Author: Zhang Qianwen, Jin Weilin

Introduction

In the current era of accelerated integration of the global digital economy, cross-border payment methods are rapidly transitioning from traditional bank card systems to blockchain networks. Nowadays, more and more merchants are beginning to accept cryptocurrencies as a means of payment, ranging from NFT artworks and metaverse real estate to cross-border e-commerce and freelance services.

This shift not only significantly enhances payment efficiency and expands transaction boundaries but also brings about dual impacts: it pushes cross-border acquiring to the forefront of financial innovation while providing new hiding spaces for illegal activities such as money laundering. In light of this trend, how should Web3 cross-border traders effectively identify and mitigate money laundering risks in their operations? This article will conduct a systematic analysis around this issue.

Evolution of Payment Systems: From Account-Based to Address-Based

To understand the new challenges faced by Web3 cross-border acquiring in the field of anti-money laundering, it is essential to clarify the fundamental differences in their underlying operational logic compared to traditional models.

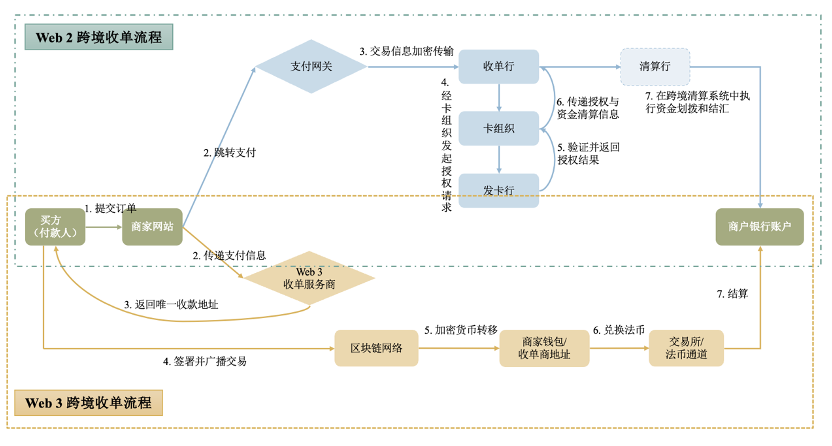

As shown in the diagram below, the traditional Web2 acquiring process is still closely centered around centralized financial institutions such as card organizations, acquiring banks, and clearing banks, forming what is known as the "account-based" system. In contrast, this process has been completely overturned in the Web3 world:

In the traditional Web2 system, cross-border payments are built around identity: all transactions must rely on trusted intermediaries such as banks and payment institutions to record and settle in their private ledgers, thus forming a closed system.

In comparison, Web3 has constructed an open payment system. Here, the payment request is not just an account but is generated through technology as an "anonymous digital address." During payment, there is no need to go through banks or payment platforms for deductions and settlements; users can complete transactions directly on a peer-to-peer basis. This mechanism relies on algorithms and networks rather than the credit of a centralized institution.

The transition from Web2's "account-based" to Web3's "decentralized settlement + address-based" is not just a technological upgrade but a fundamental shift in the underlying financial paradigm.

The payment structure of Web3 makes cross-border payments faster and lowers the barriers, breaking the limitations of countries and traditional banks. However, it is precisely this openness and anonymity that upgrades the money laundering risk from "offline concealment" to "on-chain invisibility." Under the cover of anonymous addresses and smart contracts, dirty money can be infinitely split and mixed, merging into a vast data stream like droplets of water.

On-Chain Acquiring: Common Money Laundering Tactics in Cross-Border Payments

In Web3 cross-border payments, money laundering activities exhibit a high degree of technical sophistication and concealment. The following summarizes several typical money laundering tactics:

Tactic One: Using Anonymized Mixing to Launder Money

Money launderers use "mixers" to blend illegal funds with other transactions, thereby severing the source and hiding their tracks. Subsequently, these "cleaned" funds can be used to purchase physical goods in cross-border payments or exchanged for fiat currency, completing the legitimization of illegal funds. The purpose of mixing is to cut off on-chain tracking, obfuscating transaction paths and making it difficult for the acquiring party to trace the source of funds.

