The responsibility does not lie with the current providers, but with the consumers who need to progress; the market will naturally adapt.

Written by: @0xIT4I

Translated by: AididiaoJP, Foresight News

All meme coins are ultimately destined to decline; they are a tokenized reflection of trends, and trends are inherently meant to be replaced.

Occasionally, they reflect some social movement, but movements in human history also rise and fall. Very few can withstand the test of time (like DOGE, SPX).

Ghibli-style hype wave March 25-27, 2025

Junk altcoins are the basement of the crypto world, forever filled with pump and dump schemes, exit scams, fraudulent tactics, bundled transactions, and insider trading; this is their essence. But these are also the reasons we love this basement: without risk, there is no advantage, and advantage is the foundation of this highly competitive market we are passionate about. This article may not change the larger environment, but perhaps it can change the ground beneath our feet.

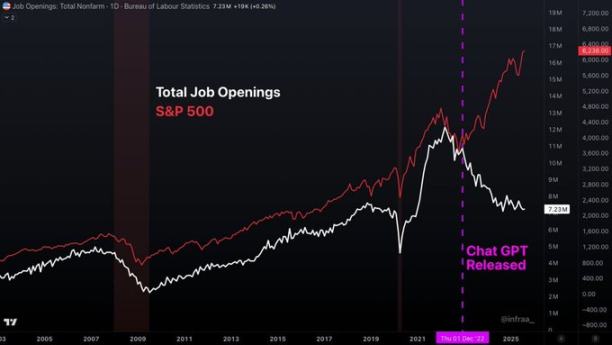

Monetary policy and waves of innovation are the two forces that determine the tone of each cycle. Policy determines how much oxygen the market has, while innovation determines whether there is anything worth breathing. Currently, with policy tightening, aside from the real-world AI chip craze, our field lacks new hotspots (perhaps privacy and perpetual DEX count, but they are far from the grassroots battlefield), so market performance aligns with expectations.

Before expressing your opinion, ask yourself: how much of your view stems from the fear of your holdings depreciating or the anxiety of declining company revenues? This article does not attack industry infrastructure providers like @Pumpfun, @AxiomExchange; I appreciate @a1lon9 and work closely with many excellent founders in the field we are about to discuss.

My goal is to empower users: to provide knowledge that may become the cornerstone of the next competitive environment, ultimately promoting fairness and repairing the parts of the industry that can be improved.

Core Issue

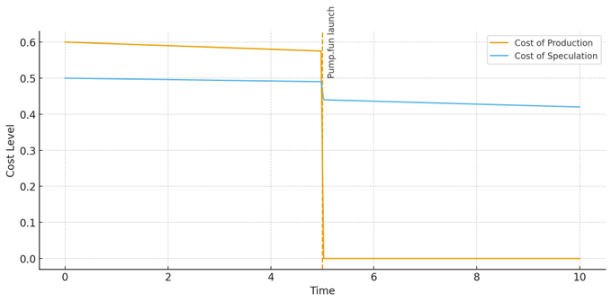

The fundamental contradiction in the current meme coin space lies in the massive imbalance between production costs and speculative costs.

Zero-cost token issuance has had a positive impact: it has lowered the entry barrier for external builders, broken technical monopolies, and promoted a more competitive and open market.

However, the resulting gap between production and speculation is unsustainable. This structure is like a system vulnerability, where the speed of value loss exceeds accumulation.

The problem lies not only in the issuance platform or trading terminal but at a deeper project level.

AI has broken through professional barriers; what used to take three months of work by a Harvard technocrat can now be completed by an Australian teenager in a basement in a week. The decades-long connection between labor and growth has already been severed.

This has far-reaching implications, but in the context of this article, it exacerbates the same issue: production has become cheap not only at the token issuance level but also at the project operation and content creation levels.

The disconnection between labor and growth has led to "junk overflow" spreading to every public chain.

Current Speculative Ecological Pattern

Trading terminals like @AxiomExchange, @gmgn_ai, and Telegram bots like @SigmaTrading (which I am honored to advise) and @MaestroBots all charge a 1% fee. Issuance platforms like @Pumpfun charge about 1% before a token reaches a market value of 3-4 million (the vast majority of tokens cannot break through). Four.meme also charged 1% before migration. According to data from the @bonkfun website, the trading volume in the past 24 hours was 2.4 million, with fees of 23,000 dollars, and the rate is still about 1%.

Therefore, the industry standard for grassroots battlefield speculation is 2% (1% issuance fee + 1% terminal fee).

As a reference, here are the spot trading fee rates for mainstream coins:

@binance 0.10% / 0.10%

@krakenfx 0.16% / 0.26%

@okx 0.08% / 0.10%

Of course, I understand that large traders and KOLs can receive rebates, and centralized exchanges also have tiered fee rates. Let’s estimate loosely:

The fee rate difference is still 10-15 times.

