Overall, this round of rebound has significantly improved market sentiment, reshaped key support on a technical level, and released potential participation willingness on a funding level, but there is still a phase distance from a trend-driven bull market.

Summary

Recently, the cryptocurrency market has experienced a significant rebound, with Bitcoin breaking through $94,000 and re-establishing itself in a key range. Sentiment and liquidity have shown signs of phase recovery, but this rebound is primarily driven by improved macro liquidity expectations, capital inflow after panic liquidation, and technical rebounds, which is not sufficient to prove the systematic initiation of a bull market. The mid-term trend depends on the implementation of macro policies, capital flows, and the evolution of market structure, which may continue to break new highs, maintain high-level fluctuations, or correct under policy and liquidity pressures. The institutionalization process, while enhancing long-term potential, also makes Bitcoin more sensitive to systemic risks, exacerbating pro-cyclical volatility. The performance of the altcoin market is limited and remains in a high-risk structure. In the context where the trend has not yet been confirmed, the market is in a "repair - test - wait" phase, where optimism and caution must coexist. If trading volume and the policy environment continue to improve, a new growth cycle is possible; if expectations fall short, the rebound may reverse. Overall, flexible participation and risk management remain the core strategies to navigate uncertainty.

I. Macroeconomic Overview of the Cryptocurrency Market

In the past few weeks, the cryptocurrency market has welcomed significant recovery in sentiment and price after experiencing a strong correction. As the benchmark asset, BTC once fell to $80,000, during which the market exhibited widespread panic, with high-leverage positions being passively liquidated and short-term risk appetite rapidly declining. However, under the combined effects of changes in macro expectations and structural market responses, BTC has recently rebounded quickly and returned above $94,000, with 24-hour gains reported by multiple institutional platforms reaching 7%–8%. This price behavior reflects both the easing of the previous downtrend and indicates that the market is attempting to transition from extreme pessimism to structural repair. This round of rebound is not driven by a single reason but is the result of the interplay of macro liquidity, changes in market structure, technical conditions, and capital behavior.

