Author: Frank, PANews

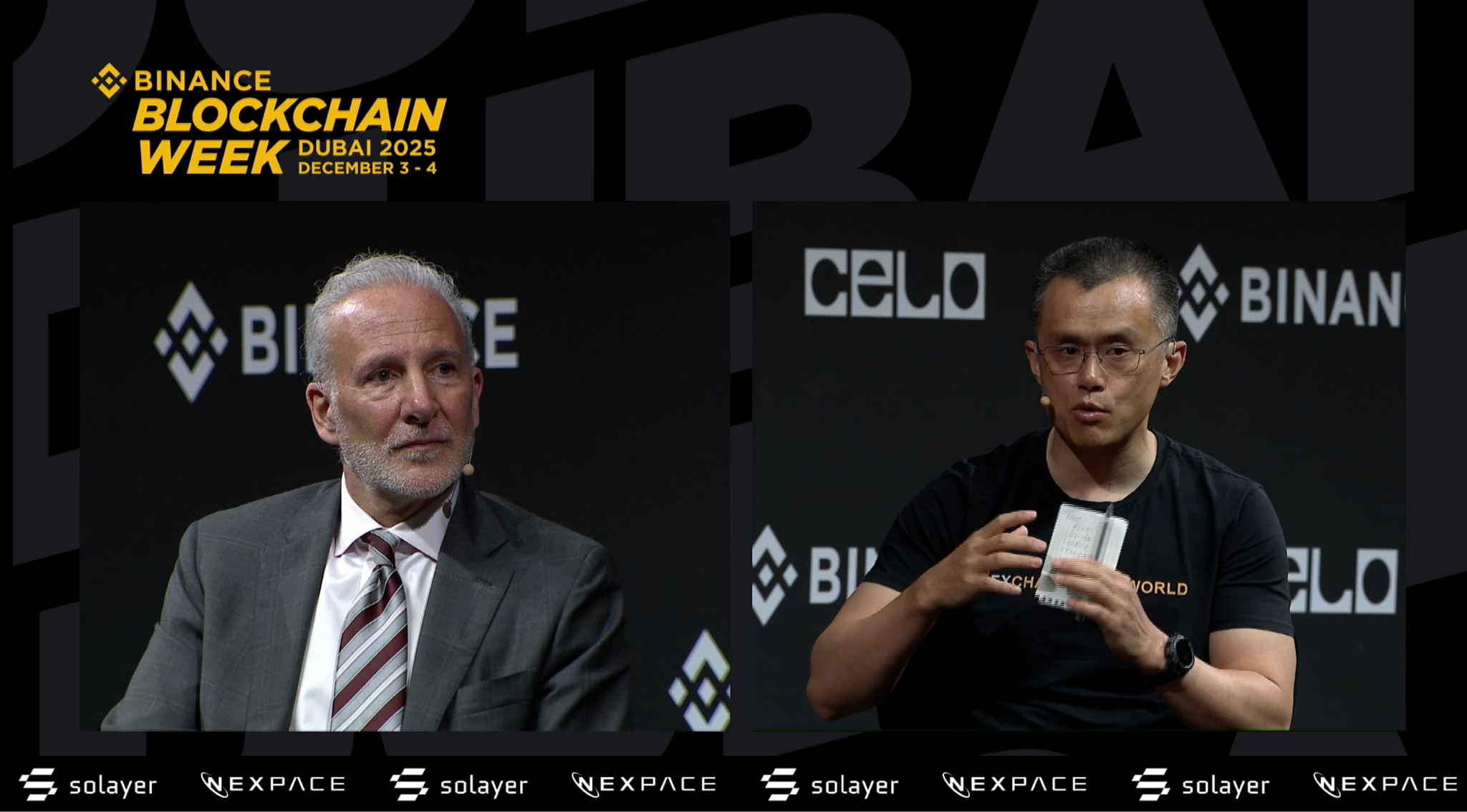

In the closing segment of Binance Blockchain Week, Binance founder Changpeng Zhao (CZ) engaged in a face-to-face deep debate with the renowned "Bitcoin skeptic" and gold advocate Peter Schiff. During this dialogue, the two engaged in a heated discussion on multiple dimensions regarding gold and Bitcoin, including value storage, trading attributes, and forms of currency.

Surprisingly, this long-time critic of cryptocurrencies, Peter Schiff, took the stage with his own "tokenization project."

Opponents of Bitcoin Enter the "Tokenization" Arena

The debate opened dramatically. Despite being in what CZ referred to as his "home turf," with a full audience of cryptocurrency supporters, Peter Schiff did not show any signs of stage fright. More interestingly, the debate did not start with fierce accusations but rather with an unexpected "consensus": the tokenization of gold.

At the beginning of the debate, CZ pointed out that although Peter Schiff has opposed cryptocurrencies for many years, he seems to be working on a gold tokenization project now. Peter Schiff readily confirmed this fact and enthusiastically introduced his new project: a product that tokenizes gold through notes.

At the end of Peter Schiff's project introduction, CZ posed a more formal question: "So, what I hear you saying is that tokenizing gold is almost better than gold itself in some ways because it is divisible, transferable, and transportable, serving as a medium of exchange." This question directly challenged Peter Schiff's past criticisms of cryptocurrencies, marking the official start of the debate.

