The current DeFi fund manager model is an accountability vacuum, with billions of dollars of user funds managed by entities that operate without substantial constraints and face no real consequences for failure.

Written by: YQ

Translated by: AididiaoJP, Foresight News

The Rise of DeFi Fund Managers

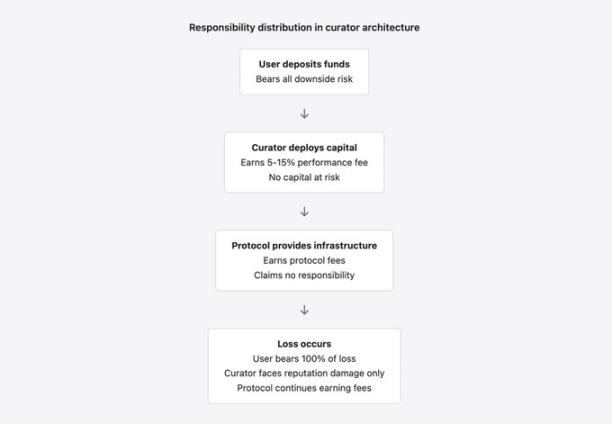

In the past year and a half, a new type of financial intermediary has emerged in the DeFi space. These entities call themselves "risk managers," "treasury managers," or "strategy operators." They manage billions of dollars in user deposits on protocols like Morpho (approximately $7.3 billion) and Euler (approximately $1.1 billion), responsible for setting risk parameters, selecting collateral types, and deploying yield strategies. They take a performance fee of 5% to 15% from the generated profits.

However, these entities operate without licenses, are unregulated, are not required to disclose qualifications or performance records, and often hide their true identities.

The Stream Finance Collapse in November 2025

The collapse of Stream Finance in November 2025 exposed the fatal flaws of this structure under pressure. The incident triggered a chain loss of up to $285 million across the entire ecosystem.

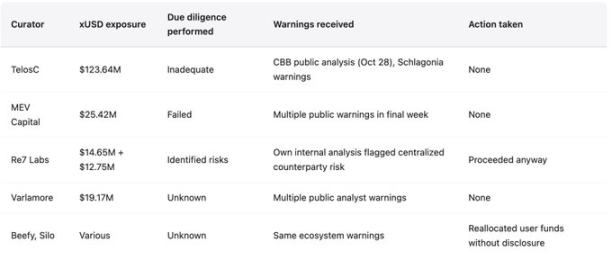

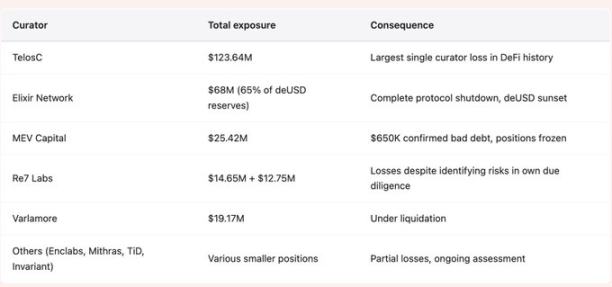

Several fund managers, including TelosC ($123.64 million), Elixir ($68 million), MEV Capital ($25.42 million), and Re7 Labs (two treasuries totaling $27.4 million), had highly concentrated user deposits with a single counterparty. This counterparty operated with up to 7.6 times leverage on just $1.9 million of real collateral.

Warning signals had long been present and were very specific. Crypto KOL CBB publicly disclosed its leverage ratio on October 28. Yearn Finance directly warned the Stream team 172 days before the collapse. But these warnings were ignored, as the existing incentive structure encouraged such negligence.

Comparison with Traditional Financial Intermediaries

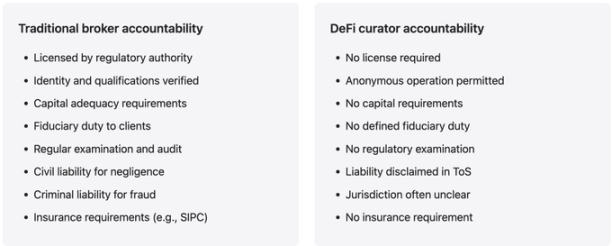

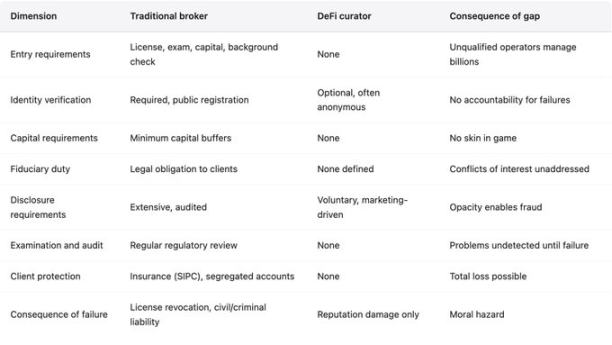

The DeFi fund manager model follows the playbook of traditional finance but discards the accountability mechanisms that have been established through centuries of painful lessons.

