We are experiencing a "purification" that the market needs, which will make the crypto ecosystem better than ever, even ten times better.

Author: Poopman

Compiled by: Deep Tide TechFlow

Ansem announced that the market has peaked, and CT refers to this cycle as "criminal."

Projects with high FDV (Fully Diluted Valuation) and no real applications have drained the last penny from the crypto space. The packaged sale of Memecoins has made the crypto industry notorious in the public eye.

Worse still, almost no funds have been reinvested into the ecosystem.

On the other hand, almost all airdrops have devolved into "pump and dump" scams. The sole purpose of Token Generation Events (TGE) seems to be to provide exit liquidity for early participants and teams.

Hodlers and long-term investors are suffering heavy losses, while most altcoins have never recovered.

The bubble is bursting, token prices are plummeting, and people are furious.

Does this mean it's all over?

Difficult times create strong individuals.

To be fair, 2025 is not a bad year.

We have witnessed the birth of many excellent projects. Projects like Hyperliquid, MetaDAO, Pump.fun, Pendle, and FomoApp have proven that there are still real builders in this field working hard to drive development in the right way.

This is a necessary "purification" to eliminate bad actors.

We are reflecting and will continue to improve.

Now, to attract more capital inflow and users, we need to showcase more real applications, genuine business models, and revenue that can bring actual value to tokens. I believe this is the direction the industry should move towards in 2026.

2025: The Year of Stablecoins, PerpDex, and DAT

Stablecoins Mature Further

In July 2025, the "Genius Act" was officially signed, marking the birth of the first regulatory framework for payment stablecoins, requiring that stablecoins must be backed by 100% cash or short-term government bonds.

Since then, traditional finance (TradFi) has shown increasing interest in the stablecoin space, with net inflows into stablecoins exceeding $100 billion this year, making it the strongest year in stablecoin history.

RWA.xyz

Institutions favor stablecoins, believing they have great potential to replace traditional payment systems for several reasons:

Lower costs and more efficient cross-border transactions

Instant settlement

Low transaction fees

Available 24/7

Hedge against local currency volatility

On-chain transparency

We have witnessed significant mergers and acquisitions by tech giants (such as Stripe acquiring Bridge and Privy), Circle's IPO being oversubscribed, and several top banks collectively expressing interest in launching their own stablecoins.

All of this indicates that stablecoins have indeed been maturing over the past year.

