- The market may have underestimated the space for interest rate cuts, and there will be more cuts next year than the market currently expects.

Compiled & Edited by: Deep Tide TechFlow

Guest: Fabian, Crypto Analyst

Host: Miles Deutscher

Podcast Source: Miles Deutscher Finance

Original Title: Smart Money Is Front-Running Bitcoin 2026 (You’re Not Bullish Enough)

Broadcast Date: December 6, 2025

Key Points Summary

In this episode of the podcast, Miles Deutscher delves into Bitcoin's response to market fear, pointing out that this may signal the early stages of the liquidity cycle in 2026. He also discusses how institutions, sovereign funds, and major market participants are actively positioning themselves ahead of a potential bull market expansion. Together with Fabian, he interprets the macroeconomic forces driving Bitcoin, Ethereum, and the entire crypto market, revealing the true competitive advantages quietly forming in the altcoin market.

Highlights

The panic selling in the market is nearing its end.

The four-year cycle has never truly existed.

Interest rate cuts are essentially a done deal.

Some sovereign funds are on standby, gradually increasing their positions at 120,000 and 100,000, and I know they bought more at 80,000.

The core driver of the Bitcoin market is liquidity, not technical chart lines or indicators like the 50-day moving average. Bitcoin is essentially a "liquidity sponge" that absorbs liquidity from the market.

The market may have underestimated the space for interest rate cuts, and there will be more cuts next year than the market currently expects.

The current market performance is more related to the macroeconomic environment than to internal events of Bitcoin.

We are currently in a bottoming phase, and in the coming months or even quarters, the market is more likely to break upward rather than continue to decline.

After the market has experienced significant volatility, when it first rebounds to key resistance levels, it will definitely encounter selling pressure. What is truly important is how the market reacts to these key levels, not just whether the price breaks above or below them.

Banks gradually opening up cryptocurrency to clients is a long-term global trend.

Financial institutions will ultimately have to compromise and join the trend of cryptocurrency; this has become inevitable.

If you are a country or a sovereign fund looking to accumulate Bitcoin, you certainly wouldn't announce it publicly at first until you are satisfied with your holdings, and you might never disclose it because you don't want to be front-run.

Bitcoin is gradually becoming an attractive long-term diversification tool.

Bitcoin-backed loans may be a sign of the gradual legitimization of Bitcoin as an asset class.

The main selling pressure on Ethereum comes from the treasury; as long as they continue to hold, ETH may outperform in the short term.

A significant advantage of prediction markets is that they allow you to trade the same underlying assets as traditional markets without the risk of liquidation.

The trading logic of prediction markets is simply "yes" or "no," and this simplicity lowers the investment threshold while also reducing unnecessary risks.

Prediction markets are a very basic yet effective way of market trading, especially in some lower liquidity areas, such as pre-market trading; it may be one of the most product-market fit innovations in the current crypto space.

Psychological Characteristics of Bitcoin Bottom Formation & Key Indicators of Extreme Selling Analysis

Miles: The past week has been filled with negative news, but the market's reaction to these messages has been relatively stable. Generally speaking, FUD often marks the bottom of the cryptocurrency market, such as China's ban on Bitcoin, negative news about Tether, and the Bank of Japan's policies; these events often herald the arrival of local bottoms. This week, I gathered some evidence and found that the flow of funds seems to have gradually shifted from bearish to bullish. Of course, there are still some things to watch out for, such as potential DAT selling pressure and some macroeconomic factors.

Overall, based on the existing information, from a probabilistic perspective, I believe the bottom may have already formed. What do you think? Do you believe Bitcoin has bottomed?

Fabian:

My view is basically in line with yours, I believe the peak capitulation has passed. We mentioned this in last Friday's live stream. In fact, from multiple indicators, we have already experienced extreme selling levels. At the beginning of this week (Monday), the market saw a slight pullback, with prices dropping to the mid-high range of 80,000, mainly due to another round of FUD.

Last weekend, the market was concerned about MicroStrategy's financial situation, while Japanese government bond yields soared, and there were even news reports about China cracking down on cryptocurrencies again, reiterating their negative stance on crypto. These messages led to a market drop at the opening, but just a day or two later, prices quickly rebounded. As you said, I believe this indicates that those who wanted to sell at the current price have basically completed their selling. In other words, the panic selling in the market is nearing its end.

However, the market's bottoming process may be quite complex. In the coming weeks or one to two months, prices may test the lows of 80,000 again, or even dip slightly below. Overall, I believe we are currently in a bottoming phase, and in the coming months or even quarters, the market is more likely to break upward rather than continue to decline.

Long-Term Resistance Breakthroughs and Challenges

Miles: There is still a significant resistance area above the market. If we look at the daily chart, we can see that prices are trying to break above the moving averages; in the 4-hour chart, the Point of Control (POC) of the Volume Visible Range (VRVP) is still around 96,000, forming a clear resistance area.

Although the market has seen a slight rebound recently, if we look at the weekly chart and indicators like the 50-week Simple Moving Average (SMA), prices are still below these key levels around 102,000. Therefore, I believe the 95,000 to 100,000 range is a difficult area to break through. Until we successfully break and hold these resistance levels, I will not choose to fully enter risk assets or altcoins, nor will I take on too much risk. What do you think?

