Author: Monad Eco

Compiled by: Tim, PANews

On the first day of the Monad public chain mainnet launch, this article will help you quickly grasp the representative projects in its DeFi ecosystem, including lending markets, yield products, and liquid staking.

Monad is built to accommodate millions of users entering DeFi, capable of supporting large financial applications to process massive business volumes daily. With a transaction processing capacity of 10,000 transactions per second, a block generation speed of 400 milliseconds, and high finality, Monad aims to eliminate common issues in DeFi, such as transaction failures, high slippage, oracle data delays, and high gas fees. DeFi applications running on Monad will operate efficiently at speeds comparable to centralized exchanges while fully implementing on-chain operations based on a decentralized network.

Lending Protocol: Asset Lending and Borrowing in the DeFi Ecosystem

DeFi lending can transform existing assets into usable liquidity. On Monad, it becomes an important way to amplify risk exposure: users can borrow stablecoins by collateralizing liquid staking tokens (LST), achieve higher yields through cyclical positions, or adopt various collateral strategies based on their level of participation. The lending protocols in the Monad ecosystem offer differentiated product solutions for different user groups.

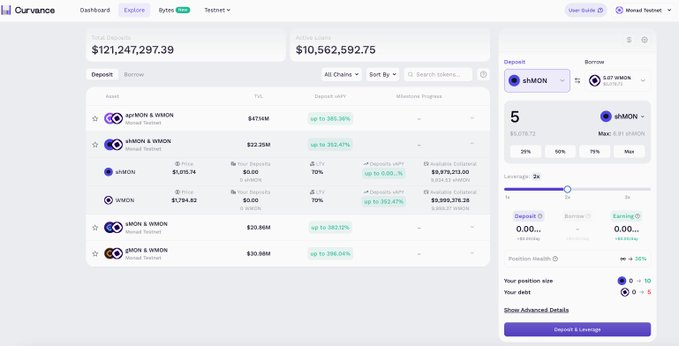

Curvance

Curvance allows users to convert interest-bearing assets such as MON, LSTs, and stablecoins into leveraged positions with a single transaction. The product interface eliminates traditional cyclical operation steps: there is no need to repeatedly deposit, borrow, or supply.

Curvance's core advantage is high capital efficiency, providing market-leading loan-to-value ratios and supporting various types of collateral: liquid staking tokens, interest-bearing stablecoins, yield derivatives, and vault tokens. The Curvance roadmap also includes support for more alternative assets.

The Curvance protocol employs a scalable liquidation mechanism: it enhances efficiency through batch liquidations, uses auction-style settlements to improve capital recovery rates, and introduces a points program to incentivize both depositors and borrowers.

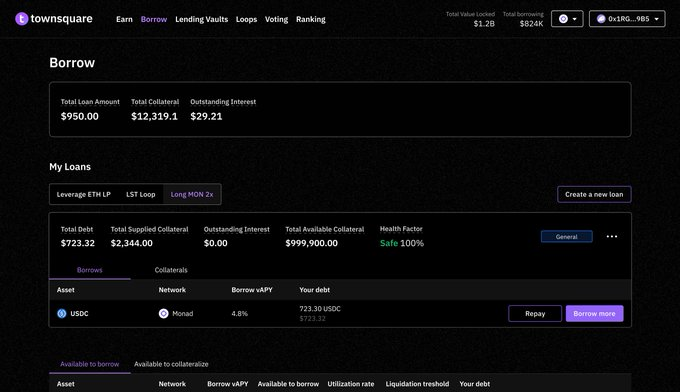

TownSquare

TownSquare adopts a more modular approach, suitable for users who prefer actively managing their positions: it allows for risk isolation, mixed collateral usage, and customization of each loan. Users can open multiple independent lending positions within a single account, each with its own dedicated collateral asset mix and borrowing target.

You can:

- Use liquid staking tokens as collateral to borrow stablecoins

- Use stablecoins to borrow MON

- Mix liquid staking tokens and stablecoins for diversified allocation

All of the above operations can be managed through a single wallet without switching between different operation interfaces.

