On November 27, $COC mining begins. The opportunity to mine the head coin will not wait for anyone.

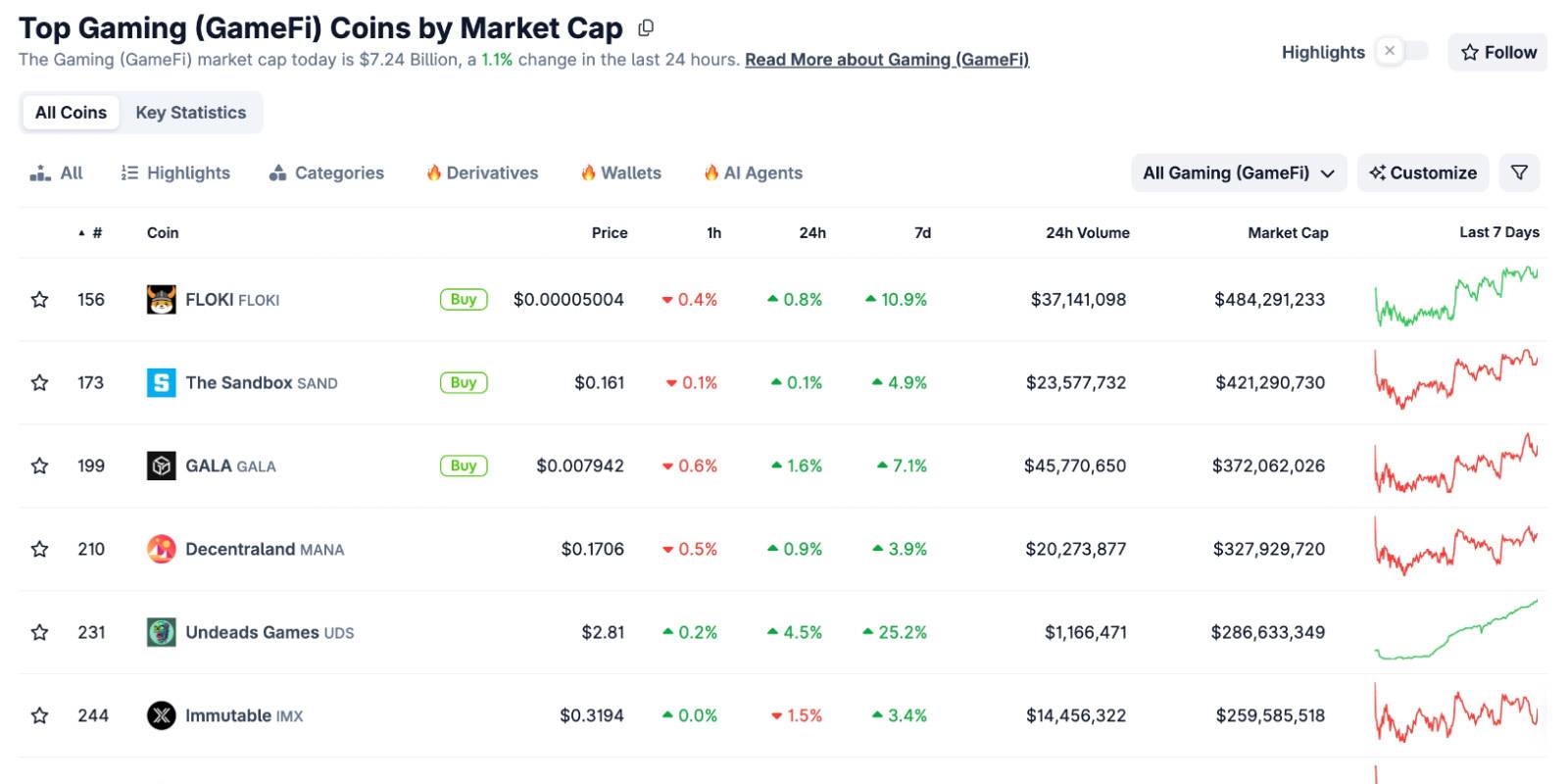

On November 28, 2025, according to Coingecko data, the GameFi token with the highest market capitalization, $FLOKI, ranks 155th.