Fabian:

I completely agree. My usual expectation is that especially after such significant volatility, when the market first rebounds to key resistance levels—particularly those resistance convergence areas you mentioned—it will definitely encounter selling pressure, at least in the short term. As for whether the market can break through these resistance levels all at once, I don't have a particularly strong opinion. However, overall, I believe the market performance in the coming weeks or even months will be relatively positive, and prices may test higher levels before observing subsequent trends.

In addition to some favorable factors within the cryptocurrency market (such as the positive flow of funds), we also see traditional financial markets (TradFi) returning to a risk-on sentiment. This is an external tailwind for Bitcoin. For example, this week the VIX index dropped significantly, and the US Dollar Index (DXY) also retreated from the structural resistance level of 100-101. Meanwhile, retail market interest in high-momentum stocks (such as Robinhood, robotics stocks, etc.) is also recovering. These signs indicate that market risk appetite is increasing. However, whether Bitcoin can break through the current resistance levels all at once is still hard to say.

Miles: I agree with your view. I believe the market's reaction to these key levels will reveal more comprehensive information, not just whether the price breaks through these levels, but more importantly, to observe the inflow and outflow of funds in the market. For example, are ETFs returning to net inflows? Is market sentiment positive? Can we see large volume candles indicating investor interest in these levels? Or is this just a brief "dead cat bounce"? Therefore, what is truly important is how the market reacts to these key levels, not just whether the price breaks above or below them.

Smart Money's Market Positioning Strategies & Trends in Institutional Adoption

Miles: Next, let's talk about the big players in the market and the positioning strategies that "smart money" is adopting. I find that the market positioning for 2026 is becoming very interesting, and I believe "smart money" has been preparing for the future market.

First, let's start with Bank of America. Recently, they officially recommended that clients allocate 4% of their portfolios to Bitcoin and cryptocurrencies. I believe this reflects a long-term trend where banks and financial institutions are gradually opening up to crypto assets. We will also discuss Vanguard's shift later, but overall, this change in banks is largely driven by deregulation policies and the Trump administration. Fabian, what do you think about the trend of banks gradually opening up cryptocurrency to clients?

Fabian:

I believe this is a long-term global trend that may even last for decades. Not just in the United States, we will see more similar news globally. I even believe that one day China will change its stance on cryptocurrencies, although it may not be today. Overall, the global adoption trend of Bitcoin and cryptocurrencies is almost irreversible; "only up, not down" is my overall judgment on this trend. Pandora's box has been opened, and regardless of how the future government in the U.S. changes (whether in the midterm elections or the next presidential election), this trend will not reverse.

The core issue in the current market is how the global adoption trend can counterbalance supply bottlenecks. In the early development of Bitcoin, a large amount of supply was concentrated in the hands of a few major players, such as early holders or companies like MicroStrategy. As investors, we are essentially trading the liquidity between these two. Additionally, I have noticed an interesting phenomenon: the emotional divergence between Crypto Twitter and traditional financial markets. Many in the crypto community feel pessimistic about the market, believing the cycle has ended; while traditional financial institutions view the current market adjustment as a "buy the dip" opportunity. This long-term perspective is very positive for the market, as the dominant force now is these traditional financial institutions.

Miles: I completely agree with your point, which is why we might see Bitcoin reaching new highs next year, or even experiencing a strong upward trend. Speaking of the shift in "smart money" and major players, I want to specifically mention the case of Vanguard. In 2024, Vanguard's CEO clearly stated that they would not offer a Bitcoin ETF and would not change this position. However, just a year later, the new CEO announced that they would provide a Bitcoin ETF to 50 million clients. As a top global asset management company managing $11 trillion in assets, this shift is significant. What do you think about this change in attitude?

Fabian:

This is almost a common path for all major financial institutions. Even leaders like Jamie Dimon of JPMorgan, who have publicly been bearish on cryptocurrencies, now have to accept this trend. This is essentially a "choice without a choice," as publicly traded companies, their primary task is to create value for shareholders and pursue profits. If they ignore the cryptocurrency market, they not only miss out on the enormous revenue potential now and in the future, but they may also hand their clients over to competitors who offer crypto products. So, regardless of their political stance or personal preferences, they ultimately have to compromise and join this trend; it has become inevitable.

Sovereign Wealth Funds' Continued Accumulation & Bitcoin's Long-Term Structural Demand

Miles: Let's talk about the market positioning of sovereign wealth funds, which could be one of the next important narratives for Bitcoin. Today, Larry Fink mentioned some things about sovereign wealth funds that I think are worth paying attention to.

Larry Fink: I can tell you that some sovereign funds are on standby, gradually increasing their positions at 120,000 and 100,000, and I know they bought more at 80,000. They are building long-term positions.

He mentioned that he knows these funds bought a lot in the 80,000 range, which also explains why we saw such a strong market reaction at this price level. Clearly, major players have intervened at this level.

Regarding the narrative of sovereign wealth funds, I think there is a lot of discussion in the market about ETFs and retail investors, and even about corporate ETFs, but the positioning of sovereign wealth funds has not received enough attention. I know there are rumors that the Trump administration might consider Bitcoin as a strategic reserve, but this plan has not fully materialized. Although they have retained confiscated Bitcoin, there are no plans to significantly increase reserves.

