Original Author: Bitcoin Magazine Pro

Original Translation: Baihua Blockchain

Bitcoin has begun to show significant weakness, with the recent drop below the six-figure ($100,000) mark prompting a reassessment of the near-term outlook. With the loss of some key technical and on-chain levels, I have adjusted my base scenario, indicating that the likelihood of retesting new all-time highs in the coming weeks has fallen below 50%. This situation could change rapidly if key levels are reclaimed, but until then, market conditions seem to have shifted from a strong bullish trend into a corrective phase.

"Buying The Dip"

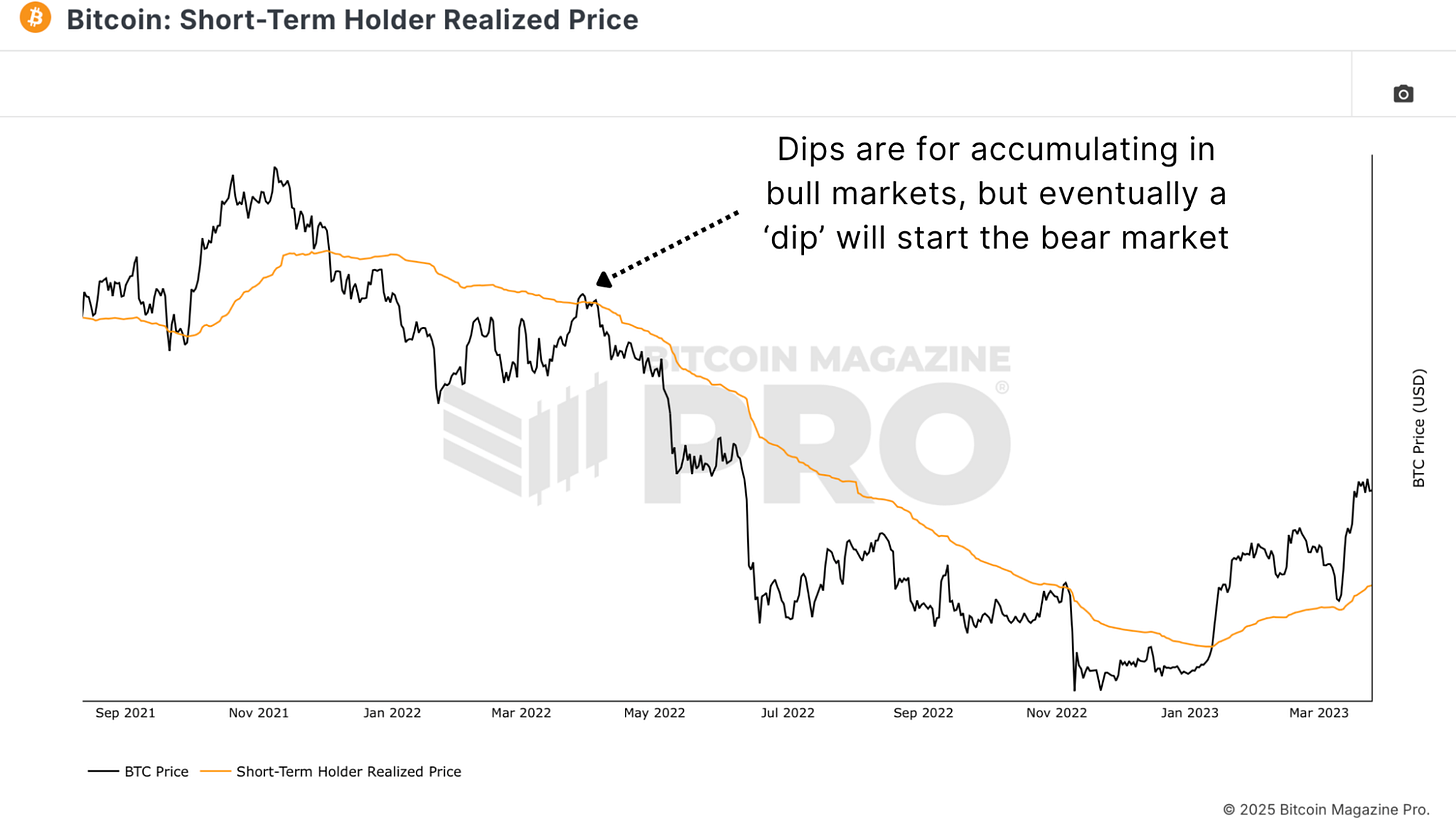

Bitcoin has experienced a considerable pullback, but buying the dip is not always the best approach unless it is within a confirmed bull market trend. In a bear market environment, nascent pullbacks can still lead to significant price declines. Short-term rebounds and upcoming retracements are typical in a downtrending market, making it increasingly important to react based on data rather than preemptively predicting a bottom.

From our chart analysis of the Short-Term Holder Realized Price, we can observe this pattern of multiple pullbacks. It is also clear that this indicator has acted as a key resistance during this phase, with sustained rebounds only occurring after BTC reclaimed the Short-Term Holder Realized Price level.

Figure 1: As observed in the previous cycle, multiple pullbacks occurred before reaching the market bottom.

Figure 1: As observed in the previous cycle, multiple pullbacks occurred before reaching the market bottom.

But there is a caveat: if the price effectively reclaims key levels, the entire picture will change. This is why making small allocations during this pullback may be sensible, while delaying further purchases until we see macro consistency in the levels, thus adopting a more defensive recovery approach.

