Author: 100y.eth, Four Pillars

Compiled by: Felix, PANews

The continuous growth of USDT indicates that a massive digital financial empire is rising. This article will review the 20 companies recently invested in by Tether and explore the three main strategies Tether is using to build its digital financial empire:

- Gaining trust through Bitcoin and gold;

- Strategic expansion across major continents;

- Enhancing convenience for retail and institutional users through services and products.

Tether and the Digital Financial Empire

Currency and Empire

Source: Dyken Wealth Strategies

Currency is a universally accepted medium of exchange and unit of value in daily life. However, from the perspective of an empire, the role of currency goes far beyond simple transactions; it can be seen as a tool of power, encompassing political, cultural, and social functions. Throughout the historical process of empires, currency has played the following roles:

- Symbol of order: The figures or imperial emblems carved on coins visually represent the authority of the empire, serving as proof of the imperial order to users.

- Tool of control: By centralizing the minting and issuance of currency, remote areas become dependent on the central empire's monetary system, thereby reinforcing imperial order.

- Standardization of resource concentration: Empires accumulate resources from various regions through taxes and tributes, and currency serves as the key medium for standardizing and transporting these resources.

Without exception, the status of currency always changes in sync with the status of the empire. When an empire rises and reaches its peak, its currency also becomes powerful and supports the empire. When an empire declines, the status of its currency also diminishes, accelerating the empire's demise.

Although terms like "empire" or "colony" have long disappeared, we have not yet escaped the influence of these concepts. The US dollar accounts for about 57% of global foreign exchange reserves and about 50% of SWIFT international settlements, maintaining its strong position.

Continuous Growth of USDT

Source: Artemis

With the development of information technology, a significant portion of the global economy has shifted to the internet. The emergence of blockchain technology has made it possible to use currency securely online. As the on-chain economy rapidly develops, stablecoins, which are used on-chain, have also quickly expanded to a scale of about $300 billion.

Among many stablecoins, Tether's USDT is the most noteworthy. USDT allows people in countries with highly unstable fiat currencies to easily access US dollars. Even without a credit history or bank account, anyone with an internet-connected device can easily obtain US dollars. This has opened the door for the rapid development of USDT, especially in developing and third-world countries.

Notably, despite the passage of the GENIUS Act and the gradual inclusion of blockchain into mainstream regulation, USDT's market share has not significantly declined. Its share remains above 60%, more than double that of the second-ranked USDC.

Towards a Massive Digital Financial Empire

Tether is building its vast empire with its USDT currency, but establishing an empire is no easy task.

Although USDT is pegged to the US dollar, its reserves include not only highly liquid cash equivalents such as cash, US Treasury bonds, and repurchase agreements but also relatively less stable assets like precious metals, Bitcoin, government bonds from countries outside the US, and corporate bonds. In major countries with established stablecoin regulatory frameworks, such assets cannot legally serve as reserve assets.

In fact, under the EU's Markets in Crypto-Assets (MiCA) regulatory framework, USDT fails to meet several conditions for electronic money tokens (EMT). As a result, exchanges in Europe have delisted USDT, effectively pushing it out of the EU market.

However, Tether has not given up. As a company, Tether acquires equity by investing in various startups and companies and occasionally donates to non-profit organizations. By examining these actions, we can infer the direction Tether has chosen and how it attempts to build its digital financial empire.

The following will outline Tether's investment cases to understand how it overcomes challenges in empire building.

What Types of Companies Does Tether Invest In?

Tether is a company that attracts significant attention from the crypto community. This is not surprising, as Tether is the issuer of the world's largest stablecoin, USDT, and is also one of the companies with the highest per capita income globally.

The crypto community seems particularly interested in protocols that issue tokens supported by Tether. Typical examples include Stable and Plasma, both specifically designed for USDT. However, these two projects are not directly invested in by Tether but rather by related entities such as Bitfinex, USDT0, and Tether CEO Paolo Ardoino.

Although Tether is very active in corporate investments, most of the companies it invests in do not issue tokens and lack strong regional characteristics, so these investments have not attracted much attention from the crypto community. Nevertheless, examining Tether's investment cases can still reveal its future development direction.

