The global cryptocurrency regulation is heading towards a future of divergence between the US and Europe: the US is pragmatically legislating to integrate it into the mainstream financial system, while Europe's MiCA rules may stifle innovation in the name of "compliance."

Written by: @TradFiHater

Translated by: AididiaoJP, Foresight News

When Satoshi Nakamoto, the inventor of Bitcoin, released the white paper, mining was so simple: any gamer with a regular home computer could accumulate wealth worth millions of dollars in the future.

With a home computer, you could have built a vast wealth legacy, allowing your descendants to avoid hard labor, as Bitcoin's potential return could reach 250,000 times.

But at that time, most gamers were engrossed in "Halo 3" on Xbox, and only a few young people utilized their home computers to earn wealth far exceeding that of modern tech giants. Napoleon established his legend by conquering Egypt and Europe, while you only needed to click "start mining."

In fifteen years, Bitcoin has become a global asset, and its mining has evolved into a large-scale industry requiring billions of dollars in funding, specialized hardware, and enormous energy consumption. Today, the average mining of a single Bitcoin consumes 900,000 kilowatt-hours of electricity.

Bitcoin has spawned a new paradigm, starkly contrasting with the traditional financial world dominated by established institutions. It may be the first genuine rebellion against the elite class since the failure of the "Occupy Wall Street" movement. Notably, Bitcoin was born right after the "Great Financial Crisis" of the Obama era, a crisis largely stemming from the indulgence of high-risk "casino-like" banking. The Sarbanes-Oxley Act of 2002 was intended to prevent a repeat of the internet bubble, ironically, the financial collapse of 2008 was far more severe.

Whoever Satoshi Nakamoto is, his invention appeared at a perfect moment, a spasmodic yet thoughtful rebellion against the powerful and omnipresent traditional financial system.

From Disorder to Regulation: The Cycle of History

Before 1933, the US stock market was essentially unregulated, relying only on scattered "blue sky laws" from various states, leading to severe information asymmetry and rampant fraudulent trading.

The liquidity crisis of 1929 became the "stress test" that crushed this model, proving that decentralized self-regulation could not contain systemic risks. The US government conducted a "forced reset" through the Securities Act of 1933 and 1934: replacing the "buyer beware" principle with a central enforcement agency (the SEC) and mandatory disclosure system, establishing a unified legal standard for all public assets to restore market trust in the system's solvency. Today, we are witnessing the exact same process unfold in the decentralized finance space.

Until recently, cryptocurrencies operated as unlicensed "shadow banking" assets, functionally similar to the US stock market before 1933, but far more dangerous due to a complete lack of regulation. Their governance primarily relied on code and speculation, failing to adequately assess the enormous risks this "beast" could pose. A series of cascading failures in 2022 became the "1929-style stress test" for the crypto world, indicating that decentralization does not equate to unlimited returns and robust currency; rather, it created a risk node that could engulf multiple asset classes.

We are witnessing a forced transformation of the zeitgeist: the crypto world is shifting from a liberal, casino-like paradigm to a compliant asset class. Regulators are attempting to make cryptocurrencies "U-turn": once legalized, funds, institutions, wealthy individuals, and nations can hoard it like any other asset, thus enabling taxation on it.

This article aims to analyze the origins of the cryptocurrency "institutional rebirth," a transition that has become inevitable. Our goal is to extrapolate the logical endpoint of this trend and attempt to depict the ultimate form of the DeFi ecosystem.

Regulation Takes Shape: Stepping Forward

Before DeFi entered its first true "dark age" in 2021, its early development was not driven by new legislation but rather by federal agencies continuously extending existing laws to cover digital assets.

The first significant federal action occurred in 2013: the Financial Crimes Enforcement Network classified cryptocurrency "exchanges" and "administrators" as money service businesses, subjecting them to the Bank Secrecy Act and anti-money laundering regulations. 2013 can be seen as the year DeFi was "recognized" by Wall Street for the first time, paving the way for future regulation and suppression.

In 2014, the IRS defined virtual currency as "property" rather than "currency" (for federal tax purposes), resulting in capital gains tax on every transaction. Thus, Bitcoin gained legal classification, meaning it became taxable, which strayed far from its original "rebellious" intent!