Key Observation Levels

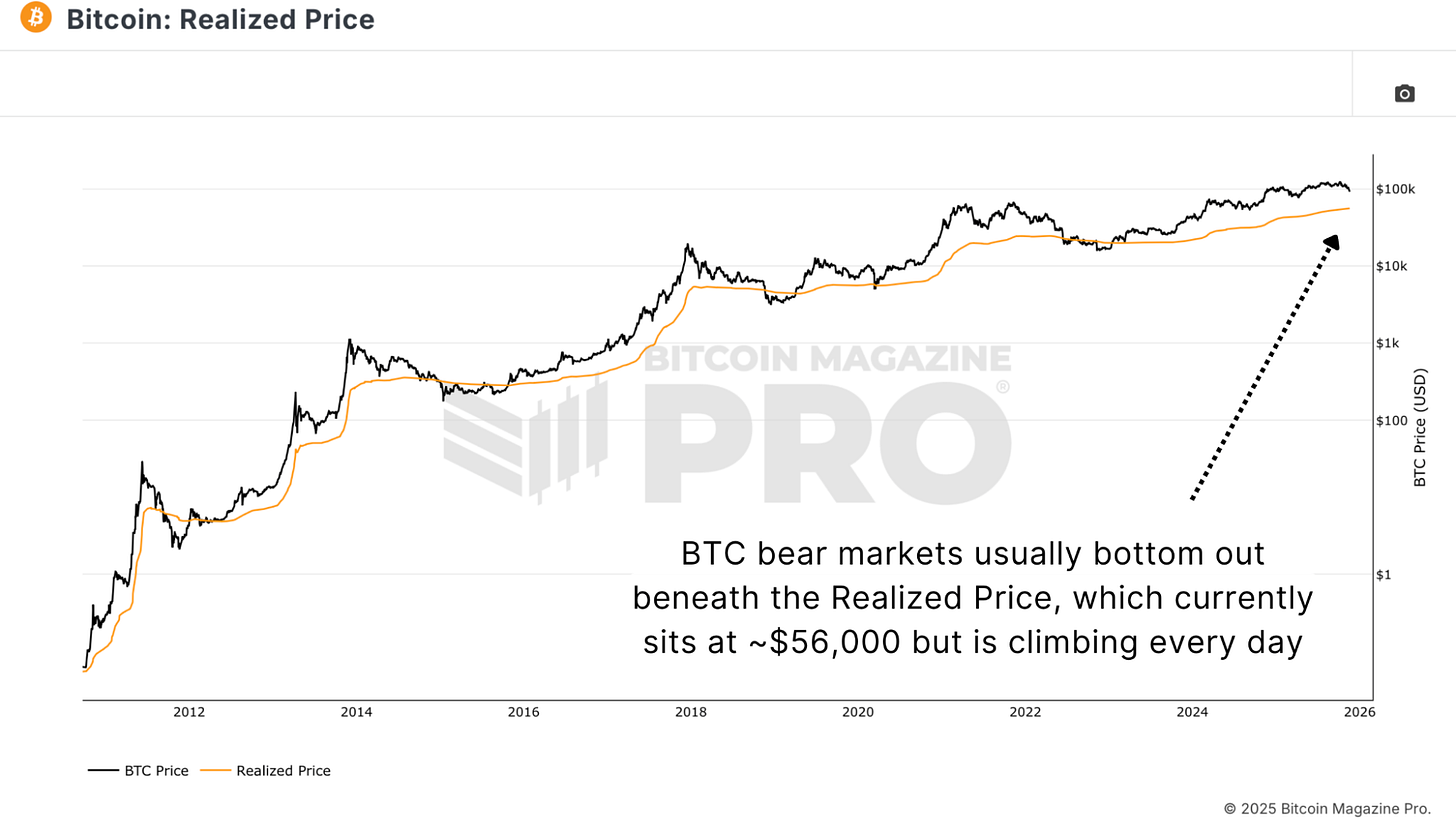

The MVRV Z-Score and Bitcoin Realized Price more clearly indicate where the broader market cost basis lies. Currently, the network's realized cost basis is clustering in the $50,000 range, but this number is rising daily.

Figure 2: Historically, bear market bottoms typically occur when BTC price is below the realized price.

Figure 2: Historically, bear market bottoms typically occur when BTC price is below the realized price.