This brings to mind a point: If you are a country or a sovereign fund looking to accumulate Bitcoin, you certainly wouldn't announce it publicly at first until you are satisfied with your holdings, and you might never disclose it because you don't want to be front-run. You would just accumulate quietly. As these funds continue to buy, the market's decline will gradually diminish, and volatility will decrease, but they may not publicly acknowledge this. This is what I find interesting. Fink knows these major players, and perhaps some countries are secretly accumulating Bitcoin. What do you think about this sovereign Bitcoin narrative? I feel this point has not been adequately discussed, but it is clearly one of the important reasons why Bitcoin is maturing as an asset and its volatility is decreasing.

Fabian:

Indeed, this perspective is very interesting. Over the past few decades, most central banks and sovereign wealth funds have primarily concentrated their holdings in two types of assets: U.S. assets (such as U.S. stocks) and government bonds (whether local or foreign, mainly U.S. Treasuries).

However, the safety and diversification capabilities of these two asset classes have been questioned in recent years. Government bonds have performed poorly since 2020, and countries that are overly exposed to U.S. assets may expose themselves to systemic risks when the U.S. economy encounters problems. Therefore, we see more and more central banks and sovereign wealth funds beginning to seek diversified allocations.

Currently, there are not many high-quality assets to choose from. Emerging markets carry higher risks and uncertainties, and among commodities, gold remains the mainstream choice. However, Bitcoin is gradually becoming an attractive long-term diversification tool. While sovereign wealth funds may not increase their Bitcoin holdings as quickly as traditional assets, the process from zero allocation to gradual increases has already begun, and this trend may continue in the coming years.

Miles: Not only BlackRock and Vanguard, but even JPMorgan has started offering structured Bitcoin products based on IBIT to institutional clients. These products can provide significant returns when Bitcoin prices rise sharply, and they also come with built-in downside protection and risk control parameters. These tools start from Bitcoin ETFs and can further develop into more complex financial derivatives, such as Bitcoin-backed bonds, which is a completely new use case we have never seen before.

Furthermore, if these tools become more mature, will we see Bitcoin-backed mortgage loans? I think this is a sign of the gradual legitimization of Bitcoin as an asset class. While this trend is happening, its evolution is slow and not instantaneous. You might feel pessimistic because Bitcoin prices temporarily drop to 80,000, 70,000, or 90,000, but in the long run, this trend is very clear, which is why I have always been a firm long-term holder of Bitcoin.

Fabian:

Indeed. This reminds me of MicroStrategy's statement earlier this week, where they mentioned they are considering borrowing against their Bitcoin holdings. Based on this, I believe the Bitcoin lending market could become a new vertical and grow rapidly in the coming years.

Miles: Yes, but do you know why MicroStrategy is doing this? In my view, their goal is to avoid the risk of being downgraded by MSCI (Morgan Stanley Capital International), which means being removed from relevant indices. Their method of avoiding downgrade is to offer more complex financial instruments, such as bonds or lending products, so that they are no longer seen as a passive fund. If a company simply holds Bitcoin without a revenue-generating business, it can easily be classified as a fund. But by activating part of their Bitcoin holdings, they can be redefined as a revenue-generating company, thus avoiding the risk of downgrade.

Fabian:

Another perspective is that they are doing this to gain more flexibility in financing. If Bitcoin assets face potential downside risks, transferring more debt can help them better protect themselves. This strategy is actually aimed at enhancing the company's resilience to market volatility.

Macroeconomic Factors Favorable to the Crypto Market

Miles: Before we delve into the core driving factors of the market, I want to share a piece of news that just came out: Eric Trump's "American Bitcoin" fund has just purchased 363 Bitcoins worth $34 million. The Trump family's continued purchase of Bitcoin is undoubtedly a positive signal for the market. As long as the Trump family has influence in politics, this support will be beneficial for the market.

Fabian:

Indeed, this indicates that their stance continues to support Bitcoin. Although the scale of this purchase is not enough to directly drive the market, it conveys a clear message: their position has not changed, and I expect this trend to continue in the future as long as they still hold some political influence.

Additionally, I believe that as the midterm elections approach, they may increase supportive rhetoric towards the crypto market in an attempt to rally voter support. Last year, they tried to court the crypto community during the campaign, as data showed that a significant proportion of voters in the U.S. hold Bitcoin, and this voter group could play a crucial role in the election outcome. While the specific numbers may not be clear, the crypto community has experienced a period of volatility since then. I expect they will boost market confidence by supporting Bitcoin and the crypto market before the elections, and we can wait and see how this unfolds.

