Author: Nancy, PANews

HashKey is accelerating its push for Hong Kong's "first crypto stock." On December 1, HashKey Holdings Limited (HashKey) passed the listing hearing on the main board of the Hong Kong Stock Exchange, with JPMorgan, Cathay Securities, and Guotai Junan International as its joint sponsors, taking a key step towards the capital market. The announced 663-page hearing document comprehensively discloses HashKey's business model, operational status, financial performance, and future strategic planning.

Passed the Hong Kong Stock Exchange hearing, expected to list as early as January next year

As early as a few months ago, news emerged that HashKey planned to IPO on the Hong Kong stock market. In October this year, as more cryptocurrency exchanges prepared for IPOs, Bloomberg cited informed sources reporting that HashKey had confidentially submitted an IPO application to the Hong Kong Stock Exchange, planning to raise up to $500 million (approximately 3.9 billion HKD) and aiming to complete the listing within this year.

Currently, HashKey has announced that it has passed the listing hearing on the main board of the Hong Kong Stock Exchange and is in the preparation stage for listing. According to the IPO process for Hong Kong stocks, the company first submits a listing application (filing), after which the Hong Kong Stock Exchange will inquire and review the information. The hearing is one of the key steps, indicating that the Hong Kong Stock Exchange has reviewed the materials submitted by the company and its compliance, granting "principle approval."

Generally, it takes about 3 weeks to 1 month from passing the hearing to formal listing to complete subsequent processes such as roadshows, pricing, and prospectus. If everything goes smoothly, HashKey is expected to officially list as early as January 2026.

According to the draft prospectus, this IPO will adopt a combination of international placement and public offering in Hong Kong, but the price range, number of shares issued, and the ratio of public to placement shares are still under discussion. The par value per share is $0.00001, and the final issuance price will be determined through negotiations between the overall coordinators (JPMorgan and Guotai Junan International) and the company, expected to be finalized by the end of 2025, and will not exceed the upper limit stated in the draft document.

However, previous reports indicated that the maximum target fundraising scale for this IPO is $500 million (approximately 3.9 billion HKD).

The document states that the raised funds are expected to be used for technology and infrastructure iteration, market expansion and ecosystem cooperation, operations and risk management, as well as working capital and general corporate purposes.