At the state level, New York introduced the controversial BitLicense in 2015, the first regulatory framework requiring cryptocurrency businesses to disclose information. Ultimately, the SEC concluded the "DAO Investigation Report," confirming that many tokens are unregistered securities under the "Howey Test."

In 2020, the Office of the Comptroller of the Currency briefly allowed national banks to provide custody services for cryptocurrencies, but this move was later questioned by the Biden administration, a common practice among past presidents.

The Shackles of the Old World: Europe's Path

Across the ocean in the "Old World," outdated customs also govern the development of cryptocurrencies. Influenced by the rigid Roman law tradition (which differs from the Anglo-American common law system), an anti-personal freedom atmosphere has emerged, limiting the possibilities of DeFi in a regressive civilization. It must be remembered that the American spirit is deeply influenced by Protestant ethics, which shaped the entrepreneurial culture, ideals of freedom, and pioneering spirit in the US.

In Europe, the Catholic tradition, Roman law, and feudal remnants have jointly fostered a distinctly different culture. Therefore, it is not surprising that established countries like France, the UK, and Germany have taken different paths. In a society that prefers obedience over risk-taking, cryptocurrencies are destined to face severe repression.

The early era of crypto in Europe was defined by a fragmented bureaucratic system rather than a unified vision. The industry achieved its first legal victory in 2015: the European Court ruled that Bitcoin transactions are exempt from value-added tax, effectively recognizing the "currency" nature of cryptocurrencies.

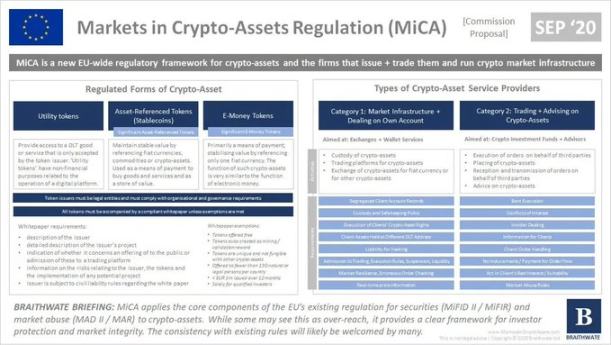

In the absence of a unified EU law, each country regulated independently until the introduction of the Markets in Crypto-Assets Regulation (MiCA). France established a strict national framework through the PACTE Law, Germany introduced a cryptocurrency custody licensing system, while Malta and Switzerland competed to attract businesses with lenient regulations.

In 2020, the Fifth Anti-Money Laundering Directive ended this chaotic era, mandating strict customer identity verification across the EU, effectively eliminating anonymous transactions. The European Commission eventually realized that 27 sets of conflicting rules were unsustainable, proposing MiCA at the end of 2020, marking the end of the "patchwork era" and the beginning of unified regulation.

The "Visionary" Model of the US?

The shift in the US regulatory system is not a true systemic reform but rather driven by opinion leaders. The power transition in 2025 brings a new philosophy: mercantilism outweighs moralism.

Trump's controversial launch of his "meme coin" in December 2024 may be a landmark event. It indicates that the elite class is also willing to "make cryptocurrencies great again." Now, several "crypto popes" are leading the way, striving for greater freedom and space for founders, developers, and retail investors.

Paul Atkins' leadership of the SEC resembles a "regime change" rather than a typical personnel shift. His predecessor, Gary Gensler, viewed the crypto industry with near-hostility, becoming the "public enemy" of a generation of crypto practitioners. A paper from Oxford University even analyzed the pain caused by Gensler's policies. Many believe that due to his radical stance, the development of the DeFi sector has been delayed by several years, with regulators who should guide the industry being severely out of touch with it.

Atkins not only halted numerous lawsuits but also effectively apologized for previous policies. The "crypto project" he promoted is a model of bureaucratic flexibility. This project aims to establish an extremely dull, standardized, and comprehensive disclosure system, allowing Wall Street to trade crypto assets like Solana as if they were oil. According to the summary from the International Law Firm, the core of the plan includes:

- Establishing a clear regulatory framework for US crypto asset issuance.

