Position adjustments have made the market clearer, but stable sentiment still requires the performance of mainstream cryptocurrencies.

Author: @Jjay_dm

Translation: Deep Tide TechFlow

Last week's market sell-off was primarily driven by the repricing of interest rate cut expectations rather than a structural collapse. Current positions have been largely cleared, and global easing policies continue. Bitcoin (BTC) needs to regain its footing in the range to improve broader market sentiment.

Macro Update

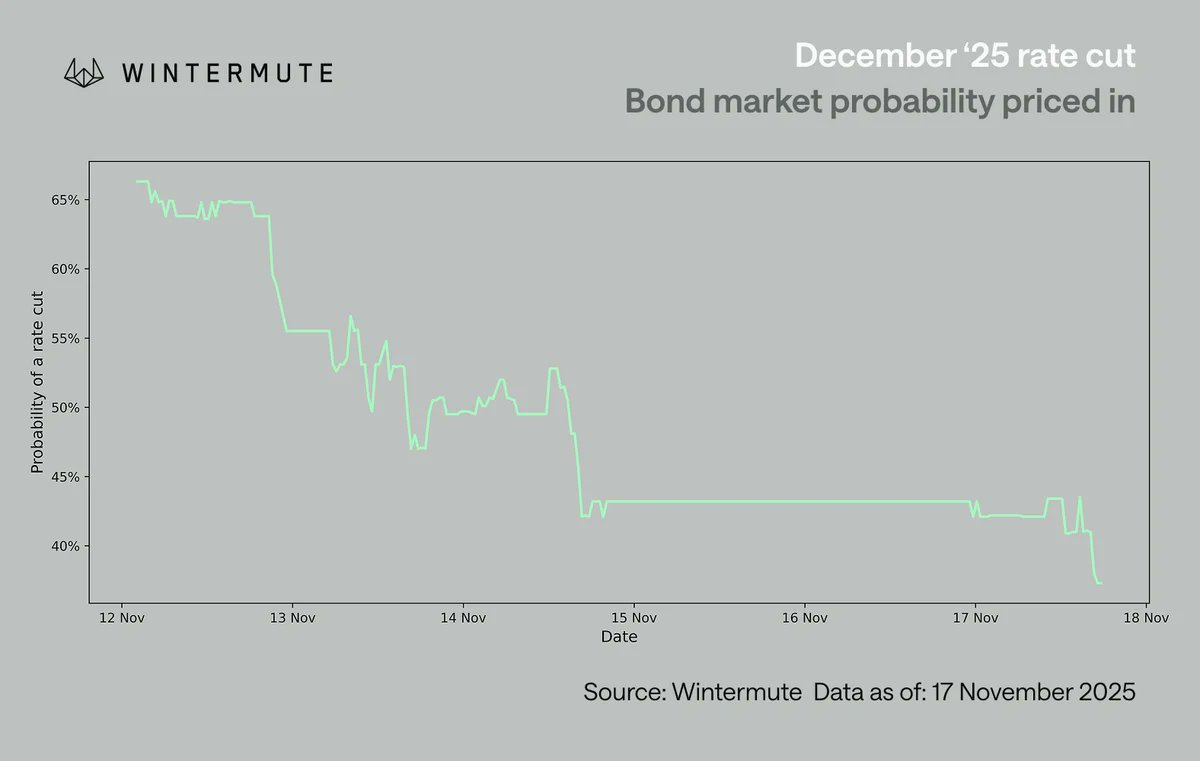

Last week, the market's focus was on digesting the sudden repricing of December interest rate cut expectations. The probability of a rate cut plummeted from about 70% to 42% in just one week, a change amplified by the lack of other macro data. Federal Reserve Chairman Powell's retreat from the almost certain December rate cut forced investors to reassess the views of various FOMC (Federal Open Market Committee) members, revealing that a rate cut is not a consensus. The market reacted swiftly: U.S. risk assets softened, and cryptocurrencies, as the most sentiment-sensitive risk assets, were hit particularly hard.

