In the brief upward trend that began in April, crypto treasury companies acted as the main force for market accumulation, providing a continuous supply of ammunition. However, when the crypto market faced a double whammy of falling prices and stock prices, these treasury companies seemed to collectively fall silent.

When prices hit a temporary bottom, it should have been the moment for these treasury companies to buy in. Yet, the reality is that buying behavior has slowed down or even come to a halt. This collective silence is not simply due to the exhaustion of "ammunition" at high points or panic, but rather a structural paralysis of the financing mechanism that heavily relies on premiums, which has rendered them "unable to use their money" during the downturn.

Hundreds of Billions in "Ammunition" Locked Up

To understand why these DAT companies are facing the dilemma of "unable to use their money," we need to conduct an in-depth analysis of the sources of ammunition for crypto treasury companies.

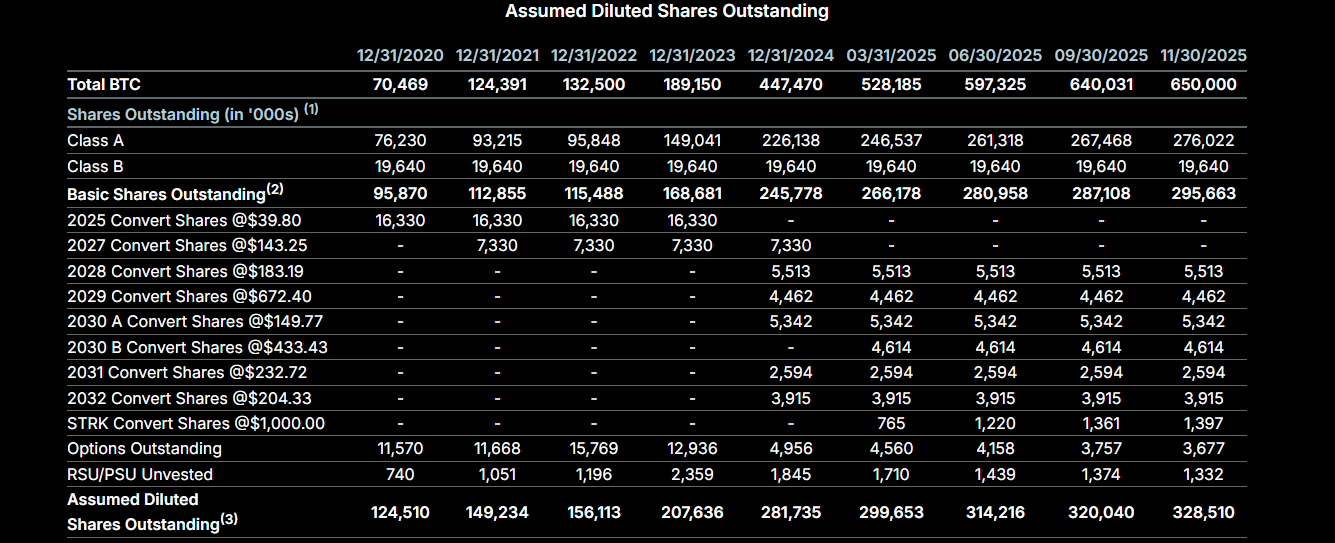

Taking the current leading crypto treasury company, Strategy, as an example, its funding has primarily come from two sources: one is "convertible notes," which involve issuing bonds at very low interest rates to borrow money to buy coins. The other is the At-The-Market (ATM) issuance mechanism, which allows Strategy to issue additional shares to raise funds for buying Bitcoin when its stock price is at a premium relative to its held crypto assets.

Before 2025, Strategy's main source of funding was "convertible notes." As of February 2025, Strategy had raised $8.2 billion through convertible notes to increase its Bitcoin holdings. Starting in 2024, Strategy began to adopt a large-scale ATM equity issuance plan, which is more flexible; when the stock price exceeds the market value of the held crypto assets, it can issue additional shares at market price to purchase crypto assets. In the third quarter of 2024, Strategy announced an ATM equity issuance plan with a limit of $21 billion, and in May 2025, it established a second ATM plan with another $21 billion limit. As of now, the total remaining limit of this plan is still $30.2 billion.

However, these limits are not cash but rather the limits of Class A preferred shares and common stock waiting to be sold. For Strategy, converting these limits into cash requires selling these stocks in the market. When the stock price is at a premium (for example, if the stock price is $200 and each share contains $100 worth of Bitcoin), selling shares is equivalent to converting the newly issued shares into $200 cash, which can then be used to buy $200 worth of Bitcoin, thereby increasing the Bitcoin content per share. This was the previous logic of Strategy's infinite ammunition. However, when Strategy's mNAV (mNAV = market capitalization / value of held coins) data falls below 1, the situation reverses; selling shares would mean selling at a discount. After November, Strategy's mNAV data has remained below 1 for an extended period. Therefore, during this time, although Strategy has a large number of sellable stocks, it cannot purchase Bitcoin.

Moreover, not only has Strategy been unable to free up funds to buy at the bottom recently, but it has also raised $1.44 billion by selling shares at a discount to establish a dividend reserve pool to support preferred stock dividend payments and existing debt interest payments.

As a standard template for crypto treasuries, Strategy's mechanism has been learned by most treasury companies. Therefore, we can see that when crypto assets decline, the reason these treasury companies have failed to enter the market to buy at the bottom is not unwillingness, but rather because the stock prices have fallen too much, locking up the "ammunition depot."