What Types of Companies Does Tether Invest In?

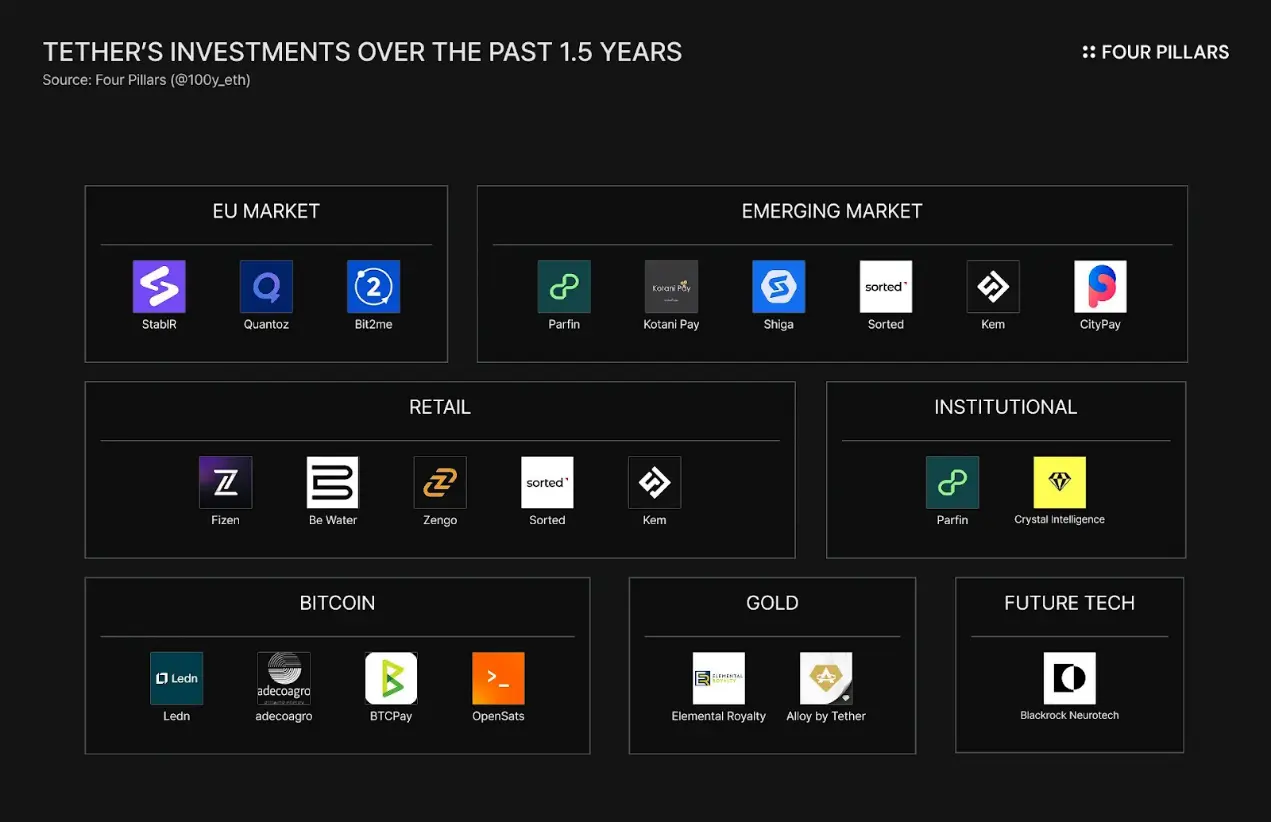

After analyzing about a year and a half of Tether's investment announcements, several key themes can be summarized:

- European Market: Although USDT has been expelled from the EU, Tether is attempting to enter the European market by investing in issuers and platforms within Europe.

- Emerging Markets: The product-market fit (PMF) of USDT has been validated in emerging markets. Tether is strategically expanding its influence in these regions.

- Retail Users: Tether invests in various non-custodial wallet developers to ensure that retail users can easily access USDT.