- Ensuring freedom of choice for custodians and trading venues.

- Encouraging market competition and promoting the development of "super apps."

- Supporting on-chain innovation and decentralized finance.

- Establishing an innovation exemption mechanism to ensure commercial viability.

The most critical shift may be within the Treasury. Former Secretary Janet Yellen viewed stablecoins as systemic risks. In contrast, current Secretary Scott Bensinger, an official with a hedge fund mindset, sees the essence: stablecoin issuers are the "only new net buyers" of US Treasury bonds.

Bensinger is acutely aware of the severity of the US deficit. Against the backdrop of central banks around the world slowing their purchases of US debt, the "insatiable" appetite of stablecoin issuers for short-term Treasuries is a significant boon for the new Treasury Secretary. He believes that USDC, USDT, and others are not competitors to the dollar but rather its "vanguard," extending dollar hegemony to countries where fiat currencies are collapsing, and people prefer to hold stablecoins.

Another typical example of "turning around" is JPMorgan CEO Jamie Dimon. He once threatened to fire any employee trading Bitcoin, but now he has completed one of the most profitable "180-degree turns" in financial history. JPMorgan's launch of cryptocurrency mortgage services in 2025 is seen as "raising the white flag." According to The Block:

JPMorgan plans to allow institutional clients to use Bitcoin and Ethereum as collateral for loans, marking Wall Street's deeper involvement in the cryptocurrency space.

Bloomberg cited insiders stating that the plan will be implemented globally and will rely on third-party custodians to safeguard collateral assets.

As Goldman Sachs and BlackRock begin to erode JPMorgan's custody fee income, the "war" has quietly ended, with banks winning the battle by "not participating."

Finally, Senator Cynthia Lummis, once seen as a "lonely crypto warrior," has now become the staunchest supporter of the new collateral system in the US. Her proposed "strategic Bitcoin reserve" initiative has moved from the margins of online forums to serious congressional hearings. Although her calls have not directly boosted Bitcoin prices, her efforts are sincere.

The legal landscape of 2025 consists of "settled" and "still unresolved" parts. The current government is so enthusiastic about cryptocurrencies that top law firms are launching real-time policy tracking services. For example, the "US Crypto Policy Tracker" from Risen Law Firm closely follows the dynamics of various regulatory agencies, which are tirelessly working to formulate new rules for DeFi. However, we are still in the "exploration phase."

Currently, two bills dominate the debate in the US:

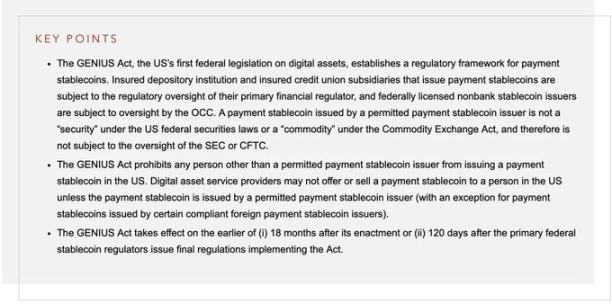

- The GENIUS Act: Passed in July 2025, this act marks Washington's first steps towards regulating stablecoins—the second most important category of crypto assets after Bitcoin. It mandates that stablecoins must be backed by a 1:1 reserve of government bonds, transforming them from systemic risks into geopolitical tools akin to gold or oil. The act effectively authorizes private issuers like Circle and Tether, making them "officially recognized buyers" of US government bonds, achieving a win-win situation.

- The CLARITY Act: This market structure bill aims to clarify the distinction between securities and commodities and resolve the jurisdictional dispute between the SEC and CFTC. It is still stuck in the House Financial Services Committee. Before this bill passes, exchanges exist in a comfortable yet fragile "gray area," operating under temporary regulatory guidance rather than solid codified law.

Currently, this bill has become a political battleground between Republicans and Democrats, seemingly used as a "weapon" by both sides.

