On November 17, the next-generation high-performance Layer 1 public chain Monad officially launched the public sale of MON tokens as the first project on Coinbase's new token public offering platform. This public offering will last until November 22, with tokens expected to be distributed on November 24, the same day Monad goes live on its mainnet. As the first token issuance case following Coinbase's launch of the new public offering platform, Monad is also seen as an important experiment for Coinbase in exploring a public, transparent, and compliant token issuance path.

It is noteworthy that the launch of Monad's public offering coincides with an overall correction phase in the cryptocurrency market, where market sentiment is generally weak. The fear index has dropped to single digits, Bitcoin has fallen to around $90,000, and Ethereum is fluctuating in the $3,000 range. In this environment, Monad has set the public offering price at $0.025 and an approximate $2.5 billion FDV, quickly sparking discussions in the market regarding its valuation, liquidity, and other aspects. Based on the above context, CoinW Research Institute will systematically analyze its public offering mechanism, actual subscription progress, and project development status in the following sections to present a more comprehensive perspective.

I. How to Participate in Monad's Public Offering

This public offering will sell 7.5 billion MON tokens at a fixed price of $0.025, with a total fundraising scale of $187.5 million. Over 80 countries/regions are eligible to participate, including Hong Kong, China. Below is the complete process and considerations for investors to participate in Monad's public offering on the Coinbase platform:

Step 1, Account and Identity Verification: Investors must have a Coinbase account and complete KYC.

Mainland Chinese identities cannot participate; identities from regions such as Hong Kong or Singapore are allowed (must provide a bank statement or utility bill along with a photo ID). This public offering only accepts USDC as a payment method. The minimum subscription amount per user is 100 USDC, and the maximum is 100,000 USDC. Additionally, Coinbase One members can apply for 1.5 to 5 times the additional token quantity based on their membership level during this Monad token sale and in subsequent sales.

Step 2, Understand the Allocation Mechanism: The public offering period for Monad is one week (from November 17 to November 22).

- "Small Amount Priority" Algorithmic Allocation

Coinbase has adopted a "bottom-up" algorithmic allocation mechanism that emphasizes fairness. It prioritizes the subscription needs of small users to ensure that more retail investors have the opportunity to participate; larger applications will be processed gradually until all tokens are allocated. This rule prevents large holders from concentrating large quotas, reducing the concentration of token distribution from an institutional level, making token sales fairer and more retail-friendly.

- Zero Fee Participation Mechanism

Throughout the token sale process, users do not need to pay transaction fees or purchase platform tokens; they only need to hold USDC to participate.

- Restrictions on Selling by Project Parties

Coinbase has set strict compliance and disclosure requirements for issuers, and the issuer and its affiliates are prohibited from selling tokens within six months after the token listing.

- Restrictions on Selling by Users

Coinbase has also introduced constraints on user behavior. If users choose to sell within 30 days after the token goes live, their priority for future participation in similar token sales on Coinbase may be reduced.

Step 3, Token Distribution: After the public offering ends

Coinbase will determine each user's final quota based on algorithm results. If a user's subscription amount exceeds their allocated quota, the system will refund the unallocated portion of USDC. The Monad mainnet will go live on November 24, and MON tokens will be distributed to participants, with MON tokens deposited into users' Coinbase wallets.

Source: coinbase

II. Current Status of Monad's Public Offering

From the current market participation situation, investor sentiment is relatively cautious. In contrast, MegaETH completed approximately $300 million in fundraising within the first hour of its sale, with a total fundraising of $1.39 billion, oversubscribed by 27.8 times. However, six hours after the launch of Monad's public sale, the subscription rate was about 45%, with cumulative funds raised only $90.05 million, indicating a significantly slower pace. However, as of the time of writing, the total subscription amount has exceeded $100 million. Some viewpoints suggest that this difference is related to the current overall market being in a correction cycle, with Bitcoin's price having fallen to around $90,000, leading to a naturally conservative sentiment towards risk assets. Therefore, it is reasonable that Monad's public offering has seen relatively mild participation in the initial phase.