- Institutions: In addition to retail users and emerging markets, Tether also invests in enterprise solution providers to help institutions more easily access USDT.

- Bitcoin: Tether continues to invest in BTC and the broader Bitcoin ecosystem.

- Gold: Tether views gold alongside BTC as an important geopolitical asset and is accelerating its dual-axis strategy centered on Bitcoin and gold.

- Future Technologies: Tether invests not only in currency-related businesses but also in advanced technologies that contribute to human society.

These themes reflect the coherent strategic direction that Tether aims to build for its digital financial empire.

Indirect Entry into the European Market

StablR

Source: StablR

StablR is a stablecoin issuer registered in Malta that complies with MiCA regulations, issuing EURR pegged to the euro and USDR pegged to the US dollar. In addition to accepting investments, StablR plans to use Tether's tokenization platform, Hadron. Hadron is a SaaS platform designed to tokenize various assets, including stocks, bonds, commodities, and stablecoins, with robust capabilities to support the entire lifecycle management of tokens, KYC, AML, monitoring, and other regulatory compliance infrastructure.

Quantoz

Source: Quantoz

Quantoz is a stablecoin issuer that complies with MiCA regulations, offering EURQ and EURD pegged to the euro and USDQ pegged to the US dollar. EURD is specifically designed for closed systems, making it a universal stablecoin compared to EURQ. Quantoz also plans to use Tether's Hadron tokenization platform.

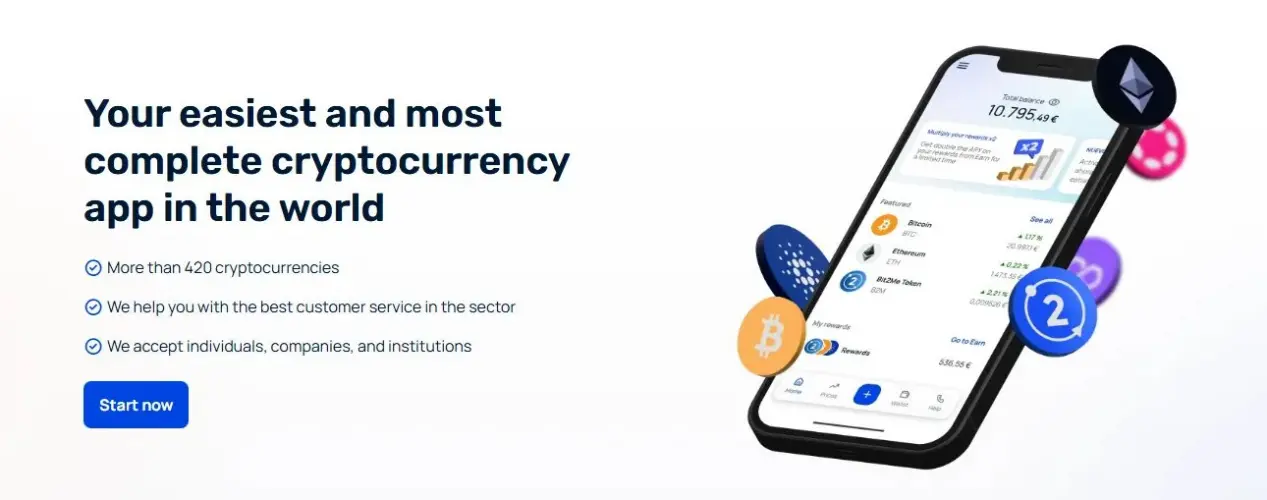

Bit2Me

Source: Bit2Me

Bit2Me is the largest digital asset platform in the Spanish-speaking world. Individuals, businesses, and institutions can trade and invest in various cryptocurrencies and participate in various financial activities such as remittances, payments, and lending. Founded in 2014, Bit2Me has been operating for over a decade and has more than 1.2 million users. Bit2Me operates under MiCA compliance and holds a CASP license, making it a highly strategic investment for Tether.

