Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The U.S. labor market has recently shown conflicting signals. Last week, the number of initial unemployment claims unexpectedly dropped to 191,000, the lowest since September of last year, indicating resilience in the job market; however, the number of continuing claims remains high at 1.94 million, reflecting structural challenges for the reemployment of the unemployed. Against this backdrop, market expectations for the Federal Reserve to cut interest rates at the meeting on December 10 have risen to 87%. National Economic Council Director Kevin Hassett predicts that the Fed may cut rates by 25 basis points. Additionally, the Fed's quantitative tightening policy has ended, and the market expects the initiation of a "reserve management purchase" plan of about $35 billion per month as early as January next year to replenish liquidity, although officials emphasize that this move is not a new round of quantitative easing, investors still view it as a dovish signal. Meanwhile, the U.S. Treasury market has surpassed $30 trillion in size for the first time. On the other hand, the Bank of Japan plans to raise interest rates this month, potentially reaching a 28-year high.

The Renminbi has recently benefited from a weaker dollar, a resurgence in the attractiveness of Chinese assets, and strong corporate demand for currency conversion, showing significant appreciation momentum. The market is actively discussing whether it can break the 7.0 mark in the short term. The mainstream view suggests a high probability of the Renminbi breaking 7.0 in the short term, but some analysts point out that even if it "breaks 7," there is still uncertainty about whether it can maintain that level, as the People's Bank of China may aim to keep the exchange rate fluctuating in both directions. Additionally, the U.S. PCE inflation data to be released this Friday will serve as an important reference for the global economic direction and Fed policy.

In the field of artificial intelligence, market competition is intensifying. Moore Threads, hailed as the "first domestic GPU stock," saw its stock price surge by 502% on its debut day on the Sci-Tech Innovation Board, with its market value briefly exceeding 300 billion yuan, and a single share yielding nearly 270,000 yuan, reflecting high expectations from the capital market for domestic AI chip tracks. It is reported that Moore Threads was founded by a core team from Nvidia and plans to use nearly 8 billion yuan raised from the IPO to accelerate the development of the next generation of AI training and inference integrated chips. Meanwhile, industry giant Nvidia is also facing fierce competition. Founder Jensen Huang stated that he feels the pressure of "30 days away from bankruptcy" every day. To respond to challenges from competitors like Google TPU, Nvidia recently released a technical blog stating that its GB200 NVL72 system can enhance the performance of top open-source AI models by up to 10 times, revealing that major cloud service providers such as Amazon Cloud, Google Cloud, and Microsoft Azure are accelerating the deployment of this system. Additionally, Nvidia has initiated a series of large-scale strategic investments, including a $2 billion investment in chip design company Synopsys and a $10 billion investment in Anthropic, leveraging its $60.6 billion in cash and short-term investments as of the end of October to further consolidate its AI ecosystem layout.

Bitcoin prices recently encountered resistance and retreated after reaching the annual opening price of $93,500, raising market concerns about future trends. Analysts believe that Bitcoin needs to break through $96,000 to confirm a trend reversal, with resistance concentrated between $93,500 and $100,000. Material Indicators data shows that if it cannot hold above $93,500, the market may further decline to $68,000. Additionally, on-chain data indicates that the current market structure is similar to the early stages of the bear market in the first quarter of 2022, with Glassnode stating that if it loses the key support level of $81,500, it could trigger a deep correction. Analyst CyrilXBT pointed out that if Bitcoin breaks through the $95,000 to $100,000 range, it will initiate a new round of increases; otherwise, it may drop to the low $70,000 range. Technically, a bearish flag pattern targets $68,150, while market liquidation data indicates that approximately $3 billion in cumulative short positions will be liquidated when Bitcoin reaches $96,000, and if it breaks $100,000, the liquidation scale will exceed $7 billion.