When traditional banks or brokers manage client funds, they face capital requirements, registration obligations, fiduciary duties, and regulatory scrutiny. In contrast, DeFi fund managers are driven solely by market incentives. Market incentives promote asset accumulation and yield maximization rather than risk management.

The protocols supporting these managers claim to be "neutral infrastructure," earning fees from activities while being completely unaccountable for the risks generated by those activities. This position is fundamentally untenable. Traditional finance abandoned this notion decades ago after experiencing multiple disasters, as bloody lessons showed that intermediaries earning fees cannot be completely exempt from liability.

The Dual Nature of Permissionless Architecture

Morpho and Euler operate as permissionless lending infrastructures. Anyone can create a treasury, set risk parameters, choose collateral, and start accepting deposits. The protocols provide the smart contract foundation and earn fees from it.

This architecture has its advantages:

- Promotes innovation: Eliminates potential vicious competition that may hinder new funding operational methods due to unfamiliarity or competitive relationships.

- Enhances inclusivity: Provides services to participants excluded from traditional systems.

- Increases transparency: Creates an auditable record of all transactions on-chain.

However, this architecture also brings fundamental problems, which were fully exposed in the November 2025 incident:

- No entry review: There is no guarantee of the quality of managers.

- No registration requirements: There is no accountability when managers fail.

- No identity disclosure: Managers can accumulate losses under one name and then change names to start anew.

- No capital requirements: Managers have no real stakes other than their reputation, which can easily be discarded.

As BGD Labs founder Ernesto Boado pointedly noted: Managers are "selling your brand for free to gamblers." The protocols earn income, managers earn fees, while users bear all losses in the inevitable failures.

Typical Failure Mode: Bad Money Drives Out Good

Stream Finance perfectly highlights a specific failure mode spawned by the permissionless architecture. Since anyone can create a treasury, managers can only compete for deposits by offering higher yields. Higher yields come either from genuine alpha returns (rare and hard to sustain) or from higher risks (common and catastrophic when they occur).

Users see "18% annualized yield" and stop probing further, assuming that the so-called "risk managers" have done their due diligence. Managers see the opportunity for fee income and accept risks that prudent risk management should reject. Protocols see total locked value and fee income grow and choose not to intervene, as the "permissionless" system should not impose limits.

This competition leads to a vicious cycle: conservative curators earn low yields and attract few deposits; aggressive curators earn high yields, attract many deposits, and rake in fees until disaster strikes. The market cannot distinguish between sustainable yields and unsustainable risks before failure occurs. At that point, losses are borne by all participants, while managers are hardly affected beyond their easily discarded reputations.

Conflicts of Interest and Incentive Failures

The manager model is embedded with fundamental conflicts of interest, making failures like Stream Finance's almost inevitable.

- Divergent goals: Users seek safety and reasonable returns, while managers seek fee income.

- Risk mismatch: This divergence is most dangerous when yield opportunities require taking risks that users would otherwise reject.

The case of RE7 Labs is highly educational. In their due diligence before integrating xUSD, they correctly identified "centralized counterparty risk" as a hidden danger. Stream concentrated risk with an anonymous external fund manager whose positions and strategies were completely opaque. RE7 Labs understood the risks but still pushed for integration, citing "strong user and network demand." The temptation of fee income outweighed the risks to user funds. When funds were lost, RE7 Labs only suffered reputational damage, while users bore 100% of the financial loss.

This incentive structure not only mismatches but actively punishes prudent behavior:

- Managers who refuse high-risk, high-reward opportunities see deposits flow to competitors who accept risks.

- Prudent managers earn low fees, appearing to perform poorly.

- Reckless managers earn high fees, attract many deposits, until exposed. The massive fees earned during this time can still be retained.

Many managers invested user funds into xUSD positions without full disclosure, exposing depositors to Stream's leverage of up to 7.6 times and opaque off-chain risks without their knowledge.

Asymmetrical Fee Structures

Managers typically take a performance fee of 5%-15% from profits. This seems reasonable but is actually highly asymmetrical:

- Share profits: Managers share in the upside profits.

- Do not bear losses: There is no corresponding risk exposure for downside losses.

