Last week, the trading volume and open interest of altcoin contracts on exchanges both declined, reflecting a continued lack of liquidity following the sharp drop on October 11.

Author: Yuuki, Deep Tide TechFlow

I. Overall Performance

1. Market Sentiment:

Last week, the market was in extreme panic. The temporary positive effect of the end of the U.S. government shutdown was quickly replaced by the negative impact of the decreased probability of a Federal Reserve rate cut in December; at the same time, Japanese long-term bond yields continued to rise, with the 10-year government bond yield reaching 1.73%, a 17-year high.

BTC fell 9.99% over the week, ETH fell 13.62%, MSTR's mNAV dropped to 1.2, and BMNR's ETH holdings faced a floating loss of 3 billion yuan. Currently, Crypto is following the decline of U.S. stocks without any upward movement, and investors are focusing on Nvidia's earnings report this Thursday, as well as the reopening of the government and the Federal Reserve's balance sheet reduction, which may bring real liquidity injection. The Coinglass Fear & Greed Index shows that market sentiment was in the panic range for all seven days last week, with five days in extreme panic; the last time a similar situation occurred was on February 27, 2025, and the market recovered two months later.

Figure: Last week's market sentiment was in extreme panic

Data Source: Coinglass

2. Macroeconomic Events:

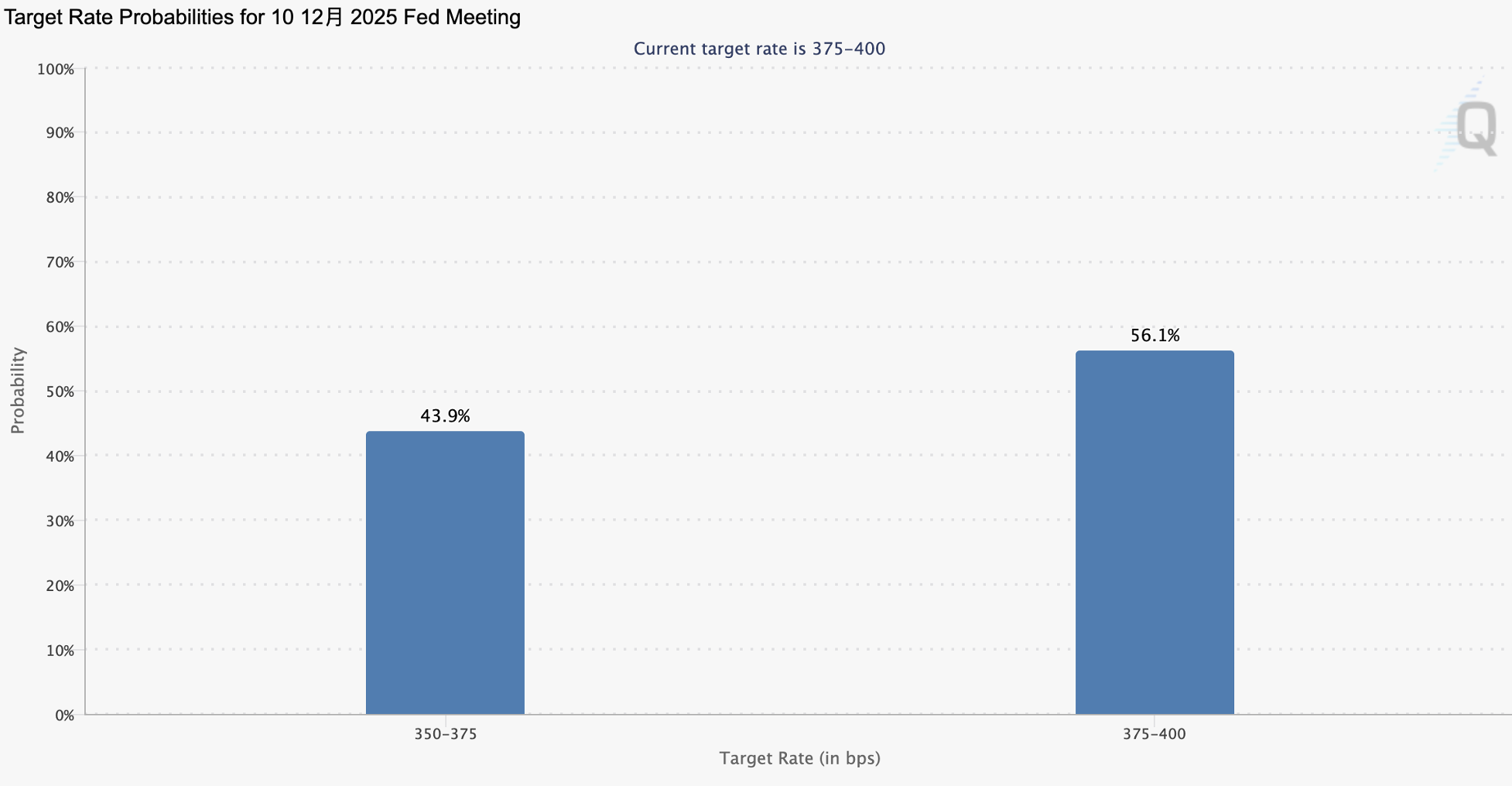

Due to persistent inflation and a lack of significant cooling in the labor market, coupled with the absence of core data during the government shutdown, several Federal Reserve officials, including Kashkari, Harmack, and Musalem, spoke hawkishly last week. The market now expects the probability of a Federal Reserve rate cut in December to drop to 43.9%, suppressing risk asset prices, and the three major U.S. stock indices showed significant pullbacks mid-week, with the crypto market continuing to decline.

Figure: Probability of a 25 basis point rate cut by the Federal Reserve in December drops to 43.9%

Data Source: CME Group

The 10-year Japanese bond yield rose to 1.73%, marking a 17-year high since June 2008. The unwinding of the yen carry trade will also lead to a tightening of global liquidity.