However, there is also a strong bullish sentiment in the market. Analyst Murad, who proposed the "Meme Super Cycle" theory, is vocally bullish, believing that this bull market will extend until 2026, with Bitcoin's peak potentially reaching $150,000 to $200,000. Ripple CEO Brad Garlinghouse predicts that by the end of 2026, the price will reach $180,000. Larry Fink, CEO of BlackRock, revealed that some sovereign wealth funds are gradually increasing their holdings as Bitcoin's price falls from a high of $126,000 to the $80,000 range, establishing long-term positions. CryptoQuant analyst Darkfost believes that Bitcoin needs to reclaim the long-term holder cost price of about $96,956 to stabilize market confidence, while JPMorgan stated that whether Stragety can hold steady has also become a key factor for Bitcoin's short-term trend. If market conditions remain stable, Bitcoin is expected to rise to $170,000 within the next 6-12 months.

Ethereum has recently broken through the key structural level of $3,200, and analysts are generally optimistic about its future, believing that if the momentum continues, Ethereum could see a 20% increase, targeting $3,650 and even $3,900. On the trading front, Cold Blooded Shiller believes that the current momentum is leaning upwards, with the top area possibly slightly above $3,300. Analyst Lennaert Snyder stated that ETH has broken through the resistance level of $3,230, with the next target at $3,440. Analyst Ted pointed out that if ETH breaks through the $3,300-$3,400 range, it will extend to $3,800. CryptoQuant data shows that retail investors are actively accumulating below $2,700, and if the price drops to $3,000, it will trigger $2 billion in liquidations, while rising to $3,300 will face $700 million in liquidation pressure. Additionally, Ethereum has officially activated the Fusaka upgrade, reducing L2 gas fees by another 60%. Vitalik emphasized that the PeerDAS technology introduced in the Fusaka upgrade is "true sharding," marking a milestone development for the network since 2015. Although it is not yet perfect in terms of L1 scaling, it lays the foundation for the future development of blockchain design.

2. Key Data (as of December 5, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $92,045 (YTD -1.68%), daily spot trading volume $45.63 billion

Ethereum: $3,167 (YTD -5.16%), daily spot trading volume $23.87 billion

Fear and Greed Index: 28 (Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.7%, ETH 12.2%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, SXP

24-hour BTC long-short ratio: 48.84% / 51.16%

Sector performance: The crypto market has retreated across the board, with PayFi and DePIN sectors down nearly 4%

