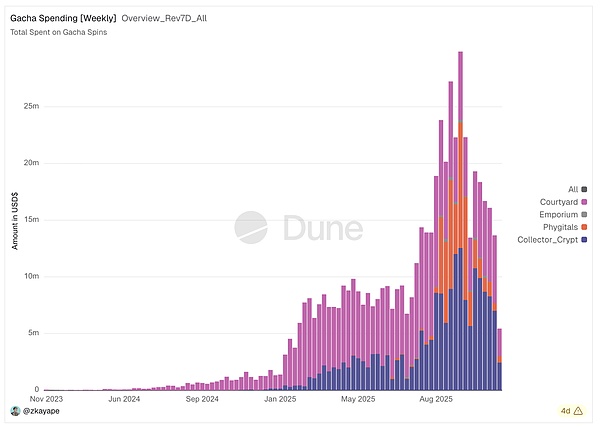

Gacha card draw platforms (Courtyard, Collector Crypt, Phygitals): unofficial TCG packs built from secondary market segments. The annual GMV of the three major platforms has reached about $750-820 million, with a net profit margin of about 10%, 80/20 coming from gamblers and fans.

Digital sealing/live pack opening platforms: sealing and opening official SKUs (packs, ETBs, boxes) through card management and grading processes, serving hardcore fans/collectors. Labor-intensive, but with higher ARPU and stickiness.

Currency markets: using tokenized segments/sealed packs as collateral, allowing collectors/stores to borrow money instead of selling cards directly; PocketDex is naturally suited as a front-end interface for "portfolio and risk management," seamlessly integrating with lending infrastructure.

Perp markets: synthetic risk exposure of TCG indices/sets; Trove is the current leading case, offering Pokémon indices and CS2 skins perps for hedging and speculation.

I. Background and Introduction

First, what is TCG? TCG (Trading Card Games) is a collectible card game where players compete against each other by building and customizing their own decks. Players obtain new cards through packs containing random types of cards or by trading with other players. However, beyond being a competitive game, TCG cards also become collectibles due to their limited nature, similar to artworks.

Some popular TCG games include:

Pokémon TCG - 1996

Yu-Gi-Oh TCG - 1996

Magic: The Gathering - 1993

From the scale of the TCG market, TCGs are comparable in market size to other popular collectibles in the market.

Currently, most reports estimate the annual sales of the TCG market to be between $8 billion and $10 billion, with an expected annual compound growth rate of 7.8%.

II. TCG Market Structure and Landscape

Currently, the TCG market can be divided into off-chain TCG experiences and on-chain + digital TCG experiences, each with different participants. Clearly, the non-chain market is more mature, but the on-chain digital TCG environment is also rapidly gaining popularity. From any perspective, every segment of the entire TCG market has reached historical highs.

Off-chain

Bottom-up perspective:

TCG publishers/factories

Distributors

Stores

TCG official retailers

Secondary market stores

Distributors/gray market

Retail

Grading companies

The current process is roughly as follows. TCG publishers/factories produce official packaging and sealed products, which are then handed over to distributors. Distributors allocate them to stores/TCG official retailers, such as Walmart, Target, or small vendors. However, due to the immense demand and popularity of these products, they are often bought in bulk by scalpers and then sold at high prices to true collectors/retailers.

Pokémon TCG Sealed Pack

Store > Distributor Relationship

Regarding the relationship between stores and distributors, new individual stores find it challenging to obtain any meaningful allocation from distributors due to the overwhelming demand. Most products flow to large corporations like Target/Walmart or well-established stores with good relationships, with only a few products reaching small stores. Therefore, many small stores source from larger stores that have better distributor allocations, such as:

Store A receives an allocation of 5,000 packs per month from the distributor

Store B has 100 packs

Store A buys 5,000 packs from the distributor at MSRP

Store B buys 2,500 packs from Store A at 15%+ MSRP

Store B sells to scalpers/retailers at 50% of the suggested retail price

Additionally, it is important to distinguish between types of stores. Large stores like Walmart/Target sell to the market at MSRP. However, there are also examples like Store A and Store B, which are individual brands with distributor quotas, selling to the market at a markup of 10%-50%. Generally, true retail collectors find it nearly impossible to obtain sealed products directly from Target/Walmart; they often have to seek out these small stores or acquire products entirely through gray channels.