Analysis of Macroeconomic Trends for 2026

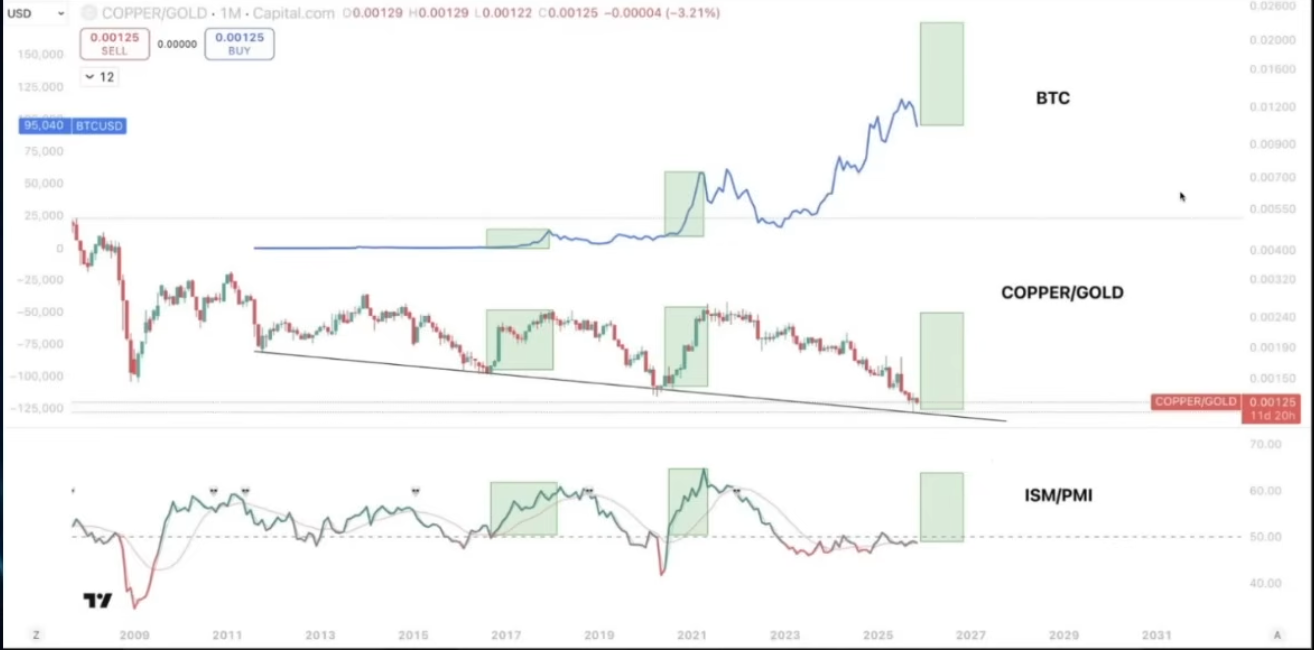

Miles: Ultimately, the core driver of the Bitcoin market is liquidity, not the lines on technical charts or indicators like the 50-day moving average. Bitcoin is essentially a "liquidity sponge" that absorbs liquidity from the market. In the current market environment, Bitcoin remains a risk asset, and risk assets typically perform well in a macro environment that is liquid and favorable to risk investments.

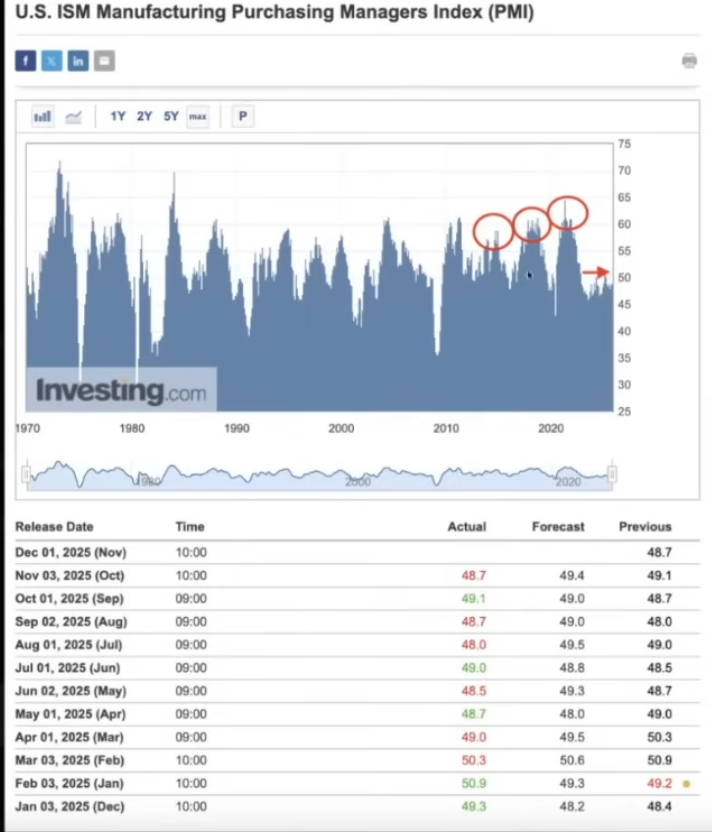

ISM Manufacturing Index and Business Cycle Outlook

Miles: If we want to determine whether the market will be bullish in 2026, we must analyze it from a macroeconomic perspective. Let's first talk about the ISM Manufacturing Index (this indicator is actually a key economic indicator used to track the business cycle). **Currently, the level of the ISM index is much lower than in previous cycles, and Bitcoin usually shows an upward trend ahead of the ISM. Nevertheless, the ISM is expected to rebound in the future. If we look back at the past three cycles, *Bitcoin only peaks when the ISM exceeds 55, in other words, the current rise in Bitcoin has not truly begun.*

To clarify whether 2026 will ultimately be bullish, we need to look at the macro layout, which is also your strong suit. First, I want to discuss the ISM. I know Raoul Pal often talks about this; the ISM index is currently much lower than in previous cycles, and Bitcoin usually runs ahead of the ISM, so it performs well. But we expect to see a rebound. If you look at the past three cycles, Bitcoin only peaks when the ISM exceeds 55. It hasn't really started to rise significantly yet.

