Author: J.A.E, PANews

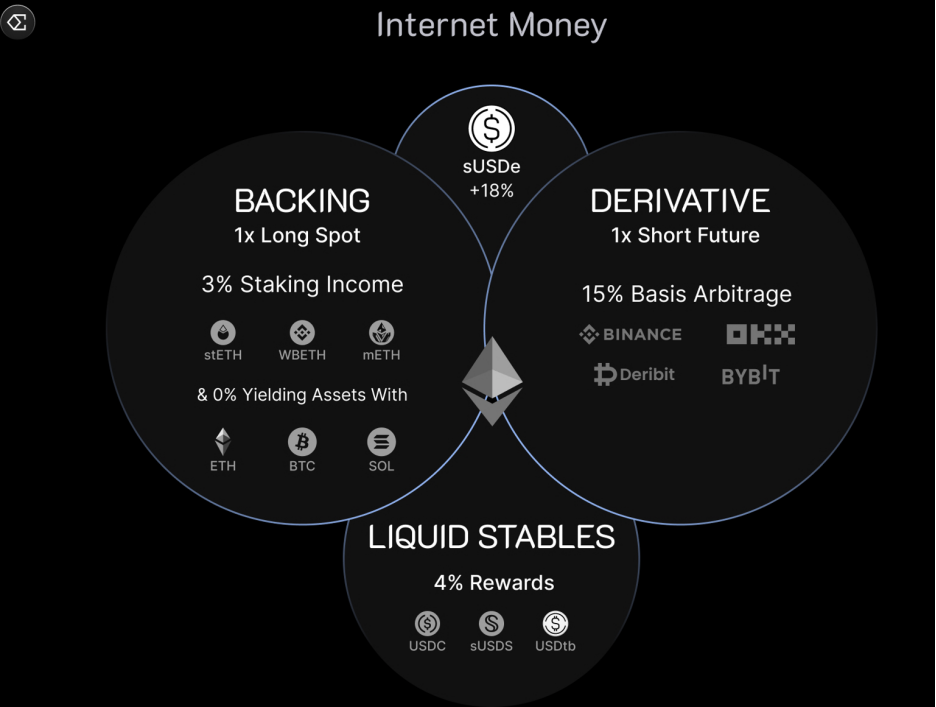

With its unique Delta-neutral hedging strategy, USDe has become a censorship-resistant, scalable synthetic dollar that captures perpetual contract funding rate yields, propelling its issuer Ethena to rapid prominence. The Total Value Locked (TVL) once approached the $15 billion mark, being regarded by the industry as a key force challenging the duopoly of traditional centralized stablecoins USDT and USDC.

However, as we enter October 2025, Ethena's situation has taken a sharp downturn, facing severe structural challenges. In just two months, the protocol experienced a halving of USDe's TVL and the unexpected termination of incubated ecological projects. These events prompted the market to reflect: Is Ethena's core mechanism vulnerable to external environmental influences? Is the high-growth model of the protocol in its early stages sustainable? Where is its second growth curve?

Leverage Arbitrage Retreat and Suspension of Ecological Projects Lead to Halving of USDe TVL

The significant challenges faced by Ethena recently are not coincidental; they expose the protocol's excessive reliance on external liquidity during its rapid expansion phase and a strategic misstep in positioning.

According to the latest data from DeFiLlama, as of December 2, 2025, USDe's TVL has dropped to approximately $7 billion, a decline of over 50% compared to the peak of over $14.8 billion in October.

The sharp decline in USDe's TVL is not due to a failure of the protocol's hedging mechanism, but primarily attributed to the "1011" USDe de-pegging incident on Binance, which triggered panic in the market and led to a systematic exit from high-leverage arbitrage strategies in DeFi. During Ethena's rapid growth phase, many users used USDe as collateral to borrow USDC on platforms like Aave, achieving leverage of over 10 times through circular borrowing operations to amplify potential returns.

The lifeline of this model lies in the window of interest rate spreads. As market lending rates fluctuate, USDe's APY (Annual Percentage Yield) dropped to around 5.1%, while the cost of borrowing USDC on Aave remained at 5.4%. Once USDe's yield fell below borrowing costs, arbitrage trades relying on positive price spreads became unprofitable. The leveraged positions that previously boosted TVL began to unwind and redeem en masse, causing a massive outflow of liquidity and a significant contraction in TVL.

