Compiled by: Jerry, ChainCatcher

Last Week's Performance of Crypto Spot ETFs

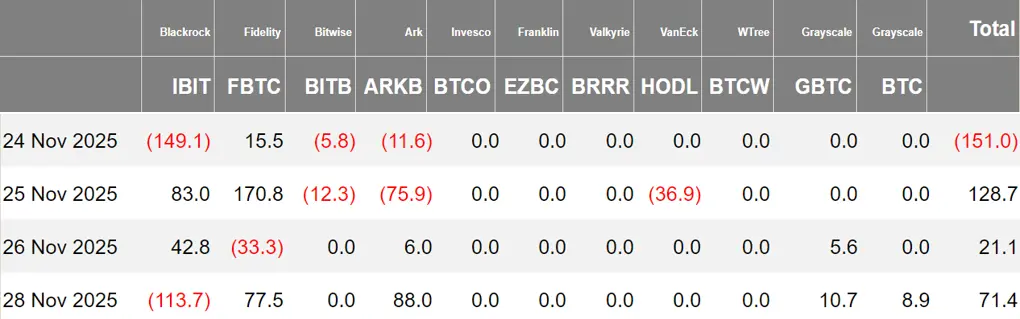

US Bitcoin Spot ETF Net Inflow of $70.2 Million

Last week, the US Bitcoin spot ETF saw a net inflow for five consecutive days, totaling $70.2 million, with a total net asset value reaching $11.939 billion.

Four ETFs were in a net inflow state last week, with inflows mainly from FBTC, GBTC, and BTC, which saw inflows of $230 million, $16.3 million, and $8.9 million, respectively.

Data Source: Farside Investors

US Ethereum Spot ETF Net Inflow of $312 Million

Last week, the US Ethereum spot ETF experienced a net inflow for four consecutive days, totaling $312 million, with a total net asset value reaching $1.915 billion.

The inflow last week mainly came from BlackRock's ETHA, which had a net inflow of $257 million. All four Ethereum spot ETFs were in a net inflow state.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 18.81 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 18.81 Bitcoins, with a net asset value of $33.9 million. The holdings of the issuer, Harvest Bitcoin, decreased to 291.56 Bitcoins, while Huaxia's holdings dropped to 2,300 Bitcoins.

The Hong Kong Ethereum spot ETF had no capital inflow, with a net asset value of $9.817 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of November 26, the nominal total trading volume of US Bitcoin spot ETF options was $3.24 billion, with a nominal total trading long-short ratio of 6.17.

As of November 26, the nominal total open interest of US Bitcoin spot ETF options reached $30.34 billion, with a nominal total open interest long-short ratio of 1.88.

The market's short-term trading activity for Bitcoin spot ETF options has decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 52.00%.

Data Source: SoSoValue

Overview of Last Week's Crypto ETF Developments

Pionex Ethereum ETF to be Listed on December 3 on Hong Kong Stock Exchange, Directly Holds ETH

Virtual asset management service licensed company Pionex officially announced that its Ethereum ETF will be listed on the Hong Kong Stock Exchange on December 3, with the stock code 3085.HK. This ETF directly holds Ethereum and is benchmarked against the CME CF Ethereum USD Index (Asia-Pacific closing price). Hong Kong investors can use their existing securities accounts to trade through cash or physical redemption options, with a trading unit of 100 shares and a minimum subscription amount of HKD 850.

CoinShares Withdraws Filing for Staking Solana ETF Submitted to SEC

Asset management company CoinShares withdrew its application for a Solana staking exchange-traded fund (ETF) submitted to the US Securities and Exchange Commission (SEC) on Friday.

According to the filing with the SEC, the proposed fund's structured transactions and asset acquisitions were never completed, stating: "This registration statement is intended to register shares related to a transaction that ultimately failed to complete. No shares are being sold under this registration statement, nor will any shares be sold."

Bitwise Updates Its Spot Avalanche ETF Application to Include Staking Feature

According to CoinDesk, Bitwise updated its application for the spot Avalanche ETF with the SEC, changing the ETF's code to BAVA and setting the sponsor fee rate at 0.34%, currently the lowest among similar products.

In comparison, VanEck's Avalanche ETF rate is 0.4%, while Grayscale's is 0.5%. The updated S-1 application also states that the trust will be allowed to stake up to 70% of its AVAX holdings on Avalanche's proof-of-stake network to earn additional tokens. However, the issuer is considering deducting 12% of the earnings as fees, with the remainder distributed to shareholders.

