Author: 1912212.eth, Foresight News

After BTC slowly rose from $86,000 to $93,000, the market has not yet paused. At 8 AM Beijing time on December 1, BTC plummeted 3.7% within an hour, dropping below $87,000 from $90,000. ETH also fell from around $3,000 to about $2,800, with altcoins experiencing a widespread decline.

Coinglass data shows that in the past 4 hours, the entire network saw liquidations of $434 million, with long positions accounting for $423 million.

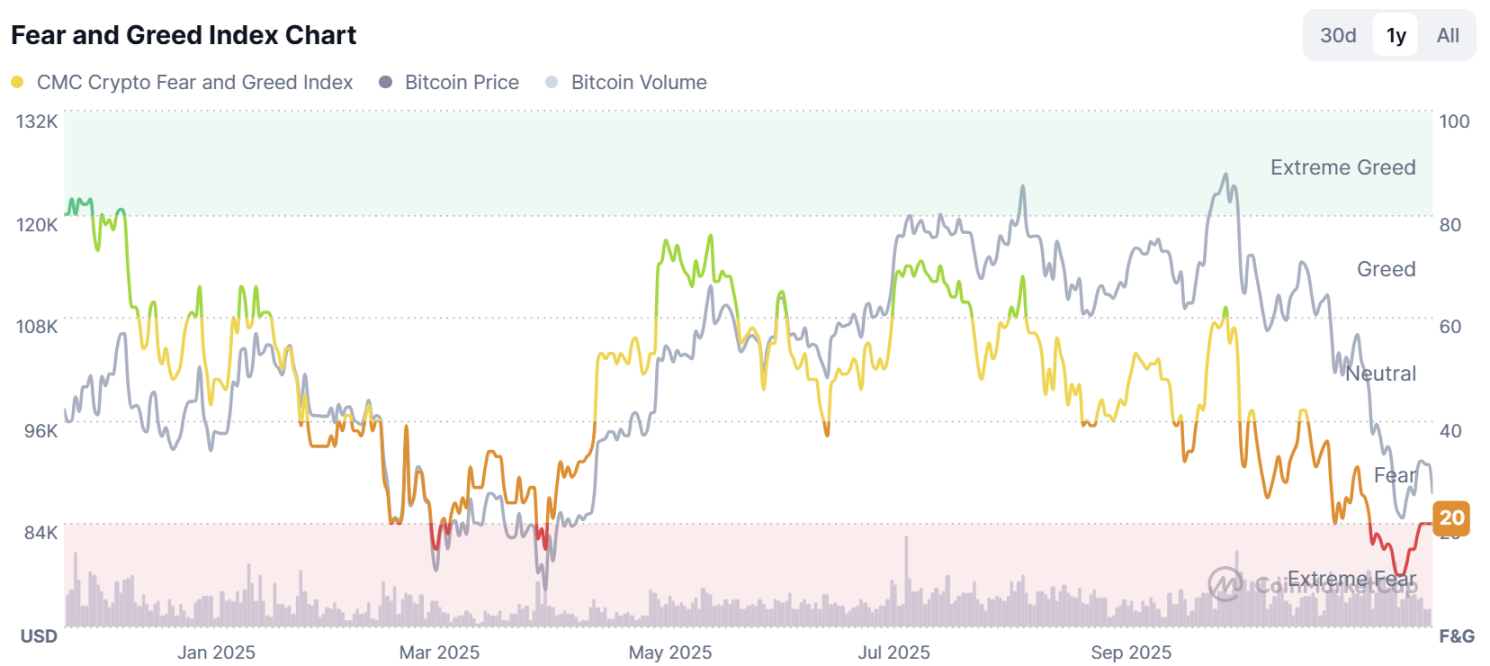

Market sentiment has once again plunged into extreme panic. This time, the timing of the sell-off was remarkably precise. The last hour of November was forcefully smashed into a large bearish candlestick with an exceptionally long upper shadow, completely destroying the last bit of confidence among bulls. The monthly candlestick closed bearish, technically declaring a "destruction of the bull market structure," potentially unraveling all bullish formations on the weekly and monthly levels.