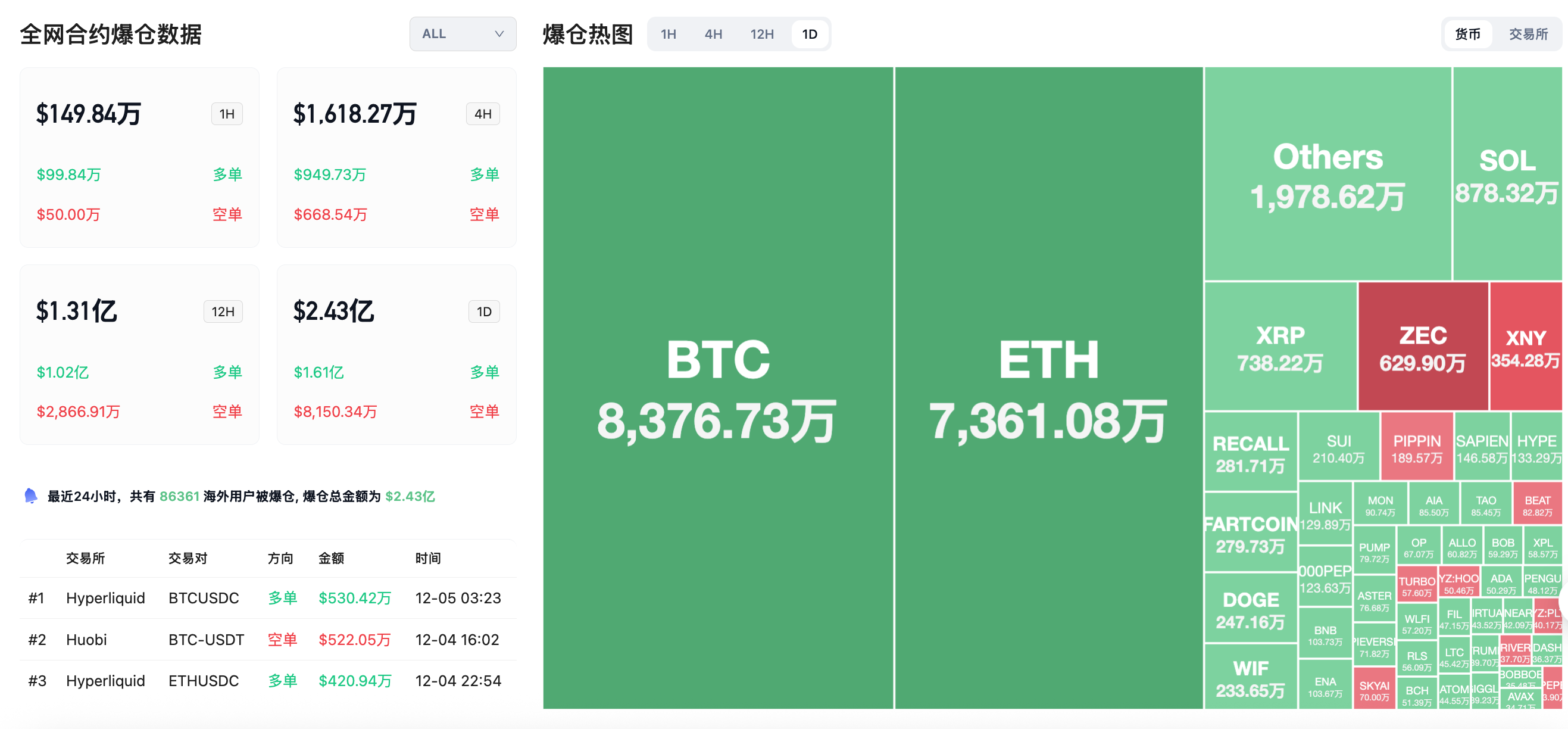

24-hour liquidation data: A total of 86,361 people were liquidated globally, with a total liquidation amount of $243 million, including $83.76 million in BTC liquidations, $73.61 million in ETH liquidations, and $7.38 million in XRP liquidations.

3. ETF Flows (as of December 4)

Bitcoin ETF: -$195 million

Ethereum ETF: -$41.57 million

Solana ETF: +$4.59 million

XRP ETF: +$1.284 million

4. Today's Outlook

Jito (JTO) will unlock approximately 11.31 million tokens at 8:00 AM on February 7, accounting for 1.13% of the total supply, valued at approximately $5.4 million.

U.S. September Core PCE Price Index YoY: Previous value 2.9%, expected value 2.8%

U.S. September PCE Price Index YoY: Previous value 2.8%, expected value 2.7%

The largest gainers among the top 100 cryptocurrencies today: Zcash up 9.6%, MYX Finance up 6.8%, Beldex up 2.9%, TRON up 2.2%, Sky (formerly Maker) up 1.7%.

5. Hot News

Bitmine reportedly bought 41,946 ETH again 5 hours ago, worth about $130 million

Matrixport withdrew 3,805 Bitcoins from Binance in the past 24 hours

Russia's second-largest bank VTB suggests allocating 7% of assets to Bitcoin and cryptocurrencies

Aster releases roadmap for the first half of 2026: Aster Chain mainnet to launch in Q1

Solana Mobile to launch SKR token in January 2026, with 30% allocated for airdrops

U.S. Treasury debt surpasses $30 trillion, doubling since 2018

The probability of the Federal Reserve cutting rates by 25 basis points in December is 87%

Jupiter: WET token public sale phase has sold out, HumidiFi project raised a total of $5.57 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。