Raoul Pal (CEO of Real Vision) believes that the ISM index will rebound in the first half of 2026, and that looser liquidity conditions will be a key trigger for the next Bitcoin rally. Are you paying attention to this indicator?

Fabian:

The ISM is a macroeconomic indicator that I pay close attention to. It reflects the overall growth of the U.S. economy and the business cycle, but it is inherently a lagging indicator, while the business cycle actually lags behind the liquidity cycle, which is a leading indicator of all these economic activities, and there is a close relationship between them.

As you mentioned, although there may be some concerns about the liquidity cycle in the long term over the next few years, at least in the first half of next year, which is the next few quarters, we are likely to see a significant increase in global liquidity, especially in the U.S. This liquidity expansion typically drives growth and a rebound in the business cycle, ultimately permeating all risk assets, including Bitcoin. So I think your point is valid; at least in the next few quarters, my view aligns with yours.

Miles: We can see that Bitcoin's price is usually highly correlated with the ISM's trend. For example, during the 2018 cycle, when the ISM peaked, Bitcoin also peaked. Although Bitcoin's performance is influenced by other factors, the ISM has not yet reached its peak. If the ISM starts to rebound, could this be a trigger for the next Bitcoin rally? This is one of the indicators we need to focus on.

Additionally, there are some related indicators worth watching, such as the copper-gold ratio and the ISM PMI ratio. These indicators seem to have rebound potential. When you start analyzing this evidence, you will find that the theory of four-year cycles does not hold up. Many people believe that Bitcoin's four-year cycle is due to the halving event, but if that were the case, why do the U.S. stock market, copper-gold ratio, and ISM all peak at similar points in time?

If the four-year cycle truly exists, does it mean that Bitcoin's halving cycle is more important than the entire U.S. manufacturing index or business cycle? This is clearly illogical. Bitcoin is just a small part of the business cycle. From my perspective, the four-year cycle has never really existed, and 2026 may prove this, which would completely overturn this theory.

If Bitcoin can rebound in the first half of next year, it will fundamentally change the market's perception. People will realize that Bitcoin is a liquidity-driven asset, rather than one that solely relies on the halving cycle. This shift in understanding could attract more investors, especially those who once believed in the four-year cycle theory.

Fabian:

In simple terms, the market has never been that straightforward. We cannot rely solely on simplistic theories like the "four-year cycle" to predict market trends. As you said, the sample size for the four-year cycle is very limited, with only two cycles (N=2), which is clearly insufficient to draw strong conclusions. Moreover, the performance of these cycles coincides precisely with the major macro turning points of liquidity and growth cycles.

Additionally, over time, the impact of Bitcoin halving on price has significantly weakened. The supply reduction brought about by halving constitutes an increasingly smaller proportion of the total supply, while the main driving force in the market has shifted to global and institutional capital flows. These capital movements are more influenced by macroeconomic cycles than by Bitcoin's own halving events.

Therefore, I have never believed in the four-year cycle theory. The current market performance is more related to the macroeconomic environment than to internal events of Bitcoin.

