Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

In the United States, due to signs of fatigue in the labor market, institutions like Goldman Sachs predict that the Federal Reserve is almost certain to cut interest rates in December, with the market pricing in a rate cut probability as high as 87%. At the same time, discussions about the next Federal Reserve chair have also drawn attention, with White House National Economic Council Director Hassett seen as a leading candidate, whose stance may push for a more aggressive rate cut policy. In stark contrast, Bank of Japan Governor Ueda has issued the clearest signal yet for a rate hike, suggesting a possible adjustment in December and plans to clarify the future path once rates reach 0.75%.

On the regulatory front, the People's Bank of China convened a multi-department meeting on November 29, reiterating its crackdown on virtual currencies and for the first time defining stablecoins as a form of virtual currency that poses risks of money laundering and illegal fundraising. Meanwhile, investigative reports on cryptocurrency speculation show that this behavior is gradually infiltrating mainstream social and e-commerce platforms, including Xiaohongshu and Taobao, creating traps for ordinary investors. Regulatory authorities may further intensify oversight of virtual currency-related activities to prevent potential financial risks and protect investor rights. In this environment, risk-averse sentiment and demand for scarce assets have risen, with spot silver prices driven by supply tightness and rate cut expectations, historically breaking through $57/ounce, while gold prices remain strong. However, the traditional "Christmas rally" in U.S. stocks may be absent this year, as Wall Street strategists point out that the disruptive impact of AI and ongoing market volatility have broken past seasonal patterns, adding uncertainty to the year-end performance of risk assets.

Bitcoin closed at $90,360 in November, marking its worst November performance since 2018, with a monthly decline of 17.55%. This downward trend continued on December 1, with the market starting "in the red," dropping over 5% at one point and falling below $86,000. This volatility triggered large-scale leveraged liquidations, further exacerbating market uncertainty. Noted trader Peter Brandt indicated that Bitcoin prices could fall below $70,000, with support at the mid-$40,000 range. Analyst James Wynn believes the market is in a phase of "anxiety and denial," with an initial target price of $67,000 and potential further declines to the $40,000 to $50,000 range. Economic analyst Timothy Peterson's analysis shows that the current Bitcoin trend has a 98% correlation with the monthly line of the 2022 bear market, suggesting that a true recovery may not occur until the first quarter of next year. Analyst Aylo also pointed out from a historical cycle perspective that Bitcoin tends to fall back to the 200-week moving average (currently around $63,000 to $65,000) after reaching a peak, and believes that miners turning to AI and other factors may act as a downward catalyst.

On the other hand, some analysts hold relatively optimistic or neutral views. Analyst Sykodelic believes this drop is a healthy liquidity cleansing. CrypNuevo predicts prices may fluctuate in the $80,000 to $99,000 range, with key resistance at $94,500. If this level is broken, prices may test the major resistance at $99,000. In this context, CoinAnk's liquidation heatmap shows short-term support at $83,200 to $84,000, while short-term upward resistance is between $94,000 and $95,200. The CEO of Strategy reiterated that Bitcoin will only be sold when its net asset value (mNAV) falls below 1 and funds cannot be secured.

Ethereum's trend is similar to Bitcoin's. Analyst Daan Crypto Trades noted that ETH is currently fluctuating in the key range of $2,600 to $3,000; if it breaks above $3,000, it may rise to $3,300-$3,400; conversely, if it falls below $2,600, it may drop to the low of $2,000. Analyst Man of Bitcoin also believes that ETH has not yet shown a clear bottoming signal, with key levels at $2,903. However, the market also faces selling pressure, as data from ValidatorQueue predicts that by the end of December, approximately 1.5 million ETH will have exited staking, which may be related to institutional rebalancing and market volatility.

Recently, project-related risk events have occurred frequently. The Yearn Finance yETH stablecoin pool was attacked, with the attacker exploiting an infinite minting vulnerability to drain the fund pool, resulting in a loss of about $9 million. Although the Yearn team stated that other core vaults were unaffected, the incident raised concerns about DeFi security in the market. Meanwhile, the SAHARA token price plummeted over 55%, with KOL disclosing that the reason was due to its active market maker being liquidated by exchanges due to abnormal operations on other projects, leading to forced liquidation of positions. Additionally, in the current panic sentiment, Binance announced that it would place tokens such as DENT, CHESS, SXP under monitoring labels, causing these tokens' prices to generally drop over 20%.

