Author | @arndxt_xo

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

In the past few months, my stance has undergone a significant shift: from "pessimistic to bullish" (a prevalent pessimistic sentiment that often lays the groundwork for a squeeze market); to "I am very bearish, and I am genuinely concerned that the entire system is entering a more fragile phase."

This change is not due to a single event, but rather based on the following five mutually reinforcing dynamic factors:

- Rising risk of policy missteps. The Federal Reserve is tightening financial conditions amid data uncertainty and clear signs of slowing.

- The model of AI/tech giants is shifting from "cash-rich" to "leverage-driven growth." This shifts risk from mere stock market volatility to more traditional credit cycle issues.

- Discrepancies in private credit and loan pricing are beginning to emerge. Although it is still early, signs of model pricing pressure are already visible.

- The K-shaped economy is gradually evolving into a political issue. For an increasing number of people, the social contract is no longer credible, which will ultimately be reflected in policy.

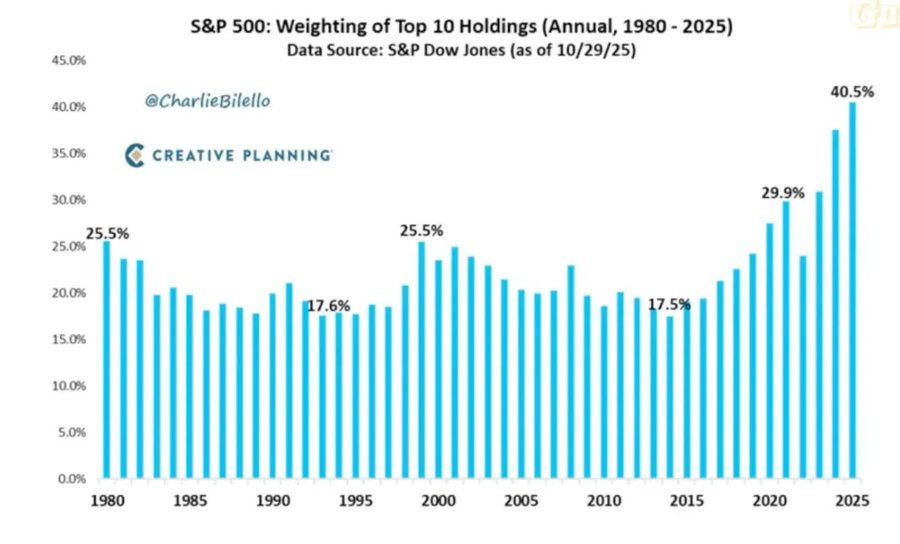

- Market concentration itself has become a systemic and political vulnerability. When about 40% of the weight in the index is dominated by a few tech giants, which are sensitive to geopolitical and leverage issues, they are no longer just engines of growth but targets of national security and policy.

The baseline scenario may still be that policymakers will eventually "inject liquidity as before" and support asset prices to enter the next political cycle. However, the path to that outcome looks bumpier, more reliant on credit, and more politically unstable, far more complex than the traditional "buy the dip" framework assumes.

1. Change in Macroeconomic Stance

For most of this cycle, a "bearish but constructive" stance was reasonable:

- Inflation remains high, but the growth rate is slowing.

- Policy is generally still supportive.

- Risk assets have been pushed higher, but each adjustment is accompanied by liquidity injections.

However, some factors have changed:

- Government shutdown: We have experienced a prolonged government shutdown, disrupting the release and quality of key macro data.

- Rising uncertainty in the statistical system: Senior officials have acknowledged that the federal statistical system has been compromised, leading to a decline in the credibility of core data that supports trillions of dollars in asset pricing.

- Against this backdrop, the Federal Reserve has chosen to adopt a more hawkish stance on interest rate expectations and its balance sheet, tightening financial conditions despite the deterioration of forward indicators.

In other words, the system is exacerbating uncertainty and pressure rather than alleviating it. This represents a completely different risk structure.

2. Policy Tightening Implemented "in the Fog"

The core issue is not just whether policy is tightening, but in what aspects and how it is tightening:

- Data "fog": After the shutdown, the release of key data (inflation, employment) has been delayed, distorted, or questioned; the Federal Reserve's own monitoring tools have become unreliable at the most critical moments.