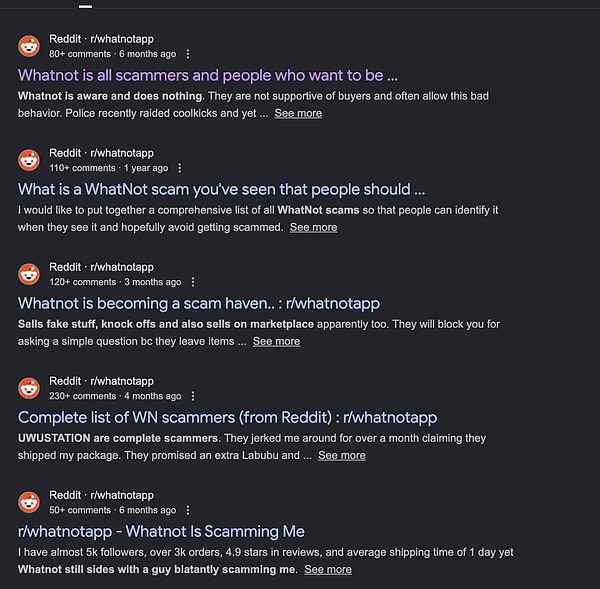

Gray Market

The gray market itself accounts for 50% of the TCG market, with some believing it to be larger than the primary market's sales. This part of the market mainly includes scalpers, eBay sellers, Whatnot/live breakers, Facebook/Discord sellers, and informal Telegram/Instagram networks, which exist between official stores and true end collectors.

Gray market participants typically do not source products from distributors but obtain them from the following channels:

Big box retail (restock events at Target/Walmart, store-hopping events, etc.)

Allocation stores like Store A, which sell part of their allocated products at a markup

Liquidating collectors/stores that need to cash out quickly and are willing to accept discounts

Then, gray market participants repackage and resell products in various ways:

Selling sealed boxes/ETBs/booster boxes at high prices

Splitting on platforms like Whatnot (purchasing partial packs instead of whole boxes, usually implying high markups)

Grading and flipping individual games on eBay/TCGplayer, or consigning to large sellers

Gacha S-level collectors

Since true retailers cannot reliably obtain MSRP products, the gray market has effectively become the core venue for price discovery. Distributors and big box stores nominally sell at market prices, but most of the economic surplus is captured by intermediaries from the secondary market premiums obtained from retail collectors. This also means that for hot-selling products, the effective price is determined by the clearing price in the gray market, rather than the official suggested retail price of Pokémon. Therefore, this puts significant upward pressure on prices across the entire TCG industry.

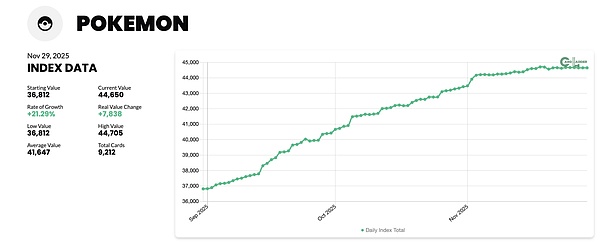

▲ Pokémon Market Index

Increased by 21.3% in three months, approximately 250% in a year and a half.

Grading

Grading companies are at the top of the entire off-chain TCG industry. They rarely have direct contact with sealed products or distributor-allocated products; instead, they receive raw items from stores, card breakers, and collectors, converting them into segments with standardized condition grades.

The major grading companies include:

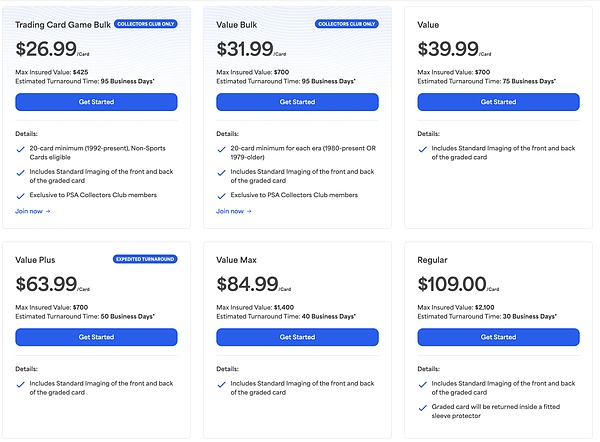

The average pricing range for grading items is:

Card grades range from 1 to 10, with 10 being mint condition, which significantly impacts the card's value. For example, an ungraded original card is worth $100, but if sent for grading and receives a PSA 10, it can be worth $2,000. Therefore, the vast majority of collectors and live breakers choose to send high-value cards for grading.

