Highlights of This Issue

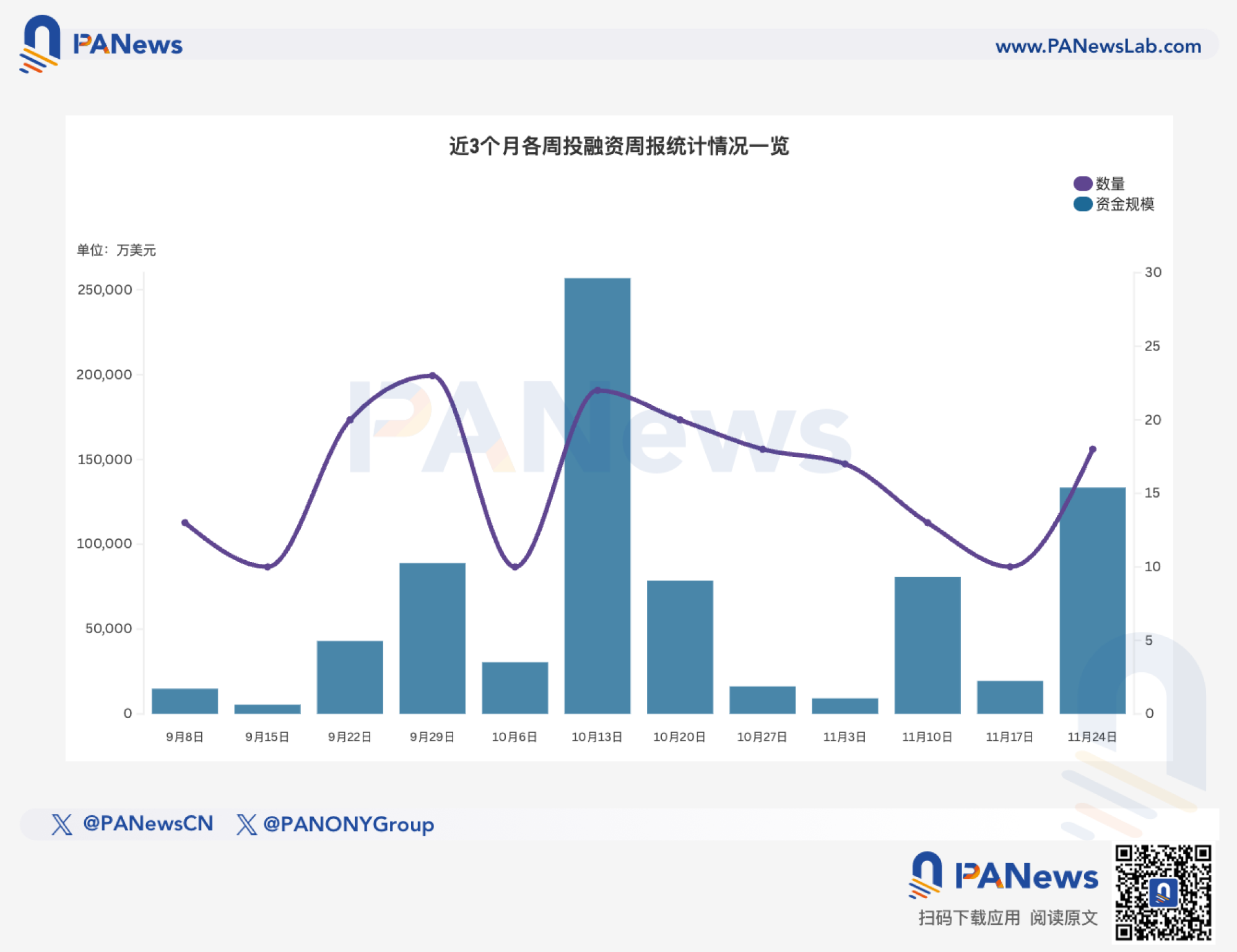

According to incomplete statistics from PANews, there were 18 investment and financing events in the global blockchain sector last week (11.17-11.23), with a total funding scale exceeding $1.334 billion. Additionally, the total financing amount for listed companies' crypto asset reserves exceeded $300 million. The overview is as follows:

