Author: Pink Brains

Compiled by: Tim, PANews

Starknet is in the early stages of a Solana-style rebound.

This L2 is mentioned less frequently, but its technology is unique and focuses on creating highly usable products.

- Since July, DeFi TVL has tripled, currently reaching about $300 million, close to its historical peak.

- The market capitalization of stablecoins has reached a historical high of $154 million.

- In the past three months, it ranks second in net inflows, with a net inflow of $584 million.

- Active accounts are on the rise, reaching 50,000 to 60,000 daily.

Why has Starknet made such progress?

First, Starknet has not simply copied existing Ethereum solutions but has built its DeFi ecosystem from scratch.

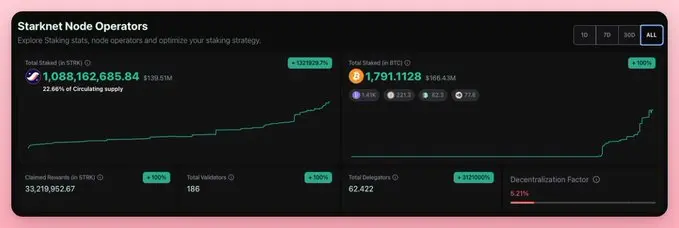

STRK native staking feature: The first L2 token with practical application scenarios. Through Endur.fi's LST product, it achieves an annualized yield of about 7%. Over the past year, more than 1 billion STRK have been staked (about 22% of the circulating supply, with a 120% increase in the past three months).

BTC native staking feature: The first dual-token staking mechanism implemented on the Starknet consensus layer. Within just one month of launch, staking has reached 1,791 BTC, valued at approximately $166 million.

Staking features are now available on wallets such as Ready, Braavos, and Xverse.

Institutional-grade custody platform Anchorage also supports BTC staking on the Starknet network.

Starknet is currently one of the most liquid Bitcoin layer two networks and is at the core of the BTCFi narrative.

It supports cross-chain transfers of BTC from Bitcoin, Ethereum, and other layer two networks, BTC staking, and ready-to-use DeFi suites.

- Re7 Capital: Provides institutional-grade strategies, including mRe7 yield (stablecoin yield) and mRe7 Bitcoin (Bitcoin yield), tokenized through the Midas RWA platform.

- Endur.fi: The largest LST project on Starknet. It has locked 60 million STRK (annualized yield of 7.75%) and 340 BTC.

- Vesu: Offers BTC collateralized lending and looping strategies. Users can deposit wBTC, tBTC, LBTC, and SolvBTC to earn up to 2.5% annualized deposit interest and borrow USDT, USDC at an annualized borrowing rate of about 2.8%. Total deposits have exceeded $60 million, with borrowing reaching $19 million.

- Extended, Avnu, and Ekubo Protocol: Focused on BTC trading and liquidity. Ekubo is the largest automated market maker DEX on Starknet, featuring scalability similar to Uni v4, supporting dollar-cost averaging, and an upcoming limit order mode.

- Uncap and Opus: Allow users to borrow Starknet native stablecoins using BTC as collateral.

- 0D Finance, Troves, and Starknet Earn: Provide convenient one-click DeFi strategies.

Starknet is also enhancing its interoperability.

In December, Starknet will support LayerZero, Stargate Finance, native USDC, CCTP v2, and NEAR interaction mechanisms.

This may accelerate the inflow of stablecoins and promote cross-chain trading among assets like STRK, ZEC, BTC, and SOL.

Starknet is vigorously promoting the privacy narrative.

StarkWare's ZK technology stack supports three of the top ten perpetual contract DEXs, all of which are privacy-focused perpetual contract DEXs. Competition with Hyperliquid and Aster is currently intense.

- edgeX (built on Starknet): $170 billion in perpetual contract trading volume over 30 days.

- Paradex (independent chain): $26 billion in perpetual contract trading volume over 30 days, with a TVL of $144 million.

- Extended (Rollup scaling solution): $28 billion in perpetual contract trading volume over 30 days, with a TVL of $99 million.

Indeed, as privacy becomes a key feature, privacy DEXs built on StarkWare and Starknet technology have stronger development potential. Starknet's zero-knowledge proof technology not only enhances transaction privacy protection but also balances scalability and security, laying the foundation for the long-term value of DeFi.

Ethereum + Bitcoin + Zcash = Starknet

Ztarknet is an L2 network based on Starknet, specifically designed for Zcash. It runs high-throughput applications on CairoVM and uses STARK proofs to settle states to the Zcash mainnet.

It adds foundational layer privacy features, enabling scalable programmability and post-quantum security for ZEC.

Yes, StarkWare is also developing Zoro, a lightweight Zcash client that utilizes STARK proofs, aiming to compress the chain verification process of Zcash into concise, verifiable proofs.

The Starknet ecosystem will fully support Zcash. This means Zcash will be able to leverage Starknet's high-performance infrastructure, including the Cairo programming language and STARK proof technology, to enhance scalability, privacy, and programmability while maintaining interoperability with the Ethereum ecosystem.

Starknet is designed to be quantum-resistant.

Vitalik recently warned that quantum computers could break the elliptic curve cryptography protecting Bitcoin and Ethereum within the next four years.

- Starknet uses STARK proofs. Unlike ECC, which relies on large number factorization (easily broken by quantum computers), STARKs are based on collision-resistant hash functions, for which quantum computers have no fast breaking method. Mathematically, Starknet is post-quantum secure.

- On most layer one networks, private keys are equivalent to wallets. Starknet's smart contract wallet mechanism allows its security to be directly enhanced through protocol upgrades without the need to transfer funds, which is fundamentally different from EOA wallets.

- Quantum-safe signatures are typically larger, while Starknet can batch compress them into proofs, allowing the Bitcoin or Ethereum network to verify them at lower gas costs while reducing the processing load on the foundational layer.

In short: Starknet is at the intersection of the most critical paths in the crypto industry.

The technology is ready, waiting for the market to prove it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。