Figure: Japanese 10-year government bond yield rises to 1.73%

Data Source: TradingView

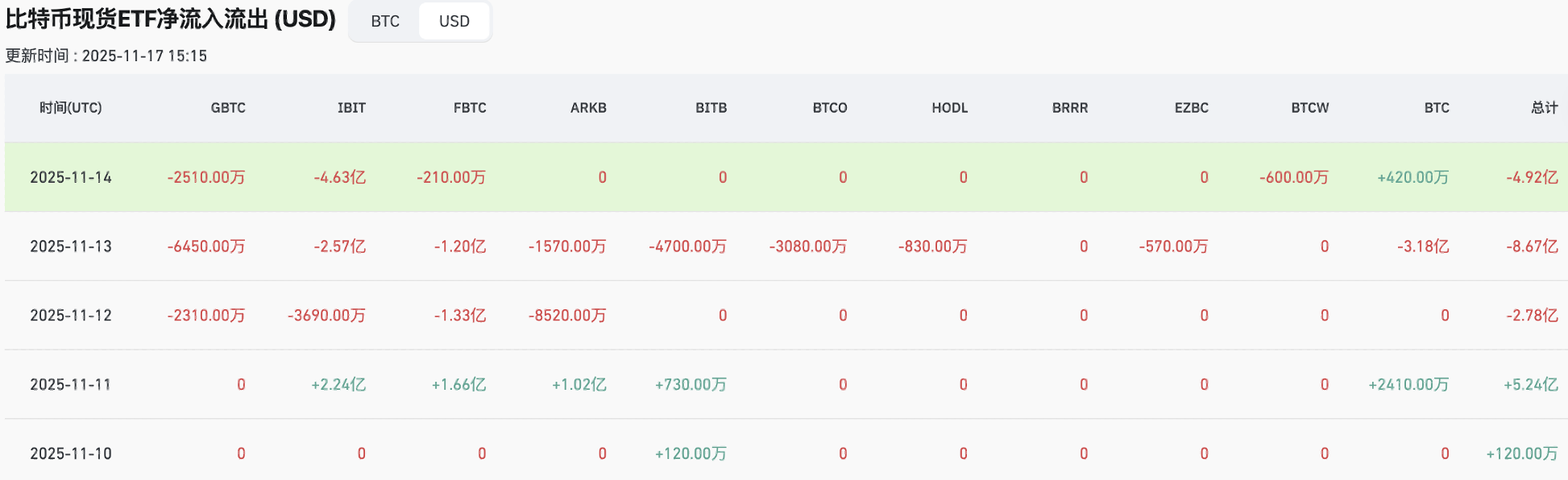

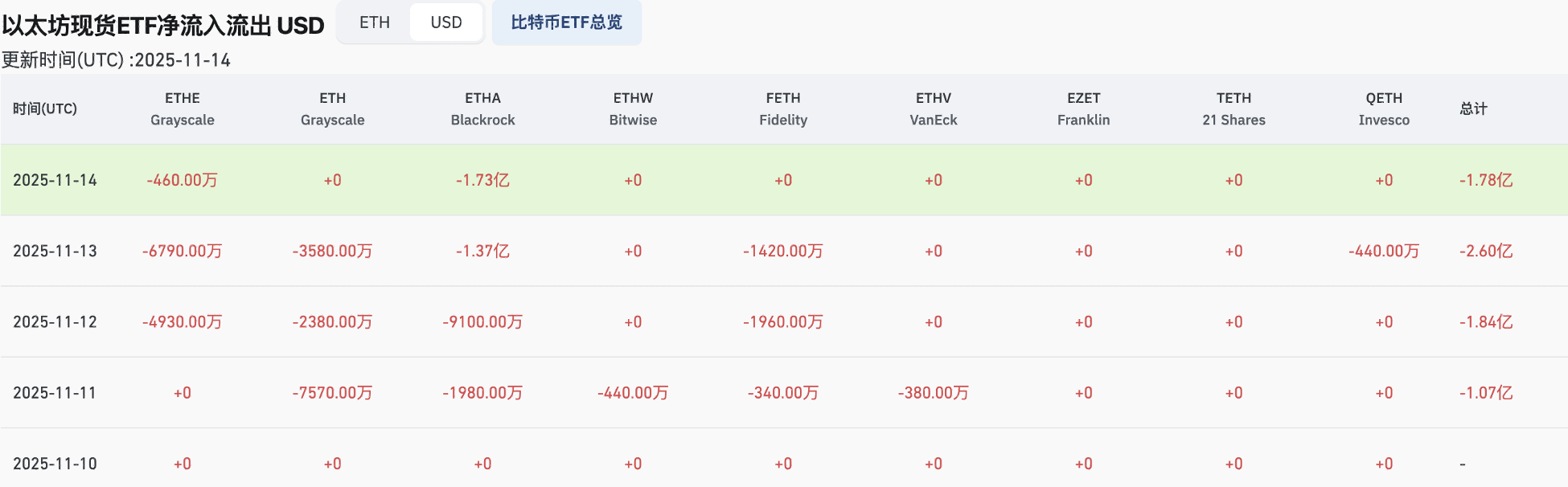

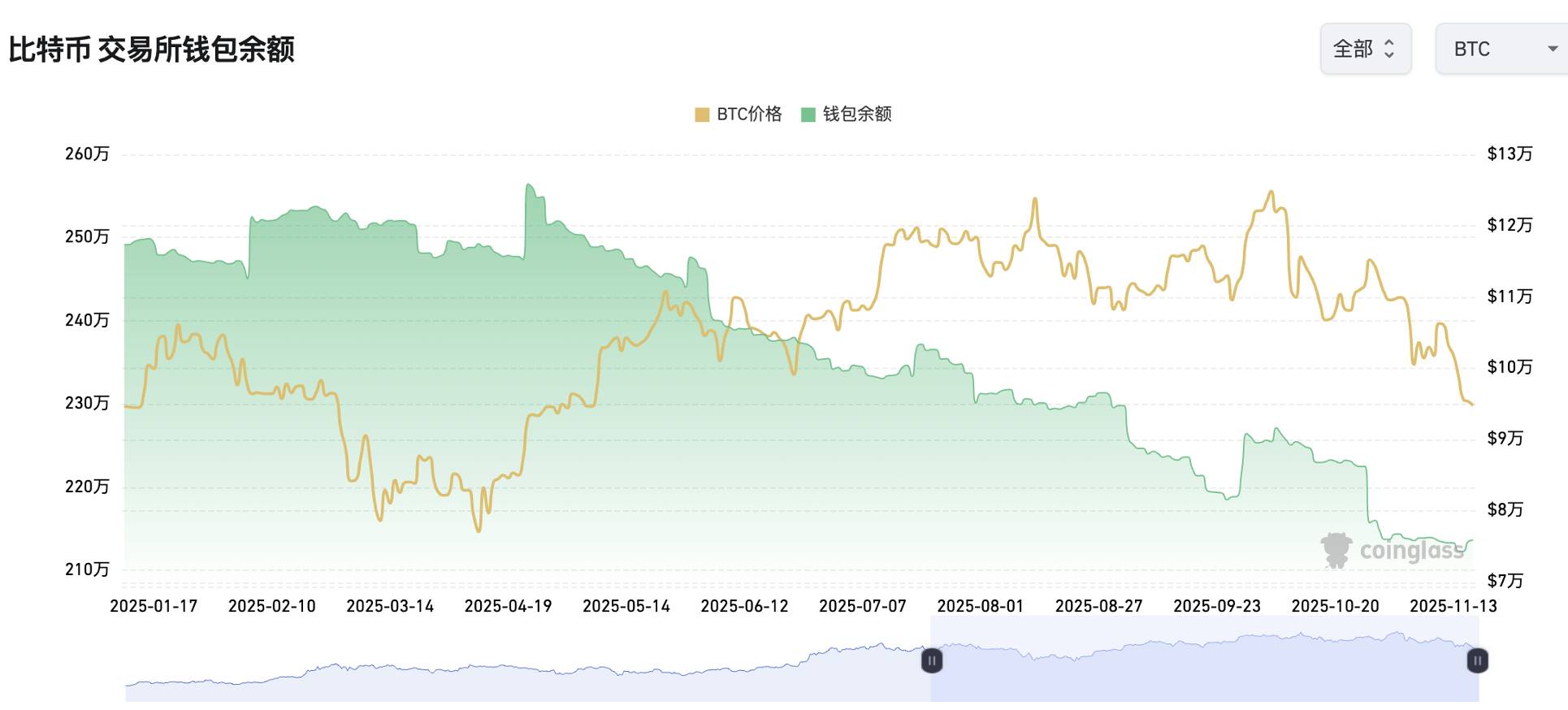

3. Specific Data:

Last week, BTC ETFs saw an outflow of $1.112 billion, a decrease of 7.9% week-on-week; ETH ETFs experienced an outflow of $729 million, an increase of 43.5% week-on-week. Currently, the BTC exchange balance is 2.1374 million coins, unchanged week-on-week; the ETH exchange balance is 12.01 million coins, a decrease of 1.75% week-on-week. Data is as of November 16, with the stablecoin market cap at $265.095 billion, unchanged week-on-week.