Targeting Emerging Markets

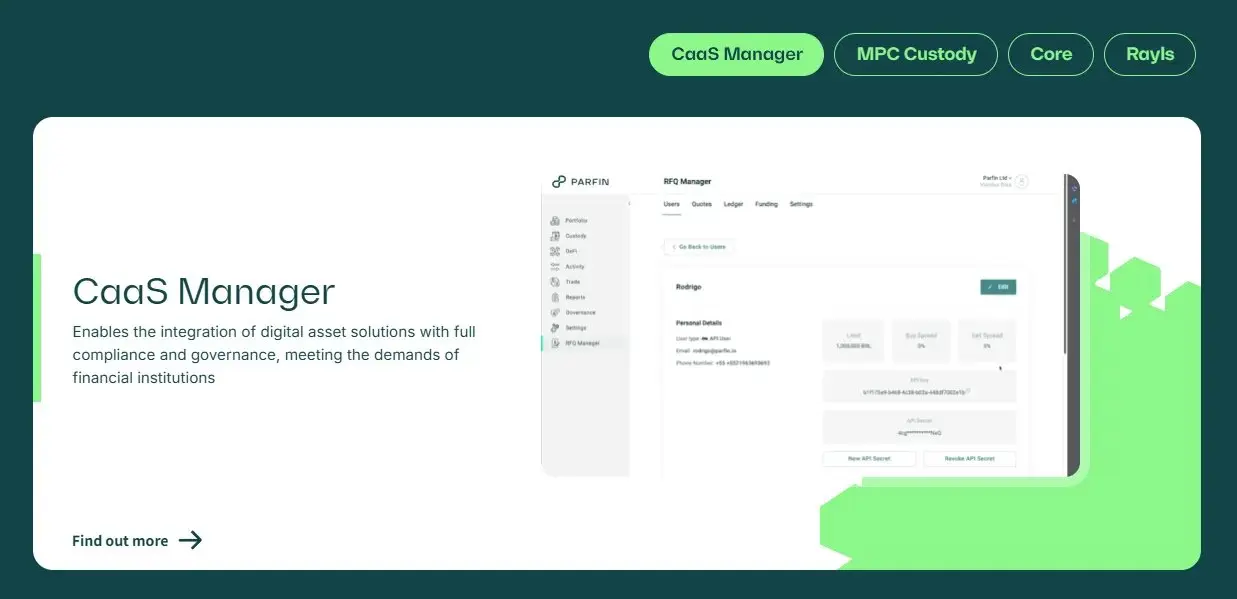

Parfin

Source: Parfin

Parfin is an institutional blockchain infrastructure company based in Latin America. Parfin provides management and workflow platforms that enable financial institutions to adopt blockchain technology and cryptocurrencies, offering secure MPC wallet solutions and asset tokenization services. Parfin has also received investments from venture capital firms such as Framework, Valor, Accenture, and ParaFi. By investing in Parfin, Tether aims to help financial institutions in Latin America more easily use USDT.

