Original Title: “Build What’s Fundable”

Original Author: Kyle Harrison

Translation: Jiahua, ChainCatcher

In 2014, I had just sold my first company. The money wasn’t much, but at the time it felt like all the wealth I needed for a long time. After that, I felt pulled in several different directions. I had previously written about one of those paths, as well as the self-exploration that led me to venture capital. But at that time, there was another pull that made me want to create something else.

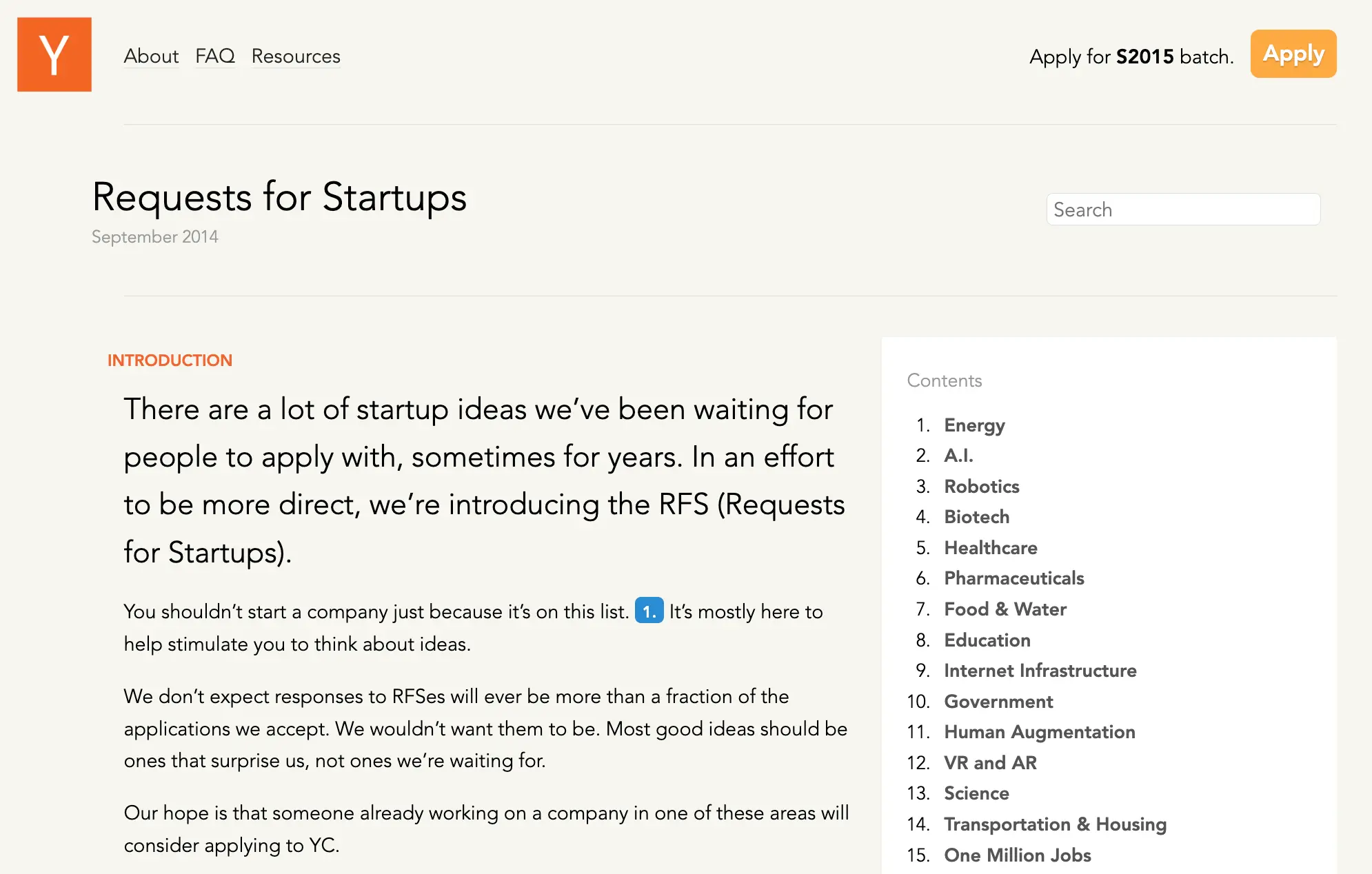

I didn’t want to start a company just for the sake of it; I wanted it to be more meaningful, to find a problem worth solving. In my search for meaningful problems, I stumbled upon Y Combinator’s (YC) RFS list, which is the “Request for Startups”.

I remember being deeply inspired. It felt like a series of ambitious, problem-oriented questions waiting to be answered. For example, opportunities to find cheaper new energy than ever before; exploring robotics from space to the human body; and Norman Borlaug-style food innovations. It was this captivating vision that led me to start my second company, focused on promoting solar energy in Africa.

