When you hear "prediction market," what is your first reaction?

Most people will certainly associate it with sports betting and financial speculation. This impression is not unfounded; since the beginning of this year, prediction markets have visibly upgraded to a new type of social information medium—in "prediction markets," the outcome of the game itself is the most priced and fair "socialized information source."

Especially in traditional prediction markets, the participation mechanism and settlement process are often shrouded in an opaque black box, while the emergence of on-chain technology has for the first time given "prediction" a public and verifiable structure.

As Ethereum co-founder Vitalik Buterin stated at the ETHShanghai 2025 main forum, during the U.S. election, many people participated in predictions through Polymarket, which itself is a success, proving that prediction markets can efficiently aggregate the public's true beliefs (see further reading: “The Breaking Moment of Prediction Markets: ICE Enters, Hyperliquid Doubles Down, Why Are Giants Competing for 'Pricing Uncertainty'?”).

This article will also attempt to reveal this hidden yet gradually emerging possibility, exploring how prediction markets can move from pricing uncertainty to influencing future trends in the real world.

1. From "Betting" to "Prediction" = A More Accurate Information Source

Ultimately, the traditional betting market, which was previously limited to a few fields like sports, is essentially just a "vote on the future." People merely decide who they think will win or lose based on their judgment or odds, and its core value stops at entertainment and gambling.

On the other hand, on-chain prediction markets resemble "cognitive trading." Their rise in the information age is due to their ability to address two major pain points of traditional information channels:

On one hand, traditional media is often dominated by a few individuals who control topics and public opinion, making it difficult to accurately reflect the importance of events and public perception; on the other hand, traditional polls and surveys lack economic incentives, allowing participants to answer freely without the motivation to disclose their true beliefs (the 2016 U.S. election is a typical example of severe deviation between polls and reality).

Source: Xinhua News

Prediction markets perfectly avoid the aforementioned flaws. They use "price," a universal and quantifiable language, to aggregate dispersed individual judgments with real economic motives from around the world. Therefore, through price signals, they can capture trends in the real world more quickly and dynamically, making them not just a "financial product," but a new information medium.

When we look back at the 2024 U.S. election or expectations for cryptocurrency policies, we find that the prediction results from platforms like Polymarket often align more closely with the final outcomes than polls do. For instance, regarding the recent betting on CZ's pardon, the probability of his pardon steadily increased even before it was officially confirmed.

These market signals are often more forward-looking and accurate than subjective guesses or unincentivized comments.

Furthermore, with the support of AI, prediction markets can be extended to smaller, more micro events, as AI models can become active participants in the market, continuously acquiring data, updating probabilities, and automatically generating predictions.

This means that future prediction markets will no longer be just a field for human gambling but may become a cognitive network co-built by "humans + AI," greatly enhancing the breadth and accuracy of information predictions.

2. A Trustless "Socialized Pricing Mechanism"

From this perspective, the biggest innovation or breakthrough of the current wave of prediction markets lies not in getting people to bet, but in making betting credible, transparent, and combinable.

Although the creation, trading, and settlement logic of prediction markets may not all be executed through smart contracts, their core mechanism is based on blockchain to achieve preliminary trustlessness and the broadest participation/settlement logic:

- Smart contracts ensure that the market's creation and settlement logic is immutable, while oracle services guarantee the (relative) fairness of outcome adjudication—though oracles themselves still need improvement, they at least represent an effort in the direction of decentralization;

- Cryptocurrency deposits and withdrawals allow people from any region of the world to participate in the market with relatively low barriers, aggregating a broader collective wisdom;

Thus, prediction markets become an information aggregation mechanism based on algorithmic trust, allowing prices to serve as transparent coordinates reflecting consensus.

Source: Vitalik's Blog

This actually forms a prototype of information finance (Info Finance), meaning that prediction markets are not just standalone applications but can also be combined with DeFi modules to create the concept of information finance. Vitalik Buterin has suggested that prediction markets are merely an early form of information finance, and in the future, any uncertain matter can be priced in a market-oriented manner.

This means that prediction markets are no longer limited to politics or sports but can be embedded in broader scenarios such as governance, scientific research, climate, and AI model evaluation, "starting from the facts you want to know, then designing a market to elicit that information in the best way," including:

- DAO Governance: Members can establish prediction markets on proposal outcomes, using market prices to reflect group expectations;

- Research and Innovation: Using market pricing to assess the credibility of research conclusions;

- AI and Algorithms: AI can participate in low-liquidity prediction tasks, automatically updating probabilities through models;

This evolution transforms prediction markets from a financial product into a "social pricing mechanism."

Additionally, another significant change is the trend towards assetization in prediction markets, such as directly integrating DeFi's yield logic on-chain: market liquidity driven by AMM allows users to earn fees like in DeFi liquidity pools; or prediction positions (like YES/NO shares) can be tokenized and freely traded in a broader secondary market; in future designs, these tokens may even be incorporated into lending protocols to achieve yield compounding.

In other words, prediction markets can not only price the future but also allow holders to earn continuous returns, turning betting into a cash-flow-generating asset behavior.

3. The Future of Prediction Markets May Change the Future

Under this trend, prediction markets are likely to begin influencing the course of the real world in return.