Since competitors have not yet launched staking services, their fees are currently limited to sponsor fees. Bitwise is also offering a full fee waiver for the first month for the first $500 million in assets, aiming to position BAVA as the lowest-cost way for traditional investors to gain exposure to Avalanche and earn staking income.

Nasdaq Applies to SEC to Increase BlackRock Bitcoin ETF Options Quota to 1 Million Contracts

According to Cointelegraph, Nasdaq has submitted an application to the SEC to increase the options quota for BlackRock's IBIT to 1 million contracts, the maximum level allowed by regulators.

SEC's New Guidelines May Accelerate Crypto ETF Approval Process

The SEC has released new guidelines that may accelerate the approval timeline for crypto exchange-traded funds (ETFs). These updates were issued after a prolonged government shutdown that resulted in a backlog of over 900 pending registration filings.

The SEC published technical guidelines outlining how issuers can advance ETF applications under Section 8(a) and Section 461 of the Securities Act of 1933. Key changes that could expedite the approval process include the SEC's approval of general listing standards for commodity trust shares on Nasdaq, Cboe BZX Exchange, and NYSE Arca on September 17, 2025. This eliminates the need for each eligible crypto ETP (Exchange-Traded Product) to obtain separate approval under Section 19(b).

For filings submitted during the government shutdown, the guidelines confirm that registration statements without delay provisions will automatically take effect 20 days later under Section 8(a). The new SEC directives allow issuers to choose automatic effectiveness or formally request accelerated effectiveness under Rule 461 for faster listing.

Bitwise Launches DOGE Spot ETF on NYSE, Code BWOW

According to The Block, Bitwise has officially launched the Bitwise Dogecoin ETF (code: BWOW) on the New York Stock Exchange, providing a compliant investment channel for Dogecoin (DOGE) holders.

Grayscale Submits S-3 Filing for Zcash ETF

According to official documents, Grayscale Zcash Trust (ZEC) submitted an S-3 registration statement to the SEC in 2025, with document number 333-291800.

The trust company is headquartered in Stamford, Connecticut, primarily engaged in commodity contract brokerage and trading (SIC code: 6221).

Franklin Templeton Submits Prospectus for Solana Spot ETF to SEC, Fee Rate of 0.19%

According to SolanaFloor monitoring, Franklin Templeton has submitted its prospectus for a Solana spot ETF to the SEC, with a fee rate of 0.19%, the lowest among Solana spot ETFs, and waiving fees for the first $5 billion in assets under management (AUM). This ETF is expected to go live soon.

Crypto asset management company Bitwise Asset Management plans to list the Bitwise Dogecoin ETF (NYSE: BWOW) today, and has officially released the ETF details: currently, BWOW holds 16,429,836.05 Dogecoins (custodied by Coinbase Custody), with a market value of $2,499,996.71 and a management fee rate of 0.34%.

Bitwise stated that if BWOW's assets under management reach $500 million within one month (whichever comes first), the management fee will be waived.

Franklin Templeton Has Submitted Form 8-A for Solana ETF to SEC

According to market news, Franklin Templeton has submitted Form 8-A for the Franklin Solana ETF to the U.S. Securities and Exchange Commission (SEC), a key step typically taken before the official launch of a product.

Usually, trading begins the day after such documents are submitted.

Texas Crypto Reserve Takes Key Step, Allocates $5 Million to BlackRock Bitcoin Spot ETF

According to Coindesk, Texas has taken a key step in building a state-level crypto reserve. Officials revealed that the state has invested $5 million in BlackRock's Bitcoin ETF, although the Texas Strategic Bitcoin Reserve plan is still in preparation.

The state has recently solicited industry opinions on establishing a compliance plan for Bitcoin reserves and allocated $10 million through legislation earlier this year. After completing the final steps, Texas is expected to become the first state government in the U.S. to seriously initiate long-term investments in crypto assets. A spokesperson for the state auditor's office confirmed on Tuesday that $5 million has been allocated to the BlackRock iShares Bitcoin Trust as a transitional measure before establishing a custody contract.

VanEck Plans to Launch BNB ETF, Code VBNB

According to SEC documents, VanEck Digital Assets plans to launch the VanEck BNB ETF, which is a spot ETF aimed at directly holding BNB tokens and tracking their price performance, net of trust operating expenses. It is expected to be listed on Nasdaq under the code VBNB.