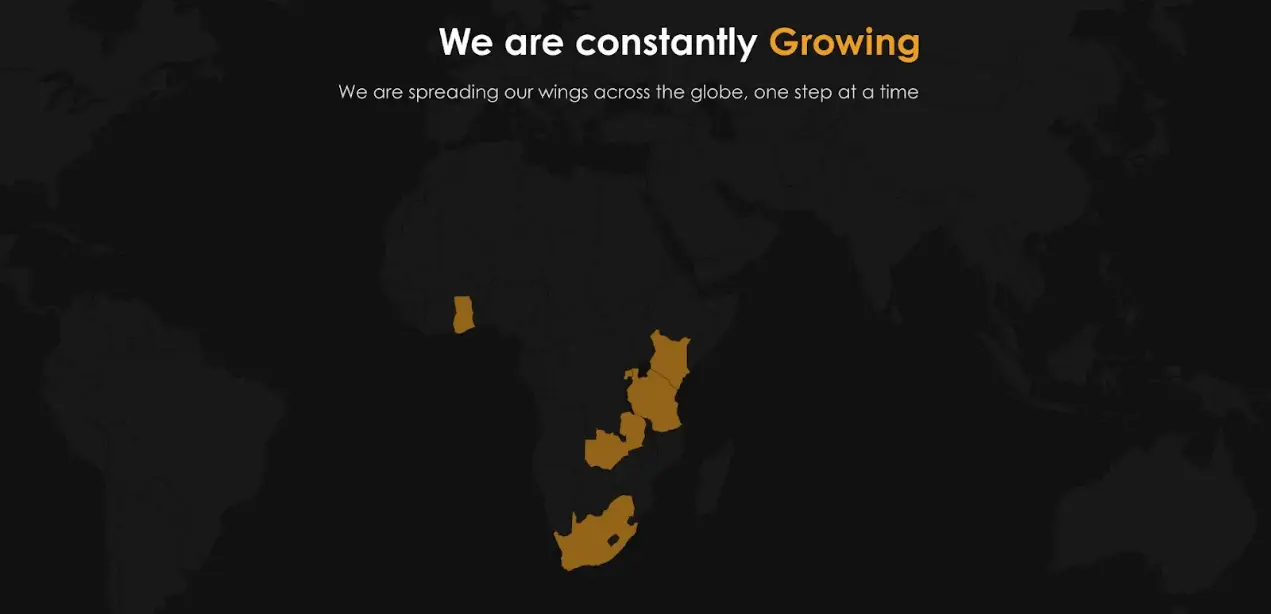

Kotani Pay

Source: Kotani Pay

Kotani Pay is a Web3 payment infrastructure company based in Africa, providing services such as deposits and withdrawals, stablecoin settlements and payments, and blockchain wallets. By investing in Kotani Pay, Tether plans to expand the deposit and withdrawal infrastructure in Africa, making it easier for African users to access USDT.

Shiga

Source: Shiga

Shiga is a blockchain financial solutions company based in Africa, offering a variety of blockchain services including exchanges between local currencies and stablecoins, over-the-counter trading, corporate virtual accounts, corporate fund management, and blockchain solution development. These services enable individuals and businesses across Africa to access the dollar economy through on-chain finance. Tether has stated that it views Africa as a key region for USDT adoption and is investing in Shiga to actively expand its presence in the African market.

Sorted

Source: Sorted

Sorted is a wallet solutions company based in Africa and South Asia, providing non-custodial wallets that run smoothly on basic phones and low-end smartphones. This greatly increases financial access for impoverished or unbanked populations. Users of Sorted can make cryptocurrency remittances, payments, and exchanges. By investing in Sorted, Tether can also expand its influence in Africa and South Asia.

Kem

Source: Kem

Kem is a widely used cryptocurrency remittance, payment, and financial management application in the Middle East. Users can use their crypto assets for remittances and payments within the Kem app, and they can also link it to physical cards or even invest in assets like gold. Like Africa and Latin America, the Middle East has a large number of foreign workers, so USDT-based crypto remittances can greatly stabilize their lives. Tether plans to expand USDT's market share in the Middle East by investing in Kem.

CityPay

Source: CityPay

CityPay is a crypto payment company based in Georgia. In addition to Georgia, it is actively expanding its business in Eastern Europe, including Armenia, Azerbaijan, Kazakhstan, and Uzbekistan, by providing wallet services, issuing payment cards, and acquiring crypto payment merchants. By investing in CityPay, Tether aims to strategically secure USDT's market share in the Eastern European payment market.

Retail Strategy

The aforementioned Sorted and Kem are also non-custodial wallet solution companies that can be included in the retail strategy.

Fizen

Source: Fizen

Fizen is a consumer-facing crypto super app. Users can store, transfer, and use cryptocurrencies for payments through a self-custody wallet, while Fizen offers features such as payments, shopping, and gift cards, allowing users to integrate cryptocurrencies into their daily lives. By investing in Fizen, Tether aims to provide users with a high-quality USDT experience, enabling USDT to be widely used for everyday payments.

Be Water

Source: Be Water

Be Water is a media and content company based in Italy, engaged in film, television, and documentary production and distribution, while also operating a news brand. Tether invested 10 million euros to acquire a 30.4% stake in Be Water, allowing Tether to establish a foothold in the global content ecosystem beyond the financial sector.