Sufficient Nominal Firepower, Actual "Guns Without Bullets"

So, aside from Strategy, how much purchasing power do other companies have? After all, there are now hundreds of crypto treasury companies in this market.

From the current market perspective, although there are many crypto treasury companies, their subsequent purchasing potential is not significant. There are mainly two situations: one type consists of companies that originally belong to crypto asset holding enterprises, whose quantity of crypto assets mainly comes from their own holdings rather than new purchases through debt issuance. Their ability and motivation to raise funds through debt are not strong, such as Cantor Equity Partners (CEP), which ranks third in Bitcoin holdings with an mNAV of 1.28. Its Bitcoin quantity mainly comes from a merger with Twenty One Capital, and there have been no purchase records since July.

The other type consists of companies that adopt strategies similar to Strategy, but due to a significant recent drop in stock prices, their mNAV values have generally fallen below 1. These companies' ATM limits are also locked, and they can only resume operations once stock prices rise above 1.

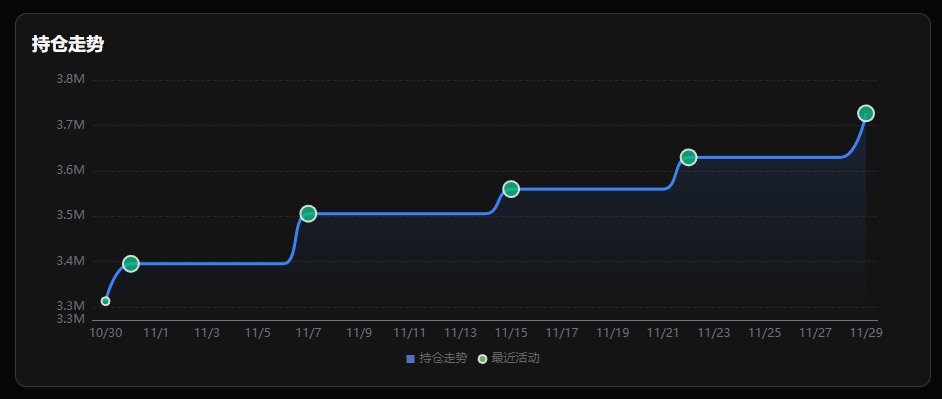

In addition to issuing debt and selling stocks, there is another more direct "ammunition depot," which is cash reserves. Taking BitMine, the largest DAT company for Ethereum, as an example, although its mNAV is also below 1, the company has still maintained its buying plan recently. According to data from December 1, BitMine stated that it still has $882 million in unsecured cash on hand. BitMine's chairman, Tom Lee, recently stated, "I believe Ethereum's price has hit bottom, and BitMine has resumed accumulation, purchasing nearly 100,000 ETH last week, which is double that of the previous two weeks." BitMine's ATM limits are also staggering; in July 2025, the total limit of this plan was raised to $24.5 billion, and there is still nearly $20 billion remaining.

Changes in BitMine's holdings

Additionally, CleanSpark proposed at the end of November to issue $1.15 billion in convertible bonds within the year to purchase Bitcoin. The Japanese listed company Metaplanet has also been a relatively active Bitcoin treasury company, raising over $400 million since November through borrowing against Bitcoin or issuing additional shares to finance Bitcoin purchases.

In total, the "nominal ammunition" (cash + ATM limits) on the books of various companies amounts to hundreds of billions of dollars, far exceeding the previous bull market. However, in terms of "effective firepower," the actual bullets that can be fired have decreased.

Shifting from "Leverage Expansion" to "Yield Seeking for Survival"

In addition to ammunition being locked up, these crypto treasury companies are also beginning to adopt new investment strategies. During the market's upward phase, most companies had a very simple strategy: mindlessly buy in, gain more financing as the prices of coins and stocks rose, and then continue to buy. However, as the situation has changed, many companies are facing not only increased difficulty in financing but also the need to deal with interest payments on previously issued bonds and operational costs.

As a result, many companies are starting to shift their focus to "crypto yield," which involves participating in network staking activities of crypto assets to obtain relatively stable staking returns, using these returns to pay the interest and operational costs required for financing.

Among them, BitMine plans to launch MAVAN (the U.S. native validator network) in the first quarter of 2026 to initiate ETH staking. This is expected to bring BitMine an annualized return of $340 million. Similar companies include Upexi and Sol Strategies, which are treasury companies on the Solana network, capable of achieving approximately 8% annualized returns.

It is foreseeable that as long as mNAV cannot return to above 1.0, hoarding cash to cope with debt maturities will become the main theme for treasury companies. This trend also directly affects asset selection. Due to Bitcoin's lack of inherent high yields, the accumulation of pure Bitcoin treasuries has slowed down, while Ethereum, which can generate cash flow through staking to cover interest costs, has maintained resilience in its treasury accumulation speed.

This shift in asset preference is essentially a compromise by treasury companies to the liquidity dilemma. When the channel for obtaining cheap funds through stock price premiums is closed, seeking yield-generating assets becomes their only lifeline to maintain a healthy balance sheet.

Ultimately, "infinite ammunition" is merely an illusion built on stock price premiums. When the flywheel is locked due to discounts, the market must confront a harsh reality: these treasury companies have always been amplifiers of trends, not saviors against the tide. Only when the market warms up again can the flow of funds be reopened.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。