▲ Ungraded card vs. graded card (slabbed)

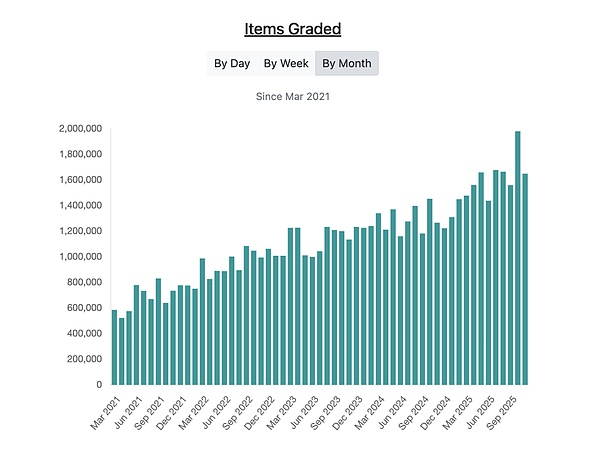

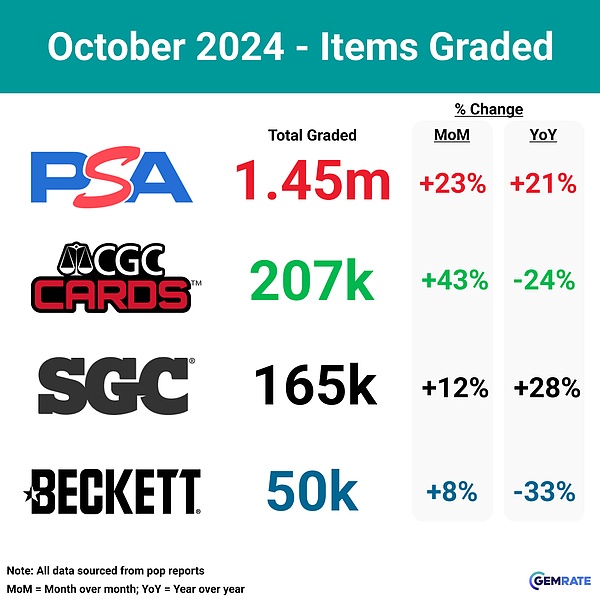

Here we can see the number of cards graded monthly by the five major grading companies. Since 2021, the average number of graded items has steadily increased year by year, more than doubling from the beginning to the end.

▲ Approximately 1.5 million items per month

Not considering growth factors, about 18 million items per year

Each item approximately $40

An industry worth $720 million annually dominated by four companies, with over 65% of grading volume coming from one TCG company.

As for the market share breakdown, PSA is clearly the leader:

PSA: ~77.5%

CGC: ~11.1%

SGC: ~8.8%

Beckett: ~2.7%

III. On-chain + Digital TCG

Now let's take a look at the market landscape of on-chain + digital TCG, which can be divided into the following categories:

Gacha platforms

Sealed pack/live pack opening and card management platforms

Currency markets (lending markets)

Perpetual contract markets

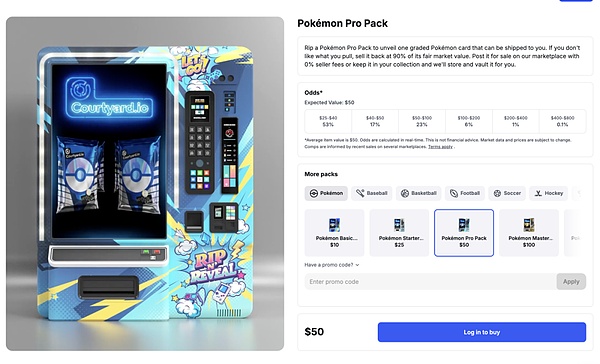

Gacha Platforms

Clearly, considering the intrinsic connection between Gacha platforms and cryptocurrency, Gacha platforms have been a focal point in CT. So, what is a Gacha machine?

Generally, Gacha machines are unofficial products curated by third parties (Courtyard, Beezie, etc.). Gacha platforms select cards from the secondary/gray market, purchase inventory, and curate unofficial card packs from it.

However, the core of Gacha is the random allocation of items at a fixed price. The term comes from Japan's claw machines: insert a coin, twist the knob, and randomly receive a toy from a known pool. In terms of TCG, when you pull from a Gacha platform, the platform randomly returns graded cards.

