Galaxy Digital's market valuation is significantly lower than the sum of its segment values.

Written by: Lawrence Lee

1. Research Summary

Galaxy Digital (GLXY) is a hybrid platform spanning crypto finance and AI computing power, with a business structure covering three core modules: ① Global Markets (trading, market making, and crypto investment banking); ② Asset Management and Infrastructure Solutions (fund management, staking, custody, and proprietary investments); ③ AI Data Centers and Computing Power Infrastructure (Helios campus).

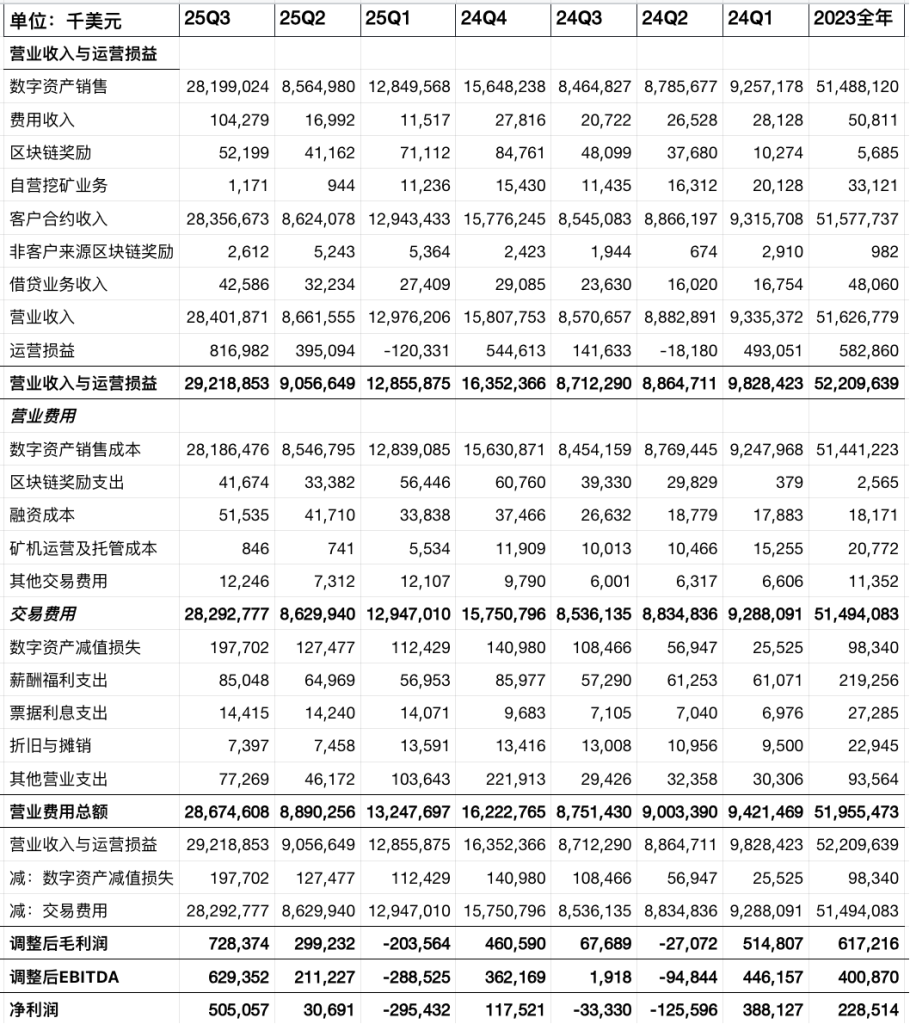

Over the past three years, Galaxy has achieved a leap from the lows of the crypto winter to synergistic growth across multiple businesses. In Q3 2025, driven by the surge in crypto treasury companies (Digital Asset Treasury Company) and the sale of 80,000 BTC, it achieved over $730 million in adjusted gross profit, setting a new record; the AUM of asset management and staking business reached $9 billion, with staking volume exceeding $6.6 billion, and annual management fees surpassing $40 million; while the Helios mining site has fully transformed into an AI computing power campus, signing a 15-year contract with CoreWeave, locking in 800MW of total power capacity in a three-phase lease, with expected annual revenue exceeding $1 billion after full delivery.

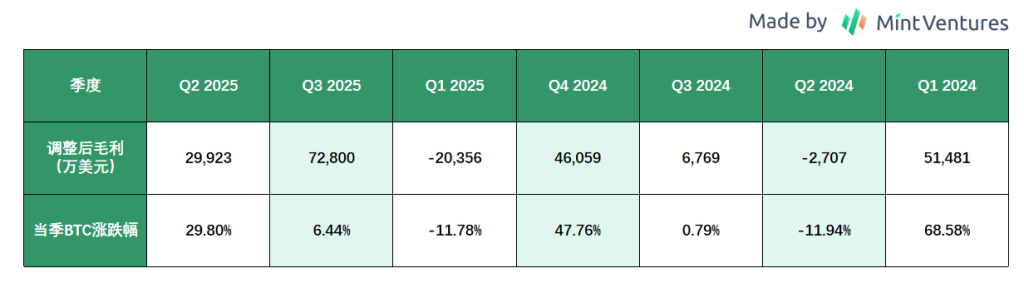

GLXY's financial performance has been highly volatile, significantly influenced by the crypto market: a loss of nearly $1 billion in 2022, a return to profitability in 2023, and a net profit of $365 million in 2024. Although there was a temporary decline in the first half of 2025, Q3's single-quarter profit reached a record $505 million amidst overall fluctuations in the crypto market, with adjusted EBITDA significantly turning positive, indicating enhanced resilience in core business.

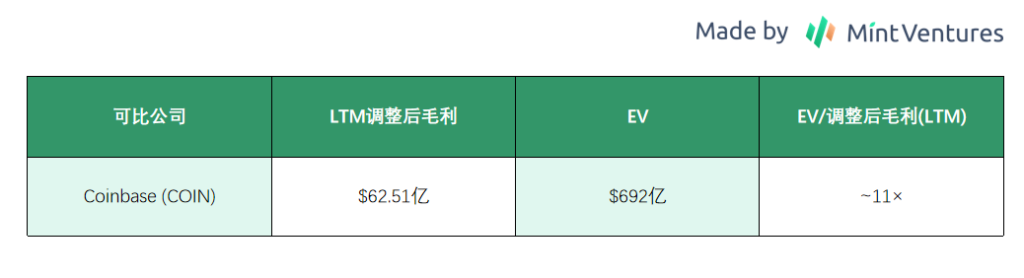

In terms of valuation, we adopt the SOTP (Sum of the Parts) framework: the segment valuation for Galaxy's digital asset financial services business is $7.7 billion; the segment valuation for AI computing power infrastructure business is $8.1 billion, totaling $15.8 billion, plus net assets yielding a total equity value of approximately $19.4 billion. However, Galaxy's current market capitalization is $10.1 billion, representing a 48% discount from our segment valuation calculation. This may be due to investors adopting a conservative valuation strategy for companies facing both industry cycle fluctuations (currently at a cycle peak according to crypto cycles) and business transformation challenges (with computing power business starting delivery only in 2026).

PS: This article reflects the author's thoughts as of publication, which may change in the future, and the views expressed are highly subjective and may contain errors in facts, data, or reasoning logic. All opinions in this article are not investment advice, and criticism and further discussion from peers and readers are welcome.

2. Business and Product Lines

Galaxy Digital was founded in 2018 by former Wall Street star investor Michael Novogratz. Novogratz was a partner and macro fund manager at the renowned hedge fund Fortress, and currently, Galaxy Digital's business landscape has formed "three core segments": ① Global Markets (including trading, derivatives market making, investment banking, and lending services), ② Asset Management & Infrastructure Solutions (including fund management, staking services, proprietary investments, etc.), ③ Data Centers and Computing Power Business (including previous Bitcoin mining and the ongoing AI/HPC high-performance computing infrastructure). Below, we will detail the business models, latest developments, and revenue contributions of each major product line.

2.1 Global Markets

Business Content and Definition

The Global Markets business encompasses the digital asset trading and related financial services that Galaxy Digital provides to institutions, serving as its core revenue source. This module includes two main segments: Franchise Trading and Investment Banking. The sell-side trading team acts as a market maker and liquidity provider in the crypto market, offering over 1,500 counterparties OTC trading services for spot and derivatives, supporting trading of over 100 mainstream crypto assets. Meanwhile, Galaxy utilizes regulated entities to conduct digital asset collateralized lending, OTC block brokerage, and structured yield products, providing leverage, hedging, and instant liquidity solutions for institutional clients such as miners and funds. The investment banking team offers professional financial advisory services to blockchain and crypto industry companies, including M&A advisory, equity and debt financing arrangements, and private placements, helping companies in the digital asset space connect with traditional capital markets. This series of services enables Galaxy to provide comprehensive financial solutions to institutional investors, akin to Wall Street investment banks, meeting the evolving demands of the crypto financial ecosystem.