- DeFi announced 6 investment and financing events, including Solana ecosystem yield trading protocol RateX, which completed a new financing round of $7 million, with participation from Animoca Ventures and others;

- The Web3+AI sector announced 2 investment and financing events, including AI agent smart data layer ZENi, which completed a $1.5 million seed round financing, led by Waterdrip Capital and Mindfulness Capital;

- The Infrastructure & Tools sector announced 3 investment and financing events, including Layer1 decentralized autonomous smart chain CratD2C, which received a $30 million strategic investment from Nimbus Capital;

- The Centralized Finance sector announced 3 investment and financing events, including French crypto bank fintech company Deblock, which completed a €30 million Series A financing;

- In the Other Web3 Applications sector, 4 investment and financing events were announced, including Web3 game WizzWoods, which completed a $10 million Series A financing, led by Animoca and IVC;

- Additionally, 1 listed company completed financing for a crypto treasury strategy: listed company Onfolio Holdings raised $300 million.

DeFi

TRONBANK, an infrastructure provider in the TRON ecosystem, announced that it has received strategic investments from five international institutions, with BlockX leading a $10 million investment. Other participating institutions include: Sky Venture Labs, K300 Ventures, Blockin.Ventures, and Onebit Ventures. It is reported that TronBank is a DeFi platform on the TRON blockchain that provides energy leasing, TRX staking, and on-chain yield services through secure and transparent smart contracts. TRONBANK currently focuses on three main areas: energy leasing, TRX staking finance, and yield optimization mechanisms.

Solana ecosystem yield trading protocol RateX has raised a total of $10.4 million in financing over the past two years. The latest round raised $7 million, with investors including Animoca Ventures, ECHO, GSR, Crypto.com Capital, Gate, Rzong Capital, BGX Capital, and Summer Capital.

It is reported that the protocol helps users trade and manage yields through tokenized financial products, and the recently launched Mooncake upgrade supports non-liquidation leveraged token trading. In June of this year, the U.S. listed company DeFi Development Corp. strategically integrated its staking tokens with the RateX ecosystem to obtain additional yield strategies.

HelloTrade, a blockchain trading platform founded by former BlackRock executives, has completed a $4.6 million first round of financing, led by Dragonfly Capital, with Mirana Ventures and several angel investors participating. The company was co-founded by Kevin Tang, former senior director of BlackRock's digital asset team, and Wyatt Raich, former head of digital asset labs, aiming to provide overseas investors from Vietnam, Indonesia, and other countries with convenient access to U.S. stock and commodity investments through blockchain technology. The platform will support derivatives such as perpetual futures and is scheduled to launch by the end of this year or early next year.

Mu Digital announced that it has completed a $1.5 million Pre-Seed round financing, with investors including UOB Venture Management, Signum Capital, CMS Holdings, Cointelegraph Accelerator, and Echo. Mu Digital focuses on bringing real assets from Asia's $20 trillion credit market on-chain and plans to launch the Monad mainnet on November 24. Products include Asia Dollar (AZND) with a targeted yield of 6-7% and muBOND with a yield of up to 15%.

Takadao completes $1.5 million seed round financing and launches LifeCard for stablecoin consumption

Web3 financial platform Takadao, headquartered in Riyadh, Saudi Arabia, with an office in Singapore, announced the completion of a $1.5 million seed round financing, with participants including Hasan VC (Malaysia), Syla Invest (France), Wahed Ventures (UK), Ice Blue Fund (Japan), Istari Ventures (USA), Adverse (Saudi Arabia), and Draper Associates from Silicon Valley, USA. The total financing has reached approximately $3.1 million (including previous pre-seed rounds and other investments). Additionally, Takadao has launched LifeCard—a prepaid VISA card that allows users to spend stablecoins like cash at any location that supports VISA.