Before we begin this article, an important reminder: I have never applied to YC. I have never attended a YC demo day. I only watched it once when it was live-streamed online during the pandemic. I have invested in a few companies that have gone through YC. I have only been to their office in Mountain View once. For most of my career, I have been neither a die-hard fan of YC nor a critic. They are just a small part of the vast and beautiful world we call the “tech ecosystem.”

But until earlier this year, I saw a tweet that made me start to think: 11 years have passed, how is that startup request list performing now?

So I conducted an investigation. My findings made me extremely sad. Dempsey was right, at least reflected in the shift of focus from the RFS list—it has moved from “problem-first” questions to “consensus-driven” ideas. Video generation, multi-agent infrastructure, AI-native enterprise SaaS, replacing government consultants with LLMs, forward-deployed agent modules, and so on. It’s like taking a million tweets from venture capital Twitter and generating a word cloud.

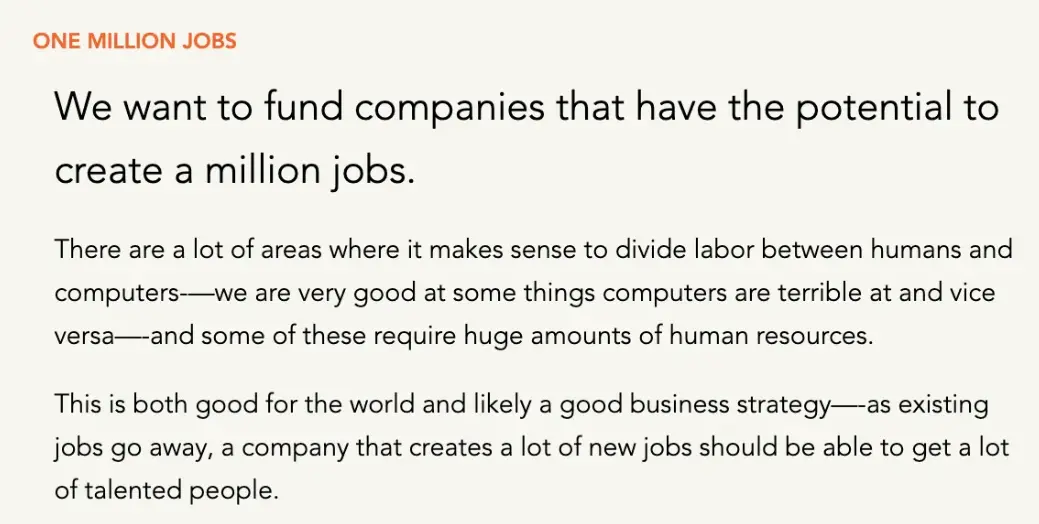

Looking back to 2014, I remember YC’s entry about “a million jobs” shocked me: since then, I have often thought about how in the U.S., only Walmart (and later Amazon) employed a million people. That’s incredibly hard to do! In a world where job opportunities are increasingly disappearing, this prompt aimed to explore what kind of business models could employ a million people. It’s very thought-provoking!

So, what about the fall version of 2025? It’s “the first company with 10 people valued at $10 billion.”

At first glance, this may feel similar. But it’s completely the opposite (for example: because of AI, hire as few people as possible!) and basically has made the “unspoken secret” loud and clear.

“What problem are you solving? Who cares! But many VCs are talking about how crazy these ‘revenue per employee’ numbers are, so… you know… just do that!”

This is Dempsey’s comment. YC is becoming “the best window to glimpse the current mainstream consensus.”

In fact, you can almost feel this startup request list is morphing instantaneously around “mainstream consensus.” It was this disappointment in such an once-ambitious product that led me down a mental “rabbit hole.” I reflected on my understanding of YC’s original purpose and why it was so valuable in its early years. At that time, the tech world was an opaque field, and YC represented the best entry point into that world.

But then, I realized the goal had changed. As the tech industry’s directional influence became stronger, YC became less focused on making the world easy to understand and shifted to catering to consensus. “Give the ecosystem what they want; they’re just playing the game under existing rules.” They are serving the demands of a larger “consensus capital machine”—those startups with a specific look and shine.

However, the toxin of “chasing consensus” has spread from capital to cultural shaping. The prevalence of “normativity” has infected every aspect of our lives. With the demise of contrarian thinking, independent critical thought has given way to a party-line cultural adherence.

We can diagnose some issues raised by YC’s evolution. We can describe it as a symptom of a broader “normative consensus engine” that spans capital and culture.

But at the end of the day, there is only one question. How do we solve it?

How do we break the chains of compliance and reignite the flame of personal struggle and independent thinking? Unfortunately, neither the “consensus capital machine” nor the “normative accelerator” (referring to YC) can be expected to help us.