Additionally, the repeal of Employee Accounting Announcement No. 121 is significant. This accounting rule required banks to list custodial crypto assets as liabilities on their balance sheets, effectively preventing banks from holding cryptocurrencies. Its repeal is akin to opening a "floodgate," signaling that institutional capital can finally enter the crypto market without fear of regulatory retaliation. Meanwhile, life insurance products priced in Bitcoin have begun to emerge, and the future looks promising.

Old World: Innate Risk Aversion

Just as the church once sent scientists to the stake, today's European authorities have enacted complex and obscure laws that may only serve to deter entrepreneurs. The vibrant, rebellious spirit of young America stands in stark contrast to the rigid, conservative, and faltering Europe. When Brussels had the opportunity to break free from its usual inflexibility, it chose to remain stagnant.

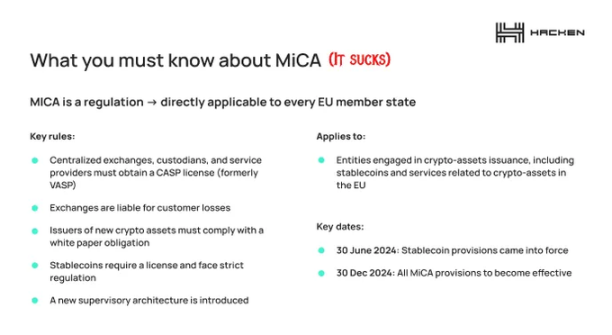

MiCA, fully implemented by the end of 2025, is a "masterpiece" of bureaucratic intent and a "disaster" for innovation.

Promoted as a "comprehensive framework," in the context of Brussels, this term often means "comprehensive torment." It does provide clarity, clear enough to make one want to escape.

The fundamental flaw of MiCA lies in its "categorical error": it treats crypto founders as sovereign banks for regulation. The high compliance costs are enough to drive most crypto startups to failure.

A memorandum from Norton Rose Fulbright objectively analyzes the regulation:

Structurally, MiCA is an "exclusion mechanism." It forcibly categorizes digital assets into highly regulated categories and imposes a compliance framework on crypto asset service providers comparable to the Markets in Financial Instruments Directive II, which was originally intended for regulating financial giants.

According to its third and fourth parts, the regulation imposes strict 1:1 liquidity reserve requirements on stablecoin issuers, effectively prohibiting algorithmic stablecoins through legal means (deeming them "insolvent" from the outset). This could itself trigger new systemic risks—imagine being declared "illegal" by Brussels overnight?

Moreover, issuers of "significant" tokens will face enhanced regulation from the European Banking Authority, including capital requirements daunting enough to deter startups. Today, without a top-tier legal team and capital comparable to traditional financial giants, it is nearly impossible to establish a crypto business in Europe.

For intermediaries, the fifth part completely denies the offshore, cloud exchange model. Service providers must establish physical offices in EU member states, appoint resident directors who pass "fit and proper tests," and implement strict asset segregation and custody. The "white paper" requirement turns technical documentation into legally binding prospectuses, where any significant inaccuracies or omissions will lead to strict civil liability, completely piercing the industry's cherished anonymity "corporate veil." It would be better to simply open a digital bank.

Although MiCA introduces "passporting," allowing service providers approved in one member state to operate throughout the European Economic Area, this "unification" comes at a high cost.

It erects a regulatory "moat" that only extremely well-capitalized institutional players can afford, bearing the enormous costs of anti-money laundering integration, market abuse monitoring, and prudential reporting.

MiCA not only regulates the European crypto market but effectively prevents entrepreneurs lacking legal and financial resources from entering, which is precisely the situation for most crypto founders.

Above EU law, the German regulator BaFin has devolved into a mediocre "compliance paperwork processor," with efficiency only reflected in handling procedures for an increasingly moribund industry. France's ambition to become the "Web3 hub" of Europe has collided with the high walls it has built. French startups are not writing code; they are "voting with their feet." They cannot compete with the speed of the US or the innovation of Asia, leading to a massive talent drain to Dubai, Thailand, and Zurich.