USD.AI development team Permian Labs announces investment from Coinbase Ventures

The development team of USD.AI, Permian Labs, announced that it has received investment from Coinbase Ventures, with the specific amount undisclosed. USD.AI is a structured on-chain credit system that connects decentralized liquidity with real-world financing supported by GPU infrastructure for artificial intelligence. It is reported that Permian Labs is responsible for developing and maintaining the USD.AI protocol, which aims to facilitate on-chain secured lending operations using verifiable productive assets as collateral. USD.AI is also the issuer of the stablecoin USDai and the yield-bearing sUSDai, both of which are foundational tokens of the protocol.

AI

Numerai completes $30 million financing at a $500 million valuation

AI-based decentralized hedge fund Numerai has completed a $30 million financing at a $500 million valuation, led by university endowment funds, marking a fivefold increase from its previous round in 2023. Existing investors, including Union Square Ventures, Shine Capital, and Paul Tudor Jones, also participated in this round of financing.

AI agent smart data layer ZENi announced the completion of a $1.5 million seed round financing, led by Waterdrip Capital and Mindfulness Capital, with participation from Rootz Labs, Attention Ventures, DePIN-X, and Metalabs Ventures. It is reported that ZENi is an intelligent data layer that supports AI agents and the emerging information finance (InfoFi) economy, planning to build a data intelligence backbone relied upon by AI agents, transforming online and on-chain signals into structured intelligent information and enabling automated execution.

Infrastructure & Tools

Layer1 decentralized autonomous smart chain (DASC) CratD2C has received a $30 million strategic investment from private alternative investment group Nimbus Capital. This funding will strengthen CratD2C's global infrastructure, expand its "12+1" diverse ecosystem, and accelerate the promotion of flagship products within its network. It is reported that CratD2C is an EVM-compatible Layer-1 blockchain that supports an interconnected ecosystem covering e-commerce, real estate, DeFi, and asset tokenization. CratD2C is based on a DPoS mechanism and has been audited by CertiK and Hacken.

The developer of the compliance privacy protocol xbow announced the completion of a $3.5 million seed round financing led by Starbloom Capital, with participation from Coinbase Ventures, Boost VC, Status, and several well-known investors. The privacy protocol Privacy Pools under 0xbow is set to launch in March 2025, achieving on-chain privacy and regulatory compliance through zero-knowledge proofs and a real-time compliance layer (ASP), having processed over $6 million in transactions to date. The protocol has recently been integrated into the wallet Kohaku launched by the Ethereum Foundation.

Stablecoin issuer Tether announced an investment in Parfin aimed at accelerating the adoption of the US dollar stablecoin USDT among institutions and enhancing access to efficient blockchain settlement solutions in Latin America. Parfin is a digital asset custody, tokenization, trading, and management platform in Latin America, providing financial institutions with secure tools to explore the potential of digital assets and blockchain technology.

DAT

(Such transactions are not included in this financing weekly report statistics)

Listed company Onfolio Holdings raises $300 million to build a digital asset treasury

Onfolio Holdings Inc. (Nasdaq: ONFO, ONFOW) announced that it has secured up to $300 million in financing through a convertible bond financing arrangement with a U.S. institutional investor. This agreement provides Onfolio with substantial long-term funding to build its digital asset treasury (including Bitcoin, Ethereum, and Solana), generate yield through staking, strengthen its balance sheet, and accelerate the growth of its operating businesses. The initial transaction terms are as follows: approximately $6 million in total proceeds will be raised at the first closing around November 18, 2025 (subject to customary conditions). A second closing is expected to raise $2 million about 30 days later. Under specific conditions, future potential batch financing could reach up to $292 million.

Centralized Finance

Kraken receives $200 million investment from Citadel Securities, valuation rises to $20 billion

U.S. crypto exchange Kraken has received a strategic investment of $200 million from Citadel Securities, raising its valuation to $20 billion. This financing follows its $600 million round completed in September, when its valuation was $15 billion, with investors including Jane Street, DRW, and Oppenheimer. Kraken plans to use the funds for global expansion and payment product development, as well as to prepare for an IPO next year. Citadel founder Ken Griffin has historically been cautious about the crypto market, and this move is seen as a key signal of his changing attitude towards digital assets.