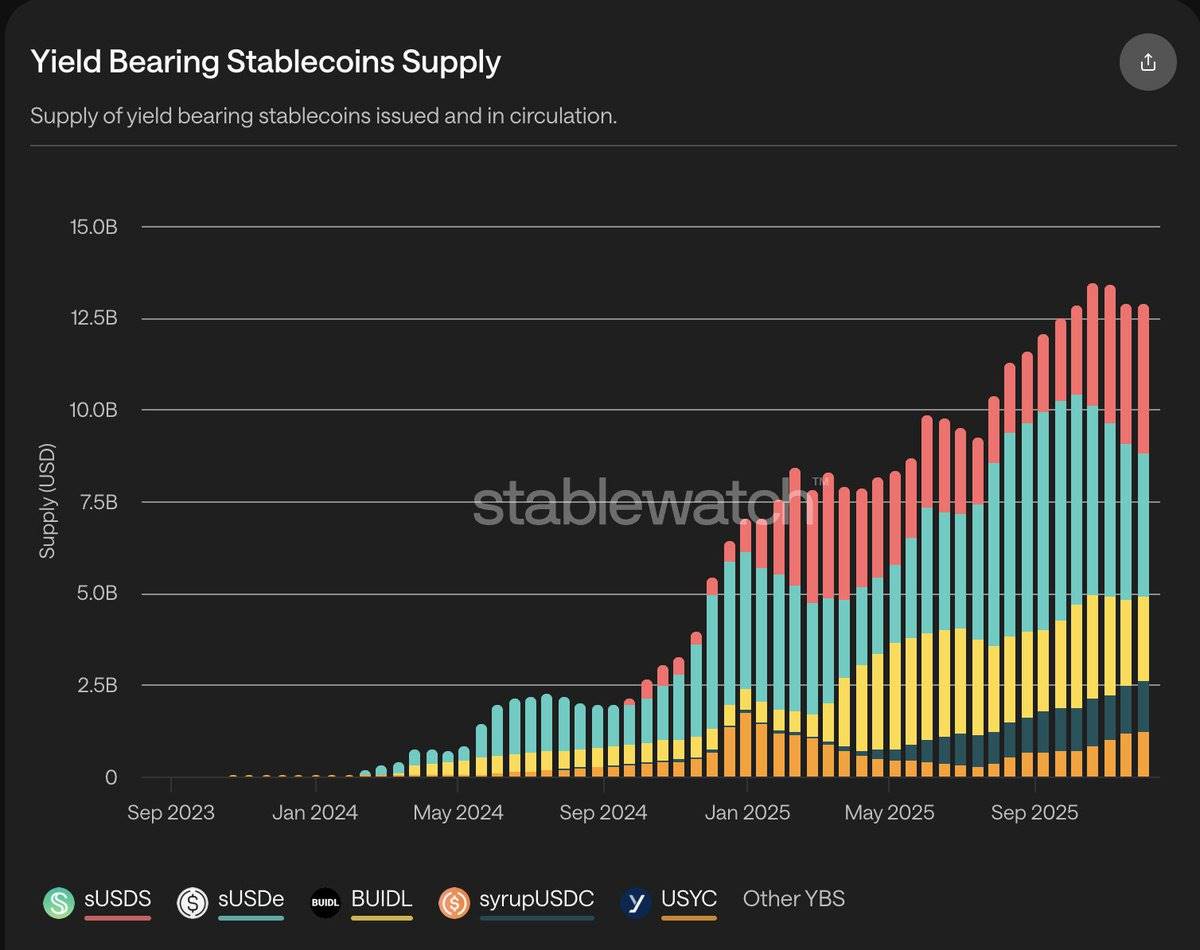

Stablewatch

In addition to payments, another major application scenario for stablecoins is earning permissionless yields, which we call Yield Bearing Stablecoins (YBS).

This year, the total supply of YBS actually doubled to $12.5 billion, driven mainly by yield providers like BlackRock BUIDL, Ethena, and sUSDs.

Despite the rapid growth, recent events with Stream Finance and the broader poor performance of the crypto market have affected market sentiment and reduced the yields of these products.

Nevertheless, stablecoins remain one of the few truly sustainable and growing businesses in the crypto space.

PerpDex (Perpetual Contract Decentralized Exchange):

PerpDex is another star of the year.

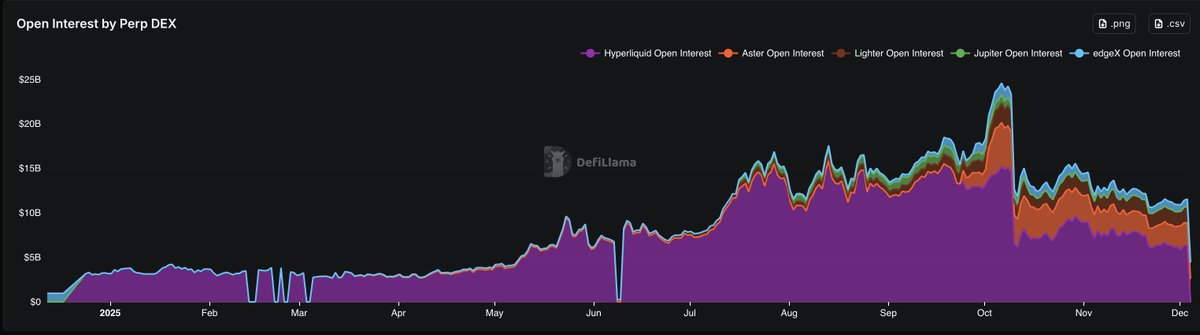

According to DeFiLlama data, the open interest of PerpDex has increased on average by 3-4 times, growing from $3 billion to $11 billion, and once peaked at $23 billion.

The trading volume of perpetual contracts has also surged significantly, skyrocketing 4 times since the beginning of the year, from an astonishing $80 billion weekly trading volume to over $300 billion weekly trading volume (part of the growth is also attributed to liquidity mining), making it one of the fastest-growing sectors in the crypto space.

However, since the significant market correction on October 10 and the subsequent market downturn, both metrics have begun to show signs of slowing down.