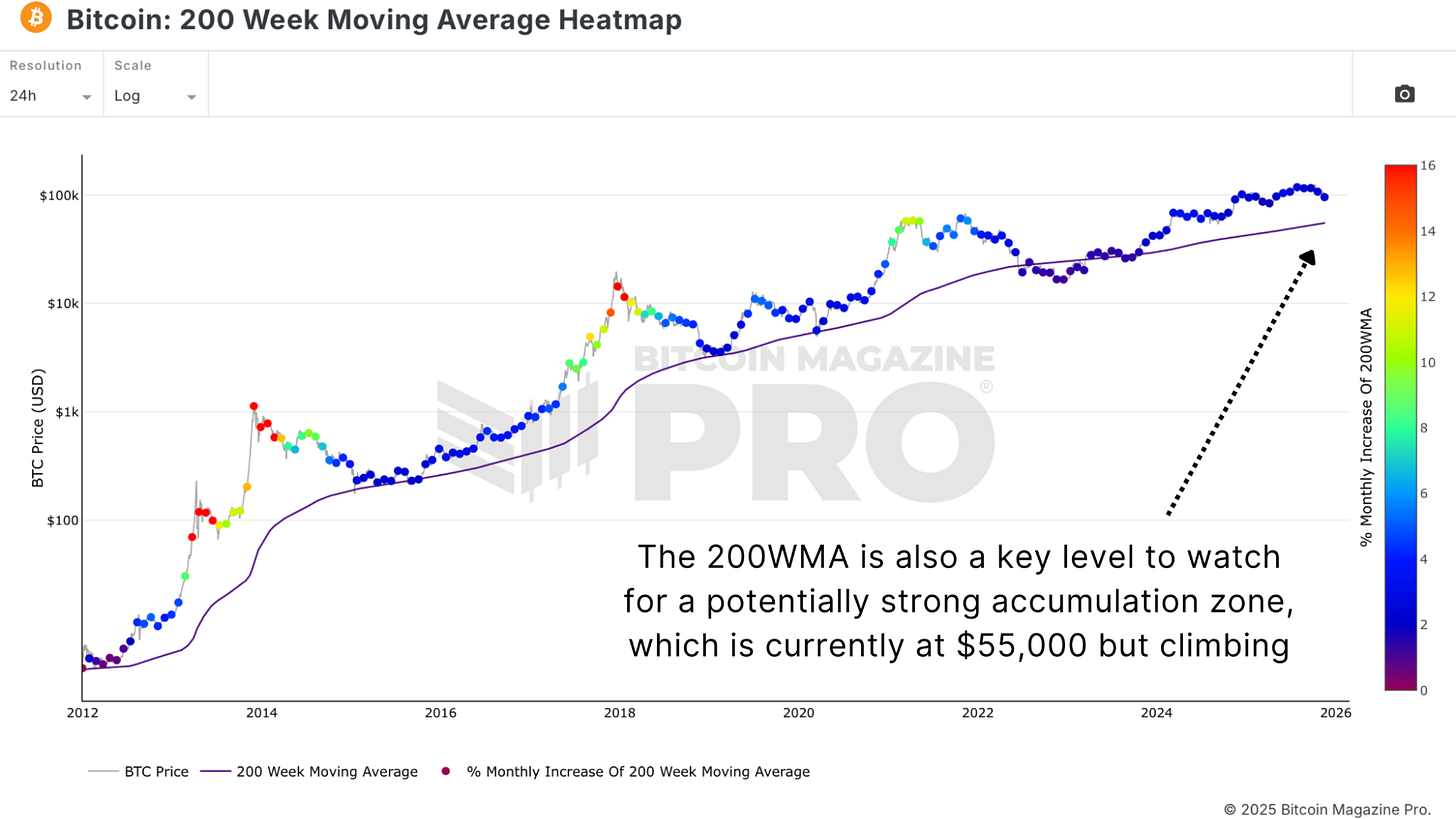

The 200-Week Moving Average is also showing a similar situation, as it currently sits in the $50,000 range. Historically, the points where this indicator meets the price provide strong long-term accumulation opportunities.

Figure 3: The 200WMA also suggests that $55k is an accumulation point, although it is rising daily.

Figure 3: The 200WMA also suggests that $55k is an accumulation point, although it is rising daily.

These levels are slowly rising each day, indicating that a potential bottom may form at $60,000, $65,000, or higher, depending on how long Bitcoin's trend continues. Importantly, when spot prices trade close to the network's historical average cost, value often appears at these levels, and key buy support levels provide consistency.

