"Support around $78,000 and $70,000 is a good entry opportunity."

Compiled & Edited by: Deep Tide TechFlow

Guest: Matthew Sigel, Portfolio Manager of VanEck Onchain Economy ETF ($NODE)

Host: Anthony Pompliano

Podcast Source: Anthony Pompliano

Original Title: Is It Time To Buy Bitcoin Now?

Broadcast Date: November 25, 2025

Key Takeaways

Matthew Sigel is the Portfolio Manager of the VanEck Onchain Economy ETF ($NODE), which is considered one of the most forward-thinking institutional products in the crypto ecosystem. In this interview, we explored how institutions evaluate Bitcoin, from market structure and investor sentiment to the driving factors behind recent price movements. Matthew introduced three key indicators he uses to assess Bitcoin's future trends and shared his buying strategies during market volatility, as well as his focus on crypto-related publicly traded companies. Additionally, this episode discussed the broader digital asset ecosystem, including smart contract platforms, stablecoins, and areas he believes have the most long-term potential.

Here’s a TL;DR version of the podcast notes to help you quickly grasp the main ideas.

Highlights

Bitcoin mining companies are transitioning to AI companies.

Volatility is one of the biggest challenges in the crypto space.

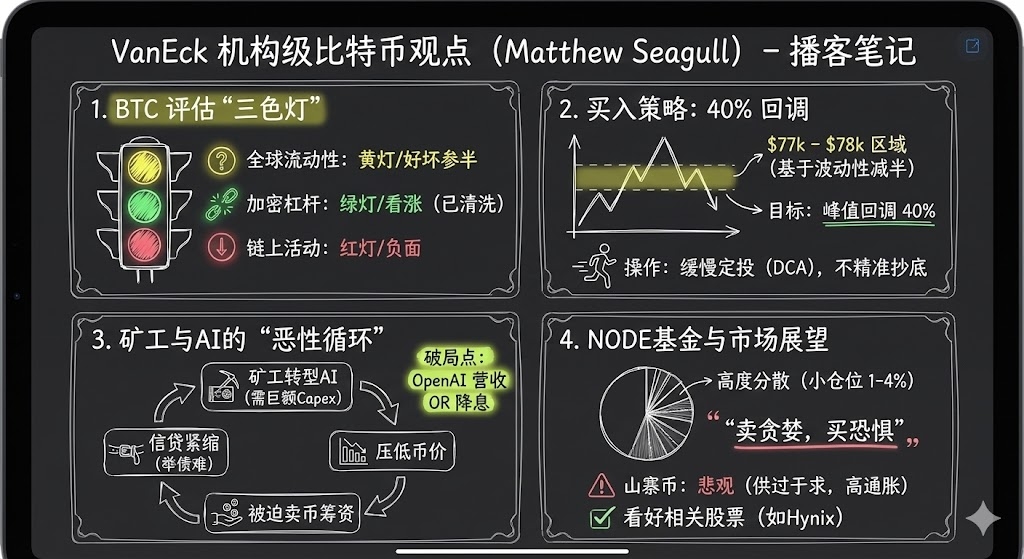

Matthew Sigel typically evaluates Bitcoin's market performance from three perspectives. The first is global liquidity, where Bitcoin has a sustained negative correlation with the U.S. Dollar Index (DXY); the second perspective is the level of leverage in the crypto ecosystem, which has decreased significantly, with financing rates dropping sharply; the third perspective is on-chain activity, which is currently weak, and the activity status is not optimistic.

Support around $78,000 and $70,000 is a good entry opportunity.

I usually prefer dollar-cost averaging, such as investing a fixed amount at a certain price level or making investments every two days.

My investment style involves small positions and high diversification, while employing a "buy low, sell high" strategy in the market. So far, this strategy has worked well.

Once I decide to buy, I don't need to invest everything at once but rather adopt a gradual approach to respond more rationally to market fluctuations.

The market is overly saturated, and the inflation rate of altcoins remains high. Besides their speculative nature, they have not truly found product-market fit.

Solana has performed exceptionally well in building cross-industry ecosystems.

Trump's deregulation policies have actually had a negative impact on altcoins, as the characteristic of decentralization has been weakened in the new regulatory environment.

