Author: Aki Wu on Blockchain

With the multinational criminal empire of Chen Zhi, the actual controller of the Prince Group in Cambodia, being jointly exposed and targeted by the British and American governments, the intricate global business network behind it has also come to light. Shockingly, this notorious gang, infamous for "pig-butchering" telecom fraud, human trafficking, and forced labor, has managed to control 50% of the global top Cuban cigar company Habanos through a complex offshore structure, with China being the largest consumer market for Habanos cigars. This unexpected connection reveals that in the digital age, the illegal economy and legitimate businesses are intertwined through blockchain and offshore financial networks, forming a new "capital spider web." This article attempts to analyze the so-called "Spider Web Capitalism 2.0" from the perspective of the Chen Zhi case—an upgrade of traditional offshore capitalism completed under blockchain technology and the unique environment of Southeast Asia, showcasing how a decentralized offshore capital network is formed.

Spider Web Capitalism 2.0 = Offshore Capitalism × Cryptocurrency × Southeast Asia

"Spider Web Capitalism 2.0" can be understood as a new form of capitalism where traditional offshore financial networks achieve self-upgrade through blockchain technology. Offshore capitalism refers to the traditional practice of capital moving globally through offshore financial centers, shell companies, etc., to evade regulation and taxation. In the past, wealthy individuals and conglomerates often used tax havens like the Cayman Islands and Swiss banks to hide assets and escape domestic regulation. The rise of cryptocurrency provides a new technological tool for such offshore operations: blockchain assets like Bitcoin can be transferred peer-to-peer globally, independent of traditional banking systems, thus constructing a "decentralized offshore structure." Nowadays, opening an on-chain wallet or exchanging stablecoins on a decentralized exchange is akin to having a Swiss account without a trust intermediary, allowing funds to flow globally without barriers and difficult to intercept. These on-chain assets, combined with shadow trading networks, enable vast wealth to be concealed within code and anonymous addresses, making it challenging for regulatory agencies to intervene effectively.

The Southeast Asian aspect highlights the geographical foothold of this new form of capitalism. Emerging market countries in Southeast Asia, due to weak regulation, an underdeveloped financial system, and a thirst for foreign investment, along with cheap labor and certain gray areas of political and business collusion, have become a frontier testing ground for the intersection of offshore capital and on-chain assets. This region has both the soil for traditional offshore finance (such as loose foreign exchange controls and a corrupt environment) and provides a safe haven for new technologies like cryptocurrency. In other words, Southeast Asia acts as a "sandbox" for the invisible structures of global capitalism. Various capital forces can boldly experiment with circulating gray funds digitally abroad. For example, in Cambodia, Sihanoukville, and Myanmar's "Special Economic Zones," a large number of network fraud parks and underground financial activities led by foreign capital have emerged in recent years, reflecting this trend.