Core of the Tactic: Achieving anonymity through "mixing," allowing funds to come and go without a trace.

Tactic Two: Laundering Money On-Chain through DeFi Protocols

Money launderers exploit the openness and composability of decentralized finance protocols to achieve rapid and complex fund transfers. By using cross-chain, exchanges, and interest-earning operations, they complicate the fund paths to a degree that is difficult for humans to parse, causing tracking efforts to become mired in the vast on-chain data.

Typical operations include:

Cross-chain bridge conversion—transferring illicit funds across different blockchain networks via cross-chain bridges, increasing tracking difficulty;

Asset swapping—exchanging one asset (such as stolen ETH) for another asset (such as USDT) on decentralized exchanges;

Staking and lending—depositing illicit funds into DeFi staking pools to earn interest or using them as collateral to borrow other clean assets for payment.

Core of the Tactic: Increasing tracking difficulty by creating complex fund flow paths.

Tactic Three: Confusing Money Laundering through Fake Trade

Money launderers conduct fake transactions through cross-border e-commerce websites they control, purchasing their own goods with dirty money. After the website converts the received cryptocurrency into fiat currency, the dirty money becomes legitimate sales revenue.

Core of the Tactic: Using fake cross-border trade as a cover for money laundering activities.

Tactic Four: High-Price Money Laundering through the NFT Market

Money launderers stage a "one-man show" to launder money: they first create an NFT and then buy it back at an exorbitant price using another wallet. This money simply shifts from one pocket to the other, transforming into "clean money" from "art sales," which can then be used normally.

Core of the Tactic: Exploiting the lack of standard pricing for NFTs to fabricate a non-existent commercial transaction through self-buying and self-selling, thus laundering the money.

Core Challenges in Risk Control: The Multiple Dilemmas of Anti-Money Laundering

The anti-money laundering efforts in Web3 cross-border acquiring are no longer a simple compliance issue but a systematic challenge involving technology, law, operations, and international cooperation. The fundamental contradiction lies in the fact that a decentralized financial new system has already formed, but the traditional regulatory logic has not kept pace, resulting in structural regulatory gaps.

1. Technical Level: Identification Blind Spots on Transparent Ledgers

The transparency of blockchain is far from sufficient for anti-money laundering. We can see transactions, but we cannot identify "who is trading" and "why they are trading." This fundamental contradiction manifests in four major technical dilemmas:

- Dilemma One: Protocols without Owners, Responsibility Vacuums

DeFi protocols like Uniswap lack clear accountability, leading to a situation where no one is held responsible when risks arise, making regulation difficult.

- Dilemma Two: Contract Black Boxes, Intent Difficult to Discern

Money launderers can bundle multiple steps into a single smart contract call, making it difficult for risk control systems to parse the underlying business logic.

- Dilemma Three: Cross-Chain Interactions, Tracking Breaks

When funds are transferred across different blockchains, their original risk identities cannot be maintained, leading to broken tracking chains.

- Dilemma Four: Privacy Tools, Polluting Data

Technologies like mixers can completely disrupt the flow of funds, rendering traditional risk control models that rely on path analysis completely ineffective.

2. Legal and Regulatory Level: Blurred Responsibilities and Boundaries

If the technical dilemma is "visible but unrecognizable," then the challenges in law and regulation are "knowing where the problem lies but being unable to find who is responsible."

The core of traditional regulation is clear territoriality and responsible parties, but the decentralized structure of Web3 is precisely the opposite. When issues arise on "ownerless protocols" like Uniswap, regulatory agencies face a fundamental dilemma: among the many roles such as development teams, governance participants, and users, there is often no clear party to hold accountable.

The Tornado Cash case further provokes thought: does releasing a piece of neutral open-source code equate to assisting in money laundering?

The cross-border nature of Web3 acquiring leads to blurred regulatory boundaries. A transaction may face multiple jurisdictions or may go unregulated due to enforcement difficulties, forcing practitioners to survive in the gap between compliance overload and regulatory vacuum.