Current Institutional Views on Bitcoin

Anthony Pompliano: Today we have Matthew Sigel, the Portfolio Manager of VanEck's Onchain Economy ETF ($NODE).

I think we can start with an important question: How do institutions currently view Bitcoin? The market signals are very complex, with both positive and negative data, poor price performance, and low investor sentiment. How do VanEck and other institutions typically view Bitcoin and its asset allocation?

Matthew Sigel:

From the perspective of investor interest, I believe institutions remain very focused on Bitcoin. We still receive a lot of demand for educational content, portfolio construction advice, and small allocation requests. However, Bitcoin's price has experienced a pullback of over 30%, and trading volumes for some of our listed products have also declined. This indicates that while investors are highly interested in researching Bitcoin, there is some hesitation in actual trading operations.

Anthony Pompliano: So, if we analyze these data points, how would you differentiate between positive and negative data?

Matthew Sigel:

We typically evaluate Bitcoin's market performance from three perspectives.

The first is global liquidity. Bitcoin has a sustained negative correlation with the U.S. Dollar Index (DXY), so global risk appetite, leverage, and deleveraging have a significant impact on Bitcoin, especially since the COVID pandemic. This macro trend has influenced Bitcoin far more than in previous phases. Unfortunately, Bitcoin miners are at the core of this process. Recently, due to tightening credit conditions and large companies (like Oracle) raising massive debt to develop their AI capabilities, Bitcoin miners have had to adjust operations to fit market opportunities. This requires substantial capital expenditure, which typically relies on debt financing, equity financing, or selling Bitcoin to raise funds. Until October, Bitcoin miners were still actively selling Bitcoin to support these developments. This situation has led to a vicious cycle: tightening credit conditions not only affect miners' financing capabilities but also further depress Bitcoin prices. Therefore, I believe that from the perspective of global liquidity, the evidence is mixed, with some funding support, but the market outlook has become more uncertain.

The second perspective is the level of leverage in the crypto ecosystem. I see this as a positive signal. We experienced a market liquidation in mid-October, leading to a decrease in leverage levels in the crypto market and a significant drop in financing rates. In the past 12 hours, the scale of market liquidation reached about $1.7 billion. This indicates that the leverage sentiment in the crypto market has significantly weakened, which I view as a bullish signal.

The third perspective is on-chain activity. We typically focus on data such as transaction fees, the number of active addresses, and transaction frequency. From this data, on-chain activity is currently weak, and the activity status is not optimistic.

How to Assess Indicators and Key Bitcoin Price Levels in Real-Time

Anthony Pompliano: So, how do you assess the Bitcoin market? We’ve discussed that global liquidity is a "yellow light," leverage in the crypto ecosystem is a "green light," and on-chain activity is a "red light." Clearly, these signals are mixed. How do you weigh these factors? Which one do you tend to focus on more? When these signals appear simultaneously, how do you adjust your strategy?

Matthew Sigel:

I think it largely depends on individual investment styles. As I mentioned earlier, trading volumes in the market have decreased, indicating that investors appear hesitant in actual operations. For example, in the Onchain Economy ETF I manage, about two to three weeks ago, I sold 15% of our Bitcoin mining positions. This was because we noticed that market optimism was beginning to wane, and the credit environment was becoming tighter. Bitcoin miners contribute significantly to our returns, so it was wise to moderately de-risk at the end of the year. Currently, we have not redeployed those funds, but I am monitoring several key Bitcoin price levels.

One key level is $78,000, which corresponds to a 40% drop from the peak. In the last market cycle, Bitcoin experienced an 80% drop. Since then, Bitcoin's price volatility has decreased by about half. If volatility is halved, I believe the price adjustment could also be halved, making a 40% drop a reasonable risk-reward opportunity. Additionally, the $78,000 level can break through the $69,000 support formed after the election. We experienced volatility around $70,000 on election day and tested this level again in April this year. Therefore, a strong technical support has formed here.

If it drops further, another level to watch is $55,000, which is the position of the 200-week moving average. If the market experiences extreme conditions, such as another 80% drop, Bitcoin could return to around $27,000, which was the price level when BlackRock applied for a Bitcoin ETF. This scenario would wipe out all ETF gains, but I believe this possibility is low. Overall, a 40% drop and support around $70,000 is a good entry opportunity.

