_This article is from: _Tuuxx

Translation|Odaily Planet Daily (@OdailyChina); Translator|Azuma (@azumaeth)_

Editor’s note: The cryptocurrency world has always had its experts, and even during the hellish market conditions of the past month, some have managed to achieve considerable profits through "unconventional" strategies.

On the evening of November 19, overseas KOL Tuuxx, focusing on the DeFi market, revealed his market-making strategy and operational details on Meteora DLMM over the past month. Tuuxx disclosed that he made a profit of 675 SOL during this period, with a win rate of 100%, corresponding to an annualized return rate close to 1000%.

The following is the full text from Tuuxx, translated by Odaily Planet Daily.

In recent weeks, the market environment has changed dramatically, so I have adjusted my Meteora DLMM strategy accordingly.

I only share strategies after testing them in a real environment. Here are the results after nearly a full month (specifically 27 days) of execution:

- 100% win rate;

- Profit of 675 SOL;

- Return rate during this period of 19.35%;

- If this pace is maintained, the theoretical annualized return rate is close to 1000%;

Let me emphasize, this is still a personal sharing based on real results — it does not constitute financial advice — but I hope it can help you refine your own strategy.

Choice of Underlying Assets

My core view remains unchanged; I firmly believe in the Solana ecosystem, aiming to accumulate as much SOL as possible in the long term. Therefore, I only provide liquidity to SOL trading pairs, not stablecoins.

If you need more reasons:

- Most tokens will form trading pairs with SOL rather than stablecoins, using SOL trading pairs can naturally increase fee opportunities;

- During market crashes, SOL trading pairs usually have lower risk than stablecoin trading pairs — if the market collapses, various tokens may drop in sync with SOL, thereby reducing the probability of completely falling below the liquidity range — while pairing with stablecoins may expose you to more severe asymmetric volatility;

- Based on the current yield, even during a bear market, the dollar value of my DLMM market-making positions will continue to grow — if SOL returns to its historical highs, this appreciation potential will be even more significant.

Liquidity Curve

I will choose a relatively wide range for buy and sell intervals, rather than a narrow range or a layout similar to spot positions. This approach can bring:

- Stronger capital protection;

- Less impermanent loss;

- Long-term resilience during volatility;

This may not seem exciting, but I prefer stable accumulation rather than treating liquidity strategies as gambling.

Choice of Market-Making Tokens

Given the current market environment, my selection criteria have become stricter, currently focusing only on tokens that meet all of the following conditions:

Protocols that generate income (not speculative Meme tokens);

- Strong and active community;

- Market capitalization above $50 million;

- Strong daily trading volume (over $5 million);

- An attractive "fee/TVL" ratio;

You can use Jupiter and Tokeo to track the above metrics: https://jup.ag/pro?tab=toptraded

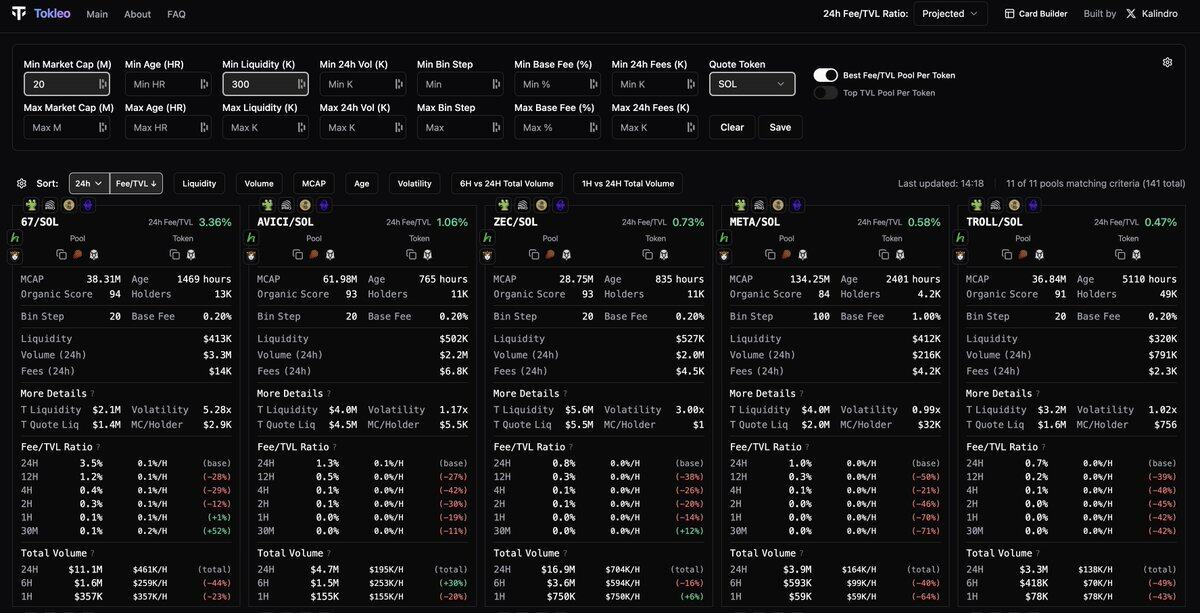

Tokens that meet all requirements are rare, which helps avoid frequent rebalancing. In the past few weeks, I have focused on the following four trading pairs: MET/SOL, ZEC/SOL, ORE/SOL, and AVICI/SOL.

