Author: Nancy, PANews

Last week, Bitcoin experienced another significant drop, and Strategy (MicroStrategy) found itself mired in FUD. In addition to facing doubts about the slowdown of the DAT flywheel, news of a potential removal from MSCI triggered short-selling alarms, further exacerbated by a Morgan Stanley research report that heightened market unease. As the current environment in the crypto market changes, Strategy is not only facing new challenges to its business model but is also gradually shifting its role from a simple Bitcoin exposure to a tactical tool.

38 Crypto Companies Targeted by MSCI, Strategy Responds that the Market Has Priced It In

Last Friday, as Bitcoin's key support level was breached, the market sentiment index fell into the "extreme fear" zone. During this sensitive period, a significant adjustment proposal from the globally renowned index company MSCI hit the market like a "bomb," putting further pressure on Strategy's stock price.

MSCI has long been regarded as a barometer for international capital. It is the core index compilation agency under Morgan Stanley Capital International, covering global listed company data such as market capitalization, liquidity, and trading volume, with a total asset value exceeding $15 trillion. Over 1,400 ETFs globally are linked to MSCI indices. This means that if a company is included in the MSCI index, it effectively receives an "entry ticket" for international large funds, attracting significant international capital attention and allocation. However, MSCI typically conducts four routine adjustments to its indices each year, including quarterly reviews in February and August, and semi-annual reviews in May and November. Therefore, removal from the MSCI index not only affects trading volume but also impacts institutional investors' investment decisions and market confidence.

In October this year, MSCI announced an extension of the consultation period regarding the inclusion of digital asset reserve companies in its indices. According to the preliminary proposal, if a company's balance sheet shows that cryptocurrencies (such as Bitcoin) account for 50% or more, that company may be excluded from the MSCI Global Investable Market Index. MSCI believes that such companies are more akin to investment funds rather than traditional operating companies, thus not meeting the equity index standards. Additionally, MSCI is soliciting market opinions on whether to add other criteria beyond asset proportion, such as whether the company self-identifies as a crypto reserve company or primarily accumulates crypto assets through fundraising.

Official documents indicate that 38 crypto mining companies and digital asset treasury companies, including Strategy, MARA Holdings, SharpLink Gaming, BitMine, MetaPlanet, Hut 8, Riot Platforms, and Marathon Digital Holdings, have been placed on the preliminary review list.

This adjustment consultation will continue until December 31, 2025, with a final conclusion expected to be announced on January 15, 2026. Any index changes may be officially implemented in the February 2026 index review.

In response, Strategy founder Michael Saylor stated in a Coindesk interview that this is "a bit alarmist" and emphasized that the market has already priced it in, suggesting that the actual outflow impact will be smaller. He noted that MSCI's decision is not directly related to index providers like Nasdaq or S&P 500 and stated that the value of digital assets is gaining widespread recognition in finance, accounting, and politics. Digital assets have become an integral part of the mainstream financial system, and the market is gradually accepting them.

MicroStrategy's Tough Choice: Reduce Bitcoin Holdings or Lose Index Eligibility

For Strategy, the potential MSCI adjustment presents two choices: first, to reduce Bitcoin holdings to below 50% to retain index eligibility. Strategy holds nearly 650,000 Bitcoins, meaning that if it chooses to reduce its holdings, it will inevitably exert significant selling pressure on the market, potentially exacerbating Bitcoin's price decline and triggering panic selling of other crypto asset treasury companies, creating a chain reaction. For Strategy itself, a short-term reduction could preserve the inflow of passive index funds, but it may simultaneously weaken market confidence in its core business model, which relies on long-term Bitcoin holdings for capital appreciation.

The second option is to maintain the current crypto asset allocation to sustain its revenue strategy. Strategy's operational model relies on holding large amounts of Bitcoin, maintaining company operations and shareholder returns through capital appreciation and financing activities. If it opts not to reduce its holdings, the company will lose MSCI index support, which could lead to investor withdrawals. Outflows and stock price pressure may further undermine market confidence, creating a negative cycle.