You need to pay a fixed amount (e.g., $3 each time)

Draw one or more cards from a predetermined card pool

The card pool has different rarity levels and probabilities (common/rare/super rare)

The entire economy revolves around chasing specific rare cards or multiple pulls

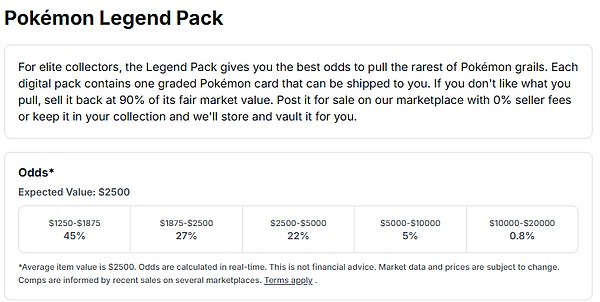

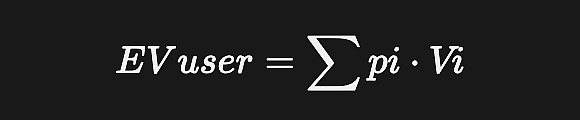

Thus, the pricing for each draw on Gacha platforms is based on the EV mechanism:

Item i = 1 … n

Drop probability $Pi (summing to 1)

Secondary market fair value $Vi (actual selling price after fees)

Price per pull/platform fee $P

Then, the expected value for a user pulling once is

Therefore, the overall goal of the platform is

And the house edge (platform profit margin)

Essentially represents the profit the platform makes for each Gacha pull.

Users chasing a specific card/trying to hit a premium card contribute most of the EV.

The EV of common/rare cards is nearly zero.

The retail price per pack is set above its resale value weighted by the probability of the built-in cards.

Insights from Beezie/Collector Crypt indicate:

"Most Gacha platforms have a net profit margin of about 10% of the total expenditure on Gacha machines. The reason is that we typically purchase cards in bulk from gray market stores at 90% of market price, and then use this inventory for our Gacha machines."

About Traffic

# Consumers

Players deposit USD/cryptocurrency

Select and purchase the Gacha pack they want to open

Sell the received cards back to the platform at 90% of their market value or exchange for physical cards

If exchanged, receive physical cards

# Platform

Purchase cards at a discount from gray market traders or the market

Curate Gacha packs and calculate pack prices based on EV

Buy back cards from consumers or send cards to consumers (if it's a physical exchange)

Repeat

So what is most important for Gacha platforms?

The ability to consistently obtain a supply of graded cards below market price

The ability to create +EV Gacha machines that encourage players to keep "gambling"

Overall, the major players in this field can be categorized as follows:

Courtyard.io

Users ~250k

Total expenditure on the platform (YTD): ~ $536.5 million

Gross profit: ~ $53.6 million

Collector Crypt ($CARDS)

Users: ~10,000

Total expenditure on the platform (annual): ~ $150 million

Gross profit: ~ $21 million

Phygitals

Users: ~20,000

Total expenditure on the platform (annual): ~ $61 million

Gross profit: ~ $6.1 million

Thus, the total expenditure of the three giants in the Gacha industry is $747.5 million, surpassing the grading card market that has been indispensable to the industry for the past decade.

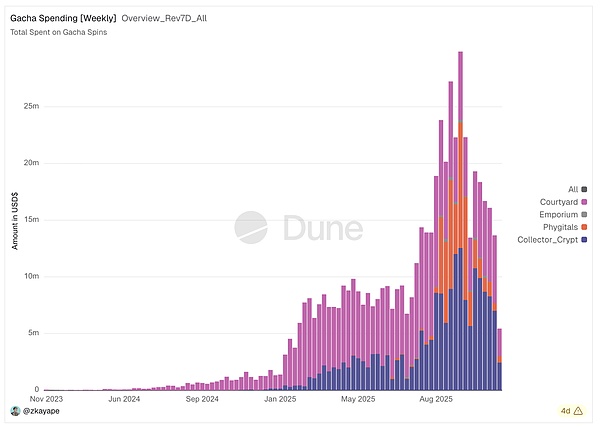

Overall, the distribution and growth of transaction volume in the entire Gacha industry over the past year are as follows.

IV. Sealed Packs/Live Pack Opening and Card Management Platforms

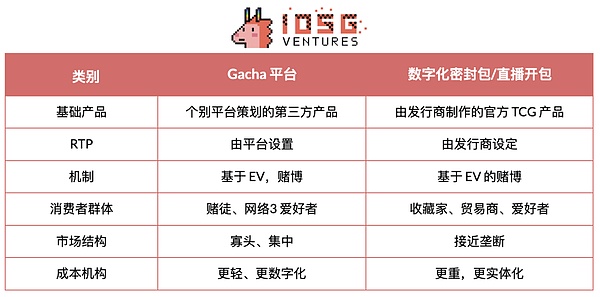

Recently, another new vertical has emerged in the on-chain TCG space, which is sealed pack/live pack opening and card management platforms. So, how do sealed pack/live pack opening platforms differ from Gacha?

