Author: Ye Kai

In the past few weeks, rumors of "pausing RWA" have stirred emotions, causing many mainland enterprises and financial peers to hesitate: Is it compliant to do RWA in Hong Kong? If business operations fail or even lead to bankruptcy, can the rights of overseas investors be protected? Some advocate for learning from the U.S. by "tokenizing standardized mature financial products first, then discussing broader assets."

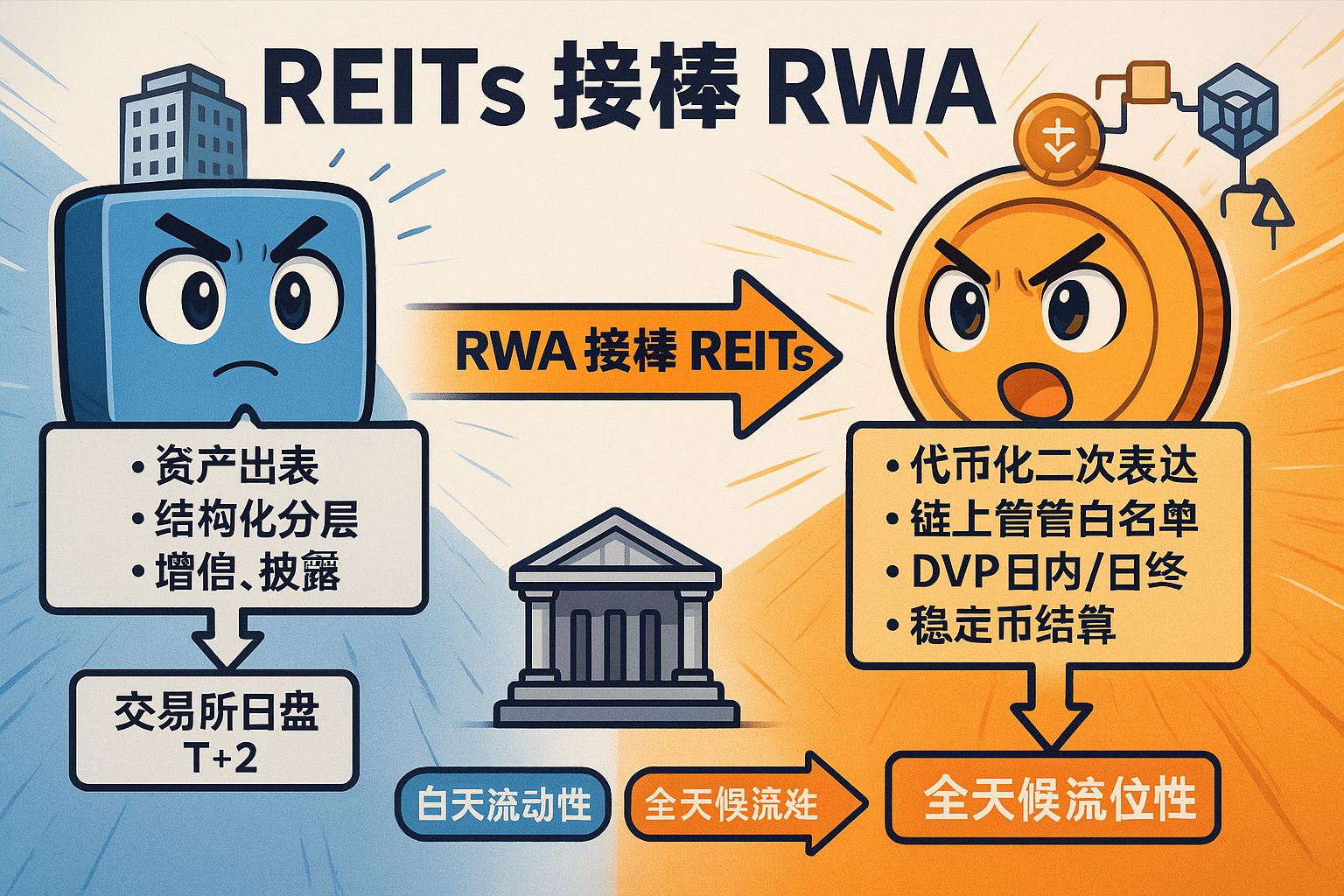

The viewpoint of Huaxia Digital Capital is straightforward: insist on the tokenization of physical assets, using ABS/private REITs in the first half to clean up, penetrate, and audit the assets; in the second half, go on-chain, extending "daytime liquidity" into "24/7 liquidity" with RWA.