TownSquare uses a unified liquidity pool model, where lenders share the same pool, while borrowers can build personalized positions. For correlated assets (such as MON and MON-LST), TownSquare also offers an "efficiency mode," allowing traders seeking to expand directional exposure to obtain higher loan-to-value ratios.

TownSquare plans to support various Monad liquid staking tokens and more mature assets, and will integrate with WLFI's USD1 stablecoin, issuing the sUSD1 interest-bearing token, which is designed for direct integration into cyclical strategies.

Other lending protocols launching on Monad:

Yield Products: Exploring Yield Opportunities

In addition to lending services, the Monad ecosystem also offers yield products that allow users to easily capture opportunities within the ecosystem. These products package investment strategies, active management features, and liquidity into holdable assets, enabling users to trade or utilize them within the DeFi ecosystem. This makes yield acquisition feasible and composable from day one. This section highlights two yield vaults that will be launched at the time of the Monad mainnet launch.

MON Vault: Actively Managed Asset Allocation

Built by Mellow and operated by Steakhouse, the MON vault provides an actively managed strategy for users who wish to earn yields without manual operations.

You do not need to deposit into various independent pools or strategies; simply deposit MON tokens, and the MON vault will automatically allocate funds to optimal choices, including liquid staking tokens, lending markets, or ecosystem incentive programs.

The MON vault primarily focuses on:

- Actively allocating various MON yield opportunities

- Dynamically adjusting strategies with the launch of liquidity platforms and LSTs

- Efficiently routing to various staking strategies

Ultimately forming a low-intervention MON yield strategy that accurately captures risk-controlled yield opportunities while maintaining liquidity, composability, and cross-Monad ecosystem portability.

earnAUSD Vault: Yield Enhancement Solution for High Liquidity Stablecoins

Jointly created by Agora and Upshift, the earnAUSD vault provides Monad ecosystem users with a one-stop stablecoin yield solution. Users only need to deposit the USD stablecoin AUSD issued by Agora to receive freely tradable interest-bearing tokens earnAUSD, without needing to personally manage investment strategies.

The earnAUSD vault will allocate AUSD assets to multiple yield channels within the Monad ecosystem. As the ecosystem develops, future strategies are expected to incorporate more diversified value-added opportunities such as basis trading and structured yield strategies.

The design of earnAUSD is based on three core functions:

- Optimized allocation: Automatically allocates funds to markets that can provide risk-adjusted returns.

- Deep composability: Supports cross-lending protocols, DEXs, and perpetual contract exchanges.

- Liquidity-first design: earnAUSD can still be used as collateral, traded in liquidity pools, and supported by the entire ecosystem.

Additionally, the earnAUSD vault integrates the native incentive layers of Agora and Upshift, creating a unified yield product for stablecoin users entering the Monad ecosystem.

MON Staking and Liquid Staking

In addition to lending protocols and yield products, the Monad DeFi ecosystem also includes MON staking and liquid staking services. By staking MON, users can earn staking rewards for maintaining network security. Users can stake directly to validator nodes through Gmonads or the MonadVision staking panel.

Liquid staking is an alternative to regular staking, allowing users to receive corresponding liquid staking tokens (LST) by staking assets. LST tokens can be used in various applications within the DeFi ecosystem, enabling stakers to earn staking rewards while simultaneously participating in other DeFi activities. By maintaining the liquidity of LST tokens, users can engage in asset trading, lending, liquidity provision, and other scenarios throughout the DeFi ecosystem.

Several protocols currently provide LST in the Monad ecosystem:

These LST tokens, with their extensive integration within the ecosystem, allow MON stakers to earn additional yields beyond the basic staking rewards.

In addition to the above protocols, the launch of the Monad mainnet will also welcome a multitude of DeFi protocols covering various categories. The launch of the Monad mainnet is just the beginning: these foundational protocols will enable users to start experiencing, optimizing, and laying out strategies to fully unleash the potential of a high-performance DeFi environment across the entire chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。