Key Developments

- 2018–2019: Galaxy Digital was established in 2018 with the goal of "bringing crypto to Wall Street and bringing Wall Street into crypto." It quickly began building a comprehensive platform covering trading, asset management, and investment, and rapidly accumulated an institutional client base.

- 2020: Galaxy achieved a leap in trading business expansion through acquisitions: in November 2020, it acquired digital asset lending and structured products company DrawBridge Lending and professional market maker Blue Fire Capital to enhance its capabilities in OTC lending, futures derivatives, and bilateral market making. This rapidly extended Galaxy's trading landscape to include leveraged loans, OTC options, structured notes, and other advanced products, increasing its annual OTC trading volume to over $4 billion and expanding its active counterparties to nearly 200.

- 2021: The company appointed former Goldman Sachs executive Damien Vanderwilt and other senior professionals to establish an investment banking department focused on the crypto industry, providing M&A and financing advisory services. That year, Galaxy continued to enrich its product line by acquiring Vision Hill Group (a digital asset investment advisor and crypto fund index provider), enhancing its fund products and data analysis capabilities. In trading, the Galaxy Digital Trading team developed the GalaxyOne integrated trading platform (combining trading, lending, and custody) and completed key technical frameworks within the year, laying the foundation for the subsequent launch of a unified institutional service portal.

- 2022: Despite the crypto market entering a winter, Galaxy's Global Markets business continued to expand steadily. The sell-side trading department increased its counterparty count to over 930 in Q4, providing continuous market making and liquidity support for over 100 digital assets. In investment banking, the team seized industry consolidation opportunities, participating in several significant transactions: for example, serving as the financial advisor for Genesis Volatility's acquisition by Amberdata and assisting CoreWeave in securing strategic investment from Magnetar Capital. Notably, at the end of 2022, when Galaxy itself acquired the Helios mining site (detailed in the data center section below), the investment banking department also provided transaction advisory support, reflecting internal synergy.

- 2023: As the market gradually recovered, Galaxy's Global Markets business rebounded strongly. That year, Galaxy continued to expand its business coverage in regions such as Asia and the Middle East, establishing teams in Hong Kong, Singapore, and other locations to serve local institutional clients (such as family offices and funds). The investment banking department remained active in the first half of 2023, participating in several industry M&A and financing transactions, such as advising on the acquisition of crypto custody company GK8 by Galaxy (as the buyer) and some mining company restructuring projects. Despite ongoing fluctuations in the crypto industry that year, Galaxy's Global Markets segment demonstrated a more stable revenue curve compared to traditional crypto exchanges, due to its more diversified business model (including interest income, market making spreads, advisory fees, etc.).

- 2024: This year, the digital asset market showed a clear recovery, and the company's Global Markets business recorded record performance. In 2024, counterparty trading and advisory revenue reached $215 million, exceeding the total of the previous two years. Q4 alone achieved $68.1 million in revenue (up 26% quarter-on-quarter). The growth was primarily driven by active derivatives trading and strong institutional lending demand – during the quarter, Galaxy's OTC derivatives and credit business surged, with counterparty trading volume increasing by 56% quarter-on-quarter, and the average loan book size expanding to $861 million, setting a historical high. By the end of 2024, the total number of Galaxy's counterparties reached 1,328, significantly increasing from the previous year. In investment banking, Galaxy completed a total of 9 advisory transactions in 2024, successfully closing 3 in Q4, including serving as the exclusive financial advisor for Ethereum staking service provider Attestant's sale to Bitwise, and assisting Thunder Bridge Capital in merging with Coincheck (SPAC transaction). These transactions brought substantial fee income to Galaxy, solidifying its reputation in the crypto investment banking market.

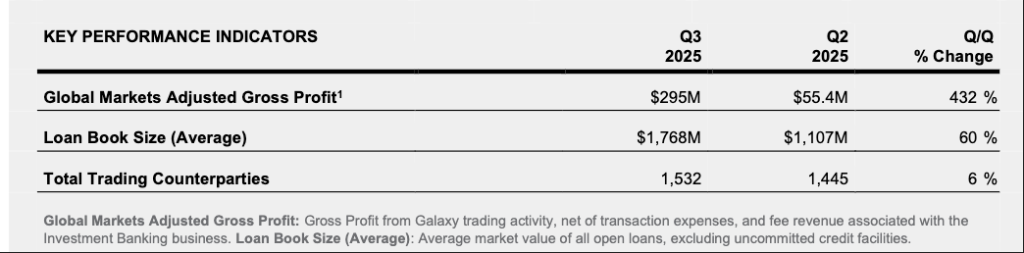

- 2025: Entering 2025, driven by favorable expectations such as ETFs, the digital asset market rebounded strongly, and Galaxy's Global Markets business reached new heights. In Q3 2025, Galaxy's Global Markets segment generated $295 million in adjusted gross profit for the quarter, soaring 432% from the previous quarter, setting a historical high. During this quarter, the company's total trading volume increased by 140% quarter-on-quarter, reaching the highest level ever, far exceeding the market's average growth rate. One standout business was Galaxy's trust in selling 80,000 BTC (nominal amount of approximately $9 billion) for a large institution, which significantly contributed to the quarterly spot trading volume. The two ETH stock companies, BMNR and SBET, also acquired ETH through Galaxy. Meanwhile, Galaxy's institutional lending business rapidly expanded, with an average loan balance of $1.78 billion in Q3, a 60% increase from Q2, indicating that more institutions are seeking crypto credit financing through Galaxy. In investment banking, Galaxy seized the market financing window, completing a $1.65 billion PIPE private financing for Forward Industries in Q3 (serving as co-placement agent and financial advisor) and acting as the exclusive financial advisor for Coin Metrics' sale to Talos. These heavyweight transaction cases further established Galaxy's leading position in the digital asset investment banking business. Looking ahead to the full year of 2025, amid the surge of crypto stock companies, the market expects Galaxy's Global Markets business to achieve revenue and profit levels far exceeding previous years.

Financial Reports and Public Report Summary (2023–2025)

Revenue and Profit: In 2023, due to the market being at the tail end of a bear market, Galaxy still recorded losses overall, but the Global Markets segment showed improvement in the second half of the year. Entering 2024, the Global Markets business became the main driver of the company's performance: the annual counterparty trading and advisory revenue reached $215 million, a significant increase compared to 2022 (which was only about $100 million due to market sluggishness). The profitability from derivatives and quantitative trading increased, and interest income also rose with the expansion of lending volume. In 2024, the adjusted EBITDA for the Global Markets business exceeded $100 million, highlighting operational leverage. In Q4 2024, the Global Markets revenue for the quarter was $68.1 million, directly driving the company's net profit for the quarter back to profitability. By Q3 2025, Galaxy reported that its digital asset business (including Global Markets and Asset Management) achieved $250 million in adjusted EBITDA for the quarter, with a significant contribution from the Global Markets segment. The adjusted gross profit for the Global Markets segment that quarter reached $295 million. This reflects the strong profitability elasticity of Galaxy's trading business under bullish market conditions. It is worth noting that in the first three quarters of 2025, the company's overall net profit was still affected by the volatility of proprietary investments (for example, losses in Q1 due to a drop in digital asset prices), but the growth trend of core operational business remained quite robust. Management projected in the Q3 2025 financial report that with the full launch of the GalaxyOne platform and the onboarding of more institutional clients, the company's trading-related revenue is expected to grow further. At the same time, the cost-to-income ratio of the Global Markets business has decreased (reflecting improved operational efficiency), bringing considerable operational leverage benefits to the company.

GLXY Q3 2025 Global Markets Profit, Loan Volume, and Counterparty Data

GLXY Q3 2025 Global Markets Profit, Loan Volume, and Counterparty Data

2.2 Asset Management & Infrastructure Solutions

Business Content and Definition

The Asset Management and Infrastructure Solutions segment integrates Galaxy Digital's businesses in digital asset investment management and blockchain infrastructure technology services, serving as an important complement to the Global Markets segment.

In Asset Management, Galaxy provides diversified crypto asset investment products for institutions and qualified investors through its subsidiary, Galaxy Asset Management (GAM). The product forms include: 1) Public market products: such as ETFs/ETPs (exchange-traded products) issued in collaboration with traditional institutions, including single-asset ETFs for Bitcoin, Ethereum, and thematic ETFs for the blockchain industry; 2) Private fund products: including actively managed hedge funds (Alpha strategies), venture capital funds (investing in blockchain startups like Galaxy Interactive), crypto index funds, and funds of funds, providing investors with diversified risk-return exposure. Galaxy also offers customized crypto investment services for institutional clients, such as digital asset index construction, treasury management, and co-investment (SPV) opportunities. As of Q3 2025, Galaxy's assets under management (AUM) approached $9 billion, covering over 15 ETFs and alternative investment strategy products. This scale positions it among the largest crypto asset managers globally.