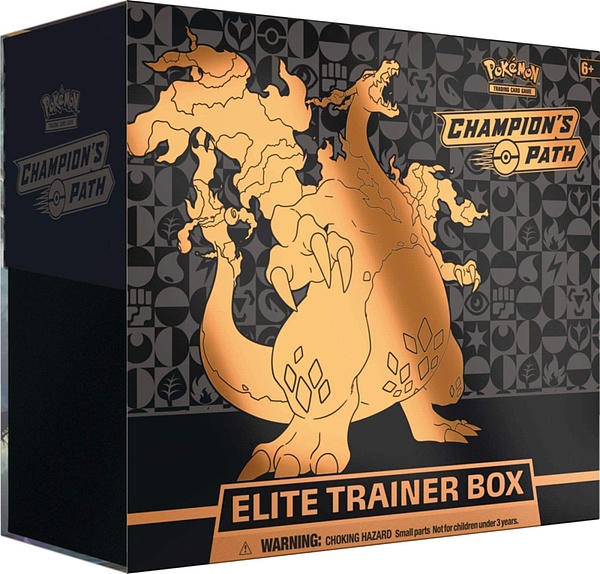

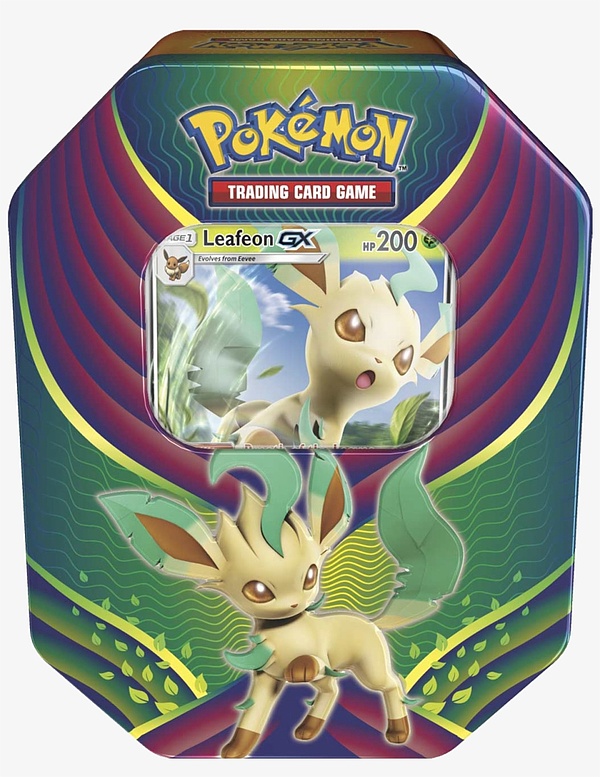

In general, Gacha machines are unofficial products curated by third parties, while sealed products are officially printed products by publishers (like Pokémon, MTG, etc.). They are usually limited in quantity, and in Pokémon, there are typically these standardized products:

Single packs (10 cards per pack)

Booster Boxes (36 packs)

Elite Trainer Boxes

Tins

Boxes

Therefore, sealed pack/live pack opening platforms sell TCG official products, rather than synthetic prize pools like Gacha. In principle, when you purchase a sealed pack or Elite Trainer Box, you are buying the original factory-configured cards and hit rates designed by Pokémon or MTG. The platform's role is to procure and store these sealed products, match them with buyers, and unseal them on demand, rather than remixing the underlying cards into a custom "internally designed" Gacha pool.

Additionally, why do sealed products/live pack opening products cater more to the needs of super fans?

Sealed products are usually limited edition, belonging to specific series with specific production dates

Collectors and fans chase specific series cards, thus preferring to open sealed products

Collectors/fans want to obtain original card grades, and to get the original cards, they need to open sealed products

About the Process

# Consumers

Players deposit USDC/cryptocurrency

Choose the official sealed pack they want to open

Wait for the platform to open the pack and watch the live opening

Sell the received cards back to the platform at 90% MP, exchange for physical cards, or request the platform to send for grading

If redeemed, receive physical cards/wait for grading to return

# Platform

Bulk purchase official packaging directly from distributors or other stores with distributor allocations

List the packaging with a set margin (10%-50%)

Actually open the packaging, store the cards, and manage them

Buy back original cards from consumers, send them to consumers if redeemed, or send them out for grading

Repeat

So, what is truly important for sealed product/live pack opening platforms?