Figure: BTC ETF outflow of $1.112 billion, a decrease of 7.9%

Data Source: Coinglass

Figure: ETH ETF outflow of $729 million, an increase of 43.5%

Data Source: Coinglass

Figure: BTC exchange balance remains unchanged week-on-week

Data Source: Coinglass

Figure: ETH exchange balance decreases by 1.75% week-on-week

Data Source: Coinglass

Figure: Stablecoin market cap remains unchanged week-on-week

Data Source: Coinglass

II. Local Hotspots

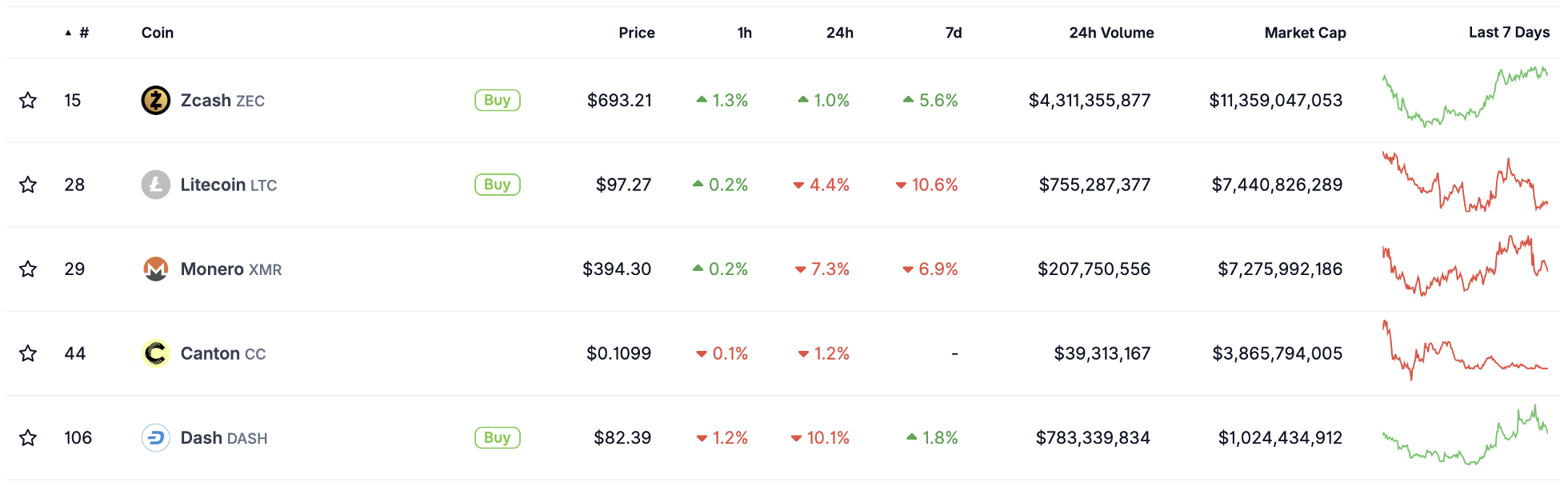

- ZEC rose 6% last week, continuing to set new highs, while STRK surged 47%. The overall market was sluggish last week, but the privacy sector continued to lead the market, with ZEC rising 6% and its market cap surpassing 15 billion, making it the 10th largest crypto asset. In Hyperliquid, the top short address for ZEC faced a floating loss of over $22 million, with a liquidation price of $1,112, and the market began to speculate on ZEC's on-chain inscriptions. STRK rose 47% last week, with the STRK founder also being a co-founder of ZEC, and Vitalik's endorsement drew market attention.

Figure: The privacy sector continues to lead the market

Data Source: Coingecko

Aster rose 16% last week, with approximately $1.7 million in daily revenue used for buybacks, increasing 30% from CZ's buy-in price of $0.9; simultaneously, the large whale that heavily shorted after CZ announced the buy-in has fully closed their position at breakeven (previously holding $44 million), leading to a significant short-term rise in Aster.