In Infrastructure Solutions, Galaxy leverages its technology and operational experience to provide institutions with foundational technology services and custody solutions for blockchain networks. This primarily includes two modules: Custody and Staking. The GK8 platform acquired by Galaxy in 2023 offers institutional-grade digital asset self-custody technology, allowing clients to securely manage crypto assets through cold wallets and MPC (multi-party computation) custody solutions. GK8 technology also supports a range of functionalities, including participation in DeFi protocols, token issuance, and NFT custody, enabling Galaxy to provide institutional clients with a "one-stop" digital asset infrastructure (such as token issuance platforms). In the staking business, Galaxy has established a dedicated blockchain infrastructure team to provide node hosting and staking as a service. This team operates a globally distributed network of validation nodes, supporting multiple mainstream PoS blockchains, including Ethereum and Solana, helping clients delegate their held crypto assets to participate in network validation to earn staking rewards. Galaxy's staking services offer institutional-level security and flexibility: on one hand, by integrating with compliant custodians like Anchorage, BitGo, and Zodia, clients can easily stake their custodial assets; on the other hand, Galaxy provides innovative features such as collateral financing for staked assets, allowing clients to use staked tokens as collateral to obtain loans, enhancing capital efficiency. Additionally, Galaxy engages in proprietary investments through departments like Galaxy Ventures, investing in high-quality blockchain startups and protocols. By the end of 2022, the company had invested in over 100 related companies (145 investments). These strategic investments not only bring potential financial returns to Galaxy but also expand the company's influence and collaboration network within the industry (for example, Galaxy's early investments in well-known projects like Block.one, BitGo, and Candy Digital). Overall, the Asset Management and Infrastructure Solutions module allows Galaxy to vertically extend its industry chain, providing "dual-driven" services from asset management to managing underlying technology.

Key Developments

- 2019–2020: Galaxy began to lay out its asset management business, collaborating with traditional financial institutions to issue crypto investment products. In 2019, Galaxy partnered with Canada's CI Financial to launch the CI Galaxy Bitcoin Fund (a closed-end Bitcoin fund listed on the Toronto Stock Exchange), making it one of the first publicly raised Bitcoin investment products in North America. Subsequently, in 2020, they jointly launched the CI Galaxy Bitcoin ETF, which became one of the Bitcoin ETFs with the lowest management fees at that time. Through these collaborations, Galaxy established its pioneering position in the public crypto product space.

- 2021: In May, Galaxy acquired Vision Hill Group (a New York-based digital asset investment advisory and asset management firm), incorporating its team and products (including crypto hedge fund indices, the data platform VisionTrack, and funds of funds) into its operations. After the acquisition, the Galaxy Fund Management platform was able to provide institutions with richer data-driven investment decision support and a more comprehensive fund product line. In the same year, the Galaxy Asset Management division continued to expand its actively managed products, such as launching the Galaxy Liquid Alpha fund, and by the end of the year, it managed approximately $2.7 billion in assets (a significant increase from $407 million at the beginning of the year).

- 2022: In Q4, Galaxy announced a strategic partnership with Itaú Asset Management, one of Brazil's largest private banks, to jointly develop a series of digital asset ETF products for the Brazilian market. By the end of 2022, they launched their first collaborative product, the "IT Now Bloomberg Galaxy Bitcoin ETF," allowing Brazilian investors to gain exposure to physically-backed Bitcoin through local exchanges. In the same year, Galaxy's asset management faced a decline in scale due to the broader crypto market environment (with AUM at $1.7 billion at the end of 2022, a 14% decrease from the previous year), but the company strategically focused on "scaling active strategies": for instance, the Galaxy Interactive fund successfully completed investments in several gaming/metaverse startups, and the Liquid Alpha hedge fund still achieved net subscriptions despite challenging market conditions.

- 2023: In February, Galaxy successfully bid to acquire the GK8 digital asset custody platform from the bankrupt Celsius Network for approximately $44 million (far below Celsius's original acquisition price of $115 million). The GK8 team, nearly 40 people (including top crypto security experts), officially joined Galaxy, establishing a new R&D center in Tel Aviv. GK8's patented technology includes offline cold storage trading and multi-party computation (MPC) hot storage, allowing institutions to sign on-chain transactions in an offline environment and perform automated, multi-signature custody operations. This acquisition significantly enhanced Galaxy's capabilities in secure custody, staking, and DeFi access infrastructure, which CEO Novogratz described as "a key step towards providing a full suite of financial platforms." GK8 was subsequently integrated into the GalaxyOne platform, becoming an important tool for Galaxy to provide self-managed asset solutions for institutional clients. In 2023, Galaxy's asset management business also had highlights: on one hand, Galaxy was appointed as an advisor to the FTX bankruptcy management team, helping to manage the FTX asset portfolio, which brought additional management fee income and enhanced reputation; on the other hand, with the market rebound, Galaxy's AUM bottomed out and recovered in the second half of the year, reaching approximately $3 billion by Q4. At the end of 2023, Galaxy announced the launch of its upgraded asset management platform brand "Galaxy Asset Management & Infrastructure Solutions," integrating traditional asset management with blockchain technology services to highlight its differentiated positioning.

- 2024: This year, Galaxy's asset management and blockchain infrastructure businesses entered a rapid development phase. In July, Galaxy announced the acquisition of most of the assets of CryptoManufaktur (CMF), a blockchain node operator founded by Ethereum veteran engineer Thorsten Behrens. CMF specializes in automated deployment of Ethereum nodes and oracle infrastructure operations, and this move immediately added approximately $1 billion equivalent in Ethereum staking assets (raising Galaxy's total staking scale to $3.3 billion). The three-person core team from CMF subsequently joined Galaxy, accelerating the company's technological accumulation in Ethereum staking and Oracle data services. Staking became one of Galaxy's biggest highlights in 2024: benefiting from the Ethereum Shanghai upgrade allowing withdrawals and institutional entry, Galaxy's staking assets skyrocketed from just $240 million at the beginning of the year to $4.235 billion by the end of the year, an increase of nearly 17 times (with $1 billion from acquisitions and the rest from organic growth). The company responded to market demand by successively partnering with several mainstream custodians: in February, Galaxy became an integrated staking service provider for BitGo, allowing BitGo's custodial clients to easily stake using Galaxy's nodes and use staked assets for third-party loans; in August, Galaxy partnered with Zodia Custody (an institutional custodian supported by Standard Chartered) to provide compliant staking solutions for European clients; additionally, it expanded technical integrations with Fireblocks, Anchorage Digital, and others. These initiatives greatly broadened the distribution channels for Galaxy's staking services.

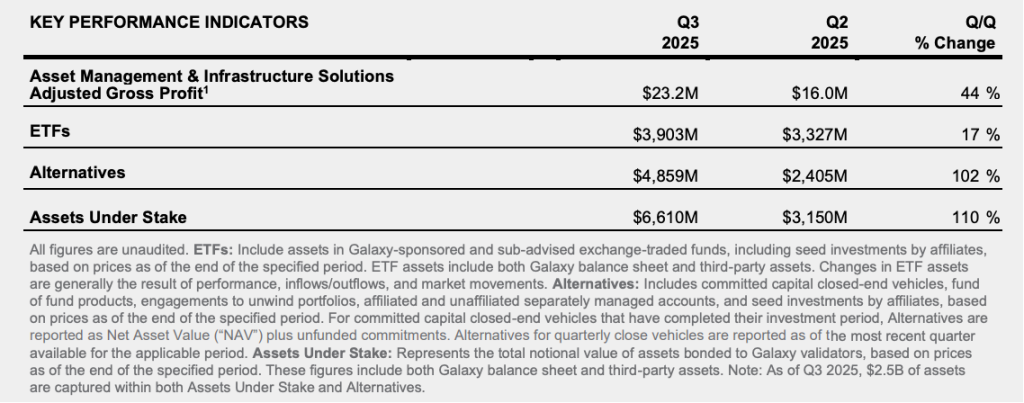

- 2025: In the gradually clarifying market and regulatory environment of 2025, Galaxy's asset management and infrastructure segment continued to make significant strides. In Q3 2025, Galaxy reported an adjusted gross profit of $23.2 million for the segment, a 44% increase from Q2, reflecting the expansion of business scale. The main driver of growth was over $2 billion in net new fund inflows for the quarter, sourced from multi-year mandates from large digital asset holding institutions. These institutions (such as crypto project foundations and publicly listed company treasuries) entrusted Galaxy with managing and staking their assets, which, as disclosed, had contributed a cumulative $4.5 billion+ in assets by Q3, generating over $40 million in recurring management fee income annually. Galaxy refers to these services as "digital asset treasury outsourcing," helping project parties or enterprises manage their crypto asset reserves for stable appreciation. As a result, Galaxy's AUM rose to nearly $9 billion, and staking assets reached $6.61 billion, both hitting historical highs. On October 29, Galaxy announced the completion of staking business integration with Coinbase Prime, becoming one of Coinbase's selected staking service providers. Through this partnership, Coinbase's institutional clients can seamlessly access Galaxy's high-performance validation node network on its platform, marking Galaxy's staking business entry into a top-tier custody ecosystem. Overall, in 2025, Galaxy achieved simultaneous progress in product innovation, scale growth, and ecosystem deepening in its asset management and infrastructure segments.