The trust will assess its asset value daily based on the MarketVector BNB Index and has not yet engaged in any staking activities. VanEck stated that if staking occurs in the future, it will be completed through a third-party staking service provider, with investors notified in advance. The trust is not regulated under the Investment Company Act of 1940 or by the Commodity Futures Trading Commission (CFTC), and the investment risks are high, potentially leading to total loss. Previously, Van Eck Associates Corporation purchased seed shares totaling $100,000. Market news indicates that the VANECK BNB ETF is registered in Delaware.

Digital asset management company Grayscale has officially disclosed details of its XRP ETF. Currently, the Grayscale XRP Trust ETF (GXRP) holds a total of 6,017,179.9823 XRP tokens, with assets under management (AUM) reaching approximately $11.673 million and a circulating share count of 310,100.

All XRP assets of the ETF are custodied at Coinbase Custody.

Digital asset management company Grayscale has officially disclosed details of its Dogecoin ETF. Currently, the Grayscale Dogecoin Trust ETF (GDOG) holds a total of 11,136,681.421 Dogecoin tokens, with assets under management (AUM) reaching approximately $1.546 million. All Dogecoin assets of the ETF are custodied at Coinbase Custody.

Franklin Templeton XRP ETF Approved for Listing on NYSE Arca, Trading Code XRPZ

According to Cryptobriefing, Franklin Templeton's XRP ETF has been approved for listing on the NYSE Arca and has been formally certified to the SEC.

The fund will trade under the code XRPZ, with an annual fee rate of 0.19% of net asset value. Franklin plans to waive fees for the first $5 billion in assets until May 31, 2026. Earlier, Canary Capital and Bitwise Asset Management had launched a spot XRP ETF earlier this month.

Views and Analysis on Crypto ETFs

BlackRock's Bitcoin spot ETF IBIT experienced a net outflow of $2.34 billion in November, with approximately $463 million flowing out on November 14 and about $523 million on November 18, both setting new single-day outflow records. Cristiano Castro, the director of business development, stated that the $2.34 billion outflow is a normal phenomenon, and BlackRock remains confident in its long-term outlook.

The Bitcoin spot ETF has become one of BlackRock's most important sources of revenue, with its rapid growth being surprising. The outflow in November was merely due to previously strong demand. Cristiano Castro told reporters, "Spot ETFs are very liquid and powerful tools designed to allow investors to flexibly allocate capital and manage cash flow. What we are seeing now is completely normal—any asset will experience such phenomena during price corrections, especially in a tool with a high retail investor ratio." With Bitcoin returning above $90,000 on Thursday, current IBIT investors have accumulated unrealized gains of about $3.2 billion, successfully offsetting losses incurred during the previous Bitcoin correction.

Analysis: BlackRock IBIT Holders Return to Profitability, ETF Selling Pressure May Slow

According to Cointelegraph, holders of BlackRock's spot Bitcoin ETF IBIT have returned to profitability as Bitcoin rose above $90,000, indicating a potential shift in sentiment among one of the key investor groups driving the market this year.

Arkham data shows that holders of the largest spot Bitcoin fund, BlackRock's IBIT, have accumulated profits of $3.2 billion. Arkham stated, "Holders of BlackRock IBIT and ETHA had nearly $40 billion in profits at their peak on October 7, which had dropped to $630 million four days ago. This means that the average cost of all IBIT purchases is nearly flat." As ETF holders are no longer under pressure, the selling speed of Bitcoin ETFs may continue to slow. The situation has significantly improved since the recorded net outflow of $903 million on November 20.

Singapore crypto investment firm QCP Capital published an analysis stating that Bitcoin has stabilized after a slight rebound, and this recovery seems related to improved risk sentiment rather than specific drivers in the crypto space, while the stock market has also seen a slight rise. The market currently expects an 85% probability of a rate cut in December. Inflation remains stubbornly high, and labor market data continues to be weak, including rising unemployment rates.

Federal Reserve officials have slightly tilted their balance toward easing. Given the lack of other significant economic data this week, the market's focus will shift to the unemployment claims and ADP employment report to be released later this week. The widening credit default swaps (CDS) and tech credit spreads related to AI indicate that investors are reassessing the dominant macro drivers of the market.