2. Key Data (as of December 1, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $8,576 (YTD -7.82%), daily spot trading volume $61.03 billion

Ethereum: $2,827 (YTD -15.18%), daily spot trading volume $20.53 billion

Fear and Greed Index: 24 (Fear)

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

Market share: BTC 58.7%, ETH 11.6%

Upbit 24-hour trading volume ranking: XRP, BTC, LSK, WAL

24-hour BTC long-short ratio: 48.49% / 51.51%

Sector performance: DePIN sector down 9.23%, L2 sector down 8.98%

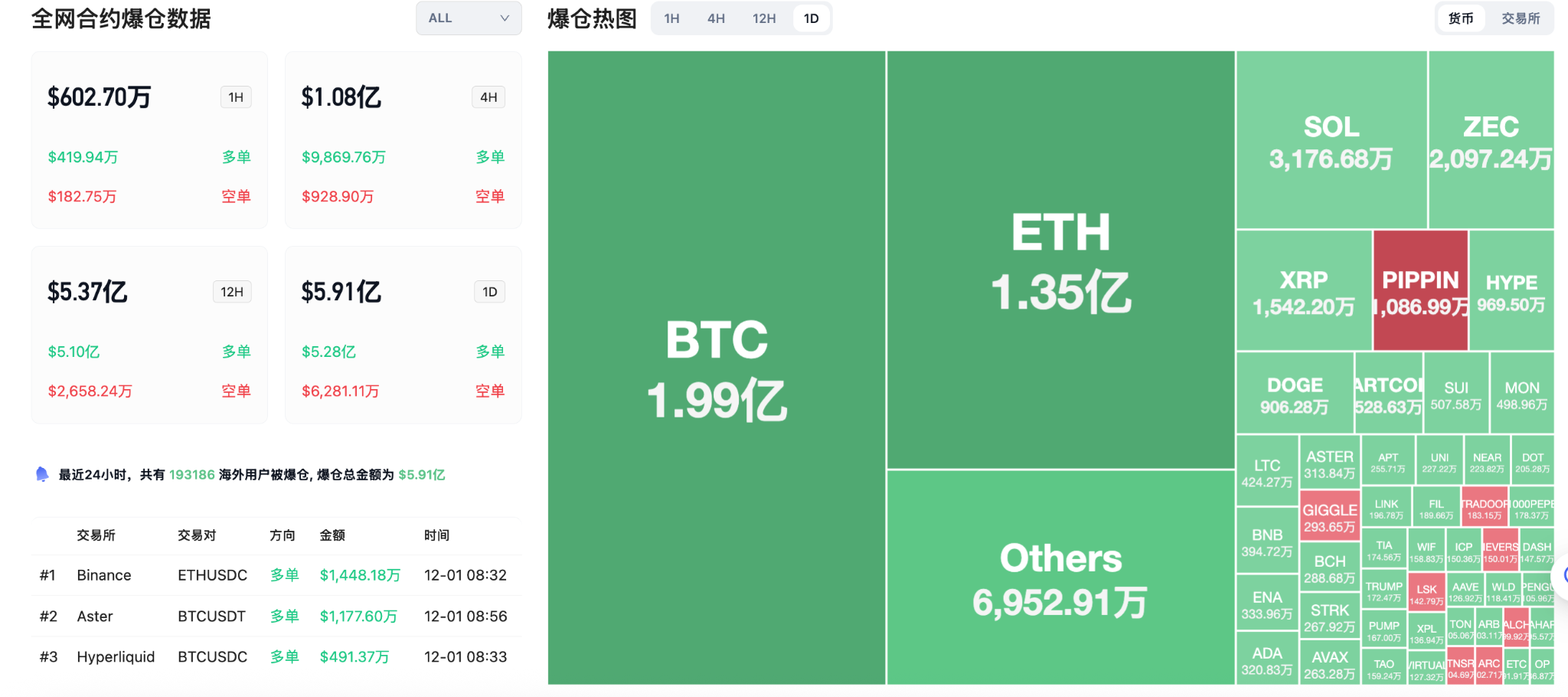

24-hour liquidation data: A total of 193,186 people were liquidated globally, with a total liquidation amount of $591 million, including $199 million in BTC liquidations, $135 million in ETH liquidations, and $31.77 million in SOL liquidations.