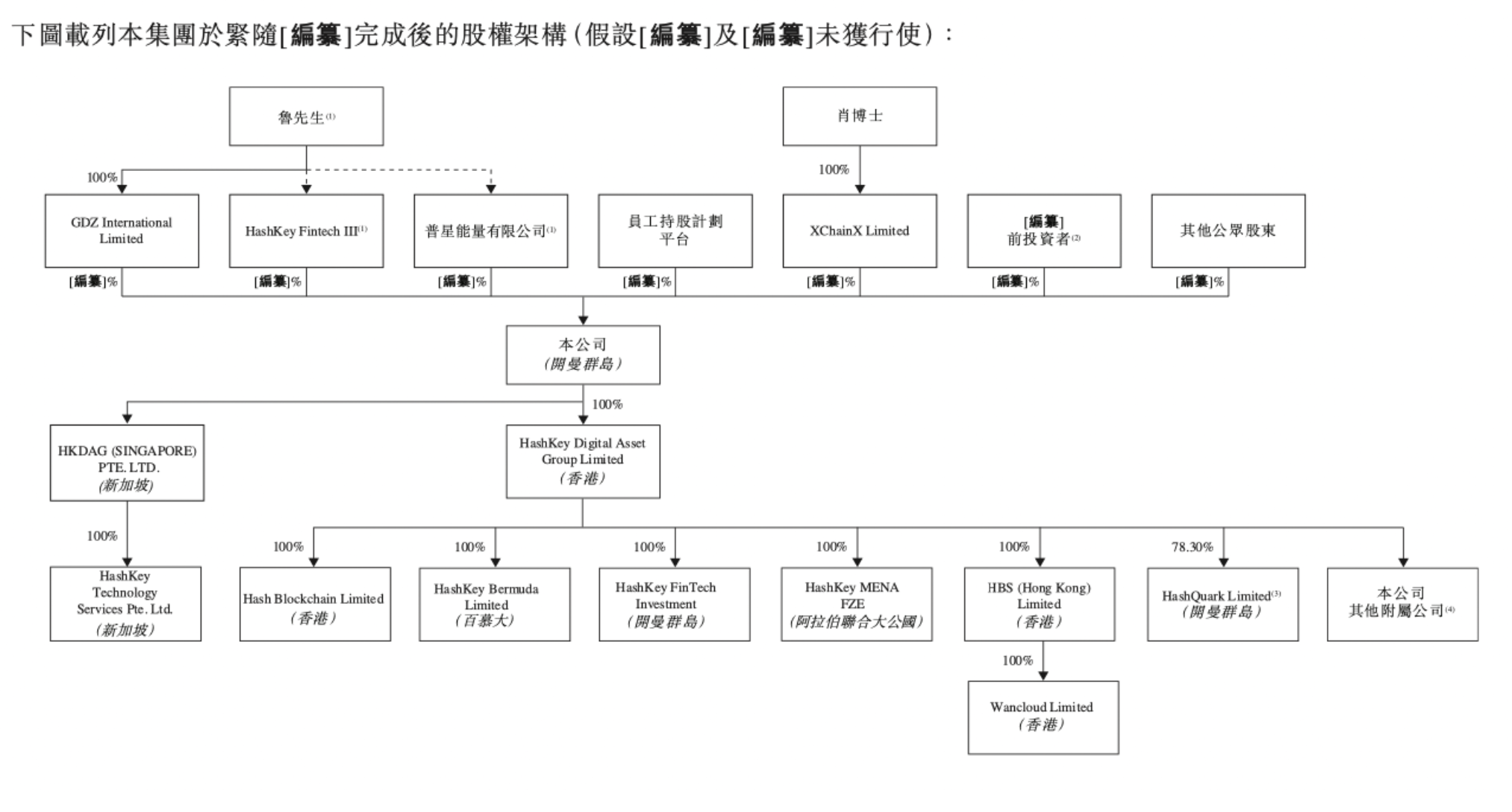

After the IPO is completed, HashKey's main shareholders include Lu Weiding, GDZ International (wholly owned by Lu Weiding), HashKey Fintech III, Puxing Energy, and XChainX, with other institutional shareholders including Hillhouse Capital, Fidelity, Meitu, Shengshi Wealth, Dinghui Investment, People's Capital, and OKG Venture, among others.

In February of this year, during HashKey's announced $30 million strategic financing, Gaorong Capital participated in the investment with a valuation exceeding $1.5 billion. By comparison, this is significantly lower than the valuations of other exchanges planning to go public, such as Kraken at $20 billion, Upbit at $10.3 billion, and Gemini at approximately $3.3 billion.

Institutional users dominate, trading business as the revenue pillar

HashKey is a mature comprehensive digital asset company with a total of 13 licenses and a registered comprehensive license portfolio globally, covering regions such as Hong Kong, Singapore, Japan, Bermuda, the UAE, and Ireland, providing a high compliance advantage.