Financial Report and Public Report Summary (2023–2025)

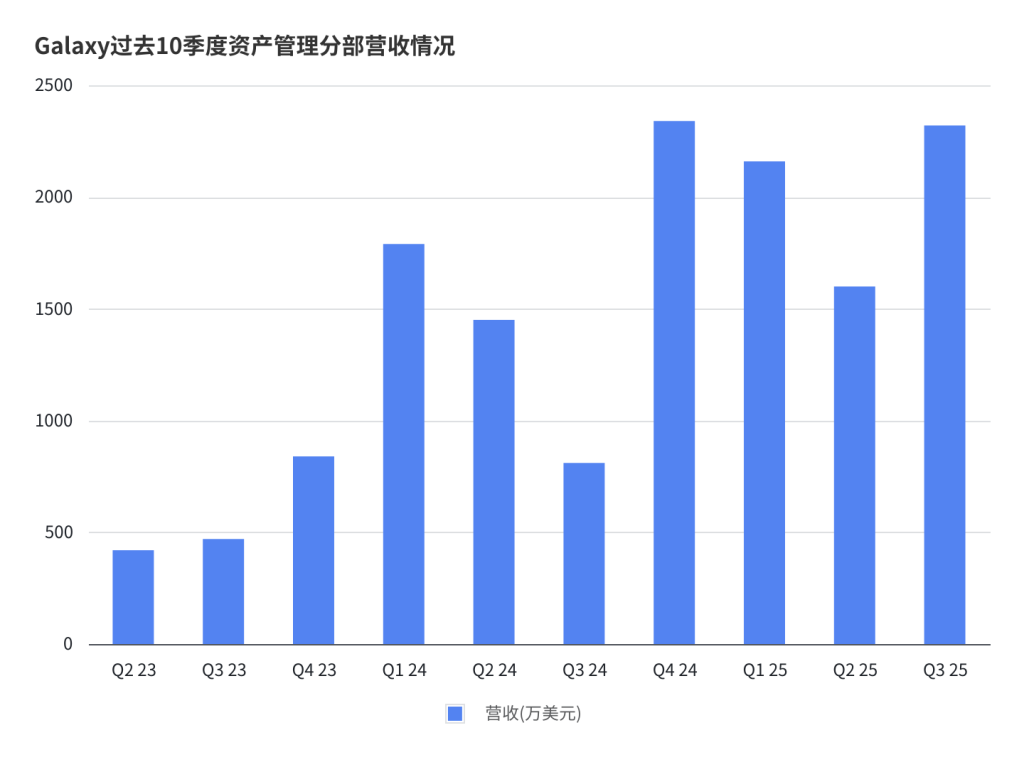

Asset Management Business Performance: In 2023, amid a sluggish market, Galaxy's asset management revenue declined, but with the market warming in Q4, management fee income began to recover. In 2024, the company's asset management business experienced a bumper harvest: it recorded a total of $49 million in revenue for the year, setting a historical high (a significant increase from approximately $28 million in 2022). The driving forces included: first, organic net fund inflows and market increases enhanced management scale and asset-based fee income; second, Galaxy's entrusted execution of FTX bankruptcy asset disposal contributed considerable income from commissions earned from selling assets for creditors. By the end of 2024, Galaxy's assets under management (AUM) reached $5.66 billion, an increase from the end of 2023 (~$4.6 billion). Among them, ETF/ETP products accounted for $3.482 billion, and alternative investment products accounted for $2.178 billion (such as venture capital funds). The operating profit margin of the asset management business also improved in 2024, with adjusted EBITDA exceeding $20 million for the year, indicating that scale effects were gradually materializing.

In the first three quarters of 2025, Galaxy's asset management segment continued to grow in a strong market environment. Especially in the recently concluded third quarter:

- Galaxy's assets under management (AUM) reached nearly $9 billion, with alternative investment products surging 102% quarter-on-quarter to $4.86 billion, and ETFs also growing to $3.8 billion;

- The scale of staking assets also increased by 110% quarter-on-quarter to $6.6 billion.

- Driven by this, the revenue (adjusted gross profit under GAAP) for Galaxy's asset management and infrastructure solutions segment was $23.2 million, a 44% increase quarter-on-quarter, with quarterly revenue approaching nearly half of the total for 2024.

Galaxy Q3 2025 Asset Management Business Adjusted Gross Profit, AUM (including ETFs and alternative products), and Staking Asset Scale

Galaxy Q3 2025 Asset Management Business Adjusted Gross Profit, AUM (including ETFs and alternative products), and Staking Asset Scale

Overall, from 2023 to 2025, Galaxy's digital asset segment, including Global Markets and Asset Management, achieved a leap from trough to peak, driven by favorable factors such as the crypto bull market, regulatory benefits, and the launch of ETFs, setting new records in both revenue and profit.

2.3 Data Centers & Computing Power

Business Content and Definition

The data center and computing power business is the second major strategic area that Galaxy Digital has developed outside of digital assets, focusing on the investment, construction, and operation of foundational computing power facilities. Its core mission is to transform abundant energy and data center resources into computing power for blockchain mining and high-performance computing (HPC), creating value for itself and its clients. Galaxy initially entered this field through Bitcoin mining: by deploying specialized mining machines and utilizing its own or hosted data center computing power to obtain Bitcoin block rewards. At the same time, the company also provides hosting services and financial support to other miners (such as machine hosting maintenance, electricity purchasing strategy consulting, and mining machine financing), building an ecosystem for mining. With the explosive growth in demand for computing power in the era of artificial intelligence and big data, Galaxy strategically adjusted in 2023, gradually expanding its data center resources for AI model training, cloud rendering, and other high-performance computing tasks. Specifically, Galaxy collaborates with AI infrastructure companies to transform its large campuses into artificial intelligence computing power supply bases, obtaining stable rental and service income through a model of leasing electricity and server racks (equivalent to providing "Infrastructure as a Service (IaaS)").

Currently, Galaxy's most core data center asset is the Helios data center campus located in Dickens County, Texas, USA. The Helios campus was originally developed by Argo Blockchain, aiming to utilize the cheap renewable energy (wind and solar) in West Texas for Bitcoin mining. However, at the end of 2022, soaring natural gas prices led to increased electricity prices, and Argo lacked effective fixed-price electricity procurement agreements, leaving it fully exposed to extreme fluctuations in electricity prices. Under the pressure of a liquidity crisis, Argo sold the Helios facility to Galaxy Digital for $65 million in December 2022 (along with an additional $35 million loan).

For Galaxy, this transaction included not only physical assets but also the critically important 800 MW grid connection approval capacity. Currently, in Texas, the queue time for grid connection approval for large loads has extended to over four years, making Helios's existing grid connection permit one of the most valuable intangible assets on its balance sheet. In terms of scale, 800 MW places Helios in the top tier of global computing power campuses—by comparison, Google's new AI data center planned in Arizona has an estimated power of about 1200 MW, and Microsoft's expansion projects in Iowa and other locations are in the 300-600 MW range. Therefore, Helios's scale is quite substantial, and if the long-term vision of 3.5 GW is achieved (with the remaining 2700 MW grid connection permit still under approval), it will be more than twice the size of the current largest data center clusters in the world.

In terms of specific business operations, Galaxy does not directly operate AI cloud services but has signed a long-term hosting agreement with CoreWeave for 15 years. CoreWeave is a top cloud service provider backed by NVIDIA, with an extreme demand for computing power infrastructure. A series of long-term leasing agreements signed between the two parties effectively convert Galaxy's electricity resources into bond-like stable cash flows. Currently, CoreWeave has exercised all available options, locking in the entire 800 MW of approved power capacity at Helios. The cooperation between the two parties adopts a Triple-Net leasing structure: Galaxy is primarily responsible for providing the physical shell and electricity access, while CoreWeave must bear its own electricity costs (including the risk of electricity price fluctuations), equipment maintenance costs, insurance, and taxes. In this model, Galaxy resembles a digital real estate developer rather than an operating service provider, resulting in a high level of cash flow stability. For Galaxy, its revenue is almost equivalent to net profit, and the EBITDA profit margin for this business is expected to reach as high as 90%.

Galaxy has divided the development of the Helios campus into multiple phases: Phase I plans to deploy 133 MW in the first half of 2026, Phase II will deploy 260 MW in 2027, and Phase III will deploy 133 MW in 2027, providing a total of 526 MW of "critical IT load" for server use (corresponding to a total power capacity of 800 MW). To meet CoreWeave's needs, Helios is accelerating the transformation from a "mining farm" to an "HPC data center," primarily including upgrades to cooling systems, redundant architecture, and structural reinforcement.