Of course, this is a trend that currently seems quite hidden, with few discussions, but it is worth being vigilant—as more funds and heavyweight players gather at the prediction market table, it will naturally spread to the real world, thereby gaining the ability to influence reality.

Especially after the news of Trump Media Group entering the prediction market business, it indicates that prediction markets will undoubtedly become more deeply embedded in real economic activities.

Source: Trump Media

To give an extreme example: if in a market, the vast majority of rational economic agents bet on a certain candidate to win, not only will the market price be pushed up, but even real-world voting behavior may be influenced by price signals. Once the outcome is swayed by massive funds, prediction markets will have the ability to change results.

In simple terms, prediction markets are pushing everyone under the assumption of "rational economic agents" to the forefront of fate, inadvertently intervening in the direction of consensus in the process of trading consensus. When "using money to influence outcomes" becomes profitable, it gains the ability to change facts.

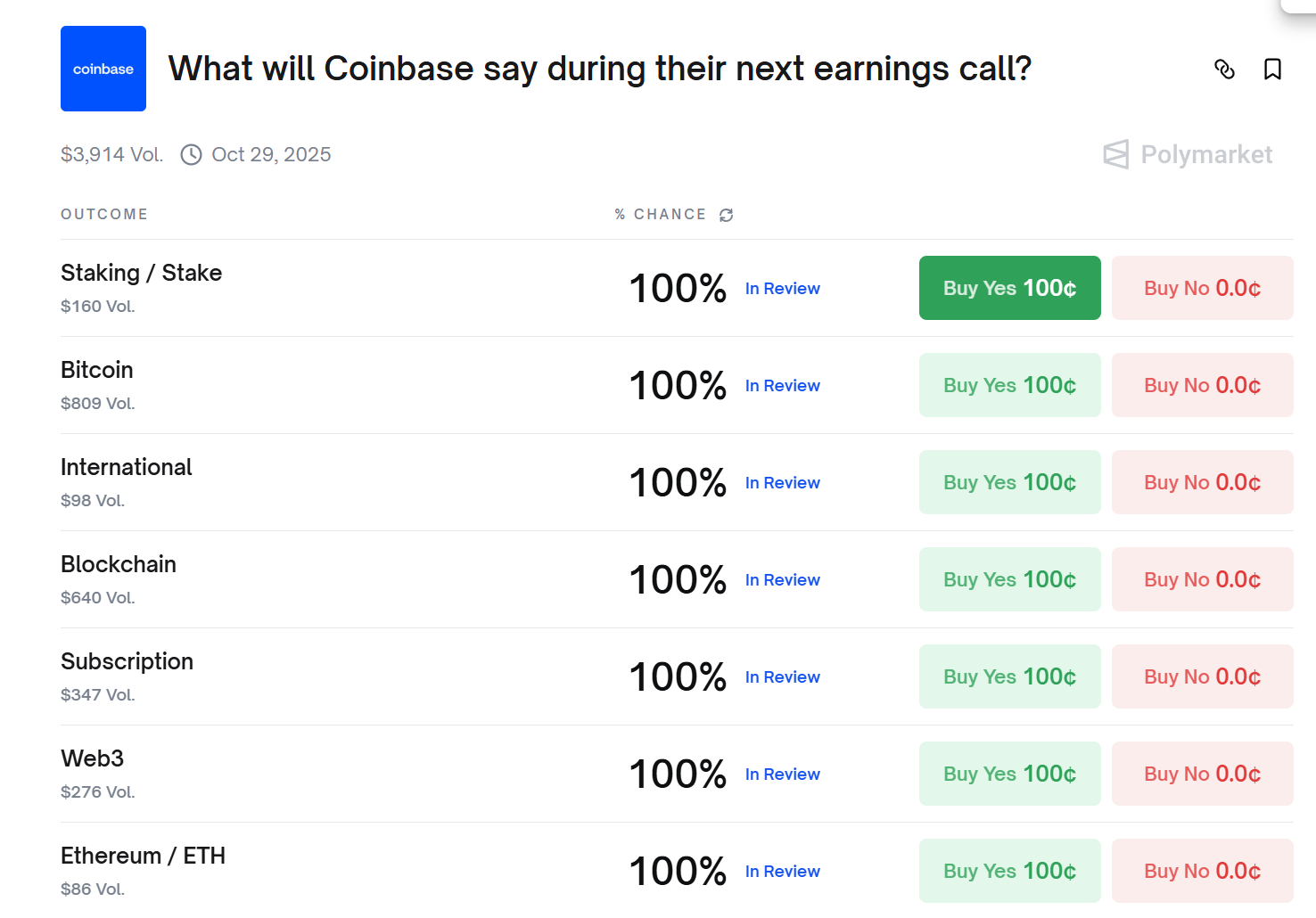

Interestingly, just at the recently concluded Coinbase Q3 earnings call, Coinbase co-founder and CEO Brian Armstrong staged a live experiment that could be described as "prediction market performance art."

When the analyst questions ended, he jokingly said, "I noticed someone betting on the prediction market whether I would mention certain keywords in today's call," and then he directly read all those keywords in one breath—resulting in the probability of related bets on Polymarket being fully maximized~

This is both a joke and a small footnote and preview:

The future of prediction markets may indeed no longer be just about predicting the future, but by making prices signals, they may change the world, thereby gaining the ability to influence the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。