- Interest rate expectations: Although forward indicators generally point to a continued decline in inflation early next year, Federal Reserve officials' statements have leaned hawkish, and market expectations for short-term rate cuts have significantly receded.

- Balance sheet: During the process of quantitative tightening, the Federal Reserve maintains its balance sheet stance and tends to push more duration onto the private sector, which will materially tighten financial conditions even if nominal rates remain unchanged.

Historically, the Federal Reserve's mistakes have often been "timing errors": tightening too late and easing too late. The current risk is that we may repeat this pattern once again—tightening in the face of slowing growth and ambiguous data, rather than easing proactively before pressure emerges.

3. Tech Giants and AI Shifting from "Cash Machines" to "Leverage Growth"

The second structural shift is reflected in the nature of large tech companies and AI leaders:

- Over the past decade, the "seven giants" have essentially acted like bonds: high market share, substantial free cash flow, significant buybacks, and very low net leverage.

- In the past two to three years, an increasing amount of this cash flow has been directed towards AI capital expenditures: data centers, chips, infrastructure.

- We are now entering a phase where AI spending increasingly relies on debt issuance rather than operating cash flow.

This brings several implications:

- Credit spreads and credit default swaps are beginning to widen, for example, Oracle, as these companies leverage up to build AI infrastructure.

- Stock price volatility is no longer the only risk. We are now seeing early signs of a typical credit cycle emerging in sectors previously considered "impervious" to such cycles.

- Market structure exacerbates this situation. The stocks of these companies hold significant weight in major indices, and their shift from "cash cows to leverage growth" alters the risk profile of the entire market.

This does not mean the end of the AI bubble. If capital expenditures yield lasting returns, then debt-financed capital expenditures are reasonable.

But it does mean that the margin for error has become smaller, especially in the context of high interest rates and policy tightening.

4. Early Cracks in Credit and Private Markets

Beneath the surface calm of the public markets, early pressures are emerging in private credit: significant discrepancies in loan quotes between different institutions (e.g., one party pricing at 70 cents, another at 90 cents). This is a typical precursor to a "model pricing vs. market pricing" conflict.

This resembles the pattern of 2007–2008:

- 2007: Rising bad assets, widening spreads, while stock indices remain relatively calm.

- 2008: Markets previously treated as "cash-like" (e.g., auction rate securities) suddenly freeze.

Meanwhile, reserves in the Federal Reserve system are beginning to decline; there is an increasing awareness within the Fed that without expanding the balance sheet, the "pipeline" of financial markets may face functional issues.

This does not mean a crisis is inevitable, but it aligns with a scenario where credit is quietly tightening while policy language remains "data-dependent" rather than proactively responsive.

REPO (reverse repurchase) is the first sign of "reserves no longer being abundant."

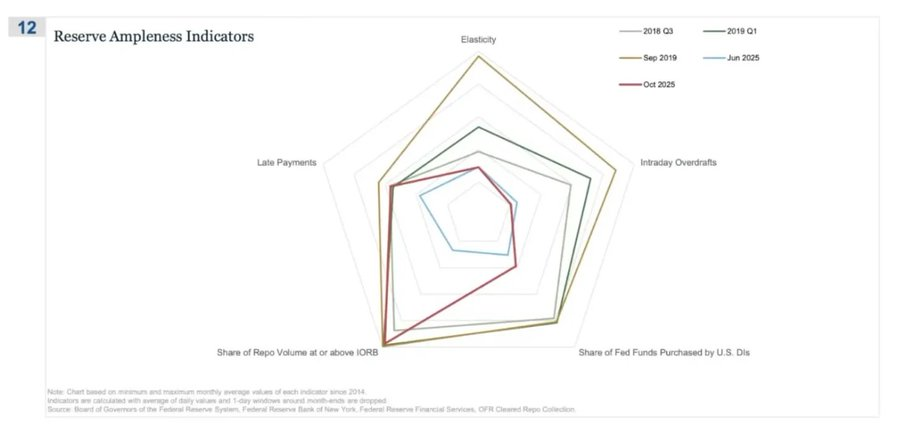

In this spider chart, the "proportion of repo transactions hitting or exceeding the IORB" is the most intuitive signal indicating that we are quietly moving away from a truly abundant reserve state.

