As long as people are still mining, those who sell shovels will never lose.

Written by: Liam, Deep Tide TechFlow

In 1849, during the California Gold Rush, countless individuals with dreams of getting rich flocked to the American West.

German immigrant Levi Strauss originally wanted to join the gold rush, but he keenly discovered another business opportunity: miners' pants often tore, and there was a pressing need for more durable workwear.

Thus, he made a batch of jeans from canvas, specifically selling them to gold miners, and from that moment, a clothing empire named "Levi's" was born, while the vast majority of those who actually participated in the gold rush ended up losing everything.

On November 20, 2024, NVIDIA once again delivered a "mind-blowing" financial report.

Q3 revenue reached a record $57 billion, a year-on-year increase of 62%; net profit was $31.9 billion, soaring 65% year-on-year. The latest generation of GPUs remains a scarce commodity that "money can't necessarily buy," and the entire AI industry is working for it.

Meanwhile, in the cryptocurrency world across the cyber divide, the same script is playing out.

From the 2017 ICO bull market to the 2020 DeFi summer, and then to the 2024 Bitcoin ETF and Meme wave, in every narrative and every story of sudden wealth, retail investors, project teams, and VCs continuously rotate, but only exchanges like Binance consistently stand at the top of the food chain.

History always rhymes.

From the California Gold Rush of 1849 to the cryptocurrency frenzy and the AI wave, the biggest winners are often not the "miners" directly competing, but those who provide the "shovels" for them. "Selling shovels" is the strongest business model that transcends cycles and harvests uncertainty.

AI Gold Rush, Enriching NVIDIA

In public perception, the protagonist of this AI wave is undoubtedly the large models represented by ChatGPT, which can write copy, create art, and code.

However, from a business and profit perspective, the essence of this AI wave is not an "explosion of applications," but an unprecedented revolution in computing power.

Just like the California Gold Rush of the 19th century, tech giants like Meta, Google, and Alibaba are the miners, engaging in a fierce AI gold rush.

Meta recently announced an investment of up to $72 billion in AI infrastructure this year and stated that next year's spending will be even higher. CEO Mark Zuckerberg expressed that he would rather risk "missing out on hundreds of billions of dollars" than fall behind in the development of superintelligence.

Companies like Amazon, Google, Microsoft, and OpenAI have all made record capital expenditures in the AI field.

Tech giants are going crazy, and Jensen Huang is smiling from ear to ear; he is the Levi Strauss of the AI era.

Every company wanting to develop large models must purchase GPUs on a large scale and rent GPU cloud services. Each model iteration consumes vast amounts of training and inference resources.

If a model can't compete with its rivals, and applications can't find a clear commercialization path, they can start over, but the GPUs purchased and the computing power contracts signed have already been paid for in real money.

In other words, on the question of "Can AI change the world?" and "Can AI applications be profitable in the long term?", everyone is still exploring, but as long as you want to participate in this game, you must first pay the "entrance tax" to the computing power providers.

NVIDIA just happens to stand at the very top of this computing power food chain.

It almost monopolizes the high-performance training chip market, with the H100, H200, and B100 becoming the "golden shovels" that AI companies scramble for. It connects software ecosystems (CUDA), development tools, and framework support from GPUs, further forming a dual moat of technology and ecology.

It doesn't need to bet on which large model will win; it just needs the entire industry to keep "gambling": betting that AI can create some kind of future, can support higher valuations and budgets.

In the traditional internet, Amazon's AWS once played a similar role; whether startups survive is one thing, but sorry, you first have to pay for the cloud resources.