In short, REITs turn "houses" into "stocks," and RWA further transforms "stocks" into "global 24/7 digital assets." The first half is the expertise of traditional finance, while the second half is the amplification on-chain. Only when the two are combined can a complete path of financialization for real estate and infrastructure be established.

I. The "Chart Story" of Hong Kong's Capital Market: The Market Awaits a New Narrative

If we plot the recent total market capitalization, daily trading volume, and new stock financing on a single chart, we can read three signals:

First, the weight is shifting. The valuation logic of traditional real estate and platform internet has changed, and the market is actively seeking new anchors that "have cash flow, have assets, and have dividends."

Second, liquidity is more selective. Daily trading volume is lower than in the previous cycle, but it is extremely sensitive to "structural increments" like RWA, AI, computing power, and Web3.

Third, the style has shifted from "storytelling" back to "looking at cash flow + arbitrage."

What does this mean? The "foundation" of REITs is still there, but the gameplay in the second half is insufficient: the moment of listing is lively, but subsequent market-making is thin, the secondary market lacks volume, and the barriers for cross-border participation are high. RWA can connect this segment—not as a replacement for REITs, but by using on-chain mechanisms to extend its liquidity radius, transforming assets that "can only be traded during the day" into "assets that can be split, mortgaged, and cycled 24/7."

II. The Essence of RWA: The First Half Returns to ABS/REITs, the Second Half is "Tokenization"

Many people have the order reversed: thinking that "issuing a token" is RWA. The truly sustainable path is to first operate off-chain, then on-chain. You can think of it as a clear evolutionary chain: physical assets → cash flow contracts (rent/traffic fees/electricity fees/interest) → ABS/REITs (off-balance sheet, layering, credit enhancement, custody) → RWA tokens (secondary expression) → on-chain market-making/mortgaging/settlement/cross-chain.

Why break it down this way? Because regulators and auditors prioritize looking at off-chain "transparency and redeemability." Only when the assets are real, the structure is clear, and the rights and responsibilities are defined does the on-chain "tradeable, mortgageable, and combinable" make sense. In other words, "the on-chain is just the expression layer; compliant cash flow is the underlying layer."

III. REITs are Mature, RWA Takes the "Second Baton"

Private REITs in mature markets have already mastered three things:

Off-balance sheet isolation—putting assets into independent vehicles, away from the credit fluctuations of the operating entity;

Clear structure—priority/subordinate, fixed/floating, tax arrangements, information disclosure, all have systematic paradigms;

Complete credit enhancement—lease locking, mortgage guarantees, ratings, credit lines, custody, and ongoing audits.

However, many "RWA debt/equity" currently resemble "credit bonds on-chain," with off-chain ratings, diversification, and cash flow history not always being complete. The correct approach is not to replace REITs with RWA, but to let RWA act like a docking station, connecting REITs to a larger liquidity network.