Anthony Pompliano: I understand your point. As individual investors, we can be more flexible in judging price levels, such as $77,000 or $80,000, which may not make much difference to individuals, but institutional investors face more constraints when deploying capital, such as risk management and rebalancing, and they also have access to data tools and experience that individual investors do not.

How do you view the difference between investing between $77,500 and $80,000? Should one act decisively as they approach their target rather than waiting for lower prices? In the current market with high emotional volatility, how would you specifically execute your investment strategy? For example, when the market is filled with extreme greed or fear, stock market volatility is low, but the VIX index reaches 28. In this case, do you enter decisively, or do you maintain discipline by setting price targets and limit orders?

Matthew Sigel:

My personal style leans towards a more gradual approach. I usually prefer dollar-cost averaging, such as investing a fixed amount at a certain price level or making investments every two days. As a professional investor, we have a dedicated trading team to support us in finding liquidity and executing trades. This is one of the advantages of institutional investing, allowing us to adopt a more disciplined investment approach.

However, I believe there is no absolute right or wrong way. The key is to make informed and reasonable decisions based on one's logic and client needs. For me, gradually building positions suits my style better.

Why $NODE Outperforms Crypto-Related Stocks

Anthony Pompliano: Let’s talk about publicly traded stocks related to Bitcoin and the crypto industry. Your ETF product $NODE has performed exceptionally well since its inception, and I understand it has increased by about 28% to 32%, outperforming Bitcoin.

In general, many people believe that Bitcoin or crypto assets themselves should outperform related stocks, but we have seen some different situations over the past year. Could you discuss the public stock strategy of $NODE and your asset allocation approach in these companies?

Matthew Sigel:

Indeed. From the perspective of investors, both institutions and retail investors tend to prefer indirect investments in the crypto industry through stocks. This is because the financial information disclosure of stocks is more standardized and can be directly adapted to their brokerage accounts. From my observation, a significant change in the crypto industry since the election is that investment banks have begun to be willing to underwrite crypto-related assets. This is also why we have seen many IPOs, SPACs, and secondary offerings over the past year. We at Van Eck have been fortunate to adjust our strategy post-election, focusing on investments in crypto-related stocks. The results show that this strategy was correct. Since the launch of $NODE, Bitcoin's price has dropped by 16%, while related stocks have significantly risen. We were able to identify the profound impact of AI on Bitcoin miners and build a relatively low-volatility portfolio.

Of course, our portfolio has also experienced some pullbacks, but compared to other competing products in the market, we have successfully reduced some downside risk by strictly controlling position sizes. In this early-stage industry, many small companies and highly leveraged firms face execution and operational risks. I believe there is no need to take on excessive risks, such as allocating 10% to a single position. Instead, I prefer to concentrate risk in the range of 1% to 4% and leverage market volatility to seek advantages.

Additionally, we have a broad definition of crypto-related stocks, focusing not only on companies whose main business is related to the crypto industry but also on those that enter the Bitcoin value chain through tokenization or sales. These companies can not only save costs but also generate revenue through related businesses, significantly impacting their price-to-earnings ratios. Therefore, my investment style involves small positions, high diversification, and utilizing a "buy low, sell high" strategy in the market. So far, this strategy has worked well.

Anthony Pompliano: The companies you mentioned do not necessarily have most of their business related to the crypto industry. Can you give an example of a company that sells products to the crypto industry or uses related technology but is not considered a traditional crypto company?

Matthew Sigel:

I can give an example: Hynex, a South Korean memory manufacturer that primarily sells products to the semiconductor industry. It competes with Micron and SanDisk and operates in an oligopolistic market. When Bitcoin mining machines sell well, Hynex's DRAM business accounts for about single to mid-single digits in Bitcoin mining. Marginally, this does have some impact on its overall business, but it is not a dominant factor. However, when we consider the impact of AI on the supply chain, the supply-demand dynamics have changed significantly. Companies like Hynex currently have a price-to-earnings ratio of about 5 times, making it a very attractive investment target. Our allocation to Hynex is about 1%, as the company is not only related to digital assets but also benefits from other structural growth opportunities. This is a great example.

