Author: Frank, PANews

Whales on Hyperliquid have become the focus of on-chain trading. Here, the drama of getting rich and going to zero unfolds every day.

Delving into on-chain data, these whales exhibit a myriad of styles. Some are "contrarian indicators" who hold large sums yet repeatedly face losses, while others are "snipers" who lie in wait for half a year to strike with deadly precision. There are also those who are "cold-blooded machines" harvesting retail investors every second using algorithms.

Data strips away the mysterious facade of these big players. PANews has selected five of the most representative addresses on Hyperliquid: including the famous "Maji Brother," a mysterious figure suspected of having insider information, a market maker with billions in capital, and the recent "comeback myth" and "Iron Head Long Army." Through their thousands of transaction records, we seem to find a portrait that belongs to ourselves.

Maji Brother: Winning like "bird feed," losing like "a crash"

When it comes to Maji Brother, he seems to have become a contrarian indicator in the current market, from the massive losses on Friend.tech to the current contract losses. His trading operations serve as a negative example for crypto industry practitioners or investors. But negative examples are still examples.

Since entering Hyperliquid trading, Maji Brother's losses have reached $46.5 million. He ranks among the top in the Hyperliquid trading loss leaderboard. From the trading style profile, Maji exhibits typical characteristics of high win rates and low profit-loss ratios. His overall win rate is 77%, but his profit-loss ratio is 1:8.6. Additionally, in terms of holding time, his profitable trades have an average holding time of 31 hours, while losing orders average 109 hours. This indicates that he tends to take profits quickly but often holds onto losing positions until they result in massive losses or liquidation.

Overall, his short-term market judgment ability is indeed quite accurate, but in terms of trading strategy, he always risks a loss of up to $8.6 to gain $1.

However, specifically in actual trading, before the market crash on October 11, his overall position was still profitable at $15 million. After the crash on October 11, due to multiple orders like XPL and ETH being liquidated, his overall profit turned into a loss of over $11 million. Subsequently, with more operations, he moved further away from breaking even.

Analyzing the fundamental reasons for Maji's losses, two characteristics emerge as his fatal flaws.

First is the "dead long" position; in all his trades, 94% are long positions, with only 6% being short. Among the long positions, he lost $46.88 million, while the short positions gained $380,000. In a declining market, this one-sided style is fatal. Second is the lack of stop-loss and the tendency to add margin on losing positions. In several of his large losing orders, it can be seen that when his orders are on the verge of liquidation, his first choice is often to add margin rather than to stop-loss. This has also led to his losses growing larger. Overall, Maji Brother's profits can be described as winning like "bird feed" and losing like "a crash." From the perspective of trading psychology, Maji Brother has obvious flaws in loss aversion, refusal to admit mistakes, and sunk cost fallacy, making him a poor example to learn from.

October 11 Short "Insider" Big Shot: Cold-Blooded Sniper

If Maji Brother is a hot-blooded warrior spraying bullets with a machine gun, this big shot is a sniper lying in ambush for three days just to pull the trigger once.

His trading frequency is extremely low, completing only five trades in six months, with a win rate of 80%, raking in $98.39 million. Moreover, unlike Maji who keeps depositing, this whale continuously withdraws funds.

His most famous trade was on October 11, when he deposited $80 million to short BTC and withdrew over $92 million in profit five days later. After completing that astonishing trade, he did not linger but instead maintained restraint. Then, on October 20, he shorted again, earning $6.34 million. Although he incurred a small loss of $1.3 million on a long position on November 8, compared to his previous profits, it was negligible. Currently, his account still holds long positions in ETH worth $269 million, with an unrealized profit of about $17.29 million. From the trading characteristics, this big shot, believed to have insider information, resembles a lurking crocodile, rarely moving but when he does, he bites off the largest piece of the market and then departs.

