Why does continuous selling occur in the face of bad news, yet there is no rebound during good news?

Author: Jeff Dorman, CFA

Translation: Deep Tide TechFlow

This might be the risk bottom

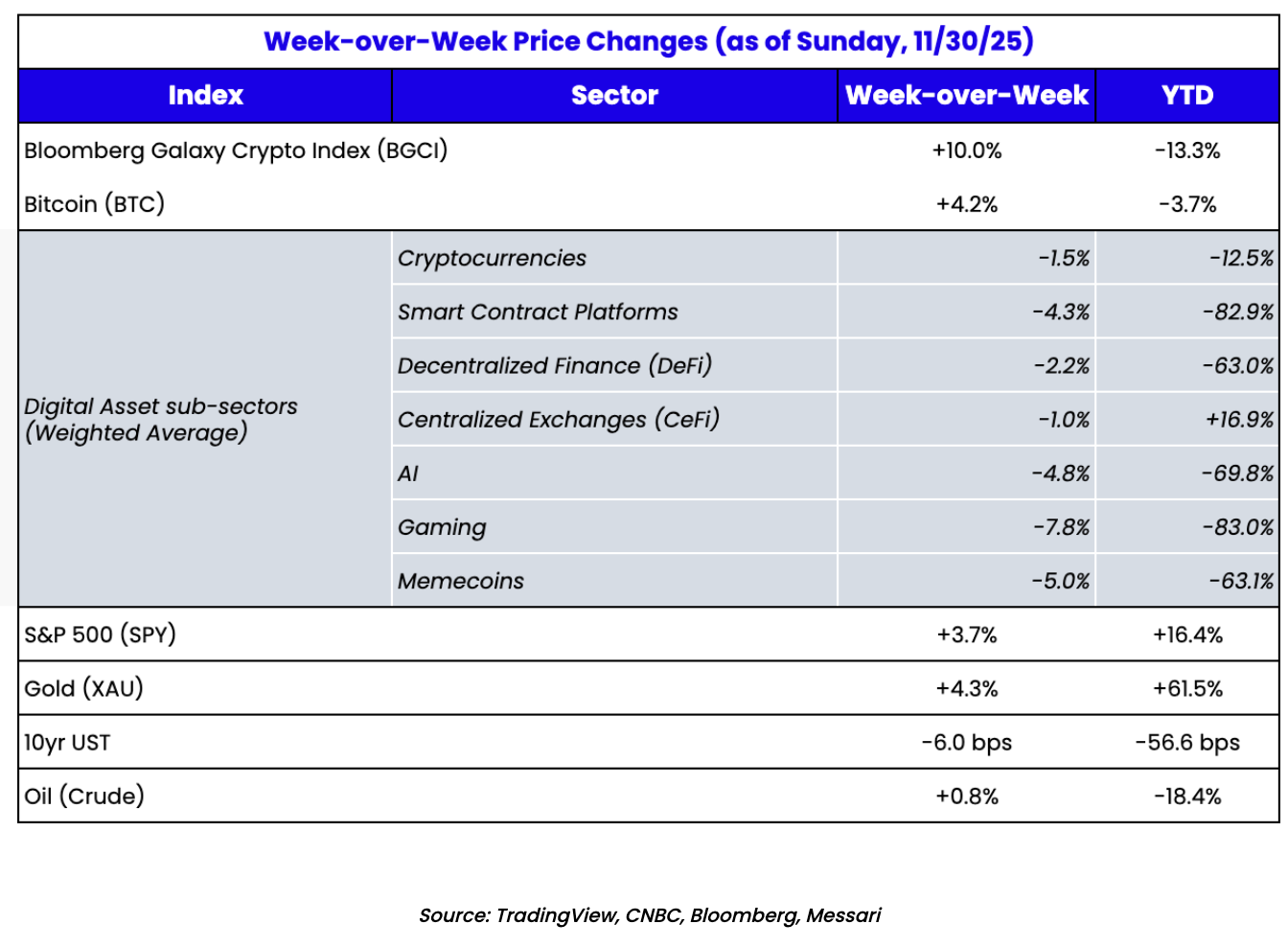

The digital asset market has been in a downtrend for 7 out of the past 8 weeks, with a brief rebound during Thanksgiving week, only to plummet again when the Japanese market opened on Sunday night (Nikkei index fell, and Japanese bond yields rose).

Although the initial drop in cryptocurrencies began on October 10, when exchanges like Binance faced issues—three weeks before the Federal Open Market Committee (FOMC) meeting—most of the weakness in November has been attributed to the hawkish comments from Federal Reserve Chairman Jerome Powell.