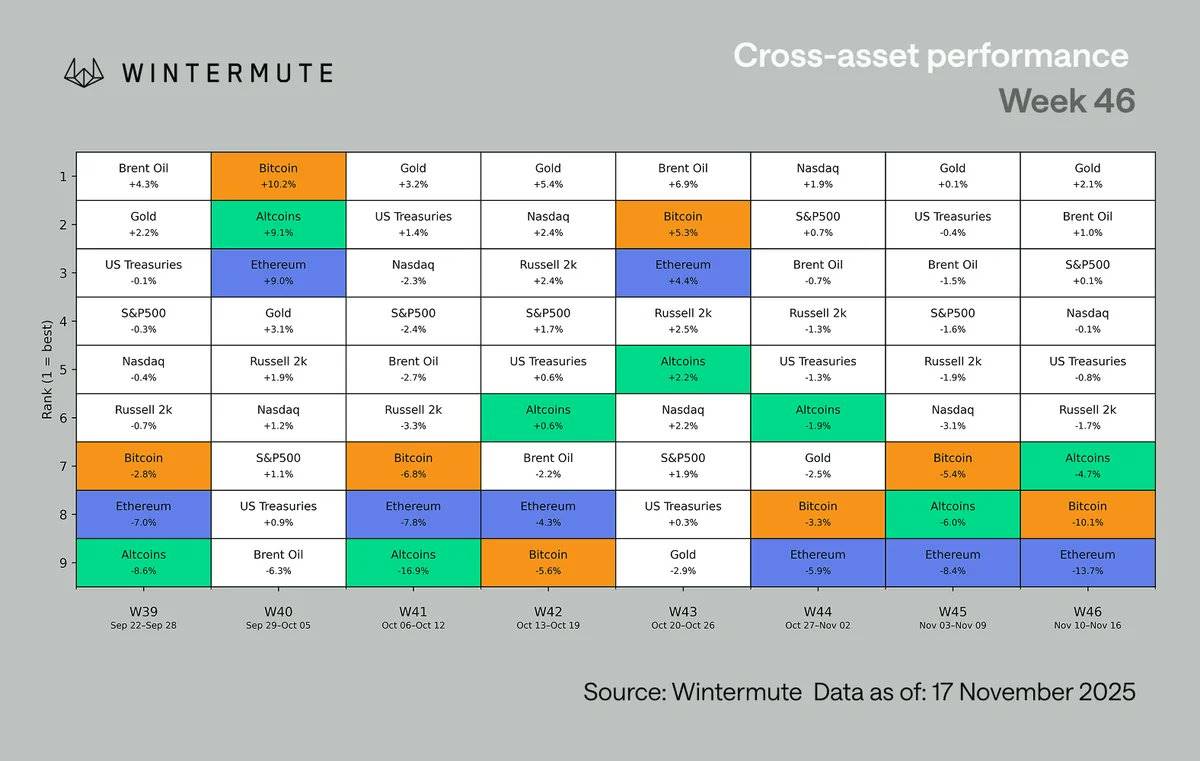

Among various asset performances, digital assets remain at the bottom of the performance spectrum. This underperformance is not new; since early summer, cryptocurrencies have lagged behind the stock market, partly due to their ongoing negative skew compared to stocks. Notably, the performance of Bitcoin (BTC) and Ethereum (ETH) has actually been worse than that of the overall altcoin market, which is relatively rare in a downturn. Two main reasons explain this phenomenon:

Altcoins have been in a prolonged decline;

A few sectors (such as privacy coins and fee-switching mechanisms) continue to show localized strength.

From an industry perspective, the performance is generally negative. The GMCI-30 index (@gmci_) fell by 12%, with most sectors declining between 14% and 18%, led by sectors including Artificial Intelligence (AI), Decentralized Internet of Things (DePIN), Gaming, and Meme coins. Even typically more resilient categories, such as Layer 1s (L1s), Layer 2s (L2s), and Decentralized Finance (DeFi), showed widespread weakness. This market volatility reflects a comprehensive risk aversion rather than sector rotation.

The chart above shows data from Monday to Monday, hence the difference from the first chart.

