As the global cryptocurrency market continues to evolve, trading platforms serve as crucial hubs connecting users, innovation, and the future digital asset ecosystem.

The world of digital assets is never short of volatility, but each significant drop contains a rethinking of the industry's essence. Bitcoin has broken above $91,000, rising 4.18% in the past 24 hours. This market movement at the end of November has brought a glimmer of warmth to the crypto market. After a decline from a high of about $126,000 in early October to below $81,000, a nearly 30% retracement, Bitcoin has finally shown signs of stabilization.

Molly, the official spokesperson for Huobi HTX, recently shared that this round of market adjustment is not merely a "sentiment crash," but a "repricing" occurring across three dimensions: macro, capital, and market structure.

Initial Stability After a Deep Drop

After several weeks of decline, Bitcoin has finally shown signs of a rebound. According to market data, Bitcoin has broken back above the $90,000 mark, rising 4.18% in the past 24 hours. Not only Bitcoin, but other major crypto assets have also shown signs of recovery: Ethereum is up 3.15%, XRP is up 6.98%, BNB is up 2.03%, and Solana is up 3.72%.

https://www.htx.com/zh-cn/trade

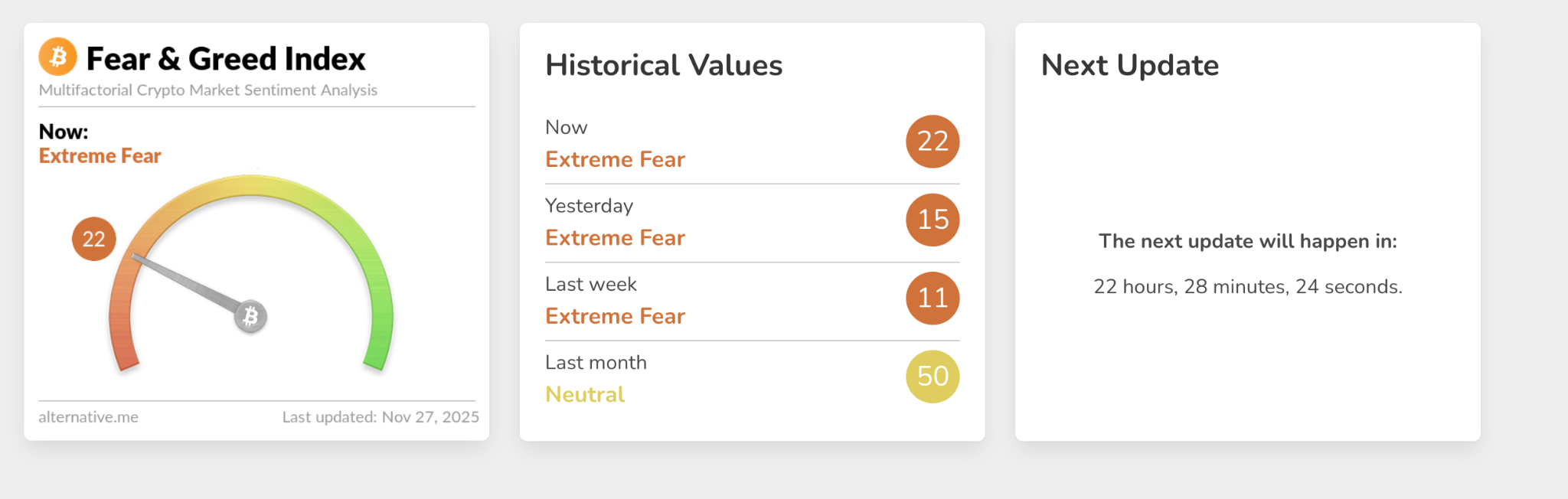

Although market sentiment has improved, it remains in a state of "extreme fear." According to Alternative data, today's cryptocurrency fear and greed index has risen from 20 yesterday to 22, but it has not yet escaped the "extreme fear" range. Restoring market confidence will take time.

Macroeconomic Background: Data Vacuum and Policy Game

Combining market analysis perspectives, this week presents a typical "dense front, vacuum back" structure for the U.S. and the crypto market: Thanksgiving and Black Friday will compress effective trading days, concentrating all core data from Monday to Wednesday. Meanwhile, delays in data due to government shutdowns and the absence of October non-farm payrolls have made the market highly reliant on high-frequency employment data. Today's release of weekly initial jobless claims in the U.S. showed a decline, indicating that employment conditions have not worsened. While institutions generally expect a high probability of the Federal Reserve cutting rates in December, some believe the Fed still has the opportunity to pause rate cuts.

The intensive speeches by Federal Reserve officials before the quiet period on November 29 will further amplify short-term macro volatility. According to the latest probability data, the market now estimates a 69.3% chance of the Fed cutting rates by 25 basis points in December, a significant reversal from last week's 22%.

Market Structure: Defensive Stance and Panic Pricing

In this context, the crypto market continues to digest the deep adjustments since October, with Bitcoin falling about 30% from its peak, ETF funds continuing to see net outflows, and Coinbase premiums weakening, indicating an overall low risk appetite.

The structure of the derivatives market clearly confirms this defensive stance: the tension in the options market has significantly eased, with the premium of one-week put options relative to call options dropping sharply from 11% (the 2025 peak) last Friday to about 4.5%.

Technical indicators show oversold conditions: Bitcoin's 14-day relative strength index (RSI) has fallen to 32, below early October levels, approaching the oversold range. Implied volatility has returned to April levels, indicating that traders are preparing for breakout volatility.

Overall, we are currently in the final stages of a downtrend, but risk appetite has not yet recovered. If this week's data continues to show marginal weakness in consumption and employment without triggering "hard landing" concerns, it may lead to a technical recovery; conversely, in an environment with extremely thin holiday liquidity, it may still trigger short-term declines.

Short-Term Outlook: Critical Points and Opportunities

From a technical perspective, Bitcoin's short-term support level is at $80,000, with resistance in the range of $90,000 to $95,000. Whether it can break through this resistance band will determine the sustainability of the rebound.

Option skew indicates that bets on a rebound from current levels are strengthening compared to further declines. Meanwhile, short positions in BlackRock's Bitcoin fund (IBIT) have also significantly decreased, indicating a weakening of bearish forces. Although overall market sentiment remains cautious, capital is shifting from single-price speculation to structured allocations around the three core logics of "liquidity efficiency—yield generation—information pricing." Signs of capital rotation have already appeared in sectors like stablecoins and perpetual derivatives.

Industry Perspective: Finding Opportunities in Panic

In an environment of heightened market volatility, Molly stated, "Between compliance and innovation, we believe this is not a matter of choosing one over the other, but rather a question of parallel systems, each improving." In the long run, our value lies in filtering trustworthy quality assets for users.

She further pointed out that the current market phase aligns with the transition from "panic" to "hope." In today's industry environment of "intense marketing and innovation," Huobi HTX's differentiated approach is not about following trends but about being sincere. Huobi HTX hopes to exchange every bit of sincerity for users' long-term trust.

Analysts believe that crypto investment in 2025 should focus on platform ecosystems, pay attention to the integration of AI and Web3, maintain a high sensitivity to policies, and adhere to long-termism. The crypto market has never lacked opportunities, but what truly changes fate is whether one can seize the dividends of consensus.

Staying calm amidst volatility and seeing opportunities in panic—this may be the best strategy in the current market environment. As the global cryptocurrency market continues to evolve, trading platforms are crucial hubs connecting users, innovation, and the future digital asset ecosystem.

Note: The content of this article is not investment advice and does not constitute any offer, solicitation, or recommendation of investment products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。