PerpDex Open Interest (OI), data source: DeFiLlama

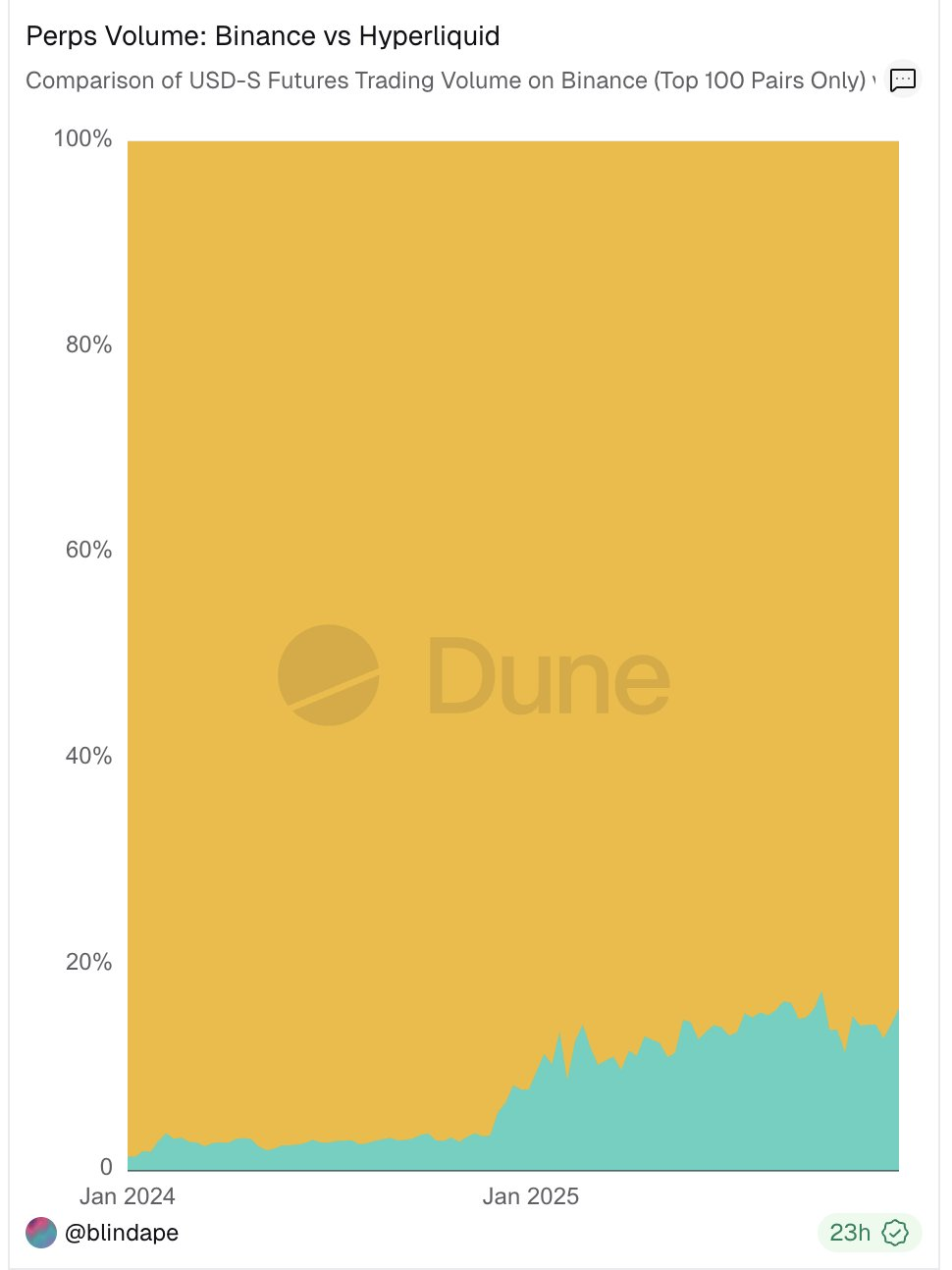

The rapid growth of PerpDex poses a real threat to the dominance of centralized exchanges (CEX).

For example, Hyperliquid's perpetual contract trading volume has reached 10% of Binance's, and this trend continues. This is not surprising, as traders can find advantages on PerpDex that some CEX perpetual contracts cannot offer:

No KYC (identity verification)

Good liquidity, in some cases even comparable to CEX

Airdrop speculation opportunities

Valuation games are another key point.

Hyperliquid has demonstrated that perpetual contract decentralized exchanges (PerpDex) can achieve extremely high valuation ceilings, attracting a wave of new competitors into the arena.

Some new competitors have received backing from large venture capital (VC) or centralized exchanges (CEX) (such as Lighter, Aster, etc.), while others are trying to differentiate themselves through native mobile applications and loss compensation mechanisms (such as Egdex, Variational, etc.).

Retail investors have high expectations for the high FDV (Fully Diluted Valuation) of these projects at launch, while also being excited about airdrop rewards, leading to the "POINTS WAR" we see today.

While perpetual contract decentralized exchanges can achieve extremely high profitability, Hyperliquid has chosen to repurchase $HYPE through an "Assistance Fund," reinjecting profits back into the token (the repurchase amount has accumulated to 3.6% of the total supply).

This repurchase mechanism provides actual value backflow, becoming the main driving force behind the token's success and effectively creating a trend of "repurchase metaverse"—prompting investors to start demanding stronger value anchoring rather than high FDV with no real use governance tokens.

DAT (Digital Asset Trust):

Due to Trump's pro-crypto stance, we have seen a large influx of institutional and Wall Street funds into the crypto space.

DAT was inspired by MicroStrategy's strategy and has become one of the main ways for traditional finance (TradFi) to indirectly engage with crypto assets.