Important Development Milestones

- 2018–2020: Driven by the bull market in digital assets, Galaxy recognized the significant value of upstream computing power and began to venture into the Bitcoin mining sector. Initially, the company adopted a cooperative hosting model, entrusting mining machines to professional mining farms while providing financing for mining machines and other financial services such as over-the-counter hedging, accumulating experience and resources. During this period, Galaxy discreetly invested in several mining infrastructure projects and formed a team proficient in power and mining machine technology to prepare for future self-built mining farms.

- 2021: Galaxy officially announced the establishment of the "Galaxy Mining" mining department, elevating mining to one of the company's core strategies. That year, Galaxy expanded its cooperation with several large mining farms in North America and actively sought suitable locations in Texas and other areas to build its own data centers.

- 2022: This year marked a milestone for Galaxy's data center business. On December 28, 2022, Galaxy announced the acquisition of the Helios Bitcoin mining facility located in Dickens County, Texas, from Argo Blockchain for $65 million (including a full set of operational assets) and provided Argo with a $35 million loan to help it through its liquidity crisis. The Helios facility had just begun operations, with a built capacity of 180 MW and significant expansion potential. After the acquisition, Galaxy immediately took over operations, establishing it as a core mining base. The company announced plans to increase Helios's operational power to 200 MW by the end of 2023, with part of the capacity used for hosting third-party mining machines and part for Galaxy's own mining. This acquisition greatly enhanced Galaxy's mining landscape and was seen as "Galaxy owning its own Bitcoin mining factory."

- 2023: Galaxy's data center business began transitioning from a "mining model" to a "mining + computing power leasing dual track." In the first half of the year, the Helios facility steadily expanded: by mid-2023, approximately 3 EH/s of computing power had been deployed, with Galaxy's own and hosted operations each accounting for half. The rebound in Bitcoin prices in the first half of the year also restored profitability in mining operations. In Q2 2023, Galaxy revealed in its financial report that its mining department's Hashrate Under Management (HUM) reached approximately 3.5 EH/s, with the unit cost of BTC production in the self-operated segment remaining relatively low in the industry. In the second half of the year, while continuing to enhance Helios's Bitcoin computing power, the company proactively negotiated with CoreWeave to explore the possibility of leasing part of Helios's power and space for deploying GPU servers. In September 2023, Galaxy reached a preliminary agreement with CoreWeave, planning for Galaxy to provide space and power infrastructure at Helios, with CoreWeave gradually deploying AI equipment. This marked the beginning of the strategic transformation of Galaxy's data center business. By Q4 2023, Galaxy's mining business Hashrate management scale rose to 6.1 EH/s, with a total of 977 BTC mined throughout the year; however, the company clearly stated that it would reduce self-operated mining scale after the agreement took effect and focus on the transformation and construction of Helios.

- 2024: This year, Galaxy's data center business focus completely shifted to HPC. On March 28, 2024, Galaxy announced the signing of a formal lease agreement for Phase I with CoreWeave: Galaxy would provide 133 MW of "critical IT load" at Helios for CoreWeave to deploy AI/HPC infrastructure, with a lease term of 15 years. According to the terms, CoreWeave would pay rent to Galaxy in a manner similar to data center hosting, with a total expected revenue of approximately $4.5 billion over 15 years for Galaxy. Galaxy stated that it plans to deliver the full capacity of Phase I for CoreWeave's use by the first half of 2026. Shortly thereafter, in April 2024, CoreWeave exercised the first option in the contract (Phase II), adding an additional 260 MW of IT load at Helios, bringing the total commitment to 393 MW. Galaxy stated that this Phase II contract would be executed under similar economic terms as Phase I (i.e., long-term lease), with Phase II capacity expected to be delivered in 2027. Meanwhile, Galaxy began significantly reducing its Bitcoin mining investments: in the first half of 2024, it sold some mining machines and gradually shut down the expansion plans for self-operated mining machines, reallocating the freed-up power and space at Helios for retrofitting the facility to accommodate high-density GPU servers. On November 7, 2024, Galaxy announced that it had reached a term sheet for financing the Helios project with a large financial institution. Subsequently, in 2025, it officially closed the financing (see below). By the end of 2024, Galaxy's mining business Hashrate had decreased to 6.1 EH/s, with some mining machines in a standby state for sale; the profit from self-operated mining accounted for a declining proportion of the company's overall performance, while capital expenditures in the data center segment surged, entering an investment phase. However, this year, Galaxy successfully completed its strategic pivot: from a pure Bitcoin mining operator to an AI data center developer with long-term contracts with major clients.

- 2025: Galaxy's data center business entered a full construction and financing phase. On August 15, 2025, Galaxy announced that it had completed project financing totaling $1.4 billion (debt financing) to accelerate the development of the Helios AI data center. The loan was led by a large institution, issued at an 80% Loan-to-Cost ratio, with a term of 3 years, secured by the assets of Helios Phase I. Galaxy contributed $350 million in equity to support this, bringing the total funding for Phase I to $1.7 billion. This means that the construction and retrofitting of Helios Phase I (including substation upgrades, cooling systems, structural reinforcement of the facility, etc.) received ample financial support, ensuring timely delivery. In August 2025, Galaxy also disclosed that CoreWeave had exercised the final option (Phase III), locking in an additional 133 MW of capacity, bringing the total leased amount at Helios to 800 MW. At this point, all of Helios's approved power capacity was covered by leases, achieving 100% occupancy. The company expects that, based on the contract terms and full utilization of the 526 MW IT load, the Helios project could generate over $1 billion in average annual revenue over the next 15 years, becoming an important long-term cash flow source for Galaxy. To plan for the long term, Galaxy acquired additional land around Helios in 2025, expanding the total area of the campus to over 1500 acres, which could support a potential power load of up to 3.5 GW (nearly double the current 800 MW). These capacity expansions are still under research with the grid operator ERCOT, and once approved, will be implemented in phases. In October 2025, Galaxy received a $460 million equity investment from a top global asset management company to support the Helios project construction and other company purposes. Market rumors suggest that the investor is BlackRock (not yet officially confirmed), and this investment, once completed in phases, will grant the investor a certain equity stake, symbolizing traditional mainstream institutions' recognition and support for Galaxy's computing power strategy. By the end of 2025, Galaxy stated that the construction of Helios Phase I was progressing as planned, with 133 MW set to be delivered to CoreWeave in the first half of 2026; preparations and infrastructure for Phase II were also underway, with an expected delivery in 2027; Phase III is planned to start delivery in 2028.

Financial Reports and Public Report Summary (2023–2025)

Mining Business Performance: In 2023, Galaxy's mining business was in the investment phase just after acquiring Helios, and due to the sluggish Bitcoin prices, the overall performance for the year still resulted in a loss. However, in 2024, with the price rebound and operational optimization, the mining segment turned profitable and contributed stable cash flow. In 2024, Galaxy's mining department generated $94.9 million in revenue, directly mining 977 BTC; after deducting operating costs such as electricity, the average gross margin for the year was approximately 50%. However, Galaxy has indicated in its financial report that due to the strategic transformation, mining revenues will significantly decline in 2025. In 2025, as mining machines were gradually sold and taken out of operation, Galaxy's mining revenue decreased sharply. In Q3 2025, the data center segment (mainly mining) generated only $2.7 million in adjusted gross profit. Galaxy expects that as the Helios transformation progresses, there will be almost no significant mining profits in the second half of 2025, until some remaining mining machines are restarted in 2026 or strategies are adjusted based on market conditions.

AI/HPC Hosting Business Prospects: Since the contract between Helios and CoreWeave will not begin execution until 2026, there will be no recurring revenue recorded for this part from 2023 to 2025. Galaxy will capitalize the costs during the construction period, so the short-term profit and loss statement has not been significantly impacted. The company clearly stated in its Q3 2025 financial report: "Galaxy expects that before the first half of 2026, the adjusted gross profit and EBITDA contributed by the data center segment will not be significant" (i.e., still in the preparation phase). However, at the same time, Galaxy has provided investors with future revenue guidance: once Helios is officially delivered for operation, the data center segment will become a new cash cow for the company. Based on the signed contracts, Galaxy expects to start recognizing substantial rental income in the first half of 2026, and since the counterparties will bear the operating costs, Galaxy's gross margin is expected to be quite considerable (similar to a REIT model). In the announcement in August 2025, Galaxy disclosed that after all contracts are executed, it will generate over $1 billion in annual revenue on average, totaling over $15 billion over 15 years, several times the current asset scale of the company. Even considering operating costs and loan interest, the net profit contribution is also expected to be considerable. This prospect attracted attention in the capital markets in 2025: Galaxy's stock price surged by about 60% after announcing full occupancy and financing news, reflecting investors' reassessment of the value of its "computing power segment." In summary, from 2023 to 2025, the data center business is still in the "seeding" phase financially, but its future "harvest" potential has been repeatedly emphasized in financial reports and management discussions, making it an indispensable part of Galaxy's narrative.