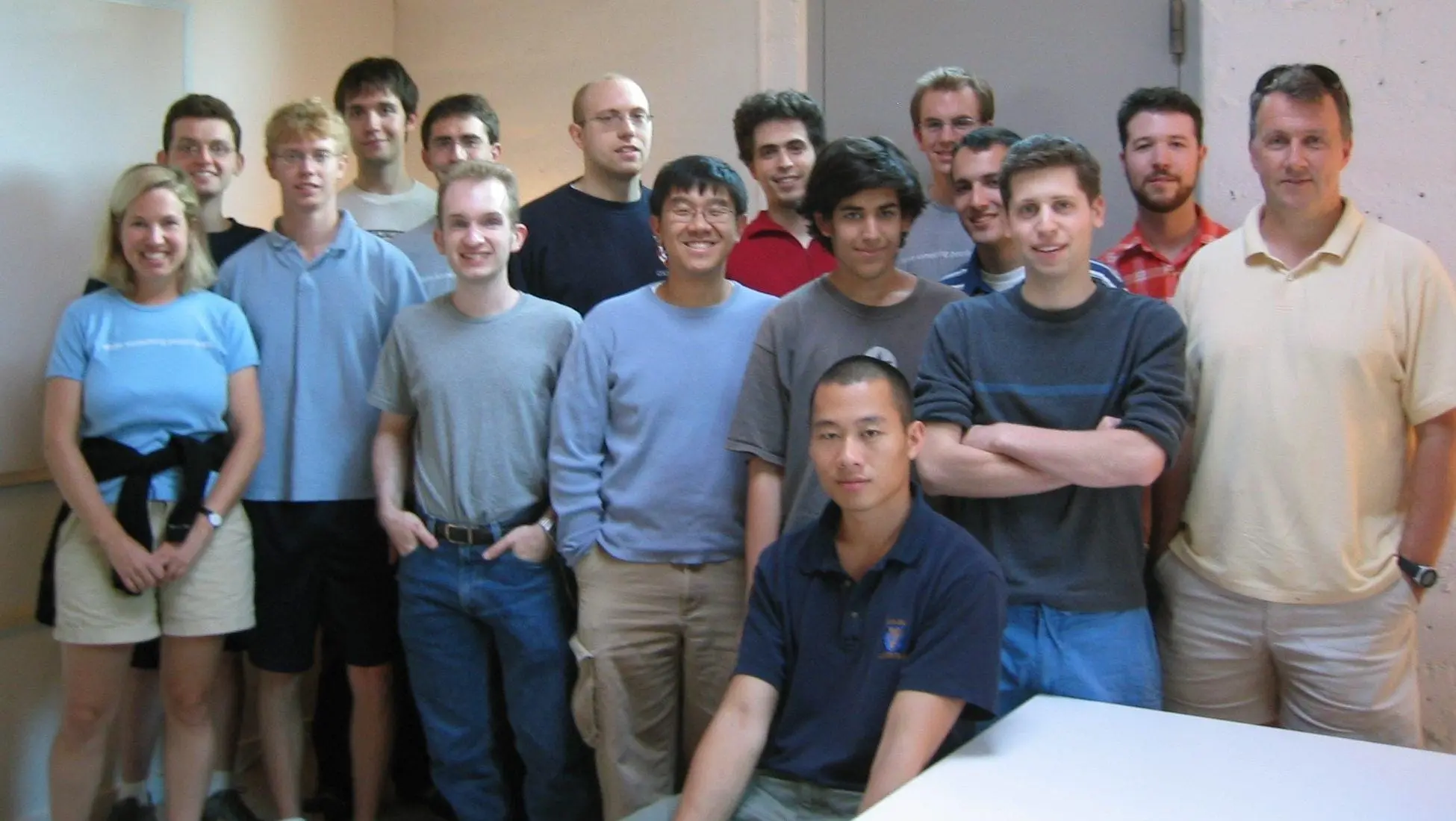

From Entry Channel to Manufacturing Plant

When you look back at YC in the summer of 2005, you can see the desire to uplift newcomers and the hopeful optimism in the eyes of Paul Graham (YC founder, far right in the picture). YC’s original vision was to serve as an “entry channel” for a startup ecosystem that was (at the time) extremely difficult to access.

In 2005, SaaS was still in its infancy. Mobile devices did not exist. Entrepreneurship was far from a common career path. Technology was still that emerging new aristocrat, not the dominant force in the world.

When Y Combinator first started, it had a clear opportunity to help demystify the process of starting a company. “Build something people want” may be laughed at today as obvious, but in the early 2000s, the default business logic was more about feasibility studies and market analysts than “talking to customers.” We took for granted many truths that YC helped popularize, which unveiled the mystery of the entrepreneurial journey for future entrepreneurs.