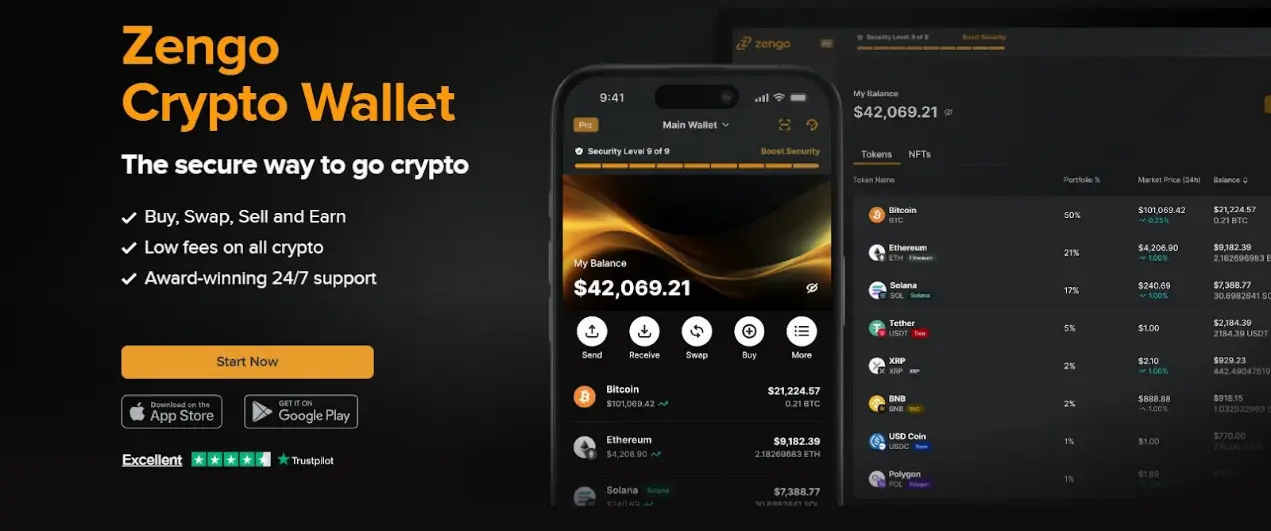

Zengo

Source: Zengo

Zengo is a wallet solution based on multi-party computation (MPC), allowing users to securely use self-custody wallets without managing complex mnemonic phrases. By investing in Zengo, Tether enables users to store, send, and use Tether-based assets for payments more securely.

Institutional Strategy

Parfin is also a company serving financial institutions in Latin America, so it can also be included in the institutional strategy.