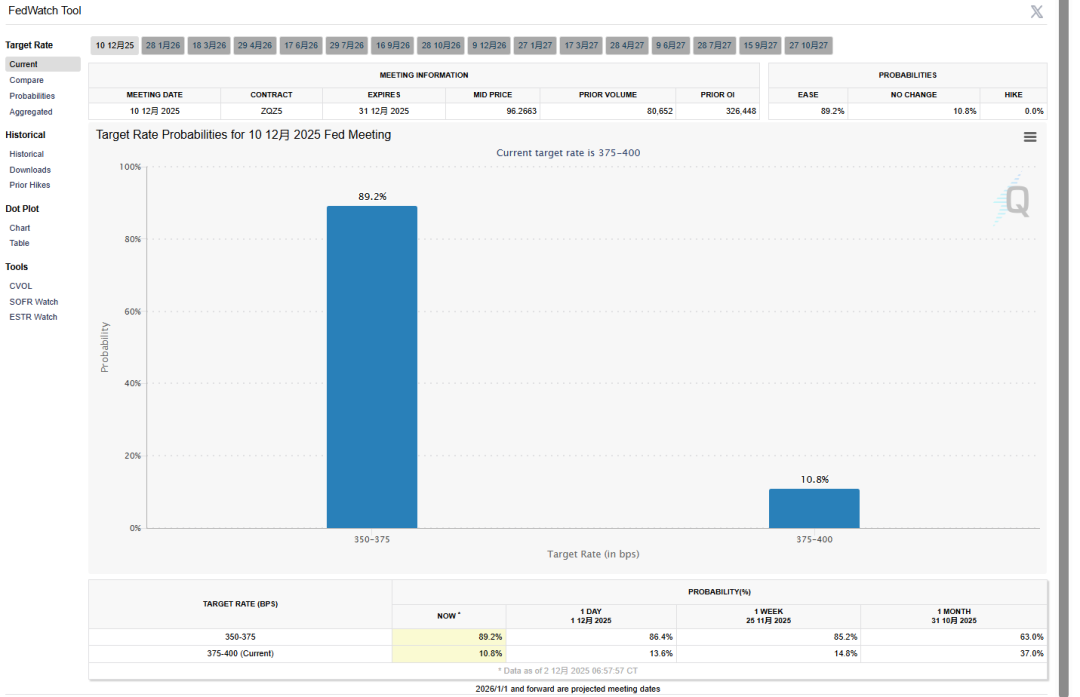

First, from a macro perspective, changes in global monetary policy expectations have become an important variable affecting risk assets. The market's anticipation of future interest rate cuts by major central banks and the enhanced expectations of marginal liquidity improvement have led to renewed attention on high-risk assets. Due to the PPI data in November being far below expectations, inflationary pressures continue to ease, and Federal Reserve officials have repeatedly emphasized that the core goal remains a "soft landing" until 2026, avoiding a premature shift to tightening. According to the latest data from the CME FedWatch tool, the market's betting probability for a 25 basis point rate cut by the Federal Reserve on December 10 has surged from 35% a week ago to 89.2%. On the other hand, on December 1, U.S. time, the Federal Reserve officially announced the end of its quantitative tightening (QT) policy. On the same day, the cryptocurrency market experienced a collective rebound. Historical experience shows that both U.S. stocks and BTC tend to perform better during easing cycles or periods of easing expectations, and the current market reflects this turning sentiment. Although macro policies have not yet clearly reversed, the expectations themselves are sufficient to drive asset prices. Additionally, under the pressure of high-interest rate policies on the real economy, the market tends to price in policy shifts in advance, providing more imaginative space for risk assets.

Secondly, from the perspective of market structure and funding, the formation of this round of rebound exhibits typical characteristics of "panic liquidation + institutional bottom-fishing." During the previous downtrend, exchange data showed that a large number of high-leverage long positions and some short positions were forced to liquidate, leading to a concentrated release of liquidity. Historically, such phases are often accompanied by exaggerated directional movements and extreme emotions, followed by a reverse change in capital flow behavior. Some long-term capital has positioned itself after significant sell-offs, forming support in the bottom region. Furthermore, when short positions become concentrated, the rebound process is likely to trigger "short squeezes," further driving up prices and accelerating the rebound, thus forming a typical rebound pattern of "structural short squeeze + capital reversal." Technical analysis also provides an explanation for the rebound. BTC has repeatedly tested and held support in the $86,000 to $88,000 range, indicating that this price level has become a phase bottom and a concentrated area of chips. The rapid rebound in short-term prices is also related to previous overselling. If technical support is formed and combined with capital inflow, it usually leads to momentum improvement and a shift in trading behavior. Recent market performance shows a synchronization of increased trading volume and price breakthroughs at key levels, indicating that some buying pressure is proactive rather than merely supported by short covering. However, since the overall market trading volume has not yet fully displayed characteristics confirming a long-term trend, this round of rebound remains in an observation window, and whether it can form a higher structure needs further verification.

In addition to BTC's recovery status, the market is more concerned about whether the rebound will drive the linkage and rotation of ETH and the altcoin market. The Fusaka upgrade activated on December 4 is another important upgrade for Ethereum after the merge. Its core PeerDAS technology increases the Blob capacity from 9 to 15, allowing Layer 2 transaction fees to potentially decrease by another 30%-50% on the current basis, and for the first time enables ordinary accounts to have "account abstraction (AA)" capabilities such as social recovery and batch operations. This upgrade not only optimizes data availability management but, more importantly, paves the way for Verkle Trees' stateless clients, compressing node synchronization time from weeks to hours. Historical experience shows that every round of rebound in the cryptocurrency market has a pattern of capital migration from mainstream assets to secondary assets to high-risk assets. The stabilization and rebound of the ETH/BTC exchange rate ratio suggest that capital may rotate from Bitcoin to altcoins. However, this migration requires certain conditions to be met. First, risk appetite must continue to improve, not just be limited to temporary emotional recovery; second, the market must have sufficient liquidity, rather than relying on short-term trading drives; third, the trend of mainstream assets needs to be stable, rather than in a high-volatility, directionless state. Currently, BTC's rebound is not only restoring market sentiment but also prompting some capital to focus on ETH and certain large altcoins. ETH has risen in tandem during this rebound and has returned to a key range, which has a positive impact on market confidence.