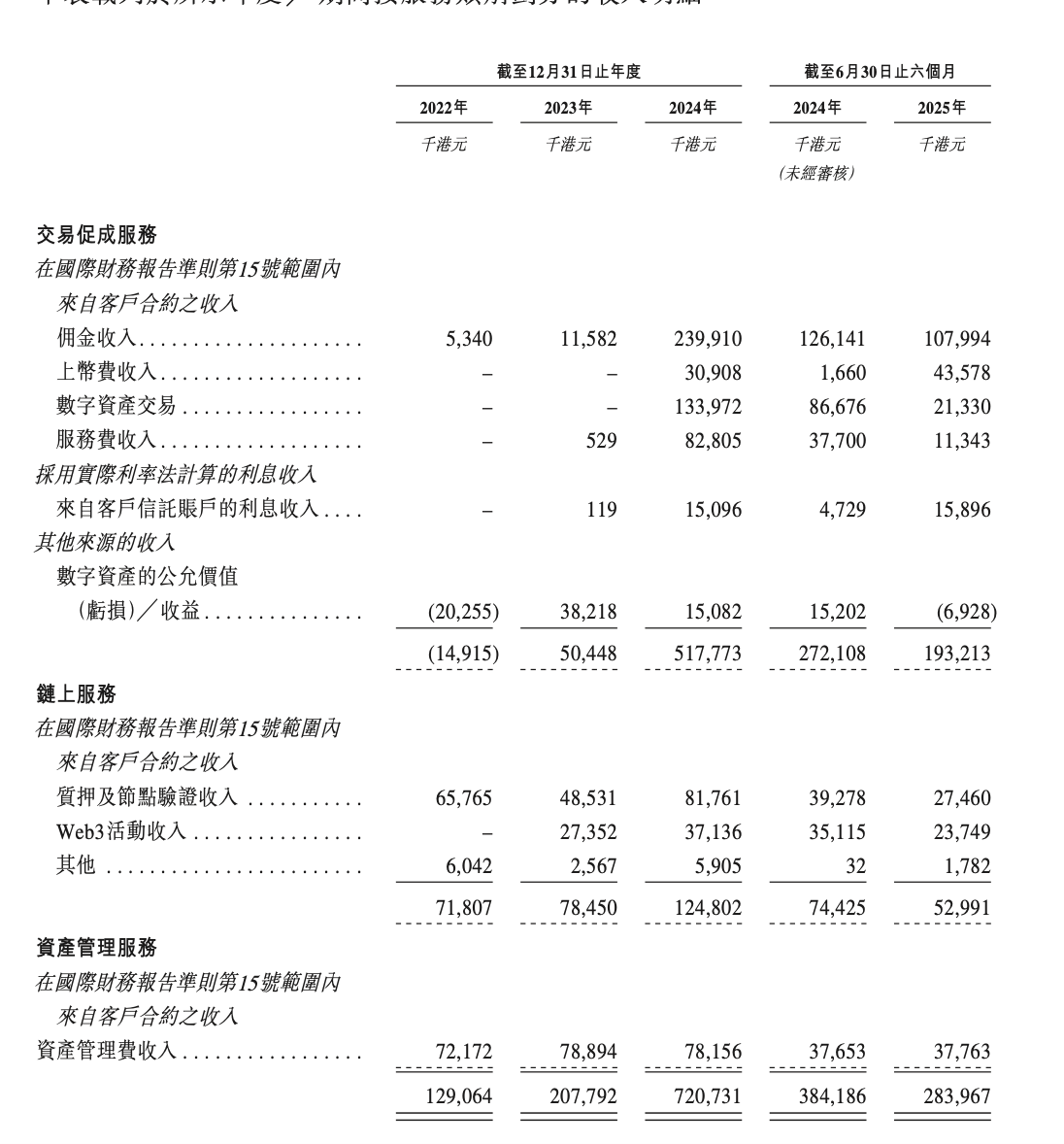

According to the disclosed documents, HashKey's main sources of income are trading facilitation services, on-chain services, and asset management services.

Trading facilitation services are HashKey's core business, accounting for 71.8%. Since its launch in 2022, this business has gradually turned from a loss to profitability, achieving nearly 5.17 billion HKD in annual revenue by 2024, becoming HashKey's largest source of income.

In terms of trading facilitation services, HashKey Exchange is one of the few exchanges that holds relevant licenses in every jurisdiction and is authorized to provide services to both professional and retail investors. Based on trading volume in 2024, HashKey is the largest regional onshore platform in Asia and also the largest exchange in Hong Kong, with a market share exceeding 75%. By the end of 2024, platform assets increased to 11.4 billion HKD, surpassing 19.9 billion HKD by the third quarter of 2025.