However, Saylor also emphasized that Strategy is not a fund, trust, or holding company, but a publicly traded operating company with a $500 million software business, executing a unique treasury strategy that utilizes Bitcoin as productive capital. This year, it has completed five public offerings of digital credit securities (STRK, STRF, STRD, STRC, and STRE), with a total nominal value exceeding $7.7 billion, and launched Stretch (STRC), a revolutionary Bitcoin-backed treasury credit tool that provides variable monthly dollar returns for institutional and retail investors. Unlike passive asset-holding funds and trusts, Strategy is the creator, structurer, issuer, and operator. The team is building a new corporate form, a structured financial company backed by Bitcoin, capable of continuous innovation in capital markets and the software sector. No passive investment tool or holding company can do what Strategy is doing.

"Index classification cannot define us. Strategy's strategy is long-term, and our belief in Bitcoin is unwavering. Our mission has always been to become the world's first cryptocurrency institution based on sound money and financial innovation," Saylor stated. Furthermore, Strategy posted on social media that during the 2022 crypto bear market, its average Bitcoin purchase cost was around $30,000, while BTC once dipped to about $16,000, during which the company chose to buy more Bitcoin, hinting that it may continue to increase its BTC holdings in this bear market.

Morgan Stanley Research Report Intensifies Market Panic, Short-Selling Sentiment Eases

Initially, MSCI's proposal did not attract widespread attention from retail investors until a recent Morgan Stanley report regarding the potential removal of Strategy from the MSCI index made many retail investors realize they were "late to the game," becoming a catalyst for further market panic.

On November 20, Morgan Stanley released a report stating that if Strategy were removed from the global financial company MSCI's stock index, it could lead to an outflow of approximately $2.8 billion; if other indices follow suit, the total outflow could reach $11.6 billion. The analyst emphasized that it is precisely due to these indices' inclusion that Bitcoin exposure has indirectly permeated retail and institutional investors' portfolios. However, with MSCI now considering removing Strategy and other companies primarily holding digital assets from the stock index, this previous indirect exposure may reverse.

It is noteworthy that Morgan Stanley's report sparked significant speculation in the market, with many believing that its report, released a month after the announcement, was a malicious short-sell and ignited a wave of resistance in overseas communities.

Some crypto users believe this is a well-orchestrated short-selling attack. For example, @_Adrian pointed out that observing the timeline, since May, short-sellers and large institutions have manipulated market sentiment; by July, Morgan Stanley significantly raised the margin for $MSTR, creating forced liquidation pressure; by September, after Metaplanet's capital increase, MSCI suspended processing its public offering; in October, MSCI extended the consultation announcement, cleverly coinciding with Trump's tariff announcement, triggering market panic; in November, Morgan Stanley leveraged old announcements to hype delisting risks. This attack on MSTR and DAT was premeditated and packaged as "regulatory action."

As the controversy continues to escalate, Bitcoin analyst The Bitcoin Therapist noted that many users have begun closing their Morgan Stanley accounts. For instance, Bitcoin advocate Grant Cardon stated he withdrew $20 million from the bank and plans to sue its credit card department for misconduct. Bitcoin advocate Max Keiser bluntly stated, "Take down Morgan Stanley, buy Strategy and Bitcoin."

From market data, it appears that Morgan Stanley itself has reduced its spot and put positions in MSTR.

According to Morgan Stanley's submitted 13F filings, it has reduced its MSTR stock holdings to varying degrees in both the second and third quarters of this year. As of Q3, it still held MSTR positions valued at over $760 million at the end of the third quarter. Meanwhile, the filings show that over the past two quarters, it has cumulatively held about $832 million in MSTR-related put options, with the number of shares corresponding to these options decreasing by approximately 79.5% compared to the previous quarter, leaving 363,000 contracts. In other words, although Morgan Stanley still holds a certain scale of put options, its overall exposure has significantly decreased. Compared to dozens of institutions like SIG, Citadel, IMC Chicago, Jane Street, and Simplex, Morgan Stanley's put position is not the largest.