Having stable distributor relationships to obtain sealed products at official pricing (MSRP), or having a network of stores that will provide them allocations

Setting up warehouses/infrastructure to effectively manage the opening process and prove that these packages are authentic

Offering sealed products at reasonable prices to attract consumer fans to purchase

In general, the management costs of these sealed pack/live pack opening platforms are significantly higher than those of Gacha. While Gacha platforms also need to manage and store cards, they do not have to deal with procuring official packs (which is a huge capability constraint), actually opening packs, scanning cards, helping customers send for grading, etc. This incurs substantial operational costs from execution and warehousing.

Quoting Beezie and Collector Crypt directly:

Neither end is interested in entering the sealed pack/live pack opening market.

- When asked very clearly, they said no.

Reasons:

Lack of understanding of this field;

They believe the operational burden is too heavy and do not know how to build the infrastructure;

No distributor relationships

They are vigorously developing more Gacha product lines, shifting towards non-Pokémon TCG products rather than the sealed pack/live pack opening route. However, this also means that players who can effectively enter this field have a significant moat and can easily dominate the market.

To summarize, the main differentiating factors:

Insights from John @ Cardmint

He is one of the largest buyers and suppliers of graded slabs for companies like Courtyard and Beezie, with monthly trading volumes reaching millions (former Chainlink engineer).

The distribution of gamblers/true fans in on-chain TCG is 80/20

However, despite the smaller number of fans, they are more loyal and sticky than gamblers and possess significant spending power

Consumer Preferences and Demand for Sealed Products

Consumer preferences for Gacha and sealed packs/live pack openings are also important. Gacha products cater more to the needs of gamblers/Web3 users, who only care about the value of the graded cards they receive, rather than the cards themselves, while consumers purchasing sealed packs/live pack openings are more likely to be die-hard fans of specific TCG series. Objectively speaking, there is demand for Gacha, so the main question here is whether there is demand for sealed packs/live pack openings, and whether the core TCG fanbase has the spending power/willingness to act as Gacha purchasers.

Some key data:

Pokemon Pocket is an official Pokémon app, a casual digital version of Pokémon TCG. Players spend money to open digital packs, but the cards have no monetary value and cannot be redeemed for anything. They are merely souvenirs.

Year one revenue: $1.3 billion

18 million packs opened

Additionally, Whatnot has generated billions of dollars in GMV. On Whatnot, Pokémon fans pay live streamers to open packs live and send the cards to them.

2024 GMV: $3 billion

2025 GMV: $6 billion (projected)

Moreover, there are significant trust issues on Whatnot. Sellers on Whatnot often steal cards, weigh packs, or switch cards before sending them to viewers. However, TCG fans are still willing to spend so much money on their platform to obtain sealed packs.

True core TCG players are not only willing to give up the physical experience of opening packs themselves in favor of digital experiences, but they also demonstrate strong spending power and high engagement with the game. For example, in Pokemon Pocket, those packs have no monetary value at all, yet core fans continue to enthusiastically open them.

Therefore, while on-chain live pack opening caters more to die-hard fans, these die-hard fans have stronger spending power and are more willing to adapt to digital experiences. It is clear that TCG's die-hard fans have a very high demand for general sealed pack products, whether they are digital or physical.

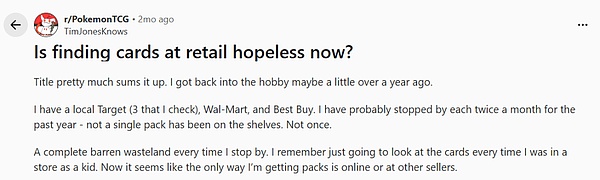

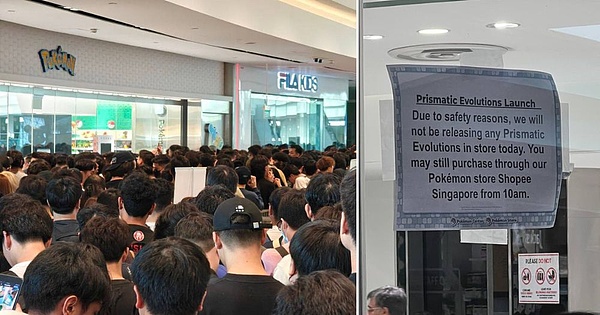

In terms of market, we also see significant demand drivers.

Pokémon TCG cards sell out in retail stores, and retailers (Walmart, Target, etc.) often have to limit the purchase quantity per person.

V. Market Size of Gacha vs. Sealed Pack Products

The TCG market is not limited to Pokémon, but on most Gacha platforms, Pokémon has almost become the only category available for drawing.