The once-glorious GameFi track has now completely fallen out of the top 100 by market cap. This is a story of collective failure in a sector.

However, this sector was once so close to changing the world.

Looking back to 2021, Axie Infinity's daily active users once exceeded 2.8 million, with SLP token trading volume surpassing $360 million in a single day. The story of Filipino players supporting their families through gaming was widely circulated in the community. At that time, everyone believed that "play-to-earn" would change the gaming industry. GameFi was seen as the most attractive application scenario for blockchain technology, with countless capital pouring in and numerous projects imitating it.

However, less than a year later, the bubble burst. Axie's token AXS plummeted by over 90% from its peak, SLP nearly went to zero, and the once-thriving player community collapsed in an instant.

In the three years that followed, this story repeated itself. StepN and various X-to-Earn projects came and went, but all inevitably reached the same conclusion.

In 2024, the Telegram gaming ecosystem brought new hope. Hundreds of millions of users flocked in, with NOTCOIN, DOGS, and Hamster Kombat creating unprecedented user scales. But after the excitement, the problems remained—players came for airdrops and left immediately after the TGE.

Why did previous Play to Earn models fail? Where is the breaking point?

On November 24, a game called COC (Call of Odin's Chosen) provided its answer—a globally pioneering VWA (Virtual World Asset) mechanism that verifies all key economic data within the game on-chain.

This may be the true key to breaking through Play to Earn 3.0.

I. Play to Earn 1.0: The Collapse of Trust in a Black Box

The failures of Axie Infinity and StepN are essentially the same issue: players cannot verify the promises of the project team and can only trust unconditionally—when trust collapses, the economic model collapses as well.

Axie's economic system fundamentally relied on a continuous influx of new players. Old players made money by breeding Axies, while new players needed to purchase Axies to enter. When the influx of new users slowed, the entire system immediately fell into a death spiral. The cost of entering by purchasing three Axies once reached thousands of dollars, which kept the vast majority of potential players out. Ultimately, participants became pure speculators rather than true gamers. The SLP token was primarily produced through battles, but the consumption scenario was limited to breeding. When the number of players peaked, the output of tokens far exceeded consumption due to a lack of consumption scenarios, leading to uncontrollable inflation.

But behind all these surface issues lies a more fundamental problem: all drops and rewards were calculated by the project team's servers, and players could not verify fairness, only trusting the official team unconditionally. This laid the groundwork for a subsequent crisis of trust.

Active participants in Axie Infinity

StepN is also part of Play to Earn 1.0, although it attempted to correct Axie's issues by expanding "play-to-earn" to running scenarios, lowering the entry barrier, and trying to make "earning money" easier. But ultimately, it was still the same formula—new players paid for old players, just packaged as a "healthy lifestyle." The GST token still experienced wild fluctuations, and players were not drawn in by "fun" but by the potential to "make money." When earnings dropped, people dispersed. Moreover, the fundamental problem remained: the project team still controlled all key data, with operational data verification and reward calculations being centralized black boxes, leaving players as the disadvantaged party in an information asymmetry.

The fatal flaw of Play to Earn 1.0 was not a poorly designed economic model, but rather that in an opaque system, even the most perfect economic model is just a house of cards. Once trust collapses, token prices collapse as well.