During Q3 2018–2019, volatility was still relatively controllable: reserves were abundant, and most secured financing rates were below the IORB floor.

By September 2019 (just before the repo market turmoil): this line expanded sharply, as more and more repo rates touched or breached the IORB, which is a typical signal of collateral and reserve scarcity.

Now looking at June 2025 vs. October 2025:

- The light blue line (June) remains safe; however, the red line in October approaches the 2019 profile, indicating that an increasing number of repo transactions are being pushed to the policy rate floor.

- In other words, traders and banks are bidding up overnight financing costs because reserves are no longer "comfortably abundant."

- Combined with other indicators on the spider chart (increased intraday overdrafts, increased Federal Reserve purchases of federal funds, and rising delinquency rates), a clear message emerges.

5. The K-shaped Economy is Becoming a Political Variable

The author of this article previously explained the K-shaped economy in the article "The Double K-shaped Economy" as the different parts of the economy moving in completely opposite directions within the same cycle:

- The upper half of K → capital markets, asset holders, tech industry, large enterprises → rising rapidly (profits, stock prices, and wealth all increase).

- The lower half of K → wage earners, small businesses, blue-collar industries → declining or stagnating.

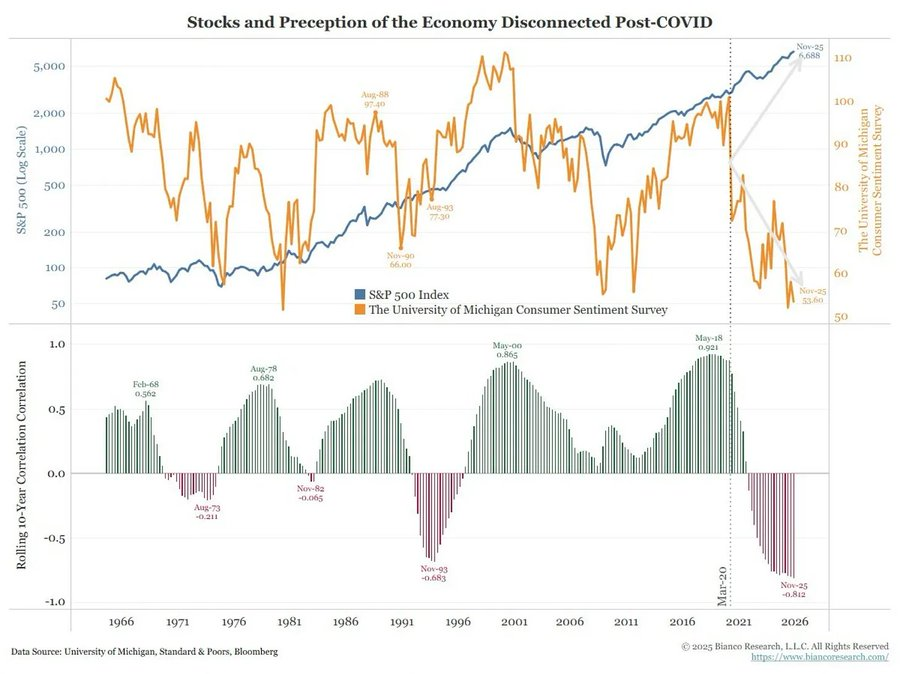

What we previously referred to as the "K-shaped economy" divergence, in my view, is no longer just an economic phenomenon but a political variable:

- Household expectations are showing clear divergence. There are significant differences in long-term financial outlooks (e.g., 5-year expectations): some groups expect stability or even improvement; others expect a significant deterioration.

- Real-world pressure indicators are also lighting up warning signals: the delinquency rate on subprime auto loans is rising; the age of first-time homebuyers is continually increasing, nearing retirement age; youth unemployment rates in multiple markets are consistently rising.

For an expanding social group, the issue is no longer just "inequality," but that the system itself has become difficult to operate for them:

- They have no assets, limited wage growth, and can hardly see a realistic path to participate in asset inflation.

- The basic understanding of the social contract—"work hard, keep improving, and ultimately gain wealth and security"—is collapsing.

In such an environment, political behavior will change:

- Voters will no longer choose "the best managers of the current system."

- They are increasingly willing to support radical or disruptive candidates from both the left and right, as they perceive their downside risk to be very limited: "It can't get worse anyway."