Sealed Products

Pokémon TCG printed 10 billion cards in 2024

Estimated around 50 million players/buyers

10 cards per pack → 1.02 billion packs per year

Approximately $15 per pack (MSRP + gray market mixed pricing)

Annual sales of sealed packs are approximately $15 billion.

Gacha

The three giants dominate the industry, holding 90% market share.

Annual Gacha sales amount to $747.5 million. If adjusted for other players at ~+10%, Gacha would become an $822.5 million industry.

The sealed pack product industry is far larger than the on-chain Gacha industry.

Currency Market

Currency Market

The currency market is also a field that on-chain TCG has just begun to explore, but logically, once cards are properly digitized and vaulted, the currency market will become the next layer. The core idea is simple: to convert blocks and sealed products into collateral, allowing collectors to borrow stablecoins from shops when they need liquidity, without having to sell their collections each time to obtain cash.

In the on-chain TCG currency market, tokenized TCG assets (representing blocks or sealed vault NFTs/ERC-1155) can be deposited into lending protocols, allowing users to borrow USDC or other liquid assets against them. This requires:

(i) Robust floor/exponential pricing

(ii) Conservative LTV considering reprint risks and pop-report shocks

(iii) Sufficient secondary liquidity to enable liquidators to actually liquidate collateral.

This is precisely where PocketDex can naturally fit into the entire ecosystem: products like PocketDex have already taken on the role of a card database + portfolio management tool, integrating card information, price data, and user collections into one interface. If this view is connected to on-chain custody and lending protocols, PocketDex could effectively become the discovery gateway for the lending market + risk management front-end interface:

Users can view their tokenized collections, real-time valuations, and system-suggested borrowing limits;

One-click access to lending protocols to establish credit lines for specific sealed cards/series;

Repayment, health metrics, and liquidation alerts can all be displayed in their daily-use "collector app."

For collectors, this is like collateral for their collections. For shops and brokers, it acts like a warehouse line backed by inventory, allowing them to smooth cash flow and scale operations.

Derivatives Market

The Perp market further expands this functionality, allowing people to engage in purely synthetic TCG long/short trading with leverage without touching physical cards. Traders can go long on the "EVSK Box Index Perp" instead of buying and storing an "Evolving Skies" box; traders can trade the "Charizard PSA-10 Index Perp" instead of building a massive "Charizard" portfolio.

Trove is the most obvious living example here: it is a decentralized perpetual futures exchange specifically for collectibles, starting with Pokémon card indices and CS2 skins, offering up to ~5x leverage. Trove aggregates pricing data from major markets, builds on-chain indices (like the Pokémon card index, Charizard PSA-10 benchmark), and allows users to go long or short on these indices through perps. In practice, this:

Provides collectors and shops with a way to hedge against the risk of physical/archival inventory declines (when they go long on cards, they can go short on Trove);

Allows traders to express views on sets, eras, or the entire Pokémon market without dealing with grading, shipping, or storage issues;

Establishes an arbitrage loop between physical spot, tokenized spot (courtyard/collector basement/Phygitals), and derivatives.

What is truly important here is index construction and data quality: if Trove (and similar platforms) can become the typical pricing and hedging venue for TCG, then perps can turn cards from illiquid collectibles into tradable macro surfaces. Combined with the currency market, a full trading suite can be realized: hold → borrow → hedge → fully speculate on TCG risks on-chain, with Trove positioned as the derivatives layer above vaults, Gacha platforms, and sealed pack/live pack opening tracks.

VI. Arguments and Observational Perspectives

Overall, it is clear that there is a significant demand driver for off-chain TCG, and we have already seen the atmosphere for on-chain TCG beginning to form. For most people, the value of cryptocurrency to society lies in abstracting the difficulties we see in traditional finance and providing new opportunities to push the frontier of financial technology. In many ways, this mirrors the relationship between off-chain TCG > on-chain TCG, where the latter exists to reduce the friction largely seen by consumers and TCG fans, while also providing more use cases, opportunities, and avenues for their hobbies.

We can also infer that this market will continue to exist; its value lies in capturing it, and the opportunities in this market have matured. This is not just a new hobby/market; TCG has been popularized over the 25 years since its inception, and cards/collectibles have become valuable assets, much like art or NFTs.