II. Play for Airdrop: The False Prosperity of Traffic

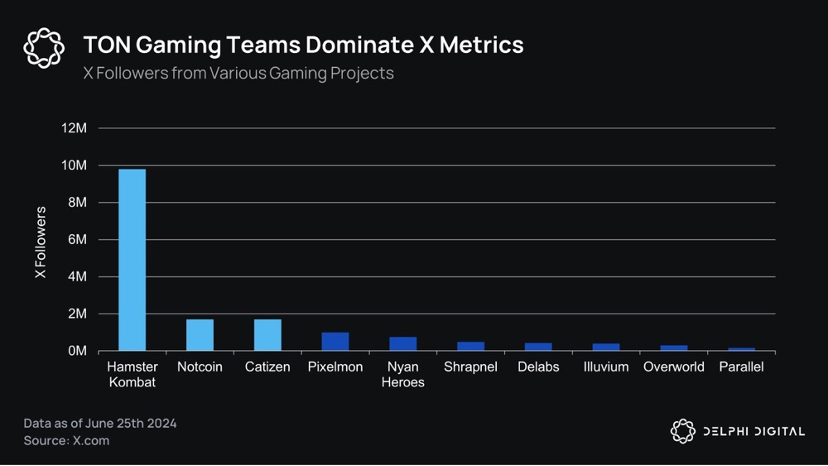

By 2024, the Telegram gaming ecosystem experienced explosive growth. From NOTCOIN to DOGS, and from Hamster Kombat to Catizen's 35 million users, the TON ecosystem proved that Telegram could become the most powerful traffic entry point for Web3. In just one year, hundreds of millions of users flooded into the on-chain world, achieving user scales that traditional game developers could hardly reach, all thanks to the magic of Telegram mini-programs.

This time, GameFi seemed to have found a new direction.

With low barriers to entry, no downloads, and social virality, Telegram mini-programs allowed hundreds of millions of Web2 users to first encounter the crypto world. Although clicker games are simple, they indeed attracted a massive user base. The airdrop mechanism also provided real rewards, and players did receive tokens.

In 2024, TON games experienced explosive growth. Leading projects attracted nearly 10 million fans on the X platform.

But after the excitement, a fatal problem emerged.

Players came for airdrops and left immediately after the TGE. The controversial airdrop of Hamster Kombat and the rapid price drop of DOGS pointed to the same dilemma: the airdrop is the endpoint, and players cannot be retained.

This is not a collapse of the economic model like Axie, nor a Ponzi scheme like StepN. The mistake made by Telegram games is fundamentally different.

Clicker games themselves lack playability. The simple mechanism of Tap-to-Earn allowed for rapid user growth, but the only goal for players was to obtain airdrops, not to enjoy the game itself. No one would stay because it was "fun."

Players came for airdrops and left immediately after the TGE. The controversial airdrop of Hamster Kombat and the rapid price drop of DOGS pointed to the same dilemma: when the endpoint of the game is the airdrop, what happens after the airdrop?

This is not an issue with a specific project, but rather a bottleneck of the "Play for Airdrop" model itself. The project team captures short-term traffic but cannot retain users, while players immediately sell their tokens after receiving them, leading both sides to consume trust in a zero-sum game.

More critically, the data remains opaque. Although tokens are issued on-chain, the calculations of in-game outputs, probability mechanisms, and distribution rules are still controlled by centralized servers. When the controversy over Hamster Kombat's airdrop erupted, the project team could not provide any verifiable evidence and could only struggle to explain amid the public outcry. Players still could not verify whether they were treated fairly.

Play to Earn 1.0 died due to the collapse of the economic model, while Play for Airdrop died because it fundamentally could not retain users.

From Axie to Hamster Kombat, two generations of GameFi projects made different mistakes but ended up with the same conclusion.

III. VWA: The Key to Breaking Through Play to Earn 3.0

On November 24, a game called COC (Call of Odin's Chosen) officially launched on Telegram. This is a strategy development + real-time plundering game set against a Viking theme, incubated by the Catizen ecosystem.

More importantly, it attempts to systematically answer the three questions above. In the project team's white paper, COC defines itself as "Play to Earn 3.0"—not an empty slogan, but a fundamental solution to the trust issues in GameFi based on the globally pioneering VWA (Virtual World Asset) mechanism.