Choice of Liquidity Pools

I will use Tokeo (https://tokleo.com/) to discover the best-performing liquidity pools, usually choosing pools with a Bin Step (to define the width of each price range) of 20 and a Base Fee (the basic fee rate) of 0.2%.

Capital Allocation

I do not strictly follow any formula; I will allocate funds based on my investment beliefs — and I prefer to use whole numbers. The current allocation is as follows:

- MET/SOL: 36%;

- ZEC/SOL: 24%;

- ORE/SOL: 24%;

- AVICI/SOL: 16%;

Market-Making Price Range

My goal is to protect the principal; I am not here to chase short-term speculation, patience is key to the effectiveness of this strategy.

Therefore, I will set a wider price range and use the support range from candlestick patterns to assist in judgment, accepting a maximum drop of 70% within the range.

Currently, the price ranges I am using for each trading pair (based on the current price) are as follows:

- MET/SOL: lower limit about -25%;

- ZEC/SOL: lower limit about -63%;

- ORE/SOL: lower limit about -69%;

- AVICI/SOL: lower limit about -70%;

Wider ranges may take longer to generate considerable returns, but they provide stability and are the only reliable, pressure-free way to withstand significant market shocks.

Position Management

This is the most variable part.

After significant price fluctuations occur between the market-making tokens and SOL, I will:

- Withdraw all liquidity (SOL + market-making tokens), but will not close the market-making position

- Redeploy in the same range:

- 100% of SOL back into the buy-sell (Bid-Ask) range;

- 50% of market-making tokens back into the (Bid-Ask) buy-sell range;

- The remaining 50% of tokens back into the spot liquidity curve;

After some time, your positions may look something like this:

- Selling high, buying low;

- Earning more fees through volatility;

- Gradually accumulating more and more SOL;

This compounding mechanism is key to long-term appreciation, even when starting with a wide range. I usually close a market-making position when the yield reaches around 10–20%.

Practical Feedback

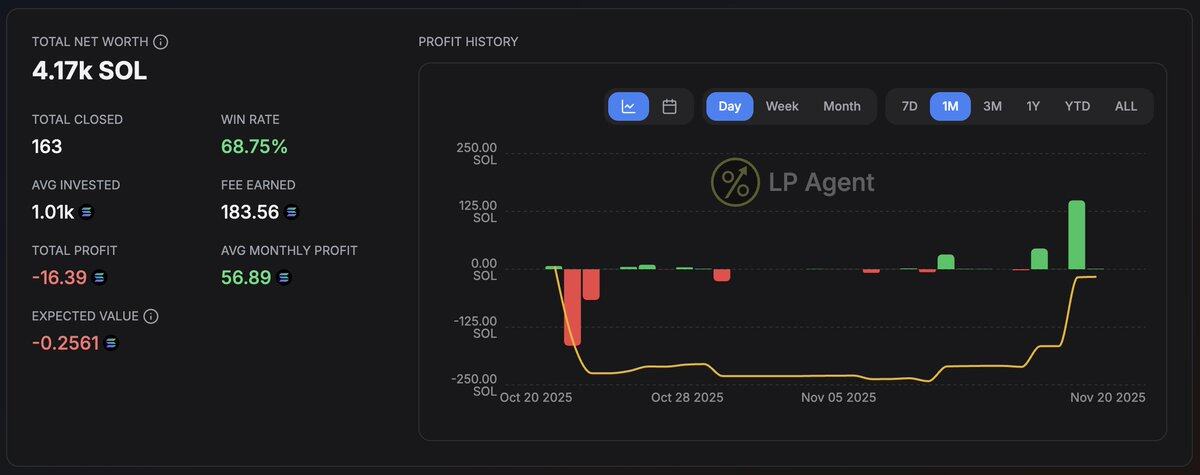

During the 27 days of testing this strategy:

• I have never closed a position due to losses;

• I have also never seen a situation where the price fell below the range;

I only check the liquidity pool 2–3 times a day, rebalancing only after significant price fluctuations (up or down) — I do not overtrade, and there is no pressure.

Whether you operate with 10 SOL or 10,000 SOL, consistency and the compounding effect are far more important than the initial scale.

Once again, I emphasize, this is not financial advice, just a sharing of a method that aligns with my appreciation goals and risk preferences.

About Strategy Replication and Address Tracking

Currently, this strategy cannot be automated or replicated — I must tell you in advance to avoid wasting your time or money.

Even portfolio tracking tools cannot accurately read position changes. For example, LP Agent may show that I incurred losses on certain days — but that is just because the current tools cannot recognize such rebalancing operations.

Strategy Guidance

I am happy to respond directly to feedback and answer questions in the comments section (original post: https://x.com/Tuuxxdotsol/status/1991158752452489477). The most valuable aspect of sharing such strategies lies in communicating with peers who are also testing, optimizing, and learning in the real market.

Additionally, due to recent inquiries from several members on how to deploy large DLMM combinations in a customized manner — I will provide one-on-one guidance through LP Army (@met_lparmy: https://www.lparmy.com/coaching).

This service is aimed at those who wish to build strategies in a professional manner — it does not provide signals or shortcuts, but rather a clear framework based on real execution.

I hope your returns become increasingly stable. Good night.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。