It is worth noting that the trend of institutionalization is changing the market structure. Over the past year, institutional capital has gradually viewed BTC as an independent asset class in its allocation strategy, rather than purely a speculative item. This has led funds to prefer to concentrate on investing in assets with clear attributes and stable value propositions, rather than chasing high-risk tokens. This factor means that altcoins may significantly underperform BTC or ETH even during market recovery phases. Meanwhile, changes in the stablecoin market size, distribution of derivatives liquidity, and changes in exchange funding rates will become important indicators for judging capital direction, and these indicators cannot clearly point to a strong cycle initiation in the short term. On the risk side, the uncertain factors affecting market trends remain significant. First, the global interest rate cycle has not yet clearly reversed; if monetary policy expectations fall short, risk assets may come under pressure. Second, if a technical rebound lacks trading volume support, it is likely to form a "fragile rise" and quickly decline in the face of macro news shocks. Additionally, the altcoin market still faces systemic risks, especially in the absence of risk appetite and capital support, making it more prone to amplified volatility. More importantly, the cryptocurrency market has experienced a rapid phase of "valuation repair + new price highs" over the past year, and in this context, investors are often more sensitive to new risk-return ratios, making it difficult for the market to form a consistent trend consensus.

In summary, the current cryptocurrency market is at a critical stage of structural repair and trend judgment. BTC's rebound reflects the market's transition from panic to repair, but it does not yet prove the comprehensive recovery of the bull market cycle. If prices break through key resistance and gain volume support, the market may enter a new round of trend development and have the opportunity to form a longer-term price range reshaping; if the rebound strength is insufficient or macro pressures increase again, it may return to the bottom range for retesting. The performance of the ETH and altcoin markets is highly dependent on BTC's stability and the continuity of capital flows, rather than being driven independently. In the near future, the market will continue to revolve around structural adjustments, changes in macro expectations, and fluctuations in risk appetite, and the trend direction will only gradually clarify after key range breakthroughs and capital confirmations.

II. Analysis of Structural Opportunities and Risks in the Macroeconomic Environment

When assessing whether the current rebound in crypto assets has sustainability, relying solely on price behavior, technical signals, or short-term emotional recovery is insufficient to build a long-term logic. The future direction of the market largely depends on the institutional environment, capital structure, macro policy direction, and the evolution of the capital cycle itself, which may constitute structural opportunities or harbor potential risks. In recent years, as the relationship between the cryptocurrency market and traditional financial markets has deepened, its price behavior has increasingly been driven by macro liquidity and policy expectations. This means that Bitcoin's valuation logic is no longer an isolated "crypto-native logic," but is gradually linked to interest rate cycles, inflation trends, asset allocation preferences, and even institutional risk budgets.

Recent research shows that the correlation between Bitcoin and traditional financial market indices is strengthening, indicating that crypto assets are gradually transitioning from "marginal speculative assets" to "mainstream financial assets," with institutions playing a key role in this process. When Bitcoin exhibits a high correlation with the S&P 500 or Nasdaq, it signifies a change in the market's risk pricing logic: it is no longer an independent category decoupled from the macro cycle but has become a component of the risk asset basket. This change reduces Bitcoin's diversification effect as an "alternative asset," but enhances its attractiveness as a "configurable asset." Especially when institutional investors, ETFs, pension funds, or large asset managers begin to intervene, the capital pool capacity for crypto assets may experience structural expansion, making the market no longer solely reliant on retail sentiment fluctuations. Behind the changes in capital structure, behaviors such as ETF capital inflows, improvements in custody infrastructure, and the establishment of compliance and reporting systems may redefine valuation ranges and risk premium structures. This not only means that crypto assets have gained broader funding sources but may also push their volatility and risk-return structures closer to traditional assets. Particularly in the context of improving macro liquidity and increasing expectations of interest rate declines, institutional capital may incorporate crypto assets as "part of the risk asset exposure" into strategic allocation frameworks, rather than viewing them as short-term trading targets. In this scenario, market uptrends can have a deeper capital foundation, rather than relying solely on exchange rollovers and retail chasing. If this mechanism holds, it will have far-reaching implications for future cycles. However, institutionalization and financialization do not mean the end of market risks; rather, they may bring new structural risks. If Bitcoin's risk attributes are closer to high-beta assets, then when the market experiences liquidity tightening and declining risk appetite, the crypto market will be more susceptible to macro systemic shocks. In traditional financial markets, such assets typically perform weakly during down cycles, and if crypto assets synchronize with them, it means an expansion of risk exposure rather than a convergence. This "institutionalization brings pro-cyclical risks" structure is an important issue that future market operations need to pay attention to.

