Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The competition in the field of artificial intelligence is profoundly affecting the macro landscape of the global technology market, with the rivalry between Google and Nvidia becoming the focal point. Google has demonstrated strong capabilities in the AI sector with its self-developed TPU-trained Gemini 3 model, directly challenging Nvidia's market dominance, leading to a drop of over 7% in Nvidia's stock price during trading, resulting in a market value evaporation of nearly $350 billion, ultimately closing down 2.6%. However, Nvidia quickly responded, claiming that its GPU platform is a generation ahead of the industry, with unparalleled versatility and performance advantages, and emphasized that Google remains an important client. Google, on the other hand, stated that the demand for its custom TPUs and Nvidia GPUs is both accelerating. Against this backdrop, macroeconomic policies have also added variables to the market, with the Federal Reserve expected to halt quantitative tightening on December 1, coupled with market expectations for a rate cut in December, injecting potential positive signals into the risk asset market, as investors closely monitor how these factors will collectively shape the future market direction.

In the Bitcoin market, most analysts currently lean towards market volatility. BitMEX founder Arthur Hayes believes Bitcoin will oscillate below $90,000 and may test the effective support level of $80,000 again, planning to hold major funds until early next year before making any moves. Analyst Murphy believes that while it is not difficult for Bitcoin to return to $90,000, there is strong resistance around $92,000 due to options data and the concentration of short-term holders' costs. Delphi Digital analyst that1618guy proposed two possibilities: in an optimistic scenario, the market could break through $103,500 after completing its adjustment; in a pessimistic scenario, the rebound may be hindered in the $95,000 to $99,000 range, followed by a drop to around $75,000. Meanwhile, James Check warned that leveraged liquidations may not be over, and prices could further dip to the $70,000 to $80,000 range. Swissblock's analysis pointed out that although prices rebounded to $89,000, market momentum remains deeply negative, and the rebound may only be a tactical response. If Bitcoin can stabilize above the $85,000 to $86,500 range, market momentum may turn. Analyst Mark Cullen predicts that if the unemployment claims data to be released later in the U.S. is poor, it could lead to a brief pullback of BTC to around $83,000. However, he believes a rebound may follow, especially around the U.S. Thanksgiving holiday. Lennaert Snyde noted that rBTC encountered resistance at $88,200 and is currently still in a downward trend. If the 4-hour candlestick breaks above $88,200, it could trigger a bullish target towards the $93,000 resistance area; if it falls below the $86,200 support, it may further dip to the low point of the $82,300 range. He emphasized that until it breaks above $93,000, the technical outlook remains bearish.

Regarding Ethereum, Fundstrat co-founder Tom Lee suggested that even if Ethereum may pull back to $2,500 in the short term, it is merely building strength for the upcoming "super cycle," predicting its price could rise 3 to 4 times in January, reaching the range of $7,000 to $9,000. This bullish sentiment is corroborated by the behavior of some market whales. According to Arkham Intelligence data, an "OG whale" who successfully profited $200 million during the market crash in October has recently increased its long position in Ethereum by $10 million, bringing its total holdings to $44.5 million. Although Ethereum's current price hovers around $2,900, market analysts believe changes in futures data may indicate a potential market bottom, but the overall trend remains filled with uncertainty.