A series of policies surrounding taxation, redistribution, regulation, and monetary support will be formulated against this backdrop.

And this is clearly not neutral for the market.

6. Market Concentration as Systemic and Political Risk

The total market capitalization is highly concentrated among a few companies. However, less discussed are the systemic and political implications behind this pattern:

- Currently, the top 10 companies account for about 40% of the market capitalization of major U.S. stock indices.

These companies share the following characteristics: they are core holdings in pension funds, 401(k) plans, and retail portfolios; they are closely related to AI, have significant exposure to the Chinese market, and are highly dependent on interest rate paths; they effectively act as de facto monopolists in multiple digital domains.

This brings three intertwined risks:

- Systemic Market Risk

If these companies encounter earnings, regulatory, or geopolitical shocks (such as issues related to Taiwan or changes in Chinese demand), the impact will quickly transmit throughout the entire household wealth system.

- National Security Risk

When such a large proportion of national wealth and productivity is concentrated in a few companies with external dependencies, they themselves become strategic vulnerabilities.

- Political Risk

In an environment where "K-shaped" dynamics coexist with populist sentiments, these companies are most likely to become focal points of discontent:

- Higher taxes, windfall taxes, restrictions on buybacks;

- Antitrust-driven breakups;

- Stricter AI and data regulations.

In other words, these companies are not only growth engines but are also becoming potential policy targets, and this possibility is on the rise.

7. Bitcoin, Gold, and the Unfulfilled "Perfect Hedge" Narrative

In a world where the risks of policy missteps, credit pressures, and political instability are intensifying, one would expect Bitcoin to stand out as a macro hedging tool. However, the reality is:

- Gold is playing the role of traditional crisis hedge: performing steadily, with low volatility, and increasing in importance within asset allocation.

- Bitcoin resembles a high Beta risk asset in trading: closely related to liquidity cycles; sensitive to leverage and structured products; long-term holders are using the current environment to reduce their positions.

The initial narrative of decentralization/currency revolution remains conceptually appealing, but the reality is:

- The dominant capital flows currently stem from financialization behaviors: yield strategies, derivatives, and short volatility models.

- Bitcoin's actual performance is closer to tech Beta, rather than a neutral, robust macro hedge.

I still believe that 2026 could be an important turning point for Bitcoin (a new policy cycle, potential stimulus, and further erosion of trust in traditional assets may collectively form a turning point).

But investors need to recognize that at this stage, Bitcoin has not provided the hedging attributes many expect; it remains part of the liquidity complex we are concerned about.

8. Scenario Framework Leading to 2026

A useful way to understand the current environment is to view it as a "controlled bubble deflation," aimed at creating space for the next round of stimulus.

The possible sequence is as follows:

1) Mid-2024 to 2025: Controlled Tightening and Pressure.

- Government shutdowns and political disorder cause cyclical drag;

- The Federal Reserve leans hawkish in rhetoric and balance sheet, tightening financial conditions;

- Credit spreads widen slightly; speculative sectors (AI, long-duration tech, some private credit) absorb the shock first.

2) Late 2025 to 2026: Re-injection of Liquidity as Political Cycle Approaches.

- As inflation expectations decline and the market corrects, policymakers regain "room for easing";

- Rate cuts and fiscal measures begin to emerge, calibrated around growth and electoral goals;

- Due to lagging effects, the consequences of inflation will appear after key political junctures.

3) Post-2026: Systemic Repricing.

The scale and form of the next round of stimulus will determine the future path:

- Either a new round of asset inflation occurs, accompanied by stronger political and regulatory intervention;

- Or a more direct confrontation with structural issues of debt sustainability, concentration, and the social contract.

This framework is not definitive, but it aligns closely with current incentives:

- Political figures prioritize re-election over long-term equilibrium;

- The most readily available policy tools remain liquidity and transfer payments, rather than structural reforms;

- To utilize these tools again, they first need to deflate the current bubble.

Conclusion

Various signals point to the same conclusion: the system is entering a more fragile and error-prone cyclical phase.

Historically, policymakers have ultimately responded with a significant influx of liquidity. However, before entering the next phase, we must navigate a period characterized by:

- Stricter financial conditions,

- Higher credit sensitivity,

- More intense political volatility,

- And increasingly nonlinear policy responses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。