Author: Frank, PANews

Since the launch of the HIP-3 growth model, this flagship product is rapidly becoming a new business growth engine for Hyperliquid, driving explosive growth in market trading volume, with monthly trading volume skyrocketing tenfold, and injecting more innovative vitality and liquidity into the Perp DEX track.

Behind the surge in trading volume is HIP-3's aim to become the underlying trading foundation for future decentralized markets. However, this transformation path is much more rugged than the data suggests.

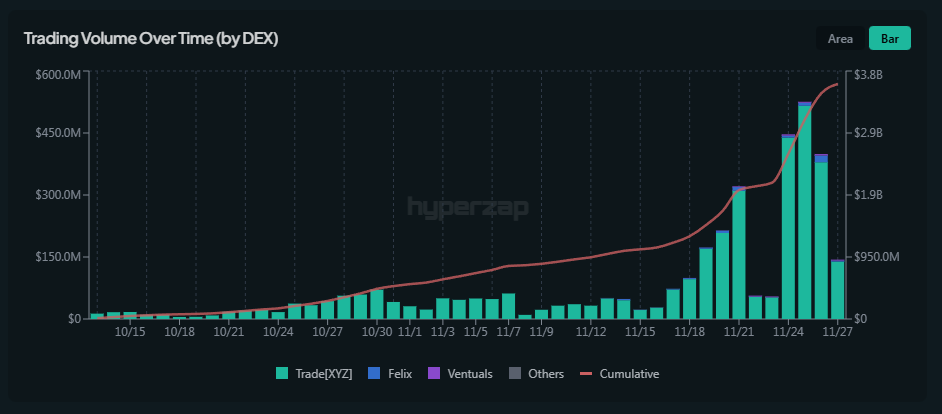

Monthly Trading Volume Grows Over Tenfold, Growth Model as Main Driving Force

The full name of the HIP-3 proposal is "Builder-Deployed Perpetuals." Its core idea is to decentralize the "market creation rights" from the core protocol team to the community and developers. Under the HIP-3 framework, Hyperliquid retreats to the background, becoming the underlying settlement and matching engine, while the rights for asset definition, risk parameter settings, oracle selection, and other aspects are completely transferred to third-party "deployers." In this mechanism,

An important threshold in the design of HIP-3 is that any developer wishing to deploy a permissionless market must stake 500,000 HYPE tokens to the network. At the current price of $35, this staking amounts to approximately $17.5 million. If a deployer engages in malicious behavior, validators can vote to confiscate this staked asset, and even if the deployer intends to exit the market, they must undergo a 7-day unlocking period.

This threshold setting forces deployers to be institutions or teams with strong financial capabilities and a commitment to long-term development, rather than opportunistic retail investors. On the other hand, such a staking amount serves as a significant deflationary measure for HYPE tokens. It is worth noting that the maximum supply of HYPE is 1 billion tokens, with a current market cap of approximately $9.5 billion; each lock-up under this model corresponds to 0.2% of the tokens being locked.

Additionally, the current HIP-3 market mandates a isolated position model. This means that the position risk in a specific HIP-3 market is completely isolated from the BTC/USDC positions on the mainnet. Even if an asset experiences a flash crash or oracle attack, the impact is confined to that specific market and will not affect the user's overall account funds or other mainstream asset positions.

Since its launch, HIP-3 has experienced exponential growth, with trading volume exceeding $3.6 billion as of November 28, a more than tenfold increase compared to a month ago. The single-day trading volume on November 25 even surged to $500 million. This performance is already comparable to the monthly trading volume of Uniswap V3 on Ethereum. Furthermore, the number of trading users in the entire HIP-3 market has reached 18,000, while Hyperliquid's cumulative users have surpassed 800,000.

The recent surge in HIP-3 data is primarily due to the launch of the growth model on November 19, which allows for permissionless market deployment and significantly reduces fees, thereby enhancing liquidity. The new feature can reduce trading fees for new markets by over 90%, with top traders' fees potentially as low as 0.00144%. At the same time, the growth model requires markets to avoid overlapping with existing assets and will set a 30-day lock to maintain stability. The data changes also intuitively reflect the growth effect brought about by this upgrade.

Leading Applications Contribute Over 90% of Trading Activity, US Stock Assets Hot but Still Face Liquidity Challenges

According to data from Nansen, there are currently over 100 decentralized applications being built on HIP-3, generating $94 million in new revenue.