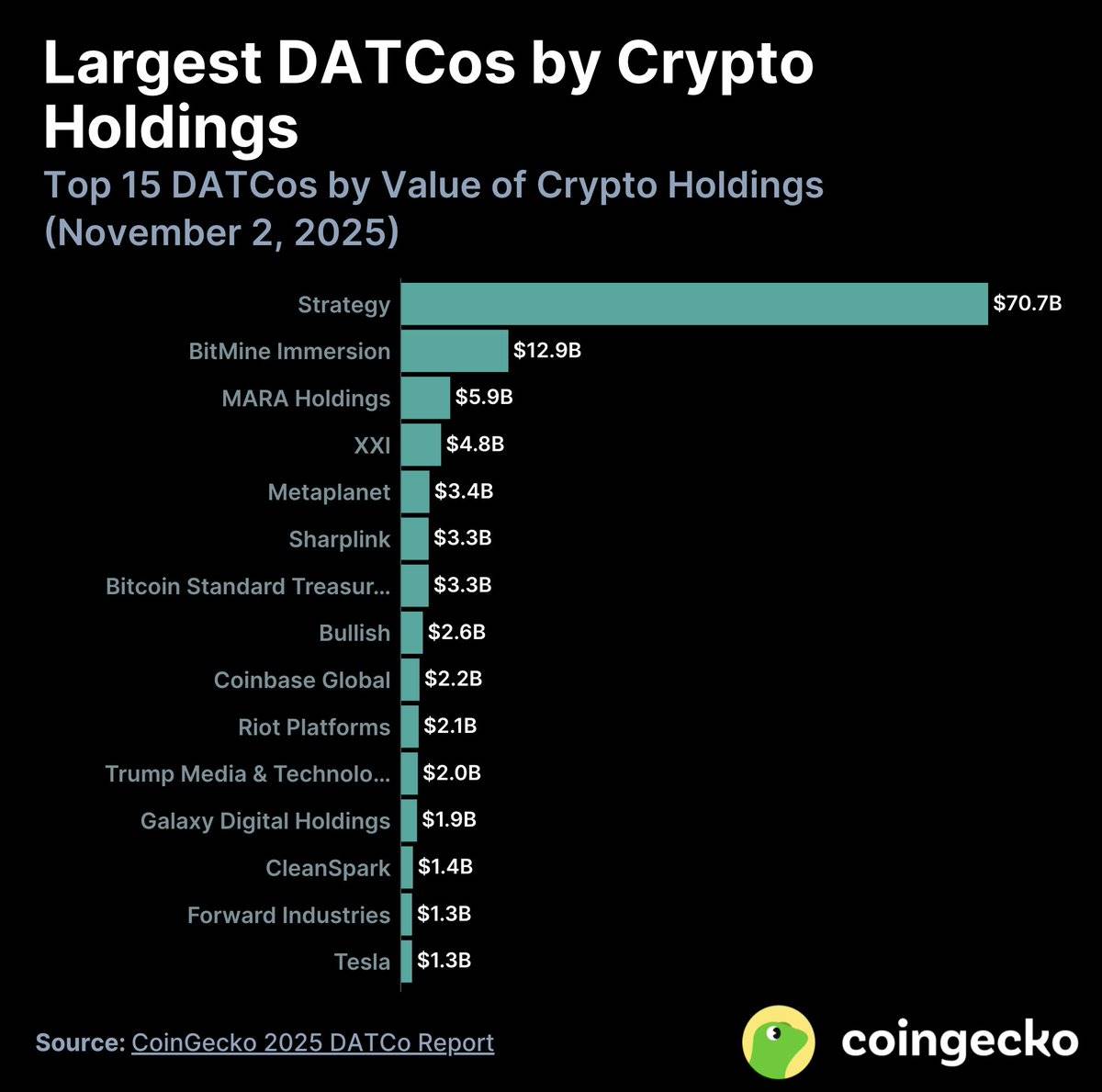

In the past year, about 76 new DATs have been added. Currently, the DAT treasury holds crypto assets worth $137 billion. Of these, over 82% are Bitcoin (BTC), about 13% are Ethereum (ETH), and the rest are spread across various altcoins.

Please see the chart below:

Bitmine (BMNR)

Launched by Tom Lee, Bitmine (BMNR) has become one of the iconic highlights of this DAT craze and has become the largest ETH buyer among all DAT participants.

However, despite early attention, most DAT stocks experienced a "pump and dump" trend within the first 10 days. Since October 10, the inflow of funds into DAT has plummeted by 90% compared to July levels, and the net asset value (mNAV) of most DATs has fallen below 1, indicating that the premium has disappeared, and the DAT craze has essentially come to an end.

In this cycle, we have learned the following points:

The blockchain needs more real-world applications.

The main use cases in the crypto space remain trading, yield, and payments.

Nowadays, people are more inclined to choose protocols with fee-generating potential rather than purely decentralized ones (source: @EbisuEthan).

Most tokens need stronger value anchors, linked to the fundamentals of the protocol, to protect and reward long-term holders.

A more mature regulatory and legislative environment will provide greater confidence for builders and talent to enter the field.

Information has become a tradable asset on the internet (source: PM, Kaito).

New Layer 1/Layer 2 projects without clear positioning or competitive advantages will gradually be eliminated.

So, what will happen next?

2026: The Year of Predictive Markets, More Stablecoins, More Mobile Applications, More Real Revenue

I believe that the crypto space will develop in the following four directions in 2026:

Prediction Market

More Stablecoin Payment Services

More Popularity of Mobile DApps

More Realized Revenue

Still the Prediction Market

Undoubtedly, prediction markets have become one of the hottest sectors in the crypto space.

"You can bet on anything"

"90% accuracy in predicting real-world outcomes"

"Participants bear their own risks"

These headlines have attracted significant attention, and the fundamentals of prediction markets are equally compelling.

As of the writing of this article, the total weekly trading volume of prediction markets has surpassed the peak during election periods (even including wash trading at that time).

Today, giants like Polymarket and Kalshi have completely dominated the distribution channels and liquidity, leaving competitors lacking significant differentiation with almost no chance of gaining meaningful market share (except for Opinion Lab).

Institutions have also begun to flood in, with Polymarket receiving investment from ICE at an $8 billion valuation, and its secondary market valuation has reached $12-15 billion. Meanwhile, Kalshi completed its Series E funding at an $11 billion valuation.