Supply and Demand Signals

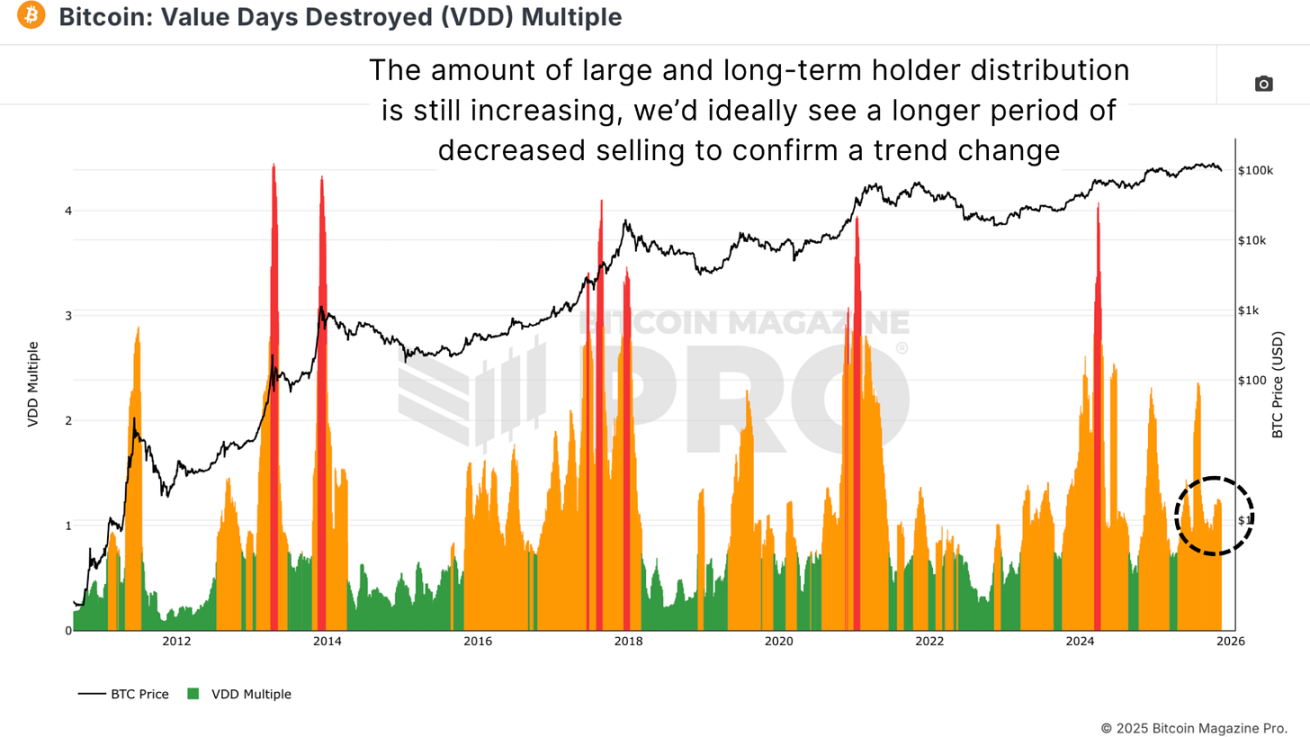

The Value Days Destroyed (VDD) Multiple remains an important indicator for identifying pressure points among long-term and experienced holders. Very low readings indicate that a large amount of long-held coins have not been moved, which often aligns with market bottoms. However, short-term spikes may indicate capitulation pressure, which typically accompanies or precedes significant market turning points.

Figure 4: Current VDD Multiple readings indicate that larger, more experienced participants in the market remain very active.

Currently, as prices decline, this indicator continues to rise, suggesting that many holders are fatigued from selling. This does not align with the characteristics of a cycle bottom, which typically features forced selling extremes and compression in the short term. At this stage, the market seems to be gradually releasing rather than being exhausted. Meanwhile, the Long Term Holder supply ideally should stabilize and begin to increase again before confirming any significant bottom, as bottoms are formed when the most patient participants begin to hold (accumulate) rather than exit.