Crypto ETFs continue to record net outflows, with several digital asset products facing liquidation. Currently, most products are trading below $1 per unit of net asset value, reflecting a heightened risk-averse sentiment in the market. As Strategy's Bitcoin reserves approach breakeven, and its stock is placed on the MSCI delisting watchlist, the Strategy issue has come back into focus.

As the year-end approaches, Bitcoin faces dual impacts from negative fund flows and supportive options structures. Correlation with AI-related stocks has increased, while the fear and greed index has declined. The demand for downside protection remains high, although open interest still leans toward call options, both positions and implied volatility have decreased.

If Bitcoin's price rebounds to around $95,000, it may encounter ETF-related selling pressure, thereby reinforcing its range-bound trend. After a recent sharp decline, the $80,000 to $82,000 range remains a key support level. The crypto market continues to serve as a barometer for overall market risk appetite, with macro drivers firmly controlling market direction.

QCP published an analysis stating that BTC is currently stabilizing at high levels around $90,000, with improved market risk sentiment and an increased expectation of a rate cut in December to 85%. However, macro signals remain complex, with inflation still high and labor data weak.

Warning signals have emerged in the AI credit space, with widening credit default swaps (CDS) raising concerns about rising accounts receivable and inventory for Nvidia. The flow of funds into cryptocurrencies shows a similar trend: ETFs continue to see outflows, and most products are trading below net asset value. MicroStrategy's strategy is once again under scrutiny, as its BTC holdings approach breakeven, and its stock is placed on the MSCI delisting watchlist.

The options market reflects cautious sentiment, with increased correlation between Bitcoin and AI stocks, and a decline in the fear and greed index. Technically, Bitcoin may encounter ETF-related selling pressure around $95,000, with the $80,000 to $82,000 range remaining a key support level.

Analyst: ETF Inflows Provide Buying Support for BTC, Recent Selling Mainly from Short-Term Holders

According to The Block, BRN's research director Timothy Misir stated that the inflow of funds into ETFs has provided the first meaningful buying support in recent days, helping Bitcoin maintain its fragile consolidation range between $84,000 and $90,000.

"The inflow of funds has started to provide support, but it cannot be called decisive," Misir said. He pointed out that on-chain pressure remains high, with about one-third of Bitcoin supply still in a state of loss. "Long-term holders and institutions are still selectively increasing their positions, while recent sell-offs mainly come from short-term holders."

Additionally, Misir mentioned that macro signals remain complex— including the U.S. Producer Price Index (PPI) meeting expectations— which leaves the Federal Reserve's policy path unclear. "Inflation data has neither forced the Fed to accelerate rate cuts nor required it to maintain a tough stance. The market must price in the possibilities of both directions this week," Misir said.

Wintermute founder Evgeny Gaevoy commented on X regarding "BlackRock's large BTC and ETH transfers to Coinbase," stating, "This is actually a very lagging indicator. The sell-off has already occurred in the ETFs. On-chain transfers by market makers often reflect the same situation."

Bloomberg ETF analyst Eric Balchunas posted on social media, stating, "IBIT's short positions have decreased significantly. Although they were initially not high, only accounting for 2% of the circulating shares, they are now almost back to the levels before April's surge. S3 Partners noted that traders typically short when prices strengthen and cover when they decline, and all ETFs were included in the analysis for reference."

Bloomberg ETF Analyst: XRP and LINK Spot ETFs Expected to Launch Within This Week

Bloomberg ETF analyst Eric Balchunas posted on social media, stating that five spot cryptocurrency ETFs are set to launch within the next six days.

In addition to Grayscale's GDOG, there are also Grayscale and Franklin's XRP spot ETFs, as well as Bitwise's Dogecoin ETF and Grayscale's LINK spot ETF. While exact numbers cannot be provided yet, it is expected that over 100 cryptocurrency ETFs will continue to be supplied in the next six months.

Citi: Bitcoin ETF Redemptions of $1 Billion Will Weigh on Prices by About 3.4%

According to Bloomberg, U.S.-listed Bitcoin ETFs have seen a cumulative outflow of $3.5 billion this month, nearing the single-month outflow record of $3.6 billion set in February 2024. Among them, BlackRock's IBIT fund has seen redemptions as high as $2.2 billion, accounting for 60%, potentially marking the fund's worst monthly performance since its launch.

The outflow of funds has intensified downward pressure on Bitcoin, with prices dipping to $80,553 at one point. Citi Research estimates that each $1 billion redemption will weigh on (spot) prices by about 3.4%, and vice versa.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。