Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

After the longest government shutdown in history, labor and inflation-related data are gradually being released: key data including the September non-farm payroll report, weekly initial jobless claims, PPI, and import-export price indices are set to be released, and the CFTC will also resume publishing trader position reports. These macro variables will determine liquidity and the performance of risk assets next year, and the market is awaiting key economic data and policy actions that may change direction. On the international front, according to Japanese media Kyodo News, the Chinese government has informed Japan that it will suspend imports of Japanese seafood. This move comes less than six months after China conditionally resumed imports of some Japanese seafood in June this year, leading to a surge in shares of seafood companies such as Guolian Aquatic, Haodangjia, and Dahu Co. in the afternoon trading session.

The outlook for the artificial intelligence sector currently hinges on the upcoming earnings report from NVIDIA CEO Jensen Huang. Against the backdrop of fluctuating expectations for Federal Reserve interest rate cuts and pressure on the AI sector, this earnings report is seen as a key "thermometer" for measuring the sustainability of the AI boom. The market is concerned that if interest rates remain high, it will increase the financing difficulties for AI companies, dragging down the entire sector. A survey by Bank of America shows that a net 20% of fund managers believe that investments in the AI sector are excessive, and 45% of respondents view the "AI bubble" as the biggest tail risk in the market. This sentiment has led to a decline of over 5% in the Nasdaq index this month, with NVIDIA's stock price also falling more than 10%. Despite doubts about the sustainability of AI valuations and capital expenditures, expectations for NVIDIA's performance remain optimistic, with analysts generally predicting a 56% year-on-year revenue growth. Jensen Huang's previously disclosed orders for over $500 billion in chips from 2025 to 2026, along with the company's strategic investments in OpenAI and Intel, have injected confidence into the industry. Therefore, Huang's statements during the earnings call regarding future guidance, demand conditions, and challenges in the Chinese market will play a decisive role in stabilizing investor sentiment and potentially reversing the downturn in tech stocks. Meanwhile, Google has released its next-generation AI model, Gemini 3, which brings a glimmer of positive signals to the turbulent AI market.

The Bitcoin market has recently rebounded after falling below $90,000, with significant volatility and mixed bullish and bearish views. Delphi Digital analyst hat1618guy points out that Bitcoin is currently in a historically low volatility state, indicating that significant changes may occur within the next one to two weeks. Regarding the future market, several analysts have expressed an optimistic outlook: Fundstrat's Tom Lee and Bitwise's Matt Hougan both believe the market is close to a bottom, presenting a "once-in-a-lifetime buying opportunity"; DeFiance Capital's Arthur Cheong sees $90,000 to $92,000 as strong support and expects a rebound; 21Shares believes Bitcoin's volatility and consolidation may continue until the end of the year, followed by a rebound. Standard Chartered's Geoffrey Kendrick believes that the recent approximately 30% correction is nearing its end, with selling pressure possibly exhausted, and also expects a rebound before the end of the year; additionally, Wintermute states that market liquidity is expected to improve in Q1 2026. However, crypto trader KillaXBT points out that short positions are accumulating in the $94,000 to $96,000 range, which may form a lower high on a higher time frame. A short-term rebound of 3-5% is possible, but a breakout above the annual opening price of $93,600 is needed to escape the consolidation. Analysts Astronomer and Ali predict that the price may first rebound to $97,000 or $99,000 before dropping to $87,000 and $81,000.

Cautious voices also exist: Arthur Hayes warns that a contraction in dollar liquidity could lead to a short-term pullback in Bitcoin to the $80,000 to $85,000 range, but he also predicts that if the Federal Reserve accelerates easing afterward, prices could soar to $200,000 to $250,000 by the end of the year. CryptoQuant's Axel Adler Jr. has outlined three "lifelines" at $87,000, $79,000, and $74,000, believing that holding these levels is key to determining the start of a bull market correction versus a bear market. Notably, Mt. Gox transferred nearly $1 billion worth of Bitcoin yesterday, but the market reacted calmly, interpreted as a signal of "bad news being fully priced in."