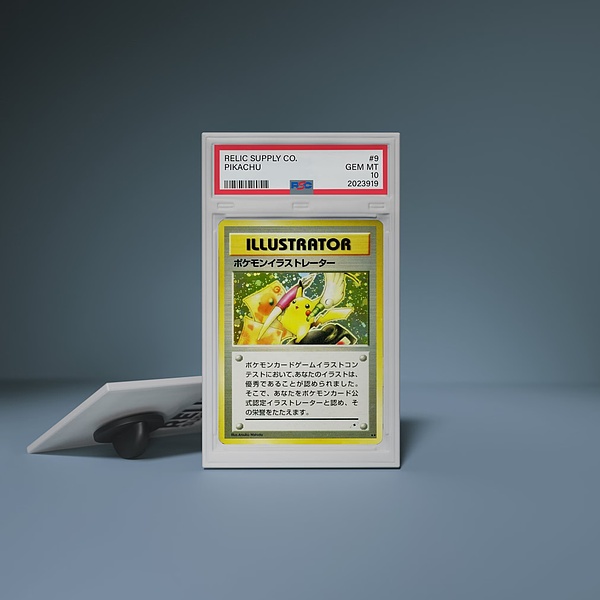

Selling for $3 million

Magic the Gathering, Black Lotus - PSA 10

Sold for $5.25 million

Pokémon, Pikachu Illustrator - PSA 10

In summary, there seem to be several interesting angles worth focusing on:

Products Bridging Retail Supply > Demand Issues

Currently, there is a severe shortage of demand in retail: distributors allocate most of the supply to whales and well-connected shops, while true collectors are pushed to the gray market, forced to pay exorbitant premiums. On-chain + digitized TCG infrastructure can directly address this issue. Here, access means: providing retailers with a trustworthy, fair pathway to obtain sealed products or single cards at close to the highest retail prices.

Examples of product directions:

An on-chain real-time pack opening platform where collectors/fans can directly purchase and open packs online, paying only a small fee, while also having the option to redeem physical cards if they wish.

Alleviating retailers' demand for packs;

Or paying scalpers 2-3 times the markup.

Fragmenting pack ownership, allowing retail users to purchase a portion of sealed inventory (like 1/36 of a box) at a reasonable price without having to pay an inflated price for an entire box they cannot afford.

Bulk purchasing from distributors/large stores and then repackaging into smaller, fairer fragmented products for global retail, rather than products under a relationship network.

On-chain queueing/lottery/whitelist lists for sealed card products, with allocation limits and transparent odds for each wallet.

These products may not necessarily change the total supply of Pokémon, but they can fundamentally change who can truly access Pokémon cards and at what effective price.

Platforms Enhancing Overall Instant Liquidity in the TCG Market

Most off-chain TCG value remains in slow, high-friction forms: physical collections or sealed packs in warehouses. Selling typically means listing on eBay, incurring fees, and facing weeks of delays. On-chain card management and custody platforms can transform this into instant, programmable liquidity.

The core gameplay is: physical vault → tokenization → insertion into DeFi-like tracks.

Platforms can enable block vaults and tokenization, allowing them to trade and transfer around the clock without physically moving items.

Real-time pack opening solutions can instantly push clicks into users' digital inventories, ready for listing, auctioning, and collateralization at any time.

Yield vault platforms can act as market makers between different markets, standing on both sides of popular SKUs (chase cards, key blocks, flagship packs) to narrow the price gap with eBay, enabling instant sales rather than "waiting for 10 days for the auction to end."

This can:

Accelerate turnover for shops and collectors.

Enable global price discovery rather than fragmented local pricing.

Incorporate TCG assets into other protocols (lending, AMM, indices, etc.), which would be impossible if everything existed in paper card form.

Auxiliary Products Built on the On-Chain TCG Market Foundation, Allowing for the Emergence of Derivatives

Related to the last point above; once TCG assets are properly digitized (NFTs, vault tokens, price feedback), derivatives and structured products can begin to be built on top of them, transforming collectibles into proper financial primitives.

Examples include:

Perpetual coins/futures

Indices of top-rated cards (e.g., Top 50 Pokémon slabs index)

Specific sealed products (e.g., evolving skies booster box perp)

Options or vault strategies allowing users to bet on the volatility or upside of a set of cards without holding specific cards

Currency markets using packs/that article as collateral, managed by oracles and liquidators

Prediction markets around issuance, reprint risks, or PSA count growth, allowing traders to hedge or speculate on the meta-factors driving TCG prices

These auxiliary products do not directly compete with Gacha or live pack opening but exist above them. Gacha and sealed card/live pack opening platforms handle buying, selling, and inventory management, while derivatives and currency markets deal with risk transfer, leverage, and hedging. Together, they transform TCG from a niche collectible ecosystem into an increasingly formalized, multi-layered on-chain financial market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。