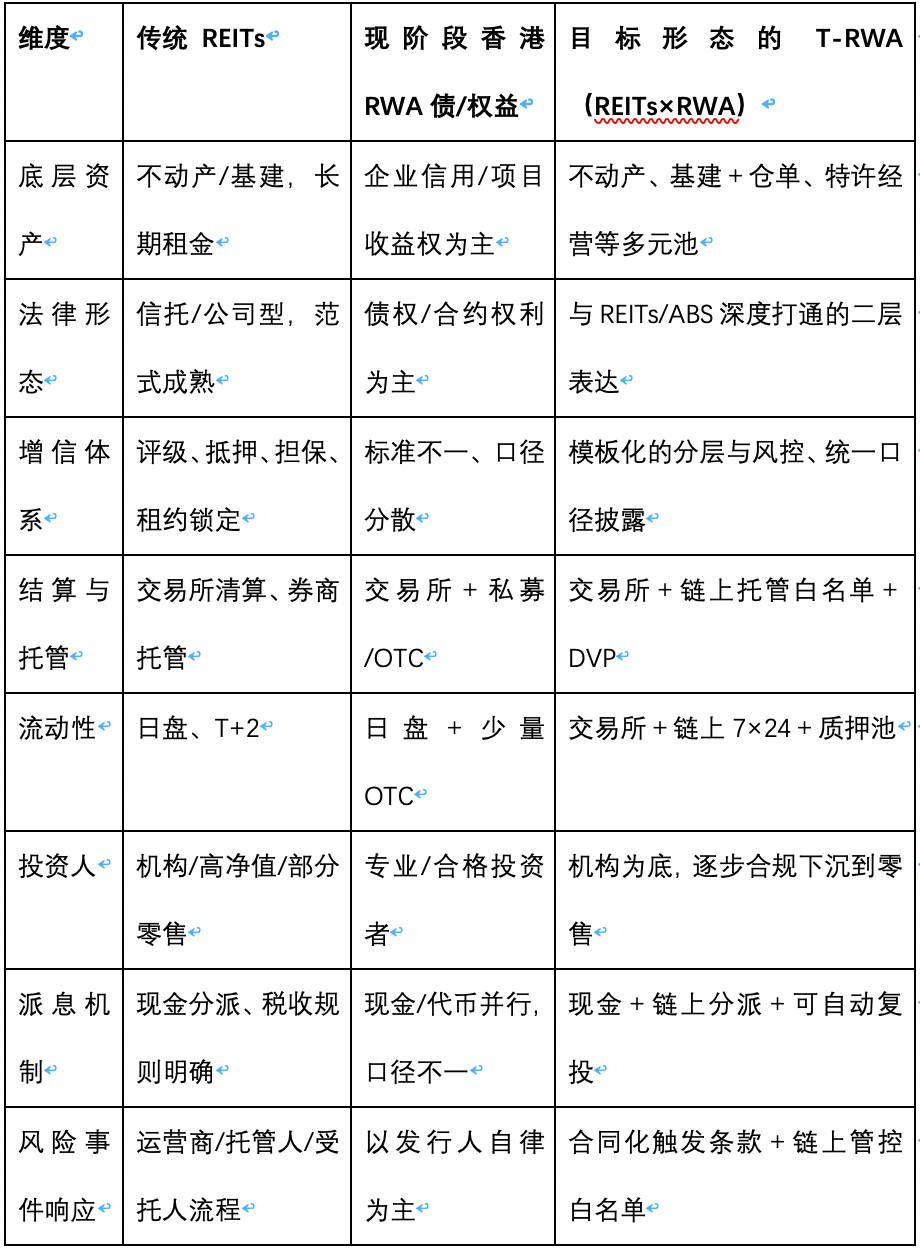

Here’s a more "complete" comparison table:

(Chart explanation)

(AI-generated image)

IV. RWA Supplements the Shortcomings of REITs: Connecting "Daytime Liquidity" to "24/7 Network"

The structure of REITs is strong, but the "subsequent performance is weak": low turnover, expanded discounts, and market-making is difficult to sustain. The enhancement of RWA mainly manifests in three points:

Shares can be split—breaking down one share of stock into freely combinable on-chain shares, lowering the minimum trading unit and increasing participation;

Assets can be mortgaged—allowing on-chain shares to enter stablecoin/interest rate pools, forming a closed loop of "holding—mortgaging—obtaining liquidity—replenishing positions";

Cross-border access—compliant wallets + stablecoin payments enable overseas funds that find it inconvenient to open Hong Kong stock accounts to participate in secondary liquidity.

In simple terms, REITs manage "daytime," while RWA manages "24/7"; REITs manage "local," while RWA manages "cross-border."

V. The Real Demands of Large Funds: Cross-border Allocation + Dollar Denomination + Stablecoin Mediation

Those who can turn RWA into "scale" include sovereign funds, insurance, pensions, large family offices, and regional financial controls. Their "three-piece set" demands are very stable:

Assets are real, structure is clear—can penetrate to the asset package and contracts, can audit cash flow;

Accounting is simple, denomination is unified—preferably in dollars, to avoid duplicate account openings and complex currency exchange declarations;

Entry and exit are smooth, risk control is stable—with compliant wallets and settlement methods, inflows and outflows do not create new risks.