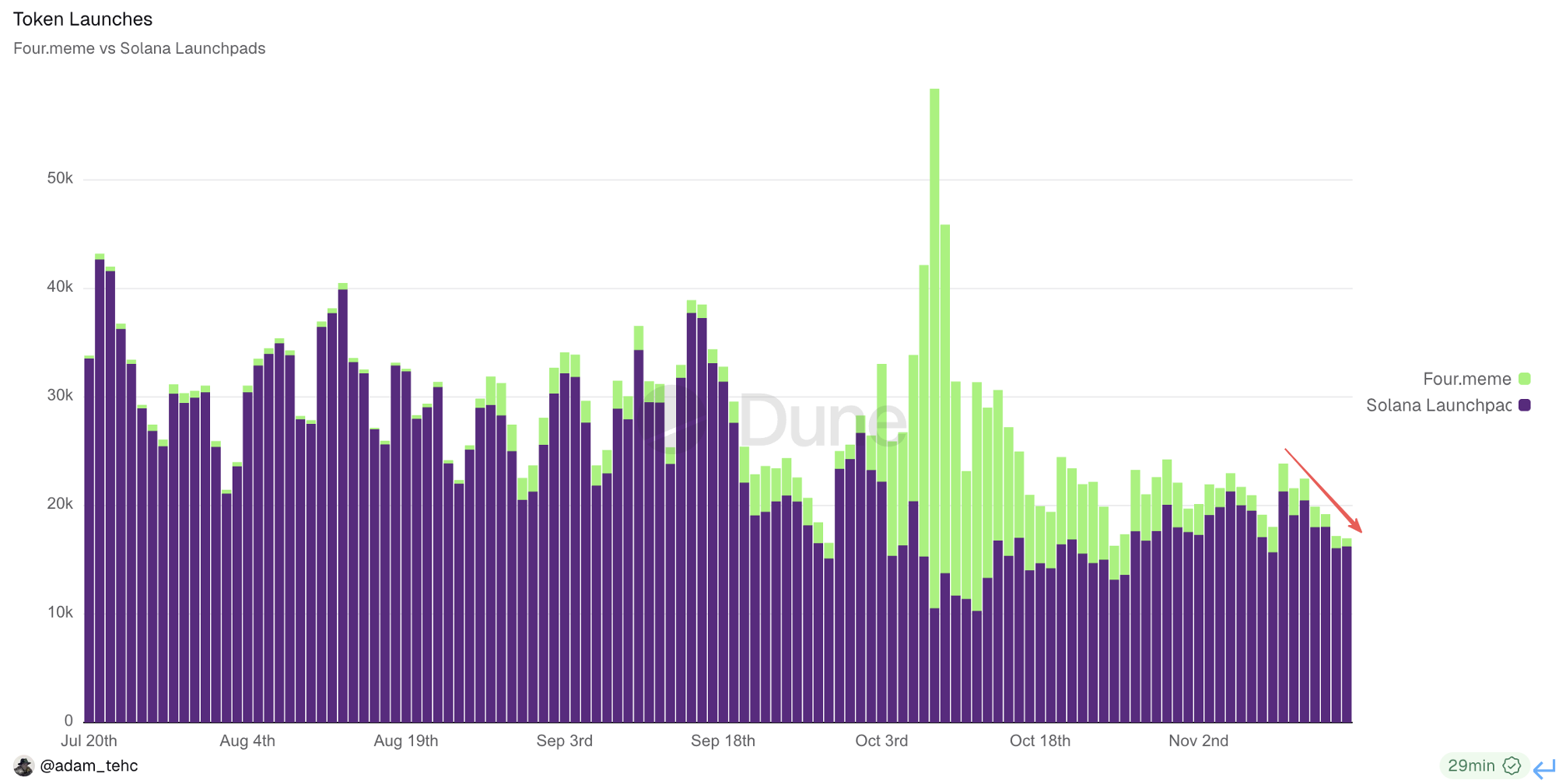

Last week, the open interest and trading volume of altcoin contracts on exchanges both declined, reflecting a continued lack of liquidity following the sharp drop on October 11; the number of tokens minted on the Solana and BSC chains is also continuously decreasing, indicating a lack of market hotspots.

Figure: Open interest and trading volume of altcoin contracts both declined

Data Source: Coinglass

Figure: Token issuance on Solana and BSC chains continues to decrease

Data Source: Dune

4. Important News Last Week:

Federal Reserve officials Kashkari, Harmack, and Musalem made cautious comments regarding rate cuts;

Tom Lee: There appears to be a significant "gap" in the balance sheets of one or two market makers;

Bitmine accumulated 67,021 ETH over the past week, valued at approximately $234 million;

The Czech National Bank became the first central bank in the world to purchase Bitcoin;

Ripple invested $4 billion to build financial infrastructure connecting cryptocurrency and Wall Street;

Tether: So far, $1.5 billion has been injected to expand commodity trade financing, exploring a new model of stablecoins + physical assets;

Grayscale will apply for an IPO;

Stable: Mainnet launch is imminent;

dYdX community vote passed: protocol fee buyback ratio significantly increased from 25% to 75%;

III. This Week's Focus

1. Macroeconomic Events:

On November 17, Federal Reserve Vice Chairman Jefferson will speak on economic outlook and monetary policy;

On November 19, 2027 FOMC voting member and Richmond Fed President Barkin will speak on economic outlook, and Nvidia's earnings report will be released;

On November 20, U.S. September unemployment rate and the Federal Reserve will release the minutes of the monetary policy meeting;

On November 21, U.S. November one-year inflation rate expected final value; several Federal Reserve officials will speak.

2. Token Unlocking:

See "This Week, ZRO, ZK, KAITO, and Other Tokens Will Experience Large Unlocks." for details.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。