What is VWA? What is the true meaning of Play to Earn 3.0?

In simple terms, VWA is the on-chain verification of all key economic data within the game. This includes:

- Recharge/withdrawal records

- Sailing mining output

- Plundering mining output

- $COC consumption records

- Time blind box lottery results

Unlike traditional games where "the project team calls the shots," every output, every consumption, and every lottery in COC will generate verifiable records on-chain.

Players can verify for themselves: Is the reward I received from sailing mining consistent with the probability? Is the lottery result of the time blind box real? Are the tokens burned by the system truly destroyed?

The project team cannot commit wrongdoing: they cannot secretly modify drop probabilities, cannot arbitrarily issue token rewards to insiders, and cannot conceal real burning data.

This level of transparency is unprecedented in GameFi history. Axie's "trust us," StepN's "data is on our servers," and Telegram games' "trust our airdrop rules" have finally been replaced by "verifiable on-chain."

VWA is not just a technological innovation; it is a redistribution of power—from the project team to the players.

This is the definition of Play to Earn 3.0: when players can verify everything, trust is no longer the Achilles' heel of GameFi, but a fact written on the blockchain.

IV. A Verifiable Economic Model Based on VWA

Based on the transparent mechanism of VWA, COC has constructed a truly verifiable economic model: 84% of tokens return to players, with a Bitcoin-style halving controlling output, and consumption and value cycles driving deflation. The goal is to create a player-driven, verifiable, and sustainable game economy.

Specifically, this economic model includes the following core mechanisms:

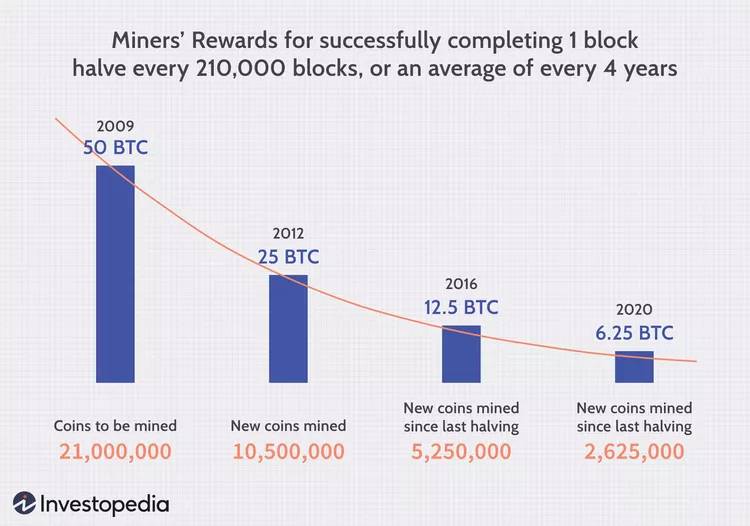

Bitcoin-style halving, reshaping the "head coin mining" narrative

Unlike the vast majority of projects, COC's token distribution mechanism directly draws from Bitcoin.

COC has set a fixed total supply of 21 billion tokens, with no further issuance. The output rhythm mimics Bitcoin: 88.2 billion tokens (42% of the total) will be released in the first month, followed by halving every 30 days. In the entire distribution, 84% will be owned by players through in-game mining, with the initial share for the team being 0.

This design directly addresses the biggest pain point of past GameFi—unrestrained inflation. When token output decreases monthly, "the earlier you participate, the higher the returns" becomes a rigid fact rather than a marketing slogan.

The 42% distribution ratio in the first month means that early players will receive nearly half of the token output over the entire lifecycle. This is not a "pie in the sky," but a guaranteed return written into the smart contract.

More critically, the 84% allocation to players truly returns power to the community. Compared to traditional GameFi projects that often allocate 30-40% to teams and institutions, COC positions the project team not as the "house," but as an auxiliary role standing on the same side as the players.