What Can Reverse the Doldrums of Bitcoin Miners?

Anthony Pompliano: Bitcoin miners have experienced significant pullbacks in recent years, especially after Bitcoin prices peaked. What factors do you think could reverse the low situation for miners?

**We recently discussed an interesting point from Howard Marks in an interview at Wharton in 2018. He mentioned a common metaphor in investing—"catching a falling knife." His strategy is not to try to perfectly time the bottom but to gradually buy and accumulate positions as prices approach the bottom, even if prices may continue to fall, but continue to *add to positions* when the market recovers. So, how do you think the trend for Bitcoin miners can change?**

Matthew Sigel:

I completely agree with Howard Marks' viewpoint, which aligns with the investment strategy I mentioned earlier. Once a decision to buy is made, there is no need to invest everything at once; instead, a gradual approach is adopted to respond more rationally to market fluctuations.

From my personal analysis, there are two main factors that could help miners out of their predicament. The first is the revenue performance in the AI sector. There is considerable debate in the current market about whether investments in AI can yield actual returns. I believe that the benefits of AI are more reflected in cost optimization rather than directly increasing revenue. By reducing operating costs, companies can significantly enhance their earnings per share, which is a positive signal for the market. For example, OpenAI recently reached a partnership with Target to integrate its technology into retail applications and checkout processes. This deal could reach nine figures, and although related information disclosure is limited at the moment, as more similar deals emerge, market confidence in AI may gradually strengthen.

The second factor is the Federal Reserve's monetary policy. If the Fed chooses to cut interest rates, it will significantly improve market liquidity, which is crucial for Bitcoin miners. There is still some disagreement in the market about whether the Fed will cut rates in December, but once liquidity improves, the financing pressure on miners will ease.

Overall, these two factors—AI revenue performance and the Federal Reserve's monetary policy—could become key driving forces to reverse the low situation of Bitcoin miners.

Anthony Pompliano: When we talk about publicly traded companies related to crypto, Bitcoin miners are an important area. There are also stablecoin providers like Circle, Gemini, and Coinbase, as well as some infrastructure companies and other related themes. How do you view these companies?

Matthew Sigel:

Circle is a typical example; it was once overvalued due to market enthusiasm and is now experiencing a valuation adjustment downturn. However, at the same time, their market share is actually expanding, so we may increase our allocation to such companies in the future. Returning to Bitcoin miners, we have learned from recent market dynamics that the key role of capital costs is crucial. Over the past three months, almost all mining companies have been raising funds to support their AI infrastructure development. This is a capital-intensive process, and we are beginning to see a divergence in capital costs within the industry. For example, Cipher recently announced a partnership with Fluid Stack (backed by Google) to build infrastructure through debt financing. Meanwhile, companies like Bitdeer have had to rely on convertible debt, and Clean Spark has also adopted similar dilutive financing methods. This difference in capital acquisition capabilities will exacerbate the "winner takes all" phenomenon in the industry, so investors should prefer larger mining companies with capital advantages.

Anthony Pompliano: Economies of scale seem to be becoming an important topic of discussion. In the past, this may not have been a key issue due to the small size of the industry. However, as the industry matures, scale is becoming increasingly important, whether in private markets, liquid crypto assets, or some early public companies. For example, Coinbase has developed into a truly large company, and several companies in the mining industry have also broken through scale limits. In traditional industries, economies of scale are often crucial. Now, in the crypto industry, it is the same—either achieve scale or be marginalized.

Matthew Sigel:

I completely agree. In the early days, the main strategy for Bitcoin mining was to find the cheapest electricity to achieve profitability through regional resource advantages. However, due to limited funding support from Wall Street for these businesses, mining companies found it difficult to achieve economies of scale. Now, this situation is changing, especially at the intersection of AI and the mining industry. Companies like Tera Wolf and Cipher have been able to expand their business scale through debt financing, although these financings are rated lower, their impact on minority shareholders is an important turning point.