Example: A treasury with $100 million in deposits generating a 10% return earns the manager $1 million (at a 10% performance fee). If the manager takes on double the risk to achieve a 20% return, they can earn $2 million. If a risk event occurs, and users lose 50% ($50 million) of their principal, the manager only loses future income from that treasury, having pocketed the fees already earned.

Conflicts of Interest in Protocols

Protocols also have conflicts of interest when dealing with manager failures. Morpho and Euler earn fees from treasury activities, incentivizing them to maximize activity levels, which means allowing high-yield (high-risk) treasuries that can attract deposits. They position themselves as "neutral," claiming that a permissionless system should not impose limits. However, they are not neutral; they profit from the activities they facilitate.

Traditional financial regulation recognized centuries ago that entities profiting from intermediary activities cannot be completely exempt from the risks generated by those intermediaries. Brokers earning commissions have obligations to their clients, a principle that DeFi protocols have yet to accept.

The Accountability Vacuum

- Traditional finance: Losing client funds can trigger regulatory investigations, license revocation, civil liability, and even criminal prosecution. This deters reckless behavior beforehand.

- DeFi fund managers: Losing client funds only results in reputational damage, and they can often change names to start anew. There is no regulatory jurisdiction, no fiduciary duty (legal status unclear), and no civil liability (unknown identity + service terms disclaimers).

The Morpho incident in March 2024 resulted in a loss of approximately $33,000 due to oracle price discrepancies. When users sought accountability, the protocol, managers, and oracle providers passed the buck, with no one taking responsibility and no compensation provided. Although this was a minor incident, it established a precedent of "loss occurs, no one is responsible."

This accountability vacuum is deliberately designed, not a result of negligence. Protocols evade responsibility through service term disclaimers, emphasizing "permissionless does not control behavior," and placing governance in regulatory-friendly foundations/DAOs. This is legally advantageous for the protocols but creates a moral hazard environment where billions of dollars of user funds can be managed without accountability: profits are privatized, while losses are socialized.

Anonymity and Accountability

Many managers operate anonymously or under pseudonyms, claiming security and privacy, but this directly undermines accountability:

- Legal responsibility cannot be pursued.

- They cannot be banned from operating due to failure records.

- Professional or reputational sanctions cannot be imposed following their true identities.

In traditional finance, even without regulation, those who destroy client funds still face civil liability and reputational tracking, while DeFi fund managers face neither.

Black Box Strategies and Blindly Following Authority

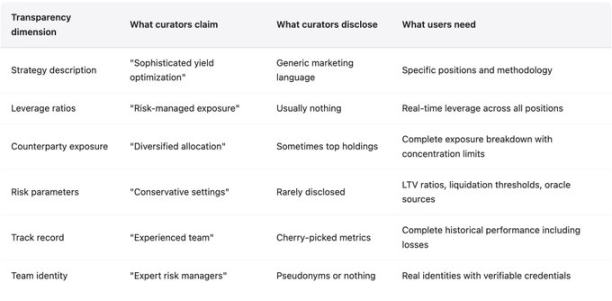

Managers tout themselves as risk management experts, but the events of November 2025 showed that many lack the necessary infrastructure, expertise, or even willingness.

- Traditional institutions: 1-5% of employees focus on risk management, with independent committees, oversight teams, stress testing, and scenario analysis requirements.

- DeFi fund managers: Often small teams or individuals focused on yield generation and asset accumulation.

Details of strategies are rarely disclosed meaningfully. Terms like "delta-neutral trading" and "hedged market making" sound impressive but do not reveal actual positions, leverage, counterparty risks, or risk parameters. The opacity justified by "protective strategies" is, in fact, a breeding ground for fraud and recklessness until exposed.

The opacity of Stream Finance has reached catastrophic levels: it claims a total locked value of $500 million, but only $200 million is verifiable on-chain, with the remaining $300 million held by "external fund managers" whose identities, qualifications, strategies, and risk controls are all undisclosed. The actual positions and leverage, wrapped in terminology, are unknown to anyone. Post-analysis reveals that it created a synthetic expansion of 7.6 times leverage through recursive lending with just $1.9 million in real collateral, leaving depositors completely in the dark, unaware that its "stablecoin" is supported by infinitely recursive borrowed assets rather than real reserves.

The danger of blindly following authority is that it leads users to abandon independent judgment. The case of RE7 Labs shows that even when due diligence identifies risks, commercial incentives can override correct conclusions. This is worse than incompetence; it is the ability to recognize risks but choosing to ignore them due to incentives.