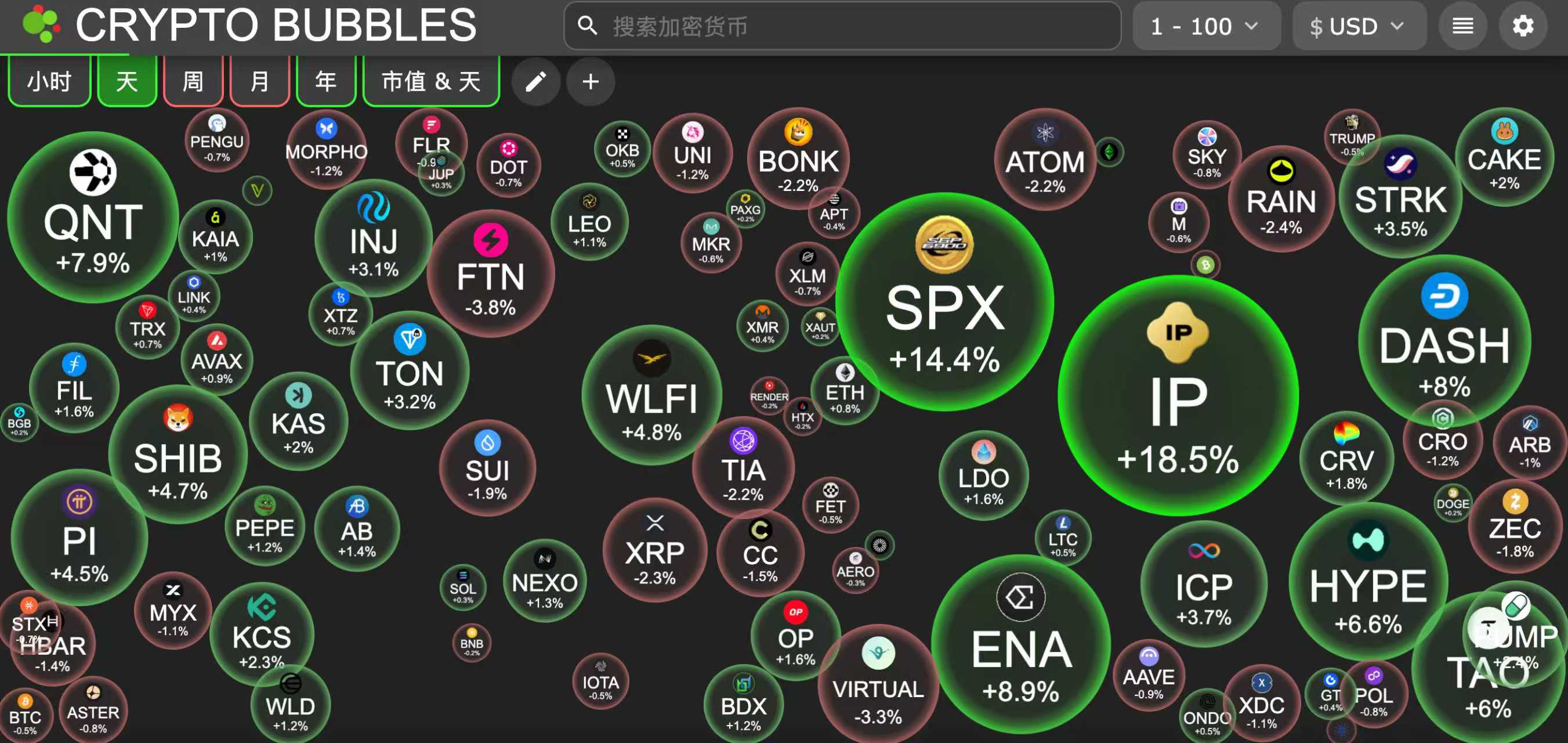

Most altcoins are in an upward state, with the PLUME token surging over 80% after being listed on the Korean crypto exchange Upbit with a Korean won trading pair. Additionally, although Hyperliquid is about to unlock $308 million worth of HYPE tokens for the first time, and some whales hold large short positions in HYPE, the token still rose nearly 10% in the past 24 hours.

2. Key Data (as of November 26, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $87,615 (Year-to-date -6.37%), daily spot trading volume $51.05 billion

Ethereum: $2,939 (Year-to-date -11.96%), daily spot trading volume $21.71 billion

Fear and Greed Index: 15 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 58.5%, ETH 11.5%

Upbit 24-hour trading volume ranking: PLUME, MON, XRP, BTC, ETH

24-hour BTC long-short ratio: 49.04% / 50.96%

Sector performance: Most of the crypto market is up, with RWA and AI sectors rising nearly 3%, while PayFi and Layer 2 sectors are correcting.