This phenomenon also reveals the reflexivity of USDe's yield model, where the protocol's yield and TVL growth form a self-reinforcing cycle, while also introducing structural fragility. When deposit rates are high, attractive yields draw in significant leveraged capital, pushing TVL upward. However, once deposit rates decline or borrowing costs rise, causing yields to fall below a critical point, a large number of leveraged positions will collectively exit the market, accelerating the protocol's contraction.

The growth of USDe depends not only on the Delta-neutral hedging mechanism but is also profoundly influenced by market panic. Although Ethena maintains a collateralization rate of over 100%, the spread of de-risking sentiment in the market, along with the crisis of USDe briefly de-pegging to $0.65 on Binance, further exacerbated the withdrawal of liquidity.

As TVL plummeted, Ethena's incubated DEX (Decentralized Exchange) Terminal Finance announced the termination of its launch plan, casting a shadow over the protocol's strategic direction. Previously, Terminal had attracted over $280 million in deposits during its pre-launch phase, garnering significant market attention.

The fundamental reason for Terminal's termination lies in the failure of the planned public chain Converge to launch as scheduled. In March of this year, Ethena Labs and Securitize announced a collaboration to build an institutional-grade public chain Converge compatible with Ethereum. Terminal was positioned as a liquidity hub on the Converge chain.

However, due to the failure of the Converge mainnet to launch as promised and the lack of a definitive launch plan recently, Terminal lost the infrastructure it relied on for survival. The Terminal team candidly stated on X that they explored various transformation options but believed these paths faced "limited ecological support, a lack of asset access potential, and bleak long-term development prospects," ultimately deciding to terminate the project.

The failure of Terminal marks a significant setback for Ethena's attempt to build its own public chain ecosystem. In the fiercely competitive public chain arena, the dispersion of resources and energy often comes at a high cost. This event suggests that Ethena must shift its focus towards a more efficient and scalable horizontal expansion model, specifically concentrating on becoming a stablecoin infrastructure provider for public chains.

Building a White Label Platform as a Second Growth Engine, Expanding USDe's Functional Utility

Despite experiencing growing pains in liquidity and ecological projects, Ethena is strategically redirecting its growth focus towards infrastructure services and product diversification, demonstrating strong resilience in its profitability.

Currently, the white label platform is Ethena's most important second growth point. This is a SaaS (Stablecoin as a Service) product that shifts the protocol's role from asset issuer to infrastructure provider. The white label platform allows high-performance public chains, consumer applications, and wallets to utilize Ethena's underlying infrastructure to efficiently issue their own customized dollar assets, with collaborations already established with DeFi, exchanges, and public chains.

For example, on October 2, Ethena announced a significant white label partnership with Sui and its Nasdaq-listed DAT company SUI Group Holdings (NASDAQ: SUIG), where the Sui ecosystem will launch two types of native dollar assets:

suiUSDe: a yield-bearing stablecoin based on Ethena's synthetic dollar model;

USDi: a stablecoin supported by BlackRock's BUIDL tokenized fund.

This collaboration with Sui marks the first adoption of the white label platform by a non-EVM public chain, indicating that Ethena's infrastructure possesses cross-chain scalability. Additionally, SUI Group will use the net income generated from suiUSDe and USDi to purchase more SUI tokens on the open market, directly linking stablecoin issuance to ecological growth.

On October 8, Ethena announced a partnership with Jupiter, a leading DEX aggregator in the Solana ecosystem, to launch JupUSD, capturing another key foothold in the non-EVM public chain ecosystem.

Jupiter plans to gradually replace $750 million USDC in its core liquidity pool with JupUSD. Initially, JupUSD will be backed by USDtb supported by the BlackRock BUIDL fund, and later will integrate USDe. This large-scale asset conversion will bring Ethena's assets into mainstream DeFi applications in the Solana ecosystem, such as Jupiter Perps and Jupiter Lend, further solidifying the application scenarios of the white label platform in non-EVM public chains.

The implementation of the white label strategy not only aims at expanding Ethena's market share but also alleviates the structural risks of the protocol. Through the white label platform, Ethena can assist various market participants in integrating and issuing RWA-backed stablecoins (such as USDtb/USDi). This also means that Ethena's revenue sources can diversify, reducing its heavy reliance on the highly volatile perpetual contract funding rates.

During periods of low or negative funding rates, the institutional-grade stable returns provided by RWA can balance the overall returns of the protocol, potentially alleviating the reflexivity exhibited in USDe's early growth model.

It is worth mentioning that Ethena is also deepening the utility of USDe as a functional asset in DeFi, thereby reducing its dependence on leveraged arbitrageurs. Ethena Labs has established a strategic partnership with Nunchi, the deployer of Hyperliquid HIP-3.