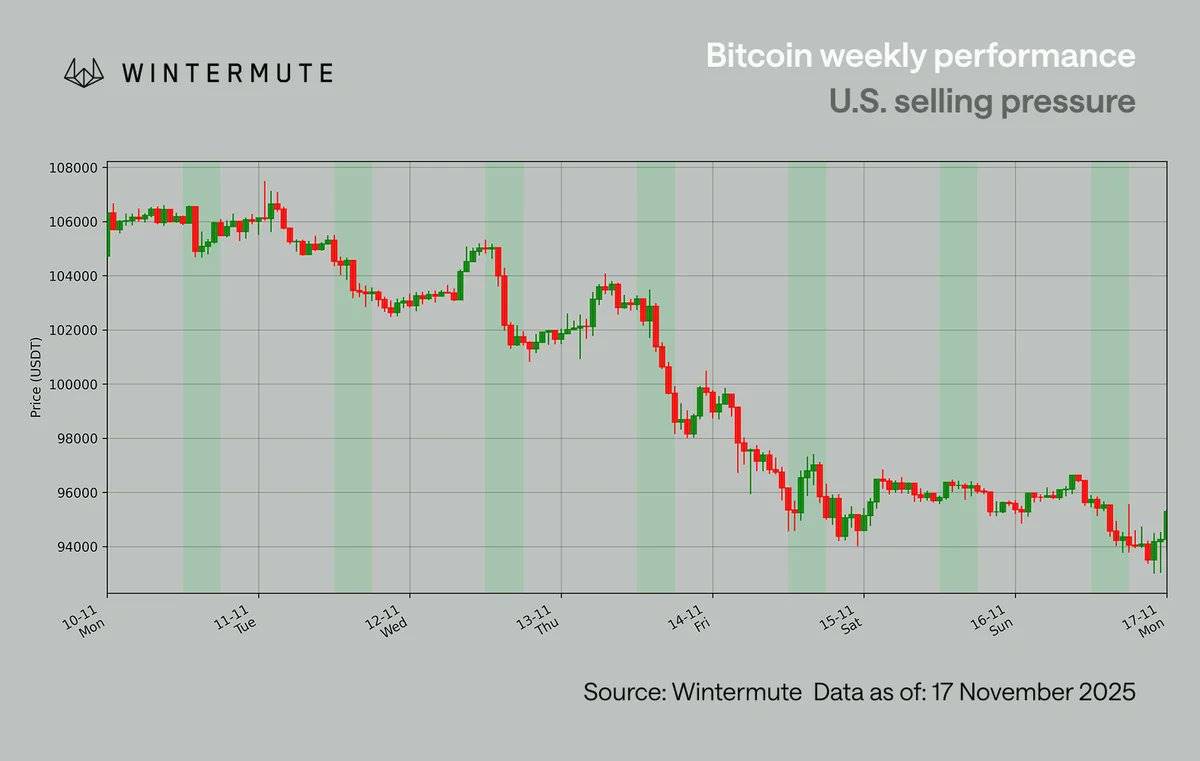

Bitcoin (BTC) has once again fallen below the $100,000 mark, marking the first occurrence since May. Prior to last week, Bitcoin had successfully held the $100,000 level twice (on November 4 and 7), even briefly rebounding to $110,000 at the beginning of last week. However, this rebound quickly faded during U.S. trading hours, with hourly candlesticks showing a clear selling pressure pattern—selling emerged every time the U.S. market opened, ultimately breaking below $100,000 after two attempts.

Some of the pressure comes from whales (investors holding large amounts of crypto assets) reducing their positions. Typically, the sell-off from the fourth quarter to the first quarter is seasonal, but this year, the trend has started earlier, partly because many traders expect the four-year cycle to bring a weaker year. This expectation has a self-fulfilling characteristic, as participants de-risking in advance amplifies market volatility. Notably, there has not been a true fundamental collapse this time; the pressure is primarily driven by the U.S. market and influenced by macro factors.

The repricing of interest rate cut expectations is a more rational driving factor. After Powell's remarks on the December rate cut, U.S. traders began to delve into the views of various FOMC members. U.S. trading desks gradually lowered their expectations for a December rate cut from about 70% to the low 60% range, while the global market only later recognized this change. This also explains why the strongest selling pressure concentrated during U.S. trading hours from November 10 to 12, even though the rate cut probability was still in the mid-60% range at that time.

Although interest rate cut expectations have affected short-term market sentiment, the overall macro environment has not deteriorated. The global easing cycle is still ongoing:

Japan is preparing a $110 billion stimulus plan

China continues to implement loose monetary policy

The U.S. quantitative tightening (QT) plan will end next month

Fiscal channels remain active, such as the proposed $2,000 stimulus plan

Current market changes are more about timing rather than direction, specifically how quickly liquidity is released and how long it takes to impact speculative risk assets. Currently, the crypto market is almost entirely driven by macro factors, lacking new data to stabilize interest rate cut expectations, and the market remains in a passive reaction state rather than a constructive development phase.

Our View

The macro environment still supports the market, and position adjustments have made the market clearer, but stable sentiment still requires the performance of mainstream cryptocurrencies.

This market sell-off resembles a macro-driven shock rather than a structural collapse. Current positions have been cleared, the U.S.-led pressure has been fully understood, and the cyclical dynamics of whales and year-end liquidity trends explain this volatility well.

The overall backdrop remains constructive: global easing policies continue, the U.S. quantitative tightening (QT) plan will end next month, stimulus channels remain active, and liquidity is expected to improve in the first quarter of next year. What the market currently lacks is confirmation from mainstream cryptocurrencies. Unless Bitcoin (BTC) returns to the top of the range, market breadth may still be limited, and the narrative will be difficult to sustain. This macro environment is not akin to a long-term bear market. As the market is driven by macro factors, the next round of catalysts is more likely to come from policy and interest rate expectations rather than internal liquidity within the crypto industry. Once mainstream cryptocurrencies regain momentum, the market is expected to recover more broadly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。