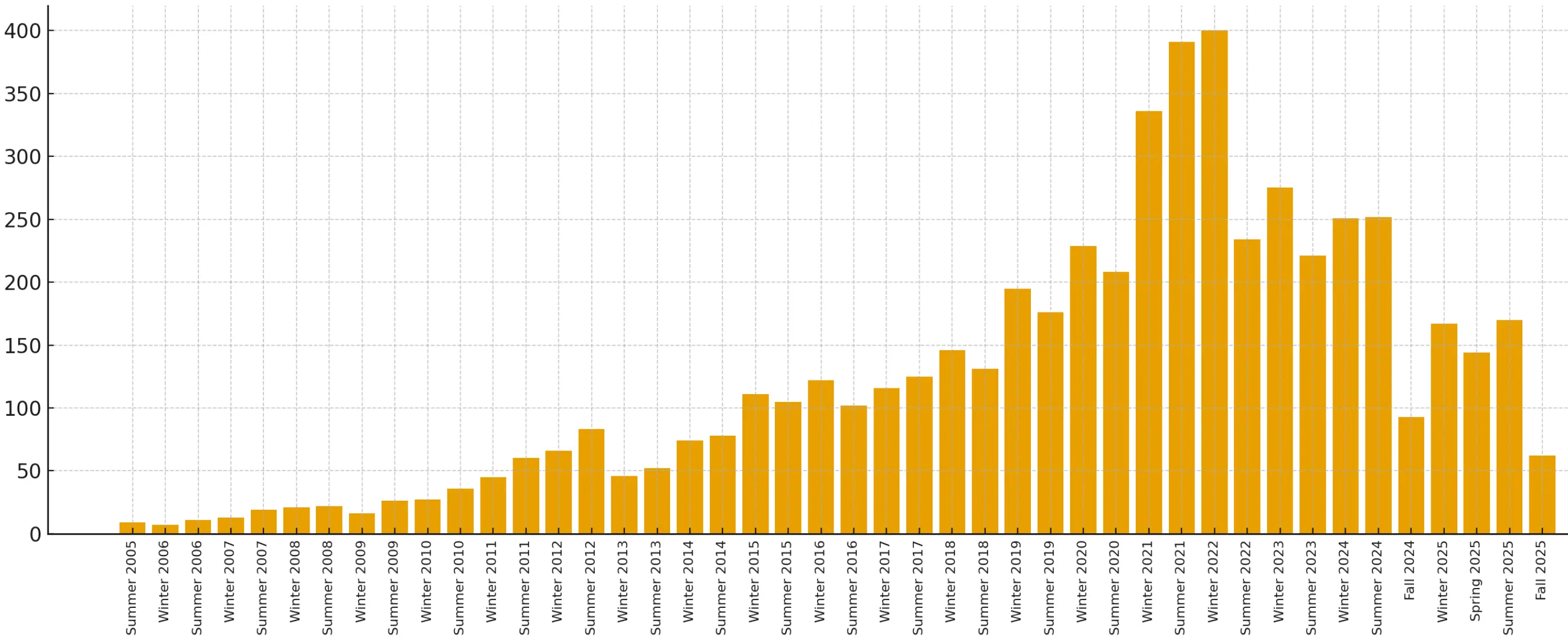

I have no doubt that YC was absolutely more beneficial than harmful to the world, at least in its first decade. But at some point, the rules of the game changed. Startups were no longer so opaque; they became easier to understand. YC could no longer just unveil the veil; it had to “mass-produce.” The scale surged from the initial 10-20 companies in the first few years to over 100 in 2015, eventually peaking at 300-400 companies per batch in 2021 and 2022. Although this number has decreased, there are still about 150 companies per batch now.

I believe YC’s evolution occurred alongside the change in the “understandability” of the tech industry. The easier the tech industry became to understand, the less value YC could provide with its original operating model. Therefore, YC adapted to this game. If technology is an increasingly clear path, then YC’s mission is to get as many people as possible on that path.

Convergence in “Hyperlegibility”

Packy McCormick (founder and author of Not Boring) introduced a term I now frequently use because it effectively describes the world around us: “hyperlegibility” (hyperlegible).

This concept suggests that due to our ability to access information through various content and understand cultural nuances through social media, the world around us has largely become extremely clear: almost to the point of being annoying.

The tech industry is also so “hyperlegible” that the show “Silicon Valley,” produced from 2014 to 2019, still accurately depicts the cultural traits of a large group of people today.

In a world where the tech industry is so “hyperlegible,” YC’s original mission to “reduce the opacity of the industry” has been forced to evolve. In the past, startups were the preferred tools for rebels breaking the norm; today, they are increasingly becoming a “consensus norm funnel.”

I am not an anthropologist of the tech industry, but my interpretation of the situation is that this is not a deliberate decline on YC’s part. It’s just the path of least resistance. Startups have become increasingly common and easier to understand. For YC, a simple North Star (fundamental goal) is: “If we can help more and more companies get funded, we’ve succeeded!”

And today, those that can get funding often look very similar to those that got funding yesterday. Thus, you begin to see this “normativity” among YC founders and teams.