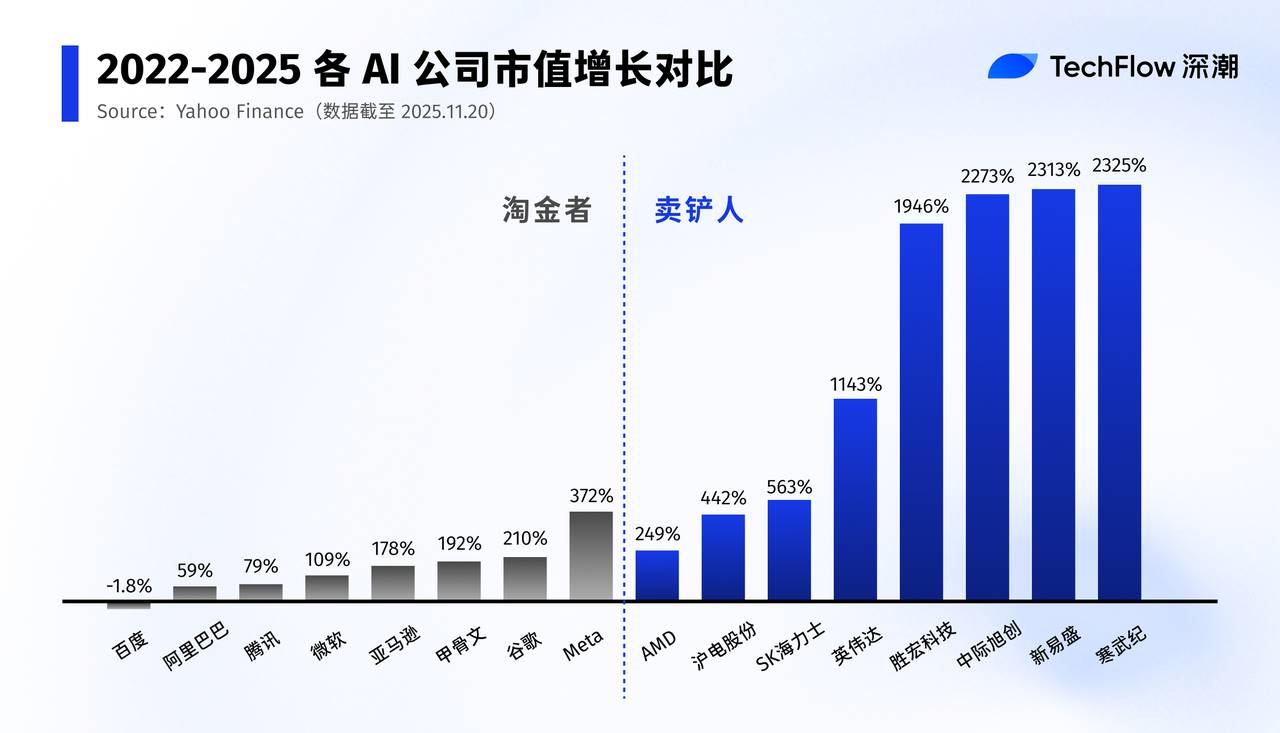

Of course, NVIDIA is not isolated; behind it is a whole "shovel-selling supply chain," and they are also the big winners laughing under the AI wave.

GPUs require high-speed interconnects and optical modules, with new companies like New Yisheng, Zhongji Xuchuang, and Tianfu Communication in the A-share market becoming indispensable parts of the "shovel." Their stock prices have risen several times this year.

Data center transformations require a large number of cabinets, power systems, and cooling solutions, with new industrial opportunities constantly emerging; storage, PCBs, connectors, packaging, and testing—all component manufacturers linked to "AI servers" are taking turns harvesting valuations and profits in this wave.

This is the terrifying aspect of the shovel-selling model:

Miners may lose money, mining activities may fail, but as long as people are still mining, those who sell shovels will never lose.

Large models are still struggling with "how to make money," while the computing power and hardware chains are already steadily counting cash.

Shovel Sellers in the Crypto World

If NVIDIA is the shovel seller in AI, then who are the shovel sellers in Crypto?

The answer is obvious to everyone: exchanges.

The industry is always changing, but the only constant is that exchanges keep printing money.

2017 marked the first true global bull market in cryptocurrency history.

The barriers to launching projects were extremely low; a white paper and a few PPT slides were enough to go live and raise funds. Investors frantically chased "tenfold and hundredfold coins," with countless tokens launching only to return to zero. Most projects were frozen or delisted within 1-2 years, and even the founding teams disappeared from the timeline.

But projects must pay to list, users must pay transaction fees, and futures contracts charge fees based on positions.

Coin prices can be halved repeatedly, but exchanges only need to focus on trading volume; the more frequent the transactions and the more volatile the market, the more they earn.