The combination method is clear: underlying REITs/ABS priced in HKD/RMB, presented on-chain as RWA tokens, forming trading pairs with compliant stablecoins; funds enter and exit using stablecoins, with returns measured in dollars.

Hong Kong's advantage lies in "connecting assets to the mainland, settling in dollars, and linking to international law," making it naturally suitable for this endeavor.

VI. Cross-domain Arbitrage Closed Loop: A Chain Running from REITs to DeFi

Understanding how "money" flows will ensure smooth implementation:

First segment, the underlying assets complete the first securitization using REITs/ABS, turning cash flow into tradeable securities, and placing credit enhancement, custody, and disclosure into a regulatory framework;

Second segment, conduct secondary issuance of RWA on-chain, "re-expressing" securities into splitable, mortgageable, and programmable shares;

Third segment, on-chain shares enter stablecoin/interest rate pools, integrating with traditional market-making and hedging, forming a three-dimensional strategic space of interest rate—discount rate—currency price;

Fourth segment, manage off-chain settlement risks using DVP + intra-day/end-of-day settlement, and manage on-chain transfer risks using whitelists and custody.

The essence of the entire chain is: REITs produce "trustworthy cash flow," while RWA produces "usable structural space."

VII. Hong Kong vs. Singapore: Which is More Like the "Main Stage"?

In recent years, Singapore has maximized family offices and asset pools, but the core issue is the lack of IPOs. Due to limited IPO supply and volatility, the arbitrage space is narrow, and family offices prefer "value-preserving allocations."

Although Hong Kong's foundation has experienced a downturn, it has "deep secondary markets, broad assets, and strong interconnectivity": it has thicker liquidity "soil" and institutional interfaces that can connect "RWA × REITs × secondary/derivatives × stablecoins" (RWA tokenization product distribution, shared liquidity orders, stablecoin prudent frameworks, etc.) are gradually becoming clear.

If your goal is to create a combination of "asset securitization (off-chain) + tokenization (on-chain) + market-making/hedging (24/7) + cross-border settlement (stablecoins)," Hong Kong is more like the main stage.

VIII. Looking Back at the Capital Market from the Crypto Sphere: Liquidity Ultimately Returns to "Stocks and Bonds"

A clear trend in the past two years: pure on-chain liquidity ultimately needs to establish a foothold in mainstream capital markets.

The reason is simple—valuation anchors and exit paths still exist in mainstream markets. Whether it is stablecoin issuers, on-chain asset management, or the combination of "digital treasury + listed companies," it ultimately needs to "return to financial statements."

This suggests to Hong Kong that "REITs + tokenization" can become the "foundation and bridge" for Web3 assets, having both cash flow and legal anchor points, as well as on-chain efficiency and global participation, to transform "on-chain excitement" into "off-chain realizability."

IX. U.S. Treasury and Money Market Fund Tokenization: A "Parallel Case" for REITs

The two paths in the U.S. provide us with a mirror: U.S. Treasury/repo tokenization and money market fund tokenization. They share the same underlying logic as REITs—"fixed cash flow asset pool + standardized legal structure."

The difference lies in the source of cash flow: one relies on the interest rate curve, while the other relies on rent/fee rate curves. Bringing this model to Hong Kong means using "corporate-type/trust-type REITs + Hong Kong stock market" as the foundation, and after tokenization, forming a combination layer similar to "U.S. stocks (equity) + U.S. Treasuries (interest rates) + money market funds (cash equivalents) + stablecoins (settlement/mortgage layer)."

For investors, this is a path to on-chain that has low cognitive costs and clear compliance radius.

X. Compliance and Risk Control: Writing Investor Protection into the Structure

"What if something goes wrong?" The answer lies not in slogans, but in structured writing:

- SPV/trust isolation separates assets from the operating entity;

- Custody and whitelisted addresses bring on-chain transfers into the audit radius;

- DVP + intra-day/end-of-day settlement reduces settlement risks;

- Information disclosure and ongoing ratings allow "cash flow quality—discount rate—leverage" to be monitored on the same panel;

- Suitability and scenario grading (PI and retail layering, stablecoin/tokenized securities whitelist) align the risk control intensity of different customer groups.

Only when these are written into contracts, embedded in systems, and executed in processes can this framework possess "replicability."