Dual-track Mining: Balancing Gameplay and Earnings

COC's token output is divided into two modes: sailing mining (75.6%) and plundering mining (8.4%).

Sailing Mining: Players send ships to "explore the seas," with settlements every 10 minutes. This is similar to Bitcoin mining— the more ships you invest (the higher the computing power), the greater the probability of receiving rewards. The system employs a "weighted lottery" mechanism to ensure fair distribution of tokens.

The design here is quite clever: 90% of the output in the game goes to sailing, while 10% enters the "plunder pool." This means that even casual players who only send ships out to sea without participating in PvP can still earn stable returns.

Plundering Mining: Players consume "battle stones" to participate in PvE levels within the game, sharing a prize pool formed by 10% of the total output from all players' sailing activities. This part emphasizes gameplay—you need to actually play the game and complete challenges, rather than just clicking on the screen.

This design breaks the past binary opposition of "purely idle" or "purely grind." Casual players can enjoy sailing, while hardcore players can earn excess rewards through plundering. Gameplay and token output are deeply intertwined for the first time.

More importantly, COC's gameplay draws on the mature game design experience of Web2. Strategy development, resource allocation, and real-time plundering—these addictive mechanisms validated in WeChat mini-games have been fully transplanted into the Web3 environment.

Players are not clicking to "mine," but naturally earning tokens while enjoying the game. This is how Play to Earn should be.

Consumption-Burning-Return Flywheel: A Sustainable Economic Cycle

The death spiral of past GameFi projects stemmed from an imbalanced token economy—output far exceeded consumption, leading to uncontrollable inflation. COC has constructed a complete token circulation system.

Players consume $COC to purchase items, accelerate processes, and draw cards, with the system automatically dividing consumption into four parts:

- 36% permanently destroyed, entering a black hole address

- 36% returned to players (through time blind box lotteries)

- 18% allocated to team operations

- 10% used for promotional commissions

The core of this design is that every dollar of $COC spent by players is put to good use.

36% is permanently destroyed. The simplest and most direct deflationary mechanism— as the game operates, the circulating supply continuously decreases, increasing the token's scarcity over time.

36% enters the blind box rebate pool. Spending equals a lottery draw, with every expenditure being a chance to win, creating positive incentives. This part allows tokens to circulate within the player community rather than flowing out unidirectionally.

18% goes to team operations. This is the most noteworthy design in COC's economic model—the team will use this income for ongoing content development and version iterations. While most GameFi projects fall into a "no new content—player loss—token decline" death loop after the TGE, COC chooses to secure development resources with real funds, allowing players' spending to directly translate into improved game quality.

10% is used for promotional commissions. This expands the player base through KOL collaborations and community incentives.

At the same time, withdrawal fees also adopt a time-decreasing mechanism: 50% for immediate withdrawals, decreasing by 3% daily, dropping to 5% after 15 days. This design effectively filters out short-term arbitrage funds, keeping tokens in the hands of long-term players.

From an economic model perspective, COC aims to build a positive cycle of "gameplay-driven consumption—consumption supporting development—development enhancing gameplay."

The fundamental difference between COC and all past GameFi projects is that—everything can be verified.

Is the halving mechanism executed on time? It can be checked on-chain. Are 84% of the tokens really distributed to players? It can be checked on-chain. Is the weight calculation for sailing mining fair? It can be checked on-chain. Are the distribution rules for the plundering prize pool transparent? It can be checked on-chain. Are 36% of the tokens really destroyed? The balance of the black hole address is clear. Are the lottery results of the time blind boxes real? Every record is traceable.

When Axie says, "Trust our economic model," and when StepN says, "We burned X tokens," players can only choose to believe.

When COC makes the same statements, players can verify for themselves.

This is the change brought by VWA—not better promises, but verifiable facts. This is the core evolution of Play to Earn from 1.0 to 3.0.