In 2020, during the DeFi summer, Uniswap challenged traditional order books with its AMM model, and various mining, lending, and liquidity pools made it seem "like centralized exchanges were no longer needed."

But the reality is very subtle; a large amount of capital moved from CEX to on-chain mining, only to return to CEX for risk control, cashing out, and hedging during peak periods and crashes.

In narrative terms, DeFi is the future, but CEX remains the preferred entry point for deposits, withdrawals, hedging, and perpetual contract trading.

By 2024-2025, Bitcoin ETFs, the Solana ecosystem, and Meme 2.0 once again pushed crypto to new heights.

In this cycle, whether the narrative shifts to "institutional entry" or "on-chain paradise," one fact remains unchanged: there is still a large amount of leveraged capital flowing into centralized exchanges; leverage, futures, options, perpetual contracts, and various structured products form the "profit moat" of exchanges.

Additionally, CEX is also integrating with DEX at the product level, making trading on-chain assets a norm within CEX.

Coin prices can rise and fall, projects can rotate, regulations can tighten, and sectors can shift, but as long as everyone is still trading, as long as volatility remains, exchanges are the most stable "shovel sellers" in this game.

Besides exchanges, there are many other "shovel sellers" in the crypto world:

For example, mining machine companies like Bitmain profit by selling mining machines rather than mining, allowing them to remain profitable through multiple bull and bear cycles.

API service providers like Infura and Alchemy benefit as blockchain applications grow;

Stablecoin issuers like Tether and Circle earn "seigniorage" through interest rate spreads and asset allocation;

Asset issuance platforms like Pump.Fun continuously tax through bulk issuance of Meme assets.

……

In these positions, they don't need to bet on which chain will win or which Meme will explode; as long as speculation and liquidity remain, they can print money steadily.

Why is "selling shovels" the best business model?

The real business world is far more brutal than most people imagine; innovation often comes with a high risk of failure. To succeed, one not only needs personal effort but also relies on the course of history.

For any cyclical industry, the outcome is often as follows:

Building upper-layer applications is like mining for gold, pursuing Alpha (excess returns); you need to bet on the right direction, the right timing, and defeat your competitors, with a very low win rate and very high odds—any slight misjudgment can lead to total loss;

Building underlying infrastructure is like being an upstream shovel seller, earning Beta; as long as the entire industry continues to grow and the number of players keeps increasing, one can reap the benefits of scale and network effects. Shovel sellers are in the business of probabilities, not luck.

NVIDIA doesn't need to choose which AI large model will "make it," and Binance doesn't need to determine which narrative will last the longest.

They only need one condition: "Everyone continues to play this game."

Moreover, once you become accustomed to NVIDIA's CUDA ecosystem, the cost of migration becomes unimaginably high. Once your assets are all in a major exchange and you are used to its depth and liquidity, it becomes very difficult to adapt to a smaller exchange.

The endgame of the shovel-selling business often leads to monopoly. Once a monopoly is formed, pricing power is entirely in the hands of the shovel sellers, as evidenced by NVIDIA's gross margin of up to 73%.

To summarize from a very blunt perspective:

Shovel-selling companies earn the "tax of industry existence," while gold-mining companies earn the "time window bonus," needing to seize user mindshare within a brief window or risk being abandoned; those creating content or narratives earn "money from attention fluctuations," and once the trend shifts, traffic evaporates immediately.

To put it more plainly:

Selling shovels is betting that "this era will move in this direction";

Building applications is betting that "everyone will only choose me."

The former is a macro proposition, while the latter is a brutal elimination race. Therefore, from a probability perspective, the win rate of selling shovels is an order of magnitude higher.

For retail investors or entrepreneurs like us, this is also a profound insight: If you can't see who the final winner will be or don't know which asset will continue to rise several times, then invest in those who provide water to all miners, sell shovels, or even just sell jeans.

Finally, let me share a piece of data: Trip.com Q3 net profit was 19.919 billion, surpassing Moutai (19.2 billion) and Xiaomi (11.3 billion).

Don't just focus on who shines the brightest in the story,

Think about who can continuously charge in all stories.

In times of fervor, serve the fervor, but remain calm; that is the highest wisdom in business.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。