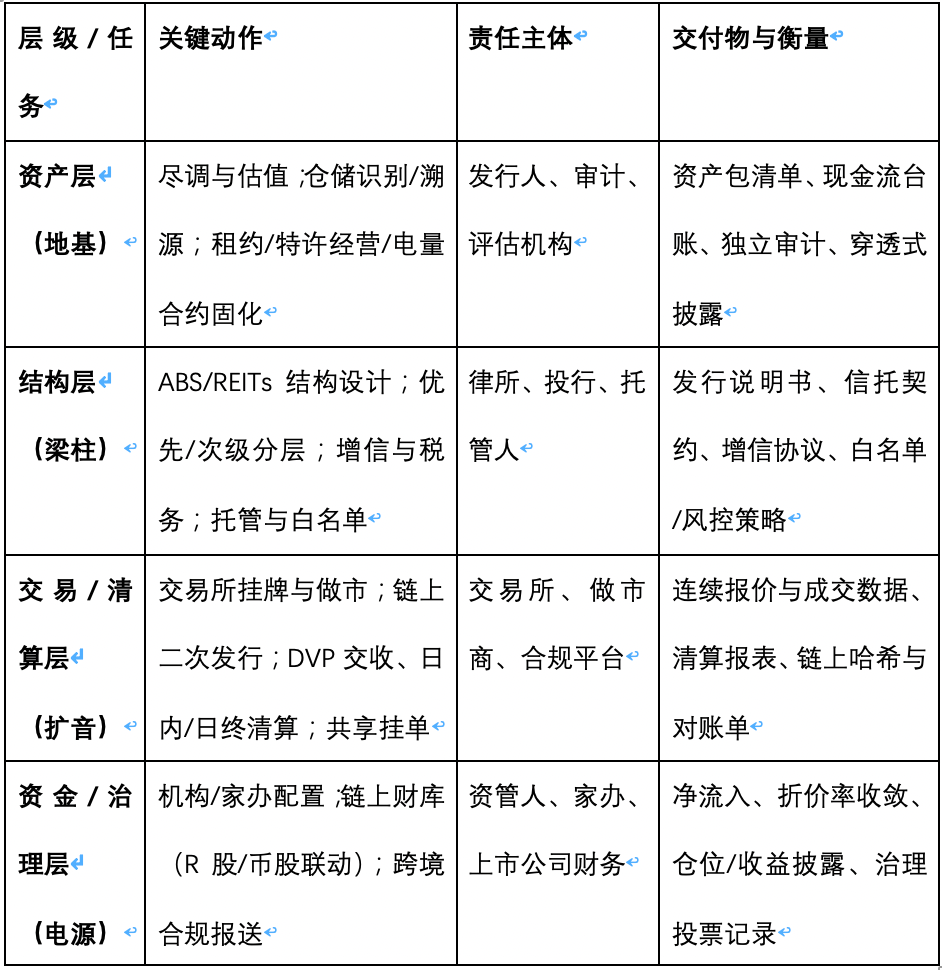

XI. Operational Essentials: Integrating "Foundation—Beams and Columns—Amplification—Power Supply" into One Diagram

To ensure executable implementation, we break down the "RWA 2.0 operational path" into four layers, allowing the financial and technical sides to easily divide labor and proceed step by step:

Capital Resonance Ecosystem: REITs as the Foundation, RWA as the Amplifier

Compressing the entire chain into one sentence: REITs/ABS (primary financialization) → RWA secondary issuance/mortgaging/structuring (on-chain financialization) → Web3 scenarios and DeFi (the "playground" for market-making and hedging) → digital treasury/listed companies (valuation and balance sheet reconstruction) → Hong Kong stocks/mainstream market refinancing (capital resonance, telling a new story).

In this chain, REITs are the foundation, RWA is the amplifier, exchanges are the speakers, DeFi is the reverb, and stablecoins are the power supply.

For Hong Kong, the real question has never been "should we do RWA," but whether to weld existing REITs, ABS, and capital markets with tokenization and global liquidity into a closed loop.

If the answer is "yes," then RWA is not just a new product, but a natural extension of Hong Kong's capital market after REITs—creating a replicable, auditable, and exit-able industrial chain from traditional assets + tokenization + global liquidity. At that time, compliance, risk control, returns, and liquidity will no longer be in opposition but will achieve a new balance within the same structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。