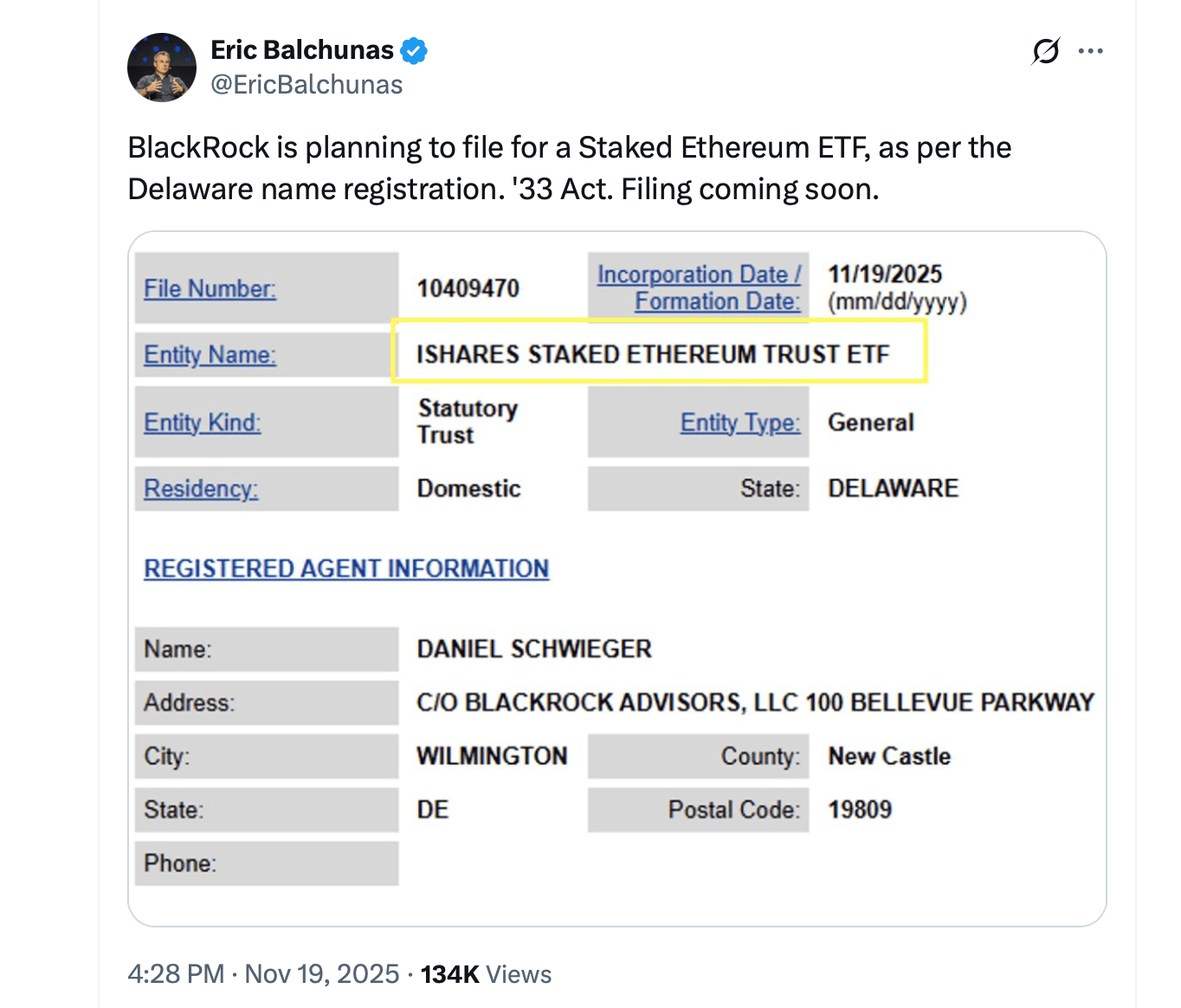

Blackrock has registered a new Delaware statutory trust named the Ishares Staked Ethereum Trust, marking the asset manager’s first procedural step toward launching a staking-oriented ethereum fund.

The filing, entered on Nov. 19 and handled by Blackrock managing director Daniel Schweiger, mirrors the process used for the Ishares Ethereum Trust formed in 2023. Delaware trusts remain a common structure for commodity and crypto products due to their flexible corporate governance rules.

Bloomberg senior ETF analyst Eric Balchunas on X.

While the filing does not confirm a launch timeline, it signals Blackrock is preparing a product designed to stake the ethereum it holds and collect network rewards. A staking-enabled ETF would differ from the firm’s existing spot ether fund, ETHA, which debuted in July 2024 without staking features.

Staking rewards on the Ethereum network typically fall in the 3% to 5% annual range, turning a standard ether vehicle into a “total return” product combining price exposure with passive onchain yield. Analysts expect such features to appeal to institutional investors seeking income in addition to asset appreciation.

Industry analysts noted that the trust’s formation indicates a Securities Act of 1933 filing—most likely an S-1 prospectus—could follow soon. Blackrock’s spot crypto ETF filings for bitcoin ( BTC) and ethereum ( ETH) in prior cycles were typically submitted within days or weeks of the initial trust registration.

Read more: Abu Dhabi Investment Council Expands Bitcoin ETF Position Threefold in Q3 2025

Several firms are already pursuing similar products. Grayscale secured approval in October to add staking to its Ethereum Trusts, while REX-Osprey launched the first staked ETH ETF in September under a different regulatory structure. Fidelity, Franklin Templeton, 21shares, and others have pending requests to add staking to their spot funds.

Blackrock has been vocal about integrating staking into its existing lineup. Nasdaq filed a 19b-4 proposal in July to enable staking within ETHA itself, a request still awaiting regulatory action. The firm’s digital assets lead, Robert Mitchnick, has described staking approval as “the next phase” for Ethereum-based ETFs.

No ticker, prospectus, or exchange listing proposal has been filed yet. Approval will require full SEC review once the S-1 is submitted.

FAQ❓

- What did Blackrock file?

A Delaware statutory trust named the Ishares Staked Ethereum Trust. - Does this mean an ETF launch is imminent?

It signals preparation, but a full S-1 filing is still needed. - How would a staked ETH fund differ from ETHA?

It would stake held ethereum to earn network rewards. - When could the product launch?

Timing depends on SEC review once formal filings are submitted.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。