Billion-Dollar Capital Market Maker: Dominating the Market with Algorithms

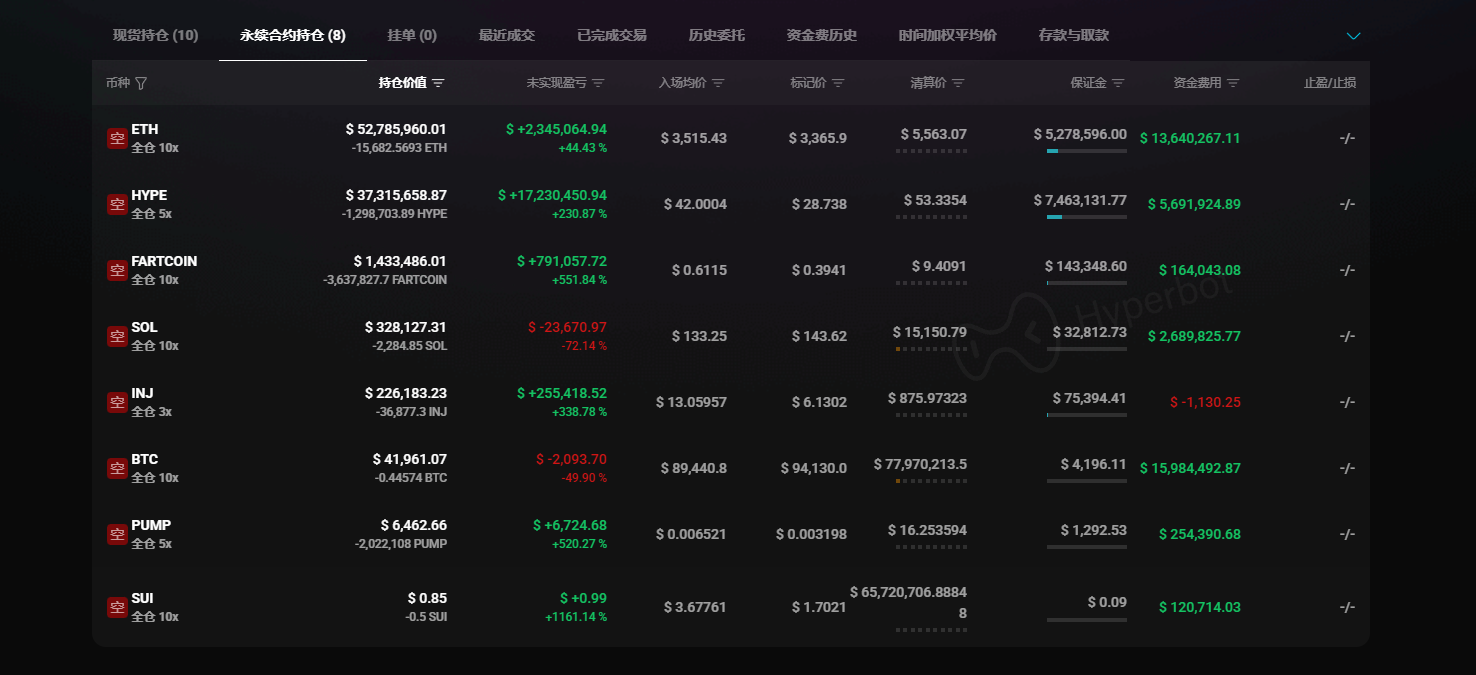

The address 0x5b5d51203a0f9079f8aeb098a6523a13f298c060 is currently the top address in terms of profits on Hyperliquid. If the first two are "gamblers" and "hunters," this one is a super whale at the market maker level. To date, this address has cumulatively deposited $1.11 billion into Hyperliquid and withdrawn $1.16 billion. The current unrealized profit is about $143 million.

His strategy involves first opening several large base positions, such as the current short positions in ETH and other tokens. Then, through algorithms, he frequently increases and decreases positions to realize profits, creating two sources of income: one from profitable short positions in a trending market and the other from high-frequency trading that captures market arbitrage opportunities.

Upon closer analysis, not only is the top profit-ranking address a trader of this kind, but the second and third-ranked addresses also employ similar arbitrage strategies.