III. Future Outlook for the Macroeconomic Cryptocurrency Market

After experiencing a significant rebound over the past few weeks, the cryptocurrency market has entered a strategic observation window filled with uncertainty. Bitcoin has re-established itself around the $90,000 mark and has tested higher levels, with market sentiment shifting from extreme pessimism to cautious optimism. However, whether the rebound can continue, whether a trend can form, and whether the market has sustainable upward momentum still depends on multiple driving factors such as capital structure, macro variables, policy changes, and market participant behavior. Considering the current environment, historical patterns, and market structure characteristics, various evolutionary paths for the cryptocurrency market may emerge in the next three to six months, each relying on specific triggering conditions and behavioral feedback mechanisms.

One possible path is for the current rebound to continue and further amplify, guiding prices to test the $95,000 to $100,000 range. This scenario often occurs when market sentiment continues to recover, trading volume increases, and both institutional and retail capital flow in simultaneously, creating a consensus directional expectation in the market. If macro liquidity improves, monetary policy shifts to easing, and risk appetite rises, and if Bitcoin can break through key resistance levels, a secondary acceleration trend structure may form. In this state, prices would not only rely on technical momentum but also be influenced by capital-driven and structural valuation repair factors. Another possible path is for Bitcoin to oscillate and consolidate in the $92,000 to $95,000 range, struggling to form a sustained upward trend. This situation typically arises when market confidence is restored but capital inflows are unstable, macro policy expectations are ambiguous, and bulls are unable to break through key resistance. In this state, price fluctuations are driven by short-term trading, and market participant behavior exhibits hesitation and game-like characteristics. If capital lacks sustained reinforcement, with institutions on the sidelines, retail cautious, and derivatives market leverage neutral or low, prices are more likely to maintain range-bound oscillation rather than trend breakthroughs. The third path is for the market to pull back again, with prices retesting support levels or even experiencing deeper adjustments, potentially targeting the $85,000 to $88,000 range. This situation is often triggered by macro risks, changes in the policy environment, or reversals in market expectations. For example, a resurgence of inflation leading to rising interest rate expectations, a hawkish shift in central bank policy tone, geopolitical risks triggering safe-haven demand, tightening market liquidity, increasing regulatory risks, or capital outflows from institutional channels like ETFs could all reshape risk appetite.

For altcoins or high-risk asset classes, although the rebound may bring short-term opportunities, the risk levels are significantly higher than those of Bitcoin and Ethereum. Due to their fragile valuation systems, insufficient liquidity, strong speculative nature, and clear narrative-driven dynamics, altcoins often experience larger declines and slower recoveries when the market undergoes structural adjustments. Therefore, only investors with a high risk tolerance, deep understanding of the projects, and short-term trading strategies may operate in this area, while ordinary investors should remain cautious during periods of unclear trends.

Overall, while the short-term rebound in the cryptocurrency market possesses strength, the trend has not yet been confirmed. Whether prices can break through resistance, consolidate, or pull back again will depend on macroeconomic data, policy signals, institutional capital flows, and market behavior feedback in the coming weeks. The rebound phase is prone to generating optimistic sentiment and high return expectations, but the market remains embedded with liquidity risks, regulatory risks, and structural vulnerabilities, where any sudden events could alter the trend direction. Before the trend is confirmed, optimism should be built on caution, and the approach to participating in the market should focus on flexibility and risk management rather than premature predictions of a new cycle.

IV. Conclusion

Overall, this round of rebound has significantly improved market sentiment, reshaped key support on a technical level, and released potential participation willingness on a funding level, but there is still a phase distance from a trend-driven bull market. The market is currently in a transitional phase of "repair - test - wait," and whether the upward momentum can transform into a trend breakthrough will depend on the direction of macro policies, the sustainability of capital inflows, and the re-pricing process of risk by market participants in the coming weeks. For investors with risk tolerance, phased positioning and flexible allocation may have certain strategic value at this stage, but it must be predicated on strict position control and risk management. From a long-term perspective, if the rhythm of capital inflows continues to strengthen, the macro environment gradually improves, and Bitcoin achieves a breakthrough of key resistance, then a new round of structural uptrend becomes realistically possible; conversely, the market may still face oscillations and pullbacks. Cautious participation and rational judgment will be the main methodologies to navigate uncertainty.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。