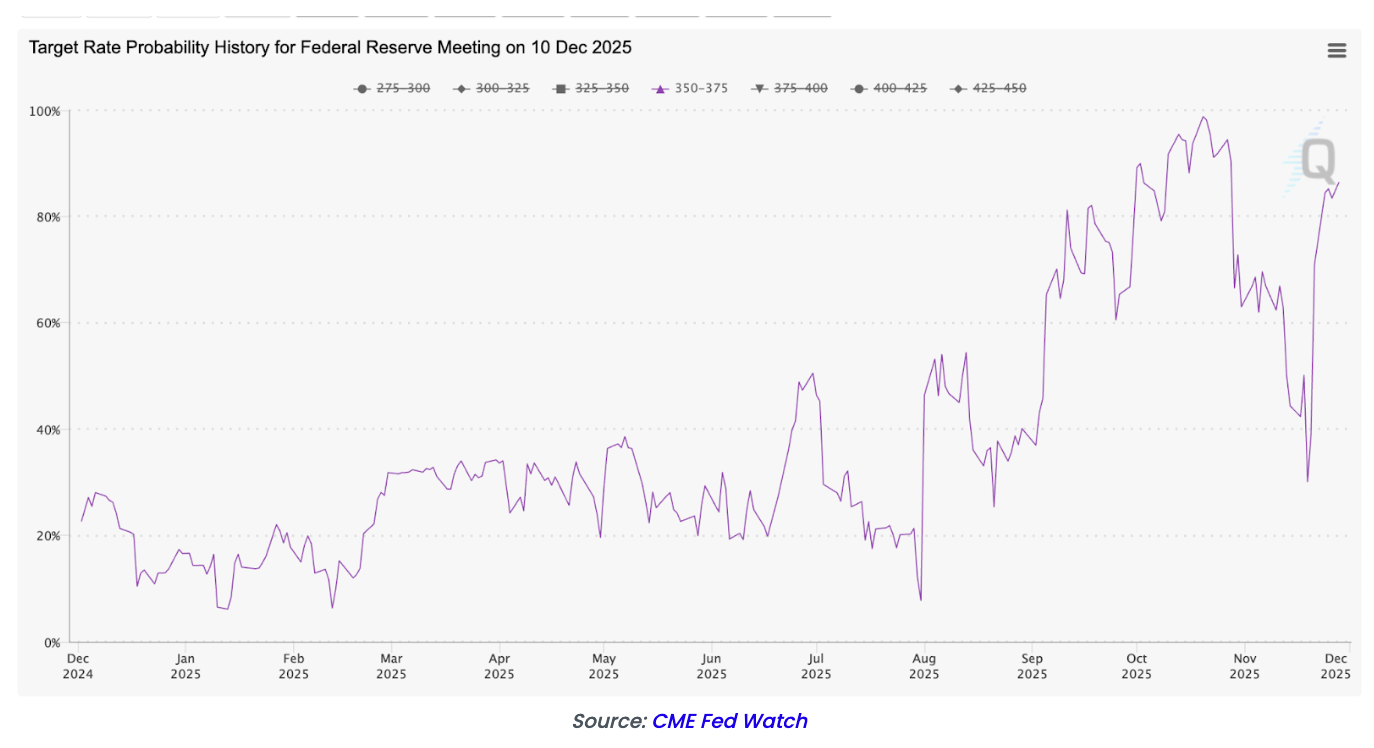

Expectations for a rate cut in December significantly declined throughout November, dropping from nearly 100% probability to a low of 30%. This led to a continuous decline in both the stock market and the cryptocurrency market throughout November.

However, something interesting happened in the last week of November. The core Producer Price Index (PPI) inflation fell to 2.6%, below the expected 2.7%. Additionally, while the labor market data we have post-government shutdown is limited, it indicates that the market is slowing down and may even be on the verge of collapse.

Expectations for a December rate cut quickly rebounded to nearly 90%, and the stock market made a strong recovery, allowing November to end positively. Furthermore, President Trump hinted that he knows who the next Federal Reserve Chairman will be, with the market almost entirely betting on Kevin Hassett.

Hassett is known for aligning with the Trump administration in supporting faster rate cuts and is a typical macroeconomic optimist.

Why does the digital asset market continue to sell off in the face of bad news, yet fails to rebound during good news?

I don't know either.

While we have experienced similar periods in the past, such as from May to June 2021 and April 2025, when all positive factors converged but prices remained unmoved.

