Author | jk

Original | Odaily Planet Daily (@OdailyChina)

Introduction: The Industry Significance of a Historic Ruling

"Justice may be delayed, but it will never be absent." On November 13, Sun Yuchen, the founder of TRON, posted a brief yet profound tweet on the X platform.

This statement responds to a ruling made by the Dubai International Financial Centre Court (DIFC): on October 17, the court officially issued an indefinite extension of the property injunction and global freeze order against Dubai-based trade finance company AriaCommoditiesDMCC, involving an amount as high as $456 million.

This is the first time the DIFC has issued a freeze order globally concerning stablecoin reserves. The judge explicitly stated in the ruling that Techteryx (the owner of TUSD) has demonstrated "significant matters requiring trial," and the relevant funds should be held in trust to prevent improper transfer or concealment of assets before the final judgment of the Hong Kong High Court.

This case serves as a mirror, reflecting the deep-seated issues accumulated in the stablecoin industry after its rampant growth: the loss of control by custodians, cross-border regulatory arbitrage… More importantly, it marks a turning point for the entire industry, transitioning from a "crisis of trust" to "reconstruction of rules." As the global stablecoin market cap has surpassed $200 billion, becoming the infrastructure of the crypto industry, this battle over $456 million is essentially a game about the future standards of the stablecoin industry.

1. A Major Case of Reserve Misappropriation Hidden for Five Years

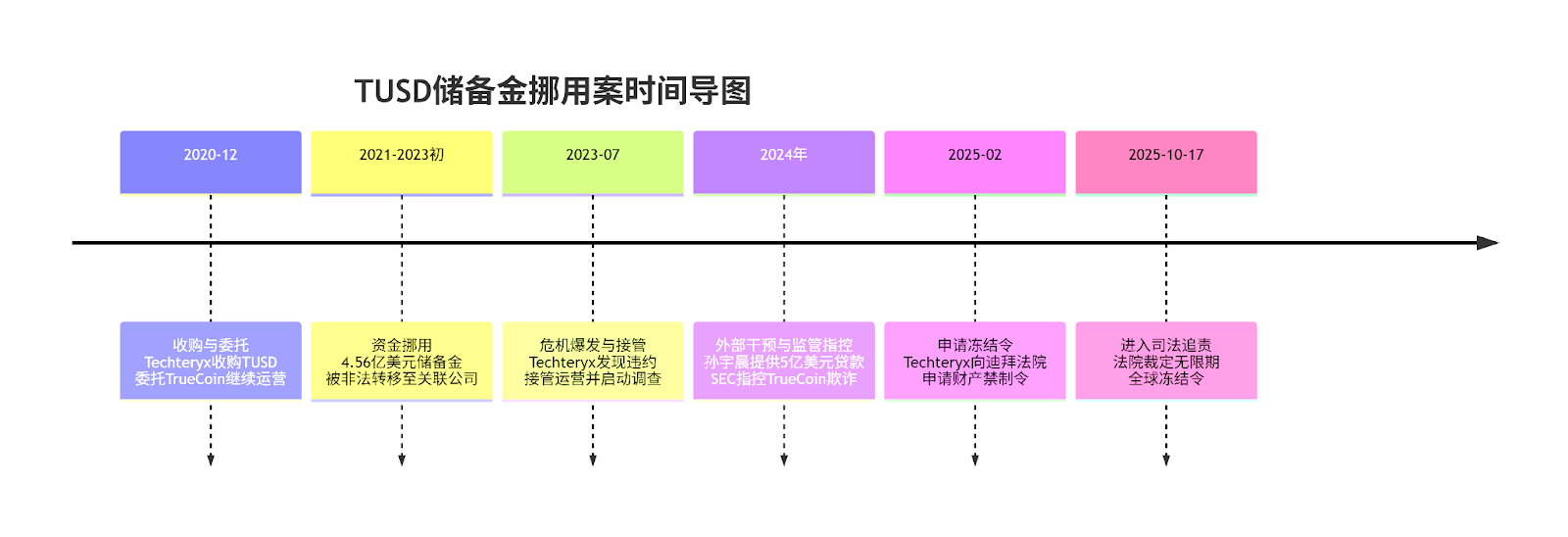

Timeline Overview

To understand the complexity of this case, we need to trace back to 2020.