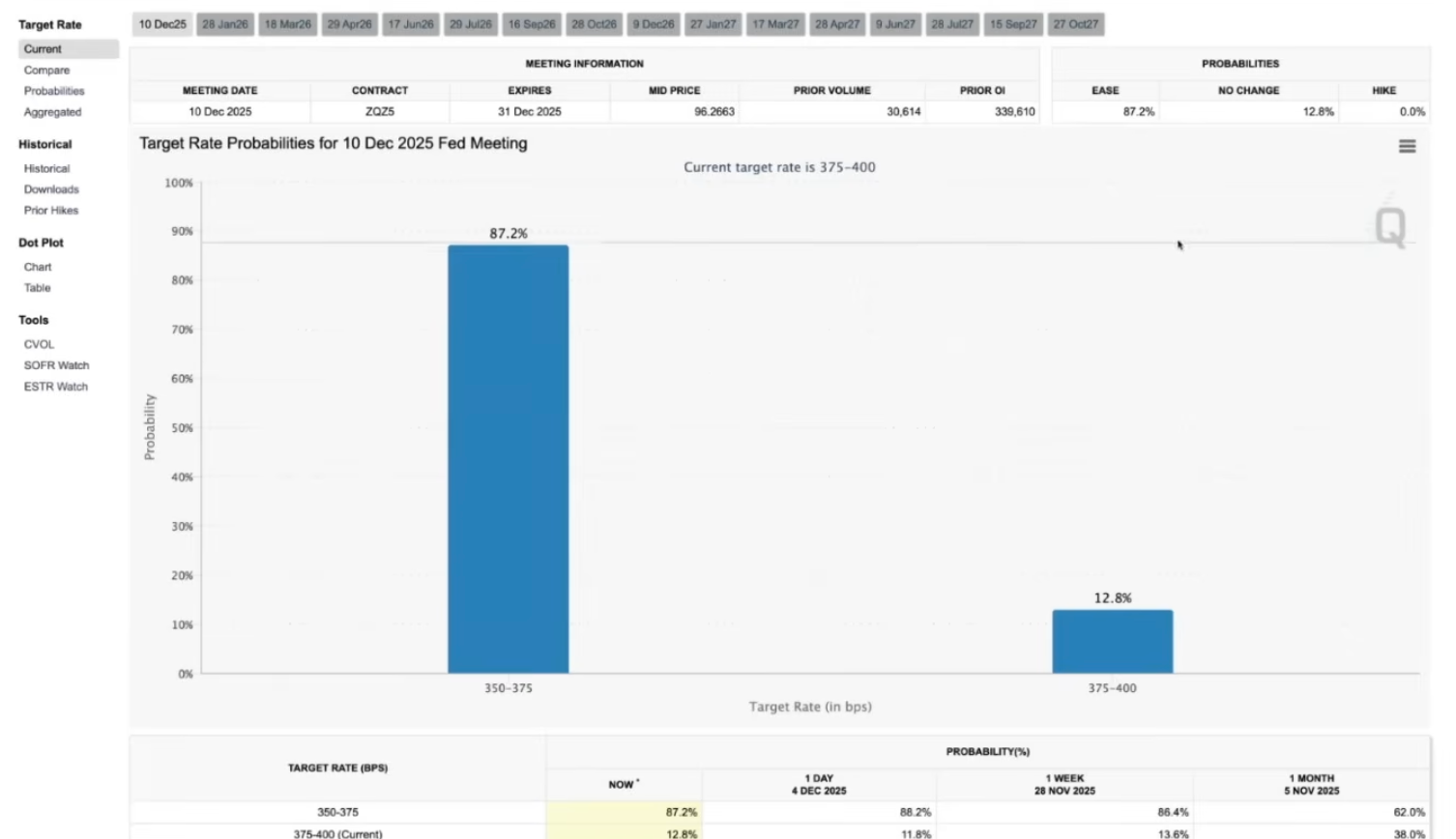

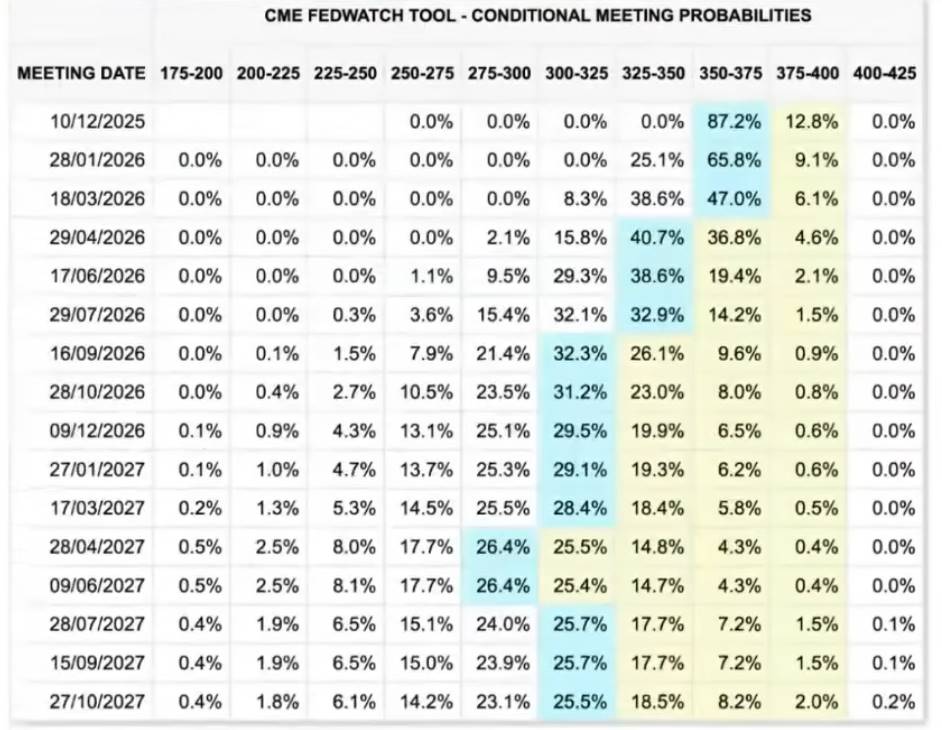

Repricing of Rate Cut Expectations

Miles: The probability of a rate cut at the next Federal Reserve meeting has significantly increased and is almost considered a done deal. Multiple authoritative sources indicate that a rate cut is imminent. What changes do you see this week regarding rate cut expectations? Or do you think this will become another catalyst for the market?

Fabian:

At this point, a rate cut is basically a certainty. In fact, I had a similar judgment last week, but typically as the decision date approaches, the market's implied probabilities tend to lean more in one direction. The Federal Reserve has always signaled in advance, so we can be more confident about the expectations for a rate cut.

The next question is, to what extent has the market priced in this rate cut? Currently, the U.S. stock market is nearing historical highs, while Bitcoin is slightly lagging, but it has its own unique issues. Therefore, I prefer to view the U.S. stock market as a representative indicator of market pricing.

However, I believe that even if the rate cut materializes, Powell may adopt a more hawkish tone at the press conference. After all, at the FOMC meeting at the end of October, he stated that they were uncertain about cutting rates without sufficient economic data to support it. Since then, key economic data has not changed significantly. Therefore, to justify this rate cut, Powell may emphasize that it is a forward-looking move, but future rate cuts will require more data to support them. He may send a signal of "hawkish rate cuts," telling the market not to have overly high expectations for further cuts.