This momentum is unstoppable.

Moreover, with the upcoming $POLY token, the forthcoming IPO, and mainstream distribution channels realized through platforms like Robinhood and Google Search, prediction markets are likely to become one of the main narratives of 2026.

That said, there is still much room for improvement in prediction markets, such as optimizing outcome parsing and dispute resolution mechanisms, developing methods to counter malicious traffic, and maintaining user engagement over long feedback cycles, all of which need further enhancement.

In addition to the dominant players in the market, we can also expect the emergence of new, more personalized prediction markets, such as @BentoDotFun.

Stablecoin Payment Sector

Following the introduction of the "Genius Act," the increased interest and activity from institutions in stablecoin payments have become one of the main driving forces behind their widespread adoption.

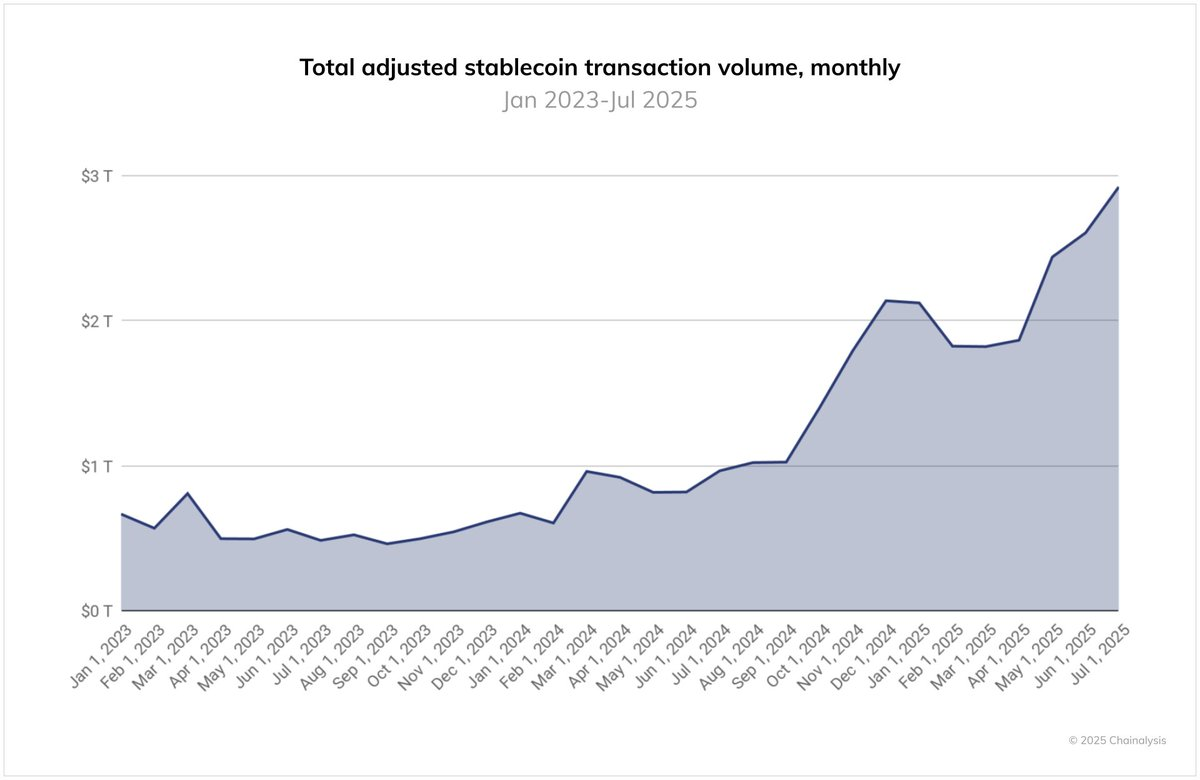

In the past year, the monthly trading volume of stablecoins has surged to nearly $3 trillion, with the adoption rate accelerating rapidly. While this may not be a perfect metric, it clearly indicates a significant increase in stablecoin usage following the introduction of the "Genius Act" and the European MiCA framework.

On the other hand, Visa, Mastercard, and Stripe are actively embracing stablecoin payments, whether by supporting stablecoin consumption through traditional payment networks or collaborating with centralized exchanges (CEX) (such as Mastercard's partnership with OKX Pay). Merchants can now choose to accept stablecoin payments without being limited by customers' payment methods, showcasing the confidence and flexibility of Web2 giants in this asset class.