However, I believe Bitcoin mining still has strong regional characteristics. For example, Cipher operates in Texas, Tera Wulf in New York, and Bitfarms focuses on the PJM region (the PJM region refers to the PJM Interconnection, which is the largest regional transmission organization (RTO) in the U.S., responsible for managing the power system covering 13 states in the eastern U.S. and Washington, D.C.). Currently, the direct competition among these companies is not very intense, but there are already signs that they are beginning to expand into more regions. For instance, Tera Wulf recently stated that they plan to enter Texas to serve more customers. As the industry develops, the advantages of economies of scale will gradually become apparent, but similar to the utility industry, regional factors will still play an important role.

Evaluating the Balance Sheets of Companies Holding Bitcoin

Anthony Pompliano: MicroStrategy **has demonstrated significant economies of scale in incorporating Bitcoin into its balance sheet. Now, many companies in the market are starting to include Bitcoin or other crypto assets in their balance sheets, some through traditional public companies and others through *reverse mergers* or SPAC listings. How do you view the entire digital asset market, and how might these assets accumulate value in the future?**

Matthew Sigel:

We are relatively cautious about this area. We believe that many small-cap digital asset companies in the current market may struggle to maintain high valuations in the long term. Of course, this does not mean that there are no such companies, but there is no reason to believe that so many small companies can maintain a premium. In my early career, I studied the Asian market, where there were also many net asset value (NAV) type companies that typically traded at a 50% discount, especially when there was no clear path for control changes or minority shareholders could not realize assets. Therefore, our strategy is to avoid such companies, although there may be exceptions in certain cases. As valuations adjust downward, we are also seeing some small companies starting to sell Bitcoin and repurchase shares, while the involvement of activist investors may also bring opportunities for these companies.

I am watching whether the Strive transaction can be completed smoothly. If the transaction is completed, I believe Strive's risk-reward profile may be more attractive because their preferred stock structure is relatively clear, allowing fixed-income investors to assess risks and returns more easily. For example, Strive's preferred stock buyback price is set at $110, while the issuance price is $75, with a par value of $100. Additionally, they manage interest rates to keep the target price between $95 and $105. This design allows investors to better gauge upside and downside risks.

In contrast, MicroStrategy's preferred stock structure is more complex. Although they have a close relationship with convertible bond arbitrageurs, allowing them to trade at a premium throughout the cycle, creditors still face significant uncertainty because the company retains the option to reclaim debt. This design increases the difficulty of risk assessment for creditors and may not be friendly enough for fixed-income investors.

A similar situation has also occurred at Meta Planet. They recently announced a new preferred stock structure that is designed to be closer to Strive's model, but this may not be optimistic for them. The reason is that this structure increases the power of bondholders, giving them priority access to cash flow, while the potential returns for equity holders are diminished. This may be a more sustainable option for bond investors, but it could have negative implications for shareholders, especially for companies that rely on equity returns, as this design may become a burden.

Anthony Pompliano: There are also some doubts in the market about these companies' ability to repay their preferred stock debt. For example, Saylor mentioned that if Bitcoin only rises 2% per year, they can still operate in the long term. If there is no growth at all, they can fund operations for up to 70 years by selling stock. How do you view these companies' debt repayment capabilities?

Matthew Sigel:

It depends on the specific structure of the company's balance sheet. For example, companies like Microstrategy rely more on the rise in Bitcoin prices and the growth of unrealized gains for their debt repayment capabilities. They can further borrow against these unrealized gains to maintain operations. In contrast, some smaller companies tend to sell Bitcoin directly to repay their debts. This model may enhance investor confidence, but it raises a question: if these companies start selling Bitcoin during a bear market, what impact will that have on the market? Such a situation could exacerbate downward pressure on Bitcoin prices, especially in a bearish market sentiment.

Anthony Pompliano: If these companies begin to concentrate on selling Bitcoin, what do you think will happen in the market? Do you think there will be forced selling? For example, could Michael Saylor be forced to liquidate assets?

Matthew Sigel:

This situation could likely exacerbate the downside risk for Bitcoin prices, particularly in a bearish market sentiment. I think Saylor's situation is somewhat unique; even if Bitcoin prices drop 50% from their peak, he does not need to sell assets. He can negotiate refinancing with creditors. However, for some smaller companies, the situation may be more complex. If these companies' stocks are trading at a 50% discount to their net asset value, activist investors may seek board seats and push for changes in corporate governance or even liquidation to return assets to shareholders. This is usually a lengthy process that could take one to two years.