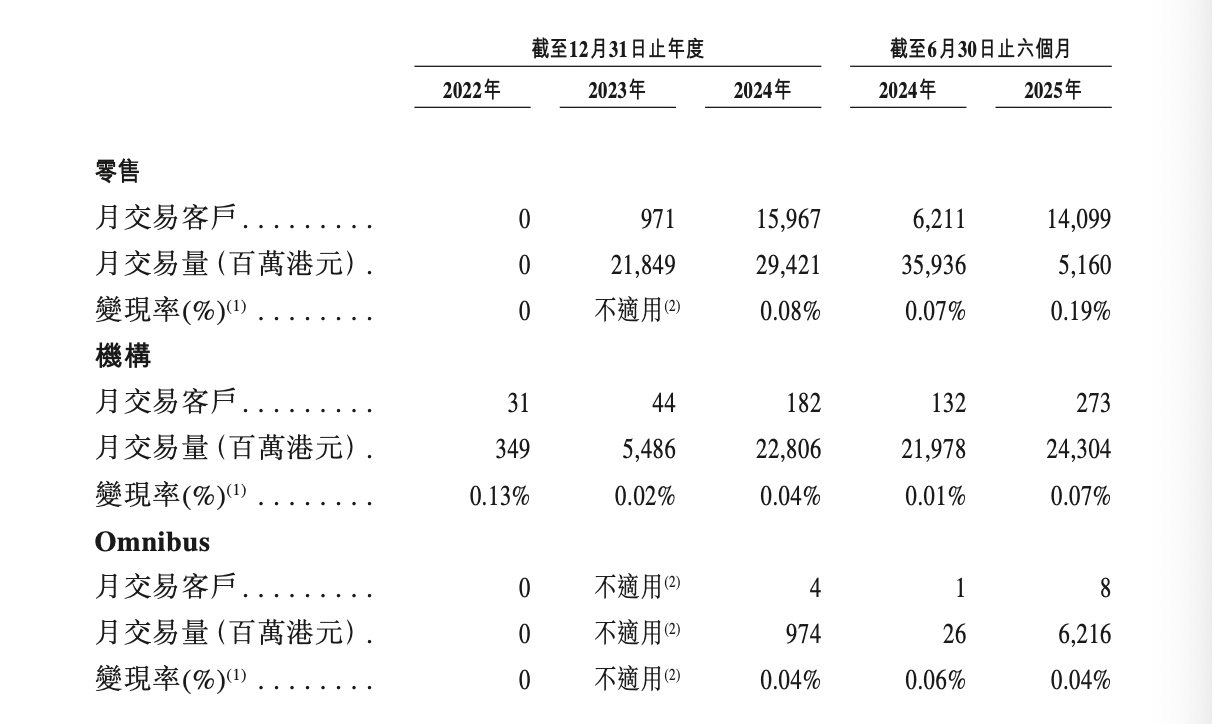

Institutional clients are the main force supporting trading volume. As of June 30, 2025, HashKey Exchange had over 1,446,926 registered users, an 8.2% increase from the end of 2024, but only about 9.6% (138,517) of clients actually deposited fiat currency or digital assets. Its clients mainly consist of institutional clients (including banks, asset management companies, family offices, hedge funds, and Web3 developers), omnibus clients (such as licensed securities firms), ecosystem partners, and retail users. Among them, institutional clients are the main trading force. Approximately 273 institutional clients had a monthly average trading volume of 24.3 billion HKD, about 4.7 times that of retail clients during the same period. Although the number of institutional clients is far fewer than retail clients, their trading scale is enormous, and the monetization rate improved from 0.01% last year to 0.07%, indicating a significant improvement in revenue contribution efficiency from institutional clients. In contrast, the average monthly number of retail clients is 14,099, completing a trading volume of 51.46 billion HKD, with a monetization rate of 0.19%.

From the distribution of these users, they are mainly concentrated in Hong Kong. In the first half of 2025, the trading volume in the Hong Kong market reached 18.19 billion HKD, which is more than ten times that of other institutions, but only less than 60% of last year's volume. Meanwhile, trading volume in Bermuda also sharply decreased during the same period, mainly due to the obstruction of fiat currency inflow and outflow channels in that region.

In terms of on-chain services, HashKey Cloud provides services specifically for institutional clients and is one of the first service providers in Hong Kong approved by the Securities and Futures Commission to support ETH ETF staking. As of September 30, 2025, the staked assets managed by HashKey Cloud reached 29 billion HKD, making it the largest staking service provider in Asia and the eighth largest globally. At the same time, HashKey Chain, as a compliant Ethereum Layer 2 expansion network, has a total value of RWA on the chain reaching 1.7 billion HKD. As of June 30, 2025, on-chain service revenue reached 52.99 million HKD, mainly from staking/node validation income of 27.46 million HKD and Web3 activity income of 23.75 million HKD, the latter coming from ticket sales and sponsorships for events like Web3 Carnival.

In asset management services, HashKey mainly provides digital asset investment opportunities for institutional clients. As of September 30, 2025, the total assets under management reached 7.8 billion HKD, completing over 400 investments (including infrastructure, tools, applications, and service providers), with the HashKey Blockchain Investment Fund achieving a return on investment exceeding 10 times, demonstrating its robust performance in the institutional asset management sector. This business generated over 280 million HKD in revenue in the first two quarters of this year, lower than the 380 million HKD in the same period last year.