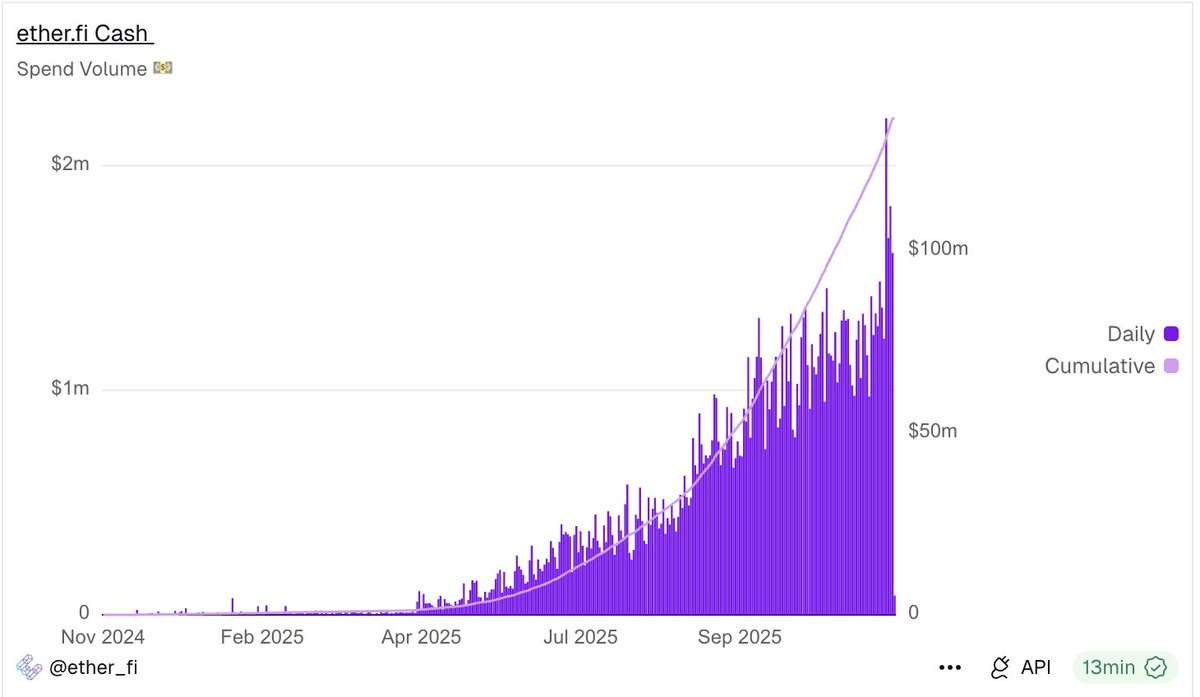

At the same time, new crypto banking services like Etherfi and Argent (now rebranded as Ready) have begun offering card products that allow users to spend stablecoins directly.

For example, Etherfi's daily average spending has steadily grown to over $1 million, with no signs of slowing down.

Etherfi

Nevertheless, we cannot overlook some challenges that new crypto banks still face, such as high customer acquisition costs (CAC) and the difficulty of profiting from deposit funds due to users self-custodying their assets.

Some potential solutions include providing in-app token exchange features or repackaging yield products to sell as financial services to users.

With chains focused on payments like @tempo and @Plasma gearing up, I expect significant growth in the payment sector, especially driven by the distribution capabilities and brand influence brought by Stripe and Paradigm.

Popularity of Mobile Applications

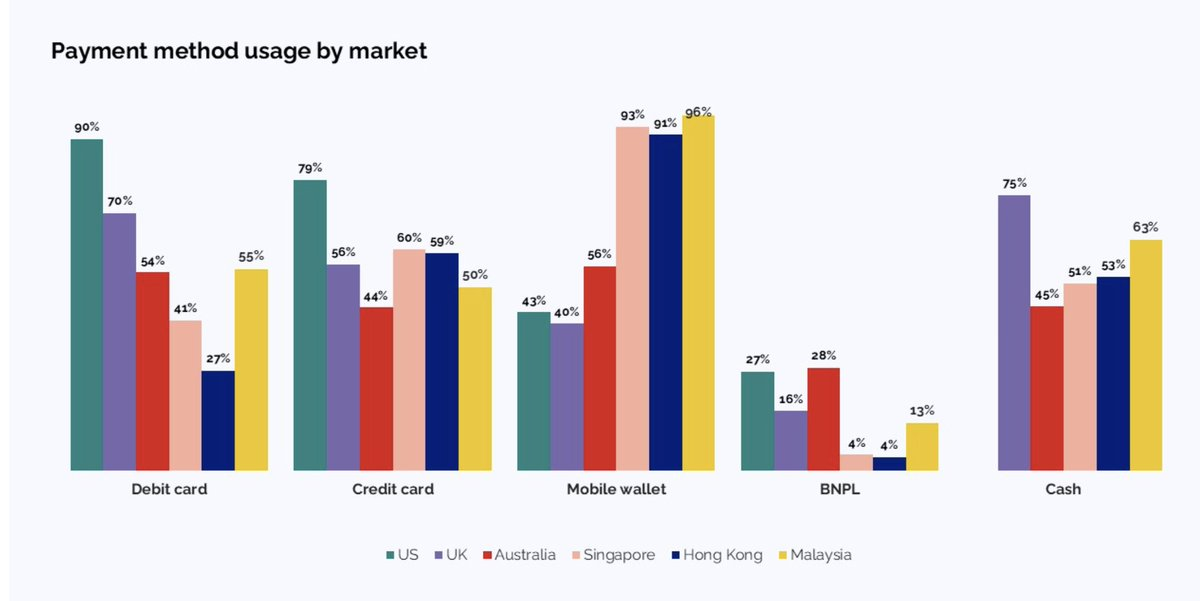

Smartphones are becoming increasingly prevalent worldwide, with the younger generation driving the shift towards electronic payments.