Summary

In summary, Galaxy Digital's three core business modules—global markets, asset management and infrastructure solutions, and data center computing power—each cover different segments of the digital asset ecosystem's value chain, forming a complementary and synergistic relationship under the company's strategy. The global markets module provides revenue from trading and investment banking, leading the market frontier; the asset management and infrastructure module accumulates long-term management fee income and technical advantages, binding high-quality clients; the data center computing power module is expected to bring substantial and stable cash flow, supporting the company's performance "safety net." Through a clear strategic layout and a series of bold acquisitions and collaborations, Galaxy has positioned itself as a unique player straddling finance and technology. In the rapidly changing landscape of the digital asset industry, the growth potential and mutual support exhibited by Galaxy's various modules give it a rare cyclical resilience and comprehensiveness in the eyes of investors. This also explains why an increasing number of institutional investors are showing interest and confidence in Galaxy. Looking ahead, the three modules of Galaxy are expected to continue advancing together, constantly creating new milestones and achieving value co-creation for shareholders and clients.

3. Industry Analysis

According to the analysis above, the businesses undertaken by Galaxy can be divided into two industries: the cryptocurrency industry and the AI computing power infrastructure industry. We will now analyze the current status and development trends of these two industries in detail.

3.1 Cryptocurrency Industry

Industry Status: Market Capacity, Participants, and Structure

Market Size and Major Participants: The cryptocurrency market is regaining growth momentum in 2024-2025, with North American trading activity accounting for about 1/4 of the global share. By mid-2025, North America received approximately $2.3 trillion in cryptocurrency trading value within a year, with monthly peaks occurring in December 2024. The global total market capitalization approached $4 trillion by the end of 2024, with trading volumes also reaching historical highs. In terms of market participants, centralized exchanges (CEX) still dominate the vast majority of spot and derivatives trading: in 2024, the annual spot trading volume of the top 10 CEX reached $17.4 trillion, doubling from the previous year. The share of decentralized exchanges (DEX) has rapidly increased in recent years, with DEX trading volume accounting for about 7.6% of the global total in the first five months of 2025, a significant increase from 3% in 2023. Additionally, large market makers and OTC institutions provide off-exchange liquidity, regarded as the "third pillar of liquidity" following CEX and DEX. Especially for large funds in the hundreds of millions of dollars, OTC trading can avoid public market impacts and facilitate large transactions behind the scenes. Leading market makers and brokers (such as Galaxy Digital, Jump Trading, Wintermute, Cumberland, etc.) play a key role in providing liquidity to exchanges and facilitating large off-exchange transactions. Traditional institutional investors (hedge funds, asset management companies, etc.) are increasingly participating, entering the digital asset market through high-level accounts on exchanges or OTC channels, making the proportion of "large" transactions (>$10 million) in the North American market as high as 45%, far exceeding other regions.

Market Structure Changes and Liquidity: In terms of market structure, there has been a recent trend of integration between on-exchange and off-exchange trading. On one hand, centralized exchanges have undergone a reshuffle; after events like FTX, compliant platforms in North America (such as Coinbase and Kraken) have solidified their positions, while some trading volume has shifted to off-exchange (OTC) and on-chain DEX. Since 2024, OTC market trading has surged: monthly OTC trading volumes in 2024 have consistently exceeded the same period last year, with fourth-quarter off-exchange trading volume increasing by 106% year-on-year, and a further year-on-year surge of 112.6% in the first half of 2025. Institutions tend to complete positions through "dark pool" OTC to reduce impacts on public market prices. This has made OTC an invisible liquidity pool, playing a greater role in smoothing market fluctuations. On the other hand, improvements in decentralized trading technology (such as on-chain order books and Layer 2 scaling) have driven DEX to achieve breakthroughs in long-tail assets and perpetual contracts markets. For example, by 2025, the trading share of decentralized perpetual contract platforms (such as Hyperliquid) has significantly increased. Although CEX still accounts for over 70-80% of total trading volume, DEX, with its transparency and trustless advantages, is becoming an important venue for users to exchange emerging tokens and stablecoins. Overall, market liquidity has significantly improved after the lows of 2022, with the daily trading volume of mainstream cryptocurrencies (BTC, ETH, etc.) returning to the tens of billions of dollars range. Stablecoins have played a key role in enhancing liquidity and transparency: US dollar stablecoins are widely used as a pricing unit, and by the end of 2024, the number of on-chain stablecoin transfers in North America reached a historical high. Because stablecoin transactions are transparent and traceable on-chain, the flow of funds between on-exchange and off-exchange has become more monitorable, thereby enhancing market transparency. Some institutions have also used on-chain analysis tools to monitor fund dynamics, resulting in improved information transparency in the entire market compared to a few years ago. In summary, the North American cryptocurrency trading market is evolving towards a more institutionalized and multi-layered structure: CEX provides basic liquidity and fiat entry/exit, DEX offers long-tail assets and trustless trading, while OTC serves as a connector for large funds, collectively forming a mature market system.

Regulatory Dynamics: The regulatory environment in North America (mainly the United States) has undergone significant changes in recent years, directly affecting market structure and participant behavior. The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have had disagreements over the classification of digital assets, leading to regulatory uncertainty: the SEC has classified most tokens as securities and intensified enforcement, taking legal action against exchanges like Coinbase and Binance in 2023 to "enforce rather than regulate" and clean up illegal issuance and trading. Meanwhile, the CFTC has classified Bitcoin and Ethereum as commodities, authorizing exchanges like the CME to offer regulated futures and options trading. This overlap in SEC/CFTC jurisdiction has resulted in regulatory fragmentation—some trading products can only participate in CFTC-regulated futures markets (such as Bitcoin futures ETFs), while spot exchanges face pressure from the SEC to delist certain tokens or restrict trading options for U.S. users.

The changes in the U.S. political landscape at the end of 2024 brought about a regulatory shift: the new government has shown a more open attitude, with the SEC, OCC, and other agencies retracting previous stringent guidelines that hindered banks from engaging in cryptocurrency business, instead formulating clearer frameworks to encourage traditional institutions to participate. In early 2025, U.S. regulators halted a series of high-profile investigations and enforcement actions, seen as a signal to end the "enforcement regulation" model, with the presidential task force even proposing a policy vision to make the U.S. a "global crypto capital." This policy relaxation directly boosted market confidence and institutional participation. While regulatory clarity has improved, compliance requirements are also increasing: exchanges must adhere to stricter KYC/AML and asset transparency standards, and licensed custodians are gradually entering the market to provide compliant custody and settlement services. Notably, the approval breakthrough for cryptocurrency spot ETFs has become a milestone in U.S. market regulatory dynamics. In early 2024, the first Bitcoin spot ETFs in the U.S. were approved for listing, leading to a boom in cryptocurrency investment products. By July 2025, the global Bitcoin ETF management scale had reached approximately $179.5 billion, with U.S.-listed products accounting for about $120 billion. By intervening in the form of spot ETFs, cryptocurrency assets have gained compliant investment channels through traditional brokerage firms, making it easier for institutional portfolios to allocate assets like Bitcoin. This series of regulatory dynamics has shifted the North American market environment from previous suppression to support, resulting in significant increases in trading volume and asset prices by the end of 2024. Overall, regulatory uncertainty is decreasing, and the compliance market framework is becoming more refined, clearing some obstacles for large financial institutions and publicly traded companies to engage in digital asset trading.

Development Trends: Institutionalization, Derivatives, and New Products

Institutionalization and Strengthened Compliance: The North American cryptocurrency market is undergoing a rapid institutionalization process, with participants expanding from early retail and crypto-native funds to hedge funds, asset management companies, and even traditional banks. In 2024-2025, multiple signs indicate an increase in institutional participation: the proportion of large on-chain transactions is rising, traditional investment banks are applying for trading licenses, and well-known asset management companies (such as BlackRock) are issuing cryptocurrency trust products and even spot ETFs. This is expanding market demand from simple trading to compliant custody, auditing, and risk control services. The increase in compliance demand is forcing standardization across various industry segments: exchanges are adding compliance departments and introducing on-chain analysis and monitoring tools, while OTC businesses are proactively accepting regulatory filings or obtaining licenses (for example, regions like Hong Kong and Singapore are issuing OTC licenses to attract institutional trading). The U.S. sectoral regulatory model is also prompting trading companies to adjust their business structures: some platforms choose to register as ATS (Alternative Trading Systems) or brokers, accepting SEC regulation to provide trading for security tokens; others focus on commodity-type assets regulated by the CFTC. Overall, the entry of "institutional funds" is making the market more focused on compliance transparency and risk management, driving industry reshuffling, with strong and compliant companies (such as Coinbase and Fidelity Digital Assets) gaining advantageous positions. Companies like Galaxy Digital, which have a Wall Street background and cover multiple businesses, are viewed as preferred partners by many institutions because they can provide one-stop compliance services and experience. For example, Galaxy, as a cryptocurrency investment bank, has established confidence among institutional clients based on the Wall Street experience of its founding team and corporate governance, with substantial traditional funds entering the cryptocurrency space through its OTC and asset management platforms. It is foreseeable that the proportion of institutions and trading volumes will continue to rise, leading to a more mature and stable market with relatively converging volatility.