This "hawkish rate cut" may lead to short-term market volatility, but overall, I remain optimistic about the current market layout. Based on market pricing for the future, there may only be two more rate cuts before the end of 2026, bringing the federal funds rate down to around 3%. However, the Trump administration and some potential candidates for Federal Reserve chair (like Bessent and Hasset) have indicated that they believe the federal funds rate should be closer to 2.5%, which means the market may be underestimating the space for rate cuts.

Considering that next year is a midterm election year, and the Federal Reserve Board and chair will change in May, I believe the market may readjust expectations for more rate cuts. This repricing will provide strong support for a bullish outlook on risk assets. Even if Powell appears more hawkish at this meeting, I still believe there will be more rate cuts next year than the market currently expects.

Miles: You previously mentioned the issue of inflation rates, which have actually declined. Although year-on-year data still shows an increase, according to True Inflation (a real-time inflation index), the inflation rate has fallen from local highs. This may also be an important reason for the current rate cut.

I agree with your point. If the rate cut materializes, it will become a potential bullish factor for the market, and we should closely monitor it.

As for the midterm elections, according to prediction market data, the Democratic Party seems more likely to win. From my understanding, the Republican Party may try to boost the market before the midterm elections to win votes. Does this mean that loose policies will continue? If the Democrats win the House, what impact will that have? What are your thoughts?

Fabian:

First, from a direct impact perspective, there is indeed a positive correlation between the probability of a Republican victory and Bitcoin prices. The Republican Party is generally seen as more supportive of cryptocurrencies, and they are pushing for some cryptocurrency-related legislation. If these bills do not pass before the midterm elections and the Republican Party loses some power afterward, it could hinder the legislative process.

Interestingly, we have indeed observed a certain degree of synchronization between the changes in the probability of a Republican victory and Bitcoin prices. A few months ago, when Bitcoin prices peaked, the probability of a Republican victory also reached its peak. Although other factors are at play, this correlation cannot be ignored.

On a deeper level, I believe the market has currently digested these political risks well, and it may have even overreacted to this uncertainty due to Bitcoin's decline. Moving forward, I think the Trump administration will face greater pressure and will take all measures to boost the economy and financial markets before the midterm elections to improve their chances of winning. This effort may support the rise of risk assets in the first half of next year.

My prediction is that the market may reflect these expectations in advance, especially with the new Federal Reserve chair taking office in May 2026. These factors could become strong drivers for the market's upward movement. Of course, as the midterm elections approach, volatility may increase due to the market's dislike of uncertainty. But before that, these factors will provide a clear tailwind for the market.

The Price Relationship Between ETH and BTC and Its Impact on Other Cryptocurrencies

Miles: We are likely to see Bitcoin peak in the first half of this year, and the U.S. stock market may also peak around the same time. As for what happens next, we need to continuously adjust our strategies based on market dynamics. Currently, we both agree that the overall market layout is bullish.

Recently, we have seen the ETH/BTC ratio break upward for the first time in a long time. This is very interesting. What’s more noteworthy is that this phenomenon occurs in a context of weakening Bitcoin dominance. This is the first time I’ve seen that even when the market is underperforming, Bitcoin's dominance has not increased. What do you think the significance of these two charts together is? I feel this may indicate that even if Bitcoin's price remains flat or rises slightly, altcoins could outperform in this market cycle. What are your thoughts?

Fabian:

This is a very interesting question, and to be honest, I have mixed feelings about it. I have two seemingly conflicting viewpoints.

First of all, you are right, ETH has indeed shown relative strength against BTC recently. But is this just because ETH has fallen more than Bitcoin since its peak, and now it is simply experiencing a mean reversion? This remains to be seen; I currently tend to think this is a result of mean reversion.

However, we also note that BMNR (Tom Lee's Ethereum DAT treasury company) is purchasing large amounts of Ethereum weekly, even exceeding the amount of Bitcoin purchased by MicroStrategy. This trend has continued so far. Although I haven't delved into the specifics of how BMNR operates, this ongoing accumulation clearly supports ETH's short-term performance. Therefore, as long as this buying behavior continues, I believe ETH may perform exceptionally well in this rebound.

However, from a longer-term perspective, I am cautious about ETH's performance. Between 6% to 7% of ETH's market supply is held by large treasury companies, a proportion that is significantly higher than the amount of Bitcoin held by MicroStrategy. If these treasuries are forced to sell at some point in the future, it could have a larger impact on the market. Additionally, ETH is considered a more volatile and lower-quality asset, which makes it less resilient to risk. Therefore, in the long run, I still have a more favorable view of Bitcoin, and I believe it will outperform.

Miles: From a long-term perspective, I agree with your view. But if we approach it from a short-term logic, I think you might also agree: If Bitcoin performs strongly in the first and second quarters of this year, indicating that the overall market is in a bullish state, then Ethereum may outperform Bitcoin. The reason is that Ethereum has a smaller circulating supply, with more supply held by DAT, and these institutions may be more aggressive in their accumulation. This structural advantage could allow Ethereum to achieve excess performance in the short term.

Of course, if the market environment deteriorates, these tailwinds could quickly turn into headwinds. Especially when market concerns about centralization and potential sell-offs increase, this could become a catalyst for a downturn. But this phenomenon is reflexive; it can also occur when the market rises, which is clearly favorable for altcoins, and we hope to see this positive trend.