As of now, nearly 10% of daily transactions globally are completed via mobile devices. Southeast Asia is leading this trend due to its "mobile-first" culture.

Ranking of Payment Methods by Country

This represents a fundamental behavioral shift in traditional payment networks, and I believe that as mobile transaction infrastructure has significantly improved compared to a few years ago, this shift will naturally extend into the crypto space.

Do you remember account abstraction, unified interfaces, and mobile SDKs in tools like Privy?

Today's mobile user onboarding experience is much smoother than it was two years ago.

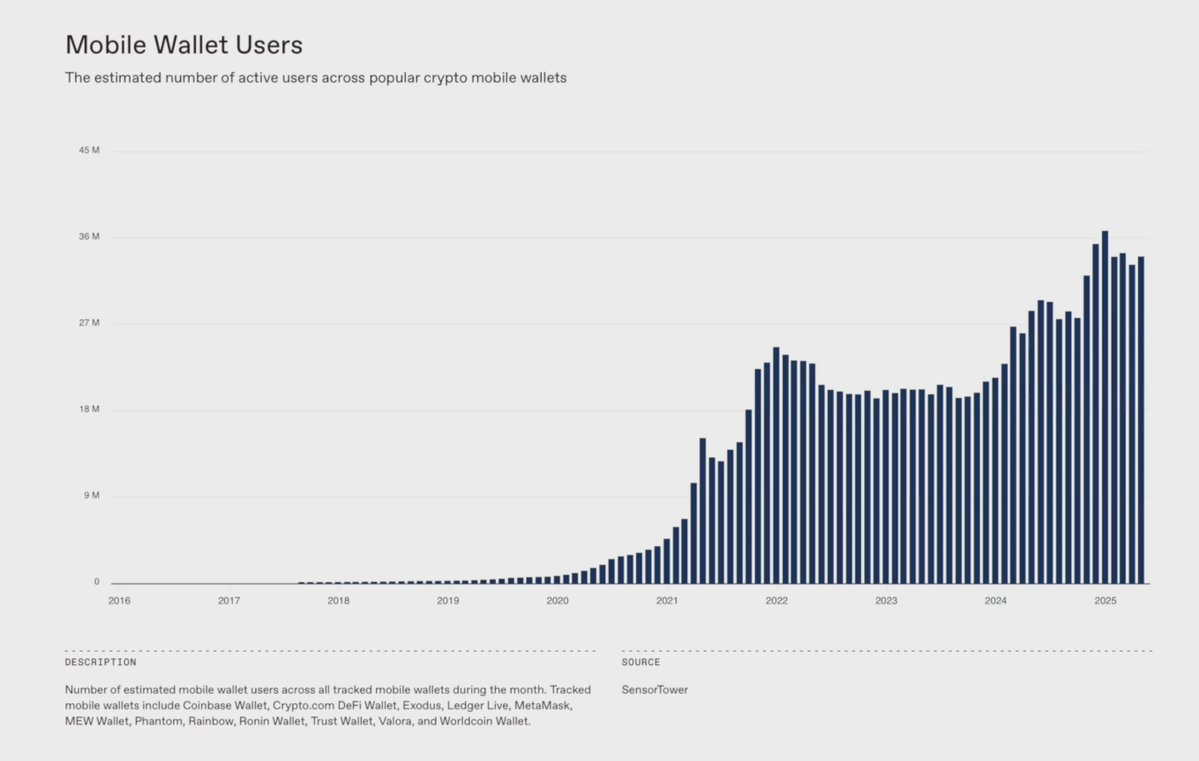

According to research from a16z Crypto, the number of crypto mobile wallet users has increased by 23% year-over-year, and this trend shows no signs of slowing down.

In addition to the changing consumption habits of Generation Z (Gen Z), we are also seeing the emergence of more native mobile DApps in 2025.

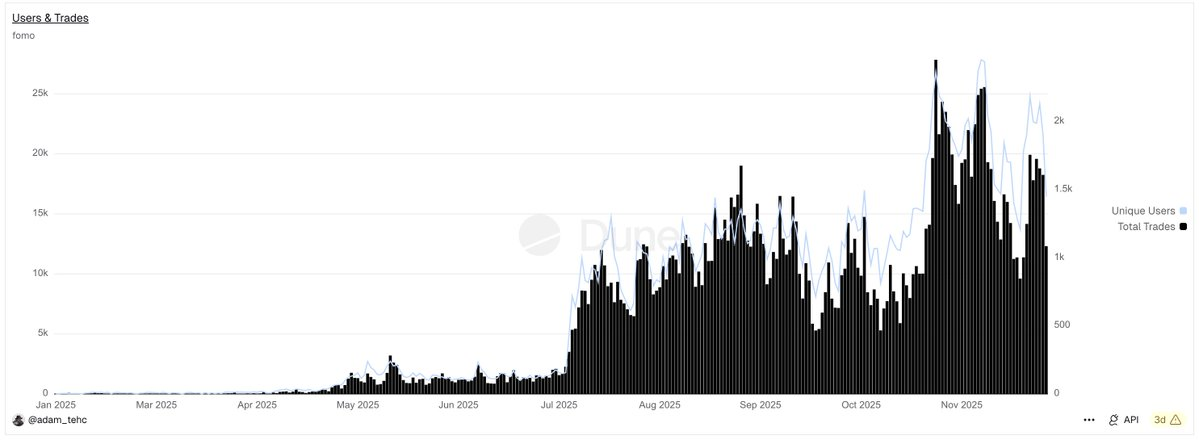

For example, Fomo App, as a social trading application, has attracted a large number of new users with its intuitive and unified user experience, allowing anyone to easily participate in token trading even without prior knowledge.