But the real "death knell" is the stablecoin ban. The EU has effectively prohibited non-euro stablecoins like USDT under the guise of "protecting monetary sovereignty," which stifles the most reliable area of the DeFi ecosystem. The operation of the global crypto economy relies on stablecoins. Forcing European traders to use illiquid "euro stablecoins" that are ignored outside the eurozone, Brussels is digging itself a "liquidity trap."

The European Central Bank and the European Systemic Risk Board have urged the EU to ban the "multiple issuance" model (where global stablecoin companies treat tokens issued inside and outside the EU as interchangeable). Led by ECB President Christine Lagarde, the ESRB warns that non-EU holders could redeem EU-issued tokens, potentially "amplifying financial risks within the EU."

Meanwhile, the UK is considering capping individual stablecoin holdings at £20,000, while lacking regulation for riskier "junk coins." Europe's risk-averse strategy urgently needs comprehensive reform; otherwise, regulation itself may trigger systemic collapse.

The reason may be simple: Europe wants its citizens to remain bound by the euro, unable to participate in the US economy to escape its stagnation or even decline. As quoted by Reuters, the ECB warns:

Stablecoins could siphon valuable retail deposits from eurozone banks, and any run on stablecoins could have widespread implications for global financial stability.

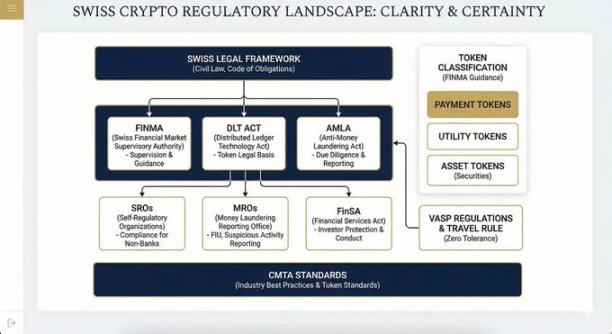

Ideal Model: The Swiss Model

Some countries have successfully avoided the binary dilemma of "over-regulation" and "under-regulation" by breaking free from partisan struggles, foolish decisions, and outdated laws, finding an inclusive path. Switzerland is such an example.

Its regulatory landscape is diverse, effective, and friendly, highly favored by practitioners and users:

- Financial Market Supervision Act: Enacted in 2007, it integrates banking, insurance, and anti-money laundering regulatory bodies, establishing an independent, unified Swiss Financial Market Supervisory Authority.

- Financial Services Act: Focuses on investor protection, creating a fair competitive environment for various financial service providers through strict codes of conduct, client classification, and information disclosure.

- Anti-Money Laundering Act: The core framework for combating financial crime, applicable to all financial intermediaries (including crypto service providers).

- Distributed Ledger Technology Act: Passed in 2021, it amends ten federal laws, formally recognizing the legal status of crypto assets.

- Virtual Asset Service Provider Ordinance: Enforces FATF rules with a "zero tolerance" attitude.

- Swiss Penal Code Article 305bis: Clearly defines money laundering as a criminal offense.

- Industry Standards: Issued by the Capital Markets and Technology Association, though not mandatory, they are widely adopted.

- Regulatory System: Clear structure with parliamentary legislation, FINMA issuing detailed rules, self-regulatory organizations conducting daily supervision, and money laundering reporting offices reviewing suspicious reports and forwarding them for prosecution.

Thus, the Zug Valley has become a "sanctuary" for crypto entrepreneurs. Its logically coherent framework not only allows for innovation but also provides a clear legal safety net, reassuring users and banks willing to take controlled risks.

The US Embraces and Utilizes

The new world's acceptance of cryptocurrencies is not purely driven by a desire for innovation (France has yet to send anyone to the moon); it is more a pragmatic choice under fiscal pressure. Since the 1980s, when it handed over the dominance of Web2 internet to Silicon Valley, Europe seems to view Web3 as yet another "tax base" to be harvested rather than an industry to be nurtured.

This suppression is both structural and cultural. Against the backdrop of an aging population and a pension system under strain, the EU cannot tolerate the rise of a competitive financial industry that is not under its control. This evokes images of feudal lords imprisoning or killing local nobles to eliminate potential threats. Europe has a tragic "self-destructive tendency," sacrificing the potential of its citizens to prevent uncontrolled change. This is foreign to the US, where the culture celebrates competition, initiative, and a Faustian will to power.