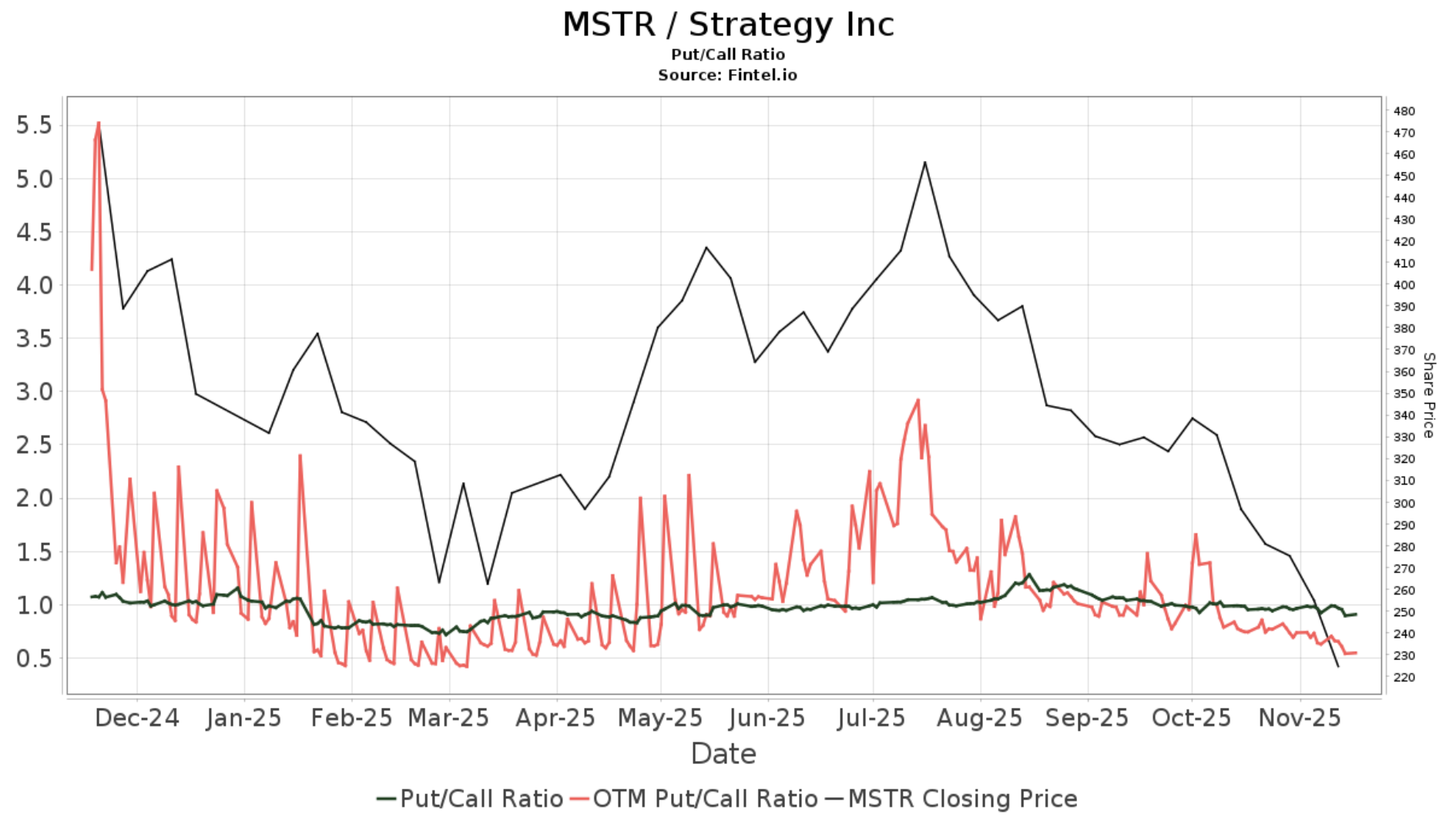

Additionally, Fintel data shows that the current put/call ratio for MSTR's open contracts is 0.74, where a ratio greater than 1 typically indicates bearish market sentiment, while a ratio less than 1 indicates bullish sentiment.