A few days ago, I saw an analysis of YC team statistics:

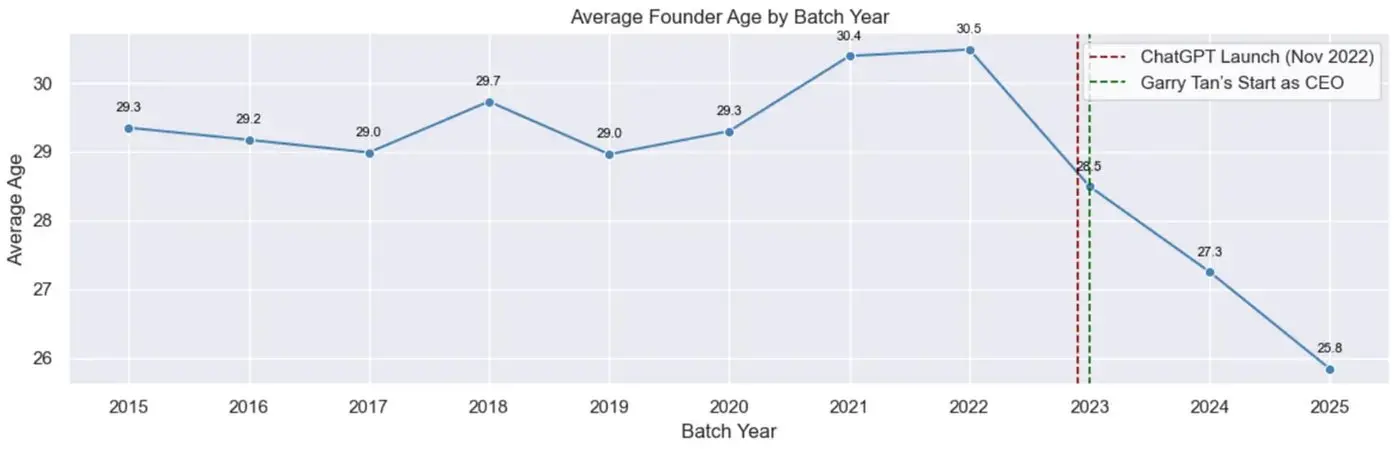

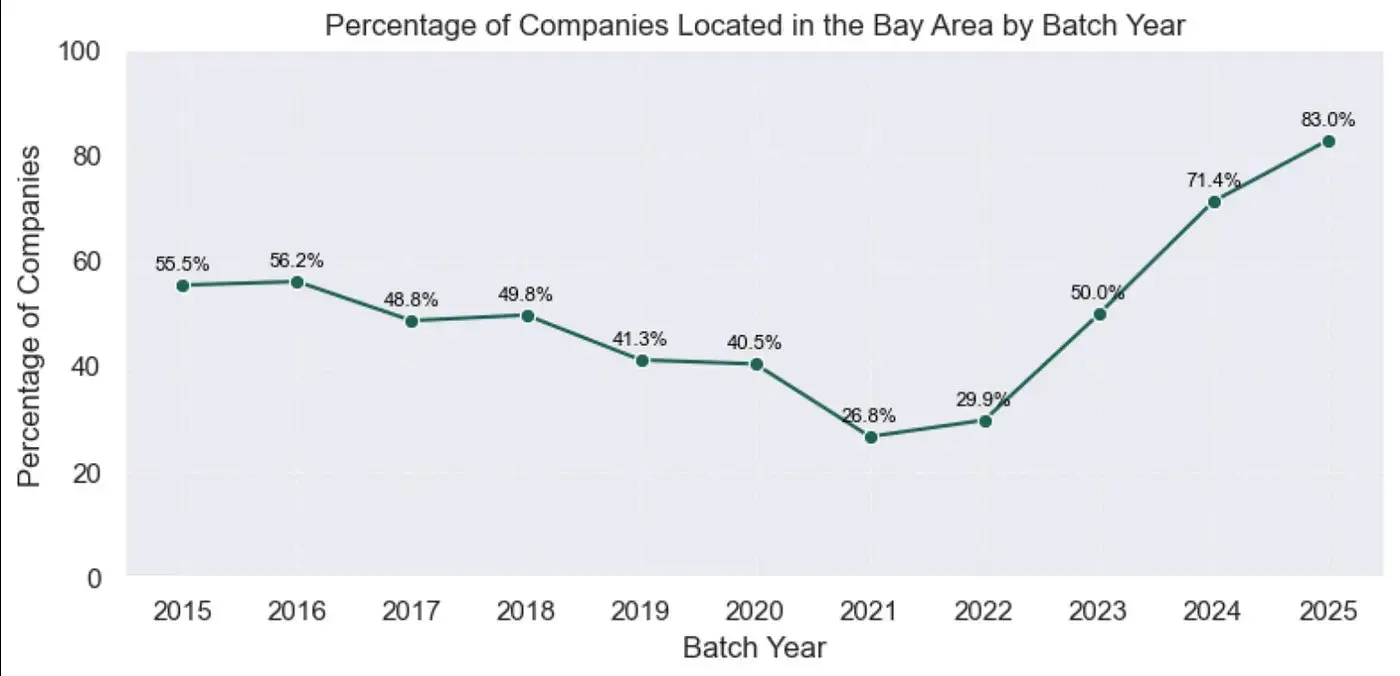

- Younger: The average age of YC founders has dropped from 29-30 to about 25 now.