Developed in just six months, the app has achieved an average daily trading volume of $3 million and peaked at $13 million in October.

With the rise of Fomo, major players like Aave and Polymarket are also beginning to prioritize mobile savings and betting experiences. New entrants like @sproutfi_xyz are attempting to implement mobile-centric yield models.

As mobile behavior continues to grow, I expect mobile DApps to become one of the fastest-expanding sectors in 2026.

Please Give Me More Revenue

One of the main reasons people find it hard to believe in this cycle is simple:

Most tokens listed on major exchanges still generate almost no meaningful revenue, and even when they do, they lack a value anchor to their tokens or "shares." Once the narrative fades, these tokens struggle to attract sustainable buyers, and the subsequent trend often only goes one way—down.

Clearly, the crypto industry is overly reliant on speculation while paying insufficient attention to real business fundamentals.

Most DeFi projects have fallen into the trap of designing "Ponzi schemes" to drive early adoption, but the result each time is a shift in focus to how to sell off after the Token Generation Event (TGE), rather than building a lasting product.

So far, only 60 protocols have generated over $1 million in revenue within 30 days. In contrast, about 5,000-7,000 IT companies in Web2 achieve this level of monthly revenue.

Fortunately, with Trump's pro-crypto policies driving change, 2025 has seen a shift. These policies have made profit-sharing possible and helped address the long-standing lack of value anchoring for tokens.

Projects like Hyperliquid, Pump, Uniswap, and Aave are actively focusing on product and revenue growth. They recognize that crypto is an ecosystem centered around holding assets, which naturally requires positive value backflow.

This is why buybacks have become such a powerful value anchoring tool in 2025, as it is one of the clearest signals of alignment between the team's and investors' interests.

So, which businesses are generating the strongest revenue?

The main use cases in crypto remain trading, yield, and payments.

However, due to the compression of costs in blockchain infrastructure, on-chain revenue is expected to decline by about 40% this year. In contrast, decentralized exchanges (DEX), exchanges, wallets, trading terminals, and applications have emerged as the biggest winners, growing by 113%!

Please bet more on applications and DEX.

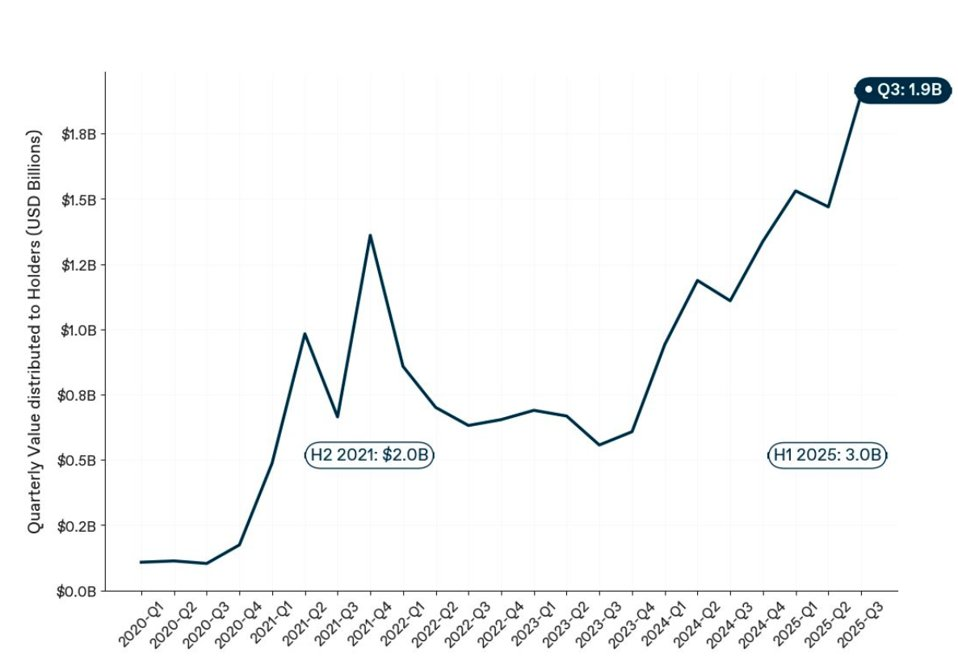

If you still don't believe it, according to research from 1kx, we are actually experiencing the highest peak of value flowing to token holders in crypto history. Please see the data below:

Conclusion

The crypto industry is not over; it is evolving. We are experiencing a "purification" that the market needs, which will make the crypto ecosystem better than ever, even ten times better.

Projects that can survive, achieve real-world applications, create real revenue, and build tokens with actual utility or value backflow will ultimately become the biggest winners.

2026 will be a key year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。