Anthony Pompliano: So, for those companies that hold Bitcoin but are not Bitcoin companies, like Tesla or Block, do you think this trend will continue to grow? Or will the market differentiate in this regard?

Matthew Sigel:

This is a question worth paying attention to. We noticed a similar situation while managing the Node ETF. For example, companies like Tesla and Allied Resources (ARLP) hold Bitcoin, but the market has not given significant valuation rewards for these small Bitcoin holdings. However, this situation may reverse with market changes. Recently, MSCI considered removing Microstrategy from certain indices, which may prompt many companies to adjust their strategies to keep their Bitcoin holdings below 49% of total assets to avoid exclusion from the indices. This strategy allows companies to enjoy the benefits of Bitcoin price increases while retaining their eligibility in the indices. The market is always changing, and I believe that as rules adjust, the market may assign higher valuations to these companies that hold small amounts of Bitcoin.

Matthew's Outlook on Altcoins and Bitcoin's Dominance

Anthony Pompliano: Your team has spent a lot of time studying crypto assets and the publicly traded companies related to these assets. What is your current view on other crypto assets outside of Bitcoin?

Matthew Sigel:

Objectively speaking, we are not as aggressive as some ETF competitors in launching single-token solutions. We have submitted applications for a BNB ETF and an Avalanche (AVAX) ETF. Frankly, the market is oversaturated, and the inflation rate of altcoins remains high. Aside from their speculative characteristics, they have not truly found product-market fit.

Therefore, our attitude towards this area is not positive. Clearly, the market has significantly retreated. I attended the MultiCoin Summit yesterday and found that Solana is performing exceptionally well in building cross-industry ecosystems. Many industries are leveraging its blockchain architecture. However, compared to some company chains (like Tempo or Circle), decentralized blockchains lack the support of sales teams. Company chains typically attract merchants through sales teams and incentivize employees to develop the market through stock options, while decentralized blockchains can only rely on community strength and monetization potential to seize opportunities. This conversion mechanism is not direct enough to drive merchant adoption of their payment systems like Visa, Mastercard, Square, or Solana.

Anthony Pompliano: What about performance relative to Bitcoin? Historically, altcoins tend to outperform Bitcoin during bull markets. But this time, it seems Bitcoin has outperformed most altcoins, which has surprised many. Why is that?

Matthew Sigel:

From a fiat currency perspective, Bitcoin's performance has indeed surpassed that of other assets. I believe Trump's deregulatory policies have actually had a negative impact on altcoins, as the characteristic of decentralization has been weakened in the new regulatory environment. In the past regulatory environment, Ethereum had a clear advantage among decentralized alternatives. Now, that advantage has been neutralized, and every project is on a relatively balanced competitive platform. This is also part of the reason why company chains are starting to rise. These companies are not fully decentralized, and their roadmaps do not have clear decentralization goals, but they can leverage tokens to conduct some businesses that were previously considered illegal. This has caused truly decentralized projects, like Ethereum and Solana, to lose some of their differentiated advantages.

Inside $NODE: Structure, Allocation, and Strategy

Anthony Pompliano: Can you briefly introduce NODE and what your investment strategy is?

Matthew Sigel:

NODE is an actively managed ETF, and we can hold up to 25% of our assets in cryptocurrencies through the ETF. We currently hold 11% in a Bitcoin ETF, with Ethereum and Solana each around 1%.

The remaining portion is in stocks related to the field. Our goal is to invest in any company that clarifies how to make or save money through the adoption of Bitcoin, blockchain, or digital assets. I personally believe that Bitcoin mining companies are transitioning to AI companies. Mining companies represent the largest exposure in the fund, accounting for about one-third. The remaining funds are allocated to fintech, e-commerce, energy infrastructure, etc. This diversification aims to smooth out the volatility of the portfolio.

If we only invested in pure crypto companies, like Microstrategy and Coinbase, the volatility of these highly leveraged companies could be very high, even reaching 10%. According to feedback from institutional investors, volatility is one of the biggest challenges in the crypto space. Therefore, our strategy is to reduce overall volatility through diversified investments while still allowing investors to enjoy the growth dividends brought by the popularization of digital assets. This is the core goal of NODE.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。