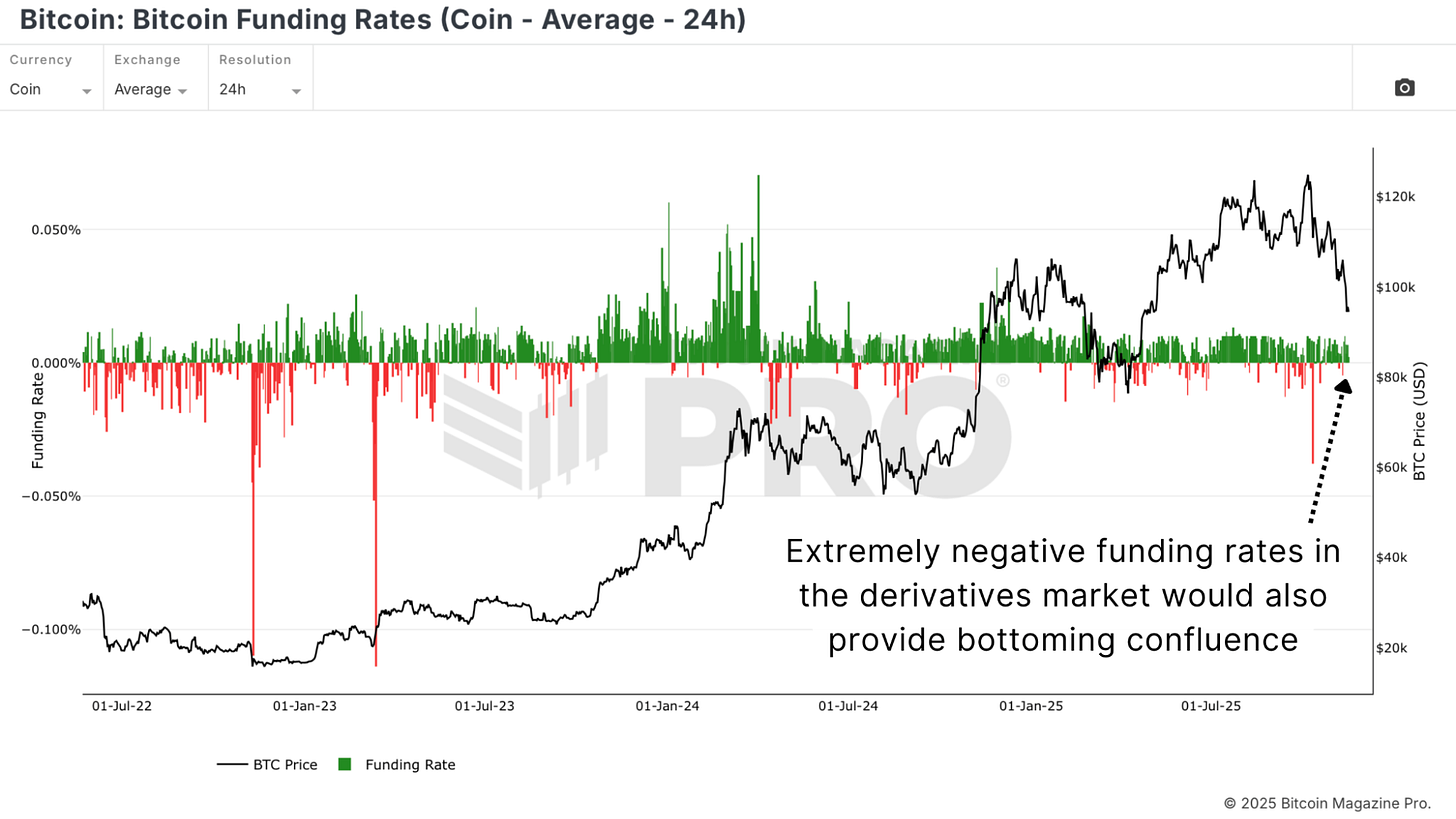

Funding Rates

Periods of extreme fear are often clearly manifested through a large number of short positions, as indicated by negative Bitcoin funding rates, and significant realized losses. These conditions suggest that weak hands have capitulated, while strong hands are absorbing this supply.

Figure 5: The timing of severely negative Bitcoin funding rates often coincides with significant market lows, followed by price rebounds.

Figure 5: The timing of severely negative Bitcoin funding rates often coincides with significant market lows, followed by price rebounds.

The market has yet to show the characteristic panic selling and shorting typically associated with significant cyclical lows. Without pressure from the derivatives market and no rush to realize losses, it is difficult to say that the market has fully cleared.