Chen Zhi and the Prince Group: A Perfect Microcosm of Spider Web 2.0

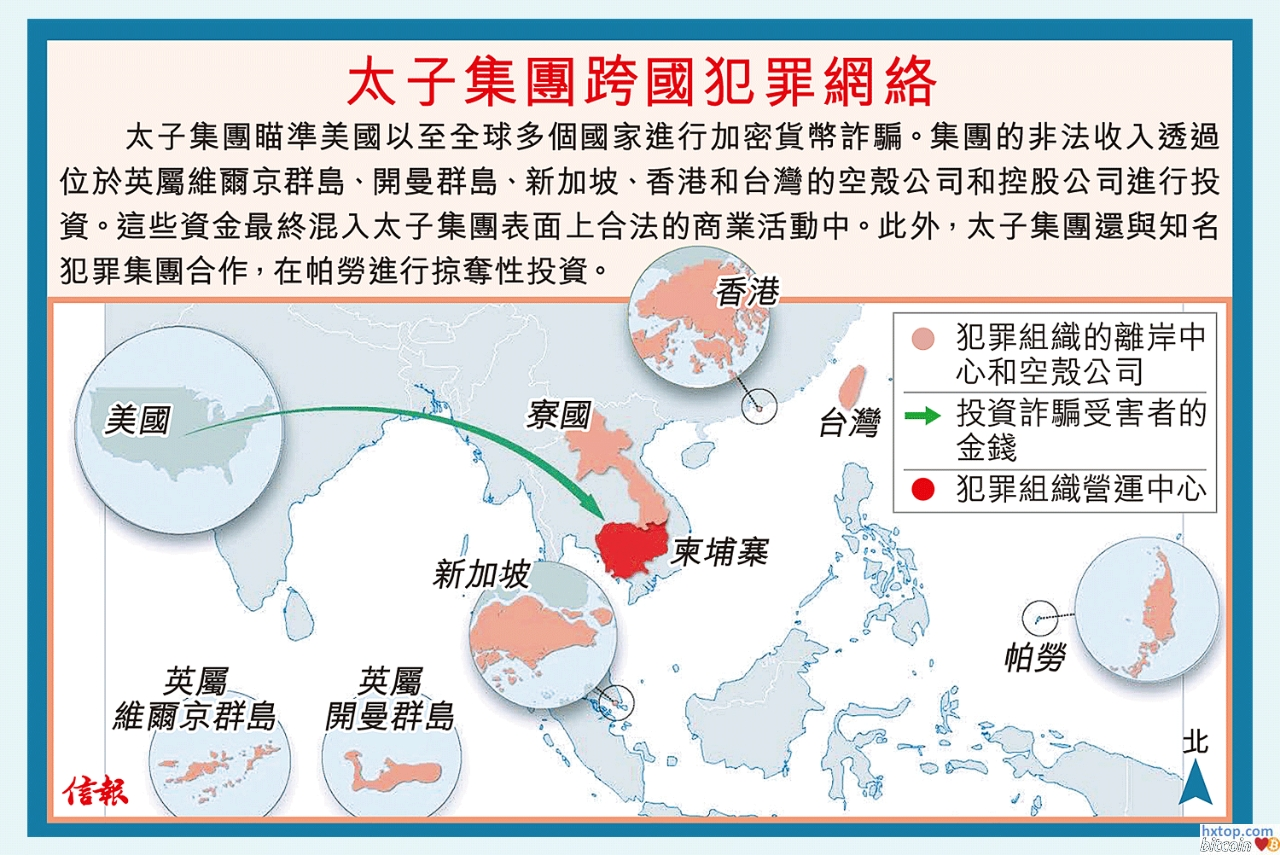

Chen Zhi and his controlled Prince Group in Cambodia can be seen as a typical case of "Spider Web Capitalism 2.0": the integration of traditional elite protection, local gray industries, on-chain money laundering channels, and global offshore structures. Looking at Chen Zhi's business empire, its registered entities span mainland China, Hong Kong, Singapore, as well as offshore jurisdictions like the British Virgin Islands (BVI) and the Cayman Islands, forming a complex holding network.

According to an investigation by Singapore's Lianhe Zaobao, Chen Zhi is associated with as many as 128 companies globally, 17 of which are registered in Singapore. Most of these companies declare to engage in investment consulting, real estate, intermediary services, etc., but their actual functions are questionable. Many shell companies also adopt a "multiple names in different locations" layout—such as Alphaconnect, Alphaconnect Investments II, Greenbay, Binary, Drew, etc.—appearing simultaneously in the registries of Singapore and Taiwan, China. Four companies with the same name were almost simultaneously established in early 2019, all controlled by Singaporean citizen Lim Zhongliang, yet Lim himself is not listed on the sanctions list. These companies declare business activities in both locations, including investment advisory and international trade, and use local legal forms (such as Singapore's exempt private companies) to conceal the identities of actual controllers. Additionally, it has been disclosed that many of the companies directly held by Chen Zhi in Singapore are registered as private limited companies (which require shareholder disclosure), while the aforementioned exempt companies are directly held by him with no more than 20 shareholders, exempting them from institutional shareholder disclosure.

Real Estate and Infrastructure:

Chen Zhi's aggressive expansion is also inseparable from the capital market of Hong Kong, an Asian financial center. From 2017 to 2019, he successively took control of two Hong Kong main board listed companies, Zhi Haoda Holdings (01707.HK) and Kun Group Holdings (00924.HK).

Zhi Haoda Holdings (01707.HK): Originally a local engineering contractor in Hong Kong, it was listed in October 2017. Just over a year after its listing, the original shareholders quickly exited in December 2018, and Chen Zhi took over all shares, instantly becoming the absolute controlling shareholder with a 54.79% stake. In the month he took over, Chen Zhi became the executive director and brought in his confidant, senior executive of the Prince Group, Qiu Dong, to serve as a director. Subsequently, the company's business began to "Cambodia-ize," maintaining its main engineering business in Hong Kong while expanding into real estate development in Cambodia starting in 2019, and even entering the luxury goods sales sector in 2023. Chen Zhi himself once served as a director of its luxury goods subsidiary until resigning in mid-2023. Notably, even though Chen Zhi superficially resigned from Zhi Haoda in July this year, the companies he controls still have business dealings with Zhi Haoda, such as Zhi Haoda providing property management services for properties held by Chen Zhi's companies in Hong Kong, and the company's cash was once stored in the Prince Bank controlled by Chen Zhi. This indicates that the financial ties between Chen Zhi and the listed company have not been completely severed.