However, this time feels different. There seems to be very low investor interest in most digital assets, yet no one we have interacted with can pinpoint the exact reason. This is quite different from previous situations.

In the past, whether before a market crash or in a lagging response, we could at least figure out the underlying reasons through discussions with other funds, exchanges, brokers, and industry leaders. However, so far, this sell-off seems to lack a clear logic.

Recently, Bill Ackman commented that his investments in Freddie Mac and Fannie Mae were impaired due to their correlation with cryptocurrency prices. Although this correlation does not make sense from a fundamental perspective, as these assets have completely different investment logics, it becomes reasonable when considering the increasing overlap between traditional finance (TradFi), retail investors, and crypto investors.

The once relatively isolated crypto industry is now intertwined with other sectors. In the long run, this is undoubtedly a good thing (after all, it is unreasonable for any part of the financial industry to be completely isolated), but in the short term, it poses significant problems, as crypto assets seem to be the first to be sold off in any diversified portfolio.

Moreover, this also explains why participants in the crypto industry cannot truly understand the source of the sell-off—likely because these sell-offs are not coming from within the industry. The crypto world is very transparent, sometimes overly so, while traditional finance remains a "black box."

And now, this "black box" is dominating the flow of funds and market activity.

Several Possible Explanations for the Weakness in the Crypto Market

Aside from the obvious reasons (lack of education and a plethora of low-quality assets), there must be better explanations for why the crypto market is in such a severe downward spiral.

We have always believed that for an asset to have value, it must possess some combination of financial value, utility value, and social value. The biggest problem facing most digital assets is that their value primarily derives from social value—which is the hardest to quantify of the three.

In fact, in an article we published earlier this year, we conducted a disaggregated valuation analysis of layer one blockchain tokens (like ETH and SOL) and found that their financial and utility value components were relatively small, while the social value component needed to be inferred.

Therefore, when market sentiment is at a low point, tokens that primarily rely on social value should see significant declines (and indeed most have, such as Bitcoin, L1 tokens, NFTs, and meme coins). Conversely, assets that rely more on financial value and utility value should perform better—although some have performed well (like BNB), most have not (like DeFi tokens and PUMP). This seems somewhat strange.

You might also expect "reinforcements" to appear to support prices, but this is also rare. In fact, quite the opposite is true; we see more investors flooding into a weak market, expecting it to weaken further, even if this expectation is based solely on market trends and technical analysis.

Our friends at Dragonfly (a well-known crypto venture capital firm) indeed defended the valuation of layer one tokens through a thoughtful article, which was at least indirectly influenced by our disaggregated valuation analysis of L1 tokens. Dragonfly essentially supports the last two paragraphs of our article, arguing that valuations based on current revenue and utility value are meaningless because all assets in the future will run on blockchain rails.

This does not mean that any individual L1 token is cheap, but overall, the total value of all blockchains is undervalued, and betting on the success of any single L1 token is essentially a probability issue.

In other words, rather than focusing on current usage, it is better to think about the future development of the industry from a broader perspective. And their viewpoint is correct. If prices continue to fall, I expect more similar "defense" articles to emerge.

Of course, a round of sell-offs in the crypto market is always accompanied by attacks on Microstrategy (MSTR) and Tether. Although we have repeatedly refuted all issues regarding MSTR (they will never be forced to become sellers), these attacks continue to emerge. The fear, uncertainty, and doubt (FUD) surrounding Tether are even more timely. In just a few weeks, we went from "Tether raises $20 billion at a $500 billion valuation" to "Tether is insolvent."