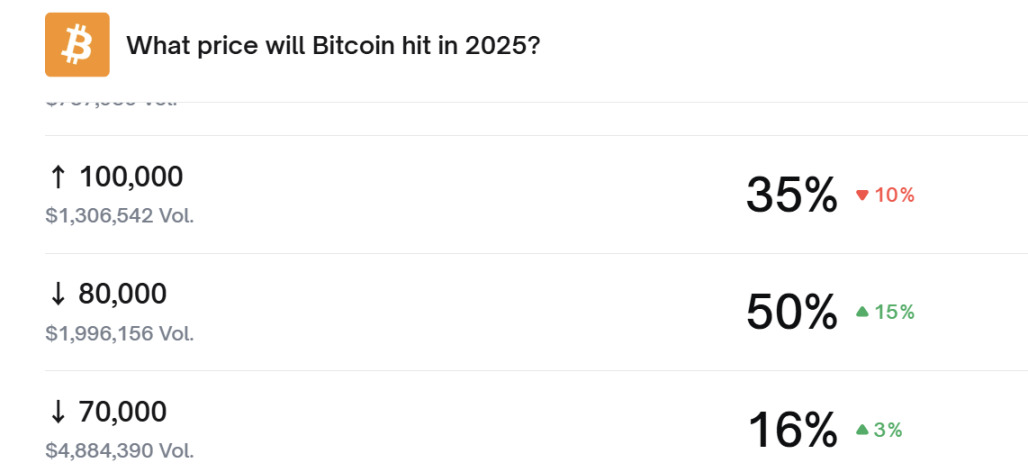

On Polymarket, the probability of BTC rebounding to $100,000 by 2025 has dropped to 35%, while the probability of it falling to $80,000 has increased by 15% to 50%.

The real trigger this time was not the Federal Reserve, not Trump's policies, nor the increasingly stringent regulations in China.

On November 29, the People's Bank of China held a meeting to coordinate efforts to combat virtual currency trading speculation. Officials from the Ministry of Public Security, the Central Cyberspace Administration, the Central Financial Office, the Supreme People's Court, the Supreme People's Procuratorate, the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Justice, the People's Bank of China, the State Administration for Market Regulation, the National Financial Regulatory Administration, the China Securities Regulatory Commission, and the State Administration of Foreign Exchange attended the meeting. The meeting emphasized that virtual currencies do not have the same legal status as legal tender, do not have legal compensation, and should not and cannot circulate as currency in the market. Activities related to virtual currencies are considered illegal financial activities. Stablecoins are a form of virtual currency that currently cannot effectively meet requirements for customer identity verification, anti-money laundering, and other aspects, posing risks of being used for money laundering, fundraising fraud, and illegal cross-border fund transfers.

The meeting required all units to adhere to Xi Jinping's Thought on Socialism with Chinese Characteristics for a New Era, fully implement the spirit of the 20th National Congress of the Communist Party and the subsequent plenary sessions, treat risk prevention and control as a permanent theme of financial work, continue to uphold prohibitive policies on virtual currencies, and persistently combat illegal financial activities related to virtual currencies. All units should deepen collaboration, improve regulatory policies and legal bases, focus on key areas such as information flow and capital flow, enhance information sharing, further improve monitoring capabilities, and severely crack down on illegal activities to protect the property safety of the people and maintain the stability of the economic and financial order.

The extensive involvement of various departments in this crackdown and the classification of stablecoins as a form of virtual currency while warning of risks such as money laundering and fraud undoubtedly poured cold water on the already precarious market confidence.

The policies of 94 in 2017 and 519 in 2021 both caused significant pullbacks in the crypto market in a short period.

The market has never lacked stories, and this time the story is called "the last batch of funds from China forcibly exiting." Once the story is told, it marks the beginning of a long winter.

However, some viewpoints suggest that since the crash on October 11, the inflow of funds into the market and macroeconomic uncertainties have had a severe negative impact on the crypto market.

Rob Hadick, a general partner at Dragonfly, stated that this deleveraging event, triggered by low liquidity, poor risk management, and weak oracle or leverage mechanisms, has caused significant losses and brought about great uncertainty.

Boris Revsin, a general partner and managing director at Tribe Capital, shares the same view, calling it a "leverage washout" that has created a chain reaction throughout the market. At the same time, the macro environment has also become less friendly: short-term interest rate cut expectations have faded, inflation remains stubborn, the job market is weakening, geopolitical risks are rising, and consumer pressures are increasing.