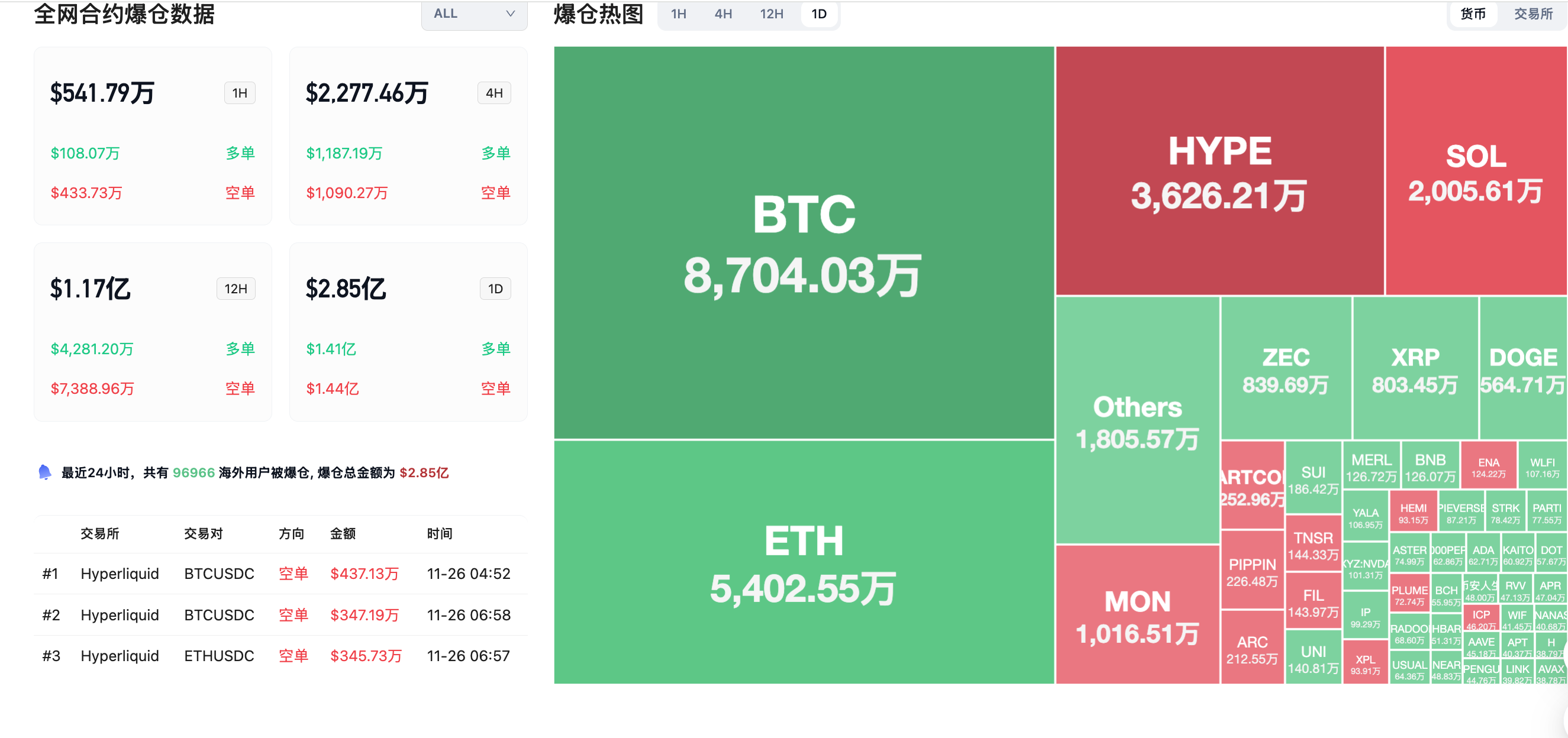

24-hour liquidation data: A total of 96,966 people were liquidated globally, with a total liquidation amount of $285 million, including $87.04 million in BTC, $54.02 million in ETH, and $32.63 million in HYPE.

3. ETF Flows (as of November 25)

Bitcoin ETF: +$129 million, with Fidelity FBTC net inflow of $171 million leading the way

Ethereum ETF: +$78.5849 million, net inflow for 3 consecutive days

Solana ETF: +$53.08 million

XRP ETF: +$35.41 million

HBAR ETF: +$986,000

DOGE ETF: +$1.8 million

4. Today's Outlook

BONK ETP under Bitcoin Capital will be listed on the Swiss Stock Exchange on November 27

Sahara AI (SAHARA) will unlock approximately 133 million tokens on November 27 at 8:00 AM, accounting for 1.33% of the total supply, valued at approximately $10.4 million;

Top gainers among the top 100 cryptocurrencies today: Story up 18.5%, SPX6900 up 14.4%, Ethena up 9%, Quant up 7.9%, Dash up 7.5%.

5. Hot News

Ark Invest increases its holdings in crypto companies like Block, Circle, and Coinbase

Multicoin Capital has purchased another 60,000 AAVE, worth $10.68 million

Arthur Hayes purchased $260,500 worth of PENDLE tokens from Flowdesk

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。