Crypto bank fintech company Deblock completes €30 million Series A financing, led by Speedinvest

French crypto bank fintech company Deblock has completed €30 million in Series A financing to support its expansion in Europe, with Germany set to be its next core market. This round of financing was led by Speedinvest, with CommerzVentures and Latitude participating, along with existing investors 20VC, Headline, Chalfen Ventures, and Kraken Ventures. Since its launch in France in April 2024, Deblock has gained over 300,000 users. It has introduced Europe’s first fully on-chain banking solution, including a regulated EMI euro account and a 100% self-custodied crypto wallet, allowing users to manage fiat and digital assets on a single platform, trade over 100 cryptocurrencies without restrictions, and use it for everyday payments such as rent, shopping, and cross-border transfers.

Tether announces strategic investment in Bitcoin mortgage market Ledn

Tether has announced a strategic investment in the Bitcoin mortgage market Ledn to expand opportunities in Bitcoin-backed loans. Ledn's infrastructure includes custody, risk management, and settlement systems, and since its inception, Ledn has issued over $2.8 billion in Bitcoin-backed loans, with over $1 billion issued in 2025 alone, marking its strongest annual performance to date. In the third quarter of 2025 alone, Ledn issued $392 million in loans, nearly matching the total for all of 2024. The company now reports that its annual recurring revenue (ARR) has exceeded $100 million, highlighting the growing market demand for secure Bitcoin-backed loan products.

Others

Prediction Market:

Kalshi completes $1 billion financing at a $11 billion valuation, led by Sequoia and CapitalG

Prediction market platform Kalshi has completed $1 billion in financing, reaching a new valuation of $11 billion, led by Sequoia and CapitalG. This round of financing comes less than two months after its previous $300 million financing at a $5 billion valuation. Kalshi allows users to bet on various events and operates within legal boundaries, with an annual trading volume exceeding $50 billion. Its main competitor, Polymarket, is also rumored to be seeking financing at a valuation of $12-15 billion.

FastX Network completes $3 million financing

FastX Network has completed a $3 million financing round, led by IBC Group, Castrum Partner, Alpha Capital, Gemhead, and TBV Partner. FastX Network is an AI-driven decentralized prediction market that uses custom LLM models for crypto predictions and integrates real-time data, accessible via web and Telegram bot.

Web3 Games:

Web3 game WizzWoods completes $10 million Series A financing

Web3 game project WizzWoods announced the completion of $10 million in Series A financing, led by Animoca Brands and Infinity Ventures Crypto (IVC), with participation from several angel investors. This round of financing will accelerate product development and promote WizzWoods' growth in the Web3 gaming sector.

Blockchain shooting game XOCIETY raises $1.6 million, led by Neoclassic Capital and Winguard

Blockchain shooting game XOCIETY has raised $1.6 million in preparation for its early access launch on the Epic Games Store in November 2025. This round of financing was announced on November 19, led by Neoclassic Capital and Winguard. The funds will be used to expand the infrastructure of the Sui blockchain and support XOCIETY's development within the broader Web3 gaming ecosystem.

Venture Capital Institutions

New crypto incubator Obex has raised $37 million to support yield-bearing stablecoins

The team behind the new crypto incubator Obex stated in an interview that it has raised $37 million to support the construction of next-generation yield-bearing stablecoins led by Framework Ventures, LayerZero, and the Sky ecosystem. The plan aims to invest in and fund projects that bring real-world asset collateral strategies on-chain, introducing institutional-level risk control and underwriting practices into this rapidly evolving field. Obex will become the latest funding allocation partner for Sky, providing financial support to projects to help them scale from the protocol's substantial reserves and generate yield through strategies.

The plan will focus on stablecoins backed by high-quality real-world assets, with a focus on three core areas: computational credit (such as tokenized GPU infrastructure), energy assets (such as municipal-level solar and battery deployments), and loans to large fintech companies. The incubator will provide early teams with a 12-week project, offering funding, technical resources, and access to Sky infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。