Expansion of the Derivatives Market: Derivatives have become one of the fastest-growing areas in the cryptocurrency market. As early as 2023, the global cryptocurrency derivatives trading volume was several times that of spot trading, and it has rapidly developed since 2024. In North America, derivatives trading is mainly conducted through regulated platforms under supervision: the CME's Bitcoin and Ethereum futures and options volumes have reached new highs, with the average daily trading volume of Bitcoin futures significantly increasing by the end of 2024 compared to the beginning of the year. At the same time, there is strong demand for off-exchange derivatives, with institutions often using forwards, swaps, and other tools to hedge risks or obtain returns. Traders like Galaxy provide a suite of customized derivatives services, including options and swaps, offering channels for mining companies, cryptocurrency funds, and other clients to hedge price fluctuations or amplify returns. Notably, innovative products like perpetual contracts are rising in the decentralized space, with trading volume on decentralized perpetual exchanges accounting for about 4-5% of all futures volume in 2024, further increasing in 2025. This indicates that derivatives trading is expanding from centralized to decentralized platforms. In the future, as regulations gradually allow more types of cryptocurrency derivatives (such as options based on spot ETFs, volatility indices, etc.), the capacity of the derivatives market is expected to expand, attracting more professional trading companies to participate and providing deeper liquidity and pricing efficiency for the market. Risk management and clearing will evolve accordingly, potentially introducing new models for central clearing counterparties (CCP) or blockchain smart contract clearing, enhancing the stability of the derivatives market.

Custody Integration and New Product Innovation: As institutionalization advances, the trend of integrating "trading - custody - clearing" has become evident. Compliant custodians have become a necessary component for institutions participating in digital asset trading: custodians and trading platforms are seamlessly connected through APIs, enabling rapid transfers of assets between cold storage custody accounts and exchanges, thus ensuring security while not missing trading opportunities. This integration has given rise to the "crypto prime brokerage" model, providing comprehensive services such as custody, financing, and execution both on and off the exchange. For example, Coinbase and Fidelity have launched comprehensive platforms aimed at institutions. Galaxy Digital is building a similar all-encompassing service system by acquiring custody technology (such as its acquisition of the GK8 self-custody platform) and integrating its own OTC and brokerage businesses to meet the "one-stop" needs of institutions. On the other hand, new trading products are continuously emerging and impacting market structure. Among them, stablecoins remain one of the most important innovations in the trading field: US dollar stablecoins have become the base currency for many trading pairs, reducing friction in fiat deposits and withdrawals and enabling 24/7 continuous trading. In the second half of 2024, the use of stablecoins surged, with monthly on-chain transfer numbers reaching record highs. The widespread application of stablecoins has improved the international consistency of market liquidity, ensuring that there is a significant amount of US dollar liquidity available for trading at any time globally. Additionally, the emergence of physically-backed ETFs (such as Bitcoin spot ETFs) in North America has provided a bridge for traditional funds to enter the market. After the first Bitcoin physical ETFs were launched in 2024, their scale skyrocketed to hundreds of billions of dollars within a year. The combination of stablecoins and ETFs allows investors to choose between two distinctly different channels to gain exposure to crypto assets, either on-chain or through securities accounts, which will somewhat change the trading structure: some trading volume may shift from crypto-native exchanges to ETF products listed on traditional exchanges (especially for long-term allocation funds), while stablecoins continue to play a role in on-chain and off-exchange trading settlement. Overall, the emergence of new products in the crypto trading market enriches investment strategies and triggers a reconfiguration of market structure, requiring industry participants to continuously adapt to the opportunities and challenges brought by innovation.

Characteristics of the North American Market and the Role of Galaxy Digital

Regulatory Fragmentation and Regional Characteristics: One major characteristic of the North American (U.S.) market is its complex regulatory system, which coexists at both federal and state levels. This has led to particularly pronounced regulatory fragmentation in the crypto space: the SEC and CFTC are in a tug-of-war over jurisdiction, federal regulations have yet to be unified, and various states (such as New York's BitLicense and exemptions in Xinjiang) have their own regulations, requiring market participants to navigate compliance requirements cautiously. This environment has historically created uncertainty for exchanges and investors; for example, some U.S. exchanges have reduced the range of tokens listed for compliance reasons, and institutions have slowed their investments due to concerns about regulatory repercussions. On the other hand, North America's highly developed financial infrastructure and rule of law environment have positioned it at the forefront of compliance innovation. The U.S. has launched futures-based crypto ETFs, and Canada was the first to approve Bitcoin spot ETFs, reflecting North America's willingness to embrace new assets within traditional frameworks. Investors in the U.S. and Canada are also more accustomed to regulated investment channels, preferring to trade digital assets through monitored platforms. This has made compliant custodians and regulated trading platforms crucial in North America. For instance, the Bakkt platform, established by ICE, the parent company of the New York Stock Exchange, initially attracted significant attention as a regulated digital asset custody and futures exchange, despite undergoing several strategic adjustments. Coinbase, as the largest compliant crypto exchange in the U.S., holds significant shares in both retail and institutional markets, and since its listing, it has leaned towards regulatory cooperation, being viewed as a "white list" member of the industry. In contrast, many global exchanges (such as Binance) face strict restrictions or have exited the North American market. This has led to a more localized trading landscape in North America, dominated by a few compliant giants (such as Coinbase and Kraken) and specialized service providers. North American investors also place a greater emphasis on transparency and auditing, requiring platforms to regularly disclose asset reserves and undergo independent audits, which are higher than some overseas market standards. Overall, the North American market is known for its high compliance and high institutional participation, and while its structure has been fragmented due to regulatory division, it is expected to gradually unify through new legislation (such as the market structure bill promoted by Congress) around 2025, laying a systemic foundation for the long-term development of the industry.

Roles of Platforms like Coinbase/Bakkt: Coinbase, as the undisputed leading exchange in North America, plays a dual role in the ecosystem as both a "retail entry + institutional portal." Its retail trading volume is substantial, and its institutional business (Coinbase Prime) serves hedge funds, corporate treasuries, and others, providing custody and large-scale matching services. After its listing, Coinbase became well-capitalized and actively developed its derivatives business starting in 2023 (gaining regulatory approval to offer crypto futures trading to U.S. users), becoming one of the main liquidity providers in the U.S. market while solidifying its spot market share. Bakkt initially started with physically delivered Bitcoin futures, attracting attention but with limited trading volume. Bakkt later transformed into a digital asset custody and settlement network aimed at institutions and businesses, entering the securities brokerage crypto service sector through acquisitions (such as acquiring Apex Crypto). Although Bakkt has a quieter presence on the retail side, it is backed by a traditional exchange group and has accumulated resources in compliant custody and payments. In the North American market, platforms like Bakkt with traditional backgrounds provide secure and compliant infrastructure for institutions, complementing the services of emerging crypto companies. It can be said that Coinbase represents a typical case of a crypto-native enterprise successfully embracing regulation and growing, while Bakkt represents the exploration of traditional finance entering the digital asset space. Both have enhanced North America's appeal to mainstream institutions. In addition to these two, licensed U.S. trading platforms like Kraken and Gemini also have their unique characteristics (for example, Gemini focuses on compliance and conservative listing strategies, while Kraken offers a variety of derivatives), collectively forming a matrix of North American trading platforms. The existence of these platforms ensures that institutions in the U.S. have "reliable" trading channels without having to rely on offshore markets, making the North American trading ecosystem healthier and more transparent.

Galaxy Digital's Positioning and Competitive Landscape: As mentioned in the previous business analysis, Galaxy's core positioning in the crypto trading space includes: market making/OTC brokerage, institutional brokerage and advisory, investment banking, asset management, and infrastructure. Through a diversified layout, Galaxy has established a certain degree of business synergy: its self-developed GalaxyOne trading platform, deep institutional relationships, and diversified revenue sources allow it to stand out in competition. In contrast, other competitors in the North American market have their own focuses: Coinbase emphasizes exchanges and custody, Fidelity focuses on custody and custody trading, while market makers like Cumberland and Jump specialize in market making, and traditional investment banks like Goldman Sachs and Citigroup also provide some brokerage or liquidity services. However, Galaxy, with its "trading + asset management + infrastructure" full-stack model, is relatively unique in the industry. Its main competition comes from comprehensive platforms like Coinbase and some emerging crypto financial companies (such as Fidelity Digital Assets, Anchorage, FalconX, etc., as prime brokers). Galaxy's advantages lie in its breadth of services and flexibility: it can act as a market maker providing deep liquidity (which is the most valued factor by institutions) while also obtaining high-end client business in its investment banking role. Recently, Galaxy successfully raised funds by listing on NASDAQ (in May 2025), enhancing its brand and transparency.