Fabian:

You are right, and I am completely open to the idea that Ethereum could indeed outperform Bitcoin in the short term, as long as these DATs do not sell and continue to accumulate, ETH has the potential to perform well.

In contrast, Bitcoin currently faces some unique structural issues. For example, miners may continue to sell as they transition to AI data centers. Additionally, some early investors (OG holders) may continue to sell, as they are more inclined to believe in the four-year cycle theory.

There are also potential tail risks, such as the Bitcoin debt issue with Bitfinex. The U.S. government currently owes Bitfinex about 100,000 Bitcoins, which may be returned at some point in the future. If these Bitcoins are liquidated and returned to creditors, it would add additional selling pressure to the market.

In comparison, the main source of selling pressure for Ethereum comes from these treasuries; as long as they continue to hold, I agree that ETH may achieve excess performance in the short term.

Investment Opportunities and Excess Returns in Prediction Markets

Miles: Regarding prediction markets, this is a topic I plan to explore in depth in the coming weeks, as I am also trying some new things, such as using AI to create automated trading bots, which will be publicly available soon. But I know you have had several months of practical experience in prediction markets, especially in pre-market trading. Could you share your experiences with everyone and why you think this is an investment area worth paying attention to in the coming months?

Fabian:

Prediction markets are a very interesting field. I particularly enjoy using them for pre-market trading, especially in the upcoming Pre-TGE (Token Generation Event) token markets. One unique advantage of prediction markets is that they provide investors with a low-risk environment, especially suitable for shorting newly issued tokens that are overvalued by the market.

Based on experiences from the past year and even earlier, we have found that pre-market markets often overestimate the value of new tokens, and most new tokens experience a "down only" price trend after going live, like the recent Plasm. Many new tokens have been overvalued in the pre-market, such as Stable (an upcoming Plasma competitor, a stablecoin chain), ME, and Monad (which just launched last week); the valuations of these tokens are clearly inconsistent with the market reality.

One major reason for this mispricing is that many investors are reluctant to short these tokens in traditional pre-market settings. In these markets, short sellers often face short squeezes, leading to significant losses. The **advantage of prediction markets is that they offer a trading model similar to "options," especially *put options*. You can bet on a token's price declining within *24 hours after the TGE*, without worrying about price fluctuations or the risk of being liquidated in between. **This mechanism makes prediction markets an ideal tool for shorting overvalued tokens.

In the past month, I have executed multiple trades on some upcoming new tokens. For example, I bought "No" options in the pre-market for Stable at valuations of $4 billion and $5 billion, and the results were very good. I also bought "No" options in the pre-markets for Me and Monad. This trading approach leverages the discrepancies in market mispricing and is a very efficient strategy. While everyone knows the price trends of these tokens after they go live, very few can effectively capitalize on this before launch. Prediction markets provide a unique opportunity for investors to capture this discrepancy.

Miles: In traditional markets, when panic occurs, many investors choose to sell their positions, leading to a rapid decline in prices. However, in pre-market trading, investors cannot panic-sell because these trades are typically based on contracts and do not have a mechanism for spot selling. Unless a large number of investors engage in short selling, price fluctuations in pre-market markets are relatively small. Even if a liquidation spike occurs, it often scares off some investors, further reducing market volatility.

**A significant advantage of prediction markets is that they allow you to trade the same underlying assets as traditional markets, but without the risk of **liquidation. I think this is a very important feature, which is why prediction markets are a field worth exploring in depth.

Additionally, I find the simplicity of prediction markets very appealing. Compared to the complex options trading on Deribit, prediction markets are much more intuitive to operate. In the options market, you need to consider strike prices, expiration times, premium costs, and how to allocate appropriate call or put options based on your portfolio structure; while perpetual contract trading requires understanding changes in funding rates, these complex factors are not friendly to ordinary investors and can lead to high trading costs if not handled carefully.

In contrast, the trading logic of prediction markets is simply "yes" or "no." If you believe the probability given by the market is lower or higher than your expectations, you only need to trade based on that, without considering other complex factors. This simplicity lowers the investment threshold and reduces unnecessary risks.

I believe prediction markets will become a larger trend in the future. In the fields of politics and sports betting, prediction markets have achieved great success, and I believe its potential in the crypto space is equally significant. I think this is a field worth continuing to pay attention to, as it provides investors with more diverse options, rather than being limited to holding positions or simple buy-sell operations.

Prediction markets are a very fundamental yet effective market trading method, especially in some low-liquidity areas like pre-market trading; it may be one of the most product-market fit innovations in the current crypto space.

Fabian:

One overlooked advantage of prediction markets is that they can be used not only for speculation but also as a hedging tool in many cases. For example, in the pre-market, if you are eligible for an airdrop of a certain token, you already know the quantity of the airdrop but may not have enough capital or may not want to risk being liquidated by shorting. In this case, you can use the pre-market to hedge some of the risks. While this hedge may not completely cover the risk, it does provide a flexible and practical risk management approach.

Additionally, prediction markets can also help investors hedge against political or geopolitical risks. For example, if you believe Bitcoin's price may be affected by certain significant events, and there are relevant trades in the prediction market, such as "the Republican Party loses the House in the midterm elections" or "Satoshi moves funds before 2026," you can use these markets to hedge against potential tail risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。