December 2020, the Asian consortium Techteryx completed the acquisition of the TrueUSD (TUSD) stablecoin business and entrusted the original operating company TrueCoin, based in California, USA, to continue providing reserve custody services and coordinate international operations. During this transition period, TrueCoin, utilizing its role as a trustee, selected its partner, the Hong Kong trust company FirstDigitalTrust (FDT), to manage over $500 million in fiat reserves for TUSD in trust, and chose the offshore fund AriaCommodityFinanceFund (ACFF) as the main investment product. The actual controller of this fund is British citizen Matthew Brittain.

2021-early 2023, problems began to surface. According to court documents, TrueCoin is suspected of colluding with institutions like FDT to unauthorizedly transfer $456 million in TUSD statutory reserves in six installments to a Dubai-based company, AriaCommoditiesDMCC, which is wholly owned by Matthew Brittain's wife, Cecilia Brittain, rather than to the well-regulated Cayman Islands registered fund ACFF. These funds were subsequently invested in global projects with extremely low liquidity, such as manufacturing plants, mining operations, shipping vessels, port infrastructure, and renewable energy enterprises.

It wasn't until Techteryx discovered that the Aria group was unable to pay the agreed annual interest and refused to respond to redemption requests.

July 2023, Techteryx officially took over all operational rights of TUSD from TrueCoin and initiated a comprehensive investigation into FDT with an independent professional team. Meanwhile, to prevent losses to TUSD holders, Techteryx urgently isolated 400 million TUSD to ensure that retail users could still redeem normally. However, the company itself was unable to fill the reserve gap.

2024, Sun Yuchen intervened, providing a $500 million loan to Techteryx, safeguarding the interests of all TUSD public holders. In September of the same year, the U.S. Securities and Exchange Commission (SEC) issued a public statement accusing TrueCoin of engaging in fraudulent activities during the period it was entrusted to continue operations after Techteryx acquired TUSD, asserting that "TrueCoin profited through false representations of investment safety while exposing investors to significant, undisclosed risks."

February 2025, Techteryx applied to the DIFC Court for a property injunction against AriaDMCC. After several months of multiple hearings, the court ultimately ruled on October 17 to indefinitely extend the global freeze order, marking the judicial accountability phase of the five-year-long reserve misappropriation case.

Key Details Revealed

The details disclosed in court documents are shocking, revealing a meticulously designed network of fund misappropriation.

- According to the DIFC court ruling, FDT and LegacyTrust CEO and director Vincent Chok not only approved these illegal transfers but also colluded with partners from the Singapore investment advisory firm Finaport to receive over 100 million Hong Kong dollars (approximately $15.5 million) in secret illegal kickbacks through a company they controlled, GlassDoor, severely violating Hong Kong trust law and the Independent Commission Against Corruption's regulations on anti-commercial bribery.

- Matthew Brittain's testimony indicated that Vincent Chok demanded the $456 million reserve be illegally transferred to AriaDMCC's private account rather than to the regulated Cayman fund, precisely to "accelerate the receipt of over $15 million in secret kickbacks."

- Matthew Brittain stated that after AriaDMCC received the TUSD funds misappropriated by FDT, a "transfer" operation was conducted at the end of 2022—subsequently creating a new set of ACFF fund subscription documents, packaging the $456 million received by AriaDMCC as "related loans" from the ACFF fund, and "returning" it in the form of AriaDMCC transferring "assets" to the Cayman fund. This act of post-facto document forgery is seen by the court as clear evidence of fraud.