3. Operational and Risk Control Level: Challenges of Instant Decision-Making and Irreversible Settlements

The "transaction equals settlement" characteristic of Web3 compresses risk control to a minimum. Acquirers must complete risk assessments in an extremely short time, caught in a dilemma between "misjudging legitimate users" and "allowing illegal funds to pass."

Moreover, the industry generally relies on outdated black-box risk control models, lacking a unified definition of "suspicious transactions," leading to inconsistent risk assessment standards. Once an error occurs, funds will be completely lost due to the inability to reverse transactions.

4. International Cooperation Level: Disjunction of Global Transactions and Fragmented Regulation

Web3 acquiring can be completed in minutes, while judicial cooperation and regulatory responses can take months. This has led to institutions exploiting offshore lenient licenses to undertake high-risk businesses at minimal cost, creating a vicious cycle of bad money driving out good.

At the same time, the openness of on-chain data conflicts with privacy protection regulations for off-chain identity information, further exacerbating regulatory lag.

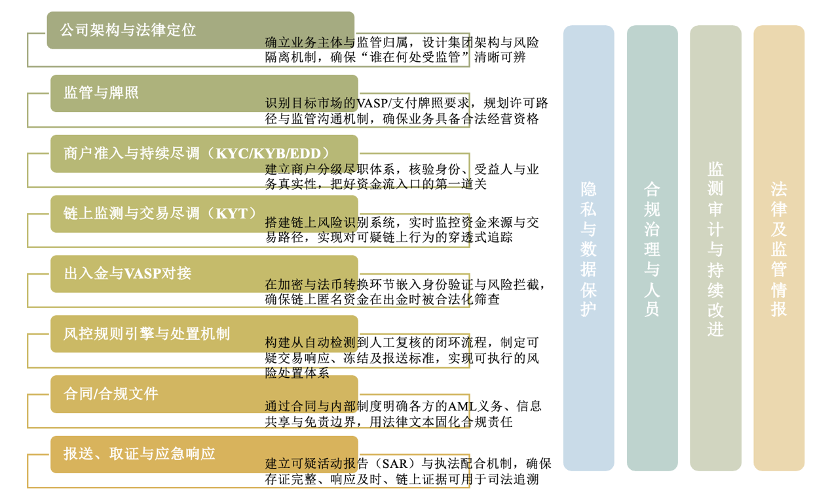

Future Path Construction: Systematic Compliance Framework Design

Anti-money laundering in Web3 cross-border acquiring is a tightly interlinked systemic challenge. It involves multiple levels, including technology, law, risk control, and global cooperation, primarily encompassing:

Decentralized Technology: Leading to the inability to find clear legal accountability;

Ambiguous Legal Provisions: Making it difficult for traditional risk control measures to intervene in advance;

Inconsistent Regulatory Standards Across Countries: Ultimately leading to a significant reduction in enforcement effectiveness.

These aspects can trigger a domino effect, so acquirers can no longer focus solely on one area but must build a systematic compliance framework that bridges the gap between the "decentralized" technological world and "centralized" regulatory requirements.

Conclusion

"Anti-money laundering" has never been about restricting us with rules and regulations; rather, it is an opportunity to rebuild a trust system. When money can flow easily across borders, when code contracts replace banks, and when algorithms automatically execute transactions, the ultimate competition between enterprises is no longer just about who is faster, but about who is more trustworthy.

For companies providing payment services, investing effort in building a complete compliance system is not only a necessary safety measure but also a way to establish their own advantages. It allows you to proactively demonstrate to regulatory authorities, partners, users, and investors that your business is compliant and transparent. In this way, what was once seen as a cost of compliance transforms into valuable trust capital.

Web3 cross-border payments are undergoing a critical transformation: from patching up problems after they arise to proactive planning and establishing systems. If you need professional legal advice or compliance framework design while exploring Web3 cross-border payment business, Mankun Law Firm has rich experience in this field, and you are welcome to contact us at any time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。