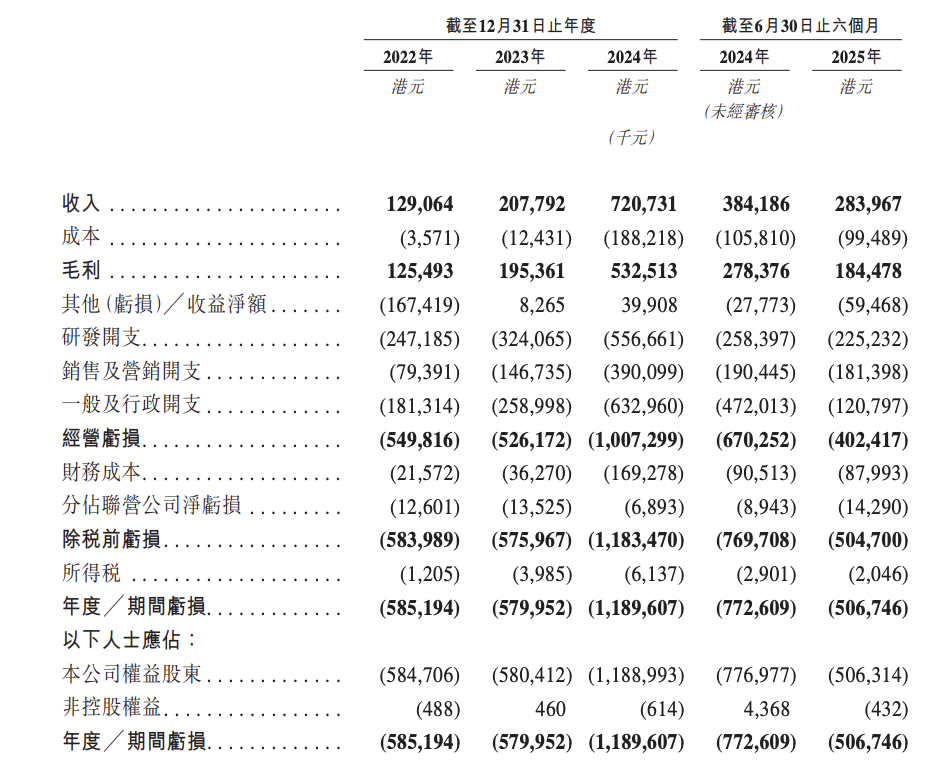

With multiple business lines, HashKey's overall revenue has also achieved rapid growth, with figures of 129 million HKD, 208 million HKD, 721 million HKD, and 284 million HKD for 2022, 2023, 2024, and the second quarter of 2025, respectively. Notably, the document discloses that HashKey's revenue was once highly concentrated among a few clients. The top five clients in 2022 contributed 79.6% of total revenue, with a single largest client accounting for more than half. However, in recent years, the company's client structure has gradually diversified, with the revenue share of the top five clients and the single largest client significantly decreasing.

Facing profitability challenges, has not initiated platform token buyback

Despite this, HashKey has yet to achieve profitability. From 2022 to 2024 and in the first half of 2025, the company reported losses of 585 million HKD, 580 million HKD, 1.19 billion HKD, and 507 million HKD, respectively. The company explained that the losses were primarily due to the market downturn and the significant upfront investments during the early stages of business development, including regulatory and licensing improvements, building technical infrastructure, research and technology optimization, as well as brand building and market expansion. However, as platform trading activities, client assets, and product utilization continue to grow, many core expenses remain relatively stable.

However, HashKey's financial situation remains relatively strong. As of August 31, 2025, the company had 1.657 billion HKD in cash and cash equivalents, as well as digital assets valued at 592 million HKD, with mainstream tokens like BTC and ETH accounting for 84%, providing strong support for future business development. Based on the current average monthly cash burn rate of approximately 40.9 million HKD, it is expected to sustain operations for 40.5 months, but the company also stated that future business expansion is expected to bring positive cash flow.

HashKey also disclosed its future growth strategies and product innovations in the document, focusing on building a one-stop digital asset ecosystem, including creating super applications, expanding exchange products and services, launching crypto debit cards, and offering enterprise-oriented Crypto-as-a-Service and exclusive asset management services based on HashKey Chain.

Additionally, the document mentions HashKey's platform token HSK, which serves as a functional tool to incentivize users, developers, and ecosystem partners, with its price primarily influenced by overall market sentiment and changes in investor expectations. According to the document, the operating costs and expenses for HSK in 2022, 2023, 2024, and up to June 30, 2025, were 9.9 million HKD, 70.8 million HKD, 176 million HKD, 82.9 million HKD, and 123 million HKD, respectively. It is evident that the issuance cost of HSK has also become one of the important factors affecting profits. The low utilization rate of HSK is notable, with rates of 1.71% and 0.49% as of December 31, 2024, and June 30, 2025, respectively. To increase practicality and liquidity, HashKey is also attempting to expand HSK into everyday financial scenarios, such as using HSK as a consumption reward in credit cards launched in collaboration with commercial banks. It is important to note that according to the commitment in the white paper, HashKey will use 20% of its net profit to repurchase and destroy HSK in the market, but no repurchase has been conducted as the conditions for repurchase have not yet been met.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。