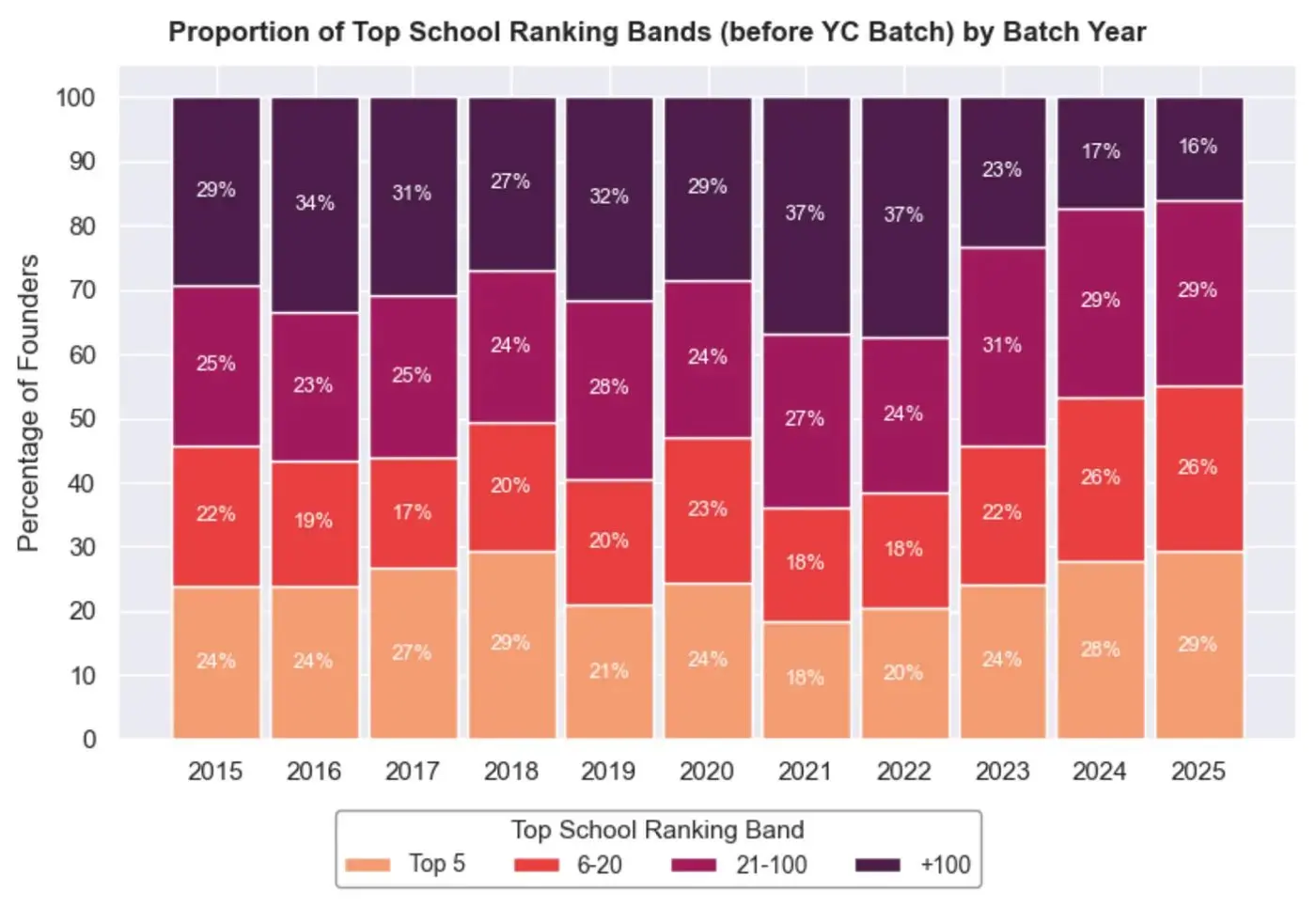

- Elite Education: The proportion of founders graduating from the top 20 schools has increased from about 46% in 2015 to 55% now.