Kun Group Holdings (00924.HK): An electromechanical engineering company headquartered in Singapore and registered in the Cayman Islands, it was listed in Hong Kong in July 2019. In January 2023, the founding Hong family sold all their shares, and Chen Zhi took over completely, holding 55% of the shares to become the controlling shareholder. Kun Group primarily provides electromechanical engineering for Singapore government housing projects and continues to be operated by the original management team after listing. It is worth mentioning that after the U.S. OFAC sanctions list was published, Kun Group acknowledged Chen Zhi as the actual controlling shareholder and announced his shareholding ratio of about 55%. Although Chen Zhi does not hold a director position at Kun Group, he has clearly achieved control over the company through behind-the-scenes investments.

In Hong Kong, including the aforementioned two listed companies, Chen Zhi directly or indirectly controls 10 companies. Most of these companies are aimed at holding and investment purposes. For instance, the U.S. indictment reveals that the Hong Kong shell company Hing Seng Ltd acted as Chen Zhi's underground bank for cross-border transfers of large sums of money. Investigations show that Hing Seng transferred approximately $60 million to an associated company in Laos responsible for the Prince Group's cryptocurrency mining business within just four months from November 2022 to March 2023. The funds from this Laotian mining company were subsequently used to pay for luxury consumption by the spouses of senior executives of the Prince Group, including purchases of Rolex watches and Picasso paintings. The sole shareholder and director of Hing Seng, Sun Weiqiang, is registered with a Shantou, China ID card, but has no public record beyond that and is not listed on the sanctions list. It is speculated that such Hong Kong shells are merely "fronts" for Chen Zhi to facilitate fund circulation, potentially corresponding to the real fund operators and the whereabouts of offshore assets. As a free financial center, Hong Kong provides an excellent laundering ground for Chen Zhi to clean funds through engineering, real estate, and luxury goods sales, while holding local luxury residences and commercial properties. According to reports, Chen Zhi's associated companies own the entire building at 68 Kimberley Road, Tsim Sha Tsui, and purchased the top luxury residence MOUNT NICHOLSON for 1.4 billion HKD.

Data Source: Photo by Yu Junliang

Investment and Money Laundering in the Gambling Industry:

The gambling industry in Cambodia once thrived, and the Prince Group actively engaged in casino and online gambling businesses. In addition to participating in several casino hotels in Sihanoukville, the Prince Group has constructed projects like the Golden Fortune Technology Park in the border area between Cambodia and China, which are essentially online casinos and fraud centers. At the same time, it controls online gambling platforms like Amiga Entertainment, registering online casino licenses abroad and soliciting bets from within China through websites and apps. Chinese courts have ruled that the Prince Group obtained over 5 billion RMB in revenue through illegal online gambling and engaged in large-scale money laundering. The highly anonymous and cross-border flow of funds in the gambling industry makes it an important channel for Chen Zhi's money laundering—gamblers' chip trading and collusion among gambling companies can mix dirty money into cash flow. U.S. prosecutors pointed out that some of the fraudulent proceeds from the Prince Group were laundered through its gambling operations before flowing into legitimate accounts.

The "Huione Group" has been identified as one of the core channels through which Chen Zhi secretly operates large flows of funds in Hong Kong and Southeast Asia. Huione Group claims to provide leading financial technology services, including electronic payments (HuionePay), among others. According to several insiders, the founder of Huione was once a financial manager under Chen Zhi at the Prince Group, thus maintaining a close relationship with him. U.S. FinCEN disclosed that between August 2021 and January 2025, Huione Group assisted in laundering at least $4 billion in illegal funds, of which about $37 million came from North Korean hacker theft, $36 million originated from virtual currency investment scams, and about $300 million was associated with other cyber crimes. Huione has even been referred to as "the world's largest online black market" platform—U.S. blockchain analysis firm Elliptic found that Huione had built a "one-stop crime platform" on Telegram, gathering black market vendors selling malicious software, personal data, and money laundering services, primarily serving Southeast Asian cryptocurrency scam groups. As early as May 2015, Telegram had banned all channels and groups related to Huione, indicating that the platform had a notorious reputation long ago. In the recent joint crackdown by the U.S. and the U.K., Huione Group was directly identified by FinCEN as a key hub of the Prince Group's money laundering network and was cut off from any connection to the U.S. financial system under Section 311 of the USA PATRIOT Act. The sanctions announcement requires financial institutions to prohibit opening or maintaining agency accounts for Huione and to prevent its indirect access to the dollar system. Through shadow financial institutions like Huione, Chen Zhi has woven a vast money laundering pipeline both in front of and behind the scenes. Following the recent news of U.S. and U.K. sanctions, a large number of Cambodian citizens rushed to cash out at Huione's offline exchange points, even willing to sell their electronic cash at a 10% discount to escape quickly.