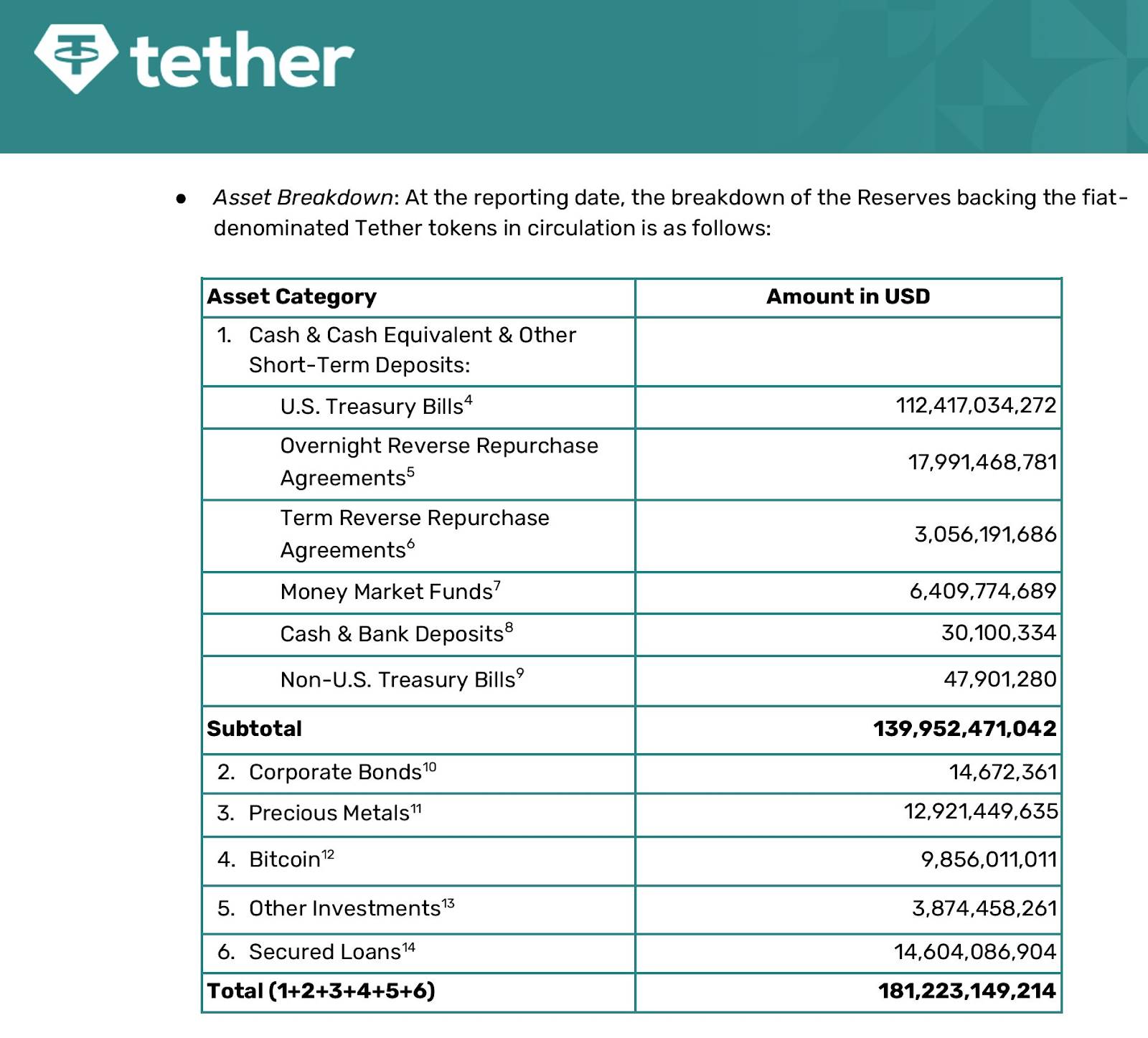

S&P recently downgraded Tether's rating to junk status, while Tether's latest audit report (as of September 30, 2025) shows that 70% of its US dollar stablecoin is backed by cash and cash equivalents, and 30% by gold, Bitcoin, corporate loans, and equity buffers.

I guess this scares people, even though it seems completely in line with the expectations of a private company with no regulatory restrictions on its asset portfolio. Of course, being almost fully collateralized with cash is certainly much better than the operation of the entire fractional reserve banking system. However, until the GENIUS ACT comes into effect, I won't attempt to compare USDT with banks.

What I want to say is that there is no scenario that would lead to more than 70% of USDT being redeemed overnight, which is the only situation where they could potentially face liquidity issues. Therefore, any questions regarding their liquidity seem absurd. But solvency issues are another matter.

If their 30% holdings (including Bitcoin, gold, and loans) incur losses, they would have to tap into other assets held by the parent company, which are not explicitly designated to support USDT. Given the profitability of the parent company, this is not a major issue, and I doubt any serious investor would see this as a problem.

Even so, Tether's CEO Paolo Ardoino still has to explain this. USDT has not experienced even a slight depegging because that is simply not an issue, but perhaps it has indeed triggered some market anxiety?

My only question is: since the market only wants you to hold cash and cash equivalents, and Tether can earn over $5 billion in profits just from government interest income (with an annual rate of 3-4% based on $180 billion in assets), why hold these other investments at all?

So, again, in hindsight, we can at least attempt to find some rational explanations for part of the market's decline. But this ongoing weakness still leaves us puzzled.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。