Proof of Reserves: Technologically Mature but Rarely Implemented

Verifiable proof of reserves cryptographic technologies (such as Merkle trees and zero-knowledge proofs) have matured over decades, being efficient and privacy-preserving. Stream Finance's failure to implement any proof of reserves is not due to a lack of technology but rather a deliberate choice for opacity, allowing fraud to persist for months despite multiple public warnings. Protocols should require managers of large deposits to provide proof of reserves. The absence of proof of reserves should be treated as equivalent to a bank refusing external audits.

Evidence from the November 2025 Incident

The collapse of Stream Finance is a complete case study of the failure of the manager model, encapsulating all the issues: insufficient due diligence, conflicts of interest, ignoring warnings, opacity, and lack of accountability.

Failure Timeline

- 172 days before the collapse: After analyzing Schlagonia, a direct warning was issued that Stream's structure was doomed. A 5-minute analysis revealed the fatal problem: $170 million in on-chain collateral supporting $530 million in loans (4.1 times leverage), with strategies involving recursive lending creating circular dependencies, and another $330 million in total locked value completely off-chain and opaque.

- October 28, 2025: CBB publicly issued specific warnings, detailing leverage and liquidity risks, directly labeling it as "degenerative gambling." Other analysts followed suit.

- Warnings were ignored: Managers like TelosC, MEV Capital, and Re7 Labs continued to hold large positions and attract deposits. Acting on the warnings would mean reducing positions and fee income, making them appear to perform poorly in competition.

- November 4, 2025: Stream announced losses of approximately $93 million from external fund managers. Withdrawals were paused, xUSD plummeted by 77%, and Elixir's deUSD (65% of reserves lent to Stream) crashed by 98%. The total contagion risk reached $285 million, with Euler's bad debts around $137 million, and over $160 million in funds frozen.

DeFi Fund Managers vs. Traditional Brokers

The comparison aims to reveal the lack of accountability mechanisms in the manager model, not to suggest that traditional finance is perfect or that its regulation should be copied. Traditional finance has its flaws, but the accountability mechanisms developed through costly lessons have been explicitly discarded by the curator model.

Technical Recommendations

The manager model does have benefits: it enhances capital efficiency through professional parameter setting; allows experimentation to promote innovation; and lowers barriers to increase inclusivity. These benefits can be retained while addressing accountability issues. Recommendations based on five years of DeFi failure experience include:

- Mandatory identity disclosure: Managers of large deposits (e.g., over $10 million) must disclose their true identities to the protocol or an independent registration body. Detailed privacy does not need to be public, but it must ensure accountability in cases of fraud or gross negligence. Anonymity is incompatible with large-scale management of others' funds.

- Capital requirements: Managers must hold risk capital, suffering losses when treasury losses exceed a threshold (e.g., 5% of deposits). This aligns their interests with users, such as providing collateral or holding subordinate shares of their own treasury to bear first losses. The existing structure of no risk capital creates moral hazard.

- Mandatory disclosure: Managers must disclose strategies, leverage, counterparty risks, and risk parameters in a standardized format. "Protecting proprietary strategies" is often an excuse; most strategies are known yield farming variants. Real-time disclosure of leverage and concentration does not harm alpha and helps users understand risks.

- Proof of reserves: Protocols should require curators managing large deposits to provide proof of reserves. Mature cryptographic technologies can verify solvency and reserve ratios without disclosing strategies. Those without proof of reserves should be disqualified from management. This requirement could prevent Stream from operating with $300 million in unverifiable off-chain headroom.

- Concentration limits: Protocols should enforce concentration limits at the smart contract level (e.g., single counterparty risk exposure of 10-20%) to prevent excessive concentration. Elixir lending 65% of reserves to Stream, leading to inevitable contagion, serves as a lesson.

- Protocol accountability: Protocols that earn fees from manager activities should bear some responsibility. For example, they could allocate insurance funds from protocol fees to compensate users for losses or maintain a blacklist of managers with poor records or insufficient disclosures. The current model where protocols profit while being completely exempt from liability is economically unreasonable.

Conclusion

The current implementation of the manager model is an accountability vacuum, with billions of dollars of user funds managed by entities that operate without substantial constraints and face no real consequences for failure. This is not to deny the value of the model itself; capital efficiency and professional risk management are indeed valuable. Rather, it emphasizes that this model needs to incorporate the accountability mechanisms that traditional finance developed through painful lessons.

DeFi can develop mechanisms suited to its characteristics, but it cannot simply discard accountability and expect results to surpass those of traditional finance before accountability mechanisms were established. The existing structure is destined to see failures repeat. Failures will continue until the industry accepts that intermediaries earning fees cannot be completely exempt from the risks they create.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。