Reduced Holdings by Multiple Wall Street Institutions, Becoming the Preferred Hedge in the Crypto Market

MSTR was once an important tool for Wall Street investors to gain Bitcoin exposure. With its unique capital structure and leveraged holding strategy, MSTR was seen as a shortcut to high-risk, high-return Bitcoin exposure. Especially during Bitcoin price uptrends, this high volatility and high leverage structure could amplify returns, making investors willing to pay extra premiums for potential excess returns.

However, as the market environment changes, MSTR's role has undergone a significant transformation. First, Bitcoin spot ETFs and custody solutions have provided more direct and transparent investment tools, allowing investors to bypass MSTR to gain Bitcoin exposure directly. These products not only simplify the investment process but also reduce structural and leverage risks, offering investors lower-cost and easier-to-manage options. Second, competition among similar DAT companies has intensified, providing more alternative investment spaces. Meanwhile, MSTR's premium advantage has gradually diminished, meaning that investors are incurring additional costs for its leverage and structural risks, while potential returns may not increase correspondingly.

In fact, as early as the third quarter of this year, investors significantly reduced their MSTR stock holdings. According to CryptoSlate, in the third quarter, institutions sold off positions worth approximately $5.38 billion, with institutional holdings dropping from $36.32 billion to $30.94 billion, a decline of 14.8%. This involved institutions such as Capital International, Vanguard, BlackRock, and Fidelity, each reducing their holdings by over $1 billion. This sell-off was not due to forced liquidation caused by a market crash; Bitcoin remained relatively stable during the quarter, and MSTR's stock price was consolidating, indicating that MSTR is shifting from a necessity in investors' eyes to an optional investment, yet it still maintains over $30 billion in institutional market exposure.

It is worth mentioning that MSTR's high volatility and leveraged characteristics have attracted the attention of Wall Street hedge funds and arbitrage traders. Institutional investors are using its stock price fluctuations and capital structure differences for arbitrage trading, making MSTR no longer the only choice for long-term holders, but rather a tool for strategic hedging and leveraged operations in the market. For example, Tom Lee, Chairman and CEO of BitMine, recently pointed out in an interview with CNBC that Strategy has become the preferred tool for crypto investors to manage risk, which partly explains the significant decline in its stock price over the past month. After the market crash in October, native hedging tools like Bitcoin and Ethereum derivatives lacked liquidity for large funds, preventing major investors from directly hedging risks in the crypto market. With nearly 650,000 Bitcoins held, Strategy may be the most important observation target at the moment, as it serves both as a Bitcoin proxy stock and as a highly liquid alternative asset, prompting investors to use MSTR's highly liquid options chain for hedging operations. In his view, during the current downtrend, MSTR is one of the most severely affected targets, partly because it has taken on the market's "pressure valve" function, absorbing all the hedging pressure generated by the entire crypto industry to protect long positions. In fact, since the October 11 incident, the underlying structure of the crypto market remains fragile, and the phenomenon of Strategy becoming a hedging tool reveals deeper structural issues.

Crypto KOL @Rui also stated that at the beginning of October, institutions realized that MSTR might be removed from the index and preemptively sold off to protect themselves, causing MSTR's stock price to drop from $310 to $170, nearly a 50% decline. During this process, DCA (Dollar-Cost Averaging) selling and short-selling behaviors resonated, accelerating the panic decline. After JP Morgan released related news on November 20, a panic drop and large-scale short-covering operations occurred before the U.S. stock market opened, marking a pause in this round of MSTR speculation. He believes that the next market focus may shift to the next wave of institutional actions before the end of the year, and investors need to pay attention to whether the stock price stabilizes and whether there is significant selling pressure to assess the potential bottom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。