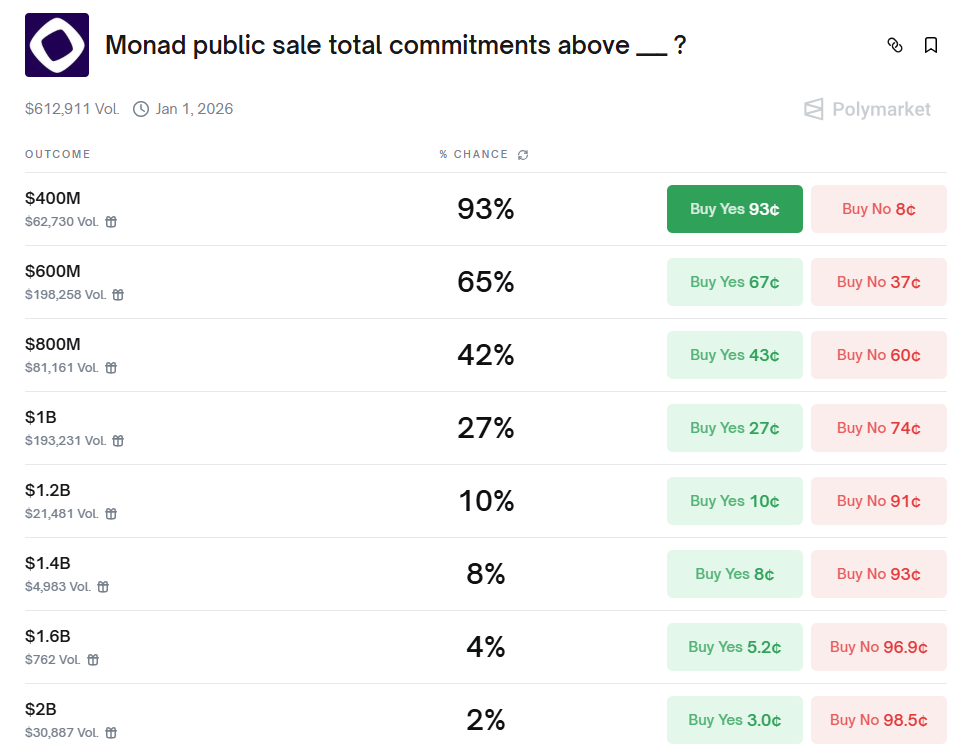

Data from the prediction market Polymarket more intuitively reflects the current market sentiment. At this stage, most funds are betting that the public offering scale will exceed $400 million, with a probability of 93%; the probability of the final amount breaking $600 million is 65%. As the target subscription amount range increases, market confidence rapidly declines, with the probability of exceeding $1 billion at about 27%, and the probability of exceeding $2 billion only at 2%. Overall, the market generally believes that Monad's public offering will most likely fall within the range of $400 million to $1 billion.

Source: polymarket

Another interesting observation point is that the prediction market reflects, to some extent, the real risk preferences and expectations of public offering participants. Many users treat Polymarket's market prediction results as a trading strategy and hedge on Polymarket after the new token issuance. For instance, based on Monad's current prediction results, some users believe that its total public offering amount will ultimately not exceed $1 billion, so they would buy $1 billion No contracts in advance and sell the corresponding positions as the public offering end time approaches. Meanwhile, since the MON token has already launched pre-market trading, some users may choose to hedge in the pre-market, a strategy that is a common trading tactic and will not be elaborated on here.

III. Current Status of Monad Public Chain

Monad is an EVM-compatible Layer 1 public chain aimed at improving transaction processing efficiency and confirmation speed. Official data shows that Monad supports approximately 10,000 transactions per second and compresses block confirmation time to about 0.8 seconds. According to gmonads data, Monad's testnet has covered 25 countries and 53 cities, operating a total of 174 validator nodes. The pre-market price of its token MON reached a high of $0.07 but has currently fallen to around $0.04.

Source: gmonads

In terms of ecological progress, Monad has over 300 projects joining its ecosystem, of which 78 are unique to its ecosystem. Its ecosystem covers areas such as DeFi, Gaming, consumer applications, AI, and NFTs. As the mainnet launch approaches, the number of ecosystem projects continues to increase, and the subsequent user activity, developer retention rate, and actual performance after the mainnet launch will determine whether the Monad ecosystem can continue to expand.

IV. Summary

Currently, Monad's public offering is still ongoing, and there are significant differences in market opinions, with discussions mainly focusing on the token distribution structure, initial liquidity arrangements, and funding participation during the public offering phase. Some users believe that Monad's token structure leans towards a traditional VC model, with 38.5% for ecosystem development, 27% for the team, 19.7% for investors, and only 7.5% for public sale, resulting in a combined share of over 46% for the team and investors. Therefore, some investors hold a cautious attitude towards the expected selling pressure after the token unlocks, especially against the backdrop of the current weak market sentiment.

Liquidity is another concern. According to public information, Monad has partnered with five market makers, four of which use one-month loans and renew monthly, with only Wintermute providing a year-long commitment. Out of a total supply of 10 billion tokens, only 160 million have been borrowed for market making, and the foundation will provide a maximum of 0.2% for initial DEX liquidity, which is overall lower than the industry-standard market-making input of about 2%. Therefore, some users believe that such a cautious market-making scale may not be sufficient to absorb significant selling pressure in the early stages of the launch, thus affecting price stability.

However, despite the relatively slow subscription pace in the early stages of the public offering, Monad holds special significance in the broader industry context. Since the ICO model faced strong regulatory scrutiny from the SEC in the U.S. in 2018 and retreated, there has been a near absence of public, transparent, and publicly accessible token issuance channels in the U.S. After acquiring the Echo platform founded by Cobie, Coinbase is attempting to rebuild a compliant public offering framework and plans to continuously launch new projects on a monthly basis. It is worth mentioning that Coinbase's profile on X has now changed to December 17, leading the market to speculate that the next token issuance may be Base. Monad being chosen as the first project represents Coinbase's first step in rebuilding the public issuance market in the U.S. and is seen by some industry insiders as a signal of compliant token issuance returning to the mainstream stage. For the market, Monad is not just a new token issuance; it is more like Coinbase's attempt to restart the public issuance market and push the industry back onto a compliant track, thus being imbued with the significance of opening a new cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。