V. From 0 to 1 Million: Verified Growth Potential

Before the game officially launched, COC's pre-registration users had already surpassed 1 million. What does this number indicate? It shows that there is still a huge demand in the market for "real games."

COC is not a clicker, nor is it a simple "Tap-to-Earn." On the surface, it appears to be an idle game, but the internal strategic depth far exceeds expectations. Players need to allocate resources wisely, choose upgrade paths, and decide when to set sail and when to plunder. The game's art style is exquisite, with a visually immersive Viking theme, and the gameplay itself is engaging—this is how a game should be.

It is worth mentioning that COC has allocated 18% of team revenue to token distribution, ensuring continuous updates for future versions. Many GameFi projects fail midway because the team runs out of funds to continue development. COC's design is long-term oriented—retaining players through ongoing content updates rather than relying on a one-time influx.

There are no complex narrative packages, no flashy metaverse concepts, only a simple pursuit of gameplay. Allowing players to feel growth in every choice and experience excitement in every competition is the essence of a game.

This dedication to gameplay may be what past GameFi projects have lacked the most.

COC defines itself as Play to Earn 3.0, which is not a marketing concept, but a systematic response to three core questions:

How can we make the value of "playing games" greater than "making money"?

By drawing on mature game design from Web2 to create genuinely playable strategy development and plundering gameplay. Let players stay because it is "fun," not just because they can "make money."

How can we maintain the economic system without relying on new players?

By employing a Bitcoin-style halving and consumption-burning mechanism to build a sustainable deflationary model. The spending of old players provides value support for new output, rather than relying on new players to take over.

How can we make players truly trust the project team?

By using VWA on-chain verification to make all key data public and transparent. The project team is no longer "trust me," but "verify for yourself."

These three answers point to a single conclusion: the core of Play to Earn 3.0 is not "making money," but "sustainability."

Sustainable gameplay—game mechanics are deep enough to encourage long-term player investment.

Sustainable economic model—deflationary mechanisms ensure token value increases over time.

Most importantly—VWA's transparent mechanism allows players to verify everything, truly returning to the essence of Web3's "decentralization of trust."

From Axie's "play-to-earn," to StepN's "X-to-Earn," and then to Telegram games' "Play for Airdrop," we finally see a model that does not rely on new players taking over, does not depend on continuous funding from the project team, and does not rely on narrative bubbles.

This may be the future of GameFi.

Bitcoin's supply halved every four years

Conclusion: The Next Story of Play-to-Earn

The GameFi ecosystem has reached a point where it has proven that Web3 can achieve the user scale of Web2. NOTCOIN, DOGS, Catizen—each project has contributed to this ecosystem.

But the next question is: can we truly retain these users?

The Play for Airdrop model has brought traffic, but that traffic will eventually dissipate. Only true value creation can turn users into residents and the ecosystem into a home.

COC aims to be the next chapter in this story—not attracting players with "airdrops," but retaining them with "games"; not hyping tokens with "narratives," but winning trust through "transparency."

On November 27, $COC mining begins.

The first month's 42% output window lasts only 30 days.

The opportunity to mine the head coin will not wait for anyone.

About COC (Call of Odin's Chosen):

COC is a Viking-themed strategy development + plundering game based on the TON ecosystem, incubated by the Catizen ecosystem. The game employs a Bitcoin-style halving mechanism, with 84% of tokens distributed to players through mining. The globally pioneering VWA (Virtual World Asset) mechanism enables on-chain verification of the entire process of recharge/withdrawal/output/consumption/lottery.

With nearly 2 million pre-registered users, the game officially launched on November 24, and mining will begin on November 27.

The first month's output is 88.2 billion $COC (42% of the total), with halving occurring every month thereafter.

For more information, please refer to the project white paper

Call of Odin’s Chosen Telegram channel: https://t.me/COCWeb3News

Call of Odin’s Chosen Telegram game bot: https://t.me/COCWeb3bot

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。