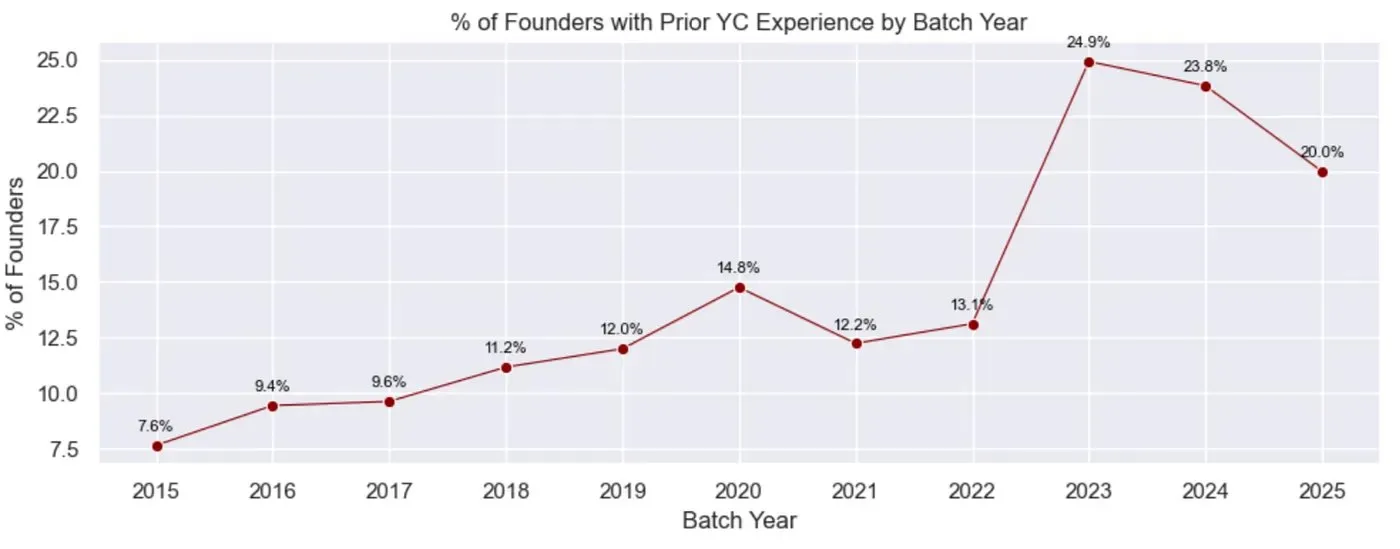

- Returning YC Founders: The number of founders with YC experience has increased from about 7-9% to about 20%.

- Concentration in the San Francisco Bay Area: The proportion of YC founders headquartered in the Bay Area is even higher than pre-pandemic levels, now reaching 83%.

Reflecting on these dynamics, they are just part of a larger story. YC has evolved from an “entry channel” for an opaque category (like tech) into more of a “consensus-shaping machine.”

It’s not just the founders being shaped by consensus. You can almost see the entire YC team being molded around “mainstream consensus.” As trends like voice assistants touch everyone’s consensus, you can see its reflection in the YC team.

Ironically, Paul Graham described this consensus as a logical reflection of technological reality. I’m sure that’s true. But I think what’s different is that the consensus characteristic of “what can get funded” has become the ultimate goal of the entire operation, pushing aside those things that might have been more contrarian and unconventional in the past.

In early 2025, YC celebrated its 20th anniversary. In that celebration, it described its achievements as “creating $800 billion in startup market value.” Note the word “creating,” not “helped create” billions in value. They see it as something they “created.” Something they “manufactured.” I believe YC’s ultimate goal has shifted from “helping people understand how to build companies” to “maximizing the number of companies that pass through this funnel.” Although they feel similar, these two are not the same.

The most important insight here is that I don’t think this is YC’s fault. Rather than blaming an individual participant for the sins of the entire industry, I would say they are simply following a rational economic incentive shaped by a larger force: the “consensus capital machine.”

You Must Look “Investable”

A few weeks ago, Roelof Botha (head of Sequoia Capital) stated in an interview that venture capital is not really an asset class:

“If you look at the data, over the past 20-30 years, on average only 20 companies a year end up being worth $1 billion or more at exit. Only 20. Despite more capital flowing into venture capital, we haven’t seen a substantial change in the number of those huge outcome companies.”

Venture capital funding for 2024 is $215 billion, up from $48 billion in 2014. Despite putting in 5 times the capital, we haven’t gotten 5 times the results. But we are desperately trying to get more companies through that funnel. And in the venture capital engine, every loud, clear voice feeding the startup manufacturing machine revolves around this idea: desperately trying to get more companies through a funnel that can no longer expand.

YC has become an accomplice in this process of pursuing a scalable model within an “unscalable asset class.” a16z is the same. These engines that thrive on more capital, more companies, more hype, and more attention are exacerbating the problem. In the pursuit of the unscalable, they are trying to scale in places that shouldn’t be scaled. In business building, the biggest and most important outcomes cannot be meticulously planned. And in trying to create formulaic scaling for companies, the “rough edges” of important ideas are smoothed out.

Just as YC’s “Request for Startups” has shifted from “problem-driven” ideas to “seeking consensus” concepts, the formula for building startups reinforces a demand: you must look “investable,” rather than build something “truly important.” And this is increasingly true not only in the way companies are built but also in the way culture is shaped.

The Normative Trend from Capital to Culture

Peter Thiel is highly praised for his many correct judgments. But interestingly, one of the points Thiel is most often discussed for (like “being a contrarian/inverse investor”) is something he was again far ahead of everyone else on, and which was once mocked as “common sense, obvious.” Yet now it has become increasingly rare, almost extinct.

The ongoing pursuit of consensus has poisoned every aspect of company building and is increasingly poisoning the way culture is built.

Venture capital, as a profession, also has the same “normative” characteristics. Starting a startup, attending YC, raising venture capital, building a “unicorn.” This has become the new version of “go to a good school, get a good job, buy a house in the suburbs.” It’s a normative culture; it’s that tried-and-true stable path. Social media and short videos only exacerbate this “programmable normativity,” as we see these “hyperlegible life paths.”

The most dangerous aspect of this path is that it undermines the need for the masses to engage in critical thinking. Because the thinking has been done for you.