Taking the second-ranked address as an example, 51% of its trades are limit orders, placing buy and sell orders on both sides of the order book to capture small profit fluctuations. Although the scale of such trades is small, averaging only $733, this address completed 1,394 coin orders in a single day, accumulating tens of thousands of dollars in profit over the day.

However, the operations of such whales offer little reference value for retail investors, as whales not only have fee advantages but also possess high-speed quantitative programs and hardware support.

Highest Earnings in the Past Week: Steady Progress through Trials

This address is not exactly a whale, but its high earnings in the past week have brought it into the spotlight of PANews.

In terms of capital scale, this address previously invested about $46,000, appearing to be an ordinary retail investor. From past trading results, until the end of November, his account funds were continuously decreasing, with a loss rate of 85%. During this phase, he was a typical loser, with chaotic operations and stubbornly holding onto small coins.

However, after December 2, he seemed to have transformed, or perhaps found a trading holy grail. By December 9, he had achieved 21 consecutive victories. He increased his principal from $129 to $29,000, creating an exponential growth curve.

On December 3, he tentatively opened a position of 1 ETH, earning $37. On December 5, confirming his feeling, he increased his position to 5-8 ETH, earning about $200 per trade. On December 7, he raised his position to 20 ETH, with a single profit reaching $1,000. On the 8th, he increased his position to 50-80 ETH, with a single profit of $4,000. On December 9, his position reached 95 ETH, with a single profit of $5,200.

The above is an overview of his recent trading process, from which he made several changes. First, he stopped trading everything and focused solely on ETH. Previously, his trading range included over ten different coins. Second, he no longer stubbornly held positions but chose a quick and efficient approach. His average holding time was about 33.76 hours, but in the past week, it shrank to 4.98 hours. It seems he has bid farewell to holding onto losing positions and shifted to a model of taking profits when available. Third, his position management changed from disorderly opening to a "rolling position" model. This "rolling position" model is a common method for rapidly growing small funds.

However, while his profits have become faster, his leverage has also increased. In past trades, his average leverage was 3.89 times, recently rising to about 6.02 times. This has also amplified his trading risks. As of the time of writing, his recent ETH position has already incurred over $9,000 in losses due to the rapid market rise, causing his profits to drop by nearly half. The profit curve has shifted from an upward exponential increase to a cliff-like drop.

Overall, this change in trading style has indeed made him stronger, but also more vulnerable. Whether he can recover his losses will depend on how he handles losing orders and maintains a high win rate.

Iron Head Long Army: The Lament of a Dead Long

Compared to the aforementioned traders, this whale's style resembles that of a staunch long believer and is also a "victim" of SOL.

This whale's total entry capital has reached $236 million, with a long position ratio of 86.32%. Among over 700 trades, 650 orders were long positions. He has incurred losses exceeding $5.87 million on long positions, while making a profit of $189,000 on short positions. Although he has an overall loss of over $5 million, relative to his over $200 million turnover, this drawdown (about 2.4%) is still within a controllable range. However, his biggest problem lies in his holding structure.

His loss structure is quite peculiar, with almost all profits consumed by SOL. Among the tokens he has traded, FARTCOIN and SUI have profits exceeding $1 million, while ETH and BTC profits are also close to $1 million. However, his single loss on SOL reached $9.48 million. If SOL's losses are excluded, he would actually be a very good trader (with cumulative profits of about $4 million from other tokens). But he seems to have an obsession with SOL, persistently holding long positions and repeatedly getting harvested by SOL's bearish trend.

From his trading, we can glean the following insight: even if you have over a hundred million in capital, if you develop "feelings" or "obsessions" for a particular coin, it can easily destroy you, especially if you go against the trend.

In summary, in this deep sea interwoven with whales, algorithms, and insider information, there is no so-called "sure-win holy grail." For ordinary investors, the operations of these whales are mostly non-replicable. What we can learn from them may not be how to earn a hundred million dollars, but how to avoid becoming a loser like Maji Brother who stubbornly holds onto losing positions, and not to attempt to challenge tireless algorithmic machines with our limited funds and speed.

Respecting the market and honoring the trend may be the most valuable insights the market has to offer us.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。