Anirudh Pai, a partner at Robot Ventures, emphasized concerns about the slowdown of the U.S. economy. Key growth indicators—including the Citigroup Economic Surprise Index and 1-year inflation swaps (derivatives used to hedge against inflation risk)—have begun to weaken. Pai noted that this pattern has previously appeared before recession concerns, driving broader risk-averse sentiment.

Dan Matuszewski, co-founder of CMS Holdings, stated that aside from tokens supported by buyback mechanisms, the crypto market has almost no "incremental capital inflow," except for DAT (Digital Asset Treasury) companies. As new demand dries up and ETF inflows no longer provide effective support, price declines accelerate.

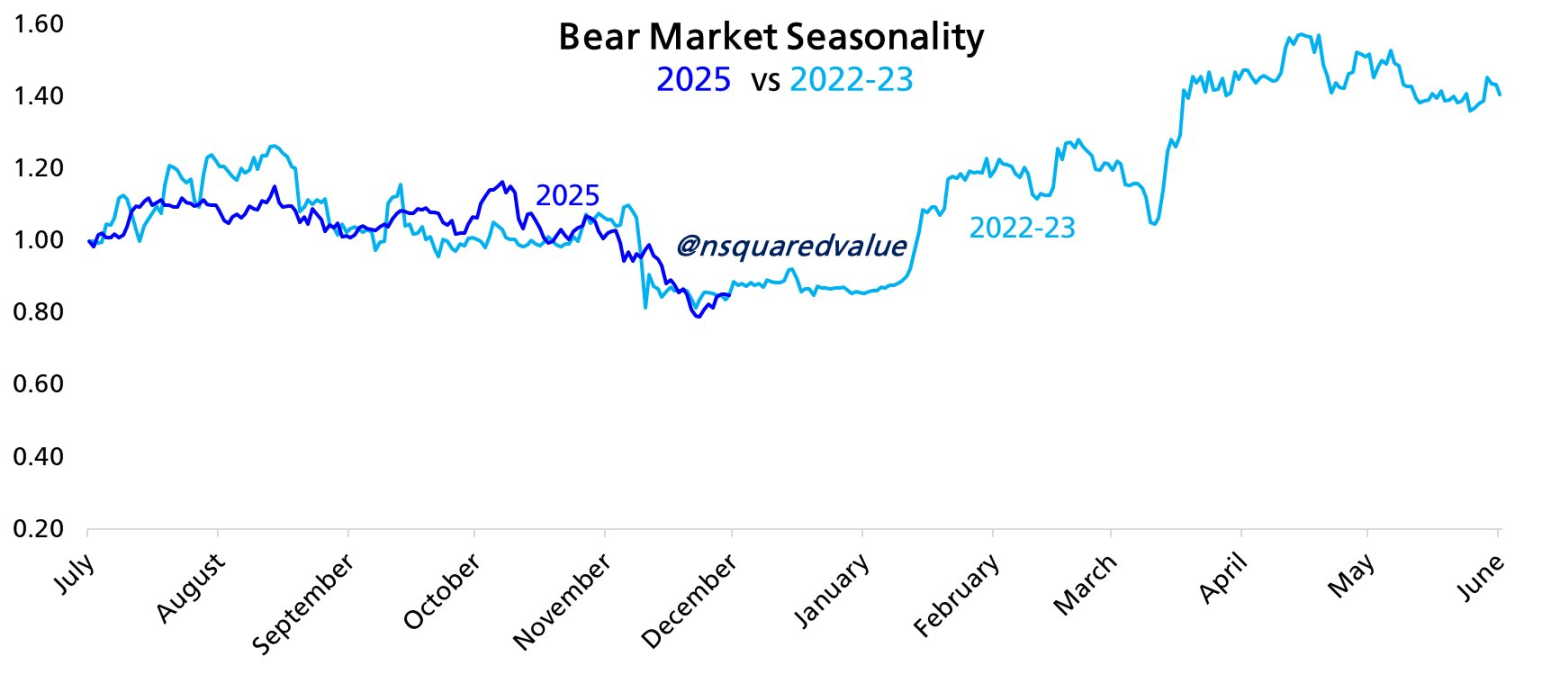

Analyst Timothy Peterson indicated that the current Bitcoin trend is highly similar to the bear market of 2022, with an 80% correlation on the daily chart and a 98% correlation on the monthly chart compared to 2022. If history repeats itself, a true rebound in Bitcoin's price may not occur until the first quarter of next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。