The Trump administration says 2026 tax refunds are on track to be the biggest in U.S. history, pointing to a mix of retroactive tax cuts, unchanged 2025 withholding rules, and legislative timing that effectively caused widespread overpayment throughout the year.

The projection stems from several analyses tied to the One Big Beautiful Bill Act (OBBBA), passed in July 2025. Because the IRS did not update withholding tables midyear, most workers continued paying taxes under pre-OBBBA rules, only to discover in 2026 that they had been overpaying by a sizable margin.

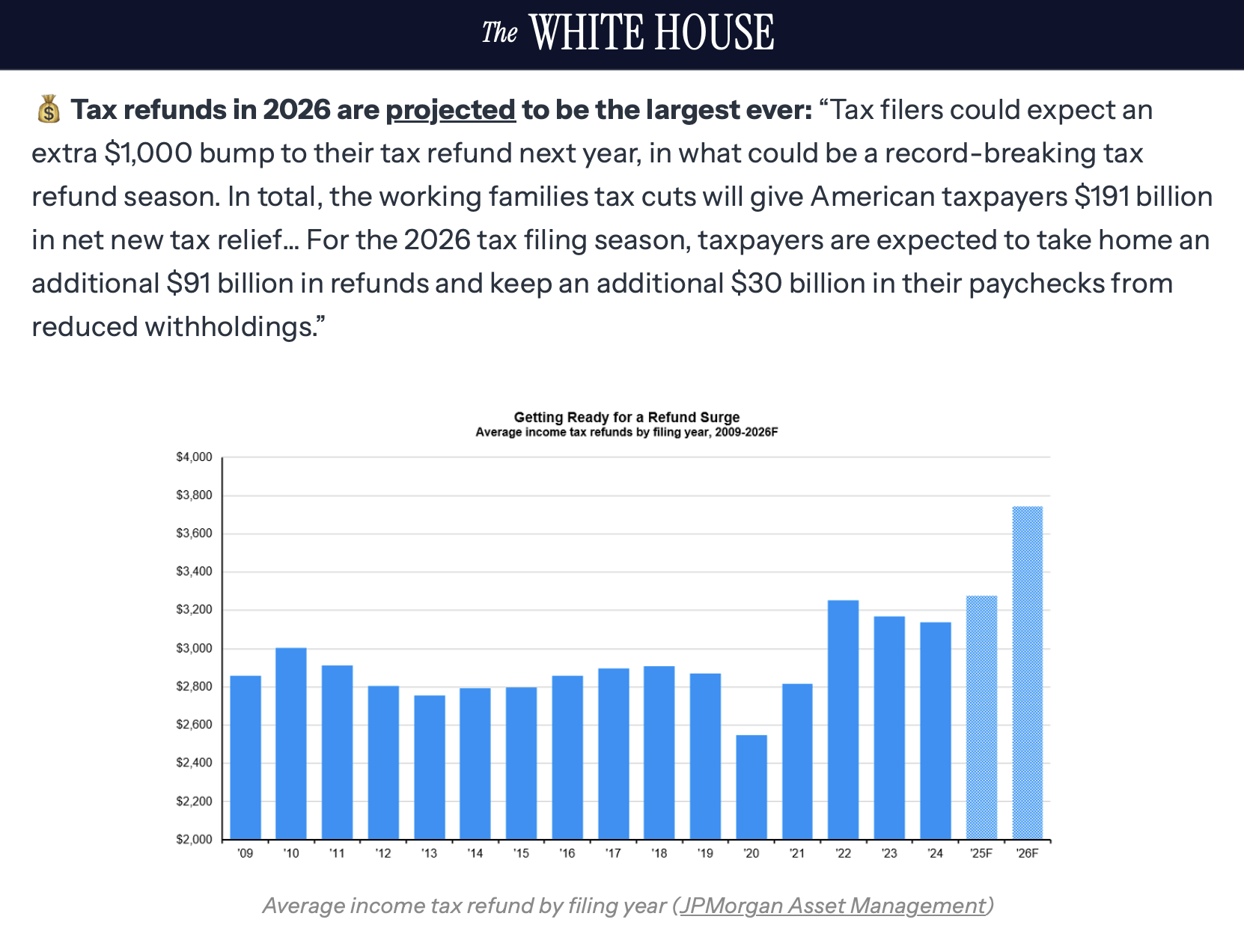

The White House and U.S. House Committee on Ways and Means cite early estimates showing the average refund could climb by roughly $1,000, adding as much as $91 billion to nationwide refund totals. The report also notes $30 billion in reduced withholdings ahead — a shift that increases take-home pay but does not affect the upcoming 2026 refund wave.

Screenshot source: The White House website.

Combined with other tax-credit changes, the total package represents roughly $191 billion in net tax relief. While that number sounds sweeping, analysts emphasize that effects vary widely depending on income, deductions, and filing status. Several OBBBA provisions drive the expected refund spike. Tips and overtime are no longer subject to federal income tax (up to $25,000 for single filers), Social Security benefits are tax-free for about 88% of seniors, and the state and local tax deduction cap jumps from $10,000 to $40,000.

Families also see a boosted Child Tax Credit, while the standard deduction and qualified business income deduction continue under extended rules first introduced in 2017. Although the administration frames these changes as relief for working families, distributional models reveal a more layered picture. The news follows statements from Trump on U.S. citizens getting checks, alongside Treasury Secretary Scott Bessent hinting at “substantial” 2026 refunds.

Middle- and upper-middle-income households — roughly $60,000 to $400,000 a year — are positioned to reap the largest gains. Higher earners may capture as much as 60% of the benefits, while many low-income households, which generally take the standard deduction, see smaller boosts. Phaseouts above $500,000 curb the impact for top-tier earners.

Read more: Grayscale Moves Toward First Zcash ETF With SEC Filing

Historically, the expected jump is significant. Data shows average refunds hovering between $2,800 and $4,300 over the past decade, with total annual refunds typically landing between $275 billion and $330 billion. Projections place 2026 refunds around $366 billion in nominal terms — high enough to qualify as “largest ever” before inflation adjustments. In real terms, the margin is thinner, but analysts agree the total will still be larger.

Crypto advocates, meanwhile, have seized on the projections with enthusiasm. Many argue that a wave of early-2026 liquidity is precisely the kind of spark that historically nudges retail investors toward bitcoin and other digital assets, referencing the stimulus-era buying frenzies of 2020 and 2021. While institutional dominance in today’s market may dilute the effect, supporters insist the consumer influx could still act as kindling for a broader risk-asset rally.

Whether the refunds ultimately hit record territory will depend on economic conditions — but analysts agree the ingredients for a substantial payout are already baked in.

FAQ ❓

- Why does the White House expect record refunds in 2026?

Retroactive 2025 tax cuts and unchanged withholding tables created widespread overpayments. - How much larger could refunds be?

Analysts estimate an extra $1,000 per filer and roughly $91 billion in additional refunds. - Who benefits most from these tax changes?

Reports claim that middle- and upper-middle-income households are projected to see the biggest gains. - Why are crypto advocates excited about larger refunds?

They believe extra liquidity could boost interest in bitcoin and other digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。