The first sincerity in the crypto world is not advertising, but clearly explaining the risks.

Who is the "most sincere" C2C in the crypto world? After all, in a world full of "deep tricks," only "sincerity" can win people's hearts.

Especially as the market has slid from its highs in November, the cries of "the bear market is here" are echoing everywhere. More and more people are realizing that the most important thing is not the market, but whether your money can return to your hands.

However, in the world of crypto C2C, risks never diminish due to bull or bear markets: freezing, disputes, merchants running away, and no recourse for complaints… Any broken link can cause your assets to "disappear instantly" in the real system.

Therefore, this long article is not meant to take sides, but to answer the most critical question: when risks truly arise, which platform can better protect users?

This article selects the most mainstream platforms in the Chinese-speaking region that everyone commonly uses: Binance, OKX, and Huobi HTX, and evaluates them from three perspectives: security, compensation system, user experience, and risk control mechanisms. The reference information comes from: public announcements from the three platforms; real user feedback from KOLs and Twitter; and personal user experience. This is provided for comparison and reference.

1. Security: Avoiding freezing is a hundred times more important than compensation

In C2C, the most frustrating incident is probably freezing.

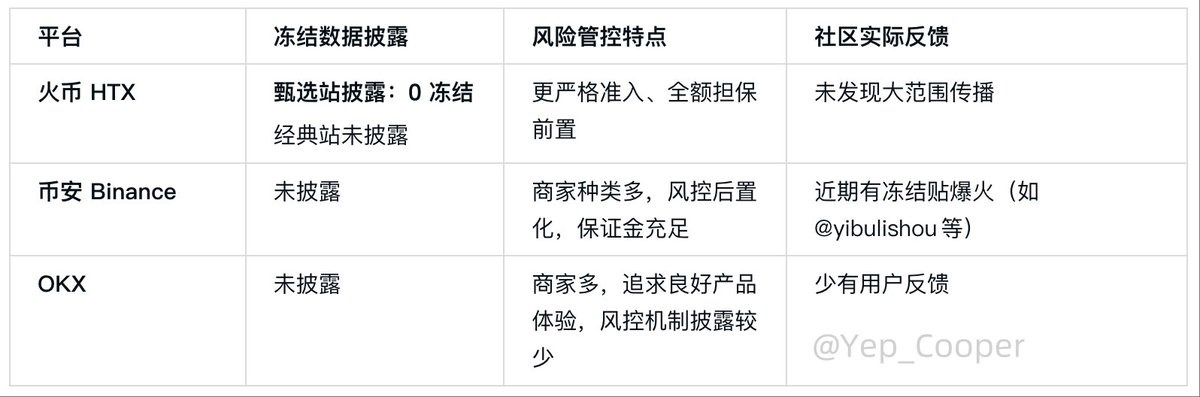

Let's first present a table of the "freezing-related data and public disclosure" from the three platforms:

Image from Twitter user @Yep_Cooper

It can be clearly stated: Avoiding freezing ≫ Resolving freezing. One freezing incident is enough to make a user leave a platform forever. Among the three, Huobi was the first to publicly disclose "0 freezing" data.

This action itself represents the highest level of transparency in the current industry.

For any platform, as trading volume continues to grow and the merchant ecosystem becomes more complex, the difficulty of risk control will increase exponentially. Mechanisms can be continuously optimized, but if the "freezing risk" cannot be effectively anticipated, user experience will always hang in uncertainty.

2. Compensation System: All 100%? Surface uniformity, but actual differences are huge

The complexity of the rules from the three platforms is comparable to credit card agreements. Below is a clear panoramic evaluation of the compensation mechanisms of the three platforms, organized in chronological order of their launch.

① Huobi HTX (the first to launch 100% full compensation)

Launch date: April 7, 2025, launched the selection site; August 20, 2025, launched 100% full compensation

Public, transparent, no transaction amount limit

Tagged merchants = 100% compensation (single transaction limit of 10,000 USDT)

Application within 30 days after judicial freezing

Users do not need to pay additional fees

② OKX

Launch date: August 27, 2025

Also offers up to 100% compensation

Good clarity of rules

User operation process is friendly

Compensation limits for ordinary users are relatively limited

③ Binance

Launch date: July 29, 2025, testing the selected area; September 15, 2025, announced the upgrade to 100% compensation

Selected area: up to 100% compensation (shield merchants limit 50,000 USDT)

Ordinary area: small amounts 100%, large amounts only 10%, limit 3,000 USDT

Merchant deposit must be 100,000 USDT

Compensation application: for judicial freezing orders that occur within 30 calendar days after the transaction is completed

Shield merchants must pay nearly 0.1% in fees, which will be passed on to advertising prices, ultimately burdening the users

At first glance, they all seem to offer 100%, but the coverage of the groups is vastly different. Binance's selected area covers less than 5% of users, while the rules in the ordinary area are significantly reduced. A simple structure with a very low learning cost can be referenced from Huobi, which was the first to launch the C2C selected area.

3. The essence behind the rules: What are the three platforms thinking?

To translate complex rules into what is "truly important to users," this article summarizes the core ideological differences among the three platforms:

① Huobi HTX: Preemptive risk control > Post-compensation

Huobi started in C2C the earliest, so its philosophy is: "Preventing incidents is more important than compensating after they occur."

The "0 freezing" data from the selected site is the result. Although there is still room for experience optimization and occasional lag on the product page, the security is perceptible, the rules are the simplest, the labels are the clearest, and merchant reviews are very strict. Most importantly, the compensation mechanism is transparent, with no "differentiated treatment."

② Binance: Strong backing ability, but complex mechanisms, leaning towards post-compensation

Binance is large, being the world's largest exchange, so its approach is more like: "First open up, then provide backing."

No public freezing data; a large number of merchants; the shield system is gradually maturing, but the compensation strength for ordinary users is significantly weaker than that of the selected area. Fees are shifted to merchants, but ultimately passed on to users.

Binance's strength lies in: if you are a large trader + can choose shield merchants = you are well protected. But for ordinary users, this mechanism has a very high learning cost.

③ OKX: Best experience, slightly weaker risk control

OKX's product logic is the smoothest in the industry, but the "transparency of the compensation mechanism" and "disclosure of freezing data" are not as good as the other two. Moreover, the compensation coverage is not strong, making it suitable for users who prioritize experience and trade more frequently.

4. How should the ranking of the three be viewed?

Based on the organization of all the information in this article, three conclusions can be drawn:

- If you are most afraid of freezing → choose Huobi HTX

The reason is the only publicly available freezing data, the only one continuously disclosing "0 freezing," the most preemptive risk control, and the friendliest to ordinary users.

- If you are a large trader + can identify merchants → Binance's selected area

The reason is strong backing ability for large users and high compensation limits.

- If you pursue trading experience → OKX tagged merchants will suffice

Because product experience is prioritized, with moderate risk.

In conclusion: The first sincerity in the crypto world is not advertising, but clearly explaining the risks

From the launch of Huobi's selected site in April, to the testing of full compensation in May, to the official launch of 100% compensation in August, and then to OKX and Binance successively launching similar mechanisms— the industry has indeed become healthier due to a "transparent competition."

Huobi took the first step in the industry; OKX improved user experience; Binance raised the compensation amount to the highest in the industry.

This is healthy competition and a blessing for all users. To quote a very realistic saying in the industry: The end of Web3 is not getting rich quickly, but safety. Bringing money home is the highest value.

The first sincerity in the crypto world: What can touch users?

The answer is always the same: Transparency + Risk Control + Responsibility.

May everyone who trades seriously be able to safely bring every penny they earn back home.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。