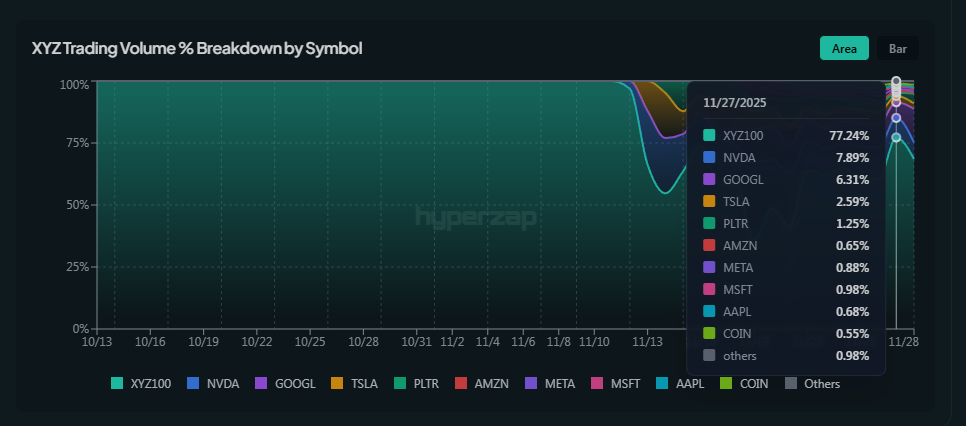

In terms of trading volume sources, the main trading activity on HIP-3 is almost entirely contributed by Trade.xyz, which maintains a share of over 95%. Trade.xyz is the first permissionless perpetual contract exchange built on the HIP-3 protocol within the Hyperliquid ecosystem, developed by the Hyperunit (Unit) team. Behind the explosive trading scale, in addition to the market's high expectations for airdrops from Trade.xyz, analysis by @kungfu_crypto indicates that Trade.xyz has real active trading rather than wash trading, primarily due to its provision of contract levels close to ultra-low fee rates in the US stock market, offering excellent cost advantages for high-frequency, lightly leveraged trading. It can be seen that the trading group of this DEX has a low average transaction size but is highly active; at the same time, the Unit team has long been deeply involved in Hyperliquid, establishing a trust moat.

Currently, Trade.xyz's flagship product is XYZ100, an on-chain index contract tracking the top 100 non-financial technology companies in the US (comparable to the Nasdaq 100 index). As of now, XYZ100 accounts for over 60% of Trade.xyz's trading volume. In addition, it has also launched perpetual contracts for popular US stocks such as NVDA (Nvidia), TSLA (Tesla), and MSFT (Microsoft).

It is worth noting that the on-chain stock trading targets of Trade.xyz are not traditional real stocks, but rather index contracts that cannot be physically delivered and do not share liquidity with US stocks. The biggest advantage of these index contracts is that they allow participation in US stock market fluctuations without KYC, and they achieve 24/7 uninterrupted trading through the introduction of a simulation mechanism. For investors who do not require delivery but wish to profit from US stock fluctuations, this simulated trading model is the most convenient way.

However, this model also exposes liquidity issues. Recently, KOL He Bi revealed that three trading pairs built on another market, Ventuals, cannot close short positions and can only short, leading to abnormal price surges. The fundamental reason is indeed the lack of liquidity.

In fact, this is not a unique problem for the HIP-3 market; the overall on-chain stock trading market is still immature, and this liquidity deficiency issue seems to be widespread. Another crypto practitioner, @EthWiz0X, stated that purchasing $100,000 of Ondo Finance's TSLAon on Uniswap would result in a price impact of up to 83.34%. In the HIP-3 market, currently, apart from the trading volume of a few targets like Trade.xyz's XYZ100 and NVDA, the daily trading volume of other markets like Felix and Ventuals remains at a low level of several million dollars, primarily because trading pairs in markets like Felix and Ventuals generally use Hyperliquid's native stablecoin USDH. Compared to the widely used USDC, USDH's current market recognition is still severely lacking.

Moreover, the current on-chain stock trading service is facing more competition from new players. For instance, Binance Wallet announced on November 26 that it has added on-chain stock trading, with fees reduced to as low as 0%. In addition, mainstream exchanges like Bitget and Bybit have also launched similar US stock trading sections.

Of course, as a permissionless market, HIP-3's application scenarios are not simply limited to on-chain stock trading. Another project, TROVE, is targeting collectible trading, such as Pokémon cards, CS2 skins, and perpetual contracts for stocks like Nintendo and Pop Mart. Ventuals is targeting the pre-IPO market. Compared to the US stock market, these market directions are still considered niche, so the lack of trading depth in these alternative markets is also significantly related to their themes.

Multiple Positive Factors Drive Rising Popularity, but Still Face Dilemmas of Ecological Expansion and Stablecoins

The recent attention on the HIP-3 market may be attributed to several key reasons:

The recent reduction in differences in the crypto market. As the market turns bearish, the majority of token movements are influenced by Bitcoin. In an environment where the entire market rises and falls together, there is a strong preference for assets that can break out independently, and the US stock market is relatively unaffected by the crypto market, exhibiting stronger independence.

Airdrop expectations for HIP-3 ecosystem projects. Previously, Hyperliquid's airdrop left a good impression on the market, leading to a general belief that projects within the Hyperliquid ecosystem are likely to replicate the success of the Hyperliquid airdrop. Currently, these unlaunched projects are in a volume-boosting phase.

Greater imagination regarding the potential of HIP-3. As mentioned earlier, the potential of HIP-3 is not limited to the stock market; it may explode in more alternative markets in the future. Therefore, for a market currently experiencing narrative exhaustion, such imaginative space can easily evoke optimistic sentiments. In September of this year, the Hyperliquid community also proposed the concept of HIP-4, aiming to introduce perpetual contracts for prediction markets. This roadmap aligns more closely with the current hot directions in the market.

A report from Falconx also pointed out, "We expect that the incremental fees generated by the HIP-3 builder-deployed perpetual futures market will drive a 67% increase in HYPE over the next year, with the stock and index markets being the main driving forces."

Despite the multiple positive factors in the market, for the HIP-3 market, these optimistic expectations do not necessarily determine its bright development prospects. In terms of liquidity, currently, apart from Trade.xyz, the liquidity and trading volume of other markets remain pitifully low. In terms of trading currencies, the popularity of the HIP-3 market still relies on the mainstream recognition of USDC, while Hyperliquid hopes to support its native stablecoin USDH to become the mainstream trading currency. How to strike a balance between the two is the biggest issue limiting the true explosion of the HIP-3 market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。