Publicly disclosed financial data shows that since 2022, HashKey has been in a high-investment phase. As a result, there are inevitable doubts in the market about whether it can sustain itself. If we only look at this company from the perspective of CEX or traditional enterprises, the conclusion seems pessimistic. However, to understand why HashKey is investing heavily, why it can go public, and even why it must go public now, we need to change our frame of reference—view it within the development path of financial infrastructure.

1. Financial Deconstruction: Clearing the Fog to See the Essence of the Business

Most of the market's concerns about HashKey stem from a misinterpretation of its financial report structure rather than the quality of its business itself. By breaking down the numbers, we can see a reality that is completely different from the surface impression: HashKey's core business is rapidly expanding and possesses the high profit potential typical of platform-type companies.

First is the growth rate. The prospectus shows that HashKey's revenue grew from HKD 129 million in 2022 to HKD 720 million in 2024, more than a fivefold increase over two years, with a significant acceleration in 2024. Such growth rates are very rare in the current Hong Kong IPO market.

Next is the gross profit margin. HashKey's business gross profit margin has long been at a very high level, reaching 94% in 2023 and 73.9% in 2024. High gross margins mean that marginal costs are extremely low; once it crosses the breakeven point, profits will be rapidly released as scale expands, which is a typical characteristic of platform-type infrastructure businesses.

More critically, we need to look at the sources of negative expenses. The high proportion of negative expense items in HashKey's reports is mostly unrelated to business operations. For example, in 2024, the negative expenses mainly came from two types of non-operating expenditures: one is share-based compensation expenses amounting to HKD 566 million, which essentially belongs to equity incentives and does not result in cash outflow; the other is fair value changes of digital assets, which are paper losses due to asset price fluctuations and do not reflect the actual operating conditions. If we exclude these two items, HashKey's operating cash flow is actually quite healthy.

2. High Investment is the Norm for Infrastructure Companies

First, it is important to clarify that the early high investment in regulatory license-type businesses is an industry consensus, not a sign of poor management.

The construction cycle of financial infrastructure is inherently long and requires heavy investment. Banks, brokerages, exchanges, and custodians have almost universally been high-investment in their early stages—typical examples include Coinbase, which invested far more than its revenue for several consecutive years before going public, the New York Stock Exchange (NYSE), which suffered long-term losses during its initial digital transformation, and PayPal, which burned through hundreds of millions of dollars in its early days. The pattern for such businesses is: infrastructure comes first, profitability relies on scale thresholds; it is impossible to make money before expanding.

HashKey is essentially not a centralized exchange in the traditional sense; its positioning is closer to that of a digital asset infrastructure service provider aimed at institutions. It requires extremely high levels of security, risk control systems, compliance systems, and custodial capabilities, with a large amount of fixed costs needing to be invested upfront. For institutional investors, a high investment but with complete compliance licenses and a large market expectation is more valuable than profitability with a lack of regulatory moats. This also means that high investment is a normal phenomenon during the construction phase.

Many critics of HashKey understand it through the lens of traditional businesses: they believe it should first stabilize its fundamentals and strengthen its internal capabilities before going public. However, the operational logic of Web3 infrastructure is completely different. Its path has always been to scale up first and then discuss profitability; to establish regulatory licenses and compliance systems before expanding the business; to build infrastructure through financing before pursuing growth. For an infrastructure-type company like this, positioning, obtaining licenses, and building ecosystems are always the top priorities, while profitability is a natural result that emerges only after these conditions mature. Evaluating HashKey from the perspective of traditional business will inevitably lead to incorrect conclusions; when placed back in the context of infrastructure, its strategic path is precisely reasonable and in line with industry norms.

3. Going Public is HashKey's Inevitable Path

For a capital-intensive business like HashKey, relying on private equity funding can no longer support its pace of expansion. Over the past two years, the global Web3 primary market has significantly contracted, and Hong Kong has been particularly affected. In such a macro environment, a model that emphasizes compliance and infrastructure requires continuous investment, while venture capital will not provide sufficient funding and valuation space for such long-term projects. This is not because HashKey's business is poor, but because its capital structure dictates that it must rely on more mature and larger-scale financing channels to survive into the future.