When I think about the true value of something, I often reflect on Buffett’s famous saying about the market. In the short term, it’s a voting machine; in the long term, it’s a weighing machine. However, a system that increasingly forms consensus, even “manufactures” consensus, has the problem that it becomes increasingly difficult to “weigh” the value of anything. The formation of that consensus “invented” the value of specific assets, backgrounds, and experiences.

The tech field is no different. This “normative mindset” built around consensus-driven ideas is permeating the lives of millions and will have negative effects on them, not only because they will create worse things but also because they will be unable to develop independent thinking skills.

There are always some who know. They know that following the normative path does not lead to the best outcomes.

Be a “Puritan” Founder

When reflecting on this cycle, honestly, the only answer I can think of is that we are facing a massive economic shock.

When you observe those successful contrarian cases, you’ll find that many are established by existing billionaires: Tesla, SpaceX, Palantir (CIA data supplier), Anduril (military drone company). I think the insight gained from this is not “first become a billionaire, then you can think independently.” Rather, it prompts us to reflect on what “other characteristics” often lead to those outcomes.

In my view, another commonality among these companies is that they are led by “ideological purists,” those who believe in a mission and dare to challenge consensus and authority.

Last week, I wrote about “founder ideology,” and there are different types of founders: missionaries, mercenaries, bards, etc. Among all these types, one of the most important categories is “missionaries.” The best founders often come from this category.

The key insight here is that for a “normative culture” increasingly built around “consensus formation,” the only antidote is to motivate the participants of that culture to pursue ideological purity: to “believe” in something!

YC’s slogan has always been “build something people want,” which is a sound suggestion. But more importantly, it’s “build something worth building.”

Embark on the Right Path

The first element of becoming a mentally puritanical person is something I have repeatedly written about: embark on the right path.

Last week, YC announced one of its latest investments: Chad IDE, a “brain-eroding” project.

This product can integrate your social media, dating apps, or gambling apps, so you can do other things while waiting for prompts to load code. There’s nothing wrong with that, of course. Everyone knows we switch contexts between tasks, jumping back and forth between mindless leisure and work.

But there’s something “off” about that vibe, and the whole world has noticed. One reaction to Chad IDE precisely captured the “atmospheric shift” that is happening:

Will O’Brien, founder of Ulysses, commented: “Venture funds that choose to support ‘assembly line startups’ like this and other ethically questionable startups should know that mission-driven founders will notice this and seriously look down on the company’s reputation.”

“Assembly line startups” carry a deep nihilistic tone. Supporting them is akin to saying: nothing matters. We should try to make money, even if it means producing complete garbage or encouraging evil. This infuriates mission-driven founders and creates a profound sense of aversion when we consider potential partners.

The concept of “assembly line startups” is a natural extension of pursuing a scalable model within an “unscalable asset class.”

It’s not just YC that feels this atmospheric shift.

Be the Purpose, Not the Tool of Tools

Technology itself is not a benevolent force. Technology, like any amorphous concept and collection of lifeless objects, is a tool.

It is those who “wield” technology that determine whether it produces good or bad outcomes.

Incentives are the forces that drive people down specific paths (for better or worse). But beliefs, if steadfast, can transcend incentives in the pursuit of more important things.

My incentives might encourage me to lie, cheat, and steal, as these could make me wealthy. But my beliefs prevent me from becoming a slave to those incentives. They inspire me to live at a higher level.

YC originally served as an “entry channel” to help people better understand how to build technology. What they choose to do with that ability depends on them. But in the process, the incentives have shifted, and scaling has revealed its ugly head. As technology has become a more navigable path, YC’s goal has shifted from “illuminating this path” to “getting as many people as possible on this path.”

From YC to giant venture capital firms, the pursuit of scaling has turned a vast array of participants in the tech field into slaves of incentives. The fear of failure further exacerbates this enslavement. We allow incentives to shape us out of fear. Fear of poverty, fear of ignorance, or simply the fear of being left behind. Fear of Missing Out (FOMO).

That fear guides us down the “normative” path. We are assimilated. We seek convergence. We smooth out the rough edges of our personalities until we are worn down to fit that “path of least resistance.” But the path of least resistance has no room for “contrarian beliefs.” In fact, it has no room for “any beliefs” because it fears that your beliefs will lead you down a path that consensus is unwilling to take.

But there is a better way. In a world of normative systems seeking conformity, anchor yourself in beliefs. Find things worth believing in. Even if they are difficult. Even if they are unpopular. Find beliefs worth sacrificing for. Or better yet, find beliefs worth living for.

Technology is a tool. Venture capital is a tool. YC is a tool. a16z is a tool. Attention is a tool. Anger is a tool. The good news is that tools are abundant. But only you can become the craftsman.

A hammer seeks nails. A saw seeks wood. But when you “believe” that something is possible, it allows you to transcend the raw materials and see the potential. To see the angel in the marble and chisel away relentlessly until you set him free.

We must never become the tools of our tools. In this consensus-seeking “normative” world, filled with incentives that want to make you their slave. And if you have no particular “beliefs,” then they are likely to succeed.

But for those who understand the underlying principles, there will always be a better path.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。