Ethereum has also shown weakness in this round of market adjustments, with prices dropping over 20% in November, entering a historically recognized "buying zone." However, the short-term market structure still appears fragile. Analyst Man of Bitcoin points out that as long as the price fails to break above $3,658, the downward trend will continue, with resistance levels at $3,223 to $3,560. Liquid Capital founder Yi Lihua suggests that in the current uncertain situation, one could consider bottom-fishing in the $3,000 to $3,300 range and maintain positions without using leverage. From an on-chain liquidity perspective, although the price drop has cleared some long leverage, data from Hyblock Capital shows that there are still dense liquidation clusters around $2,904 and $2,760, indicating that the market may need a deeper liquidity washout to form a solid bottom.

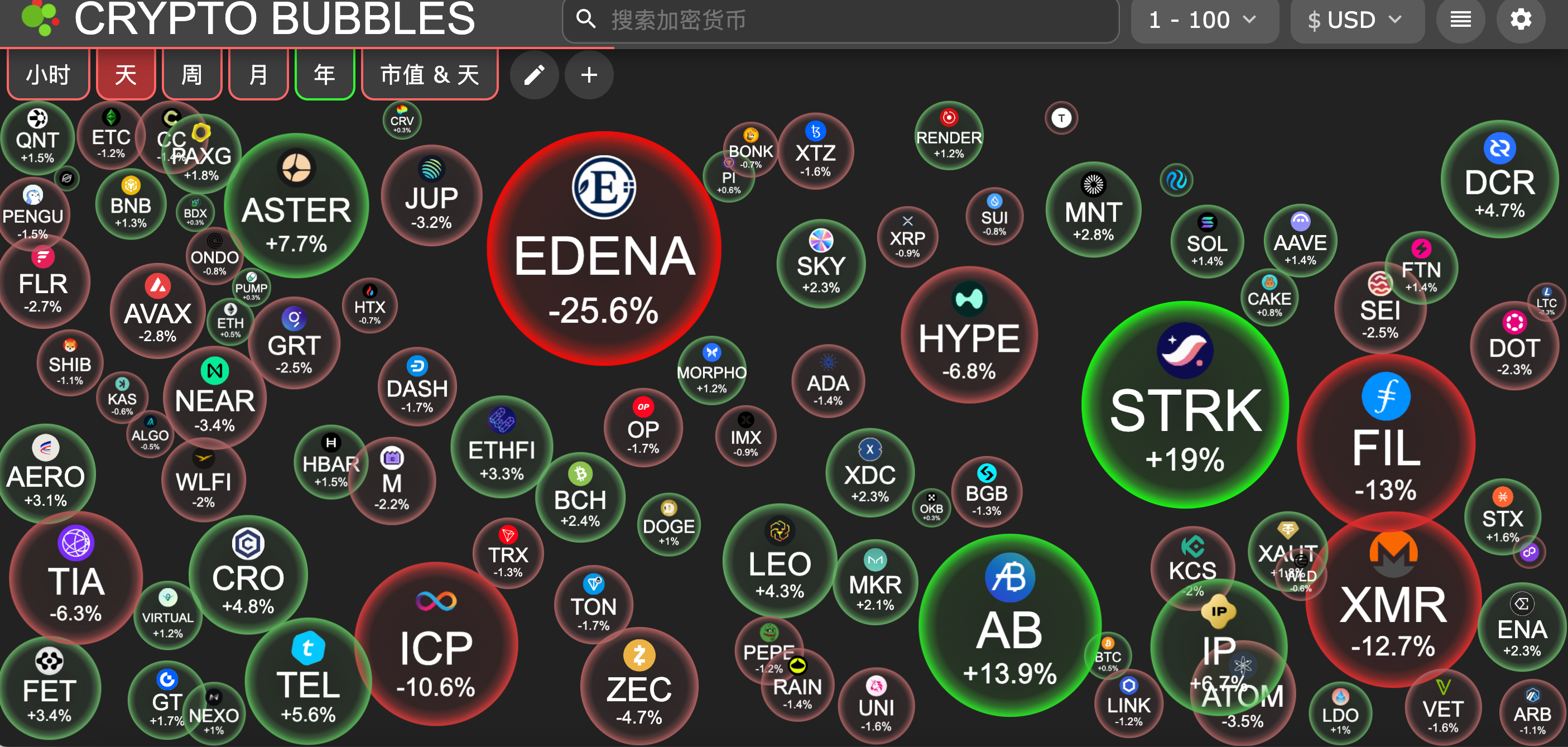

Altcoins like Solana are showing signs of decoupling from traditional financial markets, rebounding strongly from the $130 weekly support level despite a general decline in U.S. stocks. Market analysis suggests that its price may return above $200. Other altcoins have also performed variably, with ASTER rising 16% in a single day and STRK recovering in price driven by privacy concepts. In terms of project dynamics, Filecoin has hinted at a transition from storage to on-chain cloud services and has launched a testnet, but its price has not risen and has instead dropped over 10%.

2. Key Data (as of November 19, 13:00 HKT)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $90,589 (Year-to-date -3.21%), daily spot trading volume $85.64 billion

Ethereum: $3,030 (Year-to-date -9.27%), daily spot trading volume $33.75 billion

Fear and Greed Index: 16 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 58.7%, ETH 11.9%