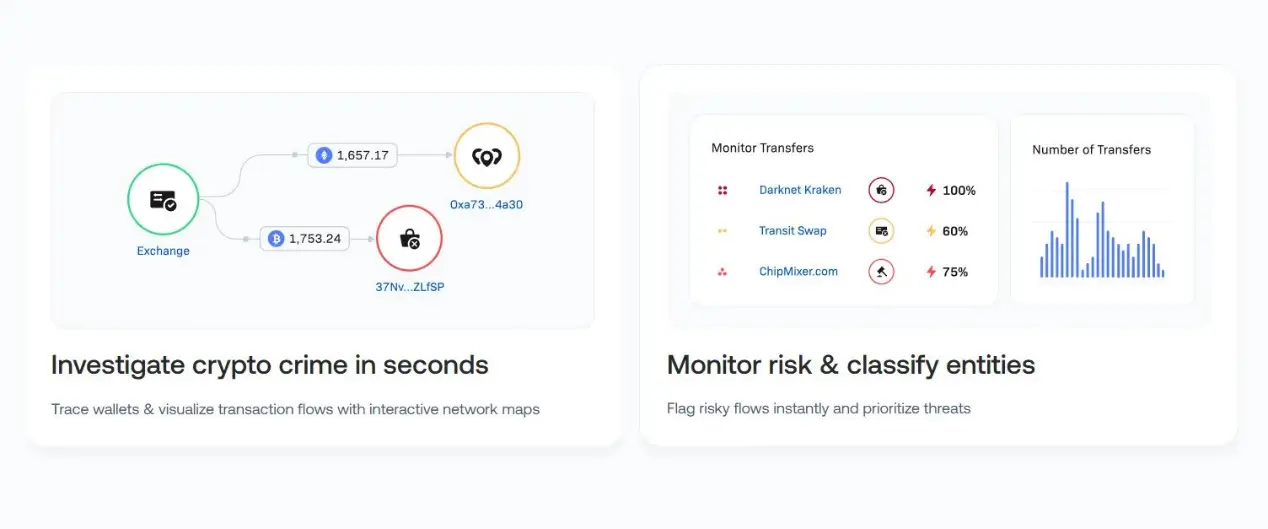

Crystal Intelligence

Source: Crystal Intelligence

Crystal Intelligence is a blockchain intelligence company engaged in fraud detection, risk monitoring, real-time wallet address analysis, regulatory support, illegal fund tracking, and crime response. By investing in Crystal Intelligence, Tether strengthens its collaboration with Crystal Intelligence and enhances its ability to prevent USDT from being misused for illegal activities. This is an important strategic investment for USDT's development as an institution-friendly stablecoin.

Investments in the Bitcoin Space

Ledn

Source: Ledn

Ledn is a Bitcoin-collateralized lending platform that allows individuals and businesses to borrow stablecoins using Bitcoin as collateral. Tether has been committed to building infrastructure that connects crypto assets with real financial use cases, and since Ledn is pioneering new financial markets based on Bitcoin, Tether has invested in it.

Adecoagro

Source: adecoagro

Adecoagro is the largest sustainable agriculture and renewable energy company in South America, listed on the New York Stock Exchange. Adecoagro sells part of its self-generated electricity on the spot market, but due to severe price fluctuations, revenues can be unstable. From this perspective, Bitcoin mining can serve as a stable buyer of electricity. Tether plans to acquire up to 70% of Adecoagro's shares and jointly promote a Bitcoin mining project.

BTCPay Server Foundation

BTCPay is an open-source Bitcoin and stablecoin payment processor. Its uniqueness lies in its self-hosted model, allowing users to run it directly on their own servers. Tether has supported BTCPay for two consecutive years to strengthen the infrastructure for censorship-resistant payments using Bitcoin and USDT.

OpenSats

Source: OpenSats

OpenSats is a 501(c)(3) nonprofit organization in the United States dedicated to funding Bitcoin and anti-censorship technologies. OpenSats operates a sustainable model to support the Bitcoin open-source ecosystem, with donations used to fund Bitcoin protocol development, privacy tool development, research, and education. Although this is not an investment, Tether has been donating to OpenSats, indicating its ongoing support for Bitcoin and the open-source ecosystem.