MiCA is not a "development" framework but a "death sentence." It aims to ensure that if European citizens engage in crypto trading, it must occur within a state-controlled grid, guaranteeing the government a share of the pie, much like an obese monarch trying to squeeze the farmers dry. Europe is positioning itself as the world's "luxury consumption colony" and "eternal museum," where awestruck Americans come to mourn an irretrievable past.

In contrast, countries like Switzerland and the UAE have jumped out of the historical and structural flaws. They do not bear the imperial burden of defending a global reserve currency, nor do they suffer from the bureaucratic inertia of a 27-nation bloc. By exporting "trust" through laws like the Distributed Ledger Technology Act, they attract foundations with core intellectual property like Ethereum, Solana, and Cardano. The UAE is following closely behind, and it is no wonder that more and more French people are "invading" Dubai.

We are heading towards an era of "radical jurisdictional arbitrage."

The crypto industry will experience geographical fragmentation: consumers will remain in the US and Europe, subjected to comprehensive identity verification, high taxes, and integration with traditional banks; while the core protocol layer will migrate entirely to rational jurisdictions like Switzerland, Singapore, and the UAE.

Users will be spread across the globe, but founders, venture capitalists, protocols, and developers will have to consider leaving their home markets in search of more suitable places to build.

Europe's fate may become that of a "financial museum." It is crafting a shiny yet useless legal system for its citizens, which could even be deadly for actual users. One cannot help but ask: Brussels' technocrats, have you ever bought Bitcoin or transferred stablecoins across chains?

Cryptocurrencies have inevitably become macro assets, and the United States will maintain its status as the global financial center. Bitcoin-priced insurance, crypto asset collateral, crypto reserves, unlimited venture capital support, and a vibrant developer ecosystem—America is building the future.

A Worried Conclusion

In summary, the "Brave New World" that Brussels is constructing resembles not a coherent digital framework but rather a clumsy patchwork, attempting to awkwardly graft 20th-century banking compliance rules onto 21st-century decentralized protocols, designed mostly by engineers who are oblivious to the temperament of the European Central Bank.

We must actively advocate for an alternative system: one that prioritizes real needs over administrative control. Otherwise, we will completely stifle Europe's already anemic economy.

Unfortunately, cryptocurrencies are not the only victims of this "risk aversion." They are merely the latest target of a complacent and well-rewarded bureaucratic class. This group wanders the lifeless postmodern corridors of the capital, and their heavy-handed regulation only exposes their lack of real-world experience. They have never experienced the tediousness of account verification, the hassle of obtaining a new passport, or the difficulties of applying for a business license. Therefore, despite Brussels being filled with so-called "technocrats," crypto-native founders and users must contend with a group entrenched in incompetence, only capable of producing harmful legislation.

Europe Must Turn and Act Immediately

While the EU is busy binding itself with red tape, the United States is actively planning how to "normalize" DeFi, moving towards a framework beneficial to multiple parties. Achieving some degree of "re-centralization" through regulation is inevitable; the collapse of FTX has long been a warning written on the wall.

Investors suffering heavy losses are yearning for justice; we need to break free from the current cycle of meme coin frenzy, cross-chain bridge vulnerabilities, and regulatory chaos in this "Wild West." We need a structure that allows traditional capital (with firms like Sequoia, Bain, BlackRock, Citigroup already taking the lead) to enter safely while protecting end users from predatory capital.

Rome wasn't built in a day, but the crypto experiment has been underway for fifteen years, and the institutional foundation remains mired in the mud. The window for building a functional crypto industry is rapidly closing; hesitation and compromise in times of war will lead to total loss, and both sides of the Atlantic need swift, decisive, and comprehensive regulation.

If this cycle is truly coming to an end, now is the best time to restore the industry's reputation and compensate serious investors who have been harmed by bad actors for years.

Those weary traders from 2017, 2021, and 2025 demand a thorough clearing and a final answer to the cryptocurrency issues; most importantly, we must usher in a new historical peak for our world's most beloved asset, one that it rightfully deserves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。