- The DIFC court explicitly pointed out in its ruling that the obtained litigation document evidence supports Techteryx's claims: Vincent Chok, Matthew Brittain, and other involved parties "were fully aware and jointly engaged in fraudulent means and actions that harmed Techteryx."

2. The Core of Stablecoins: The Cost and Value of Trust

This incident, through the complex technology and regulation behind it, elucidates that the core of stablecoins always revolves around one word: trust.

It warns us that no matter how sophisticated the code is, it cannot replace systems and integrity. When future CEOs receive hefty kickbacks, and fund managers allocate reserves to low-liquidity assets, technology is powerless to stop it—only laws, industry norms, and ethics can.

This also highlights Sun Yuchen's crucial role in this incident. He is not a primary stablecoin issuer; TRON is more of an infrastructure for circulation. However, during the TUSD crisis, he pushed the case towards judicial breakthroughs: from cross-border litigation to court freeze orders, the case forced regulators and the judiciary to confront the institutional loopholes in reserve management.

In the crypto world, too many victims remain silent or settle privately, tacitly accepting the jungle law of "code is law." Techteryx's public rights protection has set a precedent for legal accountability.

What the industry needs is precisely such "imperfect promoters," rather than "perfect bystanders." The perfect often stop at moral high ground, while controversial actors may objectively promote rule establishment and problem exposure—this may be the realistic logic of the crypto industry's development: between controversy and construction, there is a need for those willing to take risks and drive change.

Ultimately, the cornerstone of stablecoins is not technology, but trust. The TUSD incident, at the cost of $456 million, prompts the industry to reassess the cost of trust. Transparent reserves, legal constraints, independent audits, and timely disclosures, though all have costs, are fundamental to the word "stability."

As Sun Yuchen tweeted after the case concluded: "Justice may be delayed, but it will never be absent." The second half of stablecoins belongs to the trust foundation built jointly by regulation and the industry.

3. Accelerating Legislation, Stricter Trends in Stablecoin Regulation

Stricter regulation has become a foregone conclusion. Major global economies are accelerating the legislative process for stablecoins.

The "GENIUS Act," passed in the U.S. in 2025, serves as the first federal stablecoin regulation, establishing a strict framework for "payment stablecoins": requiring issuers to obtain regulatory approval, hold 100% reserves (limited to cash and short-term government bonds), and disclose monthly. If this law had been in effect earlier, the misappropriation of TUSD reserves would have clearly been illegal.

The European MiCA regulation will take effect in 2024, stipulating that stablecoins with issuance exceeding 5 million euros must hold an electronic money license, with reserves required to be isolated, valued daily, and ensured to be redeemable at par at any time.

Hong Kong and Singapore are also set to launch similar systems in 2024, both emphasizing that reserves must be high liquidity, low-risk assets, allowing users to redeem 1:1.

The recent ruling by the DIFC Court regarding stablecoin custodians is particularly noteworthy, as its issuance of a global freeze order indicates that even in the more flexible regulatory environment of the Middle East, crypto disputes are now subject to strict judicial scrutiny—any individual or institution assisting AriaDMCC in violating the injunction could be found in contempt of court, facing fines or even asset seizure, setting a precedent for other regions.

Technological innovation is also reconstructing trust mechanisms. On-chain reserve proofs are gradually becoming an industry standard, with oracle networks verifying bank reserves in real-time; some projects have achieved daily automatic updates, allowing users to verify at any time.

Smart contract custody enables automated redemption through asset tokenization, where users destroying stablecoins trigger smart contracts to release equivalent reserve tokens, technically eliminating the possibility of misappropriation.

Under dual pressure, the market is rapidly reshaping. Particularly, traditional financial institutions are accelerating their entry, leveraging mature licenses and risk control systems to enhance industry information disclosure while posing competition to native crypto projects.

The market is also reassessing the paths of two types of stablecoins: centralized models rely on institutional credit, with risks stemming from custodial malfeasance; algorithmic stablecoins depend on collateral and arbitrage, with risks arising from death spirals in extreme market conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。