Gold as a Geopolitical Asset

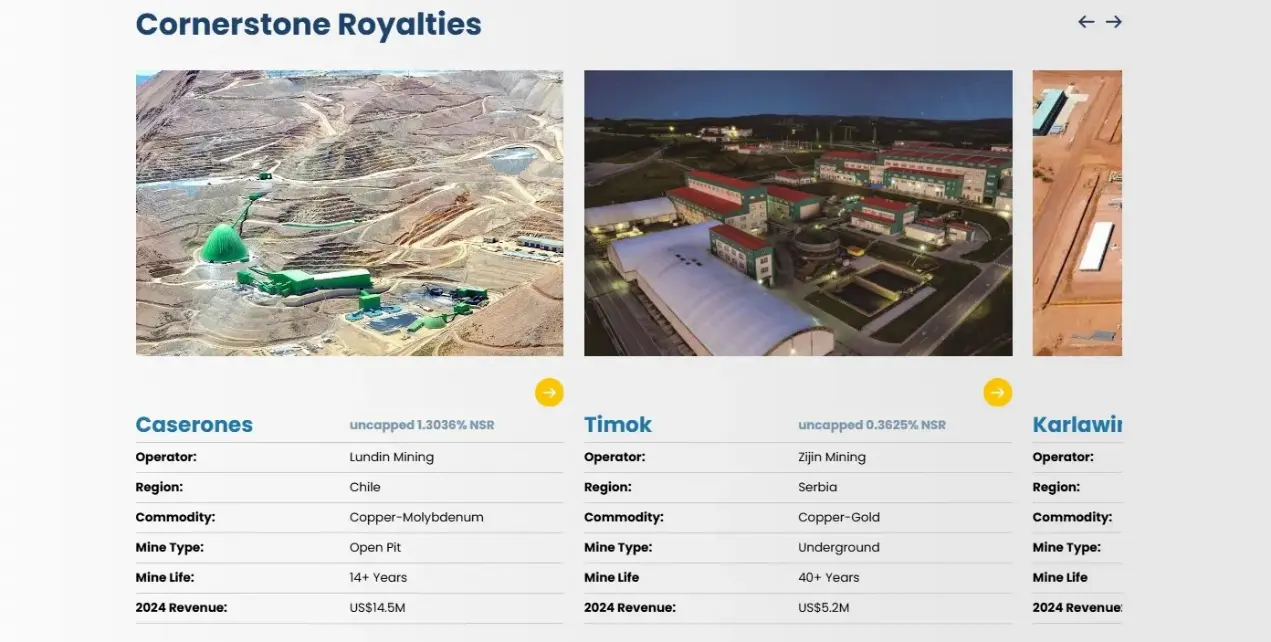

Elemental Altus Royalties

Source: Elemental Royalties

Elemental Altus Royalties is a company related to gold mining, but it does not directly mine gold. Instead, it generates revenue by entering into licensing agreements with gold mining companies. Tether views gold alongside Bitcoin as the infrastructure of digital currency and has acquired a 31.9% stake in Elemental Altus Royalties to strengthen its gold-related strategy.

Alloy

Source: Alloy

Alloy is a service directly launched by Tether rather than an invested company, but it plays a key role in Tether's gold-related strategy, so it is mentioned here. Tether offers a gold token service called XAUT, while Alloy issues aUSDT, a gold-backed stablecoin collateralized by XAUT. This is an attempt to recreate the gold standard and is part of Tether's efforts to strengthen its gold and Bitcoin strategy.

Related reading: Tether's Gold Empire: The Ambitions and Fractures of a "Stateless Central Bank"

Future Technology Investment

Blackrock Neurotech

Source: Blackrock Neurotech

Blackrock Neurotech is a company in the field of brain-computer interfaces, founded by a research team from the University of Utah. The technology developed by the company implants electrodes in the brain, converting thoughts into digital signals. Those who are mobility-impaired, lack sensory function, or face communication barriers can significantly improve their quality of life through Blackrock Neurotech's technology. With this investment, Tether has become a major shareholder, indicating that its ambitions extend beyond the financial sector to advanced future technologies designed for humanity.

Conclusion

Source: Tether

Tether holds $135 billion in U.S. Treasury bonds, ranking 17th globally, surpassing South Korea. In fact, Tether has built a digital empire with its currency, USDT.

Through the companies Tether has recently invested in, we can observe its strategy for building a digital empire.

- Gaining Trust: Tether aims to earn user trust through its two main assets, Bitcoin and gold.

- Global Expansion: Tether seeks to cover major continents worldwide, including Asia, Africa, South America, Europe, the Middle East, and recently entering the U.S. market through USAT.

- Increasing Accessibility: Tether is committed to making it easy for retail users, businesses, and institutions to use USDT in their daily and financial activities through various services.

Some have predicted that as blockchain regulation becomes increasingly strict, the status of Tether and USDT would be weakened, but this prediction has proven to be incorrect. The U.S.-centered stablecoin industry will continue to grow, and the influence of Tether and USDT will accelerate.

Related reading: Interview with Tether CEO: The "Genius Act," Circle IPO, Bitcoin, and Tether's Trillion-Dollar Market Cap

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。