3. ETF Flows (as of November 28)

Bitcoin ETF: +$71.371 million, net inflow for 3 consecutive days

Ethereum ETF: +$76.5491 million, net inflow for 5 consecutive days

Solana ETF: +$5.37 million

XRP ETF: +$22.68 million

4. Today's Outlook

Sui (SUI) will unlock approximately 55.54 million tokens on December 1 at 8 AM, accounting for 0.56% of the total supply, valued at approximately $85 million;

Santos FC Fan Token (SANTOS) will unlock approximately 5.7 million tokens on December 1 at 8 AM, accounting for 19% of the total supply, valued at approximately $12.7 million;

Walrus (WAL) will unlock approximately 32.7 million tokens on December 1 at 8 AM, accounting for 0.65% of the total supply, valued at approximately $5.5 million;

Ethena (ENA) will unlock approximately 95.31 million tokens on December 2 at 8 AM, accounting for 0.64% of the total supply, valued at approximately $27.2 million;

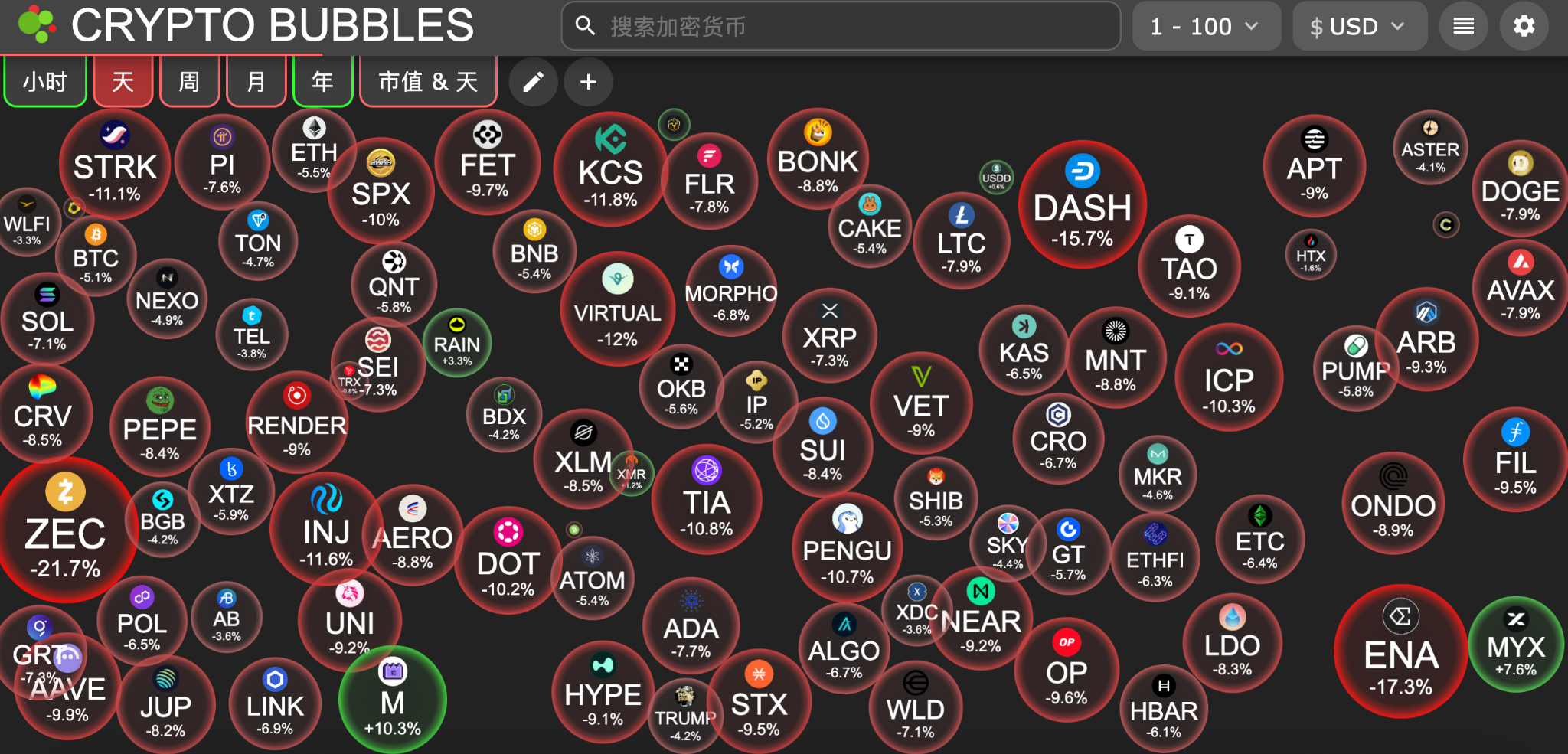

Today's largest declines among the top 100 cryptocurrencies by market capitalization: Zcash down 21.7%, Ethena down 17.2%, Dash down 15.5%, KuCoin down 12.1%, Virtuals Protocol down 12%.

5. Hot News

November crypto trading volume fell to approximately $1.6 trillion, hitting a new low since June

Total cryptocurrency market capitalization evaporated $140 billion in the past 4 hours

Data: Token sales in November raised $14.47 billion, the highest month in the past two years

A certain ancient ETH whale sold 7,000 ETH in the past month, potentially profiting $19.745 million

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。