In response to CZ's challenge, Peter Schiff demonstrated a high level of debate skill, acknowledging that "in terms of the use of currency, that is indeed the case." He argued that this practice of gold tokenization has existed since ancient times, but now it can be represented digitally to signify "ownership of gold." This opening set a subtle tone for the entire debate: both sides recognized the utility of technology, but there were fundamental disagreements on the "source of value."

Peter Schiff then shifted his argument, stating that both fiat currency and Bitcoin are, like "air," "backed by nothing." He claimed that the legality of tokenized gold comes from the physical metal backing it, while Bitcoin's value purely stems from "belief."

CZ countered that the internet, Google, and Twitter are all virtual and have no physical entities, yet they hold immense value. Although Bitcoin does not physically exist (it is merely a record on a ledger), its value comes from utility, scarcity, and global consensus.

CZ then pointed out the Achilles' heel of gold—its lack of portability. He presented a one-kilogram gold bar (worth about $130,000) gifted by a prominent figure from Kyrgyzstan.

When CZ handed the gold bar to Schiff for verification, Schiff displayed a "cautious" demeanor typical of a gold advocate: "The color looks a bit off… If I don't know the name of the mint, I can't confirm this is real gold; I need to take it for testing." Schiff even joked about whether this gold bar could be given to him as a gift.

This moment became the climax of the event, vividly exposing the pain points of physical assets.

CZ seized this opportunity for a sharp rebuttal: "If I give you a Bitcoin right now, we can immediately verify on-chain that you received it. But this gold bar, even an expert like you cannot instantly identify its authenticity on-site, and I cannot easily take it across borders."

Value Discussion: What is True Money?

The mid-point of the debate entered the core theoretical clash: what constitutes true money?

CZ pointed out that while gold has scarcity, we currently do not know its true stock, and in the future, there may be a peculiar "alchemy" that makes gold unlimited. In contrast, Bitcoin has a fixed supply of 21 million, which is a known operating principle. From this perspective, Bitcoin's property as "money" is undoubtedly scarce.

However, Peter Schiff argued that while Bitcoin does have scarcity, the number of newly issued tokens in the world is limitless. He noted that Bitcoin's current use primarily comes from speculation, with few people using Bitcoin as money.

The two then shifted the topic to another aspect of these two assets as "money": payment. Regarding the significance of payment, CZ attempted to demonstrate that cryptocurrencies are used for payments by showcasing the Binance Card. Schiff countered that this merely converts Bitcoin into fiat currency to pay merchants, meaning users are "liquidating assets" rather than directly using Bitcoin as currency.

CZ pointed out that for user experience, this is indeed payment and solves the issue of merchant acceptance. He shared a story about a user in Africa: before cryptocurrencies, paying bills required a three-day walk; now it only takes three minutes. This illustrates the real utility of Bitcoin as a technology.

Bitcoin's Investment Returns Inferior to Gold?

When the topic shifted to investment returns, the exchanges between the two became charged with tension.

Peter Schiff presented a sharp statistic: priced in gold, Bitcoin's current price has dropped 40% compared to four years ago. He argued that despite numerous favorable developments over the past four years, such as ETFs, Super Bowl ads, and El Salvador's adoption of Bitcoin as legal tender, Bitcoin has failed to break its previous high, indicating a bubble burst. He defined Bitcoin as "pure speculation," claiming buyers are merely gambling. Even when CZ pointed out that looking at a longer time frame, Bitcoin's return from 5 cents to $100,000 far exceeds that of gold, Peter Schiff seemed to intentionally overlook this.

CZ then asked Peter Schiff whether he preferred Bitcoin or gold, to which Schiff made a controversial statement: "It's a good thing for young people to lose money in Bitcoin because it's a valuable lesson. Losing money when you're young is better than losing it when you're old; it will teach them how to invest prudently in the future."

CZ humorously retorted, "I know many early Bitcoin buyers who have made hundreds of millions or even billions. They can be my neighbors because they sold some Bitcoin to afford houses there."

CZ then downplayed short-term volatility, emphasizing that looking at the longer term, Bitcoin's rise from worthlessness to tens of thousands of dollars is already a significant success. He countered Schiff's characterization of the entire ecosystem as "speculators" by pointing out that there are also many builders and real users.

Schiff even predicted that as gold breaks a 12-year stagnation and begins to rise, future investors will sell Bitcoin to return to gold, leading to a collapse in Bitcoin prices. CZ, however, held a reserved stance, believing that was part of the "seeking common ground while reserving differences."

Despite their divergent views, the debate remained focused on the discussion of value. Although Schiff was relentless in his criticism, labeling Bitcoin holders as "people in a casino," he also acknowledged his previous misjudgment regarding Bitcoin's price predictions (not expecting it to rise so much).

As the host, CZ displayed great inclusivity, not only offering to arrange a debate between Schiff and Michael Saylor (founder of MicroStrategy) but also generously wishing Schiff success with his gold tokenization project:

CZ: "Welcome to the blockchain and digital world. I certainly have a completely different view; I believe gold will perform well, but Bitcoin will perform even better."

This debate did not have a clear winner; it resembled a microcosm of an era: traditional physical assets are striving to adapt to the digital wave, while emerging digital assets are working hard to prove their monetary attributes amid skepticism.

As Schiff stated on stage: "The room may be small, but there are many more people upstairs." Whether gold or Bitcoin, they are both vying for a broader financial future "upstairs."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。