Upbit 24-hour trading volume ranking: BTC, XRP, ETH, SOL, MET2

24-hour BTC long-short ratio: 49.05% / 50.95%

Sector performance: DeFi sector down 1.67%, DePIN sector down 2.03%

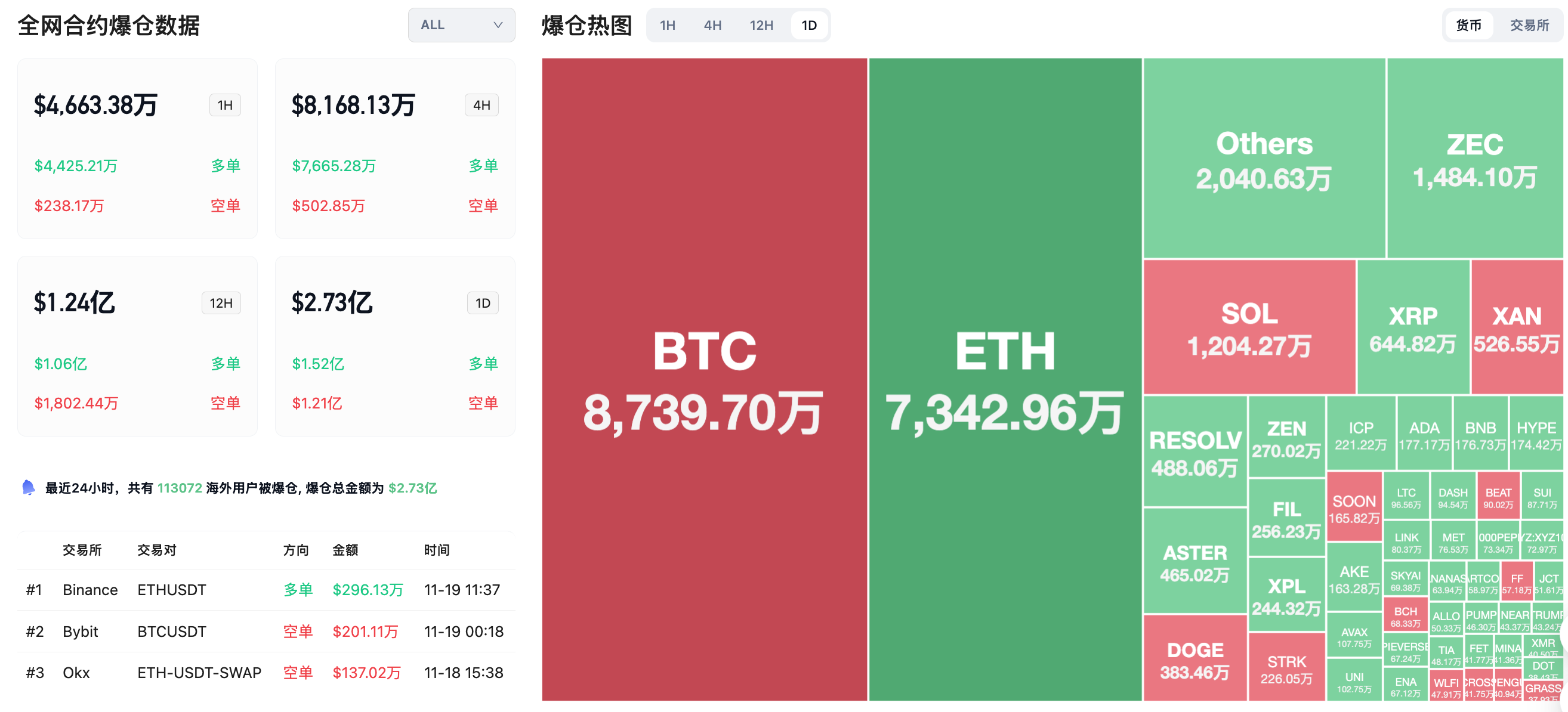

24-hour liquidation data: A total of 113,072 people were liquidated globally, with a total liquidation amount of $273 million, including $87.39 million in BTC, $73.42 million in ETH, and $12.04 million in SOL.

3. ETF Flows (as of November 18)

Bitcoin ETF: -$373 million

Ethereum ETF: -$74.22 million

Solana ETF: +$30.09 million

XRP ETF: +$8.32 million

4. Today's Outlook

Injective: New $INJ community buyback to start on November 20

USDai will increase its limit by $250 million on November 20

Federal Reserve to release minutes of monetary policy meeting (November 20, 03:00)

NVIDIA will announce earnings after the market closes (November 20, 05:00)

U.S. September unemployment rate: Previous value 4.3%, expected 4.3% (November 20, 21:30)

U.S. September non-farm payroll change (in ten thousand): Previous value 5.4, expected 2.2 (November 20, 21:30)

YZY (YZY) will unlock approximately 37.5 million tokens at 1 PM Beijing time on November 19, accounting for 12.50% of the current circulation, valued at approximately $14.1 million;

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7 PM Beijing time on November 20, accounting for 7.29% of the current circulation, valued at approximately $38.3 million;

KAITO (KAITO) will unlock approximately 8.35 million tokens at 8 PM Beijing time on November 20, accounting for 2.97% of the current circulation, valued at approximately $6.4 million;

Top gainers among the top 100 cryptocurrencies today: Starknet up 19%, AB up 13.9%, Aster up 7.7%, Story up 6.7%, Telcoin up 5.6%.

5. Hot News

Ark Invest increases holdings in crypto concept stocks Coinbase, Circle, and Bullish on Tuesday

Coinbase adds World Mobile Token (WMTX) to its listing roadmap

Block calls for a $600 tax-free allowance for Bitcoin payments to promote everyday use

New Hampshire approves the first $100 million municipal bond backed by Bitcoin collateral

Filecoin launches Onchain Cloud, ushering in a verifiable, decentralized cloud era

Fidelity has launched its Solana ETF "FSOL," with initial seed funding of 23,400 SOL

Public company Onfolio Holdings raises $300 million to build a digital asset reserve

Eightco Holdings discloses holdings of over 272 million WLD and 11,068 ETH

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。