Nunchi is building yield perpetual contracts, financial products that allow users to trade or hedge various yields (such as RWA rates, dividends, or ETH staking returns).

In this collaboration, USDe is designated as the base collateral and settlement asset for the yield perpetual contracts. More importantly, when users use USDe as margin, they will benefit from the "Margin Yield" mechanism, allowing them to earn passive income from USDe to offset trading fees and funding costs. This will not only enhance market liquidity but also reduce users' actual trading costs.

This mechanism also helps USDe upgrade from a savings tool to a functional asset in the DeFi derivatives market. A portion of the revenue generated on Nunchi will also flow back to Ethena, creating a new revenue flywheel that further promotes the diversification of the protocol's revenue sources.

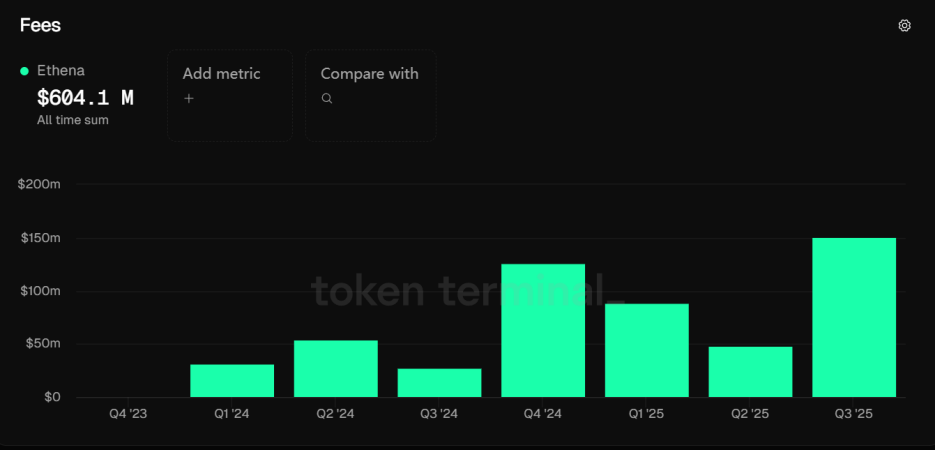

Captured Over $600 Million in Protocol Revenue, Recognized and Funded by Multicoin

In fact, before Ethena experienced turmoil, the underlying profitability of the protocol had already been validated, and the fundamentals remain robust. According to token terminal data, Ethena captured $151 million in fees in the third quarter of this year, setting a new historical high for the platform, with total cumulative revenue exceeding $600 million.

This revenue data also indicates Ethena's efficient profitability when market conditions are favorable. The revenue sources of the Ethena protocol mainly consist of three parts: 1) funding rates and basis yields earned from perpetual contract hedging positions; 2) ETH staking incentives; 3) fixed rewards for liquidity stablecoins.

This diversified revenue structure, along with the protocol's positions in BTC and ETH being hedged and a reserve fund of up to $62 million, collectively provide strong support for Ethena's fundamental robustness.

Moreover, during periods of market sentiment volatility, endorsements from leading institutions also inject confidence into Ethena's long-term prospects. On November 15, Multicoin Capital announced that it had invested in the protocol's governance token ENA through its liquidity fund.

Multicoin Capital's investment logic focuses on the enormous potential of the stablecoin sector, predicting that the stablecoin market will grow to trillions of dollars, and believes that "yield is the ultimate competitive advantage." They see Ethena's synthetic dollar model as effectively converting global market demand for leverage in crypto assets into substantial yields, a capability that distinguishes Ethena from traditional centralized stablecoins.

From a capital perspective, Multicoin Capital's investment focus is primarily on the protocol's platform potential as a yield-bearing stablecoin issuer. Ethena's scale, brand, and revenue-generating ability equip it with the capacity to expand new product lines, which will provide strategic and financial support for the protocol's later expansion into infrastructure business.

Despite facing a halving of TVL and the termination of ecological projects, Ethena has still achieved record revenues and received counter-cyclical investments from top-tier capital, and is attempting to absorb the impact of liquidity withdrawal through the "Stablecoin as a Service" white label strategy and further broaden the application scenarios of USDe, seeking new business increments.

For Ethena, the key to whether it can successfully transition from a high-yield savings vehicle for consumers to a stablecoin infrastructure provider for businesses will determine whether the protocol can reach new heights in the next cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。