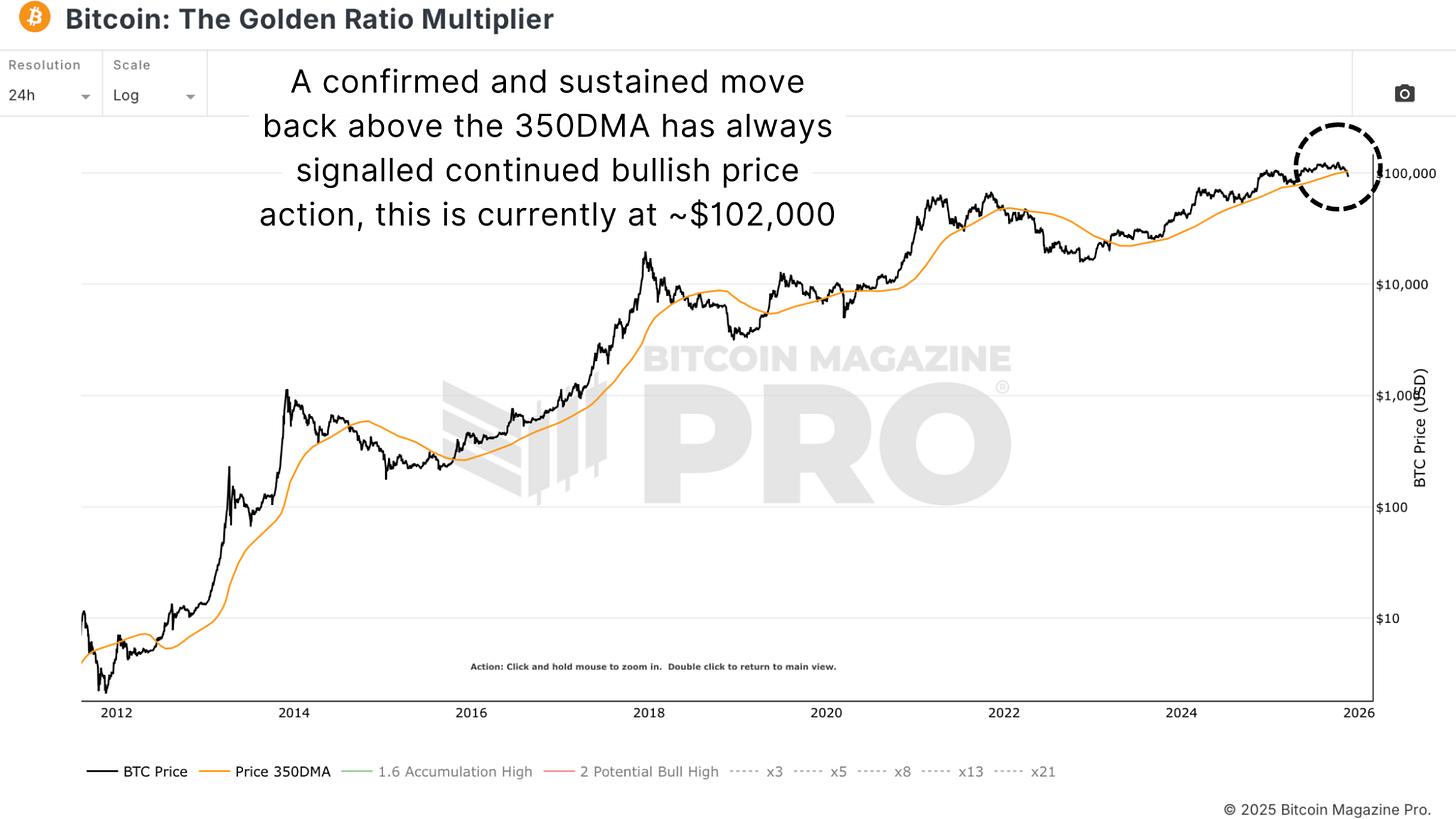

Levels That Must Be Reclaimed

Assuming the bearish scenario is incorrect, which is certainly the preferred outcome. In this case, Bitcoin needs to begin reclaiming key structural levels, including the psychological barrier of $100,000, the Short-Term Holder Realized Price, and the 350-Day Moving Average, as depicted in the Golden Ratio Multiplier chart.

Figure 6: BTC must sustain reclaiming the 350-Day Moving Average to revert to a bullish trend.

Figure 6: BTC must sustain reclaiming the 350-Day Moving Average to revert to a bullish trend.

Sustained closing prices at these levels, along with a strengthening of global risk assets, would indicate that the trend is shifting. But until then, the data temporarily leans towards caution.

Conclusion

Since breaking below several key levels, the outlook has become more defensive. Bitcoin's long-term fundamentals do not have structural flaws, but the short-term market structure is not a healthy bull trend.

Currently, the recommended strategy includes not buying the dip indiscriminately, waiting for consistency to emerge before making large allocations, respecting macro conditions and trends, and only becoming aggressive when strength is proven. Most investors can never pinpoint the top or bottom of a target; the goal is to position near areas of high probability and have sufficient confirmation of the market's excess over the months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。