Exposed Associated Companies

Cryptocurrency and Cigars:

Bitcoin mining is the most "innovative" money laundering method within Chen Zhi's criminal network. The indictment reveals that Chen Zhi invested a large amount of the proceeds from fraud into his controlled cryptocurrency mining business, thereby "mining" new bitcoins that are free from criminal taint. In the seemingly legitimate process of bitcoin mining, the original dirty money is transformed into "clean" digital assets derived from blockchain rewards, attempting to sever the connection between the funds and the crime.

However, even more noteworthy is that Chen Zhi has quietly acquired equity in Habanos S.A., the world's largest Cuban cigar company. Habanos is a cigar monopoly enterprise formed through cooperation between the Cuban government and Spain, holding exclusive distribution rights for high-end cigar brands globally. In 2020, British tobacco giant Imperial Brands decided to sell its premium cigar business, including a 50% stake in Habanos. Chen Zhi, through the Hong Kong-registered Allied Cigar Corporation, invested €1.04 billion in this equity transaction that year. After the transaction was completed, Allied Cigar frequently changed its structure within a few months, first transferring the shares to the Cayman Islands-registered fund Allied Cigar Fund L.P. in April, renaming the company to Instant Alliance Ltd in May, and then transferring the equity to an individual named Zhang Pingshun in November. By June 2021, the company was dissolved. This series of dizzying changes made it difficult for the outside world to confirm the actual beneficiaries behind Habanos.

At the end of 2023, the police in Gothenburg, Sweden, obtained documents (case number MKN-2025–5445) while investigating a cigar smuggling case, revealing the equity structure of Habanos' Nordic company, which involved Chen Zhi and a Hong Kong company, Asia Uni Corporation Ltd. The Swedish cigar media "Cigar World" published this police document, confirming that Chen Zhi indirectly controls 50% of Habanos through multiple layers of companies, including the Hong Kong-based Asia Uni.

Asset Recovery and Fund Tracking

As of now, in addition to the aforementioned large amount of bitcoin seized by the U.S. authorities, law enforcement agencies are also tracking the whereabouts of other assets belonging to Chen Zhi's group. For example, the U.S. Department of Justice is seeking civil forfeiture of Chen Zhi's assets and bank accounts in the U.S. and has issued a wanted notice for him. Properties frozen in the U.K. await court decisions for confiscation. Cambodian authorities have stated that they will cooperate with foreign law enforcement if sufficient evidence is provided and will not shelter wrongdoers under international pressure. However, the Cambodian government has yet to take action against Chen Zhi himself, and the operations of his domestic enterprises appear largely unaffected. The Prince Group has even publicly denied all allegations, claiming that "criminals have misused its name." Some senior executives of the Prince Group are also attempting to transfer assets, such as the involved Hong Kong-listed company hastily clarifying its severance from Chen Zhi. According to reports, the Hong Kong police announced that they have frozen assets related to an international telecom fraud and money laundering group, amounting to HKD 2.75 billion. Although not naming names, it is known that this group is related to Chen Zhi, the founder of the Prince Group. The police indicated that the frozen assets include cash, stocks, and funds, which are believed to be criminal proceeds.

The global capital network woven by Chen Zhi and the Prince Group has been systematically dismantled by law enforcement agencies from multiple countries. This network has achieved the cross-border flow and laundering of illegal proceeds from Southeast Asia to Europe and America through a model of "fraud parks — underground banks — bitcoin mines — shell companies — luxury goods." From luxury residences in Hong Kong and office buildings in London to equity in a Cuban cigar company and tens of thousands of bitcoin wallets, all reveal astonishing traces of wealth transfer. Behind this wealth are the tears and devastation of hundreds of thousands of victims and the suffering of tens of thousands who have been trafficked and imprisoned for forced labor.

Just as Herman Karl Lam established the "industry standard" for American robbers in the 20th century, Chen Zhi and his associated group may also demonstrate to the public how 21st-century offshore capitalism utilizes regional characteristics and emerging technologies to launder substantial gray income. However, Web3 is not a lawless land; although gray industries once attempted to evade regulation through the decentralization and anonymity of blockchain, they will ultimately face systemic liquidation brought about by on-chain transparency. This traceability provides an unprecedented technological foundation for global anti-money laundering and anti-fraud efforts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。