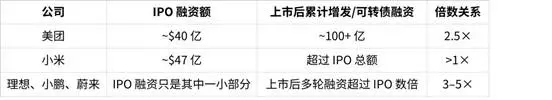

Similar companies have encountered the same issues in their early growth stages. Meituan, NIO, Xiaopeng, Tesla, and Coinbase all experienced extreme funding pressures before going public. The reason they appeared to be under pressure was not that their models were flawed, but because infrastructure-type businesses require substantial upfront investment from the start, with very long return cycles. For such companies, not relying on public financing is simply unrealistic; whether they can go public smoothly almost determines whether they can survive until they reach scale.

Therefore, the significance of going public is not just about obtaining a sum of money, but about allowing the company to enter a sustainable financing system, enabling it to continuously obtain long-term funding support through secondary offerings, stock placements, bond issuances, and convertible bonds. At the same time, the identity of a public company will enhance its ability to collaborate with institutions, increase the trust of regulators and the financial system in it, and make it easier to become part of the industry infrastructure. Historical experience also proves that the vast majority of companies do not rely on IPOs for their financing sources; IPOs often only account for one-tenth to one-third of total financing, with the real funding coming from multiple rounds of refinancing after going public. Going public is not the end, but the starting point for financing capability.

For HashKey, the current timing is particularly critical. Hong Kong is focusing on creating the world's most friendly digital asset market, and the entire policy environment is in a rare open window period. Such a window will not last forever, and market sentiment, regulatory attitudes, and international competitive landscapes can change at any time. Going public now is the stage at which it is most easily accepted by the market and can gain regulatory support. Missing this round may mean that future conditions for going public may not be better than they are now.

4. Going Public Now Best Reflects HashKey's Future Value

If HashKey waits until its business is fully mature before considering going public, it will be placed within the valuation framework of traditional financial institutions, with profit multiples as the main pricing basis. This approach is not friendly to capital-intensive, long-cycle infrastructure-type companies, as their early revenue structure and profit performance cannot truly reflect long-term value.

However, going public now means facing a completely different valuation system. The market will understand it from the perspective of new economy growth stocks, focusing more on the potential monopoly position that Web3 infrastructure may form in the future, viewing the scarce compliance licenses as important premium factors, and incorporating Hong Kong's policy support and industry development trends into the valuation logic. This future-oriented pricing method can often differ by several times from traditional financial valuations. For this reason, many large tech companies choose to go public early even before they are profitable, aiming to firmly anchor market expectations for their long-term development.

For HashKey, going public not only means obtaining capital support but also further establishing its industry positioning in the Asian digital asset space, increasing its valuation height, strengthening the regulatory advantages brought by its licenses, and gaining stronger qualifications for collaboration with international institutions. For an infrastructure-type company positioned as an entry point for Asian digital assets, the value of these strategic benefits far exceeds short-term profit performance.

5. The Hong Kong Stock Exchange Rules Allow and Encourage Such Companies to Go Public

There are frequent questions from the outside world about whether such companies are qualified to go public. In fact, the Hong Kong Stock Exchange's system itself allows unprofitable new economy companies to apply for main board listing if they meet market capitalization or revenue tests; this arrangement is precisely a channel reserved for innovative and growth-oriented enterprises.

From the perspective of industry attributes, HashKey belongs to the financial technology and blockchain infrastructure direction within the new economy sector, aligning with the track that the Hong Kong Stock Exchange has been increasingly inclined to support in recent years. It already holds formal licenses under the Hong Kong regulatory framework and has established a preliminary revenue base in compliance trading and institutional services, which gives its business model a certain degree of verifiability. At the same time, Hong Kong has been continuously strengthening its policy support for the compliant digital asset industry over the past two years, hoping to attract leading enterprises to develop locally.

Considering these factors, HashKey's listing is not an exception, nor is it a convenient channel opened by regulators for individual enterprises; rather, it happens to be at the intersection of a system that allows it, an upward industry trend, and the prominence of license scarcity. In other words, its ability to smoothly advance its listing is a natural result of the combined effects of policy direction, market positioning, and regulatory systems.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。