Overall, in the landscape of the North American institutional crypto market, Galaxy Digital occupies a leading position in the second tier: it may not be as large as Coinbase, but it has established a strong reputation in the institutional service sector, forming a competitive and cooperative relationship with traditional giants and specialized market makers. Looking ahead, as the crypto market becomes further institutionalized, Galaxy is expected to secure a place in the North American digital asset investment banking/brokerage sector through its comprehensive layout and compliant operations, shaping the industry landscape alongside other leading players.

3.2 AI Computing Power Infrastructure Industry

Industry Status: AI Computing Power Demand and Bottlenecks

Explosive Demand for AI Computing Power: In recent years, the demand for computing power for training and inference of artificial intelligence models has surged exponentially. Especially for large-scale pre-trained models (such as GPT-4, PaLM, etc.), the number of parameters reaches hundreds of billions, and their training process requires massive parallel computing. From 2023 to 2025, large tech companies and startup AI labs are competing to train larger models for applications in natural language processing, image generation, and other fields, directly driving an explosion in demand for GPU clusters. Industry observations indicate that training cutting-edge AI models often requires hundreds or even thousands of high-end GPUs running continuously for weeks or even months, a computing demand far exceeding that of traditional applications. Even in the model deployment phase, AI inference services supporting millions of users also require substantial computing power. This trend has made computing power a key "production resource" in the AI era, with a growing imbalance between supply and demand. North America, as a core region for AI technology development, is home to major power consumers like Google, OpenAI, and Meta, leading to particularly strong demand for high-performance computing (HPC) infrastructure. Some forecasts suggest that by 2025, global AI training computing demand will grow several times compared to 2022, urgently necessitating large-scale data center expansions to accommodate this demand. Overall, AI computing power has become a bottleneck constraining AI progress, with the industry even witnessing a "computing power arms race," as companies invest heavily to stockpile GPUs and build computing clusters in a bid to gain an edge in the new round of AI technology competition.

Transition from "Chip Shortage" to "Power Shortage": The most critical bottleneck currently facing the North American data center industry is undergoing a fundamental shift. If the focus in the past two years was on the shortage of GPU chips, the core contradiction in the next five years will be the insufficient power access and grid capacity. According to research by Goldman Sachs, driven by the dual demands of training and inference for generative AI large models, the power demand of U.S. data centers is expected to grow at a compound annual growth rate of 15% from 2023 to 2030, with total demand projected to reach 45GW by 2030. However, the reality is that the pace of building power grid infrastructure is lagging far behind this demand growth.

The power supply shortage is not merely due to a lack of generation capacity but is more about bottlenecks in the transmission and distribution network. In major data center cluster regions in the U.S. (such as Northern Virginia), the timelines for grid interconnection and substation construction have been significantly extended, with some projects' waiting times increasing from the previous 1-2 years to 2-4 years or even longer. Additionally, the supply chain for critical electrical equipment like transformers has also faced severe congestion, leading to significantly extended delivery cycles. This lag in physical infrastructure has led to a reassessment of the value of power assets with "instant access" capabilities.

In this context, the "power shell" held by Bitcoin mining companies—namely, approved large-scale power capacity, ready land reserves, water resource permits, and existing high-voltage substation infrastructure—has become a strategically valuable scarce asset. Traditional data center operators and hyperscale cloud service providers urgently need these sites to quickly deploy GPU clusters and seize the time window for AI development.

In fact, the reason Coreweave is willing to sign a lease agreement with terms that seem very favorable to Galaxy, as mentioned above, is due to the 800MV power grid connection permit of the Helios mining site. According to the Q3 2025 financial report, Coreweave has a revenue backlog of up to $55.6 billion, and its demand for computing power infrastructure is extremely high, with the main concern in the market being its performance accuracy.

Representing Enterprises and Their Strategies: The North American AI computing power infrastructure sector has seen the emergence of various players, including cloud giants, specialized computing power providers, and traditional data center companies, all working together to meet market demand.

First, large cloud service providers remain the dominant force: Amazon AWS has the most data center facilities globally and continues to invest in GPU/AI chips (developing its own Inferentia/Trainium chips) to meet customer AI needs. AWS is building or renovating available zones that support HPC in various locations across the U.S. and has launched products like the P4d instance (equipped with NVIDIA GPUs) to serve enterprises. Microsoft Azure, backed by its deep collaboration with OpenAI, is aggressively expanding its supercomputing clusters, having built AI supercomputing centers specifically for OpenAI in places like Iowa, USA. Reports indicate that Microsoft has invested billions of dollars for this purpose. Google Cloud, with its TPU cluster advantage, is also continuously expanding data centers domestically in the U.S. and providing AI platform services. These giants leverage their substantial funding and comprehensive technology to provide IaaS/PaaS services through their self-built data center networks, capturing a significant share of the high-end market.

Secondly, emerging specialized computing power cloud companies are rapidly rising, with CoreWeave as a representative player. Originating from crypto mining, CoreWeave has gained significant capital attention after transitioning to AI cloud services, raising over $1.1 billion in cumulative financing and $2.3 billion in debt financing from 2023 to 2024. It focuses on providing GPU computing power as a service, optimizing infrastructure for AI training, and continuously expanding its data center footprint. CoreWeave's strategy is to widely establish regional computing power centers across North America to serve AI companies nearby while rapidly enhancing power supply capabilities through partnerships with real estate and power partners. The continuously rising stock price after its listing and the $6.3 billion investment agreement with NVDA also reflect the market's enthusiasm.

Thirdly, traditional data centers and hosting service providers have also joined the fray: Neutral hosting providers like Equinix, while primarily focused on network nodes and enterprise hosting, have recognized the high power demand brought by the AI wave and have begun to retrofit some data centers to support GPU deployments, collaborating with cloud providers to offer "edge computing" services. Switch, a large U.S. data center operator known for its high-density design, has continued to expand its campuses in Nevada and other locations after being privatized in recent years, with its advanced cooling technology being very attractive to HPC customers.

The capital market's attitude towards this sector is extremely positive: AI computing power is seen as an opportunity for "next-generation infrastructure," with related companies frequently securing large financing and high valuations. For example, CoreWeave raised over $2.5 billion in a short period, including funding from well-known institutions like Blackstone and Coatue; its valuation has also continued to rise post-listing, with a market cap peak in June approaching $100 billion, currently still near $40 billion. TeraWulf successfully brought in Google as a strategic investor; even traditional data center REITs like Equinix have seen their stock prices boosted by AI demand expectations. It can be said that the capital market compares AI infrastructure to the early days of cloud computing infrastructure, assigning high growth expectations. Publicly listed or soon-to-be-listed computing power companies are being pursued by investors, with valuations soaring, reflecting market confidence in the sustainability of AI computing power demand. Of course, there are rational voices concerned about profit models (the interest burden from extensive borrowing) and uncertainties that may arise from chip supply bottlenecks. However, overall, AI computing power infrastructure is regarded as one of the most strategically valuable assets in the current technology cycle, with a generally positive and optimistic attitude from the capital market.

Development Trends: IaaS Model, Mining Transformation, and Regional Competition

IaaS Leasing vs. Self-Build Model Divergence: In the supply model of AI computing power, the industry is witnessing a divergence between two routes. One is the Infrastructure as a Service (IaaS)/leasing model, where specialized computing power providers or cloud vendors build large GPU clusters centrally, and enterprise users lease according to their usage. The advantage of this model is that users do not need to incur upfront capital expenditures and operational maintenance investments, allowing for flexible access to computing power to meet peak demand. CoreWeave and AWS are representatives of this route, capitalizing computing power investments to be shared among numerous customers. In AI startups and small to medium enterprises, the leasing model is the primary choice, as the barriers to building clusters independently are too high and the technology is complex. However, as the computing power demand from top AI labs and large companies continues to rise, another self-build model is gaining attention: sufficiently large institutions, for cost and control considerations, tend to invest directly in building dedicated data centers. For example, OpenAI, backed by Microsoft, has plans for self-developed computing facilities; Tesla is building its own Dojo supercomputer for autonomous driving training; some companies with extremely high computing power needs are even purchasing land and power plants to create their own campuses. The self-build model can optimize hardware architecture for specific workloads and secure long-term supply, but it tests financial strength and management capabilities. Therefore, the industry currently shows a polarization: super computing power demanders tend to vertically integrate their own infrastructure, while most small to medium AI projects still rely on third-party computing power clouds. In the coming years, a development trajectory similar to that of cloud computing may emerge—hybrid models becoming mainstream: leading tech companies will have core self-owned computing power while renting some external computing power to meet flexible demands, while medium-sized enterprises will primarily lease, supplemented by a small amount of local or edge deployments. For computing power providers, this means opportunities for customized services: offering dedicated hosting (renting an entire data center to a single client) or remote dedicated line connection services, allowing large clients to enjoy the security of self-built facilities while having the flexibility of the cloud. IaaS vendors will also lock in large clients through long-term contracts (such as CoreWeave signing multi-year leases with numerous AI labs), approaching traditional IT outsourcing models. In short, the coexistence of leasing and self-building will be a trend, depending on user scale and demand characteristics, with the industry chain finding a balance between standardized services and customized delivery.