This means that the cost for ordinary retail investors to purchase cheap assets (easily produced) is 10-15 times that of institutional investors purchasing expensive assets (difficult to produce)?

If this is not a problem, then you might as well go back to playing "Fortnite."

How Did the Current Situation Form?

There are various reasons: competitive network effect barriers, the early stage of the market, inexperienced young participants, inadequate builder capabilities, or bad intentions.

But fundamentally, it lies in the unique culture of this field.

Most tokens represent "trends," and holding them is like joining a "team," "movement," or "cultural circle."

Participants mistakenly extend this cultural identity to infrastructure choices, valuing sentiment over efficiency and fairness.

Project parties are well aware of this and exploit it for profit.

It's like a small football club in Eastern Europe: they would rather spend money on flags and merchandise than build a roof over the stadium; they are willing to watch games in the rain, losing potential viewers who value comfort.

Imagine a Bitcoin minimalist paying 15 times the fee at an exchange called "No Second Best" to prove a point; absurd, right?

Solution

To treat the problem, we must identify it. While there is no perfect solution, it is meaningless to criticize without offering suggestions.

My recommendations are twofold: for users and providers.

Users need to act collectively: read and share such content more, clarify what "better" means, and actively demand it. Give new platforms a chance, test experiences, and provide feedback. You might discover the next wealth opportunity. Encounter a competitor with lower fees? Try it decisively. If everyone does this, the market will naturally return to fairness.

For providers, reform requires even more courage:

The fees of issuance platforms and trading terminals will eventually align with 0.1%, integrating with traditional financial markets. While this is the trend, it may be too early at present. Therefore, I suggest:

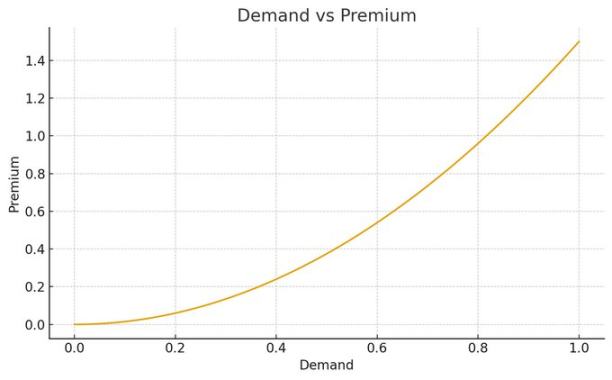

Fees should dynamically match demand, which is the common logic of modern service industries:

Hotel prices rise during holidays

Electricity prices increase during heatwaves

Delivery fees go up during heavy rain

Shipping costs rise during trade peaks

Short selling fees increase during vulnerability outbreaks

Gas fees spike during Bitcoin and Ethereum network congestion

Countless examples prove: dynamic balance is the only way to sustain.

So why should we pay 2% for unloved junk coins?

A simple formula to assess "demand": trading volume ÷ time × market value. This reflects the trading demand heat of an asset at a specific moment. Note: the core is trading demand, not the asset's value itself.

If there is trading demand → charge a basic premium

If demand is strong → increase the premium

For obscure potential coins → waive fees

This will create multiple effects:

Incentivize early value discoverers to enjoy low fees during the potential phase

Reward early discoverers, providing a first-mover advantage

Encourage project parties to implement roadmaps, exchanging results for market heat

Guide funds towards quality assets, making hollow speculation bear its own costs

Extend price cycles, reducing volatility through FOMO suppression, achieving healthy growth

For trading terminals and bots, the challenge is even more severe.

One can refer to @vnovakovski's model of transforming perpetual DEX through @Lighter_xyz: basic functions are free + advanced services are charged.

Want low latency? Purchase the premium version

Need API access? Purchase the premium version

Multi-wallet management?

Accumulate airdrop points?

There are many solutions; feel free to explore.

Dear terminal providers, face the reality: user loyalty to your platform is nearly zero. When most terminal revenues drop over 90% from their peak, when the next wave comes, it will either be you or your competitors providing fairer services with the same technology.

"I am a realist, not for honor, but for reward."

Final Chapter

The next industry dividend belongs to those who resist greed. Charging less and earning more is an inevitable law of the modern market. Platforms that align with users' essential demand for fairness will win the future.

Users must demand better, and this requires an upgrade in awareness. The responsibility does not lie with the current providers, but with the consumers who need to progress; the market will naturally adapt.

The solutions do not end here; this is just one path I firmly believe in.

Eternal thanks to Pumpfun, Trojan, and Banana Bot; they are the foundation of